The blue light protection ingredient market is expanding steadily due to increasing consumer awareness about the harmful effects of digital screen exposure on skin health. The growing prevalence of digital device usage and extended screen time across all age groups are intensifying demand for protective formulations in personal care products.

Manufacturers are focusing on developing advanced ingredients that offer multifunctional protection, combining anti-oxidative and anti-inflammatory properties. The current market environment is shaped by innovation in ingredient synthesis, rising adoption by cosmetic brands, and alignment with clean beauty trends.

The future outlook remains positive as investment in research and development enhances efficacy and compatibility of blue light protection actives with a wide range of skincare formulations Growth rationale is supported by the rising preference for preventive skincare, technological progress in photoprotection, and expanding applications in facial, body, and sun care categories, ensuring sustained market growth and value creation over the forecast period.

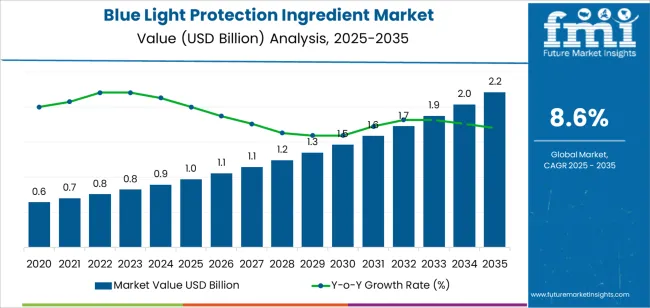

| Metric | Value |

|---|---|

| Blue Light Protection Ingredient Market Estimated Value in (2025 E) | USD 1.0 billion |

| Blue Light Protection Ingredient Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

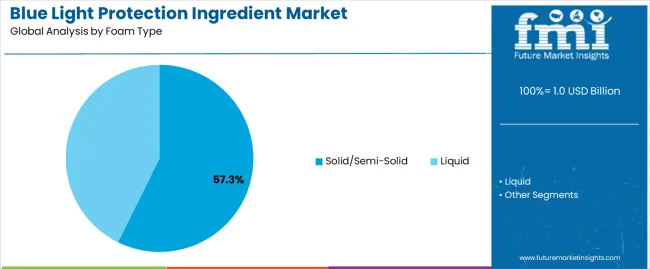

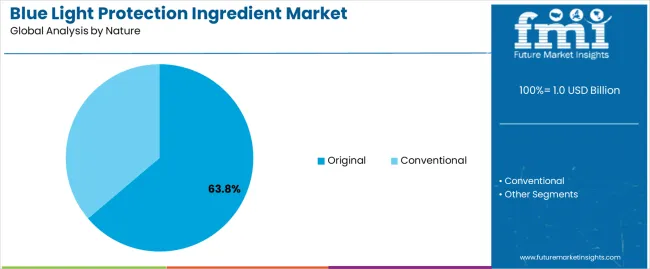

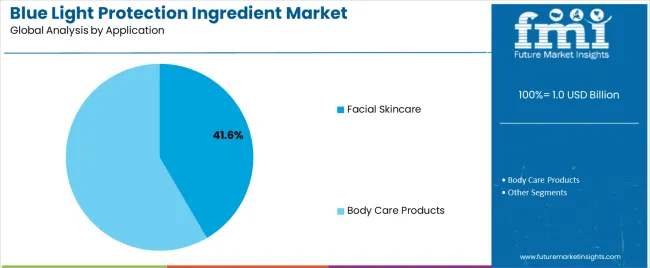

The market is segmented by Foam Type, Nature, and Application and region. By Foam Type, the market is divided into Solid/Semi-Solid and Liquid. In terms of Nature, the market is classified into Original and Conventional. Based on Application, the market is segmented into Facial Skincare and Body Care Products. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solid/semi-solid segment, accounting for 57.30% of the foam type category, is dominating the market due to its superior formulation stability and compatibility with a wide range of cosmetic bases. Its preference in creams, balms, and masks has reinforced its adoption among both manufacturers and consumers seeking long-lasting blue light protection.

Enhanced texture, controlled release of active ingredients, and better absorption characteristics have contributed to its popularity. Product development efforts focusing on optimizing ingredient dispersion in semi-solid matrices have further improved performance consistency.

As brands continue to emphasize product sensorial appeal and efficacy, solid and semi-solid formulations are expected to retain their leadership position, ensuring steady demand from premium and mass-market skincare segments alike.

The original segment, representing 63.80% of the nature category, has been leading the market due to increasing consumer trust in naturally derived, non-synthetic ingredients. Demand growth has been influenced by the clean beauty movement and preference for formulations perceived as safe, effective, and environmentally responsible.

Manufacturers are leveraging botanical sources and bio-engineered extracts that deliver strong blue light defense without compromising product purity. Consistent innovation in sustainable extraction techniques and ingredient traceability is reinforcing brand credibility and market differentiation.

As awareness of digital aging continues to rise, original blue light protection ingredients are anticipated to sustain their leading position, supported by regulatory acceptance and expanding integration into high-performance skincare lines.

The facial skincare segment, holding 41.60% of the application category, remains the largest consumer of blue light protection ingredients due to high exposure of facial skin to screens and environmental stressors. Its dominance is supported by the growing popularity of daily-use moisturizers, serums, and sunscreens formulated with blue light filters.

Continuous marketing efforts by cosmetic brands highlighting the benefits of digital light defense have elevated consumer adoption. Product innovation aimed at combining anti-aging, hydration, and blue light protection benefits has further strengthened segment growth.

With digital lifestyles becoming more entrenched globally, the demand for facial skincare products incorporating advanced blue light protection ingredients is expected to increase, ensuring the segment’s continued leadership and contribution to overall market expansion.

This study examines the blue light protection ingredient market's growth over the past five years, revealing a historical CAGR of 6.4% and a projected 8.6% CAGR growth up to 2035, indicating a growing trend in the blue light protection ingredient market.

| Attributes | Details |

|---|---|

| Blue Light Protection Ingredient Market Historical CAGR for 2020 to 2025 | 6.4% |

The market for blue-light protection ingredients in cosmetic and skin care products is anticipated to face several challenges during the forecast period due to high costs, a lack of raw materials, and supply chain issues. Additionally, shifting preferences in makeup and emergency health services have limited the global market expansion.

Critical aspects that are anticipated to influence the demand for blue light protection ingredients through 2035.

Market players are going to desire to be prudent and flexible over the anticipated period since these challenging attributes position the industry for accomplishment in subsequent decade.

Amplified Usage of Smart Gadgets Skyrockets the Blue Light Protection Ingredient Market

The rise in popularity of smart devices, such as smartphones, tablets, and personal computers, has led to increased exposure to blue light, causing health and skin issues. As people spend more time on their smartphones, concerns about the impact on their skin health and attractiveness have grown.

Expansion of technological gadgets this has led to an increased demand for blue light-protecting chemicals. As people become aware of the harmful effects of blue light on their skin and eyes, the number of blue light-protecting ingredient is expanding forming the anti-blue light ingredient market.

As more research is conducted on the effects of blue light exposure, the demand for protective goods is expected to continue to rise. Many people experience adverse health impacts, including difficulty sleeping and skin damage. Thus, this is expected to develope elevated demand for the blue light shield ingredients in the forthcoming decade.

Global Populace Demand for the Organic Ingredient

Prolonged exposure to blue light from the sun or electronic devices like smartphones, laptops, and other gadgets can lead to premature aging, wrinkles, dryness, and other skin issues.

Producers of blue light protection components are likelier to employ organic raw materials when producing blue light skincare additives. The manufacturers utilize natural alternatives for zinc oxide, titanium dioxide, and iron oxide in their blue light products.

The consumers in the blue light protection ingredient market expect to have more natural, glowing, and radiant skin, so market players offer more expensive organic blue light defense ingredients.

For the protection of the skin and youthful appearance, patrons in the blue light defense ingredient market opt for expensive blue light protection ingredient, following the trends in the blue light protection ingredient market.

Growing Cosmetic Industry Boosts the Demand for the Blue Light Shield Ingredient

The cosmetics and personal care industries are rapidly changing, with companies sourcing natural materials and creating high demand for blue light protection ingredients, highlighting the growing integration of natural components.

The increasing demand for natural personal care products with minimal chemicals and harmful pollutants has led to a surge in demand for blue light protection ingredients. This, thereby, boosts consumer demand for blue light protection formulations.

The cosmetics industry has been exploring the potential benefits of blue light skincare chemicals in treating various skin conditions. The effectiveness of these substances in refining the skin's appearance and reducing sunspots has led to their inclusion in multiple types of face masks and serums.

Blue light skincare products have gained significant traction in the beauty sector and are now considered essential to any effective skincare regimen, developing the demand for blue light skincare solutions.

This section offers in-depth analyses of particular blue light protection ingredient market sectors. The two main topics of the research are the segment with the solid or semi-solid form and the cosmetic products as the application segment.

Through a comprehensive examination, this section attempts to provide a fuller knowledge of these segments and their relevance in the larger context of the blue light protection ingredient market.

| Attributes | Details |

|---|---|

| Top Form Type | Solid or Semi-solid |

| Market share in 2025 | 64.30% |

The demand for solid or semi-solid form of the blue light protection ingredient is projected to witness a significant demand, holding a market share of 64.30% in 2025. The following aspects display the aspects supporting the development of solid and semi-solid blue light protection ingredients:

| Attributes | Details |

|---|---|

| Top Application | Cosmetic Products |

| Market share in 2025 | 39.80% |

The cosmetic products infused with blue light protection ingredients is set to acquire a 39.80% market share in 2025. Factors backing up the development of blue light protection cosmetics include:

This section anticipates examining the markets for blue light protection ingredient in some of the most important countries on the global stage, such as the United States, China, India, Japan, and the United Kingdom.

Through in-depth research, explore the several aspects influencing these nations' acceptability and demand for blue light skincare products.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 4.9% |

| United Kingdom | 5.6% |

| China | 8.6% |

| Japan | 11.0% |

| India | 17.4% |

The United States beauty and cosmetic sector is developing the demand for blue light protection ingredients with a CAGR of 4.9% from 2025 to 2035. Here are a few of the key trends:

Demand for blue light protection ingredients in the United Kingdom is expected to develop at a CAGR of 5.6%. The following factors are propelling the demand for organic blue light protection ingredients:

China has witnessed an increasing number of skin diseases, and the demand for blue light protection ingredients is predicted to extend at a CAGR of 8.6% between 2025 and 2035. Some of the primary trends in the industry are:

The demand for blue light protection ingredients in India is expected to register a CAGR of 17.4% from 2025 to 2035. Some of the primary trends are:

The blue light protection ingredient industry in Japan is expected to register a CAGR of 11.0% by 2035. Among the primary drivers are:

The market remains highly fragmented, with numerous players vying for market share. However, despite the intense competition, product quality and safety remain top priorities for consumers.

As the shift toward organic and natural products continues to gain momentum, ingredient manufacturers are diversifying their offerings or launching new units dedicated to organic production to meet this growing demand.

Market players focus on boosting their social media presence and investing in effective advertising tactics to increase customer awareness of their products. Additionally, expansion initiatives play a significant role in various businesses' strategies.

By participating in such events, companies can increase their customer base and more easily adapt to the rising demand for blue light protection ingredients.

Looking ahead, players in the blue light protection ingredient market are actively developing their businesses in the forthcoming decade through strategic alliances, product innovations, partnerships, research and development, and targeted marketing campaigns.

By adopting these measures, companies strive to stay ahead of the curve and establish themselves as key players in this highly competitive industry.

Recent Developments in the Blue Light Protection Ingredient Market

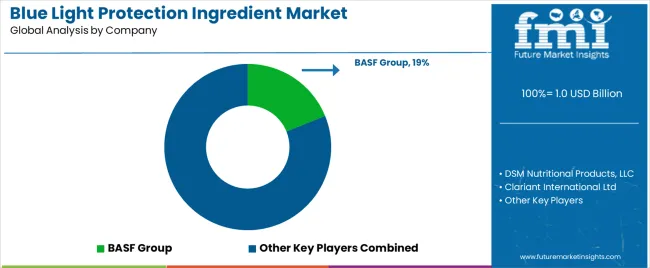

The global blue light protection ingredient market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the blue light protection ingredient market is projected to reach USD 2.2 billion by 2035.

The blue light protection ingredient market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in blue light protection ingredient market are solid/semi-solid and liquid.

In terms of nature, original segment to command 63.8% share in the blue light protection ingredient market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of Blue Light Protection Ingredient Providers

Blue Ceramic Abrasive Market Size and Share Forecast Outlook 2025 to 2035

Blueberry Extract Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Bluetooth Photo Capture Device Market Size and Share Forecast Outlook 2025 to 2035

Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Bluetooth Hearing Aids Market Trends – Growth & Forecast 2025 to 2035

Bluetooth Low Energy Market Analysis by Technology, Application and Region Through 2035

Blueberries Market Analysis – Size, Share & Forecast 2025-2035

Bluetooth Adapter Market

Market Share Insights for Blueberry Ingredient Providers

Blue Light Blocking Glasses Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Blue Light Blocking Glasses Market Share & Industry Leaders

Blue Light Protection Skincare Market Size and Share Forecast Outlook 2025 to 2035

Food Blue 5 Market Size and Share Forecast Outlook 2025 to 2035

Brilliant Blue FCF Colors Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Brilliant Blue FCF Colors Market Share

Industrial Bluetooth Market Size and Share Forecast Outlook 2025 to 2035

iBeacon and Bluetooth Beacon Market Outlook 2025 to 2035 by Component, Technology Platform, End Use, and Region

UK Brilliant Blue FCF Colors Market Analysis – Growth, Applications & Outlook 2025-2035

USA Brilliant Blue FCF Colors Market Report – Demand, Trends & Industry Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA