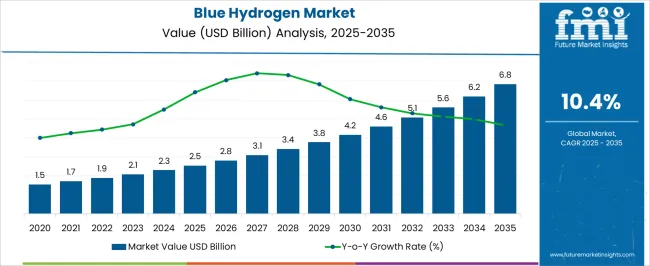

The blue hydrogen market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period. Regional growth patterns indicate notable disparities influenced by policy frameworks, infrastructure readiness, and energy transition priorities. In the Asia-Pacific region, rapid industrialization, government incentives for low-carbon energy, and rising natural gas consumption are driving early adoption of blue hydrogen.

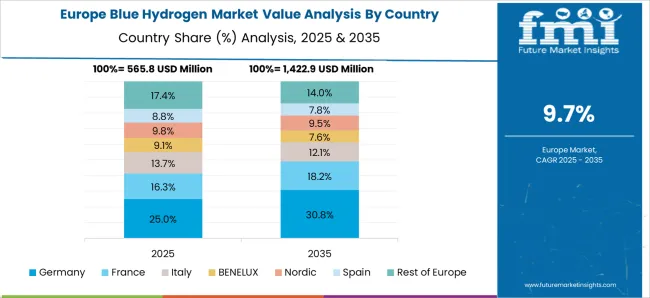

Key markets such as China, Japan, and South Korea are investing in carbon capture and storage (CCS) technologies, establishing the region as a dominant contributor to global market growth. Europe is also witnessing steady expansion, supported by the European Green Deal, decarbonization mandates, and cross-border hydrogen transport infrastructure. Countries such as Germany, the Netherlands, and Norway are leveraging existing gas pipelines and CCS facilities to accelerate deployment, resulting in a moderate but consistent market share. North America is experiencing measured growth, primarily driven by policy incentives under federal energy strategies and state-level clean energy mandates.

The United States and Canada are investing in industrial-scale blue hydrogen projects, but progress is comparatively slower due to regulatory hurdles and high initial capital expenditure. Asia-Pacific is expected to capture the largest share of market expansion, Europe maintains steady but controlled growth, and North America experiences gradual uptake. These regional dynamics underscore the uneven pace of blue hydrogen adoption, reflecting infrastructure, policy, and investment capacity differences across continents.

| Metric | Value |

|---|---|

| Blue Hydrogen Market Estimated Value in (2025 E) | USD 2.5 billion |

| Blue Hydrogen Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

The blue hydrogen market is witnessing rapid expansion as global economies prioritize clean energy transition and carbon reduction strategies. Rising industrial decarbonization goals and large-scale government investments in hydrogen infrastructure shape the current market landscape. Blue hydrogen, produced using natural gas with carbon capture, is gaining prominence due to its balance between scalability and emission control.

Industry-led initiatives and energy company announcements have emphasized its role in bridging the gap between fossil-based systems and future green hydrogen adoption. In addition, policy frameworks and international agreements are accelerating investment into carbon capture and storage technologies, further enhancing the viability of blue hydrogen. The future outlook remains optimistic as energy-intensive sectors continue to seek low-carbon alternatives to meet their sustainability targets.

Infrastructure developments, technological improvements, and strategic partnerships are expected to unlock new opportunities for growth in both mature and emerging markets. These developments are positioning blue hydrogen as a pivotal component in the evolving global energy ecosystem.

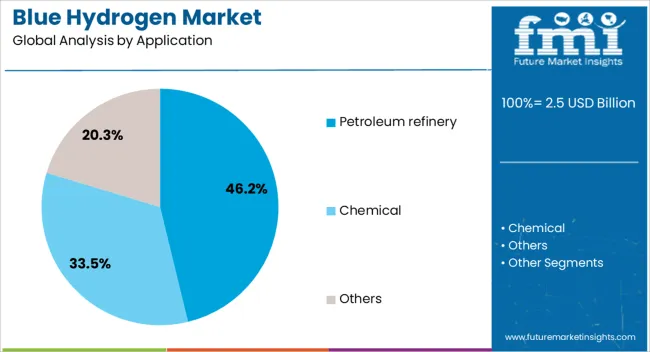

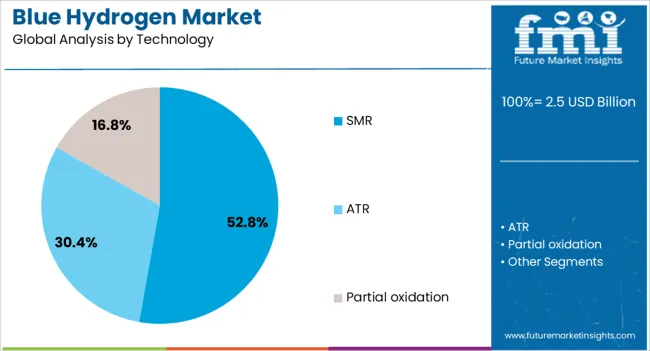

The blue hydrogen market is segmented by application, technology, and geographic regions. By application, the blue hydrogen market is divided into Petroleum refinery, Chemical, and Others. In terms of technology, the blue hydrogen market is classified into SMR, ATR, and Partial oxidation. Regionally, the blue hydrogen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The petroleum refinery segment is projected to hold 46.2% of the Blue Hydrogen market revenue share in 2025, making it the leading application segment. This dominance is being driven by the sector’s high hydrogen demand and regulatory pressure to reduce carbon emissions from traditional refining operations. Refinery operators are increasingly adopting blue hydrogen to meet clean fuel standards and lower their carbon footprint without overhauling existing infrastructure.

As observed in energy transition strategy documents and industry announcements, blue hydrogen enables the continued use of hydrogen in desulfurization and hydrocracking while integrating carbon capture systems. The segment’s growth is further supported by its alignment with refinery decarbonization roadmaps outlined by major oil companies.

Additionally, blue hydrogen allows refineries to achieve compliance with environmental regulations while maintaining operational efficiency. These factors have led to the strong adoption of blue hydrogen in refinery applications, securing its top position in the market.

The SMR segment is expected to account for 52.8% of the Blue Hydrogen market revenue share in 2025, establishing it as the leading technology segment. This leadership is being attributed to the maturity, cost-efficiency, and scalability of steam methane reforming as a production method. SMR has remained the most widely used hydrogen production technology globally, and its integration with carbon capture solutions has made it suitable for blue hydrogen generation.

According to technology-focused industry publications and energy provider disclosures, SMR infrastructure is already well established, which minimizes the need for large-scale capital deployment when transitioning to low-carbon alternatives. The ability to retrofit existing SMR plants with carbon capture systems has further contributed to its market strength.

Moreover, the relatively low production cost of hydrogen via SMR compared to other pathways has reinforced its economic viability. These characteristics have ensured that SMR remains the preferred technology for blue hydrogen projects across industrial applications.

The market has been expanding due to growing industrial demand for low-carbon energy and the global push to reduce greenhouse gas emissions. Hydrogen produced from natural gas with carbon capture and storage (CCS) technologies has been widely adopted in refining, chemical production, and power generation. Investments in infrastructure, storage, and transportation have supported market expansion. Partnerships between energy companies and technology providers have accelerated deployment of blue hydrogen solutions, making it a viable alternative to conventional fossil fuels while enabling a transition toward cleaner energy systems globally.

The industrial sector has been a significant driver for blue hydrogen demand, particularly in refineries, ammonia production, and methanol synthesis. Hydrogen has been used to remove sulfur in petroleum refining and as a feedstock in chemical manufacturing. Blue hydrogen offers an advantage over grey hydrogen by reducing carbon dioxide emissions through carbon capture and storage technologies. Industrial adoption has been supported by long-term supply agreements between hydrogen producers and industrial consumers, ensuring consistent delivery. Growing regulatory pressure to decarbonize industrial processes has further encouraged adoption of blue hydrogen. Its application in high-temperature processes and as a supplement to natural gas has enabled operational efficiency improvements. This trend has positioned blue hydrogen as a critical intermediate energy source for industrial decarbonization efforts globally.

The expansion of the blue hydrogen market has been closely linked with advancements in carbon capture and storage (CCS) technologies. By capturing and sequestering carbon dioxide produced during hydrogen generation from natural gas, emissions are significantly reduced. CCS systems have been deployed in large-scale production facilities, enhancing environmental compliance and meeting decarbonization targets. Innovations in capture efficiency, storage safety, and monitoring systems have lowered operational costs and improved feasibility. Regulatory incentives and government support for CCS projects have accelerated its adoption. By mitigating the environmental impact of hydrogen production, CCS technologies have strengthened blue hydrogen’s role in the energy transition. Consequently, ongoing technological developments and policy support in carbon management have been key factors shaping the global blue hydrogen market.

Government regulations and national strategies for low-carbon energy have significantly influenced the blue hydrogen market. Policies promoting hydrogen as part of energy transition plans have been introduced in Europe, North America, and Asia-Pacific. Subsidies, tax credits, and funding for research and infrastructure have encouraged production and adoption. Carbon pricing mechanisms have further incentivized industries to shift toward blue hydrogen from conventional fossil fuels. Public-private collaborations have facilitated pilot projects, large-scale plants, and distribution networks. Strategic initiatives to integrate hydrogen into industrial and power sectors have strengthened investor confidence. These policy frameworks have not only reduced market entry barriers but also accelerated global deployment. Consequently, regulatory and incentive-driven momentum has remained a decisive factor in blue hydrogen’s expansion worldwide.

Blue hydrogen has been increasingly incorporated into power generation and energy systems to reduce carbon intensity. Gas turbines and fuel cells have been adapted to use hydrogen blends, supplementing natural gas in electricity production. Utility-scale projects have focused on integrating hydrogen into renewable energy storage and grid balancing, enabling stable supply despite variability in solar and wind generation. Energy companies have explored pipeline transport of hydrogen to industrial hubs and blending in existing natural gas infrastructure. Co-firing with blue hydrogen has allowed existing plants to reduce emissions without major retrofitting. The hydrogen-fired microgrids and combined heat and power systems have been tested for industrial and urban applications. This integration has reinforced blue hydrogen’s strategic importance in transitioning energy systems to lower-carbon solutions and supporting long-term energy sustainability.

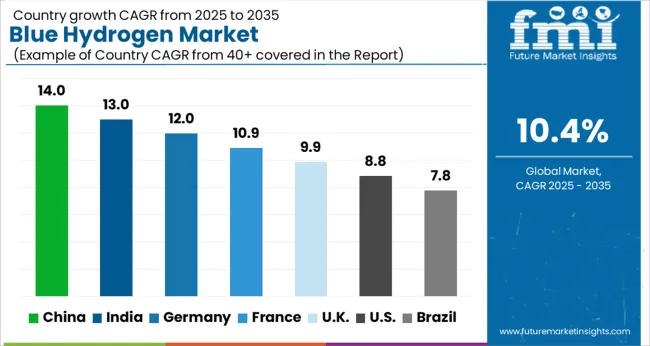

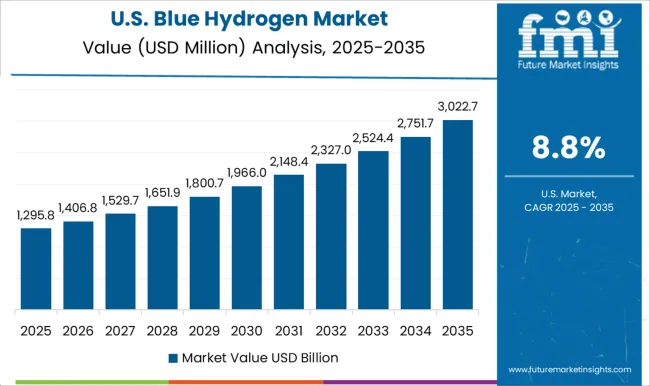

The market is projected to grow at a CAGR of 10.4% between 2025 and 2035, driven by investments in low-carbon hydrogen production, carbon capture and storage technologies, and industrial energy transition initiatives. China, with a 14.0% CAGR, leads through large-scale hydrogen production projects and supportive government policies. India follows at 13.0%, scaling rapidly with strategic energy partnerships and expanding industrial hydrogen adoption. Germany grows at 12.0%, supported by strong decarbonization targets and hydrogen infrastructure development. The UK, at 9.9%, innovates through pilot projects and integration with industrial clusters. The USA, at 8.8%, experiences steady growth from federal incentives and private sector hydrogen investments. This report covers 40+ countries, with the top markets highlighted here for reference.

China is projected to grow at a CAGR of 14.0% in the market from 2025 to 2035. Expansion in industrial hydrogen demand, government-backed carbon reduction initiatives, and investments in large-scale hydrogen production plants are driving growth. Integration of blue hydrogen in power generation, refining, and chemical industries is gaining traction. Collaboration between state-owned enterprises and technology providers is enhancing infrastructure capabilities. Policy incentives and carbon pricing mechanisms are further motivating adoption of low-emission hydrogen solutions, positioning China as a global leader in hydrogen energy deployment.

India is anticipated to expand at a CAGR of 13.0% in the blue hydrogen industry during 2025 to 2035. Rising energy demand in industrial and transport sectors and carbon reduction commitments are driving adoption. Strategic partnerships between domestic firms and international technology providers are accelerating large-scale production projects. Policy frameworks encouraging clean fuel transition and investment incentives are shaping market growth. Increased emphasis on power-to-gas and refining applications is supporting commercial deployment. India is expected to emerge as a significant contributor to the Asia Pacific hydrogen economy.

Germany is forecast to grow at a CAGR of 12.0% in the blue hydrogen market between 2025 and 2035. Increasing focus on decarbonizing chemical, refining, and steel industries is supporting adoption. Integration of carbon capture and storage technologies with hydrogen production is expanding rapidly. Government incentives and EU directives promoting low-carbon fuels are accelerating deployment. Strategic alliances between industrial companies and technology providers are enhancing supply chain efficiency. The emphasis on energy transition positions Germany as a leading European market for blue hydrogen solutions.

The United Kingdom is anticipated to record a CAGR of 9.9% in the blue hydrogen market from 2025 to 2035. Policy support for net-zero targets and industrial decarbonization is encouraging adoption. Partnerships between energy companies and technology providers are accelerating infrastructure development. Hydrogen applications in refining, chemical production, and power generation are increasing. Funding initiatives supporting carbon capture and storage integration are expanding commercial viability. Market growth is further strengthened by commitments to develop hydrogen hubs across strategic regions.

The United States is expected to grow at a CAGR of 8.8% in the blue hydrogen market between 2025 and 2035. Rising demand from chemical, refining, and energy sectors is driving growth. Policy incentives and federal funding for clean hydrogen projects are supporting commercial deployment. Integration of carbon capture and storage technologies is enhancing sustainability and compliance with emission regulations. Major energy corporations and industrial consortia are leading large-scale project development. The United States is projected to strengthen its position as a major participant in global hydrogen energy production.

The market is dominated by established energy majors and specialized industrial solution providers focused on low-carbon hydrogen production through natural gas reforming with carbon capture. Global leaders such as Shell, BP, and Exxon Mobil Corporation leverage extensive upstream gas operations, integrated infrastructure, and strategic partnerships to deliver large-scale blue hydrogen projects. Equinor and Eni strengthen their positions through regional hydrogen hubs and carbon capture utilization initiatives, enhancing operational efficiency and reducing emissions. Industrial engineering and project execution companies, including Bechtel Corporation, MaireTecnimont, Technip Energies, and thyssenkrupp Industrial Solutions, contribute to the market by designing and implementing complex hydrogen plants, providing turnkey solutions, and ensuring scalability.

Air Products and Air Liquide play a significant role in technology integration, supply chain management, and commercialization, while Johnson Matthey focuses on catalysts and process optimization critical for efficient hydrogen production. Emerging players like Woodside, SK E&S, and John Wood Group focus on regional blue hydrogen projects, leveraging partnerships and innovative project financing models to establish a presence in competitive markets. Market entry requires strong technical expertise, capital-intensive infrastructure, and regulatory compliance, creating moderate to high barriers for new entrants. Collectively, these providers drive advancements in production efficiency, carbon capture integration, and global adoption of blue hydrogen as part of the energy transition.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Application | Petroleum refinery, Chemical, and Others |

| Technology | SMR, ATR, and Partial oxidation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products, Air Liquide, Bechtel Corporation, BP, Eni, Exxon Mobil Corporation, Equinor, John Wood Group, Johnson Matthey, MaireTecnimont, Saipem, SK E&S, Shell, Technip Energies, TOPSOE, thyssenkrupp Industrial Solutions, and Woodside |

| Additional Attributes | Dollar sales by production technology and end-use sector, demand dynamics across power generation, industrial feedstocks, and transportation, regional trends in deployment across North America, Europe, and Asia-Pacific, innovation in carbon capture integration and process efficiency, environmental impact of CO₂ emissions and water usage, and emerging use cases in low-carbon industrial hydrogen supply, grid balancing, and hydrogen-fueled mobility solutions. |

The global blue hydrogen market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the blue hydrogen market is projected to reach USD 6.8 billion by 2035.

The blue hydrogen market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in blue hydrogen market are petroleum refinery, chemical and others.

In terms of technology, smr segment to command 52.8% share in the blue hydrogen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Partial Oxidation Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Blue Light Protection Skincare Market Size and Share Forecast Outlook 2025 to 2035

Blue Light Blocking Glasses Market Size and Share Forecast Outlook 2025 to 2035

Blue Ceramic Abrasive Market Size and Share Forecast Outlook 2025 to 2035

Blueberry Extract Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Bluetooth Photo Capture Device Market Size and Share Forecast Outlook 2025 to 2035

Bluetooth Hearing Aids Market Trends – Growth & Forecast 2025 to 2035

Bluetooth Low Energy Market Analysis by Technology, Application and Region Through 2035

Analyzing Blue Light Blocking Glasses Market Share & Industry Leaders

Market Share Insights for Blueberry Ingredient Providers

Blueberries Market Analysis – Size, Share & Forecast 2025-2035

Competitive Landscape of Blue Light Protection Ingredient Providers

Blue Light Protection Ingredient Market Trends – Growth & Forecast 2024-2034

Bluetooth Adapter Market

Food Blue 5 Market Size and Share Forecast Outlook 2025 to 2035

Brilliant Blue FCF Colors Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Brilliant Blue FCF Colors Market Share

Industrial Bluetooth Market Size and Share Forecast Outlook 2025 to 2035

iBeacon and Bluetooth Beacon Market Outlook 2025 to 2035 by Component, Technology Platform, End Use, and Region

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA