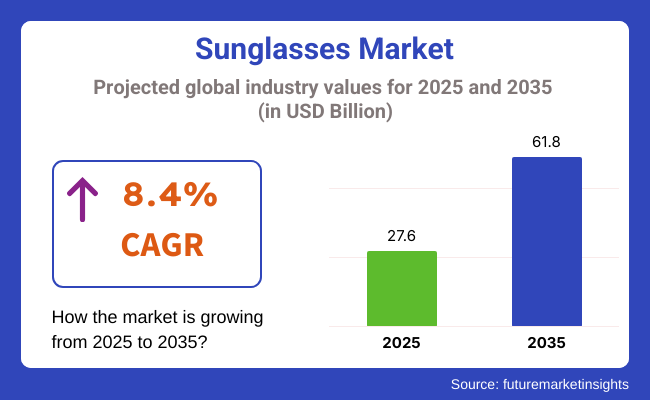

The global sunglasses market in 2025 has reached USD 27.6 billion and is anticipated to rise at an 8.4% CAGR during 2025 to 2035. The global industry is expected to expand to USD 61.8 billion by 2035.

One of the major drivers pushing this expansion forward is the growing consumer consciousness regarding UV protection and eye health, coupled with the ever-increasing need for high-end and designer eyewear that integrates fashion and functionality. Besides this, the industry is being driven by the increased outdoor sporting and leisure activities along with the culture of growing brand awareness and social media influence.

Sunglasses have transformed from simple, functional pieces to fashion statements and health must-haves. Over the past few years, buying habits have turned toward sustainable and intelligent eyewear, and in response, design and materials innovation has accelerated.

are answering back with ranges that couple innovative lens technologies, such as polarization and blue light blocking, with environmentally friendly or recycled frames that speak to eco-aware consumers.

The industry is also experiencing tremendous growth across e-commerce channels. Online platforms have broadened consumers' access to both high-end and mass-market options, particularly in emerging industries.

Virtual try-on technology, AI-driven personalization, and augmented digital marketing campaigns are optimizing the journey from interest to purchase, pushing conversion rates higher. Meanwhile, physical retail remains a critical channel through customized service, elevated in-store experiences, and limited-edition collaborations.

Regionally, Europe and North America dominate the premium segment, supported by developed fashion economies and high per capita expenditure. Conversely, Asia-Pacific is the highest-growing region based on increasing disposable income, urban living, and lifestyle change preferences. Key industries are being developed in China and India with a growing middle class and increased focus on UV protection and eye health.

Technological innovations in smart sunglasses-providing features like audio functionality, fitness tracking, and augmented reality-are starting to find commercial momentum, particularly among younger, technology-oriented consumers. These technologies, though niche, are defining the next wave of growth, placing sunglasses not only as accessories but as wearable tech staples of the future.

In 2025, the industry will be dominated by non-polarized sunglasses, holding a significant 65.9% industry share, while polarized sunglasses will capture 34.1% of the industry.Non-polarized sunglasses can be obtained from an easy-to-access industry and used in everyday locations. They come in all styles, colors, and designs for every member of society.

Consider major brands like Ray-Ban, Oakley, and Vogue Eyewear: here, non-polarized options vie for attention among fashion-conscious consumers using sunglasses as an accessory and those interested in general sun protection.

Non-polarized sunglasses could complement people who are concerned with UV protection but do not require the glare reduction or clarity benefits that polarized lenses offer. The greater share of this component is largely mapped to the large acceptance of fashion sunglasses being used mainly for style rather than some particular function.

Polarized sunglasses, in contrast, command 34.1% of the industry. The characteristic that makes polarized lenses quite popular is their ability to cut the glare off reflective surfaces, such as water, snow, and roads; hence, outdoor enthusiasts, motorists, and athletes are major consumers of these lenses.

Examples of brands that manufacture those types of sunglasses include Maui Jim, Costa Del Mar, and Oakley, which target certain polarized sunglass consumers who lead active lifestyles or stay in the sun for prolonged periods.

The other factor fueling these products' demand is the increased awareness of the additional benefits of polarization in that it reduces eye strain and enhances clarity of vision. Polarized sunglasses are increasingly being embraced into everyday fashion use for their superior performance and comfort.

In 2025, the industry will be significantly influenced by the rise of online retail, with a dominant 76.5% industry share. Offline sales, particularly through specialty stores, will account for 23.5% of the industry.Online channels are a growing preference among customers due to their convenience and the various options that e-commerce platforms provide.

Retailers such as Amazon and Zalando, along with the direct-to-consumer brands of Warby Parker and GlassesUSA, are using digital strategies that open up to consumers an assortment of sunglasses styles, personalized recommendations, and competitive pricing. The rapid proliferation of online shopping is facilitated even further by such conveniences as home delivery and the ability to compare prices, reviews, and designs at will.

The e-commerce platform usually offers consumer incentives, such as exclusive deals available online only, time-limited flash sales mostly directed at price-sensitive customers, and free-return policies quite adored by fashionistas.In-store specialty retail, selling mostly through specialty stores, is expected to occupy an equally relevant position, taking up 23.5% of the shares.

Although lower than the online sector, specialty stores bring into play a personalized shopping experience for customers who like to try sunglasses on in person. Brands like Ray-Ban and Oakley, which have a very strong presence in physical retail, benefit from customers' desires for the tactile experience of touching and feeling the product for fit and comfort. Many brick-and-mortar stores also have the added benefit of fast-tracking purchases and consultations in person to convert shoppers who are immediately after input rather than composite convenience.

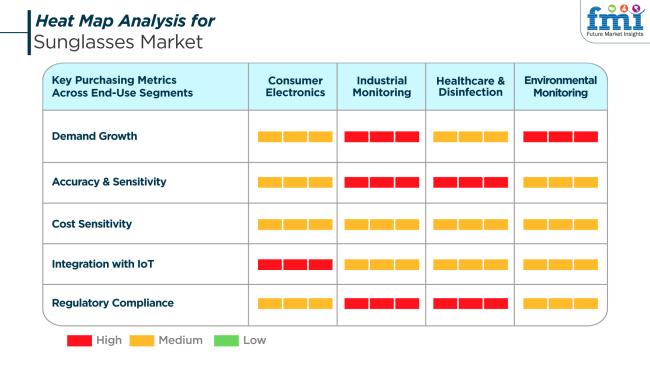

Sunglasses, particularly intelligent or adaptive sunglasses, are increasingly becoming part of the bigger ecosystem of wearable electronics, particularly in consumer electronics. There is consistent demand within this category, with customers seeking devices that have audio, notification, or AR features integrated into fashionable glasses. Nevertheless, industries such as environmental sensing and healthcare require lenses to offer precise optical clarity and UV protection, where regulatory demands and sensitivity are crucial buying criteria.

In industrial applications, especially protective eyewear and monitoring, there is extremely high demand due to strict safety requirements and operating requirements in dangerous environments. Cost sensitivity is more evident here since bulk orders are standard, and manufacturers are forced to trade-off between cost and lifespan. The healthcare and disinfection sectors also value advanced lens technologies, namely those providing antimicrobial coating and consistent clarity over extended wear.

Wearable eyewear technology is beneficial in environmental monitoring and supports field personnel in sunny, UV-exposed situations. IoT integration is a recent development whereby real-time data transmission is facilitated through embedded sensors. All industries focus on sunglasses not just for appearance but increasingly on their functionality, safety, and connectivity.

The industry, while on the verge of explosive growth, has major risks that will impact long-term profitability and innovation. The biggest risk is the increasing level of counterfeit products, particularly in emerging economies where there is poor enforcement of regulation. Such products erode brand credibility, reduce revenues for authentic manufacturers, and pose health risks due to inadequate UV protection.

The volatility of raw material prices, particularly of acetate, metal alloys, and premium lenses, creates unpredictability in the cost of manufacture. While brands endeavor to achieve sustainability objectives through biodegradable or recycled materials, they are generally faced with greater input costs and supply chain difficulties. These become obstacles to scalability and diminish the power of pricing competitiveness, more so for niche players and emerging entrants.

In addition, shifting patterns of consumer purchases, fueled by recessions or cycles of fashion, carry the danger of dependence on fashion-oriented lines of products. Brands that fail to achieve a harmony between fashion and durability may experience fluctuations in demand.

changes with regard to environmental regulations and wearables electronics standards would further create compliance burdens, requiring continuous innovation and adaptability among industry participants.

During the period 2020 to 2024, the industry witnessed dramatic fluctuations as a result of changing consumer preferences, increasing awareness regarding protection from UV rays, and fashion-forward eyewear. Over the years, the industry soared as customers were looking for accessories that merged fashion and protection from harmful UV rays.

Due to the COVID-19 pandemic, outdoor sports such as cycling, hiking, and beach vacations became extremely popular, contributing to increased demand for protective eyewear. Increased athleisure and outdoor lifestyle popularity led to increasing demand for sporty-styled sunglasses with high-performance lenses, while the fashion world continued embracing retro and vintage-inspired shapes.

Forward to 2025 to 2035, the industry will transform with smart eyewear gaining more traction. The use of technologies like augmented reality (AR) and head-up displays (HUDs) in sunglasses will become more mainstream, fusing fashion with functionality to provide a better consumer experience.

Also, sustainable trends will remain in vogue, with more and more brands emphasizing recyclable materials, carbon-neutral production processes, and environmentally friendly business practices. Customized options, employing AI-driven customization software to customize designs according to individual face shapes and tastes, will also gain popularity.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| E-commerce growth, outdoor activities, fashion-oriented style, and UV protection necessity. | Intelligent eyewear technology advancements, AR connectivity, eco-friendly features, and AI-driven personalization. |

| Fashion enthusiasts, outdoor consumers, sports users, and health-conscious buyers. | Tech users, green shoppers, and those seeking personalized eyewear experiences. |

| UV protection, polarized lenses, blue light filtering technology, retro and vintage styles, environment-friendly materials. | Augmented reality and HUD-enabled smart eyewear, photochromic lens, adaptive lenses, eco-friendly materials, and AI-based customization. |

| Online shopping, digital advertising, blue light-blocking lenses, and high-end polarized technologies. | AR integration, AI-powered lens customization, and advanced lens technology across different settings. |

| Sustainable materials, recyclable materials, recycled plastic, and eco-friendly packaging solutions. | Carbon-neutral manufacturing, biodegradable and recyclable materials, and fully sustainable eyewear brands. |

| Physical retail outlets, e-stores, and online direct-to-consumer stores. | Omnichannel shopping experiences with increasingly sophisticated online personalization tools and green stores. |

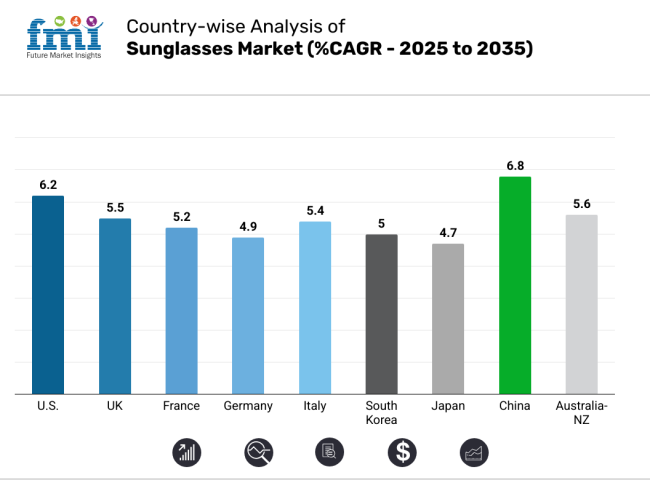

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

| UK | 5.5% |

| France | 5.2% |

| Germany | 4.9% |

| Italy | 5.4% |

| South Korea | 5% |

| Japan | 4.7% |

| China | 6.8% |

| Australia-NZ | 5.6% |

The USA industry is forecasted to develop at 6.2% CAGR during the study period. Industry growth in the USA is fueled by rising consumer demand for luxury and designer sunglasses, along with increasing awareness of UV protection and eye health. Sunglasses are now not merely a protective accessory but a large fashion statement among all groups.

The growing trend in outdoor leisure activity, sport, and tourism keeps driving continuing demand for prescription as well as non-prescription options. Online penetration, especially through direct-to-consumer players, is increasing product availability as well as customer reach.

USA customers increasingly call for polarized as well as tech-enabled lenses with durability, scratch resistance, and customization. In addition, mounting demand for eco-friendly materials and sustainable brands is shaping purchases as ecologically responsible products gain popularity.

A stronger foundation of upscale retail stores, availability of high-profile eyewear makers, and collaborative arrangements with style icons will provide further strength to the industry. Ongoing frame design innovation and material evolution, coupled with active digital campaigns, will keep customers engaged and drive long-term industry expansion.

The industry in the UK will increase at 5.5% CAGR during the period of study. It is being fueled by increasing fashion consciousness, the trend towards higher-end accessories, and increased care about the protection of the eyes from harmful UV rays. Sunglasses are increasingly being perceived more as an essential item, a fashion accessory, rather than a utility product, thereby significantly increasing the base of consumers.

The growth is also supported by expanding online sales channels and growing partnerships between eyewear companies and fashion brands. Consumer preference is shifting towards sustainable and ethically produced sunglasses, which results in growing demand for recyclable lenses and biodegradable frames. UK consumer behavior follows high fashion turnover and seasonal trends, driving style experimentation and high repurchase rates. Marketing initiatives via social media and influencer marketing also play a crucial role in targeting the younger segment.

Further, demand is supplemented by increasing tourism and tourism activities, which generally need quality glasses. Urban population agglomeration and shifting retail strategies ensure the UK industry remains in consistent momentum over the forecasting horizon.

The French industry is expected to register a 5.2% CAGR during the forecast period. Strong fashion heritage, along with an upscale consumer base that values quality and style, supports industry growth. French consumers are highly aesthetic and craftsmanship-oriented, which drives demand for luxury and designer sunglasses. Sunglasses are both functional and fashionable items, which drives wider adoption among demographic groups.

France's industry supports premium as well as mass-market brands, offering diversity and exposure to a large consumer base. Sustainability has become a primary purchasing driver, with consumers seeking products made from natural or recycled content. France's well-developed tourism industry also supports year-round demand for sun protection accessories.

Health awareness initiatives promoting protection against UV are also driving purchasing among parents in the children's eyewear industry. Continued innovation in materials and design and growth in Omni channel retail models make France a mature but continuously growing industry during the forecast period.

The German industry will increase at 4.9% CAGR during the study period. A growing focus on eye care and functional beauty primarily drives growth. German consumers are concerned with performance and durability, often opting for sunglasses that offer UV protection, polarized lenses, and ergonomic frames.

While appearance is important, functionality is the primary influence on purchasing decisions in Germany. The elderly population is also leading the demand for prescription sunglasses, while knowledge of skin and eye protection is promoting broad-based adoption among younger segments.

The very structured optical retail industry in Germany, with the leverage of strong optical chains and independent shops, facilitates broad availability and distribution. Online retailing platforms have made it easier for consumers to enter customized and innovative products.

In addition, eco-friendly eyewear, such as bio-acetate frames and reusable packaging, is gaining increasing popularity in the German industry. Strategic positioning of the products in sports and outdoor equipment stores, together with growing demand for travel accessories, is set to drive growth once more in the forecast period.

Italy's Italian industry is anticipated to grow at 5.4% CAGR during the study period. Famous globally as a hub of eyewear design and manufacturing, Italy has an advanced industry base and high brand recognition. Italian consumers are extremely brand-loyal to domestic brands and highly value craftsmanship and innovation.

This cultural affinity for design excellence has a direct impact on sustained demand in both luxury and mid-range segments. Tourism is a major part of industry dynamics in Italy, where millions of tourists throng every year, many of whom spend time buying high-end fashion accessories while there. Seasonal and style-led purchasing habits are at the heart of Italian consumer trends.

Younger consumers are also trending toward influencer-supported and limited-edition collections. Manufacturers continue to explore and innovate in a bid to create lightweight, durable, and sustainable eyewear solutions. A successful export industry also aids Italy's role as a trendsetter, and local sunglasses sales are guaranteed to maintain high forward growth throughout the forecast period.

The South Korean industry is anticipated to register growth at 5% CAGR over the forecast period. High urbanization and a fashion-conscious and beauty-focused culture significantly influence the demand for trendy sunglasses.

Korean consumers are highly fashion-forward and pick up new styles forecasted by opinion leaders and celebrities rapidly, and this influences rapid shifts in product selection and seasonal purchasing. A combination of fashion and function, with higher and higher levels of UV protection and eye health emphasis, fuels the industry. Advances in technology in South Korea allow for innovation in lens technology, frame content, and personalization. Internet retail channels enable the consumer to access local and international brands.

Small packaging, trendy branding, and limited-edition tie-ups provide additional consumer appeal. Growing demand for outdoor activities and rising levels of air pollution also fuel the consistent use of sunglasses among various groups. Sustained investment in domestic advertising and retailing innovation will go on to fuel robust development throughout the forecasting period.

The Japanese industry is projected to grow at 4.7% CAGR during the research period. Japanese consumers are famous for being detail-conscious, quality-focused, and design-aware. Functionality is highly prized, with high demand for strong, light, and effective UV-protection sunglasses.

A significant segment of the population uses sunglasses primarily for eye protection rather than fashion, although fashion-oriented segments are increasing. Japan's aging demographic is a driver of prescription sunglasses demand even further, and heightened awareness of ocular well-being in all demographics boosts adoption.

The industry is also characterized by simplified styling and technology advancements in lenses, including photochromic and anti-reflective coatings. Retailing remains a mix of optical stores, department stores, and online channels.

Cultural trends like the popularity of travel and outdoor leisure activities continue to drive year-round utilization. Japanese brands tend to emphasize craftsmanship and sustainability, which are consumer values they support and strengthen brand loyalty even more. Sunglasses are integrated into daily life routines to ensure the steady performance of the industry throughout the forecast horizon.

The industry in China is expected to move at 6.8% CAGR during the study timeframe. An aggressively expanding middle-class population, an increase in disposable income, and high fashion awareness are key growth drivers. Chinese consumers are adopting international fashion trends at a rapid rate, and they are becoming more interested in designer and branded sunglasses, especially among Gen Z and millennials.

The industry is witnessing a strong shift towards social commerce and e-commerce, with platforms enabling instant access to global as well as domestic brands. Awareness of UV protection is growing through public health campaigns and consumer education. Luxury consumption habits and travel aspirations also drive seasonal peak demand.

Product innovation, especially using light materials and technology-based glasses such as AR integration, is increasingly popular. Green factors are under consideration, with an emerging niche industry for green sunglasses. Localization strategy, influencer marketing, and rapid product replacement are likely to drive long-term growth in the vibrant consumer industry in China.

The Australia-New Zealand industry is expected to grow at 5.6% CAGR during the study period. High rates of UV exposure in the region guarantee a steady demand for quality sunglasses across all age groups. Government-led awareness efforts about sun safety have turned sunglasses into a part of everyday outdoor attire.

The strong emphasis on outdoor lifestyles, including beach culture and sport, guarantees steady usage patterns. Style-conscious consumers seek versatile products that merge functionality and fashion, leading to growth in polarized and performance-enhancing lenses. The retail environment is highly developed, with a mix of specialist eyewear chains, department stores, and internet channels providing product access.

Growing demand for environmentally friendly and locally produced sunglasses also mirrors broader regional environmental values. Collaborations with surf and outdoor brands contribute to a diverse and dynamic industry range. Seasonal promotions, combined with tourist demand, sustain volume sales, while brand innovation and online marketing guarantee visibility and interaction year-round.

The industry remains highly consolidated by dominant players and is supported through strong brand portfolios and strategic retail integrations. Luxottica Group continues to be the clear industry leader in this case through leveraging iconic brands such as Ray-Ban and Oakley, along with exclusive licensing partnerships with high-end fashion houses like Prada and Versace. Their vertically integrated model manufacturing to retail (Sunglass Hut, LensCrafters)-gives them a commanding advantage over both distribution and pricing across all international markets.

Safilo Group and Marcolin SpA robustly maintain their shares in the industry by offering luxury and fashionable collections of eyewear in partnership with brands such as Dior, Fendi, Tom Ford, and Guess. However, premium polarized eyewear specialists such as Maui Jim and Revo rely on lens technology and sports-lifestyle branding to secure and develop loyal customer bases, particularly in North America and parts of the Asia-Pacific region.

In Europe, retail giants like Fielmann AG and Specsavers Optical make huge chunks of their industry by selling affordable yet stylish sunglasses with the same backing from well-established brick-and-mortar networks.

Pivothead, along with its development of smart tech-enabled sunglasses, is indicative of a gradual evolution towards smart eyewear being completely integrated. Competition is growing most rapidly in the high-end due to luxury conglomerates like LVMH Group expanding into eyewear through acquisitions.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Luxottica Group | 35-38% |

| Safilo Group | 10-13% |

| MarcolinSpA | 8-10% |

| Maui Jim | 5-7% |

| Fielmann AG | 3-5% |

| Other Players | 30-35% |

Key Company Insights

The Luxottica Group, based in Italy, leads the world with an estimated 35-38% industry share in the industry. Its hallmark is aggressive brand ownership, licensing, and a fully vertically integrated manufacturing and retail model that guarantees neither exclusive brand access nor any mediation in consumer loyalty. Luxottica's consistent introduction of collections, in addition to a premium to affordable price range, allows it to target diverse industry segments very well.

Differentiation by luxury licensing portfolios and global distribution networks continues to serve Safilo Group and Marcolin SpA well. Maui Jim, a significant player in most parts of the premium segment, focuses on high-performance polarized lenses, while value-oriented European players such as Fielmann AG tap into inexpensive fashion. Selective acquisitions are also expected to reshape competition in the LVMH Group, whose entry is likely to increase luxury, fashion-inspired innovations within the eyewear industry.

By product type, the industry is segmented into polarized and non-polarized.

By end user, the industry is categorized into women and unisex.

By distribution channel, the industry is divided into offline and online.

By region, the industry spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The industry is expected to reach USD 27.6 billion in 2025.

The industry is projected to grow to USD 61.8 billion by 2035.

The industry is expected to grow at a CAGR of approximately 6.8% during the forecast period.

Non-polarized sunglasses are a key segment in the industry.

Key players include Luxottica Group, Safilo Group, Maui Jim, De Rigo, Charmant, Specsavers Optical, Revo, Fielmann AG, Pivothead, LVMH Group, MarcolinSpA.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End User, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by End User, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by End User, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by End User, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 22: Global Market Attractiveness by End User, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 46: North America Market Attractiveness by End User, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sunglasses Pouch Market

Plano Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA