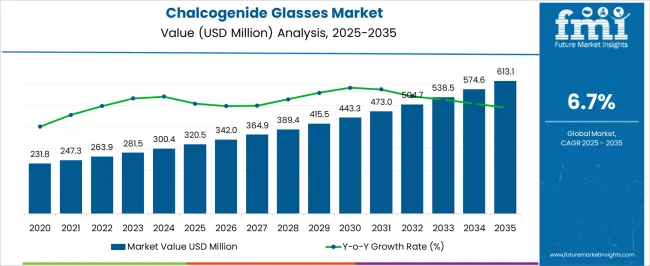

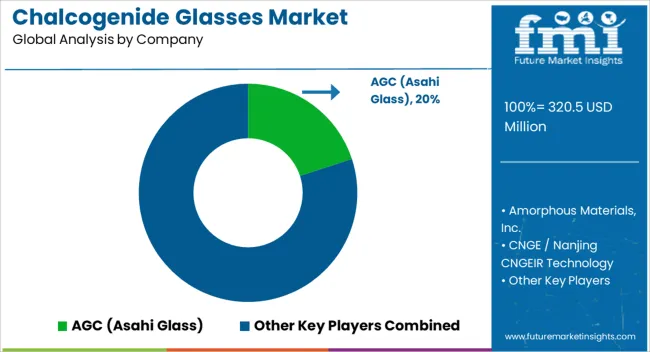

The chalcogenide glasses market is estimated to be valued at USD 320.5 million in 2025 and is projected to reach USD 613.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

Between 2021 and 2025, the market expands from USD 231.8 million in 2021 to USD 320.5 million in 2025, representing the first five-year growth phase. This period reflects the increasing adoption of chalcogenide glasses in optical fibers, infrared sensors, and photonic devices, driven by rising demand for high-performance materials in telecommunications, defense, and aerospace applications. Incremental growth is observed with values reaching USD 247.3 million in 2022, USD 263.9 million in 2023, USD 281.5 million in 2024, and USD 300.4 million prior to attaining USD 320.5 million in 2025. The subsequent decade from 2026 to 2035 shows accelerated expansion, with the market increasing from USD 320.5 million to USD 613.1 million.

Annual growth increments reflect rising deployment of chalcogenide glasses in advanced optical components, mid-IR imaging systems, and non-linear photonic devices. Market values rise steadily to USD 342.0 million in 2026, USD 364.9 million in 2027, USD 389.4 million in 2028, and USD 415.5 million in 2029, reaching USD 443.3 million by 2030. From 2031 to 2035, the market continues to gain momentum, climbing to USD 613.1 million. Growth during this phase is fueled by technological integration, expansion in defense and industrial applications, and adoption in emerging economies.

| Metric | Value |

|---|---|

| Chalcogenide Glasses Market Estimated Value in (2025 E) | USD 320.5 million |

| Chalcogenide Glasses Market Forecast Value in (2035 F) | USD 613.1 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The chalcogenide glasses market is shaped by multiple parent markets that influence its growth and adoption in advanced applications. The specialty glass market plays a significant role, with chalcogenide glasses holding about 10-12% of this segment. Their unique optical and infrared transmission properties make them highly valuable in niche applications such as advanced lenses and infrared sensors. The optoelectronics market contributes around 12-15%, as chalcogenide glasses are widely used in photonic circuits, detectors, and waveguides due to their high refractive index and nonlinear optical capabilities. The semiconductor materials market also supports this sector, accounting for nearly 8-10% of the share. These glasses are crucial in the development of phase-change memory and other non-volatile storage devices, emphasizing their importance in electronic components.

In the telecommunications market, chalcogenide glasses account for about 7-9% of the share, particularly in fiber optics and infrared transmission systems where their ability to transmit light in the mid- and far-infrared spectrum provides an edge over traditional materials. The defense and aerospace materials market contributes around 6-8%, where chalcogenide glasses are integral to thermal imaging, night vision, and infrared sensing systems, offering reliability under extreme environmental conditions. Together, these parent markets underscore the importance of chalcogenide glasses in specialized, high-performance applications, spanning electronics, communication, and defense.

The market is witnessing notable expansion driven by their superior infrared transmission properties and adaptability across high-performance optical systems. The market growth is being supported by advancements in material engineering that have enhanced thermal stability, chemical resistance, and optical clarity. Increasing adoption in infrared imaging, photonics, and sensing applications is broadening the scope of usage across industrial, defense, and commercial domains.

The ability of these glasses to be tailored for specific wavelength ranges has positioned them as essential materials in both traditional and emerging technologies. As global demand for advanced optical systems rises, particularly in defense surveillance, medical imaging, and environmental monitoring, the need for chalcogenide glasses is accelerating.

Strategic investments in production capabilities and R&D are fostering product innovations that align with evolving industry requirements The continued integration of these materials into cutting-edge optical components is expected to sustain growth momentum, with expanding opportunities in both established and niche application areas.

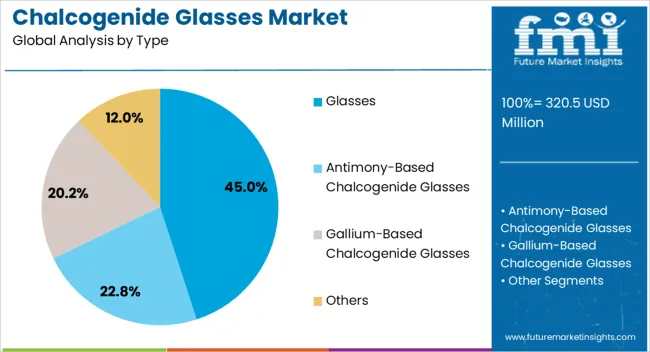

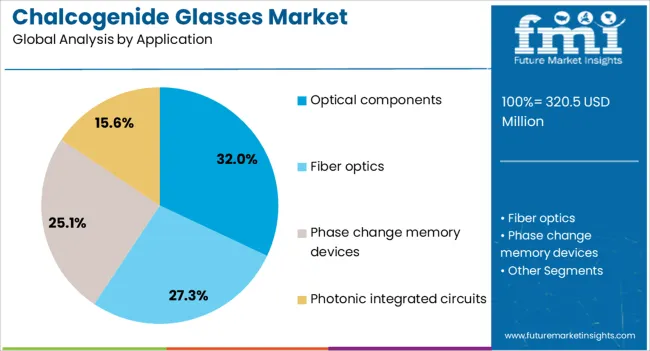

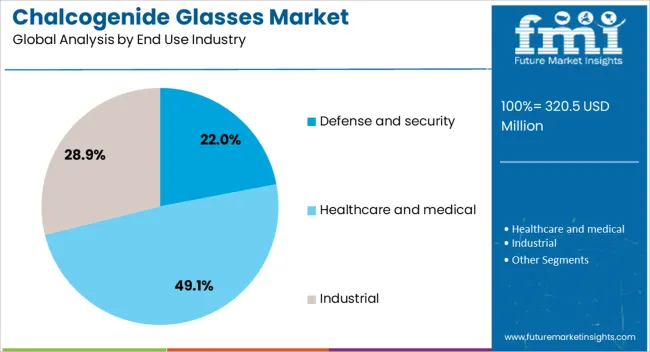

The chalcogenide glasses market is segmented by type, application, end use industry, and geographic regions. By type, chalcogenide glasses market is divided into glasses, antimony-based chalcogenide glasses, gallium-based chalcogenide glasses, and others. In terms of application, chalcogenide glasses market is classified into optical components, fiber optics, phase change memory devices, photonic integrated circuits, sensors and detectors, and others. Based on end use industry, chalcogenide glasses market is segmented into defense and security, healthcare and medical, industrial, telecommunications, electronics and semiconductor, automotive, energy, and others. Regionally, the chalcogenide glasses industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glasses type segment is expected to hold 45% of the chalcogenide glasses market revenue share in 2025, making it the leading type. This dominance has been driven by their superior optical performance, ability to transmit infrared light efficiently, and adaptability in producing complex shapes. Their chemical durability and resistance to environmental degradation have reinforced their suitability for long-term use in high-precision applications. Manufacturing processes have evolved to deliver high-quality, defect-free glass compositions, enabling their integration into demanding optical systems. The compatibility of glasses with coating technologies has further enhanced their functional versatility in various wavelengths. Industries that require consistent performance under extreme temperature variations have continued to adopt this type due to its stability and reliability As demand for advanced optical solutions expands, glasses remain a preferred choice for manufacturers aiming to balance performance, durability, and cost-effectiveness, securing their leading market position.

The optical components application segment is projected to account for 32% of the market revenue share in 2025, establishing it as the largest application segment. Growth in this area has been supported by the rising need for precision components in infrared imaging, fiber optics, and laser systems. Chalcogenide glasses have been utilized for lenses, prisms, and fibers due to their superior transmission in the mid to far infrared range. Their ability to be molded or machined into complex optical geometries while maintaining clarity has made them indispensable in advanced optical manufacturing. The expansion of industries such as aerospace, defense, and industrial automation has further increased demand for these components. Enhanced processing technologies have improved consistency and reduced production costs, making optical components more accessible across multiple sectors The combination of technical performance and adaptability has reinforced the segment’s market leadership.

The defense and security segment is anticipated to hold 22% of the market revenue share in 2025, marking it as a key end-use industry. This prominence has been attributed to the critical role chalcogenide glasses play in infrared imaging systems, night vision devices, and thermal weapon sights. Their exceptional ability to perform in low-light and adverse weather conditions has strengthened their importance in military and surveillance applications. Investments in modernizing defense infrastructure across various countries have accelerated adoption rates. The material’s resilience against thermal shock and environmental stress ensures operational reliability in challenging field conditions. Furthermore, chalcogenide glasses have been integrated into advanced sensor systems that enhance situational awareness and decision-making in defense operations The ongoing emphasis on national security and border protection is expected to maintain strong demand, ensuring the segment’s sustained leadership in the market.

The chalcogenide glasses market is expanding, fueled by applications in infrared imaging, sensing, and photonics. Their role in defense, aerospace, medical imaging, and communication systems highlights their importance in advanced optical technologies. However, high manufacturing costs, processing difficulties, and raw material constraints remain key obstacles. Opportunities are emerging from fiber optics, nonlinear applications, and integration into automotive and industrial systems. Material innovations and regional adoption trends are reshaping the market, positioning chalcogenide glasses as a vital enabler of next-generation imaging, communication, and sensing technologies across multiple industries.

The chalcogenide glasses market is gaining momentum due to their unique optical properties, particularly in infrared transmission. These glasses are widely used in thermal imaging, night vision devices, spectroscopy, and optical sensors. Their ability to transmit infrared light makes them indispensable in defense, security, and aerospace applications, where precision and reliability are critical. Beyond defense, medical imaging and chemical sensing are emerging as important sectors driving adoption. Their compatibility with fiber-drawing processes also allows integration into specialized communication systems. As industries increasingly demand materials that can withstand challenging environments while maintaining optical performance, chalcogenide glasses are being positioned as a preferred choice. Their role in enabling advanced imaging, sensing, and monitoring technologies is expected to keep expanding as innovation pushes the boundaries of optical engineering across multiple high-tech industries.

Chalcogenide glasses face hurdles stemming from high production costs and technical challenges in processing. These glasses require carefully controlled conditions during synthesis to maintain purity and avoid structural defects, which increases manufacturing expenses. Their relatively soft mechanical nature makes them more prone to damage during handling and machining compared to traditional optical materials, adding further costs in polishing and shaping. Limited scalability in mass production restricts availability, while environmental sensitivity of certain compositions complicates storage and long-term durability. Furthermore, sourcing of raw materials such as selenium or tellurium can be inconsistent, leading to supply uncertainties. These limitations often prevent their widespread adoption in cost-sensitive industries, confining usage mainly to specialized sectors where performance advantages outweigh financial barriers. Overcoming these challenges through process optimization and material engineering remains a key priority for producers.

New opportunities for chalcogenide glasses are arising with the growth of emerging technologies requiring advanced optical performance. Their integration into mid-infrared photonics is paving the way for next-generation sensors and communication systems, especially in areas such as environmental monitoring and industrial process control. Advances in fiber optics are broadening applications in high-speed data transmission, with chalcogenide-based fibers supporting wavelengths beyond the range of conventional silica. Their nonlinear optical properties are also being leveraged for ultrafast lasers and signal processing systems. The rise of autonomous vehicles and advanced driver-assistance systems is creating additional potential, as thermal imaging and LiDAR demand high-performance optics. Collaborative R&D between research institutions and industry players is expanding the design space of chalcogenide materials, unlocking opportunities that align with broader technology shifts across photonics, communications, and sensing applications.

A notable trend shaping the chalcogenide glasses market is the emphasis on material innovation and region-specific adoption. Manufacturers are investing in new compositions that enhance durability, thermal stability, and optical performance, broadening the scope of applications. Integration with nanostructures and coatings is improving resilience, allowing for deployment in more demanding operational environments. Regionally, defense-driven demand dominates in North America and Europe, while Asia is witnessing growing adoption in consumer electronics and automotive imaging. Strategic collaborations between defense contractors, research labs, and optical firms are fueling innovation pipelines. Increasing interest from medical and environmental monitoring industries is also diversifying applications. The combination of advanced R&D efforts and growing cross-industry partnerships is expected to shape the trajectory of chalcogenide glasses, making them central to future innovations in optics and photonics technologies worldwide.

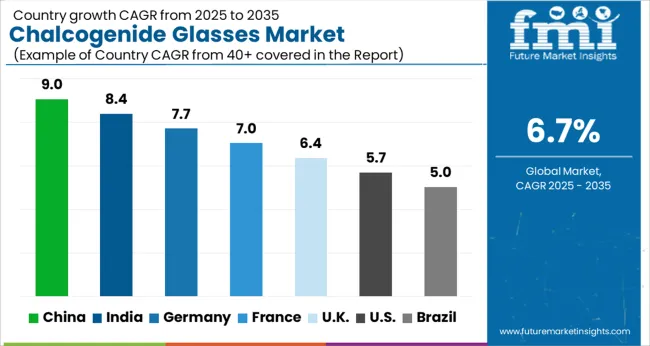

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

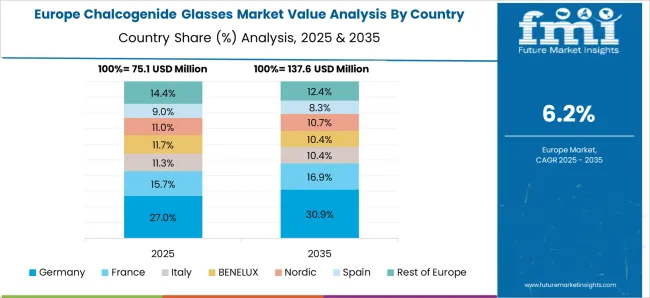

The global chalcogenide glasses market is projected to grow at a CAGR of 6.7% from 2025 to 2035. China leads with 9.0%, followed by India at 8.4% and Germany at 7.7%. The United Kingdom and the United States record growth rates of 6.4% and 5.7%, respectively. Market growth is being shaped by the rising demand for infrared technologies, photonics, and advanced optics across defense, telecommunications, and medical imaging sectors. Asia is the fastest-growing region due to large-scale investments and expanding applications, while Europe and the USA remain key hubs for innovation, research, and advanced product development. The analysis includes over 40+ countries, with the leading markets detailed below.

China is projected to lead the chalcogenide glasses market with a CAGR of 9.0% from 2025 to 2035. The growth is fueled by rising applications in photonics, infrared optics, and telecommunications. China’s significant investments in defense technologies, night-vision systems, and infrared imaging equipment create a large demand base for chalcogenide glasses. The domestic electronics and semiconductor industries are also driving adoption, with increased use of these materials in sensors and optical components. Research institutes and government-backed projects are supporting innovation in advanced glass formulations. Strong demand from both industrial and defense applications positions China as the fastest-growing market globally.

India’s chalcogenide glasses market is expected to grow at a CAGR of 8.4% between 2025 and 2035. Rising defense spending and investments in optical technologies are major contributors to demand. India’s expanding telecommunications sector is also creating opportunities, with chalcogenide glasses increasingly being used in fiber optics and infrared devices. Universities and R&D centers are focusing on new applications in medical imaging and sensor technologies, further driving adoption. The growth of India’s electronics manufacturing sector provides additional opportunities for suppliers of specialized glass materials. Collaborative projects with international technology firms are also enhancing market prospects.

Germany is projected to expand at a CAGR of 7.7% in the chalcogenide glasses market from 2025 to 2035. As a hub for advanced engineering and optics, Germany’s demand is centered on photonics, industrial lasers, and infrared systems. The country’s defense sector and precision manufacturing industries drive adoption of these materials in thermal imaging and advanced optical devices. Germany’s research ecosystem, including universities and corporate labs, is at the forefront of developing new formulations of chalcogenide glasses for high-tech applications. The strong presence of optical equipment manufacturers ensures steady integration of these materials into various end-use products.

The United Kingdom is forecast to grow at a CAGR of 6.4% in the chalcogenide glasses market between 2025 and 2035. Demand is supported by the country’s investments in defense, aerospace, and advanced optics. Infrared technologies and fiber optic applications are becoming critical drivers of growth. Universities and R&D facilities in the UK are playing a key role in discovering new uses for these materials, particularly in imaging and sensor technologies. Partnerships between defense contractors and optical material suppliers are strengthening supply chains. The UK is also witnessing increased interest in photonic applications, ensuring a steady demand trajectory.

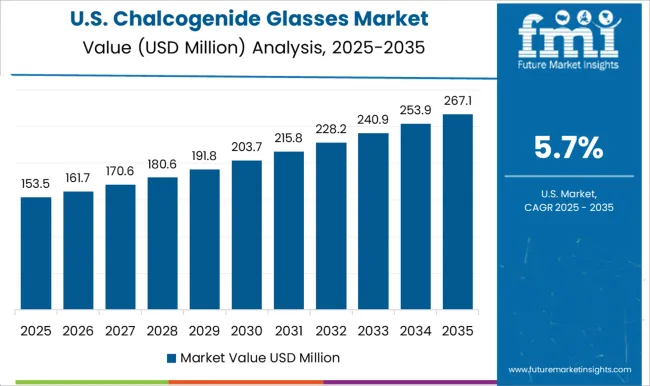

The United States is expected to grow at a CAGR of 5.7% between 2025 and 2035 in the chalcogenide glasses market. The demand is driven by advanced defense programs, aerospace projects, and a growing emphasis on infrared imaging technologies. USA companies are also investing in R&D to enhance the performance of optical materials used in sensors, medical devices, and photonics. The country’s strong electronics and semiconductor industries further support the adoption of chalcogenide glasses in specialized components. With defense modernization and continued innovation in imaging technologies, the USA is expected to remain a major market for these materials despite its relatively moderate growth rate compared to Asia.

In the chalcogenide glasses market, competition is shaped by expertise in infrared optics, precision manufacturing, and material innovation. AGC (Asahi Glass) focuses on advanced chalcogenide glass formulations designed for thermal imaging and sensing applications, offering strong optical transmission in the mid- and far-infrared spectrum. Amorphous Materials, Inc. competes as a specialized supplier of bulk chalcogenide glass and infrared transmitting materials, providing customized compositions for defense, aerospace, and industrial imaging. CNGE and Luoyang Dingming Optical Technology emphasize production scalability and affordability, targeting domestic demand in China and serving global customers seeking cost-effective infrared optics.

LTS Research Laboratories and IRradiance position themselves in niche markets, offering specialized chalcogenide glass products and research-grade materials that cater to laboratories and small-volume defense contracts. SCHOTT leverages its global reputation in specialty glass, providing chalcogenide materials integrated into its broader infrared optics portfolio, with emphasis on performance consistency and integration into thermal cameras and night-vision systems. Shape Optics Technologies and VITRON Spezialwerkstoffe compete by offering tailored chalcogenide glass solutions with precise refractive index control, ensuring high performance in medical imaging and sensor applications. Strategies across these players highlight innovation in glass composition, coatings, and scalable manufacturing.

AGC and SCHOTT invest in R&D to expand application range, while Amorphous Materials emphasizes custom formulations. Chinese manufacturers pursue aggressive pricing and regional expansion, whereas European firms focus on precision and specialty applications. Product brochures showcase chalcogenide glass blanks, precision lenses, windows, domes, and fibers, all designed for defense optics, industrial thermography, medical diagnostics, and environmental monitoring, underscoring the market’s reliance on high-performance infrared materials.

| Item | Value |

|---|---|

| Quantitative Units | USD 320.5 million |

| Type | Glasses, Antimony-Based Chalcogenide Glasses, Gallium-Based Chalcogenide Glasses, and Others |

| Application | Optical components, Fiber optics, Phase change memory devices, Photonic integrated circuits, Sensors and detectors, and Others |

| End Use Industry | Defense and security, Healthcare and medical, Industrial, Telecommunications, Electronics and semiconductor, Automotive, Energy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AGC (Asahi Glass), Amorphous Materials, Inc., CNGE / Nanjing CNGEIR Technology, Luoyang Dingming Optical Technology, LTS Research Laboratories / IRradiance (examples), SCHOTT, Shape Optics Technologies, VITRON Spezialwerkstoffe, and Others |

| Additional Attributes | Dollar sales by product type (bulk glass, preforms, optical components), application (infrared optics, thermal imaging, laser systems), and glass composition (arsenic-based, selenium-based, tellurium-based). Demand is driven by growing adoption of infrared and photonic technologies, aerospace instrumentation, and defense systems. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, fueled by increasing industrial applications, research initiatives, and investment in high-performance optical components. |

The global chalcogenide glasses market is estimated to be valued at USD 320.5 million in 2025.

The market size for the chalcogenide glasses market is projected to reach USD 613.1 million by 2035.

The chalcogenide glasses market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in chalcogenide glasses market are antimony-based chalcogenide glasses, gallium-based chalcogenide glasses, and others.

In terms of application, optical components segment to command 32.0% share in the chalcogenide glasses market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Glasses Market Size and Share Forecast Outlook 2025 to 2035

Sunglasses Market Growth, Trends and Forecast from 2025 to 2035

Sunglasses Pouch Market

Plano Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Metallic Glasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Glasses Market Growth – Trends & Forecast 2025 to 2035

Titanium Wire for Glasses Market Forecast Outlook 2025 to 2035

Augmented Reality Glasses Market Size and Share Forecast Outlook 2025 to 2035

Blue Light Blocking Glasses Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Blue Light Blocking Glasses Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA