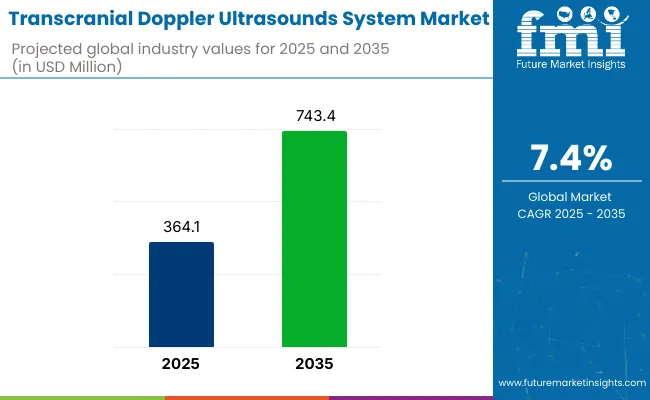

The Transcranial Doppler Ultrasounds System Market is anticipated to be valued at USD 364.1 million in 2025 and is expected to reach USD 743.4 million by 2035, registering a CAGR of 7.4%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 364.1 million |

| Industry Value (2035F) | USD 742.5 million |

| CAGR (2025 to 2035) | 7.4% |

This market is experiencing significant growth, driven by the increasing prevalence of cerebrovascular diseases and the demand for non-invasive diagnostic tools. Technological advancements, such as the integration of artificial intelligence and portable devices, are enhancing diagnostic accuracy and accessibility.

The shift towards outpatient and home-based diagnostic centers further propels market expansion. Future growth opportunities lie in the development of advanced imaging techniques and the expansion of healthcare infrastructure in emerging economies. The market's trajectory is supported by the rising need for precise, quick, and cost-effective diagnostic solutions in neurology.

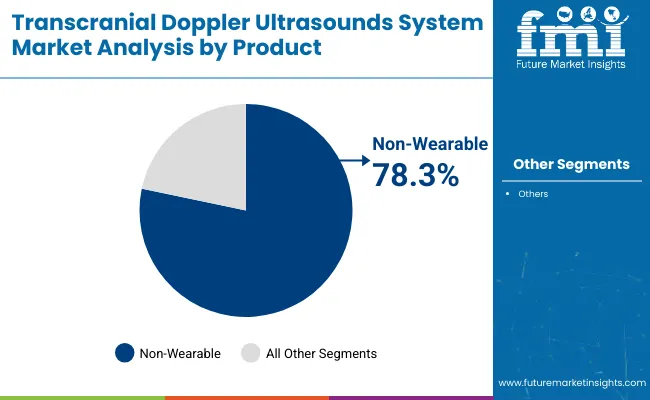

The non-wearable product type has been estimated to account for approximately 78.3% revenue share of the total market in 2025. This dominance has been attributed to the continued preference for fixed, console-based TCD systems in hospitals and imaging centers.

Superior diagnostic precision, along with their integration in high-dependency units such as neurocritical care, has played a crucial role in sustaining segmental leadership. The ability of these systems to deliver detailed cerebral hemodynamic assessments under controlled environments has made them indispensable.

Additionally, their compatibility with multi-channel probes and robotic-assisted scanning technologies has further solidified their usage in high-stakes diagnostic workflows. The reliability of non-wearable systems in acute stroke monitoring, traumatic brain injury evaluation, and intraoperative neuromonitoring has also supported their widespread adoption. While wearable technologies are emerging, regulatory approvals and clinical standardization continue to favor non-wearable devices in most neurology-focused facilities. These factors collectively have reinforced the stronghold of non-wearable TCD systems in the global market landscape.

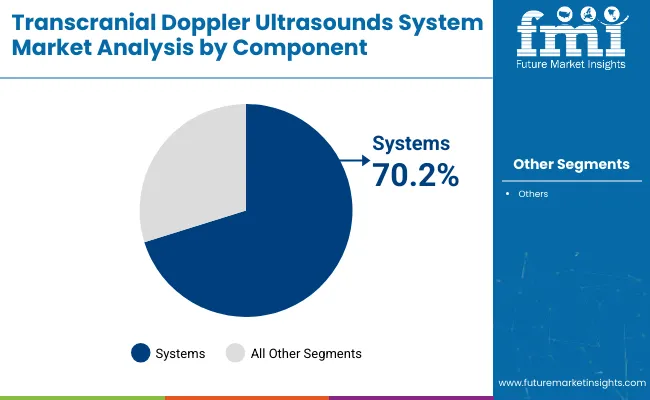

The System segment has been projected to capture around 70.2% of the total revenue share in 2025. This segment has remained dominant due to increasing demand for integrated, full-spectrum diagnostic platforms that combine signal acquisition, visualization, and cerebral hemodynamic analysis.

The expansion of AI-powered TCD systems capable of real-time analysis and pattern recognition has driven their adoption across neurology departments. Furthermore, the rising incidence of stroke, aneurysm, and cerebral vasospasm has mandated the use of high-performance systems capable of continuous monitoring. Hospital procurement trends have consistently favored full-system setups due to their compatibility with multi-probe arrays, robotic accessories, and advanced waveform interpretation modules.

The growth of this segment has also been enabled by strategic R&D investments by leading manufacturers into developing portable systems with integrated data connectivity, suitable for both ICU and OR environments. As such, the systems segment has emerged as the clinical backbone of modern transcranial monitoring workflows.

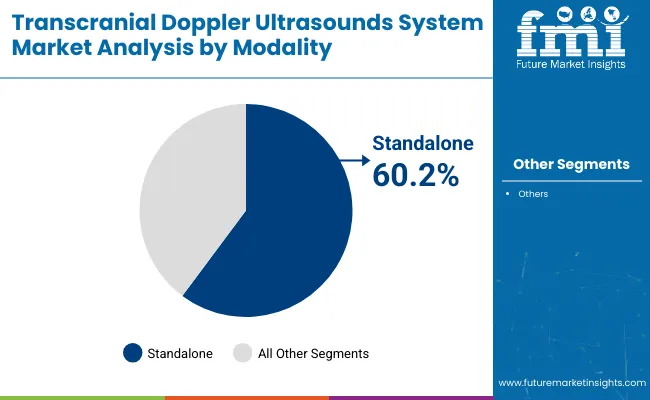

Stand Alone Units holds an estimated 60.2% market share in 2025, driven by its dedicated usage in neuro-intensive care units, stroke centers, and surgical monitoring environments. These devices have been favored for their high-throughput operation and integration with neuromonitoring protocols in institutional care settings.

Standalone systems have been designed to support continuous and precise measurement of cerebral blood velocity and autoregulation indices, which has been critical in acute care workflows. Unlike portable systems, standalone devices have typically offered enhanced signal fidelity, better thermal management, and compatibility with larger displays and data storage.

Their role in critical scenarios such as intraoperative monitoring and ICU-based stroke intervention has ensured consistent procurement by tertiary hospitals and specialty centers. In addition, a higher degree of customization and accessory integration has been facilitated in this modality, further reinforcing its relevance across major clinical applications. These operational advantages have led to the continued dominance of standalone systems.

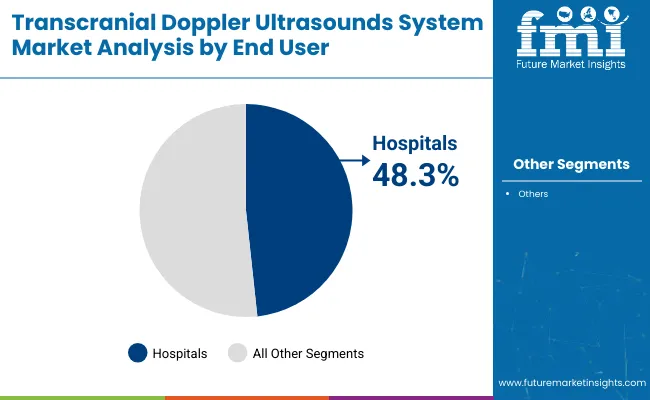

Hospital segment dominates with a maximum share of the market at 48.3% in 2025, attributed to its expansive role in both acute and preventive neurovascular diagnostics. Hospitals have remained the primary settings where transcranial Doppler ultrasound systems are deployed due to their ability to perform rapid, bedside assessments of cerebral blood flow in patients with trauma, stroke, or vasospasm. The use of TCD devices in emergency departments, ICUs, and neurosurgical units has been reinforced by institutional protocols emphasizing early diagnosis and intervention.

Furthermore, the availability of trained sonographers and integration with hospital IT infrastructure has made large-scale deployment of TCD systems feasible. Advanced TCD platforms with robotic probes and real-time waveform interpretation have been widely adopted in hospital settings, offering clinicians the ability to monitor hemodynamic fluctuations during surgical procedures or while managing critical neurological cases. The segment’s dominance has been further supported by high purchasing capacity, multidisciplinary utility, and insurance-driven diagnostic pathways.

Operator Skill Dependency, Limited Acoustic Windows, and Data Fragmentation Slowing Market Expansion

Despite the development of transcranial Doppler ultrasound systems, significant operational challenges remain in the market. One significant limitation is the high reliance on technologists to both accurately place probes as well as interpret real-time velocity waveforms-which allows results to be inconsistent across non-specialized or high-turnover clinical environments.

Significantly, however, due to the poor temporal bone acoustic windows in c. 10% of the adult population (especially in elderly or certain ethnic groups), vestibular testing can lack reliability and, thus, the principle of universality of application. In many countries, TCD data is siloed in proprietary information systems that are not interoperable with either hospital-wide imaging archives or neurovascular registries.

This fragmentation stymies longitudinal patient monitoring and restricts real-world data aggregation for clinical insights.” Moreover, the indeterminacy in reimbursement systems in various locations discourages smaller centers from venturing into TCD, particularly against other much more informative imaging techniques such as MRI or CT angiography.

Integration with Stroke Pathways, Continuous Bedside Monitoring, and Miniaturization of Systems Fueling Future Adoption

Clinical workflow changes align with an emerging transcranial Doppler ultrasound system market opportunity. One of the most exciting areas is the growing incorporation of the system into acute stroke pathways, where timely assessment of large vessel occlusion via TCD provides a time-sensitive, bedside, non-invasive triage tool particularly important in settings without immediate access to CT angiography.

Continuous bedside surveillance of cerebral autoregulation and vasospasm in neurocritical care units is additionally gaining traction, reflecting an evolution of the TCD’s role from single-use imaging to dynamic cerebrovascular management.

For ambulance, field hospitals and even military settings, now manufacturers are targeted on moving towards miniaturized devices which NSERC’s Kent Hillier explains, are lightweight, wireless and battery operated.

Such progression is driving a demand surge in prehospital and remote applications. As health systems evolve to prioritize portability and real-time neuromonitoring, TCD systems have begun positioning themselves in ways that go beyond diagnostics, embedding within the cerebral care pathway.

Market Outlook

The United States market for transcranial Doppler ultrasound equipment is growing strongly, driven by the expanding clinical application of non-invasive cerebral blood flow monitoring in stroke triage, TBI, and intensive care. Large stroke centers are incorporating TCD into formalized stroke protocols, and mobile stroke units with portable Doppler systems are spreading state to state.

Post-concussion surveillance demand is also growing in sports neurology. As AI-driven diagnostic interpretation is becoming of interest to the FDA, local manufacturers and educational institutions are expediting TCD-based innovations in brain perfusion mapping.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.6% |

Market Outlook

India's transcranial Doppler ultrasound system market is developing gradually, propelled by the increasing cerebrovascular disease burden and the demand for low-cost, portable neurodiagnostics in urban and rural environments. Public and private tertiary care hospitals are adopting TCD for stroke risk stratification, especially among patients with diabetes and hypertension.

The market is also gaining momentum in pediatric neurology for stroke screening in sickle cell disease. Local production of simplified Doppler units with regional-language user interfaces is improving access in non-metro clinics.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 7.6% |

Market Outlook

Germany is a mature and innovation-focused transcranial Doppler ultrasound system market, with extensive integration into neurovascular monitoring protocols. Stroke centers and university hospitals utilize TCD for real-time monitoring of cerebral emboli, vasospasm, and autoregulation as part of routine clinical practice.

The market enjoys organized clinical pathways, favorable reimbursement, and research institution-device manufacturer collaboration to try next-generation Doppler imaging modules. Robust regulatory requirements and early adoption of AI help foster continuous system optimization.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.3% |

Market Outlook

China's transcranial doppler ultrasound system market is growing at a breakneck pace, driven by intensive investments in stroke prevention infrastructure and early detection initiatives. TCD systems are spread across provincial stroke centers and community health centers, particularly for high-risk groups.

Domestic players are designing miniature, AI-capable Doppler devices for high-volume screening applications, while government healthcare technology policies remain supportive of rural stroke network adoption. Integration with mobile health (mHealth) platforms for cerebral blood flow monitoring is a new trend.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 7.0% |

Market Outlook

Brazil's transcranial Doppler ultrasound system market is picking up pace, especially within public hospitals and academic neurology divisions, as non-invasive monitoring takes center stage in stroke care and neurovascular research.

There is increasing recognition of TCD's value in the detection of intracranial stenosis and embolic signals, particularly within risk groups for sickle cell anemia and other inherited diseases. The market is also enhanced through collaborations between international suppliers and local distributors, enabling access to battery- and mobile-powered systems in disadvantaged regions.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.9% |

The transcranial Doppler ultrasound systems market is booming at a high rate owing to rising awareness regarding cerebrovascular diseases, increase in geriatric population and continuous developments in diagnostic technology. Such systems are crucial for evaluating cerebral hemodynamics and monitoring diseases, such as stroke, stroke, traumatic brain injury (TBI) and vascular disorders.

Hospitals, (Emergency) departments and specialized neuroclinics are the major end-users of the TCD system and seek for efficient, non-invasive diagnostic systems. The competition in the industry consists of a mixture of well-established diagnostic equipment vendors, that have existed for several decades, as well as those that are newer entrants, that provide novel solutions such as devices for portability, AI-powered analyses, and high-accuracy systems for real-time monitoring.

Key Developments

In 2025, NeuraSignal is excited to announce a new study by Dr. Thomas Devlin's team, featured at ISC 2025. It demonstrates how NeuraSignal’s robot-assisted transcranial Doppler (raTCD) outperforms traditional methods in detecting right-to-left shunts (RLS) and patent foramen ovale (PFO), key contributors to cryptogenic stroke.

In 2024, University of California San Diego have developed a revolutionary wearable ultrasound patch for continuous, non-invasive brain blood flow monitoring. Worn on the temple, this soft, stretchy patch provides 3D cerebral blood flow data, a first for wearable tech. It significantly advances beyond operator-dependent transcranial Doppler ultrasound, offering a consistent, comfortable solution for long-term clinical use.

The overall market size for transcranial doppler ultrasounds system market was USD 364.1 million in 2025.

The transcranial doppler ultrasounds system market is expected to reach USD 742.5 million in 2035.

AI integration in transcranial Doppler systems is enhancing diagnostic accuracy for stroke and vascular conditions.

The top key players that drives the development of transcranial doppler ultrasounds system market are Natus Medical Incorporated, Interacoustics A/S (Demant), GN Otometrics, Neural Analytics and Micromedical Technologies

Non-wearable is expected to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transcranial Doppler Devices Market

Repetitive Transcranial Magnetic Stimulation Market Size and Share Forecast Outlook 2025 to 2035

Cranial Doppler Market

Utrasound Doppler Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

X-ray System Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA