The contrast-enhanced ultrasound market is expected to remain steadily growing from 2025 to 2035 due to the increasing demand for non-invasive, radiation-free diagnostic imaging, awareness of the advantages of CEUS, and the applications seen in oncology, cardiology, and vascular imaging. CEUS uses gas-filled microbubble contrast agents to enhance the reflection of ultrasound signals, improving visualization of blood flowing and tissue vascularization, thus avoiding risks related to ionizing radiation.

The market is further supported by technological advancements in ultrasound systems, increased safety and cost-effectiveness compared to CT and MRI, and wider acceptance in outpatient and critical care settings. Clinical guidelines are also evolving to support CEUS in liver lesion characterization, kidney imaging, and pediatric assessments.

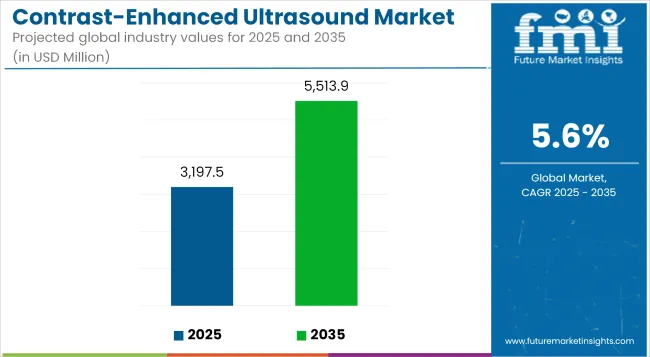

The contrast-enhanced ultrasound market is projected to grow at a CAGR of 5.6%, rising from USD 3,197.5 million in 2025 to approximately USD 5,513.9 million by 2035.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3,197.5 Million |

| Projected Market Size in 2035 | USD 5,513.9 Million |

| CAGR (2025 to 2035) | 5.6% |

North America also features some special aspects driving the market growth of CEUS, such as the installed imaging infrastructure, early users of ultrasound devices, and the latest trend towards less costly and safer methods of diagnosis. According to the WHO, over 20 million imaging studies of the liver are conducted annually in the USA, and CEUS has become the first-choice imaging agent for the characterization of hepatic lesions widely embraced by most.

The European market is largely supported by favorable regulations pertaining to CEUS contrast agents, shared use in teaching hospitals, and comprehensive training programs. Europe's elderly and chronic disease population on the increase should be favorable to radiation-free alternative diagnostic modalities like CEUS in public health systems, as per WHO.

Asia-Pacific region is the fastest-growing region due to rapid progress in the healthcare delivery system and rising incidence of cancer and extensive use of point-of-care ultrasound. As the UN indicated that more than 70 percent of the global burden for hepatocellular carcinoma is found in the Asia-Pacific region, it definitely makes the use of CEUS in liver cancer diagnosis and treatment monitoring a requirement.

Limited awareness, reimbursement gaps, and regulatory variation

Despite evident clinical benefit, CEUS acceptance remains compromised in some regions due to a lack of awareness among clinicians and Radiologists. Also, reimbursement regulations diverge significantly, impacting accessibility and commercial development. The regulatory approach to the microbubble agents is also not yet completely harmonized globally.

WHO suggests that intensified education and the presence of international clinical guidelines to acknowledge CEUS to enforce a standardized protocol will increase worldwide application in place of radiation-based imaging alternatives.

Outpatient imaging, pediatrics, and real-time vascular assessment

CEUS creates expanding opportunities in the area of ambulatory care, critical care, and emergency use. Particularly when used in children and renal imaging, it can be precious in minimizing exposure to radiation. CEUS would also be coroneted with real-time procedural guidance, such as biopsy targeting, ablative therapy monitoring, and contrast-enhanced Doppler studies. As stated by WHO, CEUS plays a growing role in improving diagnostic equity, especially low-resource settings where MRI or CT visibility is limited.

From 2020 to 2024, CEUS was growing beyond the university into the community hospitals and outpatient clinics. In this way, CEUS utility during the COVID-19 pandemic- portable bedside imaging with minimum exposure- helped increase use in critical care and cardiopulmonary evaluations.

The market will evolve with intelligent contrast agents, AI-assisted real-time interpretation, and therapeutic applications guided by CEUS, all set between 2025 and 2035. Portable ultrasound systems and CEUS would synergize their benefits for remote diagnostics, tele-imaging, and initiatives with global health.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Expansion of CEUS agent approvals in select countries |

| Consumer Trends | Increased preference for radiation-free diagnostics |

| Industry Adoption | Specialty clinics and academic hospitals |

| Supply Chain and Sourcing | Centralized production of contrast agents |

| Market Competition | Dominated by global ultrasound system manufacturers |

| Market Growth Drivers | Liver imaging and cardiac diagnostics |

| Sustainability and Impact | Low power and no radiation exposure |

| Smart Technology Integration | Manual interpretation and standard contrast timing |

| Sensorial Innovation | Basic grayscale imaging enhanced by contrast bubbles |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global harmonization of CEUS safety and diagnostic indication guidelines |

| Consumer Trends | Personalized CEUS protocols and home-based liver and kidney monitoring |

| Industry Adoption | Broader use in ambulatory centers, pediatrics, and home health networks |

| Supply Chain and Sourcing | Rise of localized microbubble production and portable ultrasound kits |

| Market Competition | Entry of biotech firms and smart agent developers |

| Market Growth Drivers | Cancer surveillance, pediatric care, and renal function imaging |

| Sustainability and Impact | Eco-friendly imaging tools for global diagnostics |

| Smart Technology Integration | AI-assisted signal interpretation and real-time perfusion analytics |

| Sensorial Innovation | Real-time microvascular visualization and smart contrast control systems |

Gradually expanding, the CEUS (contrast-enhanced ultrasound) market in the USA for liver imaging, cardiac diagnostics, and oncology is increasingly gaining attention as a safer, radiation-free alternative to CT and MRI in patients with renal insufficiency.

OECD states that USA health systems are adopting CEUS with liver lesion characterization, trauma assessment, and pediatric imaging mainly due to cost-effectiveness and rapid turnaround time. By New Microbubble Agents, regulatory approvals, and increased use for point-of-care diagnosis, market growth is being further propelled.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

In the UK NHS hospitals, CEUS is quickly taking off for liver cancer surveillance along with vascular imaging and renal mass evaluation. NICE clinical guidelines describe situations that CEUS will be used for and encourage the use of cheaper or less invasive imaging modalities wherever possible.

According to OECD, the country is fast-tracking their diagnostics and imaging efforts to complement ultrasonography by widening usage of contrast agents in primary and secondary settings. Educational programs and specialized CEUS training help boost uptake by the public.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

The market for contrast-enhanced ultrasound in the EU is seeing steady growth because countries have adopted it for use in diagnostic radiology and interventional procedures. Among the frontrunners in CEUS use for hepatology, urology, and cardiology are Germany, France, and Italy.

As per UN, the EU stands strong in favor of radiation-free diagnostic technologies and personalized medicine, giving wings to CEUS in several clinical settings. Advances in formulations and platforms for contrast agents and ultrasound imaging continue to drive market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.6% |

In Japan, market for CEUS has been developing mainly due to strong applications in hepatocellular carcinoma (HCC) monitoring and cardiovascular diagnostics. Hospitals extensively employ CEUS to evaluate liver nodules in patients, especially those afflicted with chronic liver disease.

The application states that CEUS is to be integrated into national cancer screening programs and routine clinical workflows by the Ministry of Health. Specialists in imaging are also working in Japan on developing dual-mode ultrasound systems that improve contrast visualization, which will further technologically promote this market segment.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

The CEUS market in South Korea is quickly growing. This growth is mostly due to the available advanced ultrasound infrastructure and the growing interest in early cancer detection. Besides, CEUS benefit real-time lesion characterization in hepatology and nephrology, and it is being used post-transplant monitoring very much.

OECD quotes South Korea adopting improved ultrasound methods due to the rapid transformation of digital health and diagnostic innovations. Local manufacturers are also busy developing contrast agents, making their costs lower and availability possible in the local market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The contrast-enhanced ultrasound (CEUS) market is expanding in a gradual uptick as healthcare providers are looking for advanced imaging solutions that can visualize real time and with no ionizing radiation. CEUS embraces the use of microbubble contrast agents to amplify ultrasound imaging by showing blood flow and vascularity of tissue in brilliant detail.

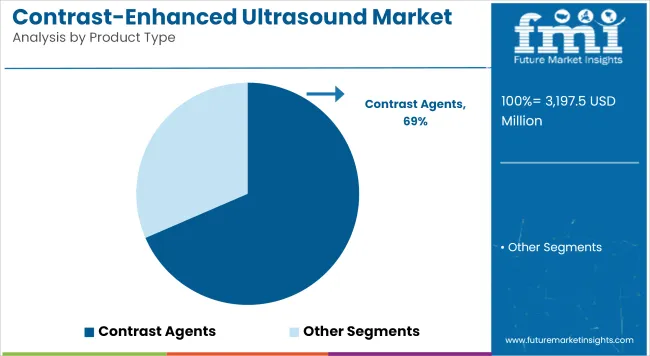

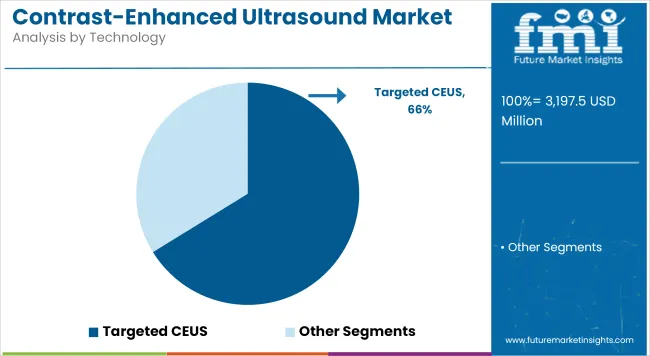

In fact, in product type and technology segmentation, microbubbles, ultrasound contrast agents, and targeted CEUS dominate the global market share owing to their efficacy, safety profile, and alignment with precision medicine initiatives hence improving diagnostic accuracy facilitating early disease detection, and endowing personalized patient care.

Increased demand for non-invasive and cost-effective diagnostic instruments has driven utilization of contrast agents in targeted CEUS applications, lending strength to the further advancing medical imaging and patient outcomes.

Contrast agents dominate product use due to their safety, real-time imaging capabilities, and compatibility with various ultrasound systems

| Product Type | Market Share (2025) |

|---|---|

| Contrast Agents | 68.5% |

Contrast agents lead the contrast-enhanced ultrasound market by providing enhanced visualization of blood flow and tissue perfusion. Safety, tolerability, and lack of exposure to ionizing radiation characterize microbubble-based agents and they are therefore applicable to virtually any type of patients, including patients with renal impairment.

By contrast agents, the realization of improved diagnostic confidence in a variety of clinical situations liver lesion characterization, cardiac imaging, and vascular assessment for example, is enhanced with the incorporation of these agents into routine ultrasound studies, which then greatly improves the diagnostic usefulness of ultrasound within several specialties.

Targeted CEUS dominates technology use due to its molecular imaging capabilities, enabling precise disease characterization and monitoring

| Technology | Market Share (2025) |

|---|---|

| Targeted CEUS | 66.2% |

Targeted contrast-enhanced ultrasound represents the largest technology segment in the market, driven by its capability to bind contrast agents to specific molecular markers, thus making it possible to visualize certain disease processes at the molecular level. This technology enhances the specificity of ultrasound imaging, which in turn allows for the early detection and monitoring of diseases like cancer and inflammatory conditions.

The continuing development and research further bolster the preference for targeted CEUS, broadening the applicability of the modality within the clinical setting. As personalized medicine evolves, targeted CEUS does promise to join other future modalities for molecular imaging that are non-invasive and real-time.

Gradually evolving with the increasing acceptance of noninvasive imaging procedures that offer real-time vascular and tissue characterization without any radiation is the driving force behind the CEUS market. CEUS uses microbubble contrast agents to enhance the visualization of blood flow, perfusion, and organ structure, especially for liver, cardiac, and renal purposes.

It is increasingly becoming the choice for both clinical and research setting in mapping tumor detection, monitoring inflammation, and assessing drug response. Increased adoption could also be boosted by developments in portable ultrasound systems, AI integration, and regulatory expansion of contrast agent indications.

According to WHO, CEUS and other non-ionizing imaging diagnostics provide a safer alternative for said imaging among vulnerable populations, particularly children and patients requiring frequent scans.

Market Share Analysis by Key Players & CEUS Technology Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Bracco Imaging S.p.A. | 14-17% |

| GE HealthCare | 11-14% |

| Siemens Healthineers | 9-12% |

| Canon Medical Systems Corp. | 7-10% |

| Lantheus Holdings, Inc. | 6-9% |

| Other Providers | 38-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bracco Imaging S.p.A. | In 2024, expanded SonoVue® indications to include pediatric liver lesion evaluation in Europe in 2025, developed real-time CEUS quantification tools integrated into radiology workflows. |

| GE HealthCare | In 2024, launched LOGIQ ultrasound system upgrades with enhanced contrast agent sensitivity in 2025, introduced AI-supported contrast wash-in/wash-out analysis for oncology. |

| Siemens Healthineers | In 2024, added CEUS modules to ACUSON Sequoia platform for organ perfusion studies in 2025, improved liver lesion characterization using contrast pulse sequencing. |

| Canon Medical Systems Corp. | In 2024, released Aplioi-series enhancements with expanded contrast perfusion imaging in 2025, introduced software packages for contrast agent tracking in abdominal diagnostics. |

| Lantheus Holdings, Inc. | In 2024, advanced clinical trials for microbubble agents in myocardial perfusion imaging in 2025, partnered with AI developers for next-gen CEUS quantitation algorithms. |

Key Market Insights

Bracco Imaging S.p.A. (14-17%)

Bracco is a global leader in ultrasound contrast agent development with its flagship SonoVue® (Lumason® in the USA). The company supports clinical and research applications in hepatology, cardiology, and pediatric imaging, and offers extensive training and post-market surveillance. According to WHO, contrast agents for ultrasound are safe, well-tolerated, and highly effective for real-time diagnostic imaging in diverse populations.

GE HealthCare (11-14%)

GE HealthCare integrates CEUS functionality into its LOGIQ and Vivid ultrasound platforms, supporting vascular diagnostics, oncology, and interventional procedures. The company emphasizes real-time contrast imaging with AI-enabled assessment tools. According to UN, diagnostic imaging systems with built-in contrast support improve efficiency and broaden access to advanced diagnostics in outpatient and rural settings.

Siemens Healthineers (9-12%)

Siemens provides CEUS-compatible imaging solutions across its ACUSON series. Its technologies focus on microvascular imaging, lesion characterization, and contrast-mode optimization for general imaging and specialty applications. According to OECD, high-performance imaging tools that reduce dependence on CT and MRI contribute to cost-effective diagnostic strategies.

Canon Medical Systems Corp. (7-10%)

Canon offers contrast imaging across its Aplio systems, with capabilities for detailed perfusion tracking and quantitative analysis. Its CEUS tools are commonly used in abdominal, cardiac, and urological evaluations. According to WHO, using contrast ultrasound in organ diagnostics reduces procedural burden and enables more frequent monitoring of chronic conditions.

Lantheus Holdings, Inc. (6-9%)

Lantheus is developing microbubble-based contrast agents for advanced applications in cardiac perfusion and oncology. It is focused on next-generation CEUS agents and partnerships that expand clinical use beyond liver imaging. According to World Bank Report, investment in new contrast agent indications enhances diagnostic reach in both developed and emerging healthcare systems.

Other Key Players (38-45% Combined)

Numerous companies are contributing to CEUS market expansion through contrast agent development, equipment integration, and clinical support services:

The overall market size for the contrast-enhanced ultrasound market was approximately USD 3,197.5 million in 2025.

The contrast-enhanced ultrasound market is expected to reach approximately USD 5,513.9 million by 2035.

The demand for contrast-enhanced ultrasound (CEUS) is rising due to the increasing prevalence of cardiovascular and gastrointestinal diseases, the introduction of affordable contrast agents, and the integration of contrast imaging modes into ultrasound systems.

The top 5 countries driving the development of the contrast-enhanced ultrasound market are the United States, Germany, China, Japan, and the United Kingdom.

Contrast agents and targeted CEUS technology are expected to command significant shares over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultrasound Conductivity Gels Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Skin Tightening Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound-Guided Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Systems Market Growth – Trends & Forecast 2025-2035

Ultrasound Imaging Solution Market

Teleultrasound Systems Market

Food Ultrasound Market Analysis – Applications & Innovations 2025 to 2035

Micro-Ultrasound Systems Market

Cardiac Ultrasound Systems Market - Trends & Forecast 2025 to 2035

Focused Ultrasound System Market Trends and Forecast 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Portable Ultrasound Bladder Scanner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wireless Ultrasound Scanner Market

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Endoscopic Ultrasound Needles Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Ultrasound Scanner Market Growth - Trends & Forecast 2025 to 2035

Anesthesia Ultrasound Systems Market Analysis – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA