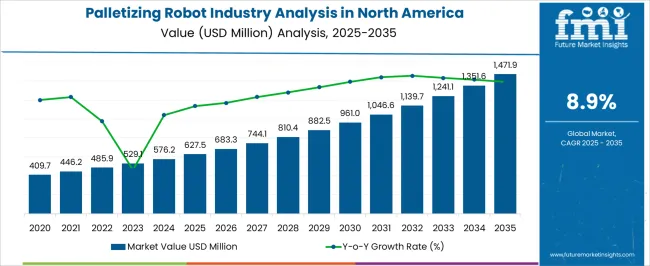

The Palletizing Robot Industry Analysis in North America is estimated to be valued at USD 627.5 million in 2025 and is projected to reach USD 1471.9 million by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

The Palletizing Robot industry in North America is witnessing robust growth, driven by the increasing demand for automation in logistics, warehousing, and manufacturing operations. The adoption of robotic solutions is being accelerated by the need to enhance operational efficiency, reduce labor costs, and improve workplace safety in material handling processes. Advancements in robotic technologies, including precision control, sensor integration, and AI-based path optimization, are enabling robots to handle complex palletizing tasks with high accuracy and repeatability.

The growth of e-commerce and rising consumer expectations for faster delivery times are further fueling the demand for palletizing robots across distribution centers. Investments in smart manufacturing, Industry 4.0 initiatives, and automated warehouses are creating opportunities for scalable and flexible robotic systems.

North America’s emphasis on technological innovation, regulatory compliance, and operational efficiency continues to drive market expansion As organizations seek to optimize supply chain processes while minimizing errors and downtime, palletizing robots are expected to remain a critical component in the region’s industrial automation ecosystem.

| Metric | Value |

|---|---|

| Palletizing Robot Industry Analysis in North America Estimated Value in (2025 E) | USD 627.5 million |

| Palletizing Robot Industry Analysis in North America Forecast Value in (2035 F) | USD 1471.9 million |

| Forecast CAGR (2025 to 2035) | 8.9% |

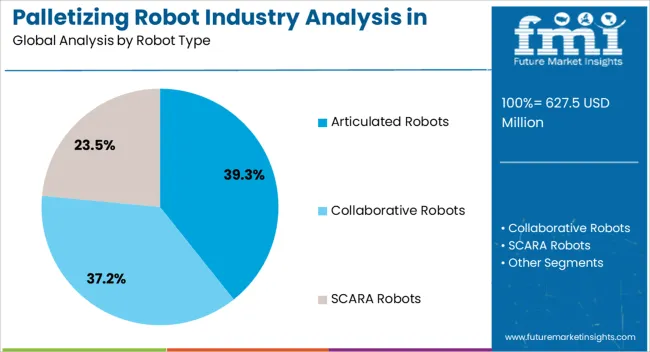

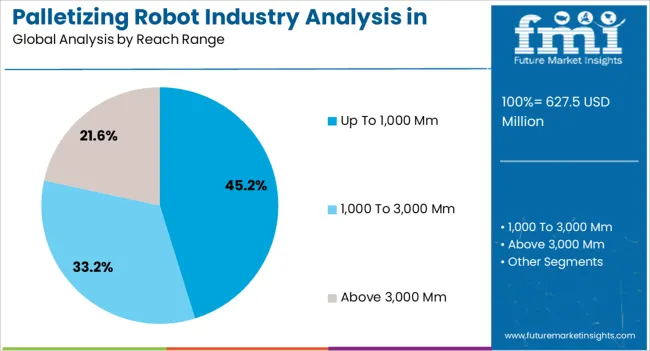

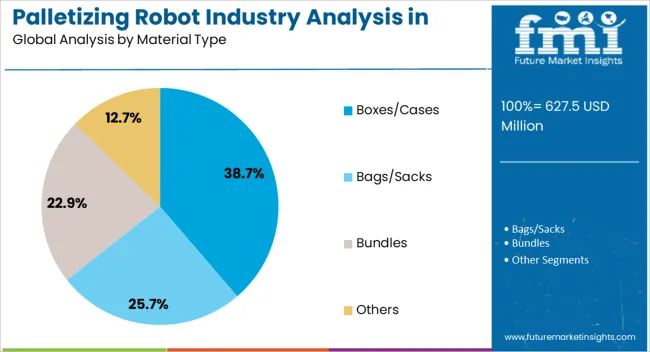

The market is segmented by Robot Type, Reach Range, Material Type, and End-Use and region. By Robot Type, the market is divided into Articulated Robots, Collaborative Robots, SCARA Robots, Delta Robots, and Gantry Robots. In terms of Reach Range, the market is classified into Up To 1,000 Mm, 1,000 To 3,000 Mm, and Above 3,000 Mm. Based on Material Type, the market is segmented into Boxes/Cases, Bags/Sacks, Bundles, and Others. By End-Use, the market is divided into Warehousing & Logistics and Manufacturing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The articulated robots segment is projected to hold 39.3% of the market revenue in 2025, establishing it as the leading robot type in North America. Growth in this segment is driven by the versatility and flexibility offered by articulated designs, which allow multi-axis movement and precise handling of various payloads. These robots can be adapted for a wide range of palletizing tasks, accommodating different product sizes and configurations.

The capability to integrate advanced vision systems and AI-based controls enhances operational efficiency and reduces cycle times, making articulated robots a preferred choice for high-volume distribution centers and manufacturing plants. Their adaptability to evolving production layouts and rapid deployment in automated lines further supports adoption.

Continuous advancements in robotic software, end-of-arm tooling, and safety features have reinforced reliability and ease of integration As industries increasingly prioritize automation, the articulated robot segment is expected to maintain its leadership, driven by its performance, scalability, and alignment with smart manufacturing initiatives.

The up to 1,000 mm reach range segment is expected to hold 45.2% of the market revenue in 2025, making it the leading category for reach. Growth in this segment is being driven by the prevalence of compact palletizing applications in warehouses, manufacturing plants, and distribution centers, where space optimization and precise handling are critical. Robots within this reach range provide a balance between flexibility and operational efficiency, enabling effective stacking of products while minimizing floor space usage.

Integration with automated conveyors, vision-guided systems, and AI-based controls enhances precision and reduces error rates. This reach range is particularly suitable for handling standard-sized packages, cases, and boxes without requiring extensive modifications to production layouts.

Rising adoption of automated material handling solutions, coupled with the need for higher throughput and reduced labor dependency, is further supporting growth As companies continue to optimize warehouse operations and improve productivity, the up to 1,000 mm reach range segment is expected to remain the most widely deployed and revenue-generating category in North America.

The boxes and cases material type segment is projected to hold 38.7% of the market revenue in 2025, establishing it as the leading material category. Growth is being driven by the widespread use of packaged goods in logistics, food and beverage, and consumer product industries, which necessitates efficient handling and stacking of standardized boxes and cases. Palletizing robots designed for this material type offer precision in stacking, reduced product damage, and high-speed operation, enhancing overall throughput.

Integration with automated sorting, conveyor systems, and vision-based guidance allows robots to adapt to variations in package size, weight, and orientation. The growing e-commerce and retail distribution sectors are contributing to increased demand for reliable palletizing solutions tailored for boxes and cases.

Operational cost savings, enhanced safety by reducing manual handling, and scalability for high-volume applications are further supporting adoption As industries focus on automation to meet growing supply chain demands, the boxes and cases segment is expected to remain the dominant material type in the North American palletizing robot market.

Revenue to Rise over 2.3X through 2035

Palletizing robot revenue in North America is forecast to surge over 2.3X through 2035, amid a 5.2% spike in future CAGR compared to the historical one. This is attributable to high adoption of automation and robotics across manufacturing, logistics, and e-commerce sectors.

Sales of palletizing robots across North America are picking up pace as industries look to automate their palletizing tasks to enhance efficiency and productivity. The escalating labor costs are also compelling the implementation of automation solutions, including palletizing robots.

United States to Remain at the Epicenter of Sales Growth

As per the latest analysis, the United States will emerge as the frontrunner, in terms of palletizing robots adoption. It is set to hold around 66.8% of the North America palletizing robot industry share in 2035.

The United States has a highly developed manufacturing sector that emphasizes automation as well as innovation. This positively influences palletizing robot sales in the nation, and the trend will persist through 2035 as companies embrace automation.

By streamlining the palletizing process, palletizing robots help reduce labor costs, increase throughput, and improve operational efficiency. Further, a strong research and development (R&D) system is in place within the United States, resulting in better technology for robotic palletizers over time.

The continuous improvement ensures that the United States-based producers remain competitive by attracting both local and foreign customers looking for innovative automation systems. Therefore, due to its vastness and scope, it’s no wonder that the United States has an insatiable thirst for automated packaging, such as palletizing machines.

Articulated Robots Becoming Go-to Solutions for Firms

Articulated robots are forecast to dominate the North America industry, holding a volume share of about 37.1% in 2025. This is attributable to rising adoption of these robots across several industries of palletizing tasks.

When it comes to a variety of industries, articulated robots are ideal for different palletizing jobs. Because of this efficiency, they are extensively utilized by companies that need convenient automation solutions.

The improved performance and reliability due to technological advancements in design and functionality of articulated robots also fuel their adoption. The enhancements include enhanced precision, speed, and payload capacity that allow articulated robots to deal with various palletizing requirements effectively.

Increased productivity and cost-efficiency needs in sectors like manufacturing, logistics, and e-commerce push higher demand for articulated palletizers in North America. In response, manufacturers are developing articulated robots that conduct high-speed, precise palletizing, boosting operational capabilities and reducing wage bills.

The NA palletizing robot sector is surging due to several important factors. The region's strong manufacturing industry is the main driver, and automation technology use is also on the rise.

Palletizing robot demand is growing as enterprises look to increase efficiency, save labor costs, and improve output. The industry's expansion is also fueled by the requirement for adaptable manufacturing lines and the capacity to meet shifting consumer expectations.

Palletizing robot adoption is also significantly influenced by North America's innovation ecosystem and technical breakthroughs. As companies look for innovative ways to stay competitive, they are increasingly embracing automation, including the usage of robots.

Palletizing robots in North America are also evolving. Modern robots can handle hard tasks faster due to AI and machine learning. Cobots or collaborative robots are gaining immense traction. They help palletizing become efficient and safe.

Cobots enable secure, efficient palletizing with human oversight. Data-driven cloud solutions optimize and maintain palletizing operations. Growing fame of these advanced palletizing robots will boost the North America palletizing robot industry growth.

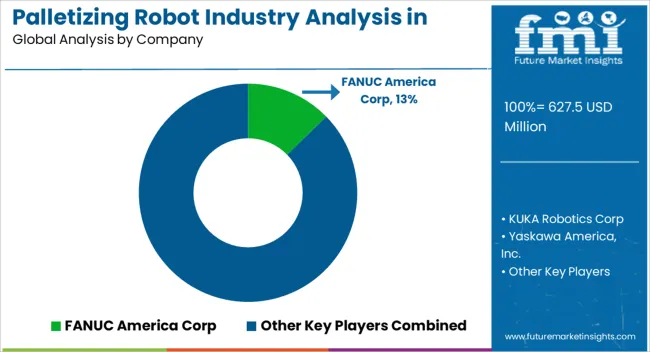

KUKA Robotics Corp., Yaskawa, Fanuc, ABB, and Universal Robotics Co. Ltd. are the key palletizing robot manufacturers empowering industries with cutting-edge instruments. They are constantly innovating to offer novel palletizing robots to their clients.

Integration of cutting-edge technologies in machines ensures heightened precision, durability, and stability during the lifting processes. Manufacturers are consistently pushing the boundaries of innovation, introducing advanced features such as increased power capacities, improved beam quality, and enhanced automation capabilities.

Robot developers focus on refining designs to withstand demanding industrial conditions. They are offering solutions with features like real-time monitoring, adaptive control systems, and seamless integration into automated manufacturing setups.

With innovative trends like AI integration and cobots shaping the industry's trajectory, the future holds opportunities for further expansion. Therefore, a robust CAGR has been predicted for the target industry through 2035.

Palletizing robot sales in North America grew at a CAGR of 3.7% between 2020 and 2025. Total revenue in the region reached about USD 627.5 million in 2025. From 2025 to 2035, demand for palletizing robots in the region is forecast to rise at a CAGR of 8.9%.

| Historical CAGR (2020 to 2025) | 3.7% |

|---|---|

| Forecast CAGR (2025 to 2035) | 8.9% |

The North America palletizing robot industry witnessed moderate growth between 2020 and 2025. This was due to increased awareness of the benefits of using palletizing robots for optimizing processes and reducing manual error.

The COVID-19 pandemic created immense demand for ventilators, diagnostics tools, and other medical equipment. This prompted pharmaceutical and medical devices manufacturers to install automatic solutions like palletizing robots.

Future Outlook for Palletizing Robot Solutions in North America

In the next decade, high adoption of automation and a shift towards smart manufacturing practices will provide impetus for sales growth. Similarly, continual advances in robotic technologies and integration with automation and Industry 4.0 practices, coupled with a focus on sustainability, may further fuel industry expansion.

Rapid Growth of the E-commerce Industry

Efficient palletizing solutions have become in high demand as a result of the growth of e-commerce. The volume of orders placed through online shopping has risen significantly, necessitating more flexible palletizing processes.

Palletizing robots with advanced automation capabilities are needed to fulfill the changing demands of the e-commerce sector. The effective palletizing system improves efficiency in the warehouse and accelerates the fulfillment of orders. This pattern emphasizes the significance of palletizing robots to e-commerce enterprises' need for flexibility and efficiency.

Companies' landscape has drastically changed due to the e-commerce industry's relentless growth. Electronic commerce is growing at a rapid pace, posing both new opportunities and challenges for companies.

The efficiency and accessibility of the Internet are posing a challenge to traditional marketing channels as customers come to appreciate the convenience of the Internet. This change in perspective has increased demand for cutting-edge technologies like robotic pelletizing devices.

Automation system offers a flexible strategy for inventory management and collection, catering to the growing requirements of e-commerce warehouses. Companies can use robotics to increase production, decrease errors, increase efficiency, and expedite order fulfillment. The e-commerce sector's explosive expansion spurs the use of cutting-edge technology like robotic palletizing equipment.

Escalating Demand for Eco-friendly and Energy-efficient Palletizing Robots

Surging demand for eco-friendly and energy-efficient palletizing robots is transforming the industrial automation landscape. As environmental sustainability takes center stage, organizations increasingly prioritize robotic solutions that align with eco-conscious practices.

As environmental sustainability becomes increasingly important, companies are giving higher priority to robotic solutions that are compatible with environmentally conscious practices. These are fueled by increased awareness of the impact of industrial activities on the environment and a commitment to reduce emissions.

Robots designed to be energy efficient not only contribute to cost savings but also affect a broader corporate responsibility to mitigate climate change. As a result, companies are constantly seeking eco-friendly and energy-efficient palletizing robots.

Labor Shortages and Rising Labor Costs

Labor shortages and the concurrent rise in labor costs will also propel growth of the palletizing robot industry in North America. As industries grapple with a scarcity of skilled workers and the increasing expenses associated with manual labor, there is a heightened recognition of the efficiency and cost-effectiveness offered by palletizing robots.

Palletizing robots equipped with advanced capabilities address the need for consistent and precise material handling, reducing dependency on human labor. The synergy between labor-related challenges and the adoption of palletizing robots underscores a transformative trend, positioning these automated solutions as indispensable assets in modern industrial settings.

High Initial Investment Costs Hinder Palletizing Robot Adoption

The restraint of high initial investment costs casts a shadow over the widespread adoption of palletizing robots, particularly affecting small companies. The substantial upfront expenses related to procuring and implementing palletizing robot systems present a financial barrier, hindering the entry of some enterprises in the automation industry.

Smaller companies, often operating with tighter budgets, may struggle to justify the initial investment. This impacts their ability to use the efficiency and benefits of palletizing robots.

The financial constraint creates a dichotomy, limiting accessibility to advanced automation technologies and potentially slowing down the broader integration of palletizing robots across industries. As a result, addressing cost considerations becomes paramount in pushing a more inclusive adoption of palletizing robots.

The table below highlights key countries’ palletizing robots industry revenues. The United States will remain the leading consumer of palletizing robots, with total valuation in the nation set to reach USD 1471.9 million in 2035.

| Countries | Palletizing Robot Industry Revenue in 2035 |

|---|---|

| United States | USD 1471.9 million |

| Mexico | USD 259.6 million |

| Canada | USD 189.4 million |

The table below shows the estimated growth rates of the top nations. Canada and Mexico are set to record high CAGRs of 9.6% and 9.3%, respectively, through 2035.

| Countries | North America Palletizing Robot CAGR (2025 to 2035) |

|---|---|

| Canada | 9.6% |

| Mexico | 9.3% |

| United States | 8.7% |

The United States leads from the forefront when it comes to adopting automation and robotics. As a result, the nation is becoming a happy hunting ground for palletizing robot manufacturers, offering lucrative revenue-generation opportunities.

As per the latest report, the United States palletizing robot industry value is forecast to total USD 1471.9 million by 2035. Sales of palletizing robots in the United States are picking up pace at 8.7% CAGR.

Rising adoption of palletizing in diverse sectors such as manufacturing, logistics, and e-commerce is providing impetus for industry growth. Technological advances in robotics, including advanced sensors and machine learning, are enhancing their appeal among end users.

Growing focus on safety and ergonomics in Industry 4.0 environments is driving palletizing robot adoption. Majority of companies across the United States are embracing automation and robotics to boost their productivity and reduce labor costs.

The adoption of Industry 4.0 principles, including connectivity, data analytics, and real-time monitoring, is driving the innovation of palletizing robots. These robots can be integrated into smart factory environments, allowing for seamless communication and coordination with other manufacturing systems.

Government subsidies and high competition further accelerate innovation, while supplier diversity provides innovative solutions. These cumulative advances are driving the robotic palletizing industry forward, revolutionizing operations across industries in the United States.

Demand for palletizing robots in Mexico is witnessing an uptick amid rapid industrialization and growing emphasis on enhanced productivity. A CAGR of around 9.3% is on the cards for Mexico's palletizing robot industry, with a total valuation set to reach USD 259.6 million by 2035.

As industries including automotive, electronics, and manufacturing rise across Mexico, the demand for robotic palletizing and other automation solutions grows exponentially. These advanced robotic solutions enable mass production and lower labor costs.

Rise in government subsidies and incentives further encourages companies to invest in automation technology, thereby boosting the target industry. With competition accelerating, palletizing robots enable Mexican companies to improve their competitiveness and broaden their reach.

The section below shows the articulated robots segment dominating the palletizing robot industry in North America, exhibiting a CAGR of 8.2%. Based on end-use, the manufacturing segment is forecast to thrive at 8.7% CAGR through 2035.

| Top Segment (Robot Type) | Articulated Robots |

|---|---|

| CAGR (2025 to 2035) | 8.2% |

There are various robots with specific configurations and functionalities to suit different needs. However, articulated robots' unmatched versatility and accuracy make them the go-to solution for companies seeking automation in their palletizing tasks.

Articulated robots are becoming top-selling robot types across North America, recording a CAGR of 8.2%. Courtesy of this, a valuation of USD 1471.9 million has been predicted for the target segment in 2035.

High adoption of articulated robots in North America can be attributed to several factors. First, these robots offer unparalleled flexibility and usability, enabling them to handle a wide range of pallet-making tasks under industrial conditions. Their lateral design provides precision and stability, making them suitable for efficient stacking and pallet sorting.

Artificial intelligence robots are highly customizable and scalable, adapting to the needs of various manufacturing processes and changing business needs. Their advanced control systems and software integration capabilities further enhance productivity and efficiency in end-use industries.

Articulated robots boast a proven track record of reliability and efficiency, instilling confidence in their operators and encouraging widespread use. Hence, the combination of versatility, accuracy, and reliability will continue to make articulated robots popular among end users.

| Top Segment (End Use) | Manufacturing |

|---|---|

| CAGR (2025 to 2035) | 8.7% |

As per the latest analysis, adoption of palletizing robots will continue to remain high in the manufacturing sector, increasing at 8.7% CAGR. The target segment is set to generate a valuation of USD 777.6 million by 2035, making manufacturing sector the prime target of palletizing robot manufacturing companies.

High demand for robotic pelletizing in the North American manufacturing sector is a key driver for the target segment. As manufacturing processes continue to become more responsive and efficient, robotic pallet manufacturing offers greater benefits, prompting industries like automotive and food & beverage to install palletizing robots.

Palletizing robots can handle a variety of materials with precision and speed, improving efficiency and reducing labor costs. They help manufacturing industries to achieve their high efficiency and productivity while reducing labor costs and workplace injuries.

The manufacturing industry in North America is experiencing strong growth, particularly in automotive, electrical equipment, food, beverage, and consumer goods. As production volumes increase, solutions such as pelletizing robots are used to meet growing demand while maintaining quality standards.

What is more is the technological advances in robotics, including sensor gripper software for improved hybridization. These innovations make palletizing robots more versatile and adaptable to different production processes in the manufacturing sector.

The section below shows the articulated robots segment dominating the palletizing robot industry in North America, exhibiting a CAGR of 8.2%. Based on end-use, the manufacturing segment is forecast to thrive at 8.7% CAGR through 2035.

| Top Segment (Robot Type) | Articulated Robots |

|---|---|

| CAGR (2025 to 2035) | 8.2% |

There are various robots with specific configurations and functionalities to suit different needs. However, articulated robots' unmatched versatility and accuracy make them the go-to solution for companies seeking automation in their palletizing tasks.

Articulated robots are becoming top-selling robot types across North America, recording a CAGR of 8.2%. Courtesy of this, a valuation of USD 1471.9 million has been predicted for the target segment in 2035.

High adoption of articulated robots in North America can be attributed to several factors. First, these robots offer unparalleled flexibility and usability, enabling them to handle a wide range of pallet-making tasks under industrial conditions. Their lateral design provides precision and stability, making them suitable for efficient stacking and pallet sorting.

Artificial intelligence robots are highly customizable and scalable, adapting to the needs of various manufacturing processes and changing business needs. Their advanced control systems and software integration capabilities further enhance productivity and efficiency in end-use industries.

Articulated robots boast a proven track record of reliability and efficiency, instilling confidence in their operators and encouraging widespread use. Hence, the combination of versatility, accuracy, and reliability will continue to make articulated robots popular among end users.

| Top Segment (End Use) | Manufacturing |

|---|---|

| CAGR (2025 to 2035) | 8.7% |

As per the latest analysis, adoption of palletizing robots will continue to remain high in the manufacturing sector, increasing at 8.7% CAGR. The target segment is set to generate a valuation of USD 777.6 million by 2035, making manufacturing sector the prime target of palletizing robot manufacturing companies.

High demand for robotic pelletizing in the North American manufacturing sector is a key driver for the target segment. As manufacturing processes continue to become more responsive and efficient, robotic pallet manufacturing offers greater benefits, prompting industries like automotive and food & beverage to install palletizing robots.

Palletizing robots can handle a variety of materials with precision and speed, improving efficiency and reducing labor costs. They help manufacturing industries to achieve their high efficiency and productivity while reducing labor costs and workplace injuries.

The manufacturing industry in North America is experiencing strong growth, particularly in automotive, electrical equipment, food, beverage, and consumer goods. As production volumes increase, solutions such as pelletizing robots are used to meet growing demand while maintaining quality standards.

What is more is the technological advances in robotics, including sensor gripper software for improved hybridization. These innovations make palletizing robots more versatile and adaptable to different production processes in the manufacturing sector.

The North America palletizing robot industry is consolidated, with leading players accounting for about 55% to 60% share. KUKA Robotics Corp., FANUC America Corp., Yaskawa America, Inc., Universal Robots USA, Inc., Kawasaki Robotics Inc. Columbia/Okura, and ABB Robotics Co. are the leading manufacturers of palletizing robots listed in the report.

Innovation is becoming a key success tool for companies to succeed in this surging industry. As a result, top palletizing robot manufacturers across North America are developing more sophisticated robots that can handle a wide range of product sizes, weights, and packaging formats.

Several companies are concentrating on reducing palletizing robot prices to encourage their adoption among small and medium companies, especially e-commerce companies. They are also implementing strategies like mergers, acquisitions, partnerships, distribution agreements, and facility expansions to boost their revenue and broaden their footprint.

Recent Developments in North America Palletizing Robot Industry

| Attribute | Details |

|---|---|

| Industry Size in 2025 | USD 576.2 million |

| Industry Value in 2035 | USD 1,354.1 million |

| Growth Rate (2025 to 2035) | 8.9% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (Units) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Key Segments Covered | Robot Type, Reach Range, Material Type, End-use, Country |

| Countries Covered | United States, Canada, Mexico |

| Sub-region Covered | Northeast United States; Southwest United States; Southeast United States; West United States; Midwest United States; Alberta; British Columbia; Manitoba; Quebec; Ontario; Baja California; Pacific Coastal Lowlands; Mexican Plateau; Sierra Oriental |

| Key Companies Profiled | KUKA Robotics Corp; FANUC America Corp; Yaskawa America, Inc.; Universal Robots USA, Inc.; Kawasaki Robotics Inc.; Columbia/Okura; Stäubli Robotics; Kassow Robots; SCOTT Technology; FUJI Robotics; Berobox; ABB Robotics; FlexLink Systems, Inc.; Sage Automation; Kraken Automation; OnRobot US Inc.; JLS Automation |

The global palletizing robot industry analysis in north america is estimated to be valued at USD 627.5 million in 2025.

The market size for the palletizing robot industry analysis in north america is projected to reach USD 1,471.9 million by 2035.

The palletizing robot industry analysis in north america is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in palletizing robot industry analysis in north america are articulated robots, _up to 100 kg, _100 to 300 kg, _300 to 500 kg, _above 500 kg, collaborative robots, _up to 10 kg, _10 to 30 kg, _30 to 50 kg, _above 50 kg, scara robots, _up to 5 kg, _5 to 10 kg, _10 to 20 kg, _above 20 kg, delta robots, _up to 3 kg, _3 to 6 kg, _above 6 kg, gantry robots, _up to 50 kg, _50 to 150 kg and _above 150 kg.

In terms of reach range, up to 1,000 mm segment to command 45.2% share in the palletizing robot industry analysis in north america in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Palletizing Machines Market Growth & Demand 2025 to 2035

Palletizing Systems Market Growth - Trends & Forecast 2025 to 2035

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robot Assisted Surgical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic Catheterization Systems Market Growth – Innovations, Trends & Forecast 2025-2035

Robot Sensor Market Size and Share Forecast Outlook 2025 to 2035

Robotaxi Market Size and Share Forecast Outlook 2025 to 2035

Robot Market Size and Share Forecast Outlook 2025 to 2035

Robotic Vision Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Robotic Biopsy Devices Market Insights - Trends & Forecast 2025 to 2035

Robotic Palletizers & De-Palletizers Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA