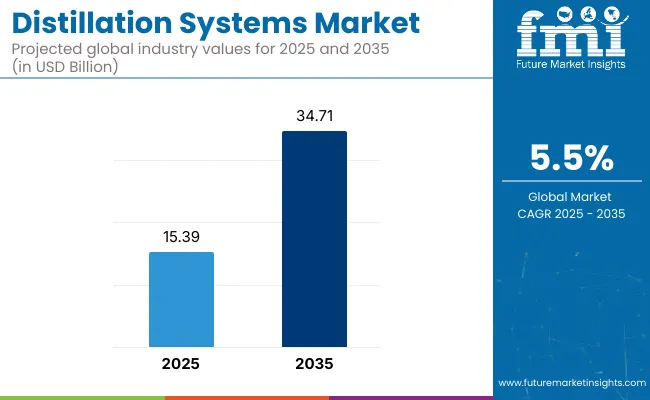

The global distillation systems market is estimated to account for USD 15.39 billion in 2025. It is anticipated to grow at a CAGR of 8.5% during the assessment period and reach a value of USD 34.71 billion by 2035.

Industry Outlook

From 2025 to 2035, the distillation systems market is expected to expand substantially on the basis of a number of factors. The growing energy demands, especially in the developing world, will drive the use of effective distillation in refining petroleum and the production of biofuels. Advances in automation, control, and integration of digital technologies like the Internet of Things (IoT) and artificial intelligence are likely to boost product quality and business efficiency.

Besides, tough environmental laws and a global focus on sustainability will be expected to compel industries to embrace improved distillation technologies that can minimize emissions and waste. The chemical and pharmaceutical industries will also propel market growth as they require accurate separation and purification technologies to manage the growing demand for high-purity products.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth was driven by petroleum refining, chemical processing, pharmaceuticals, and food & beverages. Increased demand for industrial separation and purification systems fueled adoption. | The industry will be shaped by digital transformation, environmental sustainability, and increased biofuel production. Industrial automation and green energy trends will further boost adoption. |

| Innovations included improved column designs, better materials, and enhanced heat integration techniques, leading to better efficiency and lower energy consumption. | IoT, AI, and smart automation will redefine operations, enhancing real-time monitoring, predictive maintenance, and energy efficiency, reducing production costs while improving precision. |

| Stricter emission controls and waste management rules encouraged industries to adopt distillation systems for pollution control. | Carbon-neutral and zero-emission policies will dominate, pushing industries to adopt low-energy and eco-friendly distillation processes that minimize industrial waste and emissions. |

| Growing investments in biofuels and ethanol production increased the use of distillation in processing renewable energy sources. | Wider adoption of green energy solutions like hydrogen distillation, waste-to-energy distillation, and advanced biofuel purification will drive industry evolution. |

| Emerging economies such as China, India, and Brazil saw a rise in industrialization, leading to increased demand for distillation units in the refining and chemical sectors. | The next wave of industrialization will see a focus on modular, decentralized, and on-site distillation units, making industries more self-sufficient and energy-efficient. |

| Basic automation and process optimization software improved production efficiency. However, manual operations remained dominant. | AI-driven automated systems, IoT-enabled remote monitoring, and predictive analytics will become standard, reducing human intervention and operational downtime. |

| Initial costs for advanced distillation technologies were high, limiting adoption in small-scale industries. | Advancements in manufacturing and economies of scale will reduce system costs, making advanced distillation technologies more accessible to small and medium enterprises (SMEs). |

| The focus was on basic safety measures, including alarm systems and fail-safe mechanisms to prevent accidents. | Safety will be enhanced with AI-powered hazard detection, automated shut-off systems, and real-time risk assessments, reducing operational risks significantly. |

Low-Cost and Energy-Efficient Solutions

Industry consumers in the field of distillation systems are rapidly shifting towards solutions that are economical and energy-conserving to mitigate growing economic and sustainability demands. Industrial clients are concentrating on units that conserve energy and ensure operating efficiency. In light of increasing energy prices, companies are adopting distillation systems that encompass efficient heat recovery as well as thermal integration features for lowering the costs of production.

Smart and automated distillation plants are being utilized more and more in industries to improve efficiency, safety, and precision. AI-based, IoT-enabled, and digitally networked distillation plants are what customers are looking for since these allow for real-time monitoring, remote control, and predictive maintenance. To do this, manufacturers are adding data analytics and machine learning algorithms to distillation plants so that industries can achieve maximum productivity, minimize downtime, and avoid failures from happening.

Environmental awareness is compelling industries to use green and eco-friendly distillation technologies. Low-emission, carbon-neutral, and low-waste systems are being adopted by industries to cater to the strengthening of global regulations and business sustainability models. Users of distillation systems are also seeking bio-based solvents, alternate fuel, and green chemistry technology in order to remain in sync with the increasing demand for sustainable production processes.

The demand for customized and modular distillation systems is on the rise as industries seek scalable, versatile, and application-focused solutions. Consumers want distillation technology to be customized in accordance with various process requirements from pharmaceuticals and petrochemicals to food & beverage and renewable energy generation. Companies are also looking for compact and decentralized distillation systems that allow processing on-site, saving logistics and operational expenses.

Based on components, the market is divided into column shells, plates & packings, reboilers & heaters, condensers, and others. Of the principal components of a distillation system-Column Shells, Plates & Packings, Reboilers & Heaters, and Condensers-Column Shells and Plates & Packings are used most frequently.

These elements are the backbone of the distillation process and allow separation, purification, and fractionation of materials based on boiling point. Column shells provide structural support, and plates (trays) and packings provide better mass transfer efficiency and allow efficient vapor-liquid contact. Others like petroleum refining, chemical processes, pharmaceuticals, and food & beverages rely mostly on these elements to provide high-purity outputs.

Plates (trays) are used in applications of high capacity and flexibility, and packings in low-pressure drop and high-separation efficiency industries. The popularity of these parts across various industries arises from their function to maximize the separation performance, enhance throughput, and enhance energy efficiency.

Based on end-use, the market is divided into petroleum & biorefinery, water treatment, food, beverage, pharmaceuticals, and others. Petroleum & biorefinery, water treatment, food & beverage, and pharmaceuticals, petroleum & biorefinery distillation systems are most commonly employed because of their indispensable role in the production of fuel and large-scale industrial processes.

The petroleum sector is greatly dependent on distillation to process crude oil into major fuels like gasoline, diesel, jet fuel, and lubricants, thus it is the largest user of distillation technology globally. Fractional distillation is the key process in petroleum refining, which enables crude oil separation into hydrocarbon fractions in relation to their boiling points.

Moreover, bioethanol, biodiesel, and other biofuel production make use of distillation in biorefineries. As the global demand for renewable sources of energy rises, biorefineries are adopting advanced-level distillation technologies in a bid to maximize efficiency and yield. The size of the operations in petroleum refining is considerably greater than other industries, and the continuous requirement for fuel and energy guarantees demand for distillation systems to remain high.

Distillation is as crucial in water treatment, food & beverage industries, and pharmaceuticals, though these industries operate on a small scale relative to the enormous worldwide petroleum and biofuel industries, and thus the petroleum & biorefinery distillation systems are the most common.

The USA is likely to retain its leadership in the distillation systems market due to its vast network of chemical processing plants and oil refineries. The emphasis of the country on energy efficiency and technological advancement is likely to propel the usage of sophisticated distillation systems, especially in petroleum and biorefinery. The USA government's initiative towards adopting sustainable energy practices is also expected to fuel further growth in the market.

The distillation systems market in the UK is forecasted to register consistent growth on the back of the country's push for sustainability and technological developments. The strong industry base in the UK, especially in chemicals and pharmaceutical production, demands optimized distillation operations. Efforts by the government to implement green technologies and move towards sustainable power sources will also boost the need for new-generation distillation systems.

China's distillation systems market is expected to see strong growth, fueled by intense industrialization and urbanization. The growing chemical, pharma, and food & beverage industries of the nation demand efficient distillation equipment to fulfill production needs. In addition, China's emphasis on environmental sustainability and strict emission control regulations are expected to drive the implementation of sophisticated, energy-saving distillation technologies.

India is becoming a major market for distillation systems, driven by the expansion of its petroleum refining and biorefinery industries. The rising demand for biofuels and the government's initiative towards renewable energy sources require the use of advanced distillation systems. The growth of the pharmaceutical and food & beverage industries also adds to the growing demand for efficient distillation processes.

Germany's distillation systems market will develop steadily, buoyed by its established chemical and pharmaceutical sectors. The nation's focus on technological advancement and energy efficiency complements the uptake of sophisticated distillation solutions. Additionally, Germany's focus on environmental sustainability and compliance with stringent regulatory requirements fuel demand for new, environmentally friendly distillation systems.

Brazil is set to emerge as a significant player in the market based on its thriving biofuel sector. Being among the world's largest ethanol producers, Brazil's biorefineries need to have efficient distillation systems in place to improve production levels. The nation's emphasis on renewable energy and sustainability is expected to further increase the use of innovative distillation technologies in the near future.

As per FMI analysis, the market for distillation systems continues to be intensely competitive, with a number of global and regional players dominating prominent sectors like petroleum refining, chemical processing, and pharmaceuticals. Large players keep investing in the latest technology, automation, and energy-efficient design to enhance their market position and address the growing demand for high-performance distillation solutions globally.

Industrial consumers with large-scale operations prefer well-established companies with expertise in high-capacity and custom distillation systems. Top players increase their presence in the market through mergers, acquisitions, and strategic alliances. They embed intelligent technologies such as AI and IoT, driving operational efficiency and staying ahead of smaller players lagging behind innovation and scale of production.

Regulatory changes and trends towards sustainability are leveraged by market leaders, creating low-emission and environmentally friendly distillation technologies. Businesses serving biofuel, specialty chemicals, and renewable energy markets see increasing demand, leading to increased concentration. Governments prefer businesses with compliance-ready solutions, which strengthens the leadership of established industry players over new entrants.

Local producers obtain momentum by offering affordable and modular distillation services with specific industrial applications. Nonetheless, stiff capital requirements and technology barriers present entry hurdles. Consequently, long-established global brands continue to hold the upper hand, cementing market concentration on the side of a few dominant innovators and huge production players.

Major Developments

The distillation systems industry is extremely competitive, with international players constantly improving their technological strengths to retain their leadership. Top manufacturers concentrate on innovation, automation, and energy efficiency, incorporating IoT, AI, and intelligent monitoring solutions to boost productivity. Competitors vie by presenting customized and high-performance distillation units for industry-specific applications.

Large industry players consolidate their market presence with strategic purchases, alliances, and R&D expenditures. They increase manufacturing facilities and upgrade distribution systems to cater to varied industries like petroleum, chemicals, drugs, and biofuels. Brand recognition gives established brands a competitive advantage with superior infrastructure, high brand name, and regulatory compliance abilities that are difficult for smaller companies to reproduce.

Local producers compete by offering affordable, modular, and adaptable distillation solutions tailored to local industry needs. Numerous firms specialize in sustainable and green technologies, attracting industries shifting towards low-emission and renewable energy processes. Government incentives and environmental sustainability regulations also impact market dynamics, determining competition among major industry players.

Competition is fueled by innovation in heat integration, column design, and process optimization, as companies compete to minimize operational costs and energy use. The development of biorefineries and specialty chemicals presents new opportunities for growth, and companies are forced to innovate and create sophisticated separation methods. As industries mature, companies with the latest technology and effective solutions become more entrenched.

With respect to components, the market is classified into column shells, plates & packings, reboilers & heaters, condensers, and others.

In terms of end-use, the market is segmented into petroleum & biorefinery, water treatment, food, beverage, pharmaceuticals, and others.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The market is anticipated to reach USD 15.39 billion in 2025.

The market is predicted to reach a size of USD 34.71 billion by 2035.

Prominent players include Alfa Laval, Anton Paar, Büfa Composite Systems, and others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Distillation Analyzer Market Size and Share Forecast Outlook 2025 to 2035

CDU Heat Exchanger Anti-foulant Market 2025-2035

Automatic Distillation Analyzer Market Growth - Trends & Forecast 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Catheter Systems Market

Reporter Systems Market

Aerostat Systems Market

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Metrology Systems Market

Fluid Bed Systems Market

Cognitive Systems Spending Market Report – Growth & Forecast 2016-2026

Nurse Call Systems Market Insights - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA