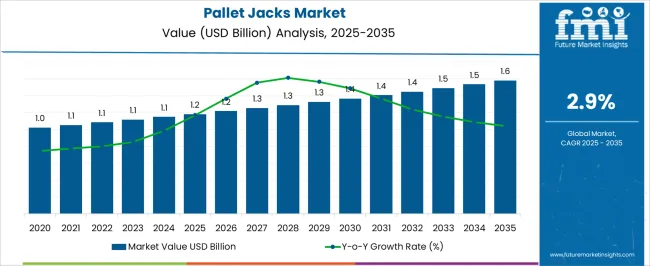

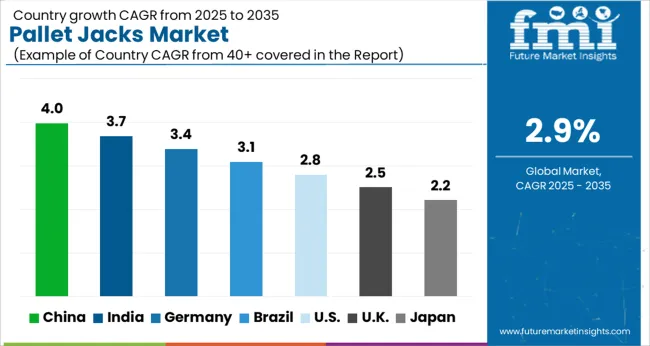

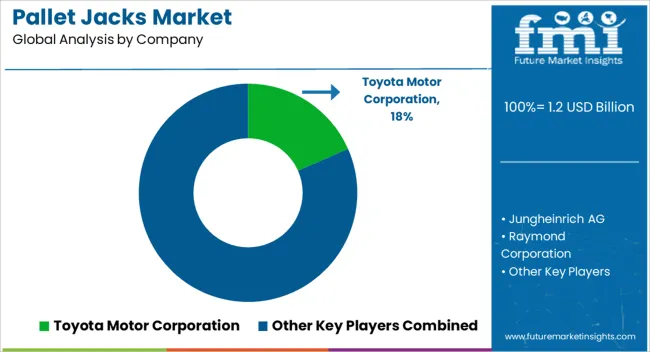

The Pallet Jacks Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period.

| Metric | Value |

|---|---|

| Pallet Jacks Market Estimated Value in (2025 E) | USD 1.2 billion |

| Pallet Jacks Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

The pallet jacks market is experiencing steady growth. Increasing industrialization, expansion of logistics and warehousing operations, and rising adoption of material handling automation are driving demand.

Current dynamics are characterized by growing e-commerce activities, higher throughput requirements in warehouses, and the need for efficient internal transport solutions. Technological advancements in powered and ergonomically designed pallet jacks are enhancing operational efficiency and reducing labor dependency.

The future outlook is shaped by the integration of smart and automated solutions, expansion of distribution centers in emerging regions, and focus on safety and productivity in material handling operations Growth rationale is founded on consistent demand for reliable and high-capacity pallet handling equipment, continuous product innovation to improve energy efficiency and user-friendliness, and the scalability of solutions to meet diverse industrial and logistics requirements, collectively underpinning long-term market expansion and adoption across commercial, industrial, and logistics sectors.

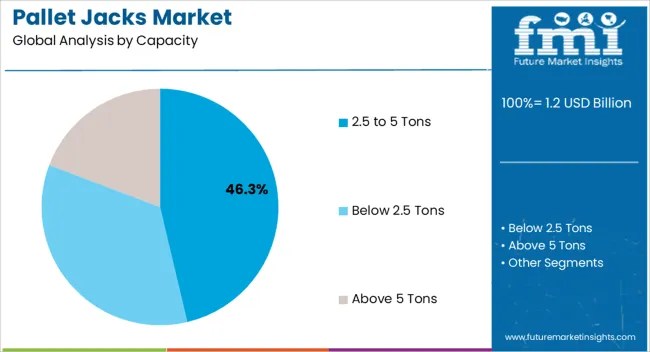

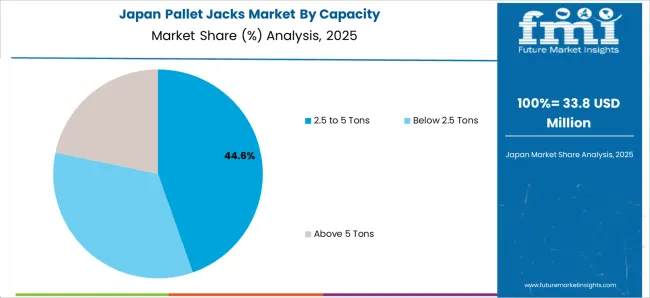

The 2.5 to 5 tons capacity segment, accounting for 46.30% of the capacity category, has emerged as the leading segment due to its optimal balance between load-handling capability and maneuverability. Adoption has been driven by the prevalent use of this capacity range in medium to large warehouses, distribution centers, and industrial operations.

Reliability, operational efficiency, and adaptability to various floor conditions have reinforced its market preference. Technological enhancements, including robust hydraulic systems and durable chassis design, have improved longevity and reduced maintenance requirements.

Strategic deployment by industrial and logistics operators has further strengthened market acceptance Continuous focus on enhancing load-handling efficiency and safety features is expected to sustain the segment’s share and support incremental adoption in both established and emerging markets.

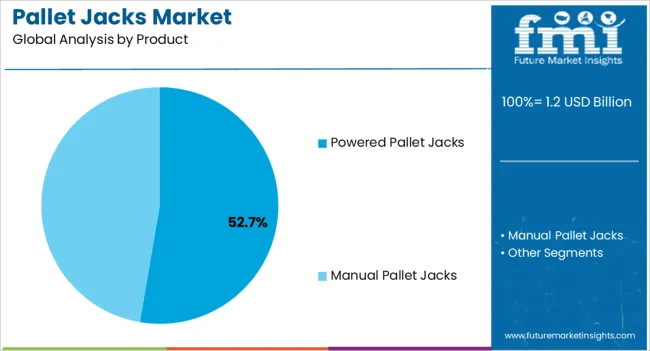

The powered pallet jacks segment, representing 52.70% of the product category, has been leading due to high operational efficiency and reduced physical strain for operators. Market adoption has been supported by automation trends in warehouses and the need for faster material movement in high-volume facilities.

Reliability, battery efficiency, and ease of maneuverability have reinforced preference over manual alternatives. Integration with fleet management and tracking solutions has enhanced operational oversight.

Manufacturers’ focus on ergonomics, energy efficiency, and low maintenance costs has strengthened product positioning Ongoing technological innovation and growing demand for labor-saving solutions are expected to sustain the segment’s market share and drive further adoption across logistics-intensive operations.

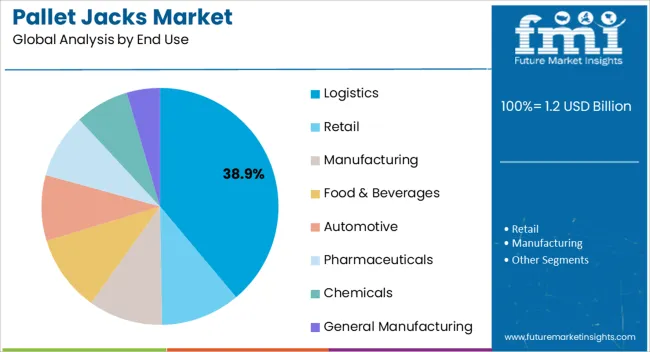

The logistics end-use segment, holding 38.90% of the category, has maintained dominance due to the sector’s high demand for efficient material handling solutions. Adoption has been facilitated by large-scale warehousing operations, e-commerce fulfillment centers, and transportation hubs requiring timely movement of goods.

Reliability, durability, and operational efficiency of pallet jacks have been key drivers for widespread usage. Strategic partnerships between manufacturers and logistics operators have ensured seamless supply and maintenance support.

Expansion of logistics infrastructure, particularly in emerging markets, coupled with growing e-commerce penetration, is expected to sustain the segment’s share and support continued market growth.

The scope for pallet jacks rose at a 4.4% CAGR between 2020 and 2025. The global market for pallet jacks is anticipated to expand at a moderate CAGR of 3.1% over the forecast period from 2025 to 2035.

| Report Attributes | Details |

|---|---|

| Market Value in 2020 | USD 955.1 million |

| Market Value in 2025 | USD 1,079.2 million |

| CAGR from 2020 to 2025 | 4.4% |

The pallet jacks market witnessed significant growth from 2020 to 2025, driven by increased industrialization and e-commerce activities globally from 2020 to 2025. The period witnessed a surge in demand for electric pallet jacks due to their efficiency, leading to a shift from manual to automated material handling solutions.

IoT integration improved operational efficiency, offering real-time monitoring and predictive maintenance capabilities. Safety standards were enhanced, reducing workplace accidents, and eco-friendly designs became prevalent, aligning with sustainability goals.

Looking ahead to 2035, the pallet jacks market is poised for continued expansion. Automation will be a defining trend, with AI-powered pallet jacks becoming commonplace, enhancing productivity and reducing labor costs.

The integration of advanced sensors and machine learning algorithms will optimize routes and payload management. Customization options are estimated to increase, catering to specific industry needs, and further driving market growth.

Emerging economies are assumed to play a significant role, with increased industrial activities and infrastructure development propelling the demand for pallet jacks. The market is set to experience a steady rise, shaped by technological advancements, automation, and environmental consciousness.

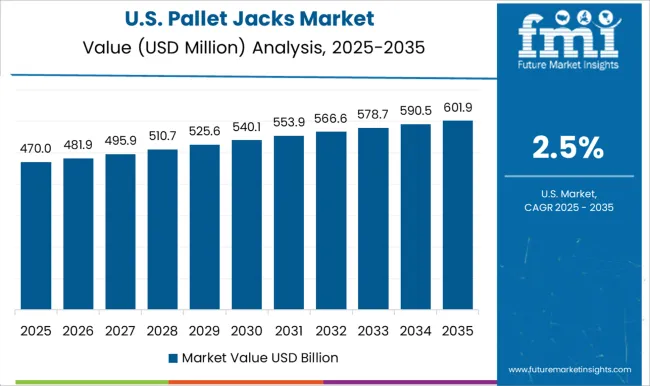

The market in the United States is anticipated to expand at a CAGR of 2.3%.

The pallet jacks market in the United States remains dynamic and vital to various industries. The growing e-commerce sector, coupled with the expansion of manufacturing and retail industries, continues to drive the demand for pallet jacks.

Electric pallet jacks have become increasingly popular due to their efficiency, reducing the physical strain on workers and enhancing productivity, especially in large distribution centers and warehouses.

There is a strong emphasis on safety and ergonomics. Pallet jack manufacturers are integrating advanced safety features and ergonomic designs, aligning with stringent workplace regulations. These innovations not only improve worker safety but also increase overall efficiency.

The rise of automation and IoT technology is another significant trend in this country. As per the International Trade Administration (.gov), in 2020, the manufacturing business accounted for 82.3 percent of the entire commercial robot deployments in the United States.

Smart pallet jacks equipped with sensors and real-time tracking capabilities are becoming prevalent, enabling businesses to optimize their supply chain operations. Also, pallet jack manufacturers are continuously innovating to meet the diverse needs of industries, making the United States a robust and competitive market.

Pallet jack trends in the United Kingdom are taking a turn for the better. A 3.5% CAGR is forecasted for the country from 2025 to 2035.

The pallet jacks market in the United Kingdom reflects the country's active industrial and logistics sectors. As per the International Trade Administration (.gov), in 2025, consumer e-commerce made up 30% of the overall retail sector in the United Kingdom, with yearly earnings exceeding USD 120 billion.

The demand for efficient material handling equipment, including pallet jacks, remains high with a thriving e-commerce industry and expanding warehouse facilities.

Safety and compliance are paramount in the United Kingdom market. Pallet jacks with advanced safety features, ergonomic designs, and compliance with industry regulations are in demand.

There is a growing emphasis on sustainable practices. Eco-friendly pallet jacks made from recyclable materials and energy-efficient components are gaining traction, aligning with the United Kingdom's environmental goals.

Market players in the United Kingdom also focus on providing tailored solutions to different industries, including manufacturing, retail, and logistics, catering to specific needs and requirements. The market flexibility and emphasis on technological advancements position the United Kingdom as a significant hub for pallet jack innovations and applications.

The market in China is poised to develop at a CAGR of 5.1% through 2035.

The pallet jacks industry in China has experienced substantial growth in tandem with the country's booming manufacturing and logistics sectors. With China being a global manufacturing hub and a leader in e-commerce, the demand for efficient material handling equipment, including pallet jacks, is high.

Electric pallet jacks, in particular, have gained prominence due to their ability to enhance productivity and reduce labor costs. China's emphasis on automation and Industry 4.0 technologies has accelerated the adoption of electric pallet jacks, contributing to market expansion.

Safety and compliance are paramount in the market of China. Pallet jack manufacturers focus on developing products with advanced safety features and ergonomic designs to ensure worker safety and comply with stringent regulations.

There's a growing trend toward environment-friendly practices. Eco-conscious manufacturing processes and the use of recyclable materials in pallet jack production align with China's green initiatives and global environmental standards.

The pallet jacks industry is poised for continuous growth and development with the ongoing modernization of China's logistics infrastructure.

The pallet jacks market in Japan is set to register a 2.5% CAGR.

The demand for pallet jacks in warehouses, manufacturing plants, and distribution centers is consistently high due to the country's emphasis on precision, safety, and productivity.

Electric pallet jacks are widely adopted in Japan, especially in densely populated urban areas where space optimization and efficient material handling are critical. These electric models enhance productivity while reducing operational costs, aligning with Japan's focus on technological advancements and automation.

There is a growing trend toward environment-friendly practices. Eco-conscious manufacturing processes, energy-efficient technologies, and the use of recyclable materials in pallet jack production align with Japan's green initiatives and sustainability goals. The market also experiences a demand for customized solutions tailored to specific industry needs, reflecting Japan's diverse industrial landscape.

The pallet jacks market in Japan is poised for steady growth and adaptation to evolving industry requirements with a continuous focus on technological innovation, safety, and environmental sustainability.

The below table highlights how the powered pallet jacks segment is projected to dominate the market in terms of product, registering a 4% CAGR through 2035. It held a CAGR of 3.2% from 2020 to 2025.

The logistics segment is likely to spearhead sales based on end use and is anticipated to witness a CAGR of 3.5% through 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Powered Pallet Jacks | 4% |

| Logistics Sector | 3.5% |

The powered pallet jacks segment dominates the market with regard to profits expanding at a CAGR of 4%.

The manual pallet jacks segment is also poised to account for a market share of 66.4% in 2025. To minimize their labor and maximize movement efficiency within factory or business facilities, many small organizations and micro enterprises are seismically transitioning from manual pallet jacks to motorized pallet jacks. Battery-powered pallet jacks are used in sectors to minimize electricity costs while improving workplace safety.

Pallet jacks have grown into a great option for micro and small businesses around the world due to their reduced cost in contrast to other commercial vehicles. As online shopping becomes popular, the logistics industry is increasingly incorporating pallet jacks into their facilities.

The logistics sector is expected to develop at a CAGR of 3.5% through 2035. The logistics segment is poised to account for a market share of 52.1% in 2025.

The industry is uneven and characterized by the presence of both large and small-scale companies. Large firms' key growth approaches include many key methods including technological development, diversification, mergers and acquisitions to increase their market share, reach, and profit.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 1.2 billion |

| Projected Market Valuation in 2035 | USD 1.6 billion |

| Value-based CAGR 2025 to 2035 | 2.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Capacity, Product, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled |

Toyota Motor Corporation; Jungheinrich AG; Raymond Corporation; Yale Materials Handling Corporation; Clark Material Handling Company Inc.; Crown Equipment Corporation,; Komatsu Ltd.; Godrej Material Handling,; Carborundum Universal Limited (CUMI); Jost's Engineering Company Limited; Patel Material Handling Equipment; Noveltek Industrial Manufacturing; Niuli Machinery Manufacture Co. Ltd; Ningbo Ruyi Joint Stock Co. Ltd.; Wesco Industrial Products LLC; Mitsubishi Caterpillar Forklift America Inc. |

The global pallet jacks market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the pallet jacks market is projected to reach USD 1.6 billion by 2035.

The pallet jacks market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in pallet jacks market are 2.5 to 5 tons, below 2.5 tons and above 5 tons.

In terms of product, powered pallet jacks segment to command 52.7% share in the pallet jacks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Pallet Stretch Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Pallet Box Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labelling System Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labeler Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pallet Drum Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Pallets Market Analysis - Size, Share, and Forecast 2025 to 2035

Pallet Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pallet Shippers Market Size and Share Forecast Outlook 2025 to 2035

Pallet Racking Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pallet Wraps Market Analysis - Size, Share, and Forecast 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Palletizing Machines Market Growth & Demand 2025 to 2035

Pallet Corner Boards Market from 2025 to 2035

Pallet Truck Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Pallet Wraps Manufacturers

Market Share Breakdown of Pallet Stretch Wrapping Machine Manufacturers

Competitive Overview of Pallet Labelling System Providers

Global Pallets Market Share Analysis – Trends, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA