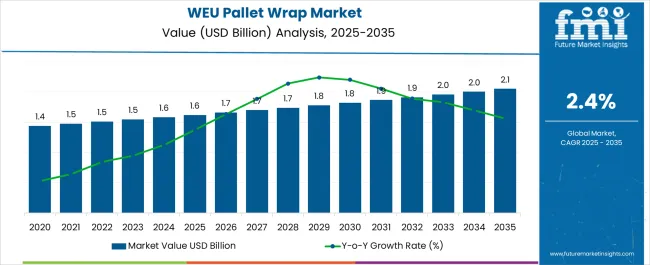

The Pallet Wrap Industry Analysis in Western Europe is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 2.4% over the forecast period.

| Metric | Value |

|---|---|

| Pallet Wrap Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 1.6 billion |

| Pallet Wrap Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 2.4% |

The pallet wrap industry in Western Europe is advancing steadily. Growth is being supported by increasing demand for efficient load stability, rising adoption of automated packaging systems, and heightened emphasis on supply chain safety and sustainability. Current dynamics reflect the strong presence of advanced logistics networks, stringent packaging regulations, and widespread use of recyclable films.

Demand consistency is being reinforced by e-commerce expansion, food and beverage distribution, and industrial trade flows. Producers are investing in process optimization, film downgauging technologies, and recycling solutions to balance performance with sustainability targets.

The future outlook is favorable as material innovations, automation integration, and circular economy initiatives reshape the market Growth rationale is founded on the increasing reliance on durable pallet wraps for safe product transit, regulatory alignment with eco-friendly practices, and the ability of manufacturers to adapt to customer requirements across diverse end-user sectors, ensuring long-term stability and competitive expansion across Western Europe.

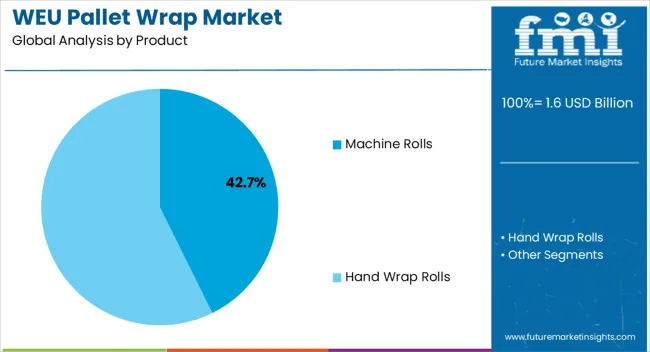

The machine rolls segment, holding 42.70% of the product category, is leading due to its compatibility with automated wrapping systems and ability to provide consistent load containment. Adoption has been reinforced by the efficiency gains machine rolls deliver in high-volume operations, reducing labor costs and improving throughput.

Demand has been further supported by the rising penetration of automation in warehousing and logistics facilities across Western Europe. Enhanced film strength, uniform application, and cost-effectiveness have consolidated the dominance of machine rolls.

Continuous development in stretch performance and downgauged options has allowed producers to meet sustainability objectives while maintaining operational reliability The segment’s resilience is expected to persist as logistics networks expand and end-users prioritize efficiency and material savings in packaging workflows.

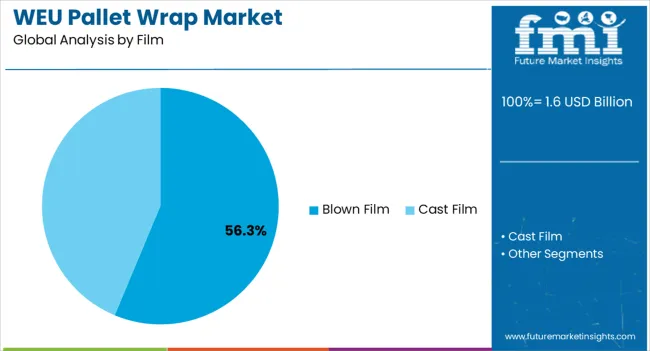

The blown film segment, representing 56.30% of the film category, has maintained its leadership position due to superior mechanical strength, puncture resistance, and load stability. Its dominance is supported by strong preference in heavy-duty packaging applications, particularly in industries where secure pallet containment is critical.

The segment benefits from established production facilities in Western Europe and continuous investment in process technology to enhance film clarity, uniformity, and downgauging capabilities. Demand stability has been driven by its adaptability to both manual and machine applications, although its strength in automated systems has ensured consistent off-take.

Market expansion is expected to be reinforced by sustainability-driven film innovations and increased focus on recyclability, ensuring blown film remains a core choice for high-performance pallet wrapping.

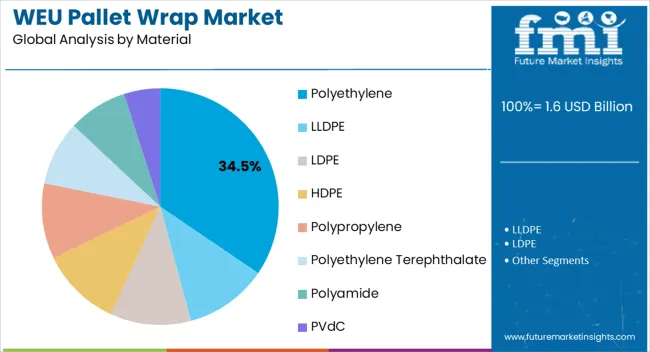

The polyethylene segment, accounting for 34.50% of the material category, has emerged as the leading material due to its balance of flexibility, durability, and recyclability. Its preference has been reinforced by widespread availability, cost competitiveness, and suitability for producing high-performance stretch films.

Continuous improvements in resin formulations have enhanced film toughness and downgauging potential, reducing material use without compromising containment. Regulatory support for recyclable and lightweight packaging has further strengthened the position of polyethylene, making it the material of choice for sustainable pallet wrap solutions.

As circular economy goals intensify across Western Europe, polyethylene’s compatibility with recycling streams and its ability to deliver both performance and environmental compliance are expected to maintain its leadership and drive future growth.

Pallet wrap done through machines dominates the product type segment. For 2025, machine rolls are expected to hold 61.8% of the industry share.

As opposed to hand wrap rolls, machine rolls require less human effort. With the mechanization of industries in Western Europe, industrialists are preferring machine rolls.

| Demand for Pallet Wrap in Western Europe Based on Product Type | Machine Rolls |

|---|---|

| Industry Share in 2025 | 61.8% |

Pallet wrap is typically used as packaging material for food & beverage. For 2025, the food & beverage sector is anticipated to account for 40.2% of the industry share by end use.

Food consumption is rising in Western Europe, with trends like premium dining and online ordering set to further propel the food & beverage sector. Pallet wrap is being used as packaging material for the increasing quantities of food being produced in Western Europe.

| Demand for Pallet Wrap in Western Europe Based on End Use | Food & Beverage |

|---|---|

| Industry Share in 2025 | 40.2% |

| Countries | CAGR (2025 to 2035) |

|---|---|

| France | 2.3% |

| United Kingdom | 2.6% |

| Germany | 2.0% |

| Netherlands | 3.1% |

| Italy | 2.4% |

The Netherlands is one of the leading countries in Western Europe for pallet wrap. The CAGR for the Netherlands over the 2025 to 2035 forecast period is predicted to be a solid 3.1%. There are a high number of local companies in the Netherlands dealing with pallet wrap. Local suppliers like Matco International and Contimeta keep the demand flowing in the Netherlands.

The eCommerce boom is leading to increased sales of small-scale and mini pallet wrap in the United Kingdom. Thus, in addition to factory use, pallet wrap is also finding usage among consumers in the United Kingdom. For the forecast period, the estimated CAGR for the United Kingdom is a commendable 2.6%.

Pallet wrap produced in Italy is not only being used in local industries. Pallet wrap produced in Italy is also being exported for use in other countries with rising frequency. For the forecast period, the expected CAGR for the industry in Italy is a respectable 2.4%.

Individuals in France are increasingly turning toward sustainable practices, encouraged by the government. Industrial practices are also shifting toward sustainability. Thus, pallet wrap made from sustainable material is gaining popularity across France. For the forecast period, the predicted CAGR for France is a steady 2.3%.

There are several local manufacturers in Western Europe for pallet wrap. In addition to supplying local industries, export is also engaged in by Western European manufacturers.

In the wake of increasing regulation from authorities, Western European manufacturers are increasingly turning toward sustainability. Partnerships are being struck between firms to pool the knowledge of the players and improvise better sustainability solutions.

Recent Developments Observed in Pallet Wrap in Western Europe

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 1.6 billion |

| Projected Industry Size by 2035 | USD 2.1 billion |

| Anticipated CAGR between 2025 to 2035 | 2.4% CAGR |

| Historical Analysis of Demand for Pallet Wrap in Western Europe | 2020 to 2025 |

| Demand Forecast for Pallet Wrap in Western Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Key Insights for Pallet Wrap in Western Europe, Insights on Global Players and Leading Industry Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western European Providers |

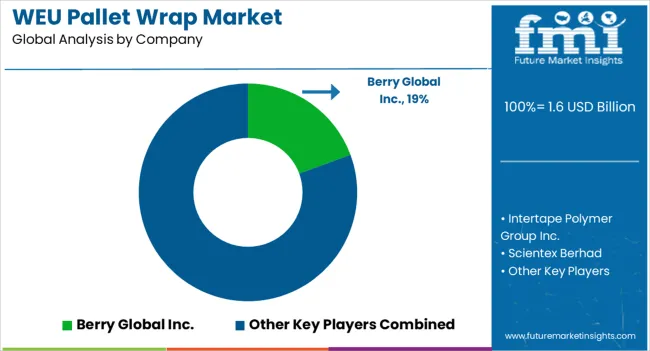

| Key Companies Profiled | Intertape Polymer Group Inc.; Berry Global Inc.; Scientex Berhad; Aep Industries Inc.; Sigma Stretch Film Corp.; Coveris; Rosenflex (United Kingdom) Limited; Polifilm GmbH; Anchor Packaging Inc.; Paragon Films Inc. |

| Key Countries Analyzed | United Kingdom, Germany, France, BENELUX, Sweden, Norway, Denmark, Italy, Spain |

The global pallet wrap industry analysis in Western Europe is estimated to be valued at USD 1.6 billion in 2025.

The market size for the pallet wrap industry analysis in Western Europe is projected to reach USD 2.1 billion by 2035.

The pallet wrap industry analysis in Western Europe is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in pallet wrap industry analysis in Western Europe are machine rolls and hand wrap rolls.

In terms of film, blown film segment to command 56.3% share in the pallet wrap industry analysis in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pallet Box Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labeler Market Size and Share Forecast Outlook 2025 to 2035

Pallet Jacks Market Size and Share Forecast Outlook 2025 to 2035

Pallet Drum Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Pallets Market Analysis - Size, Share, and Forecast 2025 to 2035

Pallet Shippers Market Size and Share Forecast Outlook 2025 to 2035

Pallet Corner Boards Market from 2025 to 2035

Pallet Truck Market Growth - Trends & Forecast 2025 to 2035

Pallet Displays Market from 2024 to 2034

Pallet Slip Sheet Market Trends, Growth and Forecast from 2024 to 2034

Palletizer Market Growth and Demand 2024 to 2034

Pallet Scales Market

Pallet Collar Market

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Palletizing Machines Market Growth & Demand 2025 to 2035

Palletizing Systems Market Growth - Trends & Forecast 2025 to 2035

Pallet Pooling Market Forecast and Outlook 2025 to 2035

Pallet Racking Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Pallet Labelling System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA