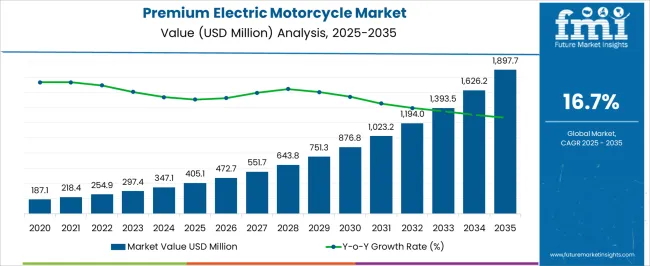

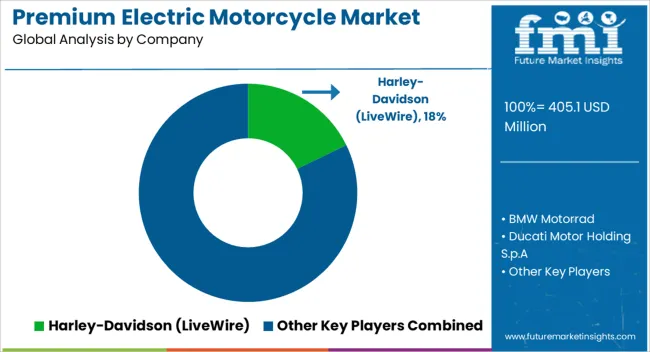

The premium electric motorcycle market is estimated to be valued at USD 405.1 million in 2025 and is projected to reach USD 1897.7 million by 2035, registering a compound annual growth rate (CAGR) of 16.7% over the forecast period. The growth curve is expected to take a steep upward shape, reflecting the rising preference for high-performance electric two-wheelers. From my perspective, this market’s appeal lies in the convergence of consumer interest in luxury riding experiences and the operational benefits of electric drivetrains, such as reduced maintenance and enhanced torque delivery.

Such motorcycles are no longer seen as niche lifestyle choices but rather as aspirational products that redefine road presence. It is evident that the premium segment is being rewarded with higher margins and loyalty, driven by riders who value exclusivity along with long-term efficiency. Over the ten-year span, the curve clearly signals accelerating adoption, where the early years show measured growth before momentum gathers pace. The increase from USD 405.1 million in 2025 to more than USD 1.6 billion by 2034 highlights that premium electric motorcycles are moving beyond experimentation and into mainstream acceptance.

This surge represents more than just a shift in vehicle type; it signals a change in consumer psychology, where prestige, design, and superior riding dynamics are considered as important as cost savings. The sharp climb in value underscores that the premium electric motorcycle market is not only resilient but also positioned to reshape the landscape of two-wheeler ownership, capturing a stronghold among affluent urban riders and long-distance commuters who demand both performance and distinction.

| Metric | Value |

|---|---|

| Premium Electric Motorcycle Market Estimated Value in (2025 E) | USD 405.1 million |

| Premium Electric Motorcycle Market Forecast Value in (2035 F) | USD 1897.7 million |

| Forecast CAGR (2025 to 2035) | 16.7% |

The premium electric motorcycle market holds an estimated 12-15% share across its parent markets, making it a fast-growing niche within the two-wheeler and EV segments. Within the broader electric vehicles (EV) market, its share stands at about 4-5%, as cars and commercial EVs dominate overall sales volumes. However, in the electric two-wheeler market, premium motorcycles represent a stronger 18-20% share, reflecting the rising demand for high-performance bikes with advanced design, speed, and range capabilities.

In the premium motorcycles and superbikes market, they command around 10-12% of the share, as electric alternatives are increasingly being adopted by urban riders seeking sustainability with luxury appeal. Within the sustainable mobility and green transportation market, premium electric motorcycles contribute nearly 6-7%, showcasing their role in reducing emissions while delivering performance. Their share in the battery technology and energy storage systems market is close to 3-4%, driven by demand for high-capacity lithium-ion and solid-state battery solutions tailored to long-distance riding and fast charging.

The premium electric motorcycle market has been steadily expanding due to consumer preference for eco-friendly mobility paired with luxury design, government incentives, and continuous improvements in battery performance.

The premium electric motorcycle market is advancing steadily, supported by the convergence of performance innovation, sustainability goals, and evolving consumer mobility preferences. Current market conditions reflect robust demand in urban and intercity commuting segments, as well as strong adoption among performance enthusiasts seeking high-torque, low-emission alternatives to conventional motorcycles. Strategic investments in battery technology, aerodynamics, and lightweight materials are enhancing range, charging efficiency, and ride dynamics, solidifying the market’s premium positioning.

Regulatory incentives, infrastructure expansion, and declining battery costs are further strengthening adoption prospects. Competitive differentiation is being shaped by advanced connectivity, rider-assist technologies, and bespoke design elements that appeal to high-income demographics.

During the forecast period, integration of solid-state batteries, faster charging solutions, and wider dealership networks is expected to drive penetration in both mature and emerging economies. The growth rationale is anchored in sustained technological evolution, supportive policy frameworks, and the premium consumer segment’s readiness to invest in high-performance, environmentally responsible mobility solutions.

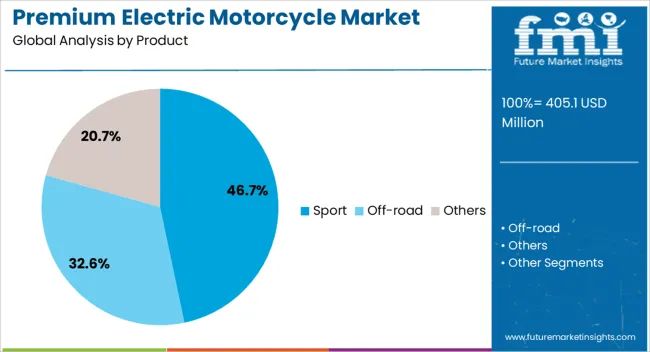

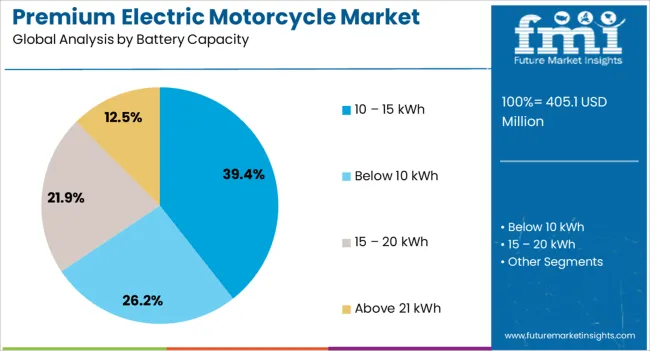

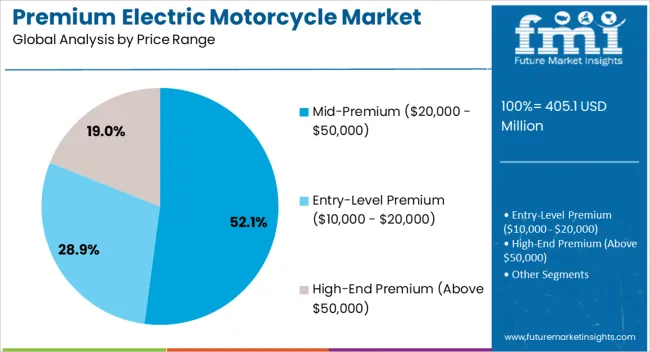

The premium electric motorcycle market is segmented by product, battery capacity, price range, and geographic regions. By product, the premium electric motorcycle market is divided into Sport, Off-road, and Others. In terms of battery capacity, premium electric motorcycle market is classified into 10 – 15 kWh, Below 10 kWh, 15 – 20 kWh, and Above 21 kWh. Based on price range, premium electric motorcycle market is segmented into Mid-Premium ($20,000 - $50,000), Entry-Level Premium ($10,000 - $20,000), and High-End Premium (Above $50,000).

Regionally, the premium electric motorcycle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sport segment, accounting for 46.70% of the product category, dominates due to its alignment with performance-oriented consumer expectations and its ability to command strong brand loyalty. Market leadership is being reinforced by advancements in acceleration, handling, and design aesthetics that cater to riders seeking both thrill and exclusivity.

Premium electric sport motorcycles are benefiting from continuous improvements in battery management systems, regenerative braking, and lightweight chassis engineering, which collectively enhance performance metrics and ride efficiency. Distribution is concentrated in established dealership networks and online premium sales channels, facilitating targeted marketing to affluent customer bases.

Competitive positioning has been strengthened by strategic collaborations with performance parts manufacturers and motorsport sponsorships, further boosting visibility in high-value segments. The segment’s continued dominance is expected to be supported by the rollout of next-generation models that blend enhanced range with cutting-edge rider technology, securing its role as a cornerstone of the premium electric motorcycle market.

The 10–15 kWh battery capacity segment, holding 39.40% of the market, is leading due to its optimal balance between performance, range, and cost within the premium segment. This capacity range supports high-speed capabilities and extended ride times while maintaining manageable charging durations, aligning with the expectations of discerning riders.

Manufacturers are focusing on refining thermal management systems, optimizing energy density, and integrating smart charging features to improve user experience further. The segment benefits from compatibility with existing fast-charging infrastructure in key markets, enabling greater convenience for long-distance travel.

Price-to-performance ratios have been favorable, encouraging both first-time premium EV buyers and experienced riders to transition from combustion models. Ongoing research into cell chemistry improvements and energy recovery systems is expected to enhance efficiency and durability further, ensuring that this capacity range remains highly competitive in the market’s evolving technology landscape.

The mid-premium price range of $20,000–$50,000, capturing 52.10% of the category, dominates due to its accessibility for affluent consumers while maintaining the exclusivity associated with premium electric motorcycles. This range offers advanced performance, high-end design, and integrated digital features without exceeding affordability thresholds for the upper-middle-income and luxury buyer segments.

Strong sales traction in this range is being driven by product launches from established motorcycle brands and emerging EV specialists who are strategically positioning offerings to compete with premium combustion-engine counterparts. Buyers in this segment value not only the environmental benefits but also the prestige, customization options, and advanced safety features bundled into their purchase.

Financing schemes, flexible ownership models, and attractive warranty packages have further broadened appeal. As charging networks expand and battery technologies advance, the mid-premium price bracket is expected to sustain its lead, attracting a growing base of performance-focused, environmentally conscious riders globally.

The premium electric motorcycle market is evolving as luxury buyers embrace eco-friendly mobility with high performance and design. Opportunities are emerging in expanding charging infrastructure and tailored dealership experiences. Trends are shifting toward performance-driven superbikes with advanced connectivity and futuristic designs. However, high costs, range limitations, and infrastructure gaps remain challenges. With strategic investments and technological enhancements, the market is expected to secure a strong foothold among luxury mobility seekers.

The demand for premium electric motorcycles is being shaped by affluent consumers seeking high-performance vehicles that align with eco-conscious values. Increasing fuel prices, coupled with stricter emission norms, are steering buyers toward electric alternatives. The premium segment is particularly attractive to urban professionals and enthusiasts who value speed, design, and environmental responsibility. Luxury motorcycle brands are positioning electric models as status symbols, appealing to early adopters eager for cutting-edge technology. This growing demand is reinforcing premium electric motorcycles as a niche yet fast-expanding category.

The premium electric motorcycle market presents opportunities through the expansion of robust charging networks and specialized dealership experiences. Investments in fast-charging infrastructure, both public and private, are crucial in reducing range anxiety and boosting consumer confidence. Manufacturers are also exploring exclusive retail spaces and premium service centers tailored for luxury buyers. Partnerships with charging service providers, as well as government incentives for electric two-wheelers, are creating favorable conditions. These developments present a pathway for companies to strengthen their market share while addressing consumer convenience and trust.

Key trends in the premium electric motorcycle market include a shift toward high-speed, performance-driven models with advanced battery technologies. Manufacturers are integrating fast-charging capabilities, extended ranges, and smart connectivity features such as ride analytics, GPS tracking, and AI-assisted riding modes. The growing popularity of electric superbikes is attracting motorcycle enthusiasts seeking thrills without compromising on environmental concerns. Design innovation is another strong trend, with companies introducing futuristic aesthetics and lightweight body materials, catering to consumers who prioritize both style and performance in their riding experience.

Despite its promise, the premium electric motorcycle market faces hurdles related to affordability and performance perceptions. The high upfront cost of premium electric models limits accessibility to a narrow segment of wealthy buyers. Battery limitations, including range constraints and charging times, create hesitancy among potential customers, especially in regions with underdeveloped infrastructure. Furthermore, competition from established internal combustion engine superbikes remains intense, making market penetration more complex. Manufacturers need to address these challenges through cost optimization, improved battery technologies, and wider availability of charging solutions.

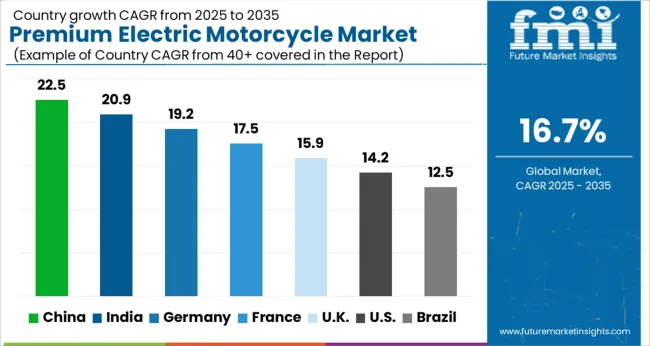

| Country | CAGR |

|---|---|

| China | 22.5% |

| India | 20.9% |

| Germany | 19.2% |

| France | 17.5% |

| UK | 15.9% |

| USA | 14.2% |

| Brazil | 12.5% |

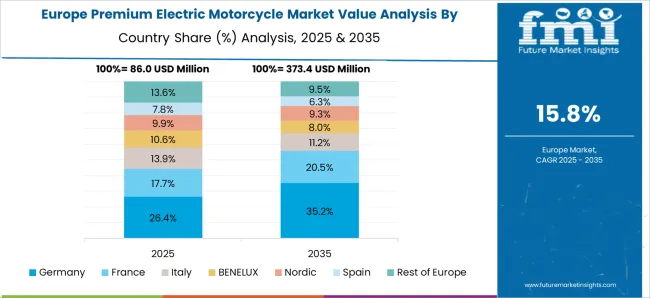

The global premium electric motorcycle market is projected to grow at a CAGR of 16.7% from 2025 to 2035. China is expected to lead with a 22.5% growth rate, followed by India at 20.9% and France at 17.5%. The UK market is forecast at 15.9%, while the USA is set to expand at 14.2%. Rising demand for high-performance electric two-wheelers, coupled with government incentives and consumer preference for eco-friendly yet premium mobility, is fueling growth across regions. China and India dominate with mass adoption and manufacturing expansion, while European countries emphasize advanced design and luxury features. The USA is seeing strong adoption among urban riders seeking performance and technology-driven solutions. Collectively, these markets highlight how premium electric motorcycles are shifting from niche products to mainstream mobility solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The premium electric motorcycle market in China is forecast to grow at 22.5% CAGR, the highest globally. China’s dominance stems from its strong electric vehicle ecosystem, robust manufacturing infrastructure, and large consumer base. Government policies promoting electrification of two-wheelers support rising adoption of premium models with enhanced performance and range. Domestic brands are scaling production and offering advanced features, including connectivity and battery-swapping systems. Rising disposable incomes and urbanization are encouraging Chinese consumers to shift toward luxury electric mobility. With a mix of affordability and cutting-edge technology, China is set to maintain its leadership in the global premium electric motorcycle industry, while also expanding exports to Southeast Asia and Europe.

The premium electric motorcycle market in India is projected to grow at 20.9% CAGR, positioning it among the fastest-growing globally. Government initiatives under “FAME II” and strong support for EV adoption are creating favorable conditions for premium electric two-wheeler sales. Rising fuel costs, demand for performance bikes, and eco-conscious urban consumers are pushing demand for high-end electric motorcycles. Domestic manufacturers are entering the premium segment, while global brands are forming joint ventures to capture market share. Battery innovation and improved charging infrastructure are key areas of development. India’s market is characterized by a young demographic with increasing interest in advanced mobility, signaling strong long-term growth prospects for premium electric motorcycles.

The premium electric motorcycle market in France is expected to grow at 17.5% CAGR, fueled by supportive government policies, rising fuel costs, and consumer demand for sustainable luxury mobility. French consumers are increasingly attracted to high-performance motorcycles with advanced features like fast charging, digital connectivity, and enhanced design. Domestic brands are focusing on niche premium segments, while imports from European manufacturers further enhance product availability. The growing trend of electrification in France’s automotive industry supports premium motorcycle adoption as well. Urban riders seeking quiet, efficient, and stylish alternatives to traditional motorcycles are propelling market expansion. France is likely to remain a key European contributor to the global premium electric motorcycle market during the forecast period.

The premium electric motorcycle market in the United Kingdom is projected to expand at 15.9% CAGR. Growing interest in eco-friendly and performance-oriented two-wheelers is driving adoption, supported by government incentives for electric vehicles. British consumers are showing preference for luxury motorcycles with advanced design, superior range, and smart connectivity. Domestic startups and international brands are actively competing in the segment, making high-end electric motorcycles more accessible. Infrastructure improvements, including fast-charging stations, are also contributing to market expansion. The UK’s premium motorcycle market reflects a balance of demand for sustainable commuting and luxury lifestyle products, ensuring consistent growth over the coming years.

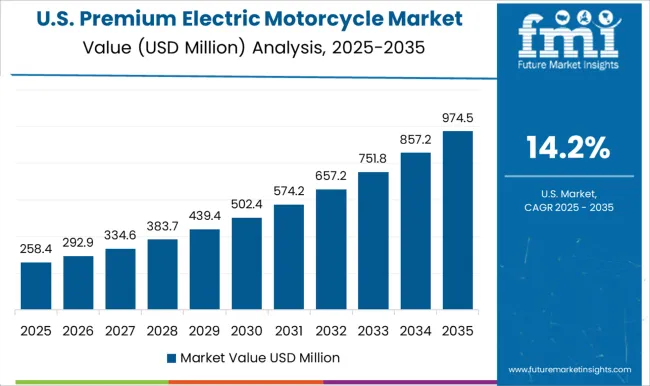

The premium electric motorcycle market in the United States is anticipated to grow at 14.2% CAGR, reflecting steady expansion in a competitive automotive landscape. American consumers are increasingly seeking high-performance electric motorcycles with advanced features, such as long-range batteries, digital displays, and connectivity solutions. Established motorcycle brands are diversifying into the electric segment, while startups bring innovative models with a focus on urban mobility. Federal and state-level incentives for EVs are further supporting adoption. The growing interest in sustainable luxury vehicles and the popularity of motorcycles as lifestyle products are driving momentum. Although growth is slower compared to Asia, the USA market is positioned as a strong innovator with high consumer purchasing power.

The premium electric motorcycle market is being shaped by a blend of legacy motorcycle manufacturers and emerging electric-first brands striving to capture riders seeking performance with electrification. Harley-Davidson, through its LiveWire brand, has positioned itself at the forefront by offering a stylish, high-performance electric motorcycle that targets riders wanting both brand heritage and cutting-edge technology. BMW Motorrad is another influential player, focusing on integrating its engineering expertise with premium electric models that highlight performance, design, and advanced connectivity features. Ducati Motor Holding S.p.A has recently entered the segment with its electric racing prototypes, signaling its intent to leverage its motorsport DNA in the premium electric category. Among specialized electric manufacturers, Energica Motor Company has established itself as a premium electric motorcycle brand, offering high-speed, long-range models that appeal to performance enthusiasts and are widely recognized in the racing domain.

KTM AG has expanded its electric lineup to serve both off-road and urban premium customers, underlining the versatility of its product strategy. Verge Motorcycles, a niche entrant, has gained attention with its hubless wheel design and futuristic aesthetics, targeting luxury-focused riders seeking exclusivity. Zero Motorcycles remains a dominant name in the electric motorcycle industry, with a robust portfolio spanning commuter to premium segments, backed by extensive R&D and global dealer networks. Together, these companies are driving the premium electric motorcycle market toward broader adoption, where luxury, advanced performance, and brand identity converge to meet the growing demand for high-end electric mobility.

| Item | Value |

|---|---|

| Quantitative Units | USD 405.1 Million |

| Product | Sport, Off-road, and Others |

| Battery Capacity | 10 – 15 kWh, Below 10 kWh, 15 – 20 kWh, and Above 21 kWh |

| Price Range | Mid-Premium ($20,000 - $50,000), Entry-Level Premium ($10,000 - $20,000), and High-End Premium (Above $50,000) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Harley-Davidson (LiveWire), BMW Motorrad, Ducati Motor Holding S.p.A, Energica Motor Company, KTM AG, Verge Motorcycles, and Zero Motorcycles |

| Additional Attributes | Dollar sales by motorcycle type (cruiser, sport, touring) and battery capacity (below 10 kWh, 10–15 kWh, above 15 kWh) are key metrics. Trends include rising demand for high-performance electric bikes, growth in luxury commuting preferences, and expansion of charging infrastructure. Regional adoption, technological advancements, and lifestyle-driven demand are fueling market growth. |

The global premium electric motorcycle market is estimated to be valued at USD 405.1 million in 2025.

The market size for the premium electric motorcycle market is projected to reach USD 1,897.7 million by 2035.

The premium electric motorcycle market is expected to grow at a 16.7% CAGR between 2025 and 2035.

The key product types in premium electric motorcycle market are sport, off-road and others.

In terms of battery capacity, 10 – 15 kwh segment to command 39.4% share in the premium electric motorcycle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Premium Bottled Water Market Size and Share Forecast Outlook 2025 to 2035

Premium Outdoor Apparel Market Size and Share Forecast Outlook 2025 to 2035

Premium Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Premium Spirits Glass Bottle Market Size and Share Forecast Outlook 2025 to 2035

Premium Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Alcoholic Beverage Market - Size, Share, and Forecast 2025 to 2035

Premium Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Lager Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Cigarette Market Growth – Demand & Industry Outlook to 2035

Premium Wine Cooler Market Analysis - Growth & Forecast 2025 to 2035

Premium Bicycle Market Analysis by Type, Usage Type, End-user, and Region Forecast Through 2035

A2P & P2A Messaging – AI-Driven Communication & Security

Demand for Lactoferrin Premiumization in Immune SKUs in EU

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA