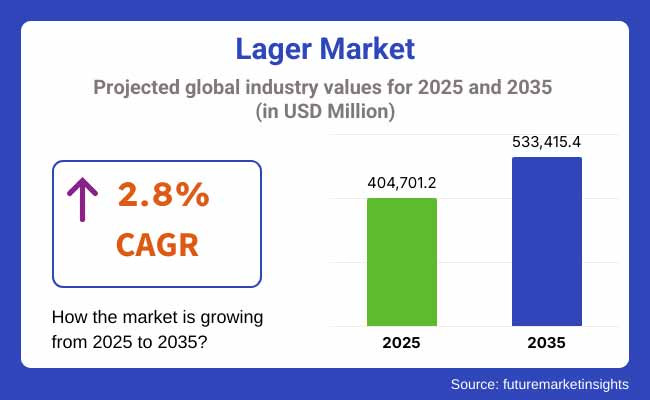

The lager market is expected to witness steady growth between 2025 and 2035, driven by rising global beer consumption, increasing demand for craft and premium lagers, and the expansion of microbreweries and specialty beer brands. The market is projected to be valued at USD 404,701.2 million in 2025 and is anticipated to reach USD 533,415.4 million by 2035, reflecting a CAGR of 2.8% over the forecast period.

Lager, famed for its clean, crisp flavour and long fermentation process, is still the most drunk beer style internationally. Market expansion is further posited by the rising consumption of low-alcohol, and gluten-free lagers, and increased consumer willingness to try unique tastes and locally brewed ones. However, challenges to broader market adoption include rising raw material costs, increasing regulatory restrictions of alcohol advertising, and changing consumer preferences it comes to alternatives toward healthier beverage options.

Meanwhile, innovations such as sustainable brewing practices, AI-driven beer flavour profiling, and blockchain-based traceability for sourcing ingredients are improving production efficiency, consumer engagement, and differentiation in the marketplace as well. The increased presence of limited-edition seasonal lagers, organic and vegan-friendly brews, as well as hybrid lager styles, which double up on brewing traditions, are opening additional pathways to market entry.

Strong demand for premium craft lagers, microbrewery culture expansion and growing preference for low-carb and session lagers are driving North America to be one of the leading market for lager. Consumer interest in locally brewed lagers is growing in both the United States and Canada, as is the expansion of independent breweries and innovation in new beer flavours aimed at health-minded drinkers. Apart from this, the growing demand for beer through e-commerce platforms and direct-to-consumer craft lager subscription services is also bolstering the market growth.

The European Lager market is fast growing owing to a rich brewing tradition, growing demand for alcohol-free and low-alcohol lagers, and increasing investment in sustainable brewing practices. Germany, the United Kingdom, Belgium, and the Czech Republic are the four best countries for traditional and craft lagers.

This is complemented by the fact that the EU is working hard to secure sustainable agriculture for the barley and hops that it produces, which is putting an additional plan on the board for further driving sustainable brewing solutions.

On a regional basis, Asia-Pacific will display the highest market growth, attributed to higher disposable incomes, increasing demand for international beer brands, and increasing social acceptance of beer consumption in China, Japan, India, and South Korea.

China remains a huge producer and consumer of lager, as do Japan and South Korea, with investment going into low-alcohol and functional lager variants that appeal to health-conscious drinkers. Opportunities being created in India with the growth of premium and craft lagers and an inflow of foreign investments in beer production.

Challenges: Regulatory Restrictions and Competition from Non-Alcoholic Beverages

Although lagers are a staple in the beer sector, issues such as strict alcohol rules, soaring levies on alcoholic drinks, and growing competition from ready-to-drink non-alcoholic substitutes are still problems for the market. Moreover, changing consumer preferences toward health-focused drinking habits and plant-based beverage substitutes will influence the market growth.

Opportunities: Premium Craft Lagers and Sustainable Brewing Innovations

The expansion of premium and small-batch lagers, AI-supported brewing methods, and carbon-neutral brewing creation among others are opening new growth opportunities. Over the long term, new technology to produce organic and gluten-free lagers, blockchain-enhanced ingredient transparency, and AI-powered beer personalization are projected to propel market growth.

The demand for new l entrepreneurs is also growing rapidly due to the emergence of digital beer tasting events, launched mobile-based lager customization apps, and alcohol-free lager product lines on the market.

Demand for lager market was optimistic in the period of 2020 to 2024, as consumption of global beer increased with premium and craft lager consumption and growing popularity of microbreweries during the period. As demand shifted toward low-calorie, gluten-free, and flavoured lagers; this trend continued to take hold, particularly among health-conscious consumers, in premium alcoholic beverage markets and in emerging economies.

And AI-assisted brewing techniques, sustainable brewing practices, and smart fermentation monitoring technologies all made for higher efficiency, taste consistency, and scalable production. Nevertheless, barriers to market expansion were presented by challenges such as fluctuating raw material costs, regulatory restrictions on alcohol consumption, and competition from the craft beer and non-alcoholic alternative segments.

Fast forward a decade to 2025 to 2035 - expect the broader beer industry to shift with the introduction of AI-powered brewing automation, blockchain-enabled ingredient traceability and innovations in sustainable brewing. Techniques harnessing lab-grown barley fermentation, AI-assisted flavour profiling, and zero-waste brewing will drive efficiency and sustainability.

Revolutionizing beer 1768, The combination of personalized AI-driven, beer recommendations, smart temperature-controlled kegs and carbon-neutral breweries will continue to fuel transformation in this vertical market. Moreover, the emergence of zero-alcohol craft lagers, AI-powered demand forecasting solutions for breweries, and the use of immersive metaverse beer-tasting experiences will reshape market dynamics by providing better sustainability, consumer-facing options, flavour innovation, and more.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with alcohol taxation laws, labeling regulations, and sustainability guidelines. |

| Technological Innovation | Use of traditional brewing techniques, temperature-controlled fermentation, and manual quality control. |

| Industry Adoption | Growth in macro breweries, microbreweries, and craft lager production. |

| Smart & AI-Enabled Solutions | Early adoption of smart keg tracking, AI-driven flavour adjustments, and digital brewery management. |

| Market Competition | Dominated by large beer manufacturers, regional craft brewers, and premium lager brands. |

| Market Growth Drivers | Demand fuelled by rising disposable incomes, growing interest in premium lagers, and expansion of beer tourism. |

| Sustainability and Environmental Impact | Early adoption of water-efficient brewing, recyclable packaging, and organic ingredient sourcing. |

| Integration of AI & Digitalization | Limited AI use in supply chain tracking, quality control, and consumer trend analysis. |

| Advancements in Brewing | Use of traditional fermentation, standard ingredient processing, and fixed brewing recipes. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven compliance tracking, blockchain-backed ingredient authenticity verification, and government-mandated carbon-neutral brewing regulations. |

| Technological Innovation | Adoption of AI-assisted fermentation monitoring, lab-grown malt alternatives, and blockchain-enabled ingredient traceability. |

| Industry Adoption | Expansion into AI-driven personalized beer formulation, immersive metaverse beer tastings, and fully automated brewing ecosystems. |

| Smart & AI-Enabled Solutions | Large-scale deployment of AI-powered fermentation optimization, predictive demand forecasting, and blockchain-secured lager production tracking. |

| Market Competition | Increased competition from AI-integrated brewing startups, blockchain-driven beer authenticity platforms, and virtual brewery experiences. |

| Market Growth Drivers | Growth driven by AI-assisted beer personalization, zero-alcohol craft lager expansion, and carbon-neutral brewing initiatives. |

| Sustainability and Environmental Impact | Large-scale transition to zero-waste breweries, AI-optimized sustainable hops and barley production, and carbon-negative brewing techniques. |

| Integration of AI & Digitalization | AI-powered real-time ingredient optimization, blockchain-backed brewing transparency, and AI-driven automated flavour development. |

| Advancements in Brewing | Evolution of AI-assisted real-time recipe adjustments, self-cleaning smart brewing systems, and precision-controlled aging processes. |

Lager is the most popular type of beer in the USA as evidenced by increased demand for craft and high-end lagers, increased demand from USA consumers for low calorie and light beers, as well as increased focus on sustainable practices in brewing their favourite beverages. The growth of microbreweries and independent craft beer brewers drive the market.

Newly adopted brewing techniques like innovative fermentation methods and locally sourced ingredients are also expanding product variety. Consumer segmentation and online sales through both direct-to-consumer and delivery channels also provide democratized access to products like lager among a more diverse consumer audience.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.0% |

The UK lager industry is experiencing gradual growth, which is driving the market for premium and imported lagers, increasing demand for alcohol-free and low alcohol by volume or notes (ABV) beers, and rising energy in sustainable brewing methods. Leading factors influencing market adoption include, the expansion of craft beer bars and the increasing trend of consumption at home.

And the growth of sustainable packaging such as recyclable aluminium cans and biodegradable beer kegs is changing what consumers buy. The shift toward gluten-free and organic lagers to meet evolving consumer health preferences further supports industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.6% |

Germany, Belgium, and Netherlands are expected to drive the lager market in the European Union, due to their well-established beer culture with a strong adoption of specialty lagers, along with growing demand for low-alcohol and session lagers. In fact, the EU’s attention to sustainability during the brewing process water and energy efficient, for example gives the industry a turbo boost in the realm of innovation.

And innovation in flavour development think fruit-infused and aged lagers is propelling consumer interest. An increasing focus on heritage brewing methods and local ingredients is also spurring market growth, especially in historic brewing centres.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 2.9% |

Japan's lager market is growing on the back of demand for premium and ultra-dry lagers and growing consumer demand for low-malt and non-alcohol beer alternatives, and strong craft brewing investment. The country’s prowess in precision brewing is fuelling new ideas for super-clear and crisp lagers. Breweries are also focusing on flavour and using AI-driven brewing analytics to maintain consistency and optimize batches. With the entry of home-brewing kits and trend for specialty beer festivals, the market for the beer is also expected to boost along to unique taste profiles and seasonal lager offerings.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.5% |

With the demand for premium and imported beer on the rise in the country, Western-style brewing is also becoming popular, as well as the preference for seasonal and light lagers, making South Korea an increasingly important market for lager.

The country’s craft beer innovation and a recent emphasis on local brewing collaborations is driving a thirst for range in lager varieties. As a result, consumers are growing more accustomed to low-temperature fermentation practices, and firms are investing in the development of custom ingredients to enhance market competitiveness. This is further stimulated with a growing phenomenon of beer pairing experiences with Korean food and the expansion of beer subscription services.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

Pale Lager Leads Market Demand as Refreshing and Crisp Beer Styles Gain Popularity

The pale lager, due to its light crisp taste and refreshing qualities, has become the most consumed beer style. Unlike darker varieties, pale lagers use prolonged fermentations at lower temperatures for a subtle and gentle bitterness that attracts the masses.

The popularity of session beers and easy drinking options has grown organically in this region, creating a growing need for access to pale lagers with aspiring seeds of growth as young consumers, casual drinkers, and low abs attributers look to add options to the beer table. The proliferation of craft and microbrewery pale lagers with more interesting hop profiles, unfiltered brewing and organic ingredients has bolstered market growth with wider array of choices.

Development of alcohol-free and low-alcohol pale lagers, targeting health aware consumers has sharpened market access, leading to higher representation in fitness-focused and non-alcoholic beverage category. The implementation of sustainable brewing practices for pale lagers, such as energy-efficient production, earth-friendly packaging, and decreased water usage, has solidified market growth, resonating with international environmental concerns.

Pale lager has the disadvantage of high competition with breweries that produce at scale, shifting tastes toward exciting and unique flavours, and price sensitivity of Root and other many-layers-flavours emerging markets. Current trends in hybrid brewing methods, improved marketing strategies, and working with local artisans are improving differentiation, which will promote future expansion for pale lagers globally.

Dark Lager Gains Popularity as Full-Bodied and Malty Beer Styles Witness Increased Demand

Dark lagers are returning as craft breweries and beer lovers alike are rediscovering the complexity of flavour, caramel notes, and toasted malt traits these beers can provide. The darker varieties roast for double or even triple the length of time as pale lagers, creating rich flavour notes that lure fans of robust and flavourful beer.

The increasing trend towards seasonal and specialty beer offerings, especially during autumn/winter months and holiday style beers, has also led to the adoption of dark lagers as they are perceived to provide warmth and pair with robust foods. In certain markets, premium and craft dark lagers have seen double-digit growth rates in recent years, showcasing a robust movement to broaden diversity within beer styles.

The rise in adoption of nitrogen infusion in dark lagers, which provide smoother textures and boost mouthfeels, revolutionised the segment and ensured these lagers stood out from the traditional carbonated vehicles.

While offering significant advantages with its taste complexity and craft appeal, dark lager suffers from difficulties like lower market penetration than its pale counterparts, limited brand awareness among mainstream consumers, and higher production costs owing to specialty malts. But education around beer diversity, partnerships with fine dining concepts, alongside innovation with hybrid styles of lager and stout beer, is fuelling re-interest in dark styles of lager, supporting continued market growth.

Standard Lager Remains Market Leader as Affordable and Accessible Beer Options Sustain High Demand

Standard lager maintains the huge share of the market with its accessibility, price point, and consumer familiarity. Unlike their premium and luxury counterparts, standard lagers prioritize mass production, cost efficiency, and wide demographic appeal, making them ubiquitous in supermarkets, convenience stores, and bars.

Standard lagers have benefitted from the trend towards cheaper beer in cost-sensitive markets, especially in developing nations, which may create a low-cost entry point for beer drinkers. Market penetration has been boosted through the growing number of regional and private-label standard lagers, which serve to provide consumers with localized branding and regional market beer experiences that establish greater consumer trust and loyalty.

Lager's appeal at both the large-format and multi-pack levels, of course, has also resulted from changing social behaviour and bulk buying habits, making it more affordable for continued household consumption. Recyclable and lightweight packaging for standard lagers, including aluminium cans and biodegradable materials, have ensured commitment to sustainability and compliance with global environmental targets.

However, standard lager also faces headwinds such as increased competition from craft and specialty beers, shifting consumer perceptions around premiumization and economic uncertainty impacting discretionary spending. But the introduction of functional ingredient enhancements (e.g., vitamin-infused lagers), as well as strategic pricing and innovations in marketing, are keeping the standard lager category growing.

Premium Lager Gains Market Share as Consumers Seek Elevated Beer Experiences

Beer is a fast-growing segment, specifically premium lager, in which consumers are searching for quality ingredients, better brewing process, and imaginative taste results. It means premium lagers those that use better hop varieties, longer aging, and more careful brewing for consumers who are willing to pay extra for better taste rather than standard lagers.

The premiumization trend within the alcoholic beverage sector has been supportive of growth within the premium lagers category as people consider quality beer as more social experience along with symbol of social status. Importing phenomena such as small-batch or limited-edition premium lagers, with experimental ingredients or collaborative brewery products has bolstered brand exclusivity and helped to maintain consumer interest and engagement.

In keeping with the history of high-end lager, premium lager differentiation has also seen increased use of refined packaging and branding that includes embossed bottles, foil-wrapped necks, and artisanal label design, for a saturating presence and high-end aspiration.

These aspects combined make premium lager less competitive against those who do acquire their core stock from craft breweries or at the high end but it also faces some challenges in that respect like higher retail price points paired with growing competition from craft breweries combined with changing consumer spending habits. But wider distribution, better marketing, experiential promotions (think brewery tours and beer tastings) and sustainably sourced ingredients have premium lager continuing to grow around the world.

The lager market is mainly fuelled by rising customer preference for crafted and premium lager varieties, increasing investment on brewing innovation, and ascending world liquor consumption. The market is growing steadily with a wider application footprint in both on premise and off-premise distribution. These include the emergence of low-alcohol and alcohol-free lagers, sustainable brewing processes, and the premiumization of lager brands with differentiated flavour profiles.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Anheuser-Busch InBev | 12-16% |

| Heineken N.V. | 10-14% |

| Carlsberg Group | 8-12% |

| Molson Coors Beverage Company | 6-10% |

| Asahi Group Holdings, Ltd. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Anheuser-Busch InBev | Develops a diverse portfolio of lagers, including global and regional premium brands. |

| Heineken N.V. | Specializes in premium and low-alcohol lager offerings with sustainable brewing initiatives. |

| Carlsberg Group | Offers a wide range of traditional and craft lagers with a strong focus on emerging markets. |

| Molson Coors Beverage Company | Focuses on innovative lager products, including alcohol-free and flavored varieties. |

| Asahi Group Holdings, Ltd. | Provides premium Japanese and European-style lagers with a focus on quality and heritage. |

Key Company Insights

Anheuser-Busch InBev (12-16%) Anheuser-Busch InBev leads in global lager production, offering diverse premium and mass-market beer brands.

Heineken N.V. (10-14%) Heineken specializes in sustainable brewing and premium lager brands, including low-alcohol alternatives.

Carlsberg Group (8-12%) Carlsberg focuses on innovative and traditional lager styles, expanding its market presence in developing regions.

Molson Coors Beverage Company (6-10%) Molson Coors pioneers in craft-inspired lagers, alcohol-free innovations, and diverse flavour profiles.

Asahi Group Holdings, Ltd. (4-8%) Asahi provides high-quality Japanese and European lagers, emphasizing tradition and premium taste.

Other Key Players (45-55% Combined) Several regional and craft breweries contribute to the expanding Lager Market. These include:

The overall market size for the lager market was USD 404,701.2 million in 2025.

The lager market is expected to reach USD 533,415.4 million in 2035.

The demand for lager will be driven by increasing consumer preference for light and refreshing alcoholic beverages, rising demand for premium and craft lagers, growing influence of social drinking culture, and advancements in brewing technology improving flavour profiles and production efficiency.

The top 5 countries driving the development of the lager market are the USA, China, Germany, Brazil, and Mexico.

The Pale Lager segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Liters) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 4: Global Market Volume (Liters) Forecast by Variety, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 8: Global Market Volume (Liters) Forecast by Packaging Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (Liters) Forecast by End Use, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Liters) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 16: North America Market Volume (Liters) Forecast by Variety, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: North America Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 20: North America Market Volume (Liters) Forecast by Packaging Type, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: North America Market Volume (Liters) Forecast by End Use, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (Liters) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 28: Latin America Market Volume (Liters) Forecast by Variety, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Latin America Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 32: Latin America Market Volume (Liters) Forecast by Packaging Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 34: Latin America Market Volume (Liters) Forecast by End Use, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (Liters) Forecast by Sales Channel, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 40: Western Europe Market Volume (Liters) Forecast by Variety, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 42: Western Europe Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 44: Western Europe Market Volume (Liters) Forecast by Packaging Type, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: Western Europe Market Volume (Liters) Forecast by End Use, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Western Europe Market Volume (Liters) Forecast by Sales Channel, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 52: Eastern Europe Market Volume (Liters) Forecast by Variety, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: Eastern Europe Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 56: Eastern Europe Market Volume (Liters) Forecast by Packaging Type, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 58: Eastern Europe Market Volume (Liters) Forecast by End Use, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Eastern Europe Market Volume (Liters) Forecast by Sales Channel, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Liters) Forecast by Variety, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Liters) Forecast by Packaging Type, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Liters) Forecast by End Use, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Liters) Forecast by Sales Channel, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 76: East Asia Market Volume (Liters) Forecast by Variety, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 78: East Asia Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 80: East Asia Market Volume (Liters) Forecast by Packaging Type, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 82: East Asia Market Volume (Liters) Forecast by End Use, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 84: East Asia Market Volume (Liters) Forecast by Sales Channel, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Liters) Forecast by Variety, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Liters) Forecast by Packaging Type, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Liters) Forecast by End Use, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Liters) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Variety, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Liters) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 12: Global Market Volume (Liters) Analysis by Variety, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 20: Global Market Volume (Liters) Analysis by Packaging Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Volume (Liters) Analysis by End Use, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (Liters) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Variety, 2023 to 2033

Figure 32: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Packaging Type, 2023 to 2033

Figure 34: Global Market Attractiveness by End Use, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Variety, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 48: North America Market Volume (Liters) Analysis by Variety, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 52: North America Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 56: North America Market Volume (Liters) Analysis by Packaging Type, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 60: North America Market Volume (Liters) Analysis by End Use, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (Liters) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Variety, 2023 to 2033

Figure 68: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 69: North America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 70: North America Market Attractiveness by End Use, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Variety, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 84: Latin America Market Volume (Liters) Analysis by Variety, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 88: Latin America Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 92: Latin America Market Volume (Liters) Analysis by Packaging Type, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 96: Latin America Market Volume (Liters) Analysis by End Use, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (Liters) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Variety, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 106: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Variety, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 120: Western Europe Market Volume (Liters) Analysis by Variety, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 124: Western Europe Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 128: Western Europe Market Volume (Liters) Analysis by Packaging Type, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 132: Western Europe Market Volume (Liters) Analysis by End Use, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Western Europe Market Volume (Liters) Analysis by Sales Channel, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Variety, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Variety, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Liters) Analysis by Variety, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Liters) Analysis by Packaging Type, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Liters) Analysis by End Use, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Liters) Analysis by Sales Channel, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Variety, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Variety, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Liters) Analysis by Variety, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Liters) Analysis by Packaging Type, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Liters) Analysis by End Use, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Liters) Analysis by Sales Channel, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Variety, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Packaging Type, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Variety, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 228: East Asia Market Volume (Liters) Analysis by Variety, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 232: East Asia Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 236: East Asia Market Volume (Liters) Analysis by Packaging Type, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 240: East Asia Market Volume (Liters) Analysis by End Use, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 244: East Asia Market Volume (Liters) Analysis by Sales Channel, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Variety, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Packaging Type, 2023 to 2033

Figure 250: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 251: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Variety, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Liters) Analysis by Variety, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Liters) Analysis by Packaging Type, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Liters) Analysis by End Use, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Liters) Analysis by Sales Channel, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Variety, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Packaging Type, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Premium Lager Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA