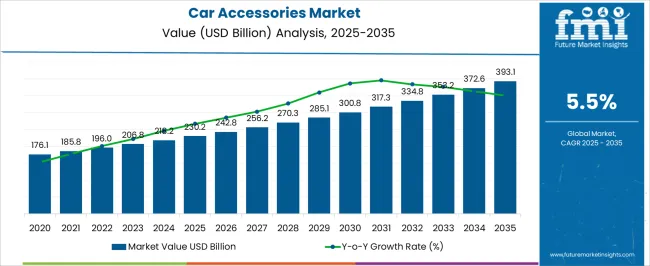

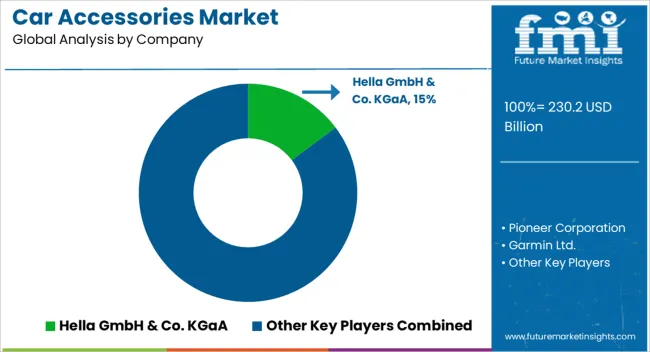

The car accessories market is estimated to be valued at USD 230.2 billion in 2025 and is projected to reach USD 393.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The car accessories market, estimated at USD 230.2 billion in 2025 and projected to reach USD 393.1 billion by 2035 at a CAGR of 5.5%, demonstrates a cost structure and value-chain framework that influences growth and profitability across the automotive sector. Raw materials, including polymers, metals, and electronics, represent a significant portion of production costs, particularly for technologically advanced components such as infotainment systems, safety modules, and electronic sensors. Manufacturing and assembly contribute further value, where automation, precision engineering, and quality control measures determine cost efficiency and product reliability.

Distribution and retail channels form the next critical link in the value chain, encompassing dealerships, aftermarket suppliers, and e-commerce platforms, which affect margins and accessibility. Services such as customization, installation, and warranty support add incremental value while also incurring operational costs. From 2025 to 2035, market growth from USD 230.2 billion to USD 393.1 billion reflects scaling efficiencies, adoption of cost-effective manufacturing technologies, and expansion of aftermarket and OEM channels. Logistics and supply chain optimization further impact overall profitability, especially with global sourcing and regional production hubs. The value chain highlights the interdependence of materials, production, distribution, and service, where each segment’s efficiency directly affects competitive positioning and long-term growth potential in the market.

| Metric | Value |

|---|---|

| Car Accessories Market Estimated Value in (2025 E) | USD 230.2 billion |

| Car Accessories Market Forecast Value in (2035 F) | USD 393.1 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The car accessories market represents a broad segment within the global automotive aftermarket, offering products that enhance comfort, performance, and aesthetics. Within the overall automotive aftermarket sector, it accounts for about 7.2%, reflecting strong consumer-driven demand. In the automotive interior components market, it secures 5.9%, supported by sales of seat covers, infotainment systems, and comfort upgrades. Across the automotive exterior components category, it contributes around 4.8%, with demand for body kits, lighting, and protective films. In the connected automotive electronics and infotainment sector, its share is about 3.7%, reflecting growing interest in smart navigation and entertainment systems.

Within the vehicle performance enhancement and modification segment, it accounts for 3.1%, highlighting trends in exhaust systems, suspension kits, and performance tuners. Recent trends in this market have emphasized personalization, smart integration, and convenience. Innovations include the integration of AI-enabled infotainment units, wireless charging systems, and advanced driver-assist accessories. Groundbreaking strategies involve the launch of eco-friendly car accessories such as biodegradable mats, waterless cleaning kits, and energy-efficient lighting solutions. Key players are entering partnerships with e-commerce platforms to expand product reach and adoption. The rise of connected accessories, such as app-controlled dash cams and smart air purifiers, is gaining momentum in urban markets. The modular and multifunctional accessories are being developed to appeal to cost-conscious consumers seeking versatility. These developments highlight how technology integration, personalization, and sustainability are reshaping the car accessories market.

The car accessories market is experiencing robust growth fueled by rising consumer interest in vehicle personalization, enhanced comfort, and improved safety features. Increasing disposable incomes, a growing middle class, and heightened awareness of in-vehicle convenience are driving higher spending on both aesthetic and functional accessories.

Advances in smart technology integration, such as connected infotainment systems and digital monitoring devices, are broadening product appeal. Additionally, the expansion of e-commerce platforms has improved product accessibility and variety for a global consumer base.

Regulatory emphasis on vehicle safety and emission standards has also encouraged the adoption of certain accessories that enhance compliance and efficiency. The outlook remains positive as automotive ownership trends and lifestyle-driven customization continue to expand demand across both developed and emerging markets.

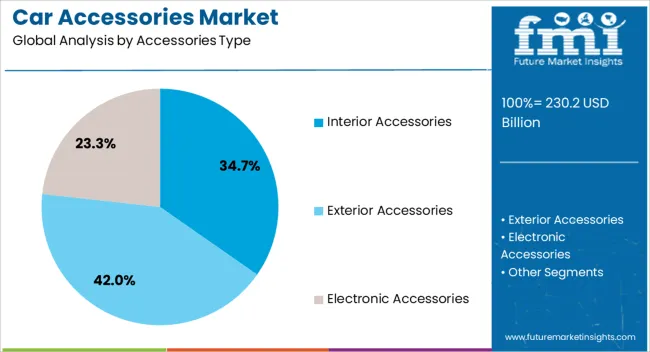

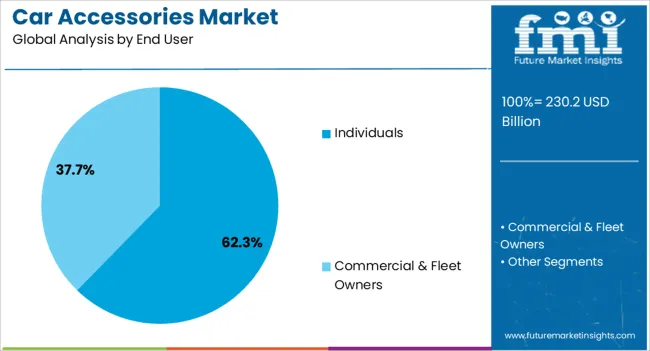

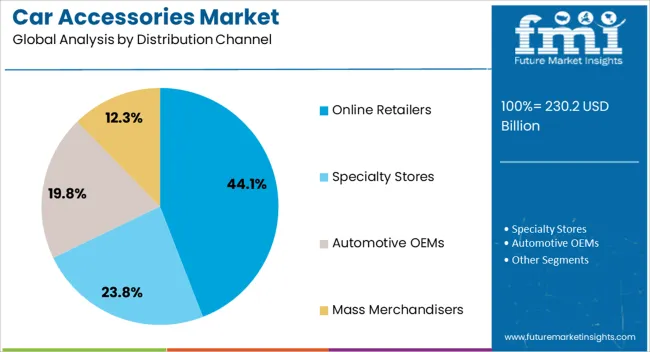

The car accessories market is segmented by accessories type, end user, distribution channel, and geographic regions. By accessories type, car accessories market is divided into interior accessories, exterior accessories, electronic accessories, performance part accessories, safety & security accessories, wheels accessories, and others. In terms of end user, car accessories market is classified into individuals and commercial & fleet owners. Based on distribution channel, car accessories market is segmented into online retailers, specialty stores, automotive OEMs, and mass merchandisers. Regionally, the car accessories industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The interior accessories type segment is projected to hold 34.7% of the total market revenue by 2025, positioning it as the leading category. This growth is being supported by increasing consumer preference for comfort, convenience, and personalization within the vehicle cabin.

Products such as seat covers, floor mats, and infotainment upgrades enhance driving experience and aesthetic appeal, encouraging repeat purchases. Rising interest in premium materials and smart-enabled interiors has further expanded the market reach of this segment.

The integration of technology-driven features within interior accessories is also elevating their value proposition, reinforcing their leadership within the overall accessories market.

The individuals end user segment is expected to account for 62.3% of total market revenue by 2025, making it the dominant customer group. This dominance is linked to the strong desire for personalized driving experiences and the growing culture of vehicle customization.

Increased vehicle ownership rates, coupled with easy access to a wide variety of accessories through both physical and digital retail channels, have strengthened adoption among individual consumers.

The segment has also benefited from the rising popularity of DIY installation and affordable customization options, enabling consumers to upgrade their vehicles without significant professional assistance.

The online retailers distribution channel segment is anticipated to capture 44.1% of total market revenue by 2025, positioning it as the leading sales channel. This growth is driven by the convenience of online shopping, wider product variety, and competitive pricing offered by e-commerce platforms.

Enhanced logistics networks and faster delivery times have encouraged more consumers to purchase car accessories online. Moreover, the ability to compare products, read reviews, and access exclusive online discounts has further boosted adoption.

The shift toward digital purchasing behavior, accelerated by evolving consumer lifestyles, continues to strengthen the dominance of online retailers in the distribution landscape.

The market has grown into a diverse and competitive industry, catering to both functional and aesthetic needs of vehicle owners. Accessories range from interior products such as seat covers, infotainment systems, and air fresheners to exterior add-ons like alloy wheels, lighting systems, and protective coatings. Increasing consumer interest in vehicle personalization has been a major driver, supported by rising adoption of digital solutions such as connected car devices and navigation systems. The market also benefits from aftersales demand as vehicle owners seek replacement and customization solutions.

One of the strongest forces shaping the car accessories market has been the rising emphasis on personalization. Consumers increasingly seek to differentiate their vehicles through unique interiors, performance enhancements, and visual upgrades. Accessories such as customized seat covers, dashboard trims, and advanced infotainment systems have become popular choices. The desire to match vehicles with lifestyle preferences has fueled demand for luxury interior fittings and connectivity solutions. This trend has been amplified by the influence of social media and digital platforms, where vehicle aesthetics are showcased as a reflection of individuality. As vehicles continue to be seen as lifestyle assets, this driver remains central to market expansion.

Technological integration has significantly reshaped demand in the car accessories sector. Smart devices, including Bluetooth-enabled systems, heads-up displays, parking sensors, and dash cameras, are being widely adopted for enhanced convenience and safety. Navigation systems and voice-controlled infotainment units highlight the shift toward digital ecosystems within vehicles. These accessories are not only popular in premium cars but also in mass-market models as aftermarket upgrades. The growing adoption of electric vehicles has further accelerated demand for accessories tailored to charging management and battery performance. The move toward connected mobility ensures that digital accessories remain a priority area for innovation and sales growth.

The aftermarket segment plays a crucial role in the expansion of the car accessories market. Vehicle owners often turn to aftermarket suppliers for replacement, customization, and upgradation needs after the initial purchase. This includes performance parts, protective coatings, lighting systems, and convenience-enhancing accessories. The aftermarket sector benefits from flexibility in price points and availability of diverse product options, which OEM channels cannot always provide. Online marketplaces have further boosted the visibility and reach of aftermarket products, allowing consumers access to a wide variety of accessories. The rising global vehicle parc ensures sustained demand through the aftermarket distribution channel in coming years.

The market has faced significant challenges due to counterfeit products and intense price-based competition. Low-quality imitations in the aftermarket segment undermine consumer trust and create safety risks, particularly in categories such as lighting, brake pads, and electronic devices. Regulatory scrutiny in several regions has increased pressure on manufacturers and retailers to ensure compliance with quality standards. The global competition from both local and international players leads to aggressive pricing strategies, limiting profitability. Market participants are focusing on product differentiation, brand value, and distribution partnerships to counter these challenges. Despite obstacles, strong demand from personalization and technology integration continues to sustain growth.

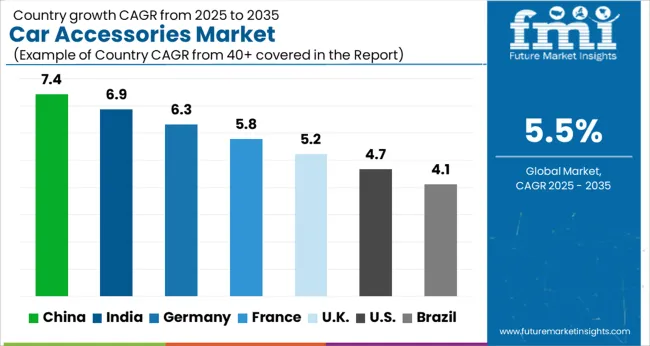

| Countries | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| U.K. | 5.2% |

| U.S. | 4.7% |

| Brazil | 4.1% |

The market is expected to expand at a CAGR of 5.5% from 2025 to 2035, driven by increasing automotive customization and aftermarket demands. India reported 6.9%, supported by rising vehicle ownership and growing adoption of interior and exterior enhancements. Germany reached 6.3%, where automotive innovation and premium vehicle segments sustained steady growth. China led with 7.4%, propelled by large-scale production, technological advancements, and rising consumer spending. The United Kingdom registered 5.2%, with gradual uptake across both passenger and commercial vehicles. The United States accounted for 4.7%, with steady interest in performance and convenience-oriented accessories. These nations are shaping production, adoption, and technological trends in the global market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.4%, driven by rising automotive production, increasing consumer focus on vehicle customization, and growing demand for safety and infotainment accessories. Adoption has been reinforced by both domestic and international manufacturers providing a range of premium and mid segment products such as car mats, seat covers, infotainment systems, and advanced safety sensors. E commerce platforms and organized retail chains support distribution, while aftermarket customization trends continue to expand. Technological integration, including IoT enabled smart accessories, enhances the appeal of modern vehicle enhancements.

India is expected to expand at a CAGR of 6.9%, supported by growing passenger car sales, rising middle class spending, and increased awareness of vehicle personalization. Adoption has been reinforced by demand for car audio systems, seat covers, alloy wheels, and LED lighting accessories. Domestic manufacturers and international brands cater to tier one and tier two cities, while online retail platforms further boost penetration. Rising interest in vehicle safety accessories, such as dash cams and parking sensors, supports additional market growth.

Germany is projected to grow at a CAGR of 6.3%, driven by demand for high quality OEM and aftermarket car accessories in passenger and commercial vehicles. Adoption has been reinforced by strict safety and regulatory compliance standards, leading to increased use of advanced safety systems, premium interiors, and infotainment solutions. Domestic manufacturers focus on innovation, durability, and energy efficient accessories, while imports complement demand for specialized products. Technological integration, particularly for connected vehicles, enhances market potential.

The United Kingdom is expected to grow at a CAGR of 5.2%, supported by adoption in passenger vehicles, fleet upgrades, and automotive customization trends. Import reliance is high for premium accessories, while domestic manufacturers supply standard interior and exterior components. Growth is reinforced by increased spending on vehicle aesthetics, comfort, and safety, alongside the rise of electric vehicles requiring specialized accessory solutions.

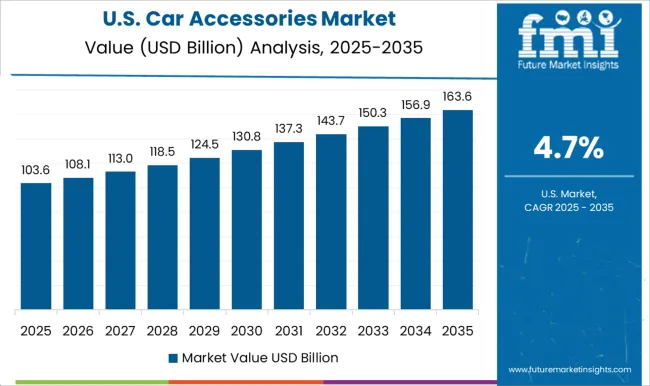

The United States is projected to grow at a CAGR of 4.7%, supported by aftermarket customization, fleet upgrades, and demand for advanced safety and infotainment systems. Domestic manufacturers focus on high performance and technology enabled accessories such as dash cameras, sensors, and smart interiors. E commerce penetration and automotive retail chains facilitate wider distribution. Rising electric vehicle sales further contribute to demand for specialized charging and accessory solutions.

The market is characterized by a mix of global leaders, automotive electronics specialists, tire and safety innovators, and regional suppliers catering to aftermarket needs. Hella GmbH & Co. KGaA stands out as a major player in automotive lighting, electronic components, and sensor-based solutions, leveraging strong OEM relationships and advanced R&D capabilities. Pioneer Corporation is prominent in in-car infotainment, audio, and navigation systems, maintaining a competitive edge through technology integration and brand recognition. Garmin Ltd. contributes extensively with GPS navigation, telematics, and connected car solutions, focusing on precision, innovation, and consumer-centric functionalities. Bridgestone Corporation and Michelin Group dominate the tire and performance segment, integrating durability, safety, and smart tire technologies into their accessory portfolios.

AutoZone Inc. functions as a leading distributor for aftermarket car parts and accessories, providing broad product availability and customer support across regions. Minda Industries Ltd., operating primarily in Asia, caters to automotive OEMs and aftermarket segments with products ranging from lighting and horns to electronic components, benefiting from cost efficiency and regional market knowledge. Competition in the market is influenced by evolving consumer preferences, increasing vehicle electrification, smart technology adoption, and a growing focus on safety and performance enhancements. Innovation in smart accessories, connected devices, and premium aftermarket products remains a key differentiator. Market participants also emphasize distribution networks, brand recognition, and collaborations with OEMs to capture expanding opportunities in both emerging and mature automotive markets.

| Items | Values |

|---|---|

| Quantitative Units | USD 230.2 billion |

| Accessories Type | Interior Accessories, Exterior Accessories, Electronic Accessories, Performance Part Accessories, Safety & Security Accessories, Wheels Accessories, and Others |

| End User | Individuals and Commercial & Fleet Owners |

| Distribution Channel | Online Retailers, Specialty Stores, Automotive OEMs, and Mass Merchandisers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hella GmbH & Co. KGaA, Pioneer Corporation, Garmin Ltd., Minda Industries Ltd., Bridgestone Corporation, Autozone Inc., and Michelin Group |

| Additional Attributes | Dollar sales by accessory type and vehicle category, demand dynamics across passenger, commercial, and luxury segments, regional trends in aftermarket and OEM adoption, innovation in materials, smart integration, and ergonomics, environmental impact of production and disposal, and emerging use cases in connected car enhancements, interior customization, and safety-focused products. |

The global car accessories market is estimated to be valued at USD 230.2 billion in 2025.

The market size for the car accessories market is projected to reach USD 393.1 billion by 2035.

The car accessories market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in car accessories market are interior accessories, seat covers, floor mats, steering wheel covers, and others.

In terms of end user, individuals segment to command 62.3% share in the car accessories market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA