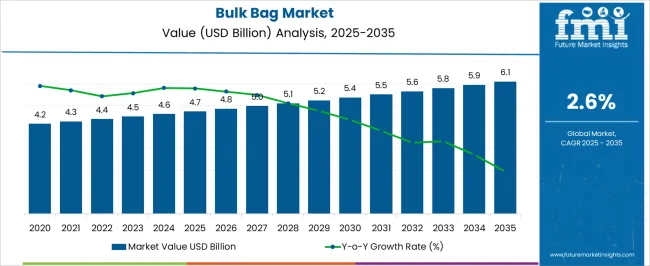

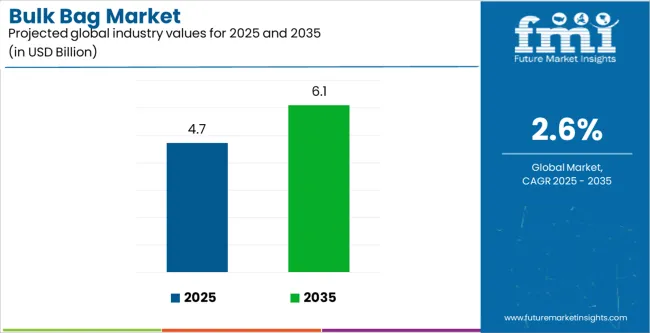

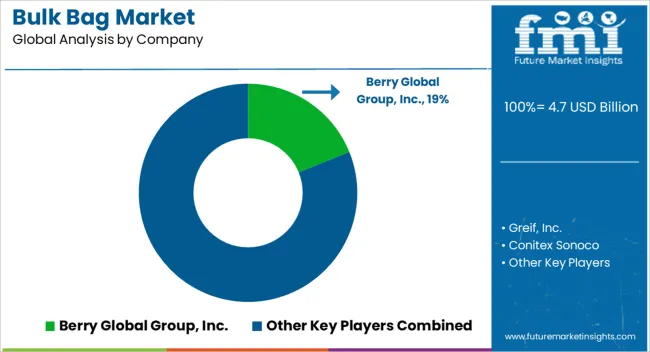

The bulk bag market is projected to expand from USD 4.7 billion in 2025 to USD 6.1 billion by 2035, advancing at a CAGR of 2.6% over the forecast period. Demand growth shows the steady shift toward flexible intermediate bulk containers (FIBCs) as efficient and cost-effective solutions for transporting and storing large volumes of dry, flowable materials. The bulk bag market is benefitting from its widespread adoption in logistics, construction, chemicals, agriculture, and mining, where operational efficiency and safety are critical.

One of the key dynamics influencing market expansion is the growing need for secure handling of bulk commodities such as grains, fertilizers, cement, sand, and chemicals. Bulk bags, with their superior load-bearing strength, reusability, and cost-effectiveness, are replacing traditional rigid packaging formats like drums and cartons. Their ability to reduce transportation costs through space optimization and lightweight design further supports adoption across global supply chains. Industrial expansion, particularly in Asia-Pacific, where construction and agricultural output remain strong, is reinforcing bulk bag consumption.

Regulatory frameworks emphasizing material safety, hygiene, and recyclability are shaping product design and manufacturing practices. Eco-friendly initiatives are pushing manufacturers to adopt biodegradable liners, recyclable fabrics, and sustainable production techniques. At the same time, compliance with stringent safety and handling regulations in food, pharmaceutical, and chemical sectors has accelerated demand for food-grade and UN-certified bulk bags. These regulatory shifts are driving differentiation among suppliers, creating opportunities for value-added innovation in design, coatings, and barrier properties. Technological progress is another driver. Automation in bag-filling and discharging systems is enabling faster handling, reduced product spillage, and enhanced efficiency. Advancements in fabric durability, anti-static protection, and moisture resistance are expanding the application scope of bulk bags across hazardous and sensitive materials. Digital tagging solutions and smart packaging features, including RFID-enabled tracking, are also emerging to improve supply chain visibility and logistics efficiency.

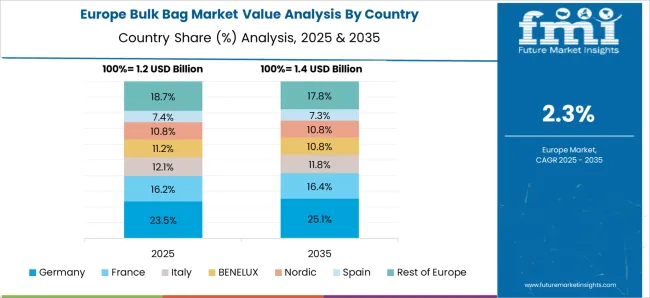

Market growth is further strengthened by trade and infrastructure development, which drive bulk movement of raw materials and construction products. Rapid industrialization in emerging markets and increasing global agricultural exports ensure consistent demand. Meanwhile, mature markets in Europe and North America are focusing on high-quality reusable bags that meet strict sustainability and safety standards, creating a dual growth pathway of volume expansion in developing economies and product premiumization in developed ones.

| Metric | Value |

|---|---|

| Bulk Bag Market Estimated Value in (2025 E) | USD 4.7 billion |

| Bulk Bag Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 2.6% |

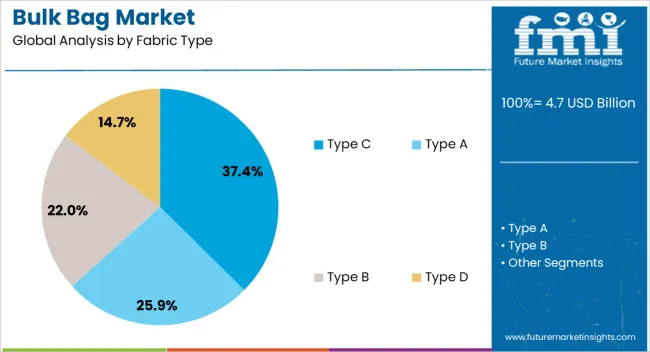

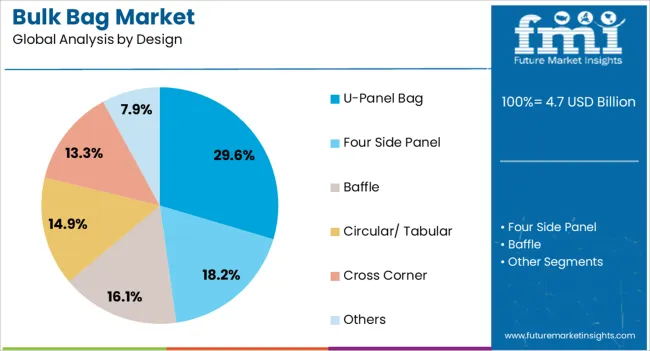

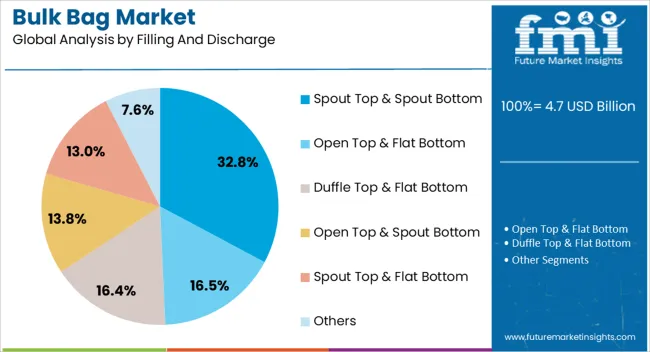

The bulk bag market is segmented by Fabric Type, Design, Filling And Discharge, End User Industry, and region. By Fabric Type, the bulk bag market is divided into Type C, Type A, Type B, and Type D. In terms of Design, the market is classified into U-Panel Bag, Four Side Panel, Baffle, Circular/ Tabular, Cross Corner, and Others. Based on Filling And Discharge, the bulk bag market is segmented into Spout Top & Spout Bottom, Open Top & Flat Bottom, Duffle Top & Flat Bottom, Open Top & Spout Bottom, Spout Top & Flat Bottom, and Others. By end-user industry, the bulk bag market is divided into Chemicals & Fertilizers, Food, Construction, Pharmaceuticals, Mining, and Others. Regionally, the bulk bag market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Type C fabric segment, accounting for 37.40% of the fabric type category, has emerged as the leading segment due to its superior static protection and safety features during material handling. These conductive bulk bags are designed to prevent electrostatic discharges in hazardous environments, making them ideal for industries dealing with flammable powders and chemicals.

Market leadership has been reinforced by stringent industrial safety regulations and the growing need for reliable packaging solutions in high-risk operations. Consistent technological advancements in fabric conductivity and testing standards have improved performance reliability and broadened the range of industrial applications.

The segment’s dominance is expected to continue as manufacturers adopt Type C fabrics to ensure compliance with international safety norms and enhance operational safety in sensitive production and logistics environments.

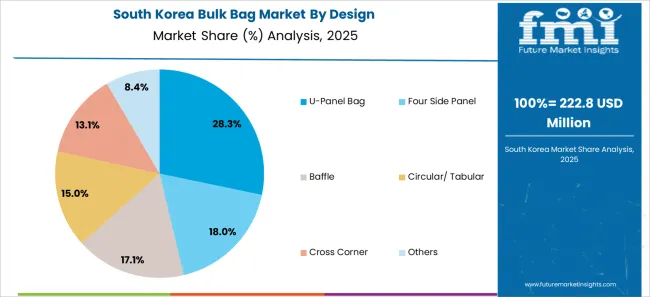

The U-panel bag design, holding 29.60% of the design category, has maintained its leading position due to its cost-effectiveness, high structural stability, and ease of production. This design provides excellent load distribution and durability, which supports the safe transportation of granular and powdered materials.

Market preference for U-panel bags has been strengthened by their ability to retain shape and withstand repeated use, making them suitable for bulk storage and export packaging. Demand growth is further supported by high manufacturing efficiency and reduced material wastage during fabrication.

Ongoing design improvements and customization options for specific industry needs have sustained their market share, while consistent performance under demanding load conditions continues to enhance user confidence and promote long-term adoption.

The spout top and spout bottom configuration, representing 32.80% of the filling and discharge category, has emerged as the most preferred type due to its versatility and operational convenience in handling bulk materials. Its design enables controlled filling and discharge, minimizing material loss and contamination risks.

Adoption has been particularly strong in industries such as chemicals, agriculture, and construction, where efficiency and cleanliness are critical. The configuration supports compatibility with various automated systems, enhancing productivity and reducing manual intervention.

Manufacturers are emphasizing improvements in spout design for better sealing and faster material flow Continued demand for efficient and safe bulk handling solutions is expected to sustain the dominance of spout top and spout bottom bulk bags, ensuring steady growth for this segment across global markets.

Bulk Bag Adoption Surges Due to Rising Diversification of End-use Industries

Bulk bags are growing in popularity in various sectors due to their adaptability, which positions them as a flexible and versatile packaging choice. Bulk sacks serve various end-use applications in agriculture, chemicals, construction, food and beverage, and other industries.

This trend demonstrates that manufacturers have strategically positioned FIBC bulk bags as an all-encompassing solution that cuts across industry boundaries. In addition to increasing market reach, this diversity presents bulk bags as a strategic asset for companies looking for a single, adaptable packaging solution that can meet the particular needs of many sectors.

Targeting the Demand for Hygienic Packaging Presents Opportunities for Market Players

Businesses have a strategic opportunity to create advanced bulk bags made of materials resistant to microbes by focusing on the need for hygienic packaging in industries like food and pharmaceuticals. These specialty bulk bags are perfect for situations where sterility is critical since research into antimicrobial coatings or materials tackles contamination problems.

In addition to satisfying the strict criteria of industry sectors where product purity and safety are non-negotiable, this tactical step positions businesses as suppliers of important solutions.

Smart Packaging Integration Rises in the Market

Bulk bag packaging's incorporation of smart technology shows a strategic commitment to improving operational information and supply chain visibility. Real-time tracking, monitoring, and data analytics are made possible by smart packaging that uses RFID and sensor technologies.

This promotes data-driven decision-making and overall supply chain efficiency and optimizes inventory management. As the industry moves toward Industry 4.0 and uses data analytics for operational excellence and strategic business insights, this trend reflects a sophisticated approach to packaging solutions.

| Trends |

|

|---|---|

| Opportunities |

|

| Challenges |

|

| Segment | Type C (Fabric Type) |

|---|---|

| Value Share (2025) | 41.5% |

Based on fabric type, the Type C segment holds 41.5% of bulk bag market shares in 2025.

| Segment | U-panel Bag (Design) |

|---|---|

| Value Share (2025) | 26.2% |

Based on design, the u-panel bag segment captured 26.2% of bulk bag market shares in 2025.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 1.3% |

| Germany | 1.1% |

| India | 5.8% |

| Japan | 1.3% |

| South Korea | 1.6% |

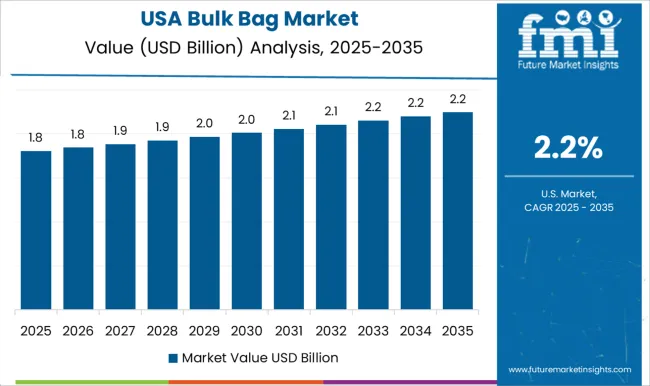

The demand for bulk bags in the United States is projected to rise at a 1.3% CAGR through 2035.

The sales of bulk bags in Germany are anticipated to surge at a 1.0% CAGR through 2035.

The bulk bag market growth in India is estimated at a 5.8% CAGR through 2035.

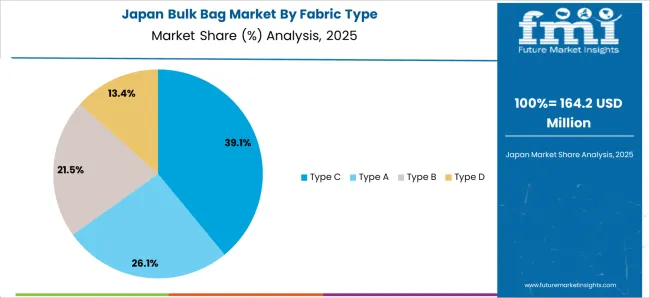

The demand for bulk bags in Japan is predicted to surge at a 1.3% CAGR through 2035.

The sales of bulk bags in South Korea are anticipated to rise at a 1.6% CAGR through 2035.

The bulk bag market is highly competitive, with both established global firms and local producers fighting for market dominance. The market is dominated by significant players like Berry Global Group, Inc., Greif, Inc., and Conitex Sonoco because of their wide range of products, worldwide presence, and tactical alliances. To keep a competitive edge, these market titans make use of economies of scale, technical superiority, and robust distribution networks.

Recent Developments

The global bulk bag market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the bulk bag market is projected to reach USD 6.1 billion by 2035.

The bulk bag market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in bulk bag market are type c, type a, type b and type d.

In terms of design, u-panel bag segment to command 29.6% share in the bulk bag market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bulk Bag Unloaders Market Size and Share Forecast Outlook 2025 to 2035

Bulk Bag Divider Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Bulk Bag Divider Companies

Industry Share Analysis for Bulk Bag Conditioner Companies

Bulk Bag Dischargers Market Trends – Growth & Outlook 2024-2034

Type-C Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Europe Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Type-C Bulk Bags Companies

Ventilated Bulk Bags Market Analysis by Construction, Strip Fabrics, Application, and Region Forecast Through 2035

Conical Top Bulk Bag Market

Bulk Terminal Market Forecast and Outlook 2025 to 2035

Bulk Molding Compounds Market Size and Share Forecast Outlook 2025 to 2035

Bulk Container Packaging Market Size, Share & Forecast 2025 to 2035

Bulk Liquid Transport Packaging Market from 2025 to 2035

Bulk Chemical Packaging Market Trends and Growth 2025 to 2035

Bulk Food Ingredients Market Growth – Industry Insights & Trends 2025 to 2035

Bulk Material Handling System Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Bulk Container Packaging Industry

Global Bulk-Drug Compounding Market Analysis – Size, Share & Forecast 2024-2034

Bulk Insulated Containers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA