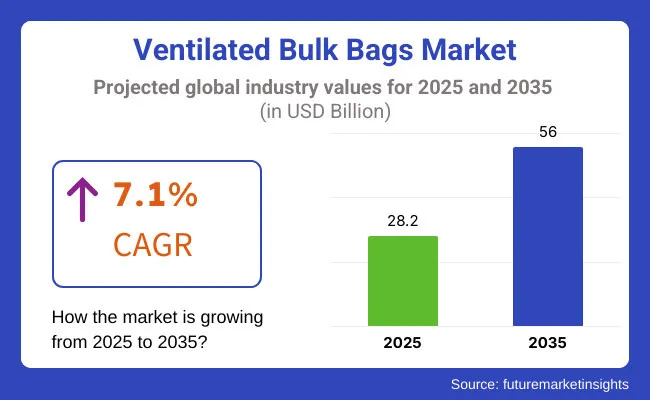

The ventilated bulk bags market is projected to grow from USD 28.2 billion in 2025 to USD 56.0 billion by 2035, registering a CAGR of 7.1% during the forecast period. Sales in 2024 reached USD 26.3 billion, underscoring the sector's resilience and growing demand across agriculture, food processing, and construction industries. This growth is attributed to the increasing need for breathable, durable, and sustainable packaging solutions that ensure product integrity during storage and transportation.

| Metric | Value |

|---|---|

| Estimated Market Size in 2025 | USD 28.2 Billion |

| Projected Market Size in 2035 | USD 56.0 Billion |

| CAGR (2025 to 2035) | 7.1% |

Ventilated bulk bags are predominantly constructed from woven polypropylene, offering strength and breathability essential for perishable goods. The market segmentation includes various designs such as U-panel, four-panel, circular, and baffle bags, catering to diverse storage requirements. Applications span across storing and transporting fruits, vegetables, firewood, and other moisture-sensitive products, with customization options available to meet specific industry needs.

New Water Capital completed the acquisitions of Norwood Paper and BulkSak on August 2, 2023, strengthening its position in the industrial packaging sector. The acquisitions become a part of New Water’s broader transportation packaging solutions platform which will now be the largest provider of specialty FIBCs and related packaging in North America. “The additions of Norwood’s complementary products and BulkSak’s long standing reputation as a premier provider of transportation packaging solutions makes the collective platform an even more valued partner to our customer base.

These businesses, along with BulkLift and Bagwell, will be able to streamline procurement for our customers, while also improving quality, service, and product expertise” said New Water Capital Principal Matt Carlos. “Both Norwood and BulkSak are exceptional brands operating for decades and have rightly earned their reputation as industry leaders.” “These two acquisitions are a significant value-add for our customers as we continue to enhance our offerings of FIBCs and related packaging product solutions,” said Tony Famiano, CEO of Bulk Lift.

The market's expansion is further propelled by the shift towards eco-friendly packaging. Ventilated bulk bags, being reusable and recyclable, align with global sustainability goals. Innovations such as UV-resistant materials and advanced ventilation designs are being integrated to enhance product longevity and reduce environmental impact.

With the increasing emphasis on sustainable and efficient packaging, the ventilated bulk bags market is poised for significant growth. Companies investing in research and development to produce advanced, eco-friendly bags are expected to gain a competitive edge. As industries continue to prioritize product integrity and environmental responsibility, the demand for ventilated bulk bags is anticipated to rise steadily through 2035.

The market is segmented based on material type, capacity, design, end use industry, and region. By material type, the market includes polypropylene, polyethylene, cotton, jute, and others. In terms of capacity, the market is categorized into less than 200 kg, 200 kg to 750 kg, 750 kg to 1500 kg, and above 1500 kg. By design, the market is segmented into U-panel bags, four side panel, baffle, circular/tabular, and cross corner formats.

In terms of end use industry, the market comprises agriculture, food & beverage, building & construction, chemicals & fertilizers, pharmaceuticals, and others. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Polypropylene is projected to account for approximately 61.7% of the global ventilated bulk bags market by 2025, as its lightweight, breathable, and cost-effective nature has made it the most widely used material in ventilated FIBC production. Polypropylene-based woven fabrics have been engineered to allow sufficient air circulation, moisture control, and protection from mold growth-features particularly important in packaging fresh produce, seeds, and firewood

UV stabilization and high tensile strength have enabled the bags to perform effectively in outdoor storage and long-haul transport scenarios. Polypropylene has been favored for its adaptability to various bag constructions such as four-panel, U-panel, and circular forms, enhancing structural integrity while maintaining ventilation properties.

Its recyclability and compatibility with food-grade standards have further supported its widespread application, particularly in compliance with agricultural safety regulations. As material handling demands continue to increase across farming and industrial supply chains, polypropylene is expected to retain its position as the most practical and scalable material for ventilated bulk bag manufacturing.

The agriculture industry is expected to dominate the ventilated bulk bags market by 2025, holding an estimated 44.5% market share, as the need for breathable packaging for potatoes, onions, carrots, and other perishable commodities has driven adoption across farms, distribution centers, and cooperatives. These bags have been designed to extend shelf life, reduce spoilage, and facilitate airflow during bulk storage and transport.

Ventilated bags have been widely used in seasonal harvest operations where large volumes of produce require temporary storage before market distribution. Their role in protecting produce from moisture accumulation, fungal growth, and heat buildup has proven critical, especially in non-refrigerated storage environments.

In developing agricultural markets, the use of ventilated FIBCs has been expanded due to their cost-effectiveness and stackable design. Forklift-friendly loops and standardized dimensions have also enhanced their utility in mechanized handling systems. As global food supply chains place greater emphasis on post-harvest efficiency, crop preservation, and export readiness, the use of ventilated bulk bags in the agricultural sector is expected to remain the largest-supported by both large-scale commercial farms and decentralized smallholder operations.

High Production Costs

The market faces a major challenge due to high production costs. These bags require specialized materials, such as air-permeable woven polypropylene and certain design modifications for optimal airflow. The extra manufacturing complexities increase the cost of production, which makes them more costly than regular bulk bags, limiting mass application in price-sensitive markets.

Environmental Concerns

Sustainability is starting to be a growing concern within the market as most standard bulk bags consist of plastic-based components. The latter are challenging to dispose of and lead to pollution. As standards tighten, there is pressure to develop biodegradable, reusable, or recyclable products so that durability is maintained, performance is upheld, and sustainability improves.

Expansion into New Industries

The market is reaching into new areas beyond the normal agriculture and food storage. These industries, such as pharmaceutical, chemical, and high-value crop storage industries, are beginning to utilize these bags because they are breathable and moisture-controlling. This new expansion brings new revenue streams and opens up the market's potential for expansion.

Advancements in Biodegradable and High-Performance Bag Technology

Innovation in lightweight, aerated, and waterproof materials is driving the development of ventilated bulk bag technology. Biodegradable and high-performance options boost sustainability without compromising durability and functionality. These technologies enable better storage solutions, reduce environmental pressure, and enable the wider use of environmentally friendly green bulk packaging across sectors.

| Country | CAGR(2025 to 2035) |

|---|---|

| USA | 4.8% |

| UK | 4.4% |

| Japan | 4.2% |

| South Korea | 4.6% |

The USA leads the market due to rising demand for breathable and moisture-resistant packaging in agriculture, food processing, and chemical manufacturing. The shift toward eco-friendly bulk packaging has driven manufacturers to develop high-performance bags with enhanced airflow.

Government regulations promoting sustainability and product safety are accelerating the adoption of recyclable and biodegradable materials. Advancements in woven fabric technology and reinforced stitching are improving bag durability and load capacity.

Companies are also exploring custom ventilation designs to optimize storage and transportation efficiency. Additionally, the growing use of automation in bulk handling processes is fostering innovation in self-sealing and tamper-resistant bulk bag designs.

The UK is expanding as businesses prioritize sustainability and compliance with environmental regulations. The rising demand for breathable and reusable bulk packaging solutions has led to increased adoption across multiple industries, including agriculture, construction, and food supply chains.

Government initiatives promoting plastic-free and recyclable materials are further pushing companies to integrate biodegradable bulk bag alternatives. Additionally, innovations in UV-resistant coatings and anti-fungal treatments are making these materials more attractive for extended storage applications.

Companies are also exploring RFID-enabled bulk bags for improved inventory management and traceability. Furthermore, the shift toward digitalized logistics systems is enhancing the efficiency and integration of ventilated bulk bags in the UK market.

Japan's market is steadily growing due to the increasing demand for precision-engineered packaging solutions in the agricultural, chemical, and food industries. Companies are focusing on developing high-performance bulk bags with advanced breathable fabrics to prevent moisture build-up and spoilage, ensuring better product protection and longevity.

With strict regulations on packaging waste reduction, businesses are shifting toward biodegradable and reusable bulk bag materials. This transition aligns with sustainability goals while addressing environmental concerns. Additionally, advancements in nanotechnology-based coatings are boosting demand in industries that require enhanced moisture control for sensitive products.

Companies are also investing in automation-friendly bulk bags to improve efficiency in material handling and storage. The rise of compact and lightweight bulk packaging solutions in Japan is further driving demand as industries seek innovative ways to optimize logistics and storage capabilities.

South Korea is experiencing significant growth due to increased exports and industrial automation. The need for cost-effective and sustainable bulk packaging solutions has led manufacturers to develop enhanced breathable materials with superior airflow and strength properties. Government regulations promoting plastic-free and biodegradable packaging further support market expansion.

Additionally, businesses are integrating smart tracking technologies such as QR codes and RFID tags into bulk bags to improve supply chain efficiency. The growing demand for high-capacity and ventilated storage solutions in the food and agricultural sectors is further boosting adoption.

Moreover, research into fire-retardant coatings is helping businesses develop ventilated bulk bag solutions tailored to safety-sensitive applications.

The ventilated bulk bags industry remains fragmented, with multiple manufacturers competing for dominance. Companies focus on expanding production capacities, improving product quality, and exploring new applications to strengthen their foothold. Intense competition drives businesses to differentiate through innovative materials, sustainable practices, and efficient supply chains, ensuring a dynamic and evolving competitive landscape.

Leading players invest in advanced manufacturing techniques to enhance durability and ventilation efficiency. By integrating cutting-edge technology, they cater to industries requiring optimal air circulation, such as agriculture and food storage. These improvements reduce spoilage and extend product shelf life, reinforcing the value of sensitive commodities and perishable goods.

Sustainability remains a key driver in the industry, prompting companies to develop eco-friendly materials and recyclable bulk bags. Businesses adopt green production practices to comply with stringent environmental regulations and consumer preferences. The push for biodegradable alternatives gains momentum, influencing purchasing decisions and positioning sustainability-conscious firms ahead in a competitive marketplace.

Global expansion strategies allow companies to enter emerging markets with a growing demand for bulk bags. By establishing strategic partnerships, optimizing logistics, and investing in localized production, firms enhance supply chain resilience. This geographical diversification helps mitigate risks from economic fluctuations and regulatory changes, ensuring long-term stability and business growth.

The competitive landscape drives continuous innovation, with manufacturers developing advanced designs for improved handling and efficiency. Automation and smart packaging solutions streamline operations, reducing labor costs and material waste.

Companies that embrace technology and customer-focused innovations strengthen their market position, ensuring sustained success in the evolving bulk packaging industry.

The ventilated bulk bags market is growing due to increasing demand in agriculture, construction, and logistics. These industries require durable and efficient packaging solutions for transporting bulk materials while maintaining ventilation. The market's expansion is driven by the need for cost-effective, high-performance packaging that ensures product integrity during storage and transportation.

Innovation in material formulations is transforming the industry, with biodegradable woven materials, moisture-resistant coatings, and reinforced stitching technologies addressing sustainability and durability concerns. These advancements improve the lifespan of bulk bags while reducing environmental impact. As companies prioritize eco-friendly alternatives, the development of sustainable bulk packaging solutions continues to gain momentum.

Technological advancements, including automated production and AI-driven supply chain tracking, are shaping industry trends. Automated manufacturing processes enhance production efficiency, ensuring consistent quality and scalability.

AI integration enables real-time tracking, optimizing inventory management, and logistics operations. These innovations contribute to reducing waste, streamlining distribution, and improving overall supply chain transparency.

The rising preference for reusable and recyclable bulk packaging solutions is further driving market growth. Companies are investing in hybrid ventilated bulk bags that balance strength and breathability, ensuring better product preservation.

Additionally, collaborations between packaging manufacturers and agricultural cooperatives are encouraging the development of customized solutions tailored to specific storage and transportation requirements.

The overall market size for the market was USD 28.2 billion in 2025.

The market is expected to reach USD 56.0 billion in 2035.

The market will be driven by increasing demand from the agriculture, construction, and logistics industries. Sustainability trends, innovations in breathable packaging materials, and improvements in structural integrity will further propel market expansion.

Key challenges include high production costs, durability concerns in extreme weather conditions, and compliance with environmental regulations. However, advancements in recyclable materials and reinforced stitching technology are addressing these issues.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Type-C Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Europe Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Type-C Bulk Bags Companies

Bulk Bag Market Forecast and Outlook 2025 to 2035

Bulk Terminal Market Forecast and Outlook 2025 to 2035

Bulk Molding Compounds Market Size and Share Forecast Outlook 2025 to 2035

Bulk Bag Unloaders Market Size and Share Forecast Outlook 2025 to 2035

Bulk Bag Divider Market Size and Share Forecast Outlook 2025 to 2035

Ventilated FIBC Market Size, Share & Forecast 2025 to 2035

Bulk Container Packaging Market Size, Share & Forecast 2025 to 2035

Bulk Liquid Transport Packaging Market from 2025 to 2035

Bulk Chemical Packaging Market Trends and Growth 2025 to 2035

Bulk Food Ingredients Market Growth – Industry Insights & Trends 2025 to 2035

Bulk Material Handling System Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Bulk Container Packaging Industry

Competitive Overview of Bulk Bag Divider Companies

Industry Share Analysis for Bulk Bag Conditioner Companies

Bulk Bag Dischargers Market Trends – Growth & Outlook 2024-2034

Global Bulk-Drug Compounding Market Analysis – Size, Share & Forecast 2024-2034

Bulk Insulated Containers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA