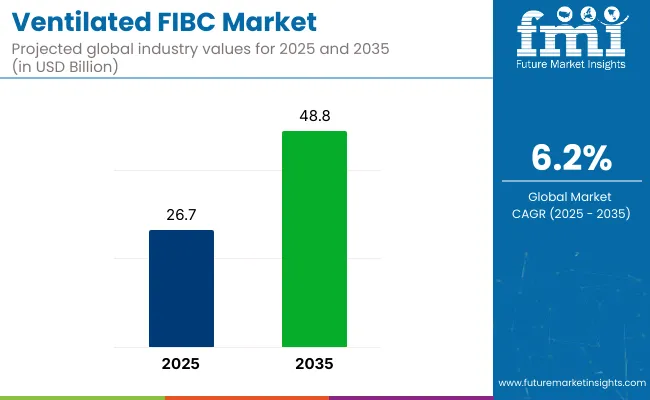

The ventilated FIBC market is projected to grow from USD 26.7 billion in 2025 to USD 48.8 billion by 2035, registering a CAGR of 6.2% during the forecast period. Sales in 2024 reached USD 25.1 billion. This growth is being driven by rising agricultural exports, post-harvest produce handling demand, and climate-conscious logistics solutions.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 26.7 billion |

| Market Value (2035F) | USD 48.8 billion |

| CAGR (2025 to 2035) | 6.2% |

Breathable storage options are being increasingly utilized for items like onions, potatoes, and firewood due to superior ventilation and moisture protection. Additional interest from aquaculture and forestry sectors is strengthening cross-sector deployment. High-volume production hubs in Asia-Pacific and Europe are contributing to global trade acceleration for these bags.

In July 2024, The Royal NNZ Group, a leader and global player in industrial and agricultural packaging solutions, and Technopac Austria are proud to announce that they joined forces. Technopac is a supplier of high-quality packaging solutions for industry and a center of excellence for supplies of FIBCs/ Big bags.

This strategic alliance strengthens NNZ's position in the market as one of the largest suppliers of FIBCs/Big Bags in Europe, North America and South Africa. “We aim to combine our strengths and deliver even greater value to both our customers,” says Len Boot, CEO of the Royal NNZ Group. Sonja Gröger Managing Director of Technopac adds that “Technopac’s commitment to quality and innovation will support our efforts to provide sustainable and efficient packaging solutions globally”.

The market is being reshaped by the demand for lower environmental impact and advanced recyclability in logistics packaging. Manufacturers have increased their investment in bio-polypropylene lining and breathable mesh configurations to reduce single-use plastic dependence. Energy-efficient looms and solar-powered production units have been introduced in India and Southeast Asia to ensure green manufacturing practices.

Several global players are adopting ISO 14001-certified facilities to ensure environmental compliance. Additionally, initiatives for liner-less FIBCs are being explored to further reduce waste generation and enable easy recycling. Anti-fungal coatings and food-grade certification compliance have added to their appeal in organic product shipping chains.

Over the next decade, the ventilated FIBC market is expected to witness significant innovation led by sustainability mandates, export volume shifts, and reusable packaging trends. Demand for lightweight yet durable transport options is expected to remain strong across horticulture and aquaculture.

Real-time tracking compatibility and RFID integration are likely to become standard for exporters handling delicate or perishable loads. Increasing tariffs on synthetic sacks and support for biodegradable solutions may further enhance market share for ventilated FIBCs.

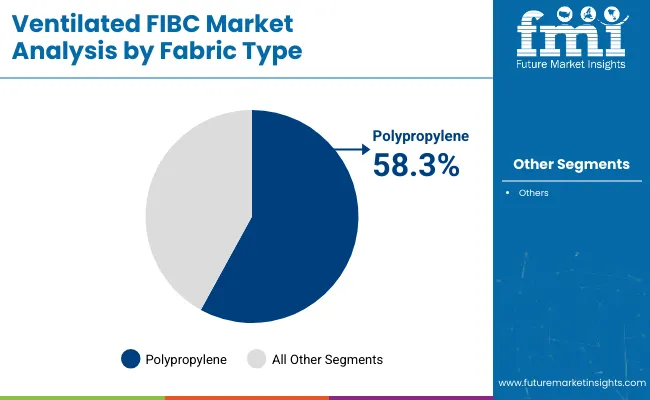

The market is segmented based on fabric type, design type, capacity, end-use industry, and region. By fabric type, the segmentation includes polypropylene (PP) ventilated fabric, UV-stabilized ventilated fabric, coated ventilated fabric, and uncoated ventilated fabric, with PP ventilated fabric leading due to its breathability, strength, and cost-effectiveness for moisture-sensitive bulk goods.

Design types comprise U-panel, circular, baffle, four-panel ventilated FIBCs, and custom loop & spout configurations where U-panel FIBCs are preferred for their load distribution and easy stacking in agricultural supply chains.

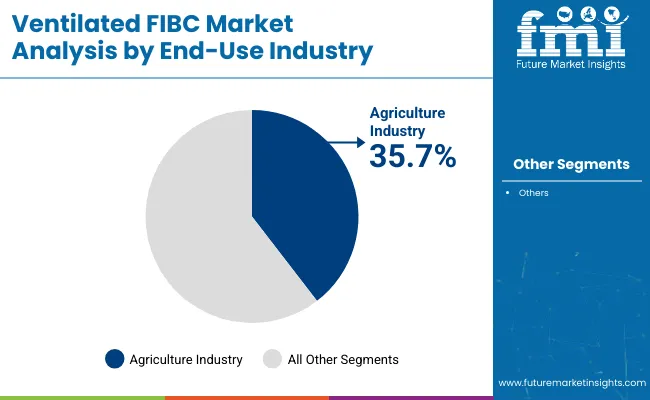

Capacity segments range from up to 500 kg to above 1,500 kg, with the 501-1,000 kg category most common for its versatility across farming and horticultural produce transportation. End-use industries include agriculture, food processing, horticulture, forestry & biomass, and retail & bulk commodity handling. Regionally, the market is distributed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Polypropylene (PP) ventilated fabric is projected to account for approximately 58.3% of the global ventilated FIBC market by 2025. Its lightweight nature and high tensile strength have made it ideal for transporting agricultural produce like potatoes and onions. The fabric's breathability ensures adequate airflow, reducing moisture accumulation and spoilage.

Additionally, its cost-effectiveness has driven widespread adoption across various industries. The recyclability of PP has aligned with global sustainability goals, further boosting its market presence. Manufacturers have favored PP for its ease of fabrication into various FIBC designs, including U-panel and circular bags. Its resistance to UV degradation, when treated, has extended the shelf life of stored products. Moreover, advancements in PP fabric technology have enhanced its durability and load-bearing capacity.

The adaptability of PP ventilated fabric to different climatic conditions has made it suitable for global trade. Its compatibility with food-grade standards has ensured safety in transporting consumables. The fabric's versatility has allowed for customization in terms of size, shape, and ventilation patterns. Furthermore, its integration with smart technologies has enabled real-time monitoring of product conditions.

As the demand for efficient and sustainable packaging solutions grows, PP ventilated fabric is expected to maintain its dominance. Its balance of performance, cost, and environmental benefits has solidified its position in the market. Continuous research and development are anticipated to further enhance its properties. Consequently, its application scope is likely to expand across emerging sectors.

The agriculture industry is estimated to hold a 35.7% share of the ventilated FIBC market by 2025. Ventilated FIBCs have been extensively used for storing and transporting crops like onions, potatoes, and garlic. Their design facilitates airflow, preventing moisture buildup and extending shelf life.

This has been crucial in reducing post-harvest losses and ensuring food security. The lightweight and stackable nature of these containers has optimized storage space in warehouses and during transportation. Their durability has protected produce from mechanical damage. The use of food-grade materials has ensured compliance with safety standards. Additionally, their reusability has contributed to cost savings for farmers.

In regions with high humidity, ventilated FIBCs have been instrumental in maintaining the quality of perishable goods. Their adaptability to various sizes and capacities has catered to different crop volumes. The incorporation of UV-resistant materials has protected contents from sunlight degradation.

Moreover, their compatibility with mechanized handling systems has streamlined logistics. As global agricultural trade continues to expand, the reliance on ventilated FIBCs is expected to grow. Their role in enhancing supply chain efficiency and reducing waste has been recognized worldwide. Ongoing innovations are likely to further tailor these containers to specific crop requirements. Therefore, their significance in the agriculture sector is anticipated to remain substantial.

Concerns over Material Durability and Reusability

The Ventilated FIBC Market faces several hurdles, one of which is ensuring that the materials used are sufficiently durable to withstand the rigors of transport and storage. Though ventilated FIBCs can provide better breathability, these solutions are often faced with challenges such as wear-and-tear problems, reduced load capacity, and degradation resulting from exposure to sunlight and moisture.

This can affect the long-term usability and reusability of these bulk bags, requiring more frequent replacements, which in turn can cost businesses more money. Moreover, the non-recyclable bulk bags, which cannot be recycled, are also a subject of environmental concerns, thus necessitating the discovery of an eco-friendly alternative to it, along with, government interventions to eradicate the incorrect disposal of these bags.

Advancements in Eco-Friendly and Smart Packaging Solutions

The growing demand for technological innovations of ventilated FIBCs to improve durability, sustainability and functional properties is palpable throughout the market. Manufacturers are focusing towards investing on ventilated bulk bags that are biodegradable, UV resistant and RFID enabled offering better performance, increased life, and enhanced traceability.

Smart packaging solutions such as real-time tracking, humidity sensors, and temperature-controlled bulk bags are emerging to create a revolution, driving the packaging industry forward, particularly in the agriculture, seafood, and pharmaceutical sectors. These units have been demonstrated to give much better control over storage conditions, lower spoilage rates and improved visibility into the supply chain for businesses.

The USA ventilated flexible intermediate bulk container (FIBC) market is poised to witness significant growth in the coming years, driven by the increasing demand for efficient bulk packaging solutions across various industries, including agriculture and food processing.

The growing use of ventilated FIBC bags for the movement of perishable items like potatoes, onions, and wood are driving the market growth. Furthermore, strict regulatory policies pertaining to food safety and sustainable packaging solutions have driven the deployment of green and reusable FIBCs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.0% |

Factors such as the growing demand for effective and eco-friendly storage alternatives in the agriculture sector are catalysing the ventilated FIBC market in the United Kingdom. Amplified exports of fresh produce along with a growing emphasis on minimizing post-harvest losses is driving the demand for ventilated bulk bags.

The adoption of ventilated FIBC bags has also been aided by the growing trend of metallurgic products being packaged in recyclable and biodegradable packaging formats due to the stringent environmental compliance imposed by the government in the country. Also, advanced manufacturing technology, including the use of high geostrength, lightweight materials, is improving product durability and performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.4% |

A key driver of the ventilated FIBC market in the European Union is an emphasis on sustainable packaging solutions, combined with the high agriculture and food processing activity in the region. The demand for ventilated bulk bags has been increasing in European nations, including Germany, France, and Italy, owing to their capability to ensure the quality of products during storage and transportation.

Moreover, strict European Union regulations regarding packaging waste, together with the use of biodegradable or recyclable products have encouraged manufacturers to provide environmentally friendly FIBC solutions. The growing market growth is attributed as well to the existing presence of major bulk packaging firms and investments in packaging R&D.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.5% |

Ventilated FIBC market in Japan is growing due to the country’s state-of-the-art agriculture sector and high-end packaging materials. The growing concern about food safety standards and the need to effectively package perishable items are leading more producers to turn to ventilated bulk bags.

Moreover, the rising trend of automation in packaging & logistics is augmenting the demand for durable, lightweight, and easily transportable FIBC solutions. To aid growth of the market, Japanese manufacturers continue innovating these bulk bags to ensure strength, ventilation & sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

The market for ventilated FIBC in South Korea is developing rapidly, as demand from agricultural and industrial sectors continues to rise. Rising initiatives across the government promoting eco-friendly solutions along with the emphasis on sustainable packaging in the country are supporting the market growth.

Furthermore, increased export of fresh fruits and vegetables, and industrial goods has resulted in a greater use of ventilated bulk bags in 2023 due to the higher airflow and moisture protection they provide. This trend is being propelled as smart tracking systems integration in packaging increases logistics efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Increasing demand for efficient bulk packaging solutions in the agricultural, food, and industrial sectors is driving the ventilated flexible intermediate bulk container (FIBC) market. To meet the industry needs for safe and sustainable packaging, organizations are working on durable and breathable materials, as well as developing advanced manufacturing approaches that will help enhance product quality, extend shelf life, and improve logistics efficiency.

The overall market size for the Ventilated FIBC Market was USD 26.7 billion in 2025.

The Ventilated FIBC Market is expected to reach USD 48.8 billion in 2035.

The demand is driven by increasing use in agricultural and food industries for bulk packaging of perishable goods, rising demand for cost-effective and breathable storage solutions, and growing emphasis on reducing post-harvest losses in global supply chains.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The Full Open Top segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ventilated Bulk Bags Market Analysis by Construction, Strip Fabrics, Application, and Region Forecast Through 2035

Auto Ventilated Seats Market Growth - Trends & Forecast 2025 to 2035

FIBC Market Size and Share Forecast Outlook 2025 to 2035

FIBC Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among FIBC (Flexible Intermediate Bulk Container) Manufacturers

2 Loop FIBC Bags Market Size and Share Forecast Outlook 2025 to 2035

4-Loop FIBC Market Growth - Size, Demand & Forecast 2025 to 2035

Breaking Down Market Share in 2 Loop FIBC Bags

Competitive Landscape of 4-Loop FIBC Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA