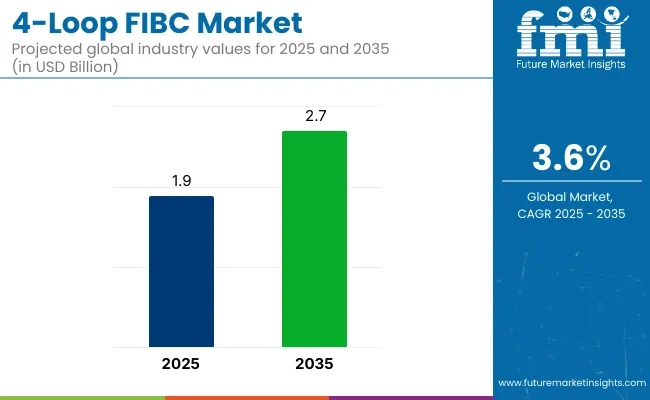

The 4-loop FIBC market is projected to grow from USD 1.9 billion in 2025 to USD 2.7 billion by 2035, registering a CAGR of 3.6% during the forecast period. Sales in 2024 reached USD 1.7 billion, reflecting the sector's resilience and growing demand across agriculture, chemicals, construction, and food processing industries. This growth is attributed to the increasing need for durable, efficient, and sustainable bulk packaging solutions that ensure safe storage and transportation of materials.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.9 billion |

| Projected Market Size in 2035 | USD 2.7 billion |

| CAGR (2025 to 2035) | 3.6% |

Companies are investing in expanding their production capacities and enhancing product offerings to meet the growing demand for 4-loop FIBCs. In July 2024, The Royal NNZ Group, a leader and global player in industrial and agricultural packaging solutions, and Technopac Austria are proud to announce that they joined forces. Technopac is a supplier of high-quality packaging solutions for industry and a center of excellence for supplies of FIBCs/ Big bags.

This strategic alliance strengthens NNZ's position in the market as one of the largest suppliers of FIBCs/Big Bags in Europe, North America and South Africa. “We aim to combine our strengths and deliver even greater value to both our customers,” says Len Boot, CEO of the Royal NNZ Group. Sonja Gröger Managing Director of Technopac adds that “Technopac’s commitment to quality and innovation will support our efforts to provide sustainable and efficient packaging solutions globally”.

The shift towards sustainable and eco-friendly packaging solutions is influencing the 4-loop FIBC market. Manufacturers are focusing on developing FIBCs that are recyclable, UV-resistant, and made from renewable resources. Innovations include the integration of anti-static properties, moisture barriers, and the use of biodegradable materials to reduce environmental impact. These advancements align with global sustainability goals and regulatory requirements, making 4-loop FIBCs an attractive option for environmentally conscious industries.

The 4-loop FIBC market is poised for significant growth, driven by increasing demand in agriculture, chemicals, construction, and food processing industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge. As global supply chains expand and environmental regulations become more stringent, the adoption of 4-loop FIBCs is anticipated to rise, offering cost-effective and eco-friendly bulk packaging solutions.

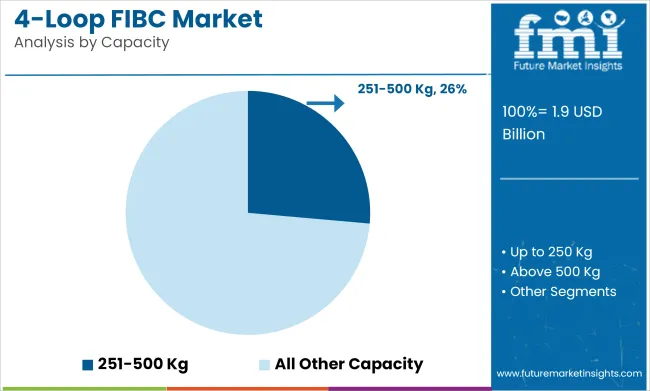

The 251-500 kg capacity segment in the 4-loop Flexible Intermediate Bulk Container (FIBC) market is anticipated to hold a market share of approximately 26.4% by 2025, emerging as a key category for medium-weight bulk handling across industries. These FIBCs are widely used in sectors such as chemicals, food ingredients, agriculture, and construction, where moderate bulk quantities require safe, stackable, and efficient packaging.

Their popularity stems from the balance they offer between load capacity and ease of handling. The 4-loop design enhances stability and allows for secure forklift movement, while the 251-500 kg range supports operational flexibility in mid-scale production and storage systems. As automation and palletized shipping increase, this segment continues to gain traction due to its compatibility with standard logistics infrastructure.

Moreover, demand in this range is being further boosted by the growing need for optimized payload configurations, reduced shipping costs, and the shift toward reusability and circular packaging models. Manufacturers are focusing on UV-resistant, food-grade, and anti-static variants in this capacity range,

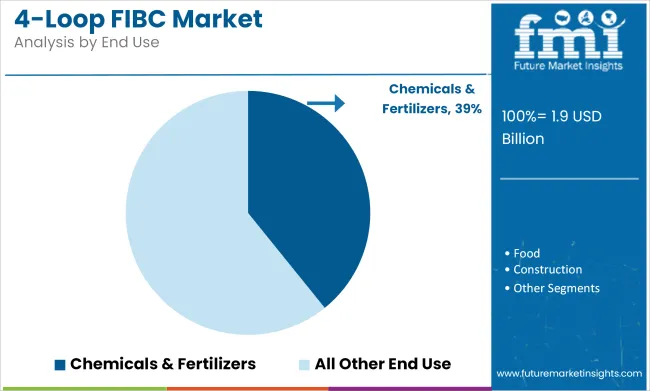

The chemicals and fertilizers segment is expected to lead the 4-loop FIBC market by end use, holding an estimated 39.2% market share in 2025, driven by its need for large-volume packaging, containment safety, and material compatibility.

These industries rely heavily on bulk bags for transporting dry chemicals, mineral-based powders, granules, and bulk fertilizers, which are often corrosive, hazardous, or sensitive to moisture. 4-loop FIBCs are favored for their high load-bearing capacity, UV-stabilized woven polypropylene fabric, and flexible storage benefits for powdered or pelletized chemicals that require secure handling. Coated, lined, or antistatic versions are widely used to prevent leaks, moisture ingress, and electrostatic discharge, offering both safety and efficiency during transport and storage.

In fertilizer distribution, 4-loop FIBCs simplify logistics by enabling stacking, bulk distribution, and seamless unloading at point-of-use with minimal manual labor. Their reusability and custom printing options also support branding and traceability in regional and international markets. As global demand for fertilizers rises with expanding agriculture and the chemical sector pushes for improved logistics and safer material handling, 4-loop FIBCs continue to be the packaging solution of choice. Their durability, compliance-ready design, and cost-effectiveness make them indispensable for high-volume, high-risk material movement.

Raw Material Price Fluctuations and Supply Chain Disruptions

The Standard FIBC Market in the Americas has been impacted heavily by the high cost of raw materials such as polypropylene, which is one of the primary drivers for production costs. Fluctuation of crude oil prices, disruption in supply chains, and political influence impacts the price of raw materials, and further higher input costs lead to lower manufacturing margins.

Transportation and logistics limitations like port congestion, increasing fuel prices and container shortages all prohibit the offer of bulk bags in a timely manner. Such issues are compounded by unexpected events including trade curbs, heat waves and labour crunches in major production centres. Manufacturers should fight back by optimizing purchasing strategies, building a strong supplier base, and tapping new raw materials sources, including bio-based polymers and recycled polypropylene.

Utilizing an advanced inventory management platform and investing in predictive analytics can enable companies to predict and avoid supply chain risks and mitigate cost increases. In addition, manufacturers will overcome market uncertainties and keep profits up and product availability high by automating production and increasing operational efficiencies.

Growth in Industrial and Agriculture Industry

An increasing demand for effective bulk packaging solutions in sectors such as chemicals, agriculture, construction and food processing have provided a significant opportunity for the 4-Loop FIBC Market. The FIBC adoption is fast-growing, as industries are trying to go for cost-effective, durable, and lightweight packaging for bulk storage and transport Furthermore, the rising focus on sustainability has further led to the need for eco-friendly packaging options, propelling the investigation into biodegradable and recyclable FIBC options.

Additionally, the introduction of a myriad of specialized features - such as UV protective coatings, moisture-resistant films, electrostatic discharge control, and increased safety options - is also testing the limits of end user demand for unambiguous product performance. With the tightening of regulations on plastic waste reduction, industries are adopting reusable and recyclable FIBC options at a greater level.

Businesses that focus on innovation, rigorous quality assurance and increased recycling efforts will be ahead of the pack. Developments in global automation and digitalization are further driving the acceptance of smart bulk bags with tracking systems, enhancing visibility within the supply chain. Manufacturers can tap into these trends to drive substantial growth and sustainability.

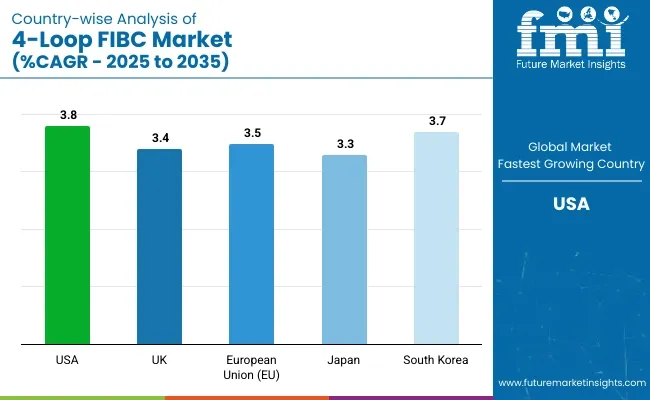

Persistent demand from industries like chemicals, construction, and agriculture anticipates a steady growth of 4-Loop FIBC market in the US. Increasing bulk material handling activities along with demands for cost-effective and robust packaging solutions are driving the adoption of FIBC bags.

Growing FIBC bags demand leads manufacturers to offer fully-tailored high-strength FIBC bags to meet quality with safety regulations. Furthermore, sustainability concerns have led to companies transitioning to recyclable and biodegradable bulk bags, driving the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

The 4-Loop FIBC market itself in the UK is experiencing steady growth as industrialization rises and demand increases both in the food and pharmaceutical industries. To maintain the integrity of their products, businesses are using bulk packaging solutions that meet food-grade and pharma-grade safety standards during packaging.

Such trends include minimalistic packaging that is lightweight, flexible, and targets space economy to meet market demand. In addition, the UK government's efforts to cut down plastic waste are encouraging manufacturers to offer eco-friendly FIBC solutions compatible with the UK's sustainability goals.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

Large demand for 4-Loop FIBC in Europe also witnesses the evolution of FIBC from cloth bags to specialized bulk bags which also includes 4-Loop FIBC, as industries prefer bulk packaging to improve efficiency and cost-effectiveness. Germany, France, and Italy are major suppliers in the market owing to the high demand from agriculture, food, and chemicals sectors.

Tight environmental laws are prompting producers to prioritize reusable and biodegradable bulk bags. Furthermore, compliance with stringent safety standards is accelerating the adoption of anti-static and conductive bulk bags in hazardous material handling.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.5% |

Japan 4-Loop FIBC Market Part is an experienced researcher in the field of Market. He provides high quality reporting and focuses on strategic trends in the new Market. The demand for premium grade FIBC bags is fuelled by the need for high-quality and innovative packaging solutions.

Another factor driving the growth of the market is the automation in logistics and material handling. Moreover, the increasing interest of Japan towards sustainable development is driving the production of environmental and reusable FIBC bags.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.3% |

Market Size in South Korea’s 4-Loop FIBC market is forecast to progress at a relatively high pace, aided by rapid industrialization in the country and the increasing chemical and construction industries. Rising demand for durable and efficient bulk packaging solutions is expected to augment the adoption of FIBC bags for logistics and transportation.

Weight Efficient, High Strength FIBC bags: Manufacturers are focusing on reusable, lightweight, but sturdy FIBC bags which help in improving all types of handling operations. Furthermore, innovations in woven polypropylene technology are enhancing both the durability and load-bearing potential of bulk bags, which, in turn will boost the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

This growth is majorly attributed to the demand for the 4-Loop Flexible Intermediate Bulk Container (FIBC) across agriculture, fluids handling, chemicals, food processing, construction, etc. Bulk bags are an economical and effective method for moving and storing bulk materials and are widely used for transportation and storage.

The all-inclusive Market is driven by the growing degree of industrialization, strict regulation of packaging, and accumulative acceptance of sustainable packaging solutions. Top organizations are incorporating sophisticated manufacturing processes, improved designs, and sustainable materials to enhance durability and marketability.

Greif Inc. (15-20%)

Greif Inc. leads the 4-Loop FIBC market with a strong portfolio of high-strength, customizable bulk bags designed to efficiently handle and transport industrial goods.

Berry Global Inc. (12-16%)

Berry Global Inc. focuses on innovative material technologies, offering FIBC solutions prioritizing weight reduction, cost-effectiveness, and durability in demanding environments.

Context Sonoco (10-14%)

Context Sonoco stands out with its emphasis on moisture-resistant FIBCs, catering to the agricultural and chemical industries and ensuring optimal product protection during transit and storage.

BAG Corp (8-12%)

BAG Corp is recognized for its high-quality, multi-use bulk bags, which are designed to meet industry regulations and enhance operational efficiency in sectors like food and pharmaceuticals.

LC Packaging International (6-10%)

LC Packaging International leverages its extensive distribution network to provide premium food-grade and sustainable FIBC solutions, addressing global packaging challenges.

Other Key Players (35-45% Combined)

The market is also driven by various regional manufacturers and specialized FIBC suppliers who contribute to advancements in packaging technology, cost efficiency, and sustainability. Notable players include:

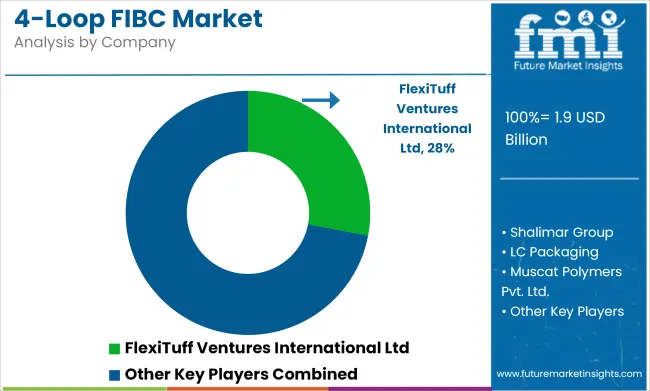

The overall market size for 4-Loop FIBC Market was USD 1.9 billion in 2025.

The 4-Loop FIBC Market expected to reach USD 2.7 billion in 2035.

The demand for the 4-loop FIBC (Flexible Intermediate Bulk Container) market will grow due to increasing industrial and agricultural packaging needs, rising demand for cost-effective bulk handling solutions, expanding global trade, and advancements in durable and recyclable packaging materials.

The top 5 countries which drives the development of 4-Loop FIBC Market are USA, UK, Europe Union, Japan and South Korea.

Chemicals & Fertilizers lead market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of 4-Loop FIBC Providers

FIBC Market Size and Share Forecast Outlook 2025 to 2035

FIBC Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among FIBC (Flexible Intermediate Bulk Container) Manufacturers

2 Loop FIBC Bags Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in 2 Loop FIBC Bags

Ventilated FIBC Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA