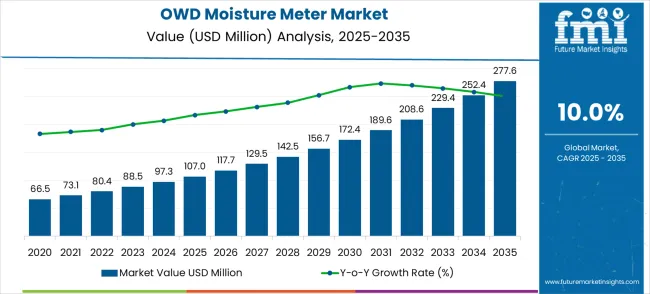

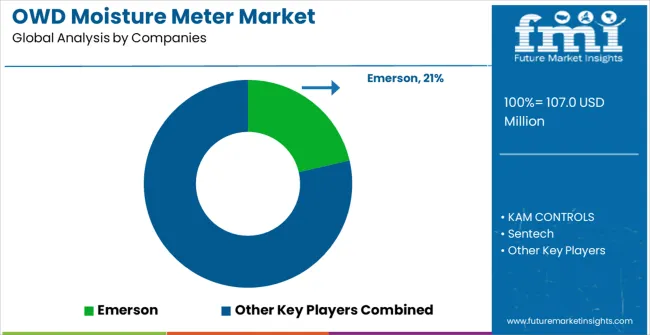

The OWD moisture meter market, valued at USD 107.0 million in 2025 and projected to reach USD 277.6 million by 2035 at a CAGR of 10.0%, demonstrates a clear trajectory of accelerating growth momentum. Between 2025 and 2030, the market value rises from USD 107.0 million to USD 156.7 million, signaling consistent annual gains as industries such as construction, agriculture, and food processing expand adoption of moisture measurement tools. This early growth phase is marked by strong compound gains, where average annual increases reflect the foundational demand for precision and digitalization across end-use sectors.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 107.0 million |

| Market Forecast Value (2035) | USD 277.6 million |

| Market Forecast CAGR (2025–2035) | 10.0% |

From 2030 to 2035, the market accelerates further, increasing from USD 156.7 million to USD 277.6 million. This phase of expansion shows heightened momentum as technological enhancements, portable device innovations, and improved sensor integration drive higher adoption rates. The absolute dollar growth is stronger compared to the first half of the decade, highlighting the compounding effect of earlier adoption patterns. Industrial demand in manufacturing, wood processing, and quality control systems amplifies the revenue base during this late-stage growth, showing how momentum builds toward the peak years of value creation.

The overall growth momentum analysis suggests a compounding acceleration curve where the second half of the forecast period delivers sharper revenue increments compared to the initial years. This pattern indicates that the OWD moisture meter market is not only scaling in volume but also gaining stronger market penetration due to product innovation, improved accuracy, and diversified applications. Stakeholders can capitalize on this accelerating momentum by investing in capacity expansion, regional penetration, and advanced product portfolios to secure a stronger share of the market’s rising long-term value potential.

OWD Moisture Meter Market Opportunity Pools

The OWD Moisture Meter market is entering a new phase of growth, driven by demand for precision analytical measurement, petroleum industry expansion, and evolving quality control and digitalization standards. By 2035, these pathways together can unlock USD 75-95 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Crude Oil Processing Leadership (Refining & Quality Control) The crude oil segment already holds the largest share due to its critical measurement requirements and processing complexity. Expanding measurement precision, process integration, and quality standards can consolidate leadership. Opportunity pool: USD 25-35 million.

Pathway B -- Medium-Range Measurement Excellence (0-20% Range) Medium-range meters account for the majority of demand. Growing petroleum focus on precise moisture control, especially in processing optimization, will drive higher adoption of advanced 0-20% range measurement systems. Opportunity pool: USD 20-28 million.

Pathway C -- Digital Integration & Industry 4.0 Growth Smart manufacturing and digital process control systems are expanding, especially in advanced petroleum facilities. Meters with digital connectivity, data analytics, and process optimization capabilities can capture significant growth. Opportunity pool: USD 12-18 million.

Pathway D -- Emerging Market Expansion Asia-Pacific, Middle East, and Latin America present growing demand due to rising petroleum processing infrastructure. Targeting distribution networks and cost-effective product lines will accelerate adoption. Opportunity pool: USD 10-15 million.

Pathway E -- Specialized Application Markets With advancing petroleum processing technologies, there is opportunity to develop meters for specific applications like natural gas liquids, condensate processing, and specialty fuel production. Opportunity pool: USD 8-12 million.

Pathway F -- High-Precision & Extended Range Solutions Meters with enhanced accuracy, extended measurement ranges (0-100%), and specialized calibration offer premium positioning for critical process applications and research facilities. Opportunity pool: USD 6-10 million.

Pathway G -- Service, Calibration & Technical Support Recurring revenue from calibration services, technical support contracts, and measurement optimization programs creates long-term value streams. Opportunity pool: USD 4-7 million.

Pathway H -- Advanced Analytics & Predictive Maintenance Integration with process analytics, predictive maintenance systems, and quality optimization platforms can elevate moisture meters into comprehensive process intelligence solutions. Opportunity pool: USD 3-5 million.

Why is the OWD Moisture Meter Market Growing?

Market expansion is being supported by the rapid increase in petroleum processing facility development worldwide and the corresponding need for precision moisture measurement equipment that provides superior analytical performance and quality assurance capabilities. Modern petroleum operations rely on consistent product quality and moisture content monitoring to ensure optimal processing outcomes including crude oil refining, natural gas processing, and fuel production facilities. Even minor moisture measurement inaccuracies can require comprehensive quality protocol adjustments to maintain optimal product standards and regulatory compliance.

The growing complexity of petroleum quality requirements and increasing demand for automated analytical solutions are driving demand for OWD moisture meter equipment from certified manufacturers with appropriate measurement capabilities and technical expertise. Petroleum processing companies are increasingly requiring documented measurement accuracy and instrument reliability to maintain product quality and operational efficiency. Industry specifications and quality standards are establishing standardized moisture monitoring procedures that require specialized measurement technologies and trained operators.

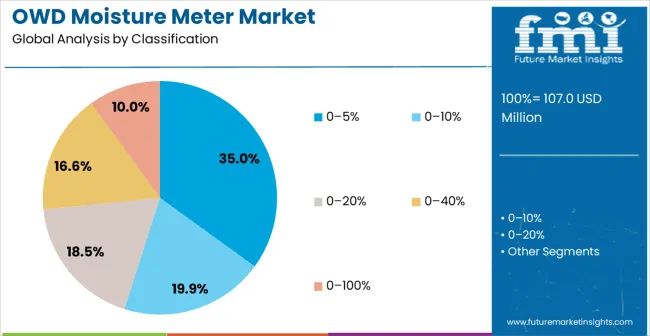

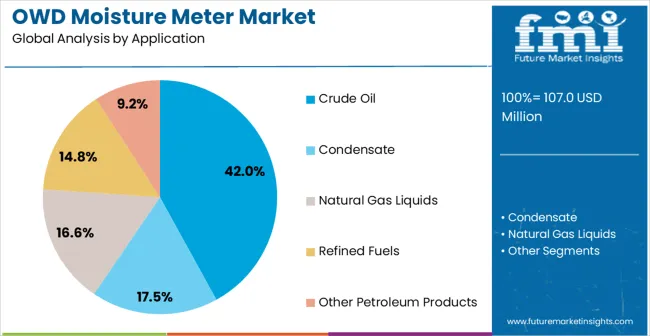

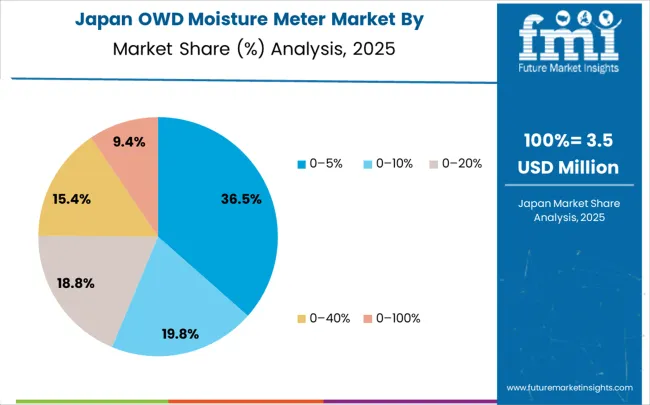

The market is segmented by moisture measurement range, application, and region. By moisture measurement range, the market is divided into 0-5%, 0-10%, 0-20%, 0-40%, and 0-100%. Based on application, the market is categorized into crude oil, condensate, natural gas liquids, refined fuels, and other petroleum products. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The 0–20% moisture measurement range is projected to secure nearly 35% of the total OWD moisture meter market share in 2025. This segment maintains a leadership position due to its adaptability across petroleum refining, petrochemical operations, and fuel quality testing. Its precision in delivering stable readings without requiring complex calibration processes makes it highly attractive to end users. This range also enables consistent analytical performance for both crude oil and refined fuel applications, ensuring operational dependability. Global refiners and laboratories favor the 0–20% range since it provides the ideal balance between sensitivity and ease of operation. Availability of standardized calibration protocols and strong aftermarket support from manufacturers further consolidates its preference across industries. Petroleum processors prioritize this range to reduce operational errors, cut maintenance costs, and guarantee dependable monitoring. Strong adoption in both developed and emerging petroleum economies ensures the segment’s sustained demand over the forecast horizon.

The crude oil segment is expected to contribute nearly 42% of overall OWD moisture meter demand in 2025, maintaining its role as the largest application sector. Moisture monitoring in crude oil remains crucial since even slight variations can disrupt refining efficiency, degrade product quality, and increase operational risks. Real-time measurement capabilities offered by OWD moisture meters support operators in ensuring accurate water-in-oil analysis at multiple stages of crude processing. Continuous adoption in both onshore and offshore facilities reinforces the position of this application. Growth in global refining infrastructure, especially in Asia and the Middle East, is creating strong demand for reliable moisture analysis systems. Stricter international quality benchmarks for crude oil products are encouraging petroleum companies to prioritize advanced moisture measurement equipment. This application benefits from operators’ growing reliance on OWD moisture meters as vital tools for compliance, cost optimization, and efficiency-driven refining operations.

The OWD Moisture Meter market is advancing steadily due to increasing petroleum processing facility development and growing recognition of precision moisture measurement advantages over traditional analytical methods. However, the market faces challenges including higher initial equipment costs compared to basic measurement devices, need for specialized technical expertise for calibration and maintenance, and varying measurement standards across different petroleum processing applications. Technology advancement efforts and sensor development programs continue to influence equipment development and market adoption patterns.

The growing development of advanced sensor technologies is enabling superior measurement accuracy with improved response times and enhanced reliability characteristics. Enhanced measurement sensors and optimized detection systems provide precise moisture content analysis while maintaining industrial durability requirements. These technologies are particularly valuable for petroleum processing operators who require reliable measurement performance that can support demanding process conditions with consistent analytical results.

Modern OWD moisture meter manufacturers are incorporating advanced digital features and connectivity improvements that enhance operational efficiency and data management effectiveness. Integration of advanced data logging systems and optimized communication protocols enables superior process monitoring and comprehensive quality control capabilities. Advanced digital features support use in diverse industrial environments while meeting various process requirements and data management specifications.

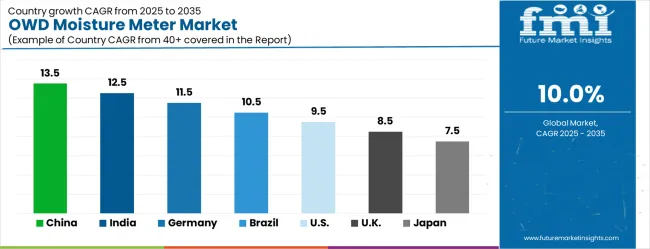

| Country | CAGR (2025–2035) |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| Brazil | 10.5% |

| United States | 9.5% |

| United Kingdom | 8.5% |

| Japan | 7.5% |

The OWD moisture meter market is growing rapidly, with China leading at a 13.5% CAGR through 2035, driven by strong petroleum processing infrastructure development and increasing adoption of advanced analytical instrumentation. India follows at 12.5%, supported by rising refining capacity development and growing awareness of precision measurement solutions. Germany grows steadily at 11.5%, integrating OWD moisture meter technology into its established petrochemical manufacturing infrastructure. Brazil records 10.5%, emphasizing petroleum industry modernization and quality control enhancement initiatives. The United States shows solid growth at 9.5%, focusing on process optimization and measurement precision advancement. The United Kingdom demonstrates steady progress at 8.5%, maintaining established petroleum processing applications. Japan records 7.5% growth, concentrating on technology advancement and measurement precision optimization.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from OWD moisture meters in China is forecast to grow at a CAGR of 13.5% through 2035, driven by rapid petroleum infrastructure expansion and refinery modernization initiatives. The country is emerging as the largest consumer of advanced analytical instrumentation, supported by large-scale petrochemical projects and urban industrial growth. Competitive rivalry is intensifying, as local producers compete with global leaders to supply instruments meeting international standards. Strategic partnerships are being formed with refinery operators to secure long-term equipment contracts. Government-led modernization programs are accelerating adoption, as operators prioritize measurement accuracy, regulatory compliance, and operational safety. As China pushes toward energy sector expansion, its OWD moisture meter demand is exceeding regional competitors, positioning the market as a global benchmark for adoption.

Revenue from OWD moisture meters in India is projected to expand at a CAGR of 12.5% through 2035, supported by growing refining capacity and rapid infrastructure expansion. The Indian market is gaining traction as petroleum companies invest in precision instrumentation to meet strict quality standards. Competitive intensity is high, as multinational suppliers target India for equipment distribution while domestic players emphasize cost efficiency. Refineries are increasingly integrating advanced measurement tools to enhance process performance and ensure consistent quality. Training initiatives and skill-development programs are supporting technology adoption by operators, bridging gaps in expertise. India is emerging as a competitive growth hub, gradually narrowing its gap with China while strengthening its influence in Asia’s petroleum instrumentation demand.

Revenue from OWD moisture meters in Germany is forecast to increase at a CAGR of 11.5% through 2035, supported by advanced petrochemical operations and strict industrial standards. The German market emphasizes measurement precision, analytical reliability, and compliance with European regulations. Companies in the country are early adopters of advanced OWD systems, ensuring performance consistency across diverse processing environments. Strong rivalry exists between domestic instrumentation leaders and global suppliers, with competition centered on innovation, calibration accuracy, and durability. Germany’s reputation for precision manufacturing positions its market as a benchmark in Europe. Investments in R&D and specialized operator training are reinforcing demand, ensuring German companies maintain leadership in adopting sophisticated moisture measurement technologies.

Revenue from OWD moisture meters in Brazil is projected to grow at a CAGR of 10.5% through 2035, fueled by modernization of petroleum facilities and new investment in refining networks. The country is gradually adopting professional-grade instrumentation to meet evolving regulatory requirements and operational efficiency goals. Global suppliers are expanding distribution networks in Brazil, while regional players compete on price flexibility and service coverage. Competitive dynamics are shaped by the country’s shift from basic process controls toward advanced analytical solutions. Demand is driven by industrial modernization, infrastructure expansion, and initiatives to improve processing quality. Brazil’s rising adoption rate strengthens its presence in South America, though its growth pace remains slightly behind Asia’s leading petroleum markets.

Revenue from OWD moisture meters in the United States is forecast to grow at a CAGR of 9.5% through 2035, supported by advanced refining operations and established petroleum infrastructure. USA petroleum companies are focusing on optimization strategies, using precision measurement technology to minimize process inefficiencies and maximize output. Competition is led by established multinational instrumentation suppliers, with USA operators demanding systems offering proven reliability and compliance. Professional certification and operator training programs play a critical role in expanding adoption, ensuring skilled handling of advanced systems. Domestic refiners are emphasizing standardized workflows across multiple facilities, further reinforcing demand for high-performance OWD meters. The USA remains competitive with Europe and Asia, though its growth rate trails the faster expansion in China and India.

Revenue from OWD moisture meters in the United Kingdom is expected to grow at a CAGR of 8.5% through 2035, driven by refining facility upgrades and regulatory compliance requirements. British operators are prioritizing precision measurement systems to ensure consistent quality and efficiency in petroleum applications. Market competition is shaped by international suppliers offering high-grade technology and domestic players focusing on customization and service. Adoption is strengthened by government-led infrastructure initiatives and established quality standards that emphasize accuracy and safety. Training programs and technical certifications are supporting effective utilization, reinforcing the UK’s position as a structured yet moderate-growth market. While growth remains steady, the country’s expansion pace is slower than Asia and South America but competitive within Europe.

Revenue from OWD moisture meters in Japan is projected to expand at a CAGR of 7.5% through 2035, supported by technological innovation and high-precision manufacturing standards. Japanese petroleum operators emphasize advanced measurement tools that ensure accuracy, efficiency, and compliance with stringent industrial standards. Global suppliers compete alongside domestic companies that focus on reliability, calibration excellence, and integration with existing workflows. Competitive rivalry is intensified by the demand for compact, efficient, and technologically advanced systems. Continuous R&D investment, combined with specialized operator training, supports adoption across multiple petroleum applications. Japan’s market is highly advanced but grows at a slower pace than leading Asian economies, balancing steady demand with innovation-driven differentiation.

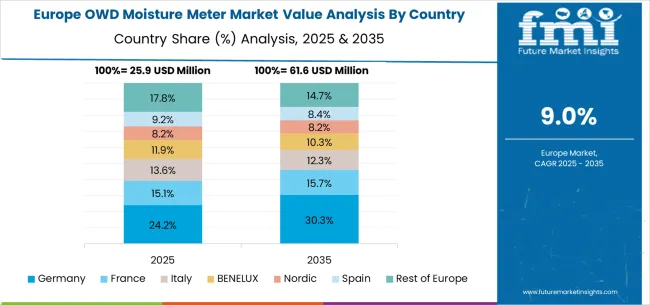

The OWD moisture meter market in Europe is forecast to expand from USD 28.7 million in 2025 to USD 74.3 million by 2035, registering a CAGR of 10%. Germany will remain the largest market, holding 32% share in 2025, easing to 31.5% by 2035, supported by strong petrochemical infrastructure and advanced analytical systems. The United Kingdom follows, rising from 26% in 2025 to 26.5% by 2035, driven by petroleum processing facilities and measurement excellence initiatives. France is expected to decline slightly from 22% to 21.5%, reflecting industrial consolidation pressures. Italy maintains stability at around 14%, supported by refining facilities and petrochemical centers, while Spain grows from 4% to 4.5% with expanding petroleum processing and analytical demand. BENELUX markets ease from 1.5% to 1.4%, while the remainder of Europe hovers near 0.5%--0.6%, balancing emerging Eastern European growth against mature Nordic markets.

Competition in the OWD moisture meter market is defined by process automation specialists, precision instrument manufacturers, and analytical technology providers. KAM CONTROLS delivers advanced moisture measurement systems with emphasis on oil and gas applications, accuracy, and real-time monitoring. Sentech focuses on reliable moisture detection equipment with tailored solutions for industrial processes. Aquasant Messtechnik AG provides specialized sensors designed for high-performance measurement in demanding operating environments. Emerson offers comprehensive process automation systems with integrated OWD moisture measurement solutions. ABB supplies advanced analyzers and monitoring equipment with focus on precision and global service support.

Market differentiation is driven by accuracy, calibration reliability, and integration flexibility. Yokogawa delivers precision instruments with strong emphasis on process efficiency and system compatibility. Endress+Hauser provides moisture measurement technologies combined with broad process automation expertise. AMETEK emphasizes rugged, high-performance meters suitable for critical industries. Phase Technology offers laboratory and field-ready equipment with strong application focus on petroleum products. Sarasota Control Systems (Emerson brand) supplies customized OWD moisture solutions with adaptable system designs. Bartec contributes specialized devices engineered for hazardous area applications with strong compliance to safety standards.

Additional competition comes from Guided Wave, Applied Analytics, and Thermo Fisher Scientific. These companies provide targeted instruments combining optical analysis, advanced calibration, and strong application-specific expertise. Product brochures highlight measurement precision, calibration protocols, operating ranges, and system compatibility. Features such as real-time monitoring, data integration, and user-friendly interfaces are emphasized to reinforce trust and usability. Each brochure is designed to demonstrate operational value, application reliability, and technical sophistication, collectively defining the competitive strategies and positioning of OWD moisture meter suppliers in global and regional markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 107 million |

| Moisture Measurement Range | 0–5%, 0–10%, 0–20%, 0–40%, 0–100% |

| Application | Crude Oil, Condensate, Natural Gas Liquids, Refined Fuels, Other Petroleum Products |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | KAM CONTROLS, Sentech, Aquasant Messtechnik AG, Emerson, ABB, Yokogawa, Endress+Hauser, AMETEK, Phase Technology, Sarasota Control Systems (Emerson brand), Bartec, Guided Wave, Applied Analytics, Thermo Fisher Scientific |

| Additional Attributes | Dollar sales by moisture measurement range and application segment, regional demand trends across major markets, competitive landscape with established analytical instrumentation manufacturers and emerging technology providers, customer preferences for different measurement ranges and petroleum applications, integration with process control systems and quality assurance protocols, innovations in sensor technology effectiveness and digital connectivity features, and adoption of advanced calibration capabilities with enhanced measurement precision for improved analytical workflows. |

The global OWD moisture meter market is estimated to be valued at USD 107.0 million in 2025.

The market size for the OWD moisture meter market is projected to reach USD 277.6 million by 2035.

The OWD moisture meter market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in OWD moisture meter market are 0–5%, 0–10%, 0–20%, 0–40% and 0–100%.

In terms of application, crude oil segment to command 42.0% share in the OWD moisture meter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powder Feed Center Market

Powder Funnels Market

Powdered Hand Soap Market

Powder Coating Guns Market

Crowdsourced Security Market Size and Share Forecast Outlook 2025 to 2035

Crowdsourced Testing Market Size and Share Forecast Outlook 2025 to 2035

Crowd Management System Market

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA