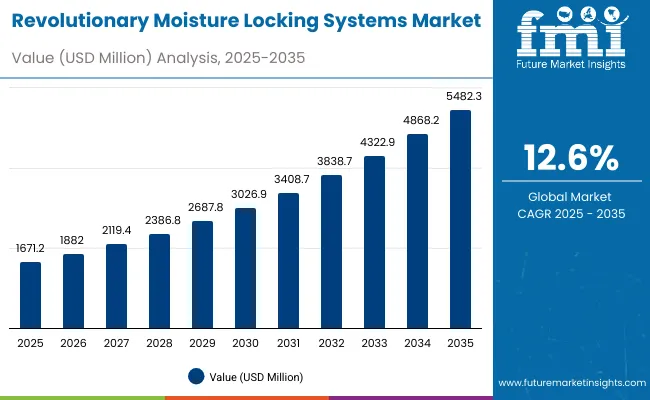

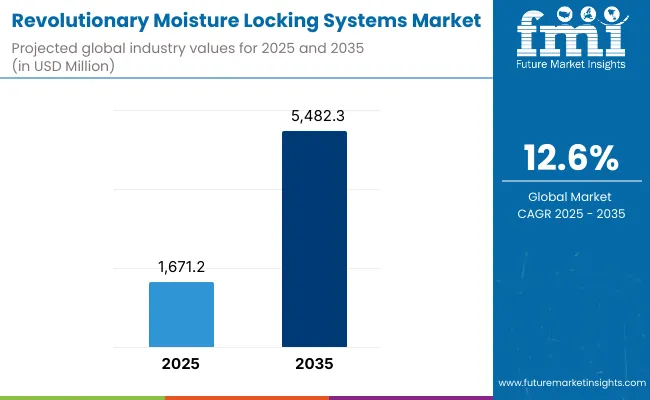

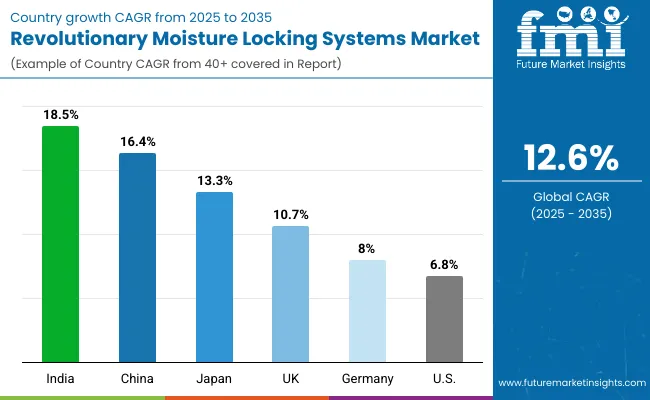

The Global Revolutionary Moisture Locking Systems Market is expected to record a valuation of USD 1,671.2 million in 2025 and USD 5,482.3 million in 2035, with an increase of USD 3,811.1 million, which equals a growth of nearly 228% over the decade. The overall expansion represents a CAGR of 12.6% and more than a 3X increase in market size.

Global Revolutionary Moisture Locking Systems Market Key Takeaways

| Metric | Value |

|---|---|

| Global Revolutionary Moisture Locking Systems Market Estimated Value in (2025E) | USD 1,671.2 million |

| Global Revolutionary Moisture Locking Systems Market Forecast Value in (2035F) | USD 5,482.3 million |

| Forecast CAGR (2025 to 2035) | 12.6% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,671.2 million to USD 3,026.9 million, adding USD 1,355.7 million, which accounts for around 35% of the total decade growth. This phase records steady adoption in hydration-focused creams, dermatologist-tested serums, and sensitive skin relief formulations, driven by the growing consumer shift toward dermatologist-recommended and clinically validated products.

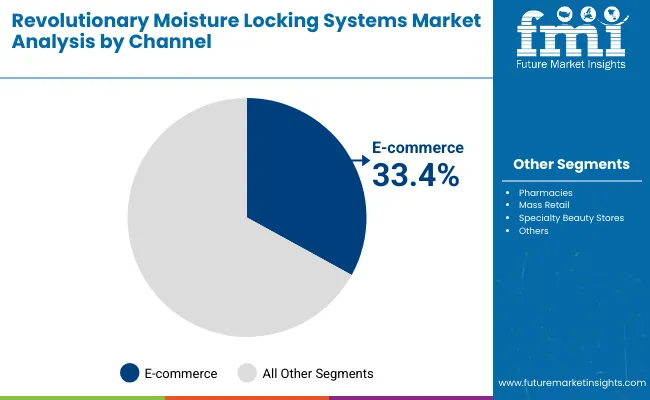

E-commerce and pharmacy-based sales dominate this period as they cater to more than one-third of distribution, reflecting consumer preference for online convenience and trusted clinical points of purchase.

The second half from 2030 to 2035 contributes USD 2,455.4 million, equal to 65% of total growth, as the market jumps from USD 3,026.9 million to USD 5,482.3 million. This acceleration is powered by the widespread deployment of AI-based skin diagnostics, hyper-personalized moisture solutions, and vegan/clean-label premium offerings. Emerging technologies in formulation science, such as moisture-locking polymers and advanced barrier-repair molecules, fuel rapid expansion.

Specialty beauty stores and mass retail channels capture larger shares above 40% by the end of the decade, while clinical-grade and natural/organic claims increasingly dominate branding and consumer trust. Subscription-based e-commerce platforms further add recurring revenue, increasing the digital channel’s share beyond 35% in total value.

From 2020 to 2024, the Global Revolutionary Moisture Locking Systems Market grew steadily, driven by hydration and anti-aging creams. During this period, the competitive landscape was dominated by established skincare leaders controlling nearly 70% of revenue, with players such as Neutrogena, Estée Lauder, and Shiseido focusing on innovation in barrier repair and long-lasting hydration formulas.

Competitive differentiation relied heavily on dermatologist endorsements, clinical validations, and product safety certifications, while vegan and clean-label positioning was still emerging as secondary claims. Online channels were gaining traction but contributed less than 25% of total market value by 2024.

Demand for Revolutionary Moisture Locking Systems expands sharply to USD 1,671.2 million in 2025, and the revenue mix shifts as e-commerce and specialty beauty channels grow to over 33% share. Traditional cream and lotion leaders face rising competition from serum and gel-based solutions offering lightweight textures suited to Asian and younger demographics.

Major brands are pivoting to AI-driven personalization, subscription models, and multifunctional moisture systems to retain relevance. Emerging entrants specializing in clinical-grade barrier repair, sensitive skin relief, and natural hydrating actives are gaining share. The competitive advantage is moving away from single-product formulations toward ecosystem strength, cross-channel scalability, and recurring revenue streams.

Advances in formulation technology have improved hydration retention, allowing for more efficient barrier repair across diverse skin types. Long-lasting hydration has gained popularity due to its ability to deliver results across day-to-night use, while anti-aging and sensitive skin relief continue to rise in relevance. The surge of dermatologist-tested and clinical-grade formulations has further enhanced consumer trust, while the rise of vegan and natural/organic positioning has contributed to broader adoption among younger demographics.

Expansion of e-commerce and digital consultation tools has fueled market growth. Innovations in serums, lightweight gels, and breathable masks are expected to open new application areas. Segment growth is expected to be led by long-lasting hydration in functions, creams/lotions in product type, and e-commerce in channel distribution due to their precision targeting, adaptability, and accessibility.

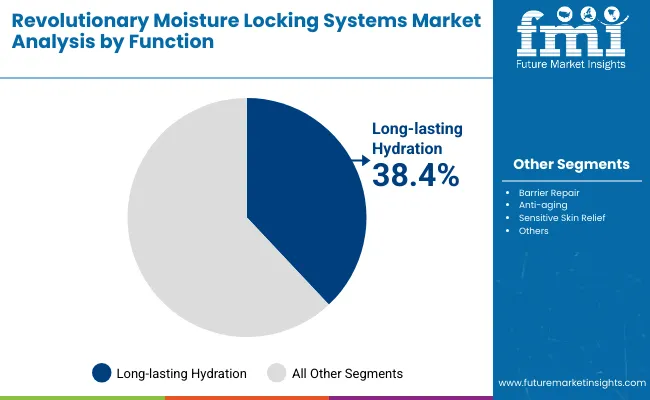

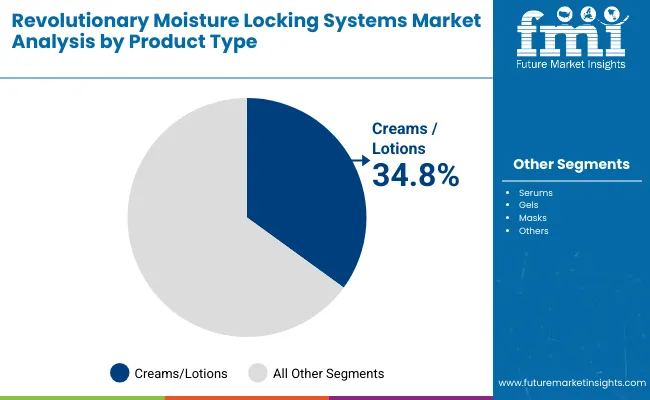

The market is segmented by function, product type, channel, claim, and geography. Functions include long-lasting hydration, barrier repair, anti-aging, and sensitive skin relief, highlighting the core consumer needs driving adoption. Product types cover creams/lotions, serums, gels, and masks to cater to different consumer preferences. Channels include e-commerce, pharmacies, mass retail, and specialty beauty stores. Claims encompass dermatologist-tested, vegan, natural/organic, and clinical-grade branding. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Long-lasting hydration | 38.4% |

| Others | 61.6% |

The long-lasting hydration segment is projected to contribute 38.4% of the Global Revolutionary Moisture Locking Systems Market revenue in 2025, maintaining its lead as the dominant functional category. This is driven by ongoing demand for advanced hydration systems enriched with hyaluronic acid, ceramides, and bio-fermented humectants. Consumers are prioritizing moisture retention and 24-hour protection, particularly in urban regions exposed to pollution and lifestyle stress.

The segment’s growth is also supported by the increasing use of polymer-based moisture lock systems and innovations in multi-layer hydration delivery. As personalization and AI-powered skin mapping become more prevalent, long-lasting hydration products are being enhanced with adaptive formulations that respond to climate, skin condition, and lifestyle factors. This segment is expected to remain the cornerstone of global adoption, ensuring consistent dominance.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams/lotions | 34.8% |

| Others | 65.2% |

The creams/lotions segment is forecasted to hold 34.8% of the market share in 2025, led by its familiarity, accessibility, and versatility across consumer groups. These products are favored for their balance of hydration, spreadability, and affordability, making them the preferred choice for mass adoption.

Their growing availability across pharmacies, supermarkets, and specialty beauty stores has facilitated widespread penetration. The segment’s growth is bolstered by texture innovations such as water-based creams, lightweight emulsions, and dermatologically enhanced formulations. As global consumers increasingly seek daily-use moisturizers that double up with claims like anti-aging and sensitive skin relief, creams/lotions are expected to sustain their leadership through the decade.

| Channel Segment | Market Value Share, 2025 |

|---|---|

| E-commerce | 33.4% |

| Others | 66.6% |

The e-commerce segment is projected to contribute 33.4% of the Global Revolutionary Moisture Locking Systems Market revenue in 2025, establishing itself as a critical growth driver. This reflects the accelerated consumer adoption of online skincare platforms, subscription services, and personalized consultation ecosystems.

E-commerce platforms have become essential for direct brand-to-consumer connections, enabling greater transparency, reviews, and personalized recommendations. The expansion of AI-driven diagnostics, augmented reality try-ons, and influencer-led campaigns has further strengthened online purchasing behavior. By 2035, e-commerce is expected to surpass 35% share, making it the fastest-growing distribution channel.

Rising Demand for Long-lasting Hydration and Barrier Repair

One of the strongest growth drivers is the rising consumer preference for products that deliver 24-hour hydration and reinforce the skin barrier. With urban populations increasingly exposed to pollution, air conditioning, and stress-induced skin issues, demand for hydration-focused skincare has surged. In 2025, long-lasting hydration alone accounts for 38.4% of market share (USD 641.2 million), making it the leading function globally.

The addition of ceramides, hyaluronic acid complexes, and bio-fermented humectants has elevated product efficacy, further enhancing trust in such formulations. As barrier repair and moisture-locking become essential for maintaining skin health, this segment is projected to sustain leadership, particularly in China, India, and Japan, where rapid urbanization is intensifying demand for daily-use hydration products.

Digital-first Distribution and Personalization through E-commerce

Another critical driver is the rapid rise of e-commerce as a skincare distribution hub. In 2025, e-commerce already contributes 33.4% share (USD 558.1 million), reflecting a global shift in purchasing behavior. Consumers are increasingly engaging with AI-driven diagnostics, subscription models, and AR-based try-on tools, which allow them to find hyper-personalized solutions for hydration, anti-aging, and sensitive skin concerns.

Younger demographics in South Asia & Pacific and East Asia have accelerated this trend, with online-first adoption contributing to higher CAGR in these regions. The integration of digital consultation platforms, influencer-driven brand marketing, and subscription-based replenishment models is creating recurring revenue streams and reshaping competitive advantage. This digital pivot ensures that e-commerce will remain the fastest-growing channel segment through 2035.

High Cost of Clinical-grade and Premium Formulations

While the market is expanding rapidly, the high cost of dermatologist-tested, clinical-grade, and premium formulations remains a significant restraint, particularly in price-sensitive economies. Products marketed as “clinical-grade” or with advanced moisture-locking polymers and bioactive complexes often carry a 30-50% price premium, making them less accessible to middle-income consumers in emerging markets such as India, Brazil, and Southeast Asia. This cost barrier limits penetration outside urban centers and slows adoption among mass-market buyers, forcing brands to balance between premium positioning and affordability-driven innovation.

Rising Competition from Substitutes and Generic Moisturizers

Another challenge arises from the availability of low-cost substitutes, including generic moisturizers and natural DIY remedies. Consumers in developing regions often substitute advanced moisture-locking products with traditional oils, herbal balms, or budget-friendly lotions that provide basic hydration but lack advanced technology. This substitution risk is particularly high in Latin America and rural Asia, where brand differentiation and clinical claims have limited influence.

Moreover, the entry of private-label store brands offering affordable hydration solutions further intensifies competition, squeezing margins for established players like Neutrogena, CeraVe, and Olay.

Growing Preference for Clean-label, Vegan, and Sustainable Claims

A major trend shaping the market is the accelerated adoption of clean-label and vegan-certified products. Consumers, especially in Europe and North America, are demanding formulations that exclude parabens, silicones, and animal-derived ingredients. In 2025, claims such as vegan and natural/organic are no longer niche but mainstream, influencing product development pipelines across top brands like La Roche-Posay, Bioderma, and Dr.Jart+.

Furthermore, eco-friendly packaging innovations, including refillable jars and biodegradable masks, are becoming crucial brand differentiators. This trend is expected to deepen as Gen Z and millennial buyers actively seek transparency and sustainability in skincare.

Integration of AI, AR, and Skin Diagnostic Technologies

The second key trend is the integration of digital technologies into both product personalization and distribution strategies. AI-driven skin analysis tools, AR try-ons, and mobile apps offering moisture-level diagnostics are helping brands capture consumer trust through precision targeting. Companies like Estée Lauder and Shiseido are already investing heavily in AI-based personalization platforms, linking diagnostic tools with tailored product recommendations.

This trend not only strengthens consumer engagement but also enhances brand loyalty, as buyers increasingly prefer data-backed, customized solutions. By 2035, such digital-first approaches will drive not only e-commerce dominance but also higher adoption of clinical-grade and premium moisture-locking systems across global markets.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 16.4% |

| USA | 6.8% |

| India | 18.5% |

| UK | 10.7% |

| Germany | 8.0% |

| Japan | 13.3% |

The growth outlook varies significantly across leading countries, reflecting differences in consumer behavior, digital adoption, and skincare maturity. India (18.5% CAGR) and China (16.4% CAGR) lead global expansion, driven by rapid urbanization, a young consumer base, and heightened awareness of dermatological health.

Rising disposable incomes and the popularity of e-commerce platforms in these countries are accelerating demand for creams, serums, and clinical-grade formulations, particularly in hydration and sensitive skin relief categories. Japan (13.3% CAGR) is another strong growth hub, fueled by its established beauty culture and consumer readiness to adopt technologically advanced, personalized products. The country’s preference for lightweight textures such as gels and masks aligns well with innovation in moisture-locking systems.

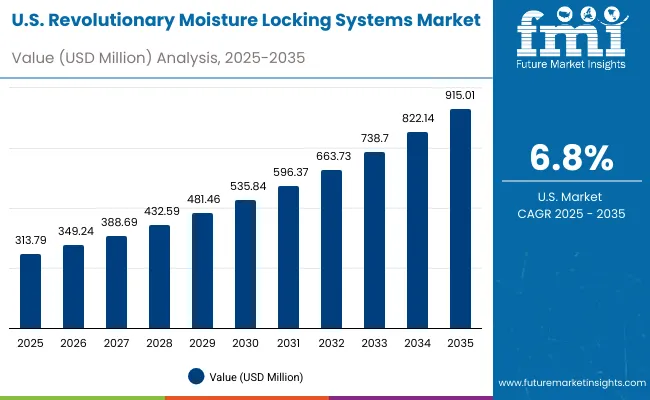

In comparison, growth is steadier in Western markets, with the USA at 6.8% CAGR, the UK at 10.7%, and Germany at 8.0%. While the USA remains one of the largest revenue contributors globally, its mature skincare market means expansion is incremental, led by clinical-grade and dermatologist-tested claims rather than sheer volume growth.

The UK’s double-digit CAGR is supported by rising adoption of vegan and clean-label products, while Germany’s moderate growth reflects its established pharmacy-driven skincare culture and cautious uptake of premium products. Together, these figures highlight a clear global divide: Asia dominates growth momentum, while North America and Europe secure maturity-driven revenue stability, ensuring the market expands in both scale and sophistication over the forecast decade.

| Year | USA Revolutionary Moisture Locking Systems Market (USD Million) |

|---|---|

| 2025 | 313.8 |

| 2026 | 349.2 |

| 2027 | 388.7 |

| 2028 | 432.6 |

| 2029 | 481.5 |

| 2030 | 535.8 |

| 2031 | 596.4 |

| 2032 | 663.7 |

| 2033 | 738.7 |

| 2034 | 822.1 |

| 2035 | 915.0 |

The Revolutionary Moisture Locking Systems Market in the United States is projected to grow at a CAGR of 6.8%, led by rising consumer interest in dermatologist-tested hydration solutions and clinical-grade barrier repair formulations. Reverse aging and sensitive skin applications recorded a notable year-on-year rise, particularly among older demographics seeking prescription-supported moisturizers.

The healthcare channel, especially pharmacies and dermocosmetic clinics, has been integrating advanced serums and creams into daily treatment routines. Adoption is also rising in e-commerce and mass retail, with strong traction for subscription-based personalized hydration kits. Growing awareness of skin microbiome science and the bundling of serums with clinical-grade claims are creating opportunities for co-branded solutions in sensitive skin and hydration relief.

The Revolutionary Moisture Locking Systems Market in the United Kingdom is expected to grow at a CAGR of 10.7%, supported by applications in sensitive skin relief, clean-label products, and anti-aging solutions. High-end beauty and dermatology clinics have accelerated the usage of vegan-certified serums to address growing demand for ethical and natural claims. Heritage skincare brands and pharmacies are expanding portfolios with natural/organic moisture-locking formulations to build consumer trust.

In retail, specialty beauty stores are increasingly integrating AR-driven consultation platforms, allowing consumers to test moisturizers virtually before purchase. Government-backed sustainability programs and consumer preference for refillable eco-friendly packaging are fueling adoption across both the mass and premium segments.

India is witnessing rapid growth in the Revolutionary Moisture Locking Systems Market, which is forecast to expand at a CAGR of 18.5% through 2035. A sharp increase in sales across tier-2 and tier-3 cities is being driven by affordable launches and rising awareness through digital platforms. Local consumers are adopting hydration and barrier-repair creams to address pollution-related dryness and sensitivity issues.

Online-first distribution has accelerated adoption among younger demographics, while traditional channels such as pharmacies and small retailers continue to provide affordable entry-level options. The education sector and vocational beauty academies are also promoting training in skincare regimens, boosting awareness of long-term hydration solutions.

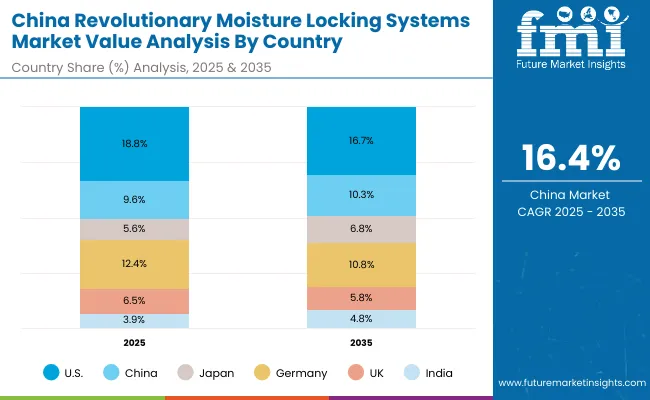

The Revolutionary Moisture Locking Systems Market in China is expected to grow at a CAGR of 16.4%, among the highest globally. This momentum is driven by smart retail adoption, premium skincare demand, and innovative launches by domestic and multinational players. Industrial-scale e-commerce platforms like Tmall and JD.com are expanding distribution, while city populations are adopting hydration masks, serums, and gels at a record pace.

Municipal awareness campaigns promoting skin health are also boosting consumption of dermatologist-tested solutions. Local companies are launching affordable hydration-focused creams and serums, enabling widespread use in student, young professional, and middle-income segments. Cross-sector digitization, such as AI-powered skin analysis kiosks in malls, remains a key growth lever.

| Country | 2025 Share (%) |

|---|---|

| USA | 18.8% |

| China | 9.6% |

| Japan | 5.6% |

| Germany | 12.4% |

| UK | 6.5% |

| India | 3.9% |

| Country | 2035 Share (%) |

|---|---|

| USA | 16.7% |

| China | 10.3% |

| Japan | 6.8% |

| Germany | 10.8% |

| UK | 5.8% |

| India | 4.8% |

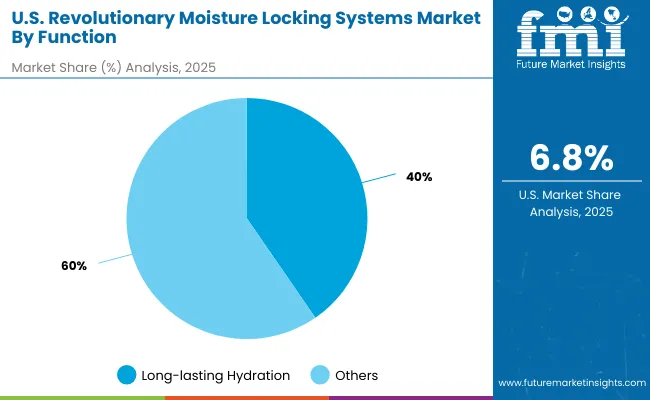

| Function Segment | Market Value Share, 2025 |

|---|---|

| Long-lasting hydration | 40.4% |

| Others | 59.6% |

The Revolutionary Moisture Locking Systems Market in the United States is valued at USD 313.8 million in 2025, with long-lasting hydration leading at 40.4% (USD 126.7 million), followed by barrier repair, anti-aging, and sensitive skin relief collectively contributing 59.6%.

The dominance of hydration-based solutions reflects the USA consumer focus on day-to-night moisturization, dermatologist-tested claims, and clinical-grade safety. Strong demand from pharmacies and dermocosmetic clinics highlights the integration of advanced hydration creams and serums into daily care routines.

This advantage positions hydration systems as an essential tool for addressing urban dryness, sensitive skin conditions, and aging-related moisture loss. Anti-aging serums and barrier repair creams are also witnessing steady traction, particularly among baby boomers and Gen X consumers. As AI-powered skin diagnostic apps and subscription-based e-commerce channels expand, the personalization of hydration solutions will strengthen USA market opportunities further.

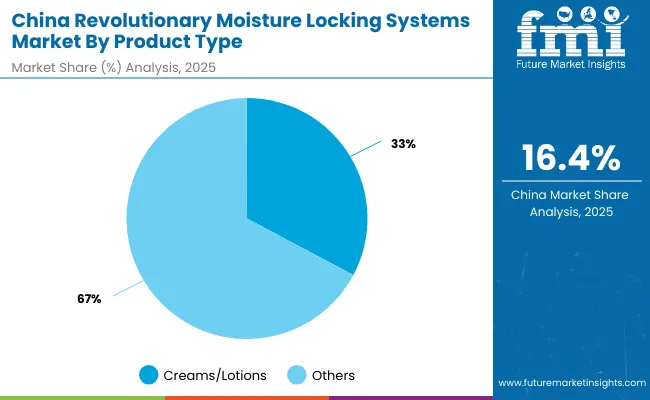

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams/lotions | 32.8% |

| Others | 67.2% |

The Revolutionary Moisture Locking Systems Market in China is valued at USD 160.4 million in 2025, with creams/lotions leading at 32.8% (USD 52.6 million), followed by serums, gels, and masks at 67.2%. The dominance of creams and lotions reflects China’s mass-market accessibility, consumer familiarity, and retail penetration across urban and semi-urban regions. Daily-use moisturizers remain an indispensable skincare category, particularly as younger consumers prioritize affordable hydration alongside premium imports.

This advantage positions creams/lotions as the entry point for new adopters while serums and gels accelerate growth in tier-1 cities, where personalization and luxury claims carry stronger weight. Affordable launches by domestic firms and digital-first distribution through Tmall and JD.com are fueling mass adoption. With rising demand for clean-label, vegan, and clinical-grade claims, China’s market is expected to outperform most regions, recording a 16.4% CAGR through 2035.

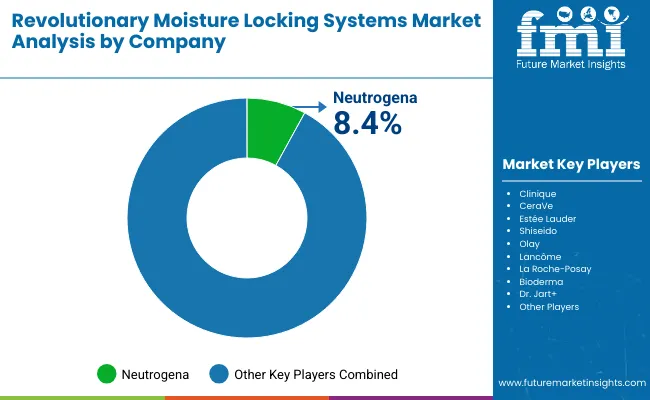

| Companies | Global Value Share 2025 |

| Neutrogena | 8.4% |

| Others | 91.6% |

The Revolutionary Moisture Locking Systems Market is moderately fragmented, with global leaders, established dermocosmetic specialists, and emerging clean-label innovators competing across diverse product categories. Global skincare leaders such as Neutrogena, Estée Lauder, and Shiseido hold significant market share, driven by advanced hydration serums, premium anti-aging formulations, and dermatologist-tested barrier repair systems. Their strategies increasingly emphasize AI-driven personalization, subscription-based replenishment, and cross-channel distribution to expand consumer engagement.

Established mid-sized brands, including CeraVe, La Roche-Posay, and Bioderma, cater to growing demand for dermatologist-tested and sensitive skin relief solutions. These companies accelerate adoption through pharmacy-led distribution, strong clinical credibility, and affordable daily-use hydration solutions, making them highly relevant for mass adoption and dermatological care.

Specialized players such as Dr.Jart+ and Lancôme focus on innovative serums, sheet masks, and hybrid gel formulations tailored to Asia-Pacific consumers. Their strength lies in trend-driven launches, clean-label innovation, and market adaptability, ensuring rapid penetration in growth regions such as China and India.

Competitive differentiation is shifting away from basic hydration claims toward ecosystem-led strategies, including AI-powered skin diagnostics, refillable packaging models, and clinical partnerships. Brands that integrate technology, sustainability, and personalization into their core offerings are positioned to capture outsized growth in the decade ahead.

Key Developments in Global Revolutionary Moisture Locking Systems Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,671.2 million |

| Function | Long-lasting hydration, Barrier repair, Anti-aging, Sensitive skin relief |

| Product Type | Creams/lotions, Serums, Gels, Masks |

| Channel | E-commerce, Pharmacies, Mass retail, Specialty beauty stores |

| Claim | Dermatologist-tested, Vegan, Natural/organic, Clinical-grade |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Neutrogena, Clinique, CeraVe , Estée Lauder, Shiseido, Olay, Lancôme, La Roche- Posay , Bioderma , Dr. Jart + |

| Additional Attributes | Dollar sales by function, product type, and channel, adoption trends in hydration and barrier repair, rising demand for dermatologist-tested and vegan formulations, segment-specific growth in creams/lotions and e-commerce, integration of AI-based personalization and subscription platforms, regional trends influenced by premiumization and digital-first retail, and innovations in long-lasting hydration polymers, bio-fermented humectants, and barrier-repair complexes. |

The Global Revolutionary Moisture Locking Systems Market is estimated to be valued at USD 1,671.2 million in 2025.

The market size for the Global Revolutionary Moisture Locking Systems Market is projected to reach USD 5,482.3 million by 2035.

The Global Revolutionary Moisture Locking Systems Market is expected to grow at a 12.6% CAGR between 2025 and 2035.

The key product types in the Global Revolutionary Moisture Locking Systems Market are creams/lotions, serums, gels, and masks.

In terms of function, the long-lasting hydration segment is expected to command 38.4% share of the Global Revolutionary Moisture Locking Systems Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Moisture Detection Stickers Market Size and Share Forecast Outlook 2025 to 2035

Moisture-resistant Packaging Market Size, Share & Forecast 2025 to 2035

Moisture Meter Market

Moisture Analyzer Market Growth – Trends & Forecast 2019-2027

OWD Moisture Meter Market Size and Share Forecast Outlook 2025 to 2035

Soil Moisture Sensor Market Size and Share Forecast Outlook 2025 to 2035

Heat Moisture Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Wood Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

TDLAS Moisture Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Paper Moisture Meter Market Growth – Trends & Forecast 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Smart-Release Moisture-Boosting Technology Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA