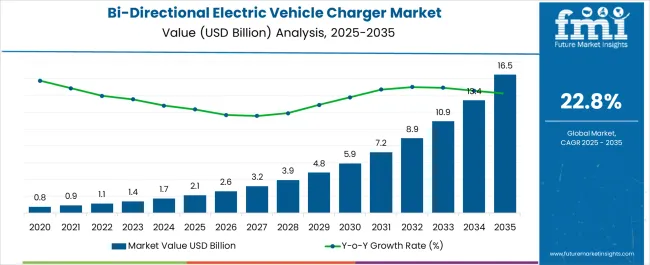

The Bi-Directional Electric Vehicle Charger Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 16.5 billion by 2035, registering a compound annual growth rate (CAGR) of 22.8% over the forecast period. Over this period, market size is expected to grow from USD 2.1 billion to USD 16.5 billion, indicating a multiplying factor of approximately 7.86×. When annual growth is segmented into five-year windows, the first block from 2025 to 2030 shows an increase from USD 2.1 billion to USD 5.9 billion, representing a compound annual growth rate of nearly 20.5%.

This early-stage acceleration is shaped by pilot deployments, grid feedback infrastructure, and OEM-level integration. The subsequent five-year phase, from 2030 to 2035, reflects an increase from USD 5.9 billion to USD 16.5 billion. This equates to a rolling CAGR of about 22.4%, suggesting growth momentum is being sustained even after the initial wave of adoption.

Slight upward curvature is visible in the last three years, where annual additions increase at a quicker pace, rising by over USD 2.5 billion per year. This consistency in high double-digit CAGR across both halves of the decade confirms the structural momentum of this segment, driven by vehicle-to-grid incentives, residential installations, and government-backed grid stability programs.

| Metric | Value |

|---|---|

| Bi-Directional Electric Vehicle Charger Market Estimated Value in (2025 E) | USD 2.1 billion |

| Bi-Directional Electric Vehicle Charger Market Forecast Value in (2035 F) | USD 16.5 billion |

| Forecast CAGR (2025 to 2035) | 22.8% |

The bi-directional electric vehicle (EV) charger market is advancing rapidly, driven by increasing adoption of vehicle-to-grid (V2G) technologies and global energy decentralization initiatives. As electric vehicles transition from mobility assets to energy storage hubs, demand for infrastructure that enables bidirectional energy flow is surging.

Supportive government policies, including incentives for grid integration and decentralized renewable management, are accelerating investments in bi-directional charging. Additionally, growing interest in energy resilience and household backup power among consumers is enhancing market potential.

Advancements in smart charging systems, communication protocols, and grid interoperability are expected to further support scalable deployment in both residential and commercial sectors. The market is also benefiting from partnerships between automakers, utilities, and charger manufacturers to streamline ecosystem integration and ensure seamless user experience.

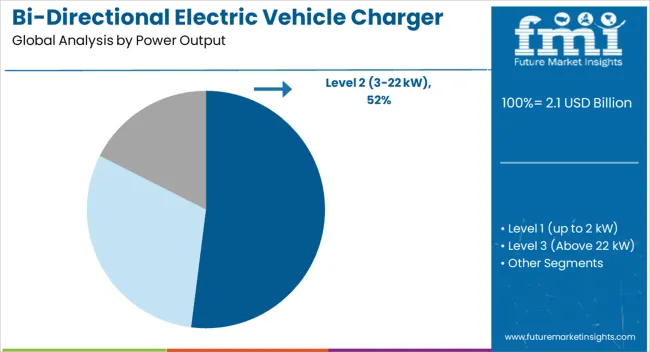

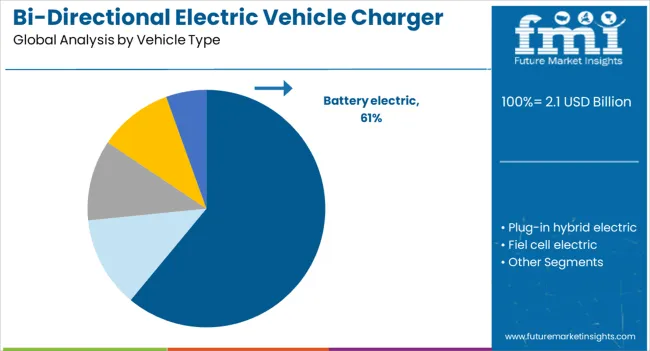

The bi-directional electric vehicle charger market is segmented by power output, vehicle type, sales channel, application, end user, and geographic regions. The power output of the bi-directional electric vehicle charger market is divided into Level 2 (3-22 kW), Level 1 (up to 2 kW), and Level 3 (Above 22 kW). In terms of vehicle type, the bi-directional electric vehicle charger market is classified into Battery electric, Plug-in hybrid electric, Fuel cell electric, Hybrid electric, and others.

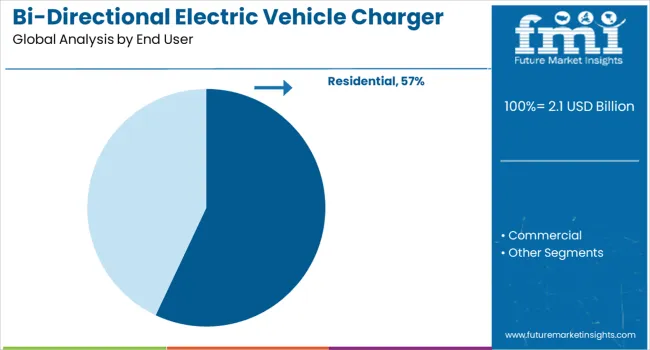

The bi-directional electric vehicle charger market is segmented into OEM and Aftermarket. The bi-directional electric vehicle charger market is segmented into Vehicle-to-home, Vehicle-to-grid, and Vehicle-to-load. The end users of the bi-directional electric vehicle charger market are segmented into residential and commercial.

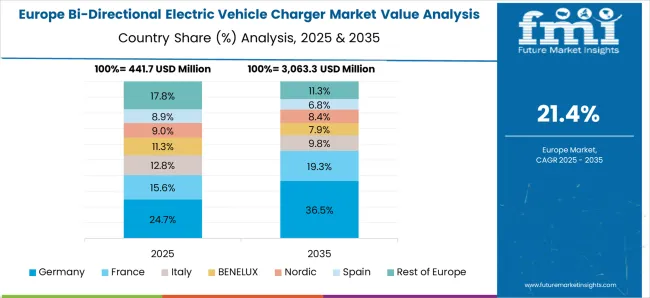

Regionally, the bi-directional electric vehicle charger industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Level 2 chargers, offering power output between 3-22 kW, are projected to dominate with a 52.00% market share by 2025. Their dominance stems from optimal compatibility with residential and light commercial environments, where infrastructure costs and space constraints make high-voltage solutions less practical.

Level 2 chargers support overnight charging, grid feedback, and energy arbitrage use cases with manageable investment.

As automakers expand support for V2H and V2G functionality, Level 2 remains the default standard for scalable deployments, especially in suburban and multi-unit dwellings.

Battery electric vehicles (BEVs) are expected to account for 61.00% of the bi-directional EV charger market by 2025, making them the dominant vehicle type. BEVs, with larger battery packs and full electric drivetrains, offer superior grid support potential compared to hybrids.

The absence of combustion engines ensures deeper discharge cycles and better integration with home energy management systems.

As automakers like Tesla, Ford, and Nissan enable bidirectional support in newer BEV models, this segment is becoming the focal point for utilities and grid service providers.

OEMs are forecast to lead the sales channel segment with a 68.00% share in 2025. This is being driven by the integration of bidirectional chargers as standard or optional features in electric vehicle packages.

Automakers are leveraging proprietary charger designs to improve performance, safety, and interoperability with their vehicles, while also strengthening brand loyalty. Moreover, bundled service offerings combining charger, installation, and smart grid apps are becoming popular among OEMs seeking to deliver end-to-end charging solutions directly to EV buyers.

OEM dominance is expected to persist as regulations begin mandating V2G readiness in new EV fleets.

The Bi-Directional EV Charger Market is experiencing traction due to the rise in EV adoption and energy decentralization. These chargers allow two-way energy transfer, enabling vehicles to return stored power to homes or the grid. Integration with smart grids, cost-saving use cases, and renewable energy support are driving interest. Use in fleet depots and residential applications is expanding. Emphasis on energy resilience and decarbonization has positioned bi-directional systems as a critical element within broader electrification strategies across transport and infrastructure sectors.

Grid operators and commercial fleet managers have expanded the use of bi-directional EV chargers to manage peak loads and store intermittent renewable energy. These chargers are central to Vehicle-to-Grid (V2G) and Vehicle-to-Home (V2H) operations, where stored EV battery energy supports demand spikes or household use. Power utilities in Europe and North America have initiated pilot programs for zdemand-side flexibility. Japan and South Korea have commercialized residential applications using V2H. Bi-directional technology aligns with grid decarbonization, enabling distributed storage and lowering transmission stress during critical consumption hours.

Upfront cost of bi-directional chargers remains over 30% higher than conventional alternatives, constraining mass deployment. Incompatibility across EV brands and charger models due to differing communication protocols limits interoperability. Battery life uncertainty from frequent charge-discharge cycles discourages widespread V2G use among consumers. Insufficient support infrastructure in multi-unit housing and rural zones adds complexity. Regional variation in standards, such as CHAdeMO in Japan versus CCS in Europe, further stalls uniform adoption. Technical complexity and limited utility incentives make large-scale rollout of bi-directional chargers financially challenging for fleet operators and residential users.

Adoption of bidirectional EV chargers in school buses, delivery fleets, and light commercial vehicles has opened grid interaction opportunities, especially during downtime. Smart home energy systems integrated with EV storage are expected to gain relevance, particularly in regions with volatile electricity pricing. Future-proof infrastructure mandates in Europe and parts of North America have prompted real estate and facility managers to consider charger installation. Demand from logistics hubs, public transit agencies, and emergency backup applications is expanding. Emerging regulatory clarity around V2G protocols is likely to reduce investment risk and unlock scale-based cost reduction.

Technological trends include the standardization of communication protocols, integration of AI-driven energy scheduling, and modularity in charger design. Chargers with built-in load-balancing software are entering commercial fleets. ISO 15118 compliance is becoming essential to ensure V2G readiness and secure energy data transmission. Automated energy arbitrage, where EVs trade stored energy at optimal rates, is under evaluation in pilot zones. Retrofit-friendly solutions are being developed to address legacy vehicle compatibility. The transition from pilot demonstrations to full-scale deployments across utilities and commercial hubs indicates strategic movement toward grid-resilient electrification pathways.

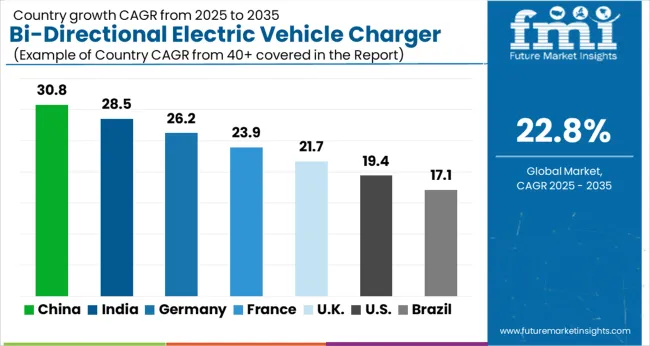

| Country | CAGR |

|---|---|

| China | 30.8% |

| India | 28.5% |

| Germany | 26.2% |

| France | 23.9% |

| UK | 21.7% |

| USA | 19.4% |

| Brazil | 17.1% |

The bi directional electric vehicle charger market is forecast to expand at a global CAGR of 22.8% between 2025 and 2035. Growth has been concentrated in countries promoting grid-resilient charging, local battery storage integration, and two-way power distribution. China, India, and Germany have surpassed the global average by a substantial margin. OECD nations have supported deployment through vehicle-to-grid trials and policy mandates, while ASEAN countries have prioritized infrastructure development in metropolitan zones. The market's acceleration remains anchored in EV adoption, energy transition goals, and utility-grade applications. Cross-border technology partnerships and energy efficiency programs have further pushed production and deployment capabilities, making this segment increasingly strategic for both automotive and energy sectors.

China is forecast to record a 30.8% CAGR through 2035, exceeding the global average by over 35%. This growth has been propelled by aggressive smart grid integration and mass-scale deployment of electric vehicle infrastructure. State-owned energy companies have collaborated with private EV manufacturers to implement vehicle-to-grid (V2G) systems across pilot cities. Large-scale procurement incentives have promoted bi directional charging in both residential and commercial segments.

India is projected to grow at a CAGR of 28.5%, 25% above the global rate. Stronger incentives under the FAME scheme and state-led EV policies have accelerated charger deployment. Demand has grown across fleet operations, last-mile logistics, and urban residential segments. Indigenous production of V2G-compatible hardware has been promoted through localization targets, while partnerships with ASEAN nations have improved regional supply chains.

Germany is anticipated to expand at 26.2% CAGR, surpassing the global pace by 15%. Government mandates through the EEG Act and integration of renewable energy targets have guided charger installations. The automotive sector has introduced factory-embedded V2G modules, while regional utilities have partnered in decentralized storage trials. As an OECD member, Germany’s cross-border energy regulations have also supported charger exports within Europe.

The United Kingdom is expected to grow at a CAGR of 21.7%, just below the global benchmark. Market demand has been supported by Ofgem’s regulation of smart charging infrastructure and automotive-sector alignment with net-zero goals. Home-based bi directional chargers have gained traction, particularly within residential solar panel ecosystems. Utility partners have focused on optimizing EV-to-grid return cycles for grid stabilization.

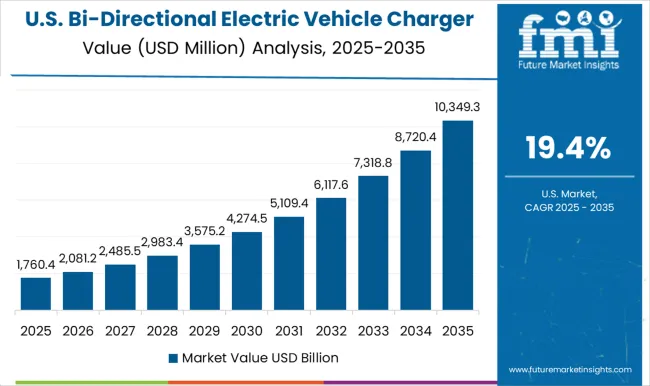

United States CAGR stands at 19.4%, approximately 15% below the global average. Federal EV infrastructure bills and energy resilience goals have shaped the market. OEMs have integrated bidirectional compatibility into new vehicle platforms. However, fragmented utility protocols have slowed uniform deployment. Despite this, pilot programs across California, Texas, and New York have tested V2G integration for disaster recovery and grid balancing.

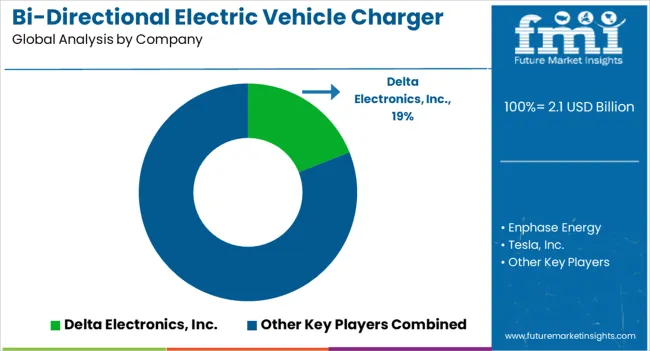

Delta Electronics, Inc. has maintained a leading position in the bi-directional EV charger market through its integration of V2G (Vehicle-to-Grid) technology and scalable charging platforms. Tesla, Inc. continues to explore bidirectional functionality for its Powerwall and EV fleet, with early signs of integration seen across home energy systems.

Enphase Energy has invested in V2H (Vehicle-to-Home) compatibility, aligning chargers with residential solar infrastructure. Indra Renewable Technologies specializes in UK and EU-centric deployments, with product offerings that meet grid balancing and off-peak optimization needs. Wallbox USA Inc. has strengthened its North American footprint through its Quasar charger, tailored for both residential and commercial use.

ABB supports large-scale installations with modular chargers optimized for fleet and utility-based energy returns. Autel focuses on adaptable bi-directional chargers suitable for public charging networks, especially in urban mobility zones. Scame Parre SpA caters to the European market with compact designs compliant with IEC standards.

The market is being shaped by increasing V2G pilot projects, EV-friendly policies, and grid integration requirements. Manufacturers are competing on efficiency, software compatibility, and regulatory certifications as demand rises from OEMs, utilities, and smart home segments prioritizing load management and grid decarbonization through bi-directional energy flows.

Japan prioritized home-backup systems tied to solar infrastructure, while South Korea advanced grid-responsive V2X solutions. Major acquisitions enhanced technology portfolios across Europe. These developments indicated real-world deployments of bidirectional systems, pushing electric vehicles from mere transport assets to active grid-supporting nodes in multiple developed markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Power Output | Level 2 (3-22 kW), Level 1 (up to 2 kW), and Level 3 (Above 22 kW) |

| Vehicle Type | Battery electric, Plug-in hybrid electric, Fiel cell electric, Hybrid electric, and Others |

| Sales Channel | OEM and Aftermarket |

| Application | Vehicle-to-home, Vehicle-to-grid, and Vehicle-to-load |

| End User | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Delta Electronics, Inc., Enphase Energy, Tesla, Inc., Indra Renewable Technologies, Wallbox USA Inc., ABB, Autel, and Scame Parre SpA |

| Additional Attributes | Dollar sales by charger type and use case, demand shifts via V2G and fleet applications, regional gains in Asia-Pacific, innovations in ISO 15118 and smart grid tie-ins, environmental impact through peak shaving, and rising use in home backup systems. |

The global bi-directional electric vehicle charger market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the bi-directional electric vehicle charger market is projected to reach USD 16.5 billion by 2035.

The bi-directional electric vehicle charger market is expected to grow at a 22.8% CAGR between 2025 and 2035.

The key product types in bi-directional electric vehicle charger market are level 2 (3-22 kw), level 1 (up to 2 kw) and level 3 (above 22 kw).

In terms of vehicle type, battery electric segment to command 61.0% share in the bi-directional electric vehicle charger market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA