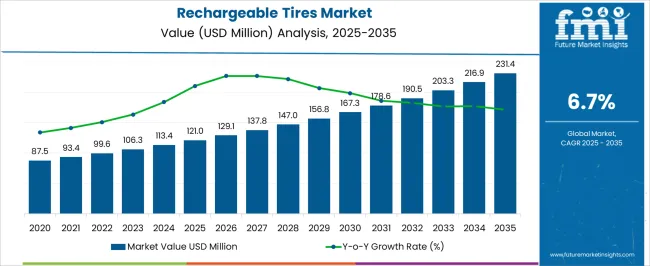

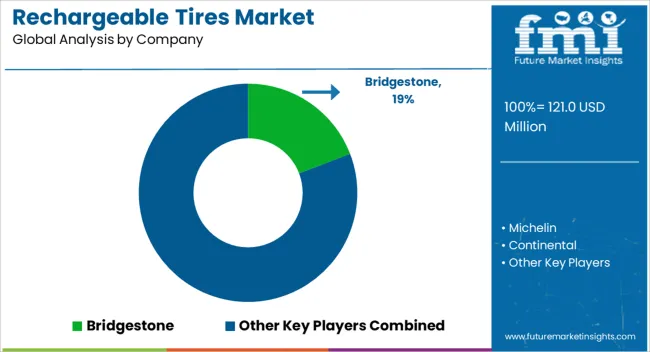

The Rechargeable Tires Market is estimated to be valued at USD 121.0 million in 2025 and is projected to reach USD 231.4 million by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. From 2020 to 2024, the market grew from USD 87.5 million to USD 113.4 million, with annual growth rates ranging between 6.0% and 6.8%. This period reflects early adoption, with manufacturers and fleet operators testing rechargeable tires in commercial and passenger vehicles. Year-on-year growth was driven by demand for cost-efficient, long-lasting tire solutions, as well as improvements in tire performance and reliability. Initial uptake focused on select regions and vehicle segments, establishing a foundation for broader market expansion.

Between 2025 and 2030, the market experiences scaling, rising from USD 121.0 million to USD 167.3 million, with YoY growth averaging around 6.2–6.9%. Wider adoption occurs across multiple vehicle segments and fleet operations, supported by increased production and distribution. From 2030 to 2035, growth continues steadily, reaching USD 231.4 million, with annual increases of approximately 6.5–7.0%. The YoY analysis demonstrates a predictable expansion pattern, with demand spreading across commercial, passenger, and specialty vehicle segments. Rechargeable tires gradually become a standard option, driven by reliability, durability, and consistent performance in diverse driving conditions.

Bridgestone, Michelin, Continental, Goodyear, Hankook, Cooper, Nexen Tire, Nokian

| Metric | Value |

|---|---|

| Rechargeable Tires Market Estimated Value in (2025 E) | USD 121.0 million |

| Rechargeable Tires Market Forecast Value in (2035 F) | USD 231.4 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The rechargeable tires market is experiencing steady expansion, supported by the increasing shift toward sustainable mobility solutions and the adoption of advanced materials and technologies in automotive manufacturing. The concept of rechargeable tires, which integrates energy storage and regenerative capabilities, is gaining traction as vehicle manufacturers and consumers focus on enhancing efficiency and reducing environmental impact.

Growth is being driven by advancements in energy harvesting systems, wireless charging technologies, and smart tire monitoring, which collectively enable improved performance and durability. Supportive government policies and investments in clean transportation infrastructure are further accelerating adoption, especially in markets with strong electric vehicle penetration.

Increasing emphasis on reducing dependence on traditional energy sources, combined with the need for extended driving range and improved safety, is also boosting development efforts As technology matures and manufacturing costs decline, rechargeable tires are expected to move from niche applications toward mainstream adoption, offering opportunities for both established tire manufacturers and new entrants focusing on innovative mobility solutions.

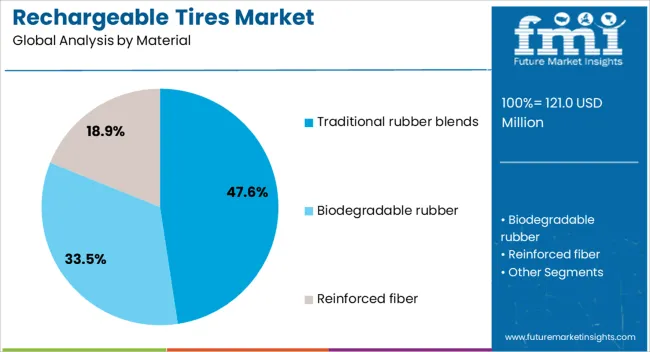

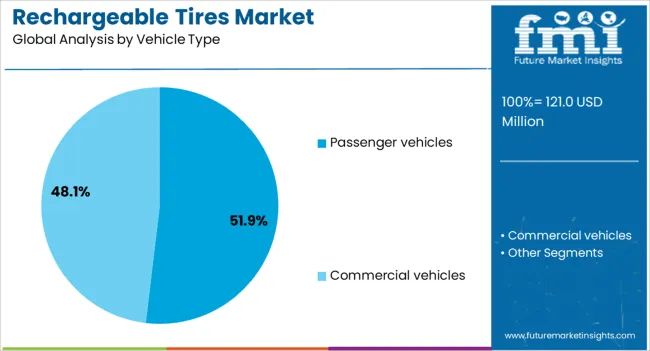

The rechargeable tires market is segmented by material, vehicle type, sales channel, and geographic regions. By material, rechargeable tires market is divided into Traditional rubber blends, Biodegradable rubber, and Reinforced fiber. In terms of vehicle type, rechargeable tires market is classified into Passenger vehicles and Commercial vehicles.

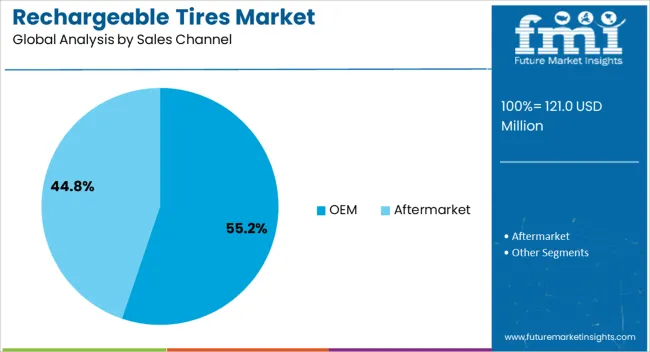

Based on sales channel, rechargeable tires market is segmented into OEM and Aftermarket. Regionally, the rechargeable tires industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The traditional rubber blends segment is projected to account for 47.6% of the rechargeable tires market revenue share in 2025, making it the leading material category. This leadership is being driven by the proven durability, cost-effectiveness, and widespread manufacturing capabilities associated with traditional rubber compounds. Manufacturers are leveraging existing rubber processing infrastructure to integrate rechargeable and energy storage features into familiar material compositions, ensuring scalability and reducing production complexity.

The segment benefits from the ability to balance mechanical strength, flexibility, and energy transfer efficiency without requiring extensive changes to current tire production methods. Traditional rubber blends also offer strong wear resistance and performance consistency under various road and weather conditions, which is critical for consumer acceptance.

Additionally, the global availability of raw materials and well-established supply chains support competitive pricing, enabling faster market penetration. As rechargeable tire technologies evolve, the adaptability of traditional rubber blends to incorporate smart sensors and energy harvesting components is expected to sustain their market leadership.

The passenger vehicles segment is anticipated to represent 51.9% of the rechargeable tires market revenue share in 2025, establishing itself as the dominant vehicle type. This dominance is being supported by the high global demand for passenger cars, coupled with growing consumer interest in energy-efficient and technologically advanced mobility solutions.

Rechargeable tires in passenger vehicles offer the potential to extend driving range, optimize energy consumption, and improve real-time performance monitoring, making them attractive for both electric and hybrid models. Manufacturers are prioritizing this segment due to its large production volumes, enabling faster return on investment and broader technology adoption.

Regulatory pressures to reduce vehicle emissions and improve efficiency are also influencing passenger car designs, where energy harvesting tires can contribute to meeting stringent environmental standards. With increasing investments in electric vehicle infrastructure and rising consumer awareness of sustainable driving technologies, passenger vehicles are expected to remain the primary focus for rechargeable tire innovation and deployment over the coming years.

The OEM segment is expected to hold 55.2% of the rechargeable tires market revenue share in 2025, making it the leading sales channel. This dominance is being driven by the growing collaboration between tire manufacturers and automotive OEMs to integrate rechargeable tire technology into new vehicle models from the production stage. OEM partnerships enable precise alignment of tire performance specifications with vehicle energy systems, ensuring optimal functionality and safety.

The segment is benefiting from the ability to standardize design, improve manufacturing efficiency, and offer integrated warranties, which increase consumer confidence. OEM adoption also accelerates technology commercialization by leveraging established dealership networks and after-sales services.

Furthermore, early-stage integration at the OEM level reduces retrofitting complexities and ensures compatibility with advanced vehicle systems such as regenerative braking and smart energy management. As competition intensifies in the electric and hybrid vehicle market, OEM-installed rechargeable tires are expected to be a key differentiator, reinforcing this channel’s market leadership in the coming decade.

The rechargeable tires market is expanding due to growing interest in energy-harvesting solutions and vehicle electrification. These tires convert kinetic energy from rotation into electrical energy, supporting sensors, monitoring systems, and low-power vehicle electronics. Applications include electric vehicles, smart tires, and autonomous driving systems. Asia-Pacific leads adoption due to rapid EV penetration, while Europe and North America focus on high-performance and technologically advanced solutions. Manufacturers emphasize durability, energy efficiency, and compatibility with existing tire designs to encourage widespread adoption.

Rechargeable tires are increasingly integrated with electric and hybrid vehicles to harness kinetic energy for powering onboard electronics and tire pressure monitoring systems. This reduces dependency on batteries for low-power devices, improving overall energy efficiency. OEMs are collaborating with tire manufacturers to develop compatible solutions that maintain safety, performance, and durability standards. Integration of rechargeable tires also supports real-time monitoring for autonomous and connected vehicles, where sensors require continuous power. Until alternative energy-harvesting technologies are deployed at scale, electric and hybrid vehicle applications remain the primary growth driver for rechargeable tires, particularly in markets prioritizing energy-efficient and high-tech mobility solutions.

Rechargeable tires provide a reliable power source for tire sensors that monitor pressure, temperature, and wear in real-time. This enables early detection of potential safety issues, reduces maintenance costs, and improves overall vehicle safety. Fleet operators and logistics companies particularly benefit from predictive maintenance capabilities powered by tire-generated energy. Manufacturers are designing rechargeable tires to be compatible with existing monitoring technologies, ensuring seamless integration without compromising tire performance. Until alternative self-powered sensor technologies achieve similar efficiency, rechargeable tires will remain an attractive option for safety-focused vehicles and fleet management systems across passenger, commercial, and industrial segments.

A major challenge for rechargeable tires is balancing energy harvesting with traditional tire performance metrics, such as grip, wear resistance, and load-bearing capacity. Energy conversion systems embedded in the tire must withstand continuous mechanical stress, varying temperatures, and road conditions without affecting safety. Designing a system that produces sufficient power while maintaining standard tire properties requires precision engineering and specialized materials. Companies focusing on long-lasting, efficient energy conversion systems gain a competitive advantage. Until manufacturing and material challenges are fully resolved, adoption may be limited to high-value, performance-sensitive vehicles where safety, energy recovery, and sensor integration are critical.

The rise of connected and autonomous vehicles creates demand for tires capable of powering sensors, communication modules, and data collection systems independently. Rechargeable tires reduce reliance on vehicle battery packs for low-power electronics, enabling longer sensor operation and reducing maintenance. Integration with telematics platforms allows real-time data transmission on tire health and road conditions. Fleet operators and automotive OEMs benefit from enhanced monitoring and energy efficiency. Until alternative methods for powering distributed sensors in autonomous vehicles are widely commercialized, rechargeable tires will continue to be a critical component in connected vehicle systems, driving growth in high-tech mobility and intelligent transportation applications.

| Countries | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| U.K. | 6.4% |

| U.S. | 5.7% |

| Brazil | 5.0% |

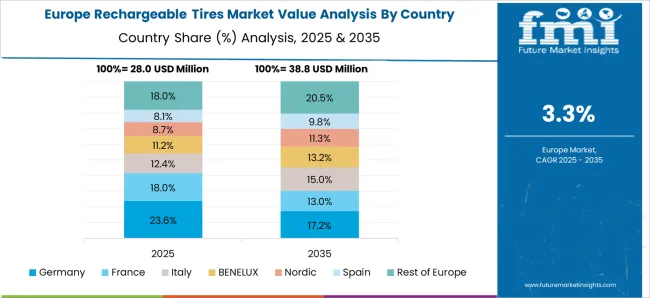

The global rechargeable tires market is projected to grow at a CAGR of 6.7% through 2035, supported by increasing demand across automotive, commercial vehicle, and electric mobility applications. Among BRICS nations, China has been recorded with 9.0% growth, driven by large-scale production and deployment in electric and hybrid vehicles, while India has been observed at 8.4%, supported by rising utilization in commercial and passenger vehicles. In the OECD region, Germany has been measured at 7.7%, where production and adoption for automotive and electric mobility applications have been steadily maintained.

The United Kingdom has been noted at 6.4%, reflecting consistent use in electric and hybrid vehicle tires, while the U.S. has been recorded at 5.7%, with production and utilization across commercial, passenger, and electric mobility sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The rechargeable tires market in China is growing at a CAGR of 9.0%, driven by the increasing adoption of electric vehicles (EVs), hybrid vehicles, and sustainable transportation solutions. Automotive manufacturers are integrating advanced rechargeable tires to improve vehicle efficiency, reduce energy consumption, and enhance road safety. China’s government incentives for EV adoption, growing environmental awareness, and development of smart city infrastructure accelerate demand for rechargeable tires. Technological innovations such as energy-harvesting tires, improved durability, and adaptive tread designs enhance performance and appeal.

Rising investment in automotive R&D, along with urbanization and increasing disposable incomes, supports market expansion. Adoption across passenger vehicles, commercial fleets, and public transportation ensures a growing customer base. Consumer interest in eco-friendly mobility solutions further drives the expansion of the rechargeable tires market in China.

The rechargeable tires market in India is expanding at a CAGR of 8.4%, supported by growing electric and hybrid vehicle adoption, government incentives, and increasing consumer awareness of sustainable transportation. Automotive manufacturers are incorporating rechargeable tire technologies to enhance energy efficiency, reduce carbon emissions, and improve vehicle performance.

Technological advancements, such as energy recovery systems, improved durability, and low-resistance tread designs, attract both passenger vehicle and commercial fleet operators. Infrastructure development, including EV charging networks and smart city initiatives, facilitates the adoption of rechargeable tires. Rising urbanization, disposable incomes, and environmental regulations encourage manufacturers and consumers to shift toward eco-friendly tire solutions. Continuous R&D and partnerships between automotive and tire companies further promote market growth in India.

The rechargeable tires market in Germany is growing at a CAGR of 7.7%, driven by strong EV penetration, automotive R&D, and environmental regulations. Manufacturers focus on integrating energy-harvesting tire technologies that improve vehicle efficiency, reduce energy consumption, and extend tire lifespan. Germany’s emphasis on sustainability, stringent emissions standards, and technological innovation fosters market growth. Advanced tire materials, adaptive tread patterns, and low rolling resistance designs enhance performance for both passenger and commercial vehicles. Infrastructure development for electric mobility, along with government incentives for eco-friendly transportation, encourages widespread adoption.

Consumer preference for energy-efficient and sustainable automotive solutions further supports the rechargeable tires market. Collaborations between tire manufacturers, automakers, and research institutions accelerate innovation and market penetration.

The rechargeable tires market in the United Kingdom is expanding at a CAGR of 6.4%, supported by growing EV adoption, sustainability initiatives, and technological advancements. Automotive manufacturers are developing tires that recover energy, reduce rolling resistance, and improve performance for electric and hybrid vehicles. Government programs promoting clean transportation, environmental awareness, and EV infrastructure development accelerate market growth.

Technological innovations, such as adaptive tread designs, long-lasting materials, and energy-efficient tires, attract consumer and commercial segments. Increasing urbanization, disposable incomes, and focus on reducing carbon emissions further encourage adoption. Partnerships between automotive and tire manufacturers ensure continuous innovation and product availability. Overall, the rechargeable tires market in the UK is positioned for steady expansion.

The rechargeable tires market in the United States is growing at a CAGR of 5.7%, driven by rising EV adoption, technological innovations, and environmental regulations. Automotive manufacturers are incorporating energy-harvesting and low-resistance tire technologies to improve vehicle efficiency and reduce emissions. Government incentives, clean transportation initiatives, and infrastructure development support market expansion. Advanced tire designs, durable materials, and adaptive tread patterns appeal to passenger and commercial vehicle segments. Increased consumer awareness of sustainability, fuel efficiency, and eco-friendly mobility solutions drives adoption.

Collaborations between automakers, tire manufacturers, and research institutions accelerate innovation and market penetration. Overall, the U.S. rechargeable tires market demonstrates steady growth due to a combination of regulatory support, technological advancements, and growing consumer demand.

The rechargeable tires market is an emerging segment within the global tire industry, focused on innovative solutions that extend tire life and integrate energy recovery technologies. These tires are designed to enhance sustainability, reduce waste, and improve vehicle efficiency by incorporating smart materials and regenerative mechanisms. Rising environmental concerns, stricter emission regulations, and increasing demand for energy-efficient mobility solutions are driving the adoption of rechargeable tire technologies across passenger vehicles, commercial fleets, and electric vehicles.

Key players in this market include Bridgestone, a global leader in tire innovation, known for integrating advanced materials and smart technologies into their products. Michelin is another prominent supplier, emphasizing sustainable and high-performance tire solutions with energy-saving properties. Continental and Goodyear are actively exploring smart tire technologies, focusing on durability, self-regeneration, and enhanced energy efficiency. Asian manufacturers like Hankook, Cooper, Nexen Tire, and Nokian are also entering this space, offering competitive rechargeable tire solutions that cater to electric and hybrid vehicles, while addressing consumer demand for eco-friendly alternatives.

The market is expected to grow as automotive manufacturers increasingly partner with tire companies to integrate rechargeable and energy-efficient tires into new vehicle models. Advancements in material science, smart sensor integration, and regenerative tire technologies are likely to reshape the competitive landscape. Leading suppliers are investing heavily in research and development to enhance tire lifespan, performance, and sustainability, making rechargeable tires a critical component of next-generation mobility solutions worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 121.0 Million |

| Material | Traditional rubber blends, Biodegradable rubber, and Reinforced fiber |

| Vehicle Type | Passenger vehicles and Commercial vehicles |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bridgestone, Michelin, Continental, Goodyear, Hankook, Cooper, Nexen tire, and Nokian |

| Additional Attributes | Dollar sales vary by tire type, including passenger vehicle tires, commercial vehicle tires, and specialty tires; by technology, spanning pneumatic, airless, and smart rechargeable tires; by application, such as electric vehicles, hybrid vehicles, and commercial fleets; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising EV adoption, sustainability focus, and innovations in tire durability and energy efficiency. |

The global rechargeable tires market is estimated to be valued at USD 121.0 million in 2025.

The market size for the rechargeable tires market is projected to reach USD 231.4 million by 2035.

The rechargeable tires market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in rechargeable tires market are traditional rubber blends, biodegradable rubber and reinforced fiber.

In terms of vehicle type, passenger vehicles segment to command 51.9% share in the rechargeable tires market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rechargeable Thin Film Battery Market Size and Share Forecast Outlook 2025 to 2035

Rechargeable Light Market Size and Share Forecast Outlook 2025 to 2035

Rechargeable Batteries Market

Non-rechargeable Thin Film Battery Market Size and Share Forecast Outlook 2025 to 2035

EV Tires Market Growth – Trends & Forecast 2025 to 2035

Winter Tires Market

Off-road Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Off Highway Tires Market Growth - Trends & Forecast 2025 to 2035

Performance tires Market

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Super Swamper Tires Market

Automotive Green Tires Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA