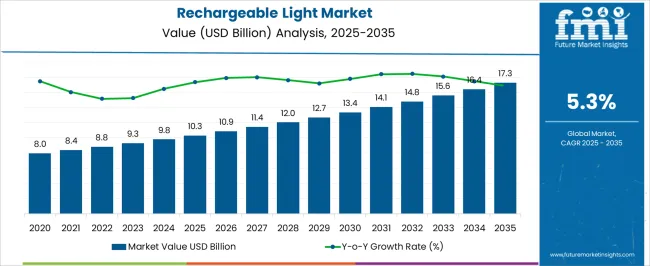

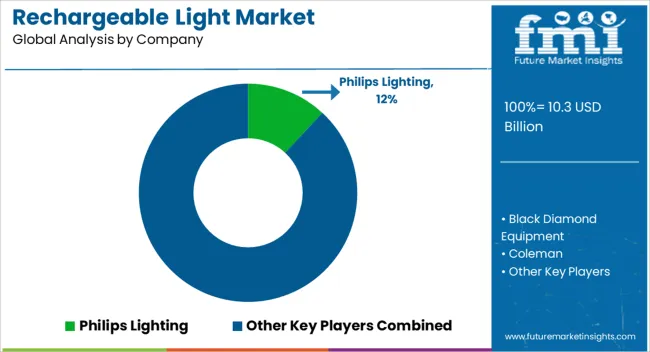

The global rechargeable light market is projected at USD 10.3 billion in 2025 and anticipated to reach USD 17.3 billion by 2035, registering a CAGR of 5.3% during the forecast period. The absolute dollar opportunity between 2025 and 2035 stands at USD 7.0 billion, which signals a steady yet meaningful expansion of demand. Growth is being fueled by rising adoption of portable and energy-efficient lighting systems across residential, commercial, and outdoor applications.

Consumer awareness of sustainability and the shift toward rechargeable solutions over disposable batteries are shaping the competitive momentum of this industry. Emergency preparedness and rural electrification programs are being highlighted as additional growth avenues, particularly in developing economies where reliable grid access is limited. From a product innovation perspective, the integration of solar charging options and longer battery life is being promoted as a differentiator by leading players. It is also evident that e-commerce penetration is boosting accessibility, as consumers increasingly purchase rechargeable lights online for convenience and cost savings. Share gains are being seen among manufacturers offering multifunctional devices, such as lights integrated with USB charging or power bank features. Companies focusing on durability, eco-friendly materials, and enhanced battery technologies are positioned to secure stronger dollar sales and expand their presence across high-potential markets over the next few years.

| Metric | Value |

|---|---|

| Rechargeable Light Market Estimated Value in (2025 E) | USD 10.3 billion |

| Rechargeable Light Market Forecast Value in (2035 F) | USD 17.3 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The rechargeable light market is influenced by five interrelated parent markets that collectively determine its growth trajectory and adoption across end-use applications. The consumer electronics and portable devices market holds the largest share at 32%, as rechargeable lights are widely adopted for personal use, camping, travel, and emergency preparedness, offering an eco-friendly alternative to disposable battery-powered devices. The residential lighting market contributes 28%, with strong uptake of rechargeable lamps, desk lights, and night lights driven by rising demand for energy-efficient and cost-effective illumination solutions in households.

The industrial and commercial lighting market accounts for 20%, as rechargeable lights are being used in warehouses, workshops, and construction sites where mobility, reliability, and backup power are crucial for productivity and safety. The automotive and outdoor mobility market represents 12%, reflecting the growing popularity of rechargeable flashlights, headlamps, and work lights integrated into vehicle kits and outdoor adventure gear.

The renewable and off-grid energy solutions market holds an 8% share, particularly in regions with limited grid access, where solar-powered rechargeable lights are being used to provide affordable, sustainable lighting. Combined, the consumer electronics, residential, and industrial segments capture 80% of the overall share, highlighting that convenience, energy savings, and mobility remain the central demand drivers for the rechargeable light market globally.

The rechargeable light market is experiencing steady expansion, driven by technological advancements in energy storage, improvements in LED efficiency, and the rising demand for portable, eco-friendly lighting solutions. Industry updates and product announcements have highlighted strong consumer adoption across residential, commercial, and outdoor applications, supported by increasing awareness of energy conservation and sustainability.

The integration of rechargeable lights into emergency preparedness kits, outdoor recreation gear, and professional work equipment has further broadened market reach. Advances in lithium-ion and NiMH battery technologies have extended operational lifespans and reduced recharge times, enhancing product usability.

Additionally, eCommerce growth and competitive retail pricing have made rechargeable lighting products more accessible to a global consumer base. Government initiatives promoting energy-efficient lighting and the reduction of disposable battery waste are also accelerating adoption. Over the forecast period, market momentum is expected to be driven by the continued preference for portable formats, the versatility of handheld flashlights, and the dominance of advanced battery-powered models that offer reliability and performance.

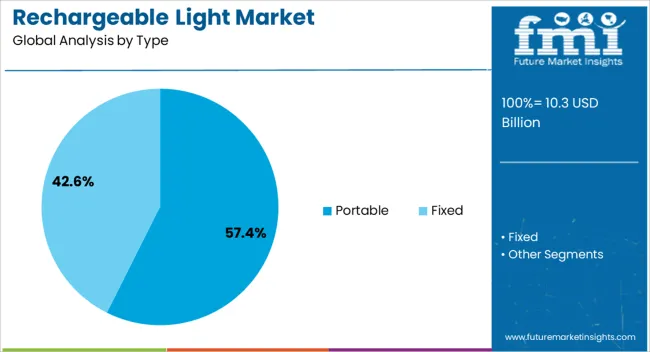

The rechargeable light market is segmented by type, product type, power source, price, end use, distribution channel, and geographic regions. By type, rechargeable light market is divided into Portable and Fixed. In terms of product type, rechargeable light market is classified into Handheld flashlights, Camping lanterns, Headlamps, Emergency lights, and Others (industrial work lights, security lighting systems).

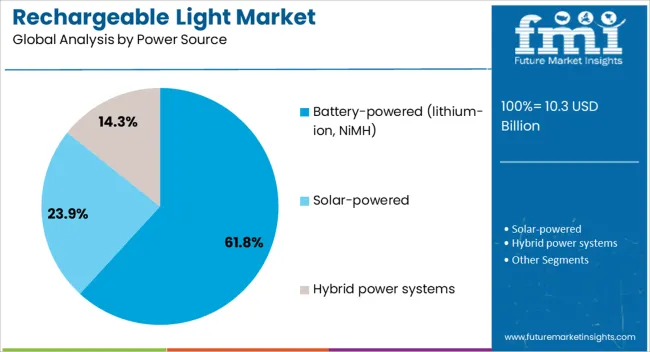

Based on power source, rechargeable light market is segmented into Battery-powered (lithium-ion, NiMH), Solar-powered, and Hybrid power systems. By price, rechargeable light market is segmented into Medium, Low, and High. By end use, rechargeable light market is segmented into Residential, Commercial, and Industrial. By distribution channel, rechargeable light market is segmented into Online and Offline. Regionally, the rechargeable light industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The portable segment is projected to account for 57.4% of the rechargeable light market revenue in 2025, maintaining its leading position due to its versatility and widespread usability across diverse environments. Growth in this segment has been driven by the increasing demand for lighting solutions that can be easily transported and deployed in outdoor, emergency, and off-grid scenarios.

Consumer preferences have shifted toward compact and lightweight designs that provide high brightness levels and extended runtime without sacrificing durability. Manufacturers have responded by introducing multi-mode lighting functions, weather-resistant housings, and ergonomic designs that enhance portability and convenience.

The segment has also benefited from urban consumers incorporating portable rechargeable lights into home emergency kits, while outdoor enthusiasts value them for camping, hiking, and night-time activities. As portability continues to be a decisive purchase factor, the segment is expected to sustain its market leadership through continuous design innovation and integration of advanced rechargeable battery systems.

The handheld flashlights segment is projected to contribute 38.6% of the rechargeable light market revenue in 2025, securing its position as the leading product type. This segment’s growth has been supported by its adaptability for use in personal, professional, and tactical applications.

Handheld flashlights have remained a staple in residential and commercial settings due to their directional lighting capabilities, ease of operation, and portability. Advances in LED technology have enabled manufacturers to produce brighter, longer-lasting beams while maintaining energy efficiency, further increasing consumer appeal.

The integration of adjustable beam focus, multiple brightness settings, and rechargeable battery compatibility has improved functionality and user control. Additionally, the segment’s adoption in law enforcement, security, and maintenance operations has reinforced its steady demand. With ongoing product enhancements and a consistent need for reliable, handheld illumination, this segment is expected to maintain strong market performance.

The battery-powered (lithium-ion, NiMH) segment is projected to account for 61.8% of the rechargeable light market revenue in 2025, dominating the power source category due to its superior energy efficiency and rechargeability.

Lithium-ion and NiMH batteries have been widely adopted for their high energy density, longer cycle life, and lightweight properties, which make them ideal for portable lighting solutions. Industry developments have shown continuous improvements in battery safety, charging speed, and capacity, enabling longer runtimes and reduced downtime between charges.

The growing availability of USB-rechargeable models and solar-compatible charging options has further expanded usage in both developed and off-grid markets. Environmental benefits, including the reduction of single-use battery waste, have aligned with consumer and regulatory priorities for sustainable energy solutions. As technological advancements in battery chemistry continue, the segment is expected to strengthen its leadership, driven by reliability, performance, and environmental compatibility.

The rechargeable light market is being influenced by consumer demand for efficiency, off-grid lighting requirements, and diversified product portfolios. Competitive battles will intensify as affordability and quality continue to drive share gains.

The rechargeable light market is being shaped by growing consumer preference for cost-effective and efficient illumination. Households are increasingly opting for rechargeable lamps, desk lights, and portable units as replacements for conventional battery-operated or grid-dependent models.

Rising electricity tariffs and the desire for longer product lifecycles are encouraging this transition. Affordability combined with convenience is the strongest motivator in consumer adoption, especially in developing markets where power outages are frequent. Dollar sales are being driven not just by demand for personal use but also by purchases in education and healthcare institutions where uninterrupted lighting is critical. These factors ensure consumer-driven demand remains central to market expansion.

A significant opportunity is being created through demand for lighting solutions in areas with limited or unreliable grid connectivity. Solar-charged rechargeable lights are being promoted as a practical option for rural households, outdoor workers, and disaster relief operations. Governments and NGOs are actively distributing rechargeable lighting systems to improve quality of life in underserved regions. This social impact dimension enhances long-term growth because once households and communities experience dependable rechargeable light, preference for conventional kerosene or non-rechargeable lamps diminishes rapidly. The share of off-grid adoption is therefore being amplified by public programs as well as private companies targeting rural customers.

Manufacturers are broadening their product portfolios to cater to diverse consumer needs. Multifunctional rechargeable lights, integrated with USB charging, power bank features, or adjustable brightness, are being introduced to differentiate offerings. Online retail platforms are boosting accessibility, helping even smaller brands reach global audiences. Consumer expectations are steadily shifting toward devices that deliver convenience beyond lighting alone. This trend is influencing companies to rethink design, durability, and portability as critical purchase factors. Dollar sales are being influenced strongly by lifestyle-driven purchases, particularly in camping, outdoor sports, and travel segments, where multipurpose rechargeable lights hold greater appeal than basic models.

The market landscape is defined by a mix of global corporations and regional manufacturers striving to secure greater share. Local players often compete on affordability, while global brands highlight innovation and durability to command premium pricing. Share competition is being influenced by strategic marketing, e-commerce penetration, and product positioning within energy-efficient portfolios. Companies capable of combining quality assurance with affordability will gain the upper hand, particularly in price-sensitive economies. Larger corporations are using acquisitions and partnerships to strengthen distribution networks. Market share shifts are likely to remain dynamic, influenced by evolving consumer expectations and brand credibility.

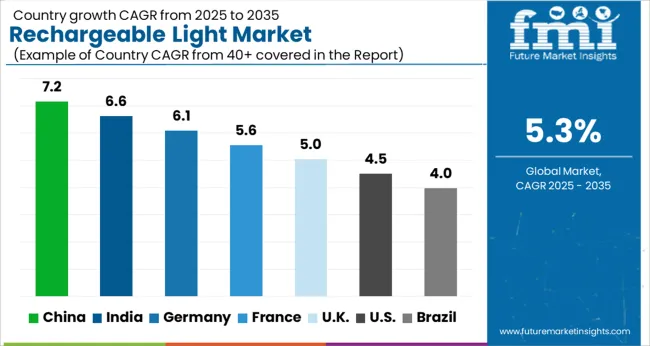

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| U.K. | 5.0% |

| U.S. | 4.5% |

| Brazil | 4.0% |

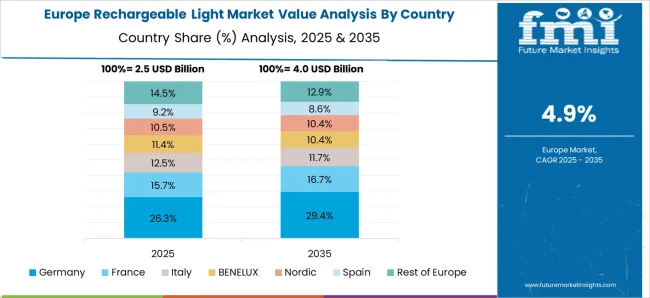

The global rechargeable light market is anticipated to grow at a CAGR of 5.3 percent between 2025 and 2035. China, with a CAGR of 7.2 percent, leads expansion supported by large-scale manufacturing, rural electrification programs, and high consumer adoption. India follows with 6.6 percent, fueled by government-backed off-grid lighting initiatives and rising middle-class demand for portable and affordable solutions. Germany stands at 6.1 percent, emphasizing premium rechargeable products and integration of advanced battery technologies in consumer and industrial segments. France, with 5.6 percent, shows consistent growth through household adoption and outdoor applications, while the U.K. at 5.0 percent is strengthening its market through online distribution and energy-efficient consumer preferences. The U.S. is growing at 4.5 percent, with demand shaped by outdoor recreation, emergency preparedness, and gradual replacement of disposable battery-based products. Asia dominates both production and adoption, while Europe and North America prioritize durability, product quality, and design-focused innovations to strengthen share in premium categories. The analysis covers over 40+ countries, with the leading contributors highlighted below.

The rechargeable light market in China is anticipated to grow from 2025 to 2035 at a CAGR of 7.2%, rising from USD 10.3 billion globally in 2025 to USD 17.3 billion by 2035, with China capturing a significant share. Growth is being driven by large-scale production capacity, widespread adoption in residential and rural segments, and government-supported electrification programs. Consumer demand for portable, solar-charged lights is rising in off-grid areas, while urban households prefer energy-efficient rechargeable desk and study lights. China’s role as both a manufacturing hub and a leading consumer market ensures dominance. Local brands compete on affordability, while global players focus on durability and advanced battery technologies.

The rechargeable light market in India is projected to expand at a CAGR of 6.6% between 2025 and 2035, supported by government initiatives for off-grid lighting and rural energy access. Widespread power outages across many regions are pushing households, educational institutions, and small businesses to adopt rechargeable lighting as a primary backup solution. Solar integration is gaining prominence, particularly in rural areas, where low-cost solar-rechargeable lamps are replacing kerosene. India’s middle-class expansion and affordable pricing strategies by local companies will keep dollar sales on an upward trajectory. Online retail platforms are further boosting access and product variety.

Germany’s rechargeable light market is set to grow at a CAGR of 6.1% between 2025 and 2035, led by consumer preference for premium, durable, and design-focused products. The emphasis is on advanced battery technology, energy efficiency, and compliance with environmental regulations. Portable rechargeable work lights are gaining adoption in industrial and construction sectors, while residential consumers prefer multifunctional desk and task lights. Germany’s innovation-driven approach and preference for high-quality imports ensure consistent market expansion. Online retail and specialty lighting outlets are helping suppliers reach a tech-savvy consumer base.

The rechargeable light market in the U.K. is expected to increase at a CAGR of 5.0% during 2025–2035. Growth is being shaped by household adoption of energy-efficient rechargeable lamps, outdoor recreation trends, and rising reliance on online retail. British consumers are showing preference for compact, multipurpose devices with USB charging and portability features. Emergency preparedness and camping applications are also influencing adoption. Brand reputation and product design play a larger role in consumer purchase decisions in this market compared to price alone. E-commerce channels are critical to expanding supplier reach and sustaining share growth.

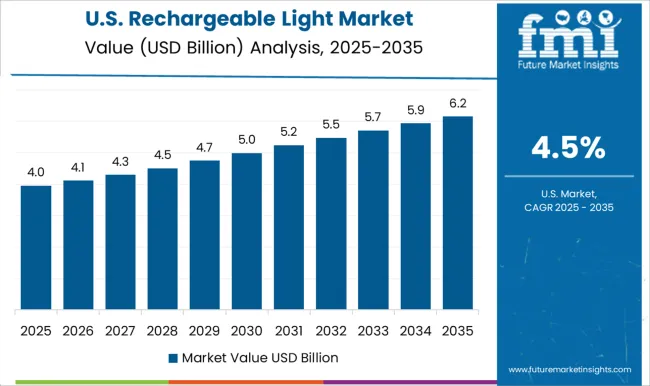

The rechargeable light market in the U.S. is forecasted to grow at a CAGR of 4.5% from 2025 to 2035, making it one of the slower-growing yet stable markets. Growth is being influenced by rising interest in outdoor recreation, disaster preparedness, and the gradual replacement of disposable battery-operated lights. Consumers prefer rechargeable flashlights, headlamps, and desk lights that combine long-lasting battery performance with portability. Brand differentiation through durability, warranty, and design appeal is crucial in this market. While demand growth is moderate compared to Asia, higher average selling prices are sustaining dollar sales.

Competition in the rechargeable light market is shaped by battery efficiency, portability, durability, and integration of multifunctional features such as USB charging or solar compatibility. Philips Lighting leads with a wide range of rechargeable desk lamps and home-use lights that emphasize energy efficiency and design appeal. Black Diamond Equipment and Petzl specialize in headlamps and outdoor rechargeable lighting targeted at climbers, campers, and adventure enthusiasts, focusing on ruggedness and lightweight performance. Coleman competes through camping lanterns and portable lighting solutions positioned for mass-market affordability. Duracell and Energizer leverage their strong consumer battery brands to expand rechargeable product lines, offering flashlights and lanterns with reliability and brand trust. Fenix Lighting, Nitecore, Olight, and Streamlight compete strongly in the tactical and professional lighting space, serving law enforcement, defense, and industrial users with high-lumen rechargeable flashlights and durability-driven designs.

Goal Zero differentiates by integrating solar-powered charging systems with its portable lights, appealing to off-grid and environmentally conscious consumers. Maglite maintains its presence through iconic designs reengineered with rechargeable features, targeting both professional and home markets. Milwaukee Tool emphasizes industrial-grade rechargeable work lights designed for construction and trade professionals, leveraging compatibility with its power tool battery ecosystem. Panasonic delivers portable rechargeable lighting as part of its broader electronics and appliance portfolio, ensuring global reach. SureFireC is recognized in defense and tactical applications where ruggedness, long battery life, and brightness are prioritized. Strategies emphasize battery optimization, fast charging, waterproof and impact-resistant designs, and versatility across home, outdoor, tactical, and professional use cases. E-commerce and direct-to-consumer channels are being leveraged for market penetration, while collaborations with outdoor gear brands and industrial suppliers expand reach.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.3 Billion |

| Type | Portable and Fixed |

| Product Type | Handheld flashlights, Camping lanterns, Headlamps, Emergency lights, and Others (industrial work lights, security lighting systems) |

| Power Source | Battery-powered (lithium-ion, NiMH), Solar-powered, and Hybrid power systems |

| Price | Medium, Low, and High |

| End Use | Residential, Commercial, and Industrial |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Philips Lighting, Black Diamond Equipment, Coleman, Duracell, Energizer, Fenix Lighting, Goal Zero, Maglite, Milwaukee Tool, Nitecore, Olight, Panasonic, Petzl, Streamlight, and SureFireC |

| Additional Attributes | Dollar sales, share, demand trends across residential, industrial, and outdoor use, competitive positioning, pricing benchmarks, consumer preferences, regulatory factors, and distribution channel insights. |

The global rechargeable light market is estimated to be valued at USD 10.3 billion in 2025.

The market size for the rechargeable light market is projected to reach USD 17.3 billion by 2035.

The rechargeable light market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in rechargeable light market are portable and fixed.

In terms of product type, handheld flashlights segment to command 38.6% share in the rechargeable light market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rechargeable Thin Film Battery Market Size and Share Forecast Outlook 2025 to 2035

Rechargeable Tires Market Size and Share Forecast Outlook 2025 to 2035

Rechargeable Batteries Market

Non-rechargeable Thin Film Battery Market Size and Share Forecast Outlook 2025 to 2035

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Light Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA