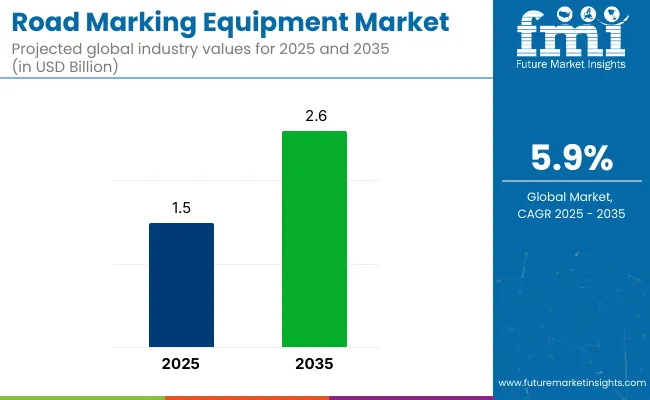

The global road marking equipment market is valued at USD 1.5 billion in 2025 and is anticipated to grow to USD 2.6 billion by 2035, which shows a CAGR of 5.9% during the forecast period. Market expansion is expected to be underpinned by rising public-sector outlays on highway upgrades, stringent visibility mandates embedded in traffic-safety legislation, accelerated urbanisation that is intensifying lane-capacity projects. The ongoing rollout of smart-city programmes in which machine-readable road markings are specified as foundational infrastructure.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.5 billion |

| Forecast Value (2035) | USD 2.6 billion |

| CAGR (2025 to 2035) | 5.9% |

Adoption is being further encouraged by contractor preference for truck-mounted and laser-guided stripers that shorten lane-closure windows, while maintenance budgets are being supported by performance-based tendering that rewards higher retro-reflectivity retention. In parallel, eco-label requirements are being strengthened, so demand is being shifted toward low-VOC thermoplastic and cold-spray systems, and regional manufacturing incentives are being applied to offset raw-material volatility and stabilise equipment pricing.

Government regulations in this market focus on safety, visibility, and environmental standards. These regulations include stringent visibility mandates, such as the Manual on Uniform Traffic Control Devices (MUTCD) in the USA, which sets standards for retro reflectivity and lane markings.

In Europe, the EU enforces eco-label requirements, promoting low-VOC thermoplastic and cold-spray systems. Additionally, governments are emphasizing sustainability, pushing for reduced emissions and compliance with road safety standards.

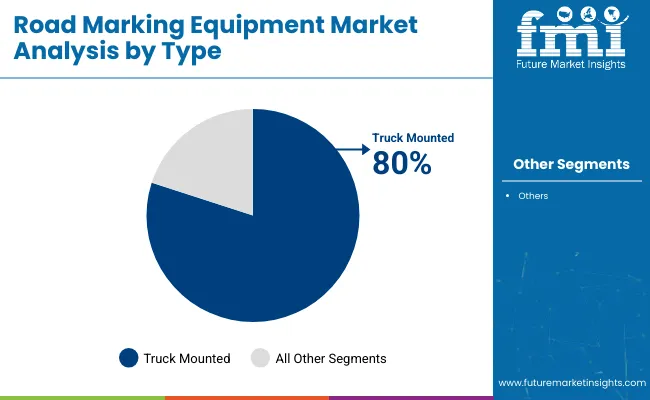

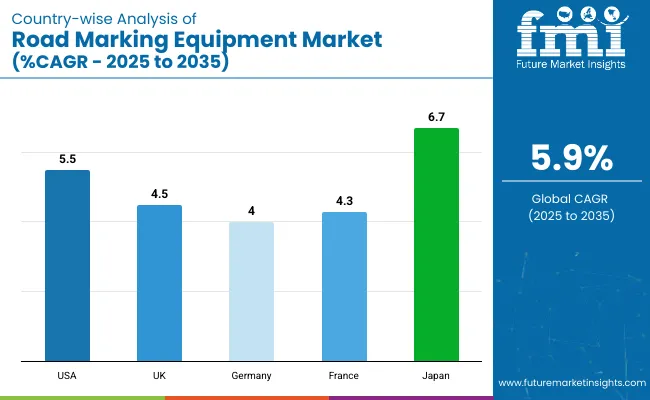

The USA is expected to be one of the fastest-growing markets for road marking equipment, with a projected CAGR of 5.5% from 2025 to 2035. Truck-mounted equipment will dominate the type segment, capturing 80% of the market share in 2025.

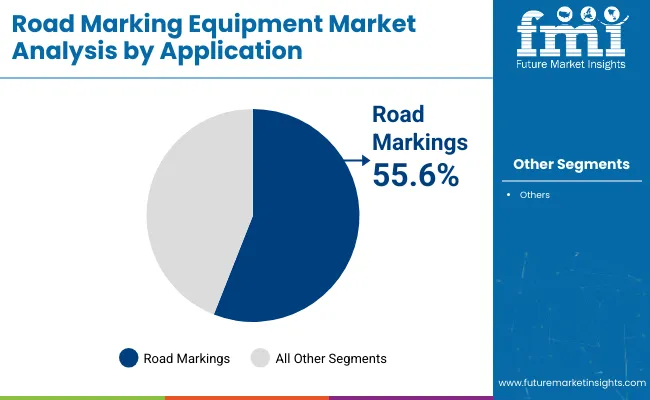

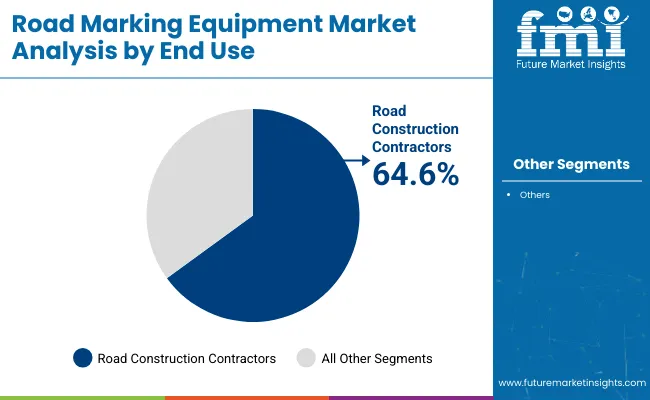

Road construction contractors are anticipated to lead the end-use segment with a 64.6% share. In terms of application, road markings will hold the largest share at 55.6%. Japan is projected to be the fastest-growing market with a CAGR of 6.7%, followed by the UK and Germany with CAGRs of 4.5% and 4%, respectively.

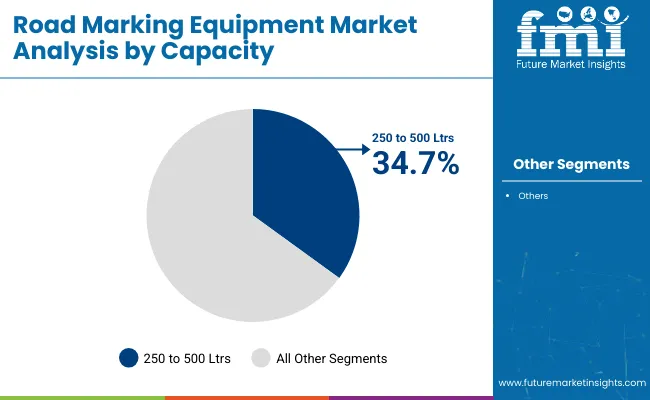

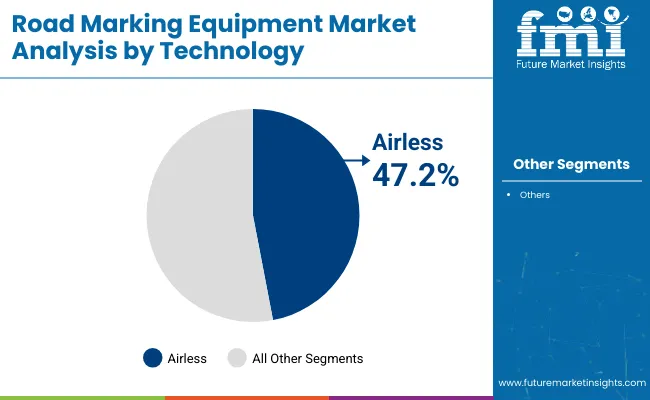

The global road marking equipment market is segmented by type, capacity, technology, application, end use, and region. Based on type, the market is divided into manual, self-propelled, and truck mounted. By capacity, the market is segmented into below 100 Ltrs, 100 to 250 Ltrs, 250 to 500 Ltrs, 500 to 750 Ltrs, and above 750 Ltrs. In terms of technology, the market is categorized into airless, airspray, and thermoplastic airspray.

By application, the market is divided into road markings, parking lots, anti-skid markings, and others (bicycle lanes, school zones, and pedestrian walkways). By end use, the market is segmented into road construction contractors (government and private), construction companies, airports, and sports infrastructures. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The truck-mounted segment is projected to hold approximately 80% of the global road marking equipment market share in 2025, making it the dominant category under the type segmentation.

The 250 to 500 Ltrs capacity range is likely to command an estimated 34.7% share of the global road marking equipment market in 2025, making it the most lucrative category under the capacity segmentation.

The airless technology segment is expected to dominate the road marking equipment market, holding an estimated 47.2% share in 2025. This dominant position is due to the system's ability to create high-pressure, clean, and clear markings on highways, airport runways, and large urban areas.

The road markings segment is forecast to remain the most dominant application category, capturing approximately 55.6% of the global road marking equipment market share in 2025.

The road construction contractors’ segment is projected to remain the most lucrative end-use category in the road marking equipment market, accounting for approximately 64.6% of the global market share in 2025.

The global road marking equipment market is growing steadily, driven by increased infrastructure investments, traffic safety regulations, and urbanization. The rise of smart-city projects and advancements in spray technologies further boost demand.

Recent Trends in the Road Marking Equipment Market

Key Challenges in the Road Marking Equipment Market

The global road marking equipment market is experiencing steady growth, driven by rising infrastructure investments, stricter traffic safety regulations, and the growing demand for smart-city projects. Advances in spray technologies and increased urbanization are further propelling market expansion.

The USA road marking equipment market is expected to expand at a CAGR of 5.5% between 2025 and 2035, supported by strong federal investments in smart infrastructure and highway modernization.

The UK road marking equipment market is projected to grow at a CAGR of 4.5% from 2025 to 2035, driven by local council-led upgrades in urban safety zones and rural connectivity improvements.

Germany’s road marking equipment market revenues are anticipated to increase at a CAGR of 4.0% during the 2025 to 2035 period, fueled by extensive highway refurbishment programs and stricter EU-mandated visibility norms.

France’s road marking equipment market is set to grow at a CAGR of 4.3% through 2035, backed by national mobility plans, urban renewal initiatives, and rising adoption of noise-reducing and anti-skid markings.

Japan’s road marking equipment market is expected to register a CAGR of 6.7% between 2025 and 2035, as aging infrastructure across tunnels, bridges, and highways is being aggressively modernized.

The global road marking equipment market is moderately consolidated, with leading companies such as Graco Inc., M-B Companies, Hofmann, MRL Equipment Co., and Vogel Traffic Services commanding significant market shares. These firms are actively competing through strategies that emphasize technological innovation, strategic acquisitions, and expansion into emerging markets.

Graco Inc. has undertaken a strategic restructuring to optimize operations, including the acquisition of Corob S.p.A., a global leader in high-tech dispensing and mixing solutions. This move aims to enhance Graco's capabilities in fluid handling systems and expand its market reach.

Recent Road Marking Equipment Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.5 billion |

| Projected Market Size (2035) | USD 2.6 billion |

| CAGR (2025 to 2035) | 5.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billions/Volume in Units |

| Type Analyzed | Manual, Self-propelled, and Truck Mounted |

| Capacity Analyzed | Below 100 Ltrs, 100 to 250 Ltrs, 250 to 500 Ltrs, 500 to 750 Ltrs, and Above 750 Ltrs |

| Technology Analyzed | Airless, Airspray, Thermoplastic Airspray |

| Application Analyzed | Road Markings, Parking Lots, Anti-skid Markings, and Others (Bicycle Lanes, Pedestrian Crossings, etc.) |

| End Use Analyzed | Road Construction Contractors (Government, Private), Construction Companies, Airports, and Sports Infrastructures |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Graco Inc., M-B Companies, Vogel Traffic Services, Hofmann, MRL Equipment Co., BORUM A/S, STiM, Roadsky, Larius S.R.L, CMC s.r.l, Toyo Nainenki Kogyosha Co., Ltd., United Pavement Marking, Inc., Winter Markiertechnik GmbH, RME, Nanjing Roadsky Traffic Facility Co., Ltd., Sibestar s.r.l, ROCOL |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The road marking equipment market is valued at USD 1.5 billion in 2025.

The market is forecasted to reach USD 2.6 billion by 2035, reflecting a CAGR of 5.9%.

Truck-mounted equipment will lead the market by type with an 80% market share in 2025.

Road markings will dominate the market with a 55.6% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6.7% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Road Marking Paints and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Road Marking Paint Market - Trends & Forecast 2025 to 2035

Broadcast Equipment Market Growth - Trends & Forecast 2025 to 2035

Marking and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Marking and Coding Equipment

Laser Marking Equipment Market Size and Share Forecast Outlook 2025 to 2035

Traffic Road Marking Coatings Market Size and Share Forecast Outlook 2025 to 2035

Industrial Marking Equipment Market Growth - Trends & Forecast 2025 to 2035

Latin America Road Marking Paint & Coating Market Trends - Growth, Demand & Forecast 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Road Profile Laser Sensor Market Size and Share Forecast Outlook 2025 to 2035

Road Haulage Market Size and Share Forecast Outlook 2025 to 2035

Road Safety Market Size and Share Forecast Outlook 2025 to 2035

Marking Coating Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Road and Highway Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Road Speed Limiter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Road Aggregates Market Growth - Trends & Forecast 2025 to 2035

Road Side Drug Testing Devices Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA