The road safety market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 13.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period. Over the 10-year period, this market is expected to add USD 8 billion in value, a significant opportunity spurred by the rising need for smarter traffic management, vehicle safety systems, and infrastructure improvements. During the first five years, from 2025 to 2030, the market will grow by USD 3.2 billion, reaching USD 9 billion, driven by regulatory changes, technological advancements, and growing awareness of road safety among government and private sector stakeholders.

The second phase of growth, from 2030 to 2035, will contribute USD 4.8 billion, reflecting 60% of the total incremental growth. The widespread adoption of connected vehicle technologies, intelligent traffic systems, and autonomous driving solutions marks this phase. Annual growth will accelerate in later years, with increments rising from USD 0.6 billion to USD 1.2 billion as urbanization and smart city development projects continue to expand globally. The market's growth is further supported by stricter government policies around road safety, which will drive demand for innovative solutions, creating a large opportunity for technology providers in this sector.

| Metric | Value |

|---|---|

| Road Safety Market Estimated Value in (2025 E) | USD 5.8 billion |

| Road Safety Market Forecast Value in (2035 F) | USD 13.8 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

Government initiatives focused on Vision Zero, smart mobility, and intelligent transportation systems have been accelerating the deployment of advanced road safety technologies.

Corporate disclosures and transportation authority briefings indicate that solutions such as automated enforcement, vehicle-to-infrastructure communication, and incident detection are being widely adopted to reduce road-related injuries and improve emergency response times. The integration of AI and machine learning into traffic management platforms is also transforming traditional safety systems into dynamic, predictive environments.

Increasing infrastructure investments, coupled with the digital transformation of transportation ecosystems, are paving the way for scalable and adaptive safety solutions. As road networks expand and urbanization continues, the need for centralized, software-driven safety platforms is expected to grow, strengthening the long-term outlook of the market across municipal and national levels.

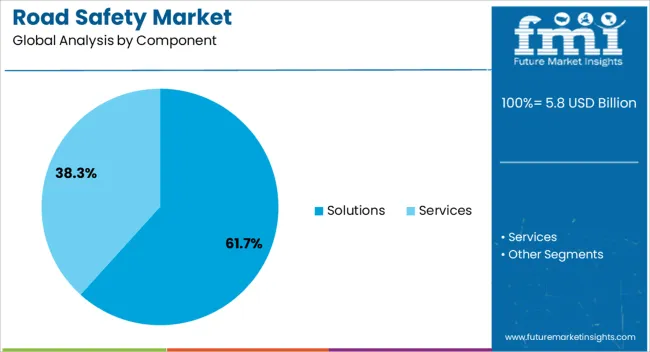

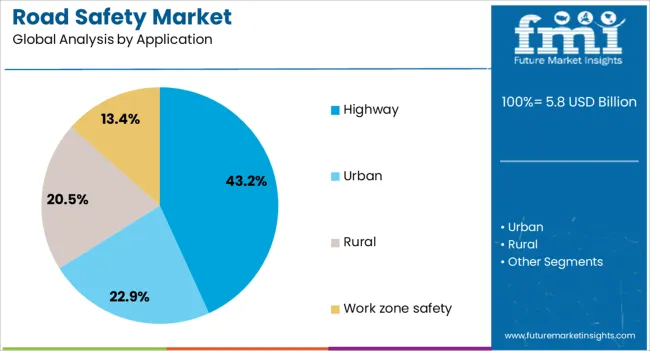

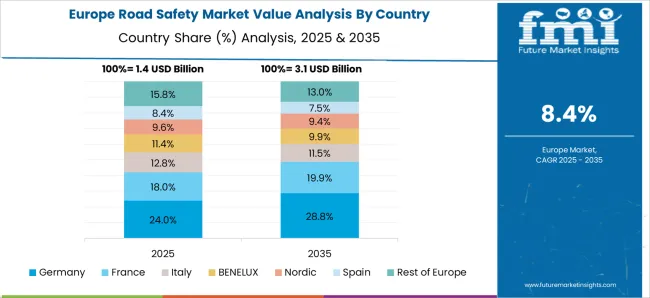

The road safety market is segmented by component, application, and geographic regions. By component, the road safety market is divided into Solutions and Services. In terms of application, the road safety market is classified into Highway, Urban, Rural, and Work zone safety. Regionally, the road safety industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solutions segment is expected to command 61.7% of the Road Safety market revenue share in 2025, emerging as the leading component segment. This dominance has been attributed to the increasing reliance on integrated traffic management platforms, speed enforcement systems, and automated number plate recognition technologies.

Solutions are being preferred over services due to their immediate impact on reducing road incidents, optimizing traffic flows, and enhancing compliance with safety regulations. It has been observed in transport authority reports and urban mobility plans that the deployment of smart signaling, surveillance, and congestion detection systems is being prioritized to improve public safety.

The ease of scalability and integration with legacy infrastructure has further contributed to the widespread adoption of these solutions Their role in supporting policy mandates and data-driven decision-making has strengthened their position in the market, leading to a larger revenue contribution when compared to service-based offerings.

The highway segment is projected to hold 43.2% of the Road Safety market revenue share in 2025, positioning it as the leading application area. The growing need for high-performance traffic enforcement and monitoring systems along national and state highways has influenced this.

It has been noted in public infrastructure updates and government transport briefs that highway corridors are increasingly being equipped with speed detection, lane violation monitoring, and real-time incident alert systems. The scale and strategic importance of highway networks have made them a priority for road safety investments, especially in regions witnessing high freight and passenger vehicle volumes.

Additionally, the integration of intelligent road safety solutions on highways has proven effective in lowering accident rates and improving emergency response coordination. These operational advantages, supported by dedicated public spending and long-term safety targets, have reinforced the highway segment’s leading status in the Road Safety market.

The road safety market is driven by increasing demand for vehicle safety features and government regulations. Opportunities in smart infrastructure and trends like connected vehicles and autonomous driving are reshaping the market. However, high costs and integration complexities present challenges. By 2025, overcoming these obstacles through affordable solutions and efficient integration will be crucial for market expansion and enhancing global road safety.

The road safety market is growing due to the increasing focus on vehicle safety and accident prevention. With rising traffic volumes and the growing awareness of road safety risks, demand for safety solutions such as advanced driver-assistance systems (ADAS), traffic monitoring systems, and pedestrian protection is rising. By 2025, the need for enhanced safety features in both vehicles and infrastructure will continue to drive market growth, particularly as road safety regulations become stricter.

Opportunities in the road safety market are growing due to the implementation of stringent government regulations and increased investments in smart infrastructure. Governments worldwide are enforcing regulations that require the adoption of safety technologies, such as automatic braking and collision warning systems. Additionally, investments in smart traffic management and intelligent transportation systems (ITS) are expected to enhance road safety. By 2025, these factors will significantly drive the adoption of advanced safety solutions, creating growth opportunities for manufacturers.

Emerging trends in the road safety market include the rise of connected vehicles and autonomous driving. Connected vehicles, equipped with communication systems that allow them to share data, are improving real-time hazard detection and prevention. Additionally, the development of autonomous vehicles is driving the demand for advanced safety features that can mitigate accidents. By 2025, these trends are expected to reshape the road safety landscape, with connected and self-driving vehicles becoming more prevalent.

Despite growth, challenges such as high implementation costs and integration complexity persist in the road safety market. The adoption of advanced safety systems, such as ADAS and autonomous driving technology, requires significant investment in research, development, and infrastructure. Additionally, the integration of these systems into existing vehicles and infrastructure can be complex, requiring specialized skills. By 2025, addressing these challenges through cost-effective solutions and simplified integration processes will be key for continued market growth.

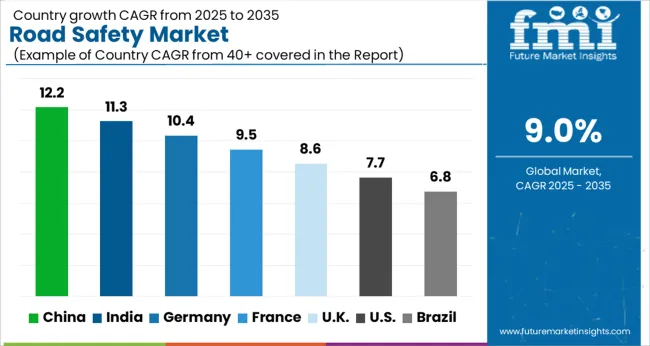

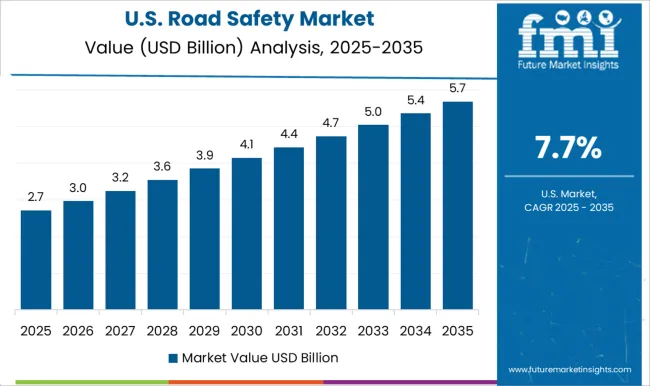

The global road safety market is projected to grow at a 9% CAGR from 2025 to 2035. China leads with a growth rate of 12.2%, followed by India at 11.3%, and France at 9.5%. The United Kingdom records a growth rate of 8.6%, while the United States shows the slowest growth at 7.7%. These varying growth rates are driven by factors such as increasing road traffic, growing government initiatives to improve road safety, and advancements in vehicle safety technologies. Emerging markets like China and India are experiencing higher growth due to rapid urbanization, increasing road accidents, and infrastructure improvements, while more mature markets like the USA and the UK see steady growth driven by stricter road safety regulations, technological innovations, and smart city infrastructure development. This report includes insights on 40+ countries; the top markets are shown here for reference.

The road safety market in China is growing rapidly, with a projected CAGR of 12.2%. The country’s rapid urbanization, increasing number of vehicles on the road, and rising road accidents are driving the demand for advanced road safety solutions. China’s government has introduced numerous initiatives aimed at improving road safety, including stricter regulations and smart city infrastructure projects that integrate road safety technologies. Additionally, the growing adoption of vehicle safety systems such as automatic emergency braking (AEB) and lane-keeping assist (LKA), coupled with advancements in traffic management systems, is further contributing to market growth.

The road safety market in India is projected to grow at a CAGR of 11.3%. India’s expanding urban population, coupled with the rapid increase in the number of vehicles on the road, is driving demand for improved road safety systems. The country’s road accident rates, which are among the highest globally, are pushing the government and industry players to invest in safety technologies. India’s focus on improving infrastructure, implementing road safety measures, and advancing vehicle safety features, such as collision avoidance systems and adaptive headlights, is contributing to steady market growth.

The road safety market in France is projected to grow at a CAGR of 9.5%. France’s focus on reducing road accidents, improving infrastructure, and enhancing driver and vehicle safety is driving steady market growth. The country’s strict road safety regulations and initiatives, such as the adoption of advanced driver-assistance systems (ADAS), smart traffic systems, and road safety awareness programs, are contributing to market expansion. Additionally, the growing trend of integrating smart city solutions to improve traffic management and vehicle safety continues to support the adoption of road safety technologies in France.

The road safety market in the United Kingdom is projected to grow at a CAGR of 8.6%. The UK is focusing on reducing road traffic accidents through the implementation of advanced vehicle safety systems, smart traffic management, and enhanced road infrastructure. The country’s regulatory frameworks that enforce safety standards, along with increasing demand for integrated road safety solutions in urban environments, are contributing to steady market growth. Additionally, the UK’s commitment to sustainable and safe transportation, including initiatives for electric vehicles (EVs) and infrastructure improvements, further boosts the demand for road safety technologies.

The road safety market in the United States is expected to grow at a CAGR of 7.7%. The USA remains a significant market for road safety technologies, driven by government regulations, growing concerns over road safety, and the adoption of advanced vehicle technologies. The country’s emphasis on reducing road fatalities, combined with the increasing demand for connected and autonomous vehicles (CAVs), is driving market demand. Furthermore, the USA focus on smart city development, traffic safety regulations, and infrastructure upgrades contributes to the continued adoption of road safety systems across urban and rural areas.

Key players such as Conduent, Inc., Cubic Corporation, and FLIR Systems, Inc. maintain significant market shares by offering integrated solutions that include automatic number plate recognition (ANPR), traffic cameras, and vehicle detection systems. These companies focus on providing high-precision technologies that enhance vehicle and pedestrian safety while reducing congestion on the roads.

Emerging players like IDEMIA, Jenoptik, and Kapsch TrafficCom are expanding their market presence by offering specialized road safety solutions for tolling, traffic enforcement, and smart city applications. Their strategies include improving system interoperability, integrating AI-powered analytics, and focusing on sustainable road safety solutions. Market growth is driven by increasing government investments in road safety, the rising demand for smart city infrastructure, and the growing adoption of advanced surveillance technologies to prevent accidents. Innovations in AI-driven traffic prediction, real-time monitoring, and automated safety enforcement are expected to continue shaping competitive dynamics and fuel further growth in the global road safety market.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.8 Billion |

| Component | Solutions and Services |

| Application | Highway, Urban, Rural, and Work zone safety |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Yunex Traffic, Conduent, Inc., Cubic Corporation, Teledyne FLIR, IDEMIA, Jenoptik, Kapsch TrafficCom, Motorola Solutions, Inc., Sensys Gatso Group AB, Verra Mobility |

| Additional Attributes | Dollar sales by product type and application, demand dynamics across automotive, transportation, and infrastructure sectors, regional trends in road safety adoption, innovation in intelligent traffic systems and accident prevention technologies, impact of regulatory standards on vehicle safety and road infrastructure, and emerging use cases in autonomous vehicles and smart city traffic management. |

The global road safety market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the road safety market is projected to reach USD 13.8 billion by 2035.

The road safety market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in road safety market are solutions, _enforcement, _automatic license plate recognition (alpr/anpr), _incident detection, _backoffice, _intelligent transport system, _traffic management system, _others, services, _consulting, _support & maintenance, _integration and _deployment.

In terms of application, highway segment to command 43.2% share in the road safety market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Road Marking Paints and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Road Profile Laser Sensor Market Size and Share Forecast Outlook 2025 to 2035

Road Haulage Market Size and Share Forecast Outlook 2025 to 2035

Road and Highway Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Road Marking Paint Market - Trends & Forecast 2025 to 2035

Road Speed Limiter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Road Marking Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Road Aggregates Market Growth - Trends & Forecast 2025 to 2035

Road Side Drug Testing Devices Market

Road-Rail Vehicles Market

Broadcast Switchers Market Size and Share Forecast Outlook 2025 to 2035

Broadband Network Gateway (BNG) Market by Component & Region Forecast till 2035

Broadcast Equipment Market Growth - Trends & Forecast 2025 to 2035

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Off-road Tires Market Size and Share Forecast Outlook 2025 to 2035

Off Road Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Railroad Ties Market Growth - Trends & Forecast 2025 to 2035

Off-Road All Terrain E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Off-road Motorcycle Market Growth – Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA