The Adtech industry globally will grow immensely from 2025 to 2035 with the growth of artificial intelligence (AI), machine learning (ML), and data analytics. The technology is transforming advertisement because it is being used to target users more relevant and efficiently.

Combination of AI and ML allows real-time processing, which is used through which user interests appealing dynamic placements are made in advertisement. This can be seen in the form of greater uptake of AI-enabled tools by larger platforms, which improves their targeting ability and overall ad performance.

North America is a notch above the rest in the AdTech space, and the United States stands at the forefront of advertising expenditure and innovation. North America enjoys a developed infrastructure that supports the widespread adoption of AI and ML by the ad habits.

The firms are using the technologies to analyze the behavior of the consumers in their quest to fuel targeted advertisement campaigns. For instance, AI platforms can now detect buying intent, and therefore, advertisers can now present targeted content at the appropriate time. Precision targeting has also been accompanied by problems regarding user privacy that have fueled controversy over tighter regulation of data and ethical use of AI in advertising.

The European AdTech sector is said to highly regard data regulation and data privacy. The General Data Protection Regulation (GDPR) placed strict controls, detailing the way in which companies need to harvest and treat customer information. The regimative framework has been an innovation stimulus for privacy-friendly advert technology.

As an example, contextual advertsing, advert directed to the subject of the topic that is being consumed and not to information pertaining to an individual, has emerged as a rule-conforming strategy. European companies are also choosing to use regulation-compliant AI, i.e., not invading user privacy while personalizing.

The Asia-Pacific is also set to see the most AdTech market growth in these years. Greater urbanization that is progressively quicker, internet penetration on the rise, and middle-class consumption rising. India and China are at the forefront here, with companies using programmatic ads for targeting diverse individuals.

In China, AI implementation on sites such as Alibaba's Alimama allows for targeted ad insertion and real-time bidding, and this enhances ad performance significantly. Similarly, Indian startups are developing AI-driven solutions to optimize ad campaigns in a way that better supports the dynamism and innovativeness of the local market landscape. Opportunities and Challenges in the AdTech Industry

Challenges

Data Privacy and Compliance with Reguations

AdTech transforming into increasingly data-hungry technology, the users' privacy and the security of the data were a cause of growing concern. While as much misuse of the illicit data was being unearthed, tighter surveillance by the world's nations has ensued. As recent history has shown that platform-based targeting of specific segments by the nature of disease as well as working within government departments came to create actual security as well as privacy concerns.

In order to counter such concerns, corporations will need to invest in robust data protection controls and remain in regulatory compliance with changing regulatory landscapes. This involves establishing some data practice and the express users' consent for their data to be harvested and utilized.

Market Consolidation

AdTech is strongly consolidating, as evidenced by Omnicom's acquisition of Interpublic Group (IPG) at USD 13.25 billion. The consolidation is a movement up of media buying, data marketing, and artificial intelligence into a USD 25 billion firm. The consolidations can provide more consolidated products but, in doing so, introduce fear of reduced competition and monopoly risk. Small companies are left behind competitively, even suppressing innovation. Regulators are watching closely these trends to make sure that there is a level playing field marketplace with competition.

Opportunities

AI-Based Ad Solutions

Application of AI in advertising strategies has never-before-seen capability for performance and targeting. AI-powered technologies have the capacity to drill through enormous sets of data as well as identify patterns that can be applied in an effort to forecast future customer behavior and enable marketers to create highly-targeted campaigns.

For example, AI-powered solutions are able to create advert content tailored in real time to user activities to deliver the maximum conversion and engagement. Responsive strategy, in this case, not only assists in improving the user experience but also positions return on investment for marketers at the right level. With AI, with technology getting more and more advanced, its usage in AdTech will continue to grow with higher generation of insights and precision of targeting capability.

Emerging Markets Growth

These markets offer a tremendous growth prospect to the AdTech industry. Southeast Asian, African, and Latin American economies are quickly getting digitized with more and more consumers going online and consuming digitally. Such opportunities provide new avenues to reach previously untapped consumer bases through advertising.

Region-sensitive content provided in format-sensitive form to the regions can potentially create more sensitivity in such markets. Mobile marketing also works in such markets where smartphones are still the leading platform to access the internet. AdTech players that create a bespoke solution in resonance with the unique dynamics of such nascent markets are likely to harvest this growth opportunity.

Between 2020 and 2024, AdTech completely transformed with a rise in usage of AI and ML technologies. These helped offer more specific adverts and real-time dynamic placement of adverts, which significantly improved the effectiveness of the campaigns. This was also when growing emphasis on data privacy mechanisms led to the establishment of more regulations across the globe. Companies were required to adapt by constructing privacy-first products as well as data use transparency.

Into the future 2025 to 2035, AdTech will grow with even better AI technology. AI will increasingly play a big part in the advertising campaign because it would be able to serve advertisements in an even better and more targeted way. This release will be able to manage real-time and dynamic ad placement resonating to a special interest of particular users.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Introduction of basic consumer data protection regulations like GDPR and CCPA. |

| Technological Advancements | Growth of programmatic advertising, AI-driven audience segmentation, and cookie-based tracking. |

| Industry Adoption | Increasing adoption of in-app advertising, connected TV (CTV) ads, and influencer marketing. |

| Supply Chain and Sourcing | Dependence on third-party data providers and digital ad exchanges. |

| Market Competition | Dominance of tech giants like Google, Meta, and Amazon in digital ad spending. |

| Market Growth Drivers | Demand for mobile-first advertising, social commerce, and OTT advertising. |

| Sustainability and Ethics | Initial discussions around carbon-neutral advertising and ethical data usage. |

| Integration of Smart Monitoring | Limited AI-driven ad fraud detection and campaign optimization. |

| Advancements in Experiential Advertising | Growth of interactive video ads, influencer collaborations, and shoppable content. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global data privacy laws, AI governance frameworks, and heightened transparency mandates for targeted ads. |

| Technological Advancements | Expansion of cookieless targeting, ad verification via blockchain, and hyper-personalized content using generative AI. |

| Industry Adoption | Influence of interactive ad formats in AR/VR, AI-created content, and metaverse-native advertising strategies. |

| Supply Chain and Sourcing | Shift to first-party data collection, privacy-focused ad networks, and decentralized advertising systems. |

| Market Competition | Rise of independent adtech firms, decentralized ad networks, and more regulatory scrutiny on walled gardens. |

| Market Growth Drivers | Ad increase in AI-based ad creatives, green marketing practices, and 5G-based real-time ad delivery. |

| Sustainability and Ethics | Implementation of green adtech solutions, carbon-tracking in digital campaigns, and sustainability compliance for ad platforms. |

| Integration of Smart Monitoring | Advanced predictive analytics, real-time sentiment analysis, and AI-powered dynamic ad placements. |

| Advancements in Experiential Advertising | Expansion of AI-powered ad personalization, haptic advertising in AR/VR, and emotion-driven AI-generated campaigns. |

The USA Adtech economy has been fueled by its leadership in programmatic ads, social media ad expenditure, and online video streaming sites. Digital ad expenditure has traditionally been controlled by industry giants like Google, Meta, and Amazon, but emerging privacy laws like the California Privacy Rights Act (CPRA) are changing the dynamics.

It is fueled by growth in AI-based ad creative platforms and the sheer size of connected TV (CTV) advertisements. Additionally, blockchain-based advert verification systems are assisting in preventing ad fraud concerns, introducing transparency and efficiency in digital advertising.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.8% |

UK's adtech ecosystem flourishes on technological innovation in digital form, deeply focusing on AI-driven advertizing and privacy-first solutions. Implementing strict data privacy regulation post-GDPR has driven pace of shift toward first-party data approaches. Constructing retail media networks, context targeting features, and AI-driven ad creatives is fueling market growth. Largest publishers also test cookieless ad environments, with interactive ad experiences for AR/VR still gaining momentum.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.3% |

The European Union adtech industry is marked by tight regulation control, and the DMA and DSA are introducing new standards for online advertising. AI-curated contextual and advertising and AI-curated contextual and content are becoming high-end growth opportunities due to strict regulatory limits on behavioral profiling.

Digital out-of-home advertising and programmatic audio advertising are also increasing in major city centers across the European Union. Technology firms are increasingly embracing sustainability-focused ad solutions, with carbon-free campaigns receiving a high degree of emphasis.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 11.5% |

Japan's adtech sector is being revolutionized by AI-driven automation and high-end consumer analysis. The combination of 5G-powered real-time ad placement and immersive digital experiences is optimizing mobile ad performance. As increasing data privacy concerns, Japan is embracing more robust consent-based ad models. The entry of virtual influencers and AI-driven storytelling is also disrupting brand engagement strategies in the digital space.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.2% |

South Korea's adtech market is growing rapidly with its low internet penetration and prevalence of digital entertainment platforms. Growth with AI-powered content creation, dynamic ad optimization, and K-pop influencer marketing is driving the market.

Government support for digital transformation strategies and robust emphasis on the sustainability of ad practices are also adding to market growth. Further, South Korea is also at the forefront in launching 6G-based ad solutions and interactive virtual advertisements for the entertainment and gaming industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.6% |

Demand-side platforms (DSPs) are highly sought after by advertisers looking for ever more AI-enabled solutions for real-time bidding and audience targeting. Brands are deploying machine learning algorithms to optimize advertising placement on display, video, and mobile.

The move to cookie-less measurement and contextual targeting is placing strain on DSP suppliers to innovate with compliance against the changing data privacy regulatory landscape. More than 70% of programmatic ad spend passes through DSPs, test experts. That in itself says a lot about how essential they are to the business. Supply-side Platforms (SSPs) Enable Publisher Monetization with AI and Header Bidding

Supply-side platforms (SSPs) are at the core of enabling publishers to realize maximum revenue from maximized ad inventory via programmatic auctions.

AI-driven header bidding products are maximizing yield management, enabling publishers to access premium demand and decrease dependence on legacy ad exchanges. SSPs are also adopting first-party data strategies to maximize targeting precision, mitigating the effects of third-party cookie deprecation. Publishers are, therefore, reaping stronger revenue streams through private marketplaces and direct programmatic transactions. Ad networks Make Themselves Heard in the Market with Data-Driven Targeting

Ad networks are expanding with rising in-app ad spend and interactive ad formats like rewarded video ads. AI-powered segmentation and real-time auctions have boosted ad network performance, connecting brands to the right people efficiently. Mobile ad networks have been observed to contribute to more than 60% of digital ad spending, as they lead the performance-based advertising benchmark. Data Management Platforms (DMPs) Play a Central Role in Audience Segmentation and Insights

With more stringent privacy policies on the rise, DMPs are turning into first-party data strategy and identity solution-oriented tools. AI-powered predictive analytics and CDPs are increasingly being integrated as part of DMPs to personalize campaigns and meet privacy requirements. The shift toward first-party data has further propelled the role of DMPs as enablers of sustained audience comprehension along with marketing efficiency. Programmatic Advertising Drives Market Growth by AI-Enabled Effectiveness

Programmatic ads continue to dominate the online advertising space through computerized, real-time buying of ads. AI-driven bidding software boosts ad placement with behaviorally optimized optimization of customer actions, increasing engagement and return on investment higher.

Spending on ads through programmatic advertisements will keep on growing as AI-powered automation eliminates wastage while increasing precision for higher targeting. Soon, advertisement buyers will be contacted directly by advertisers, similar to how publishers have gone to Facebook.

Search ad remains a high-impact segment, and predictive bidding and AI keyword targeting enhance the ad's performance. Paid search campaigns continue where brands are paying to reach high-intent consumers with live search intent signals to maximize conversion.

Display advertising itself is changing with dynamic creative optimization, which enables the ad to be adjusted depending on user interaction. AI-powered display ads in the form of rich media and video content interact more through web and mobile media. Mobile Ads Expand as Brands Capitalize on App-Based Engagement

Mobile ads are one of the highest drivers, and in-app advertising, location targeting, and video ad formats are fueling engagement. Brands are utilizing interactive advertizing experiences such as gamified ads and augmented reality campaigns to engage mobile shoppers. AI-powered mobile ad optimization ensures that the ads are reaching highly relevant consumers, driving maximum conversion and return on advertise spend.

Email marketing remains in pla,y with AI-powered automation supplementing personalization and campaign efficiency. Businesses use real-time behavioral triggers, A/B testing, and predictive analytics to personalize their emails and render them more engaging.

Native advertising is also on the rise, with AI-powered platforms optimizing frictionless ad placement within content ecosystems. Native ads are known to generate 53% more engagement compared to traditional display ads, making them an alternative for content-oriented marketing campaigns.

Major companies lead the Adtech investment, going for AI-driven advertisement platforms that provide real-time analytics, cross-channel attribution, and hyper-personalized advertising. Small and medium-sized enterprises (SMEs) are, on the other hand, turning to self-service Adtech platforms and utilizing low-cost programmatic buy and easy advertisement management platforms. The introduction of AI-driven intuitive platforms has enabled SMEs to be on equal footing for digital adverts.

Web-based Adtech platforms continue to lead the way in digital advertising, with brands investing in AI-based audience insight, retargeting, and real-time bidding technology. Emerging digital media such as connected TV (CTV), digital out-of-home (DOOH), and voice search ads are also making headway. Growing adoption of AI-powered advertising guarantees more accurate targeting, lower ad waste, and enhanced campaign performance.

Media & entertainment remain the biggest industry drivers of Adtech adoption, led by streaming services, content monetization, and dynamic ad insertion. Retail and consumer goods businesses use AI-powered Adtech platforms to deliver maximum e-commerce ad results and customized recommendation personalization.

The BFSI sector is using Adtech to win customers and connect with them, and the IT & telecom sector is implementing cross-device and cross-platform ad delivery. Education, healthcare, and other verticals are adopting Adtech, too, to raise the engagement of both audiences and campaigns. Adtech Future is characterized by Sustainable Advertising and Privacy-First Strategies.

The Adtech sector is transforming quickly to address regulatory hurdles and consumer privacy needs. Brands are embracing carbon-offset digital advertising, blockchain-ad-verification, and policy-enforced responsible use of data to be compatible with global privacy regulations. AI-based protection from fraud and privacy-friendly targeting solutions are boosting advertiser confidence and making the industry sustainable in the long term.

The AdTech space is experiencing remarkable growth triggered by technological and merger strategies. Corporate firms are increasingly employing AI and data analysis in an effort to tap the power of ad efficiency and relevance. AppLovin, for instance, has seen a tremendous rise in ad revenues through AI, receiving massive injections of capital from leading hedge funds.

The sector has also seen a merger and acquisition frenzy, where the consolidation between Omnicom Group and Interpublic Group plans to make the world's biggest advertising company saturated with data and AI. This is part of the development of the business to all-embracing technology-powered advertisement on every platform.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Alphabet Inc. (Google) | 30-35% |

| Meta Platforms Inc. (Facebook) | 20-25% |

| Amazon Advertising | 10-15% |

| AppLovin Corporation | 5-10% |

| The Trade Desk | 3-5% |

| Other Companies (combined) | 15-20% |

| Company Name | Key Offerings/Activities |

|---|---|

| Alphabet Inc. (Google) | Operates Google Ads, a platform enabling advertisers to display ads across Google's vast network, including Search, YouTube, and partner sites. |

| Meta Platforms Inc. (Facebook) | Provides targeted advertising services through Facebook Ads Manager, allowing businesses to reach specific demographics on Facebook and Instagram. |

| Amazon Advertising | Offers advertising solutions that enable brands to promote products directly on Amazon's platform, reaching consumers at the point of purchase. |

| AppLovin Corporation | Specializes in mobile app advertising, utilizing AI to optimize ad placements and maximize revenue for app developers. |

| The Trade Desk | Provides a demand-side platform (DSP) that allows advertisers to manage digital advertising campaigns across various formats and devices. |

Key Company Insights

Alphabet Inc. (Google) (30-35%)

Alphabet Inc. reigns supreme in the AdTech space with its end-to-end ad platform, Google Ads. Advertisers can target many individuals across many channels like search pages, YouTube video views, and affiliate sites using Google Ads. Alphabet's consistent investment in artificial intelligence (AI) has enabled it to create its ad-targeting feature, which renders ad campaigns more targeted and efficient.

Meta Platforms Inc. (Facebook) (20-25%)

Meta Platforms Inc. enjoys strong ad features in Facebook Ads Manager that enable businesses to connect with specific groups based on Facebook and Instagram user data. Its machine learning and AI focus has enhanced the quality of ad response and ad delivery so that advertisers can create compelling and high-quality content around target groups.

Amazon Advertising (10-15%)

Amazon Advertising allows brands to put their products as ads on Amazon's website itself in front of customers who are literally about to make a purchase. With shopping and purchase history, Amazon provides highly targeted ad options, where brands can show ads to customers who are actively looking for similar products.

AppLovin Corporation (5-10%)

AppLovin Corporation deals in mobile app advertising, offering developers spaces where they can monetize their apps and prosper. AppLovin's AI-driven platform optimizes ad placement to offer user engagement and revenue maximization. AppLovin's recent success has seen investors subjecting the company to huge investments that are indicative of the trust reposed in the company's innovative ideas in mobile ads.

The Trade Desk (3-5%)

The Trade Desk is an ad demand-side platform for advertisers to manage and optimize digital ad campaigns across devices and channels. Prioritizing data-driven decisions and transparency, The Trade Desk enables targeted audiences and real-time bidding to optimize ad spend and make it more efficient and effective.

Other Key Players (15-20% Combined)

The remaining market share includes other companies that are offering niche products and creative solutions for the AdTech market. Major players are:

These companies, and others similar to them, have the responsibility of shaping the AdTech ecosystem, driving innovation in advertising solutions, and delivering diversity in solutions to meet evolving advertiser and publisher needs.

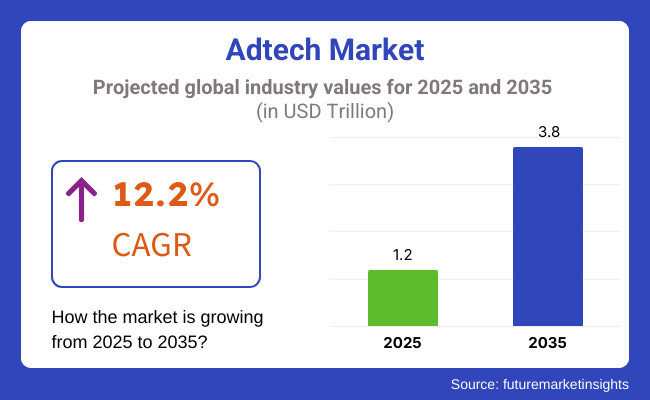

The overall market size for AdTech market was USD 1.2 Trillion in 2025.

The AdTech market is projected to reach approximately USD 3.8 Trillion by 2035.

The demand for the AdTech market will be driven by digital transformation, increasing use of programmatic advertising, and growing demand for personalized and targeted advertising.

The top 5 countries driving the development of the AdTech market are the United States, China, Canada, Japan, and Germany.

Demand-side platforms (DSPs) are among the fastest-growing segments of the AdTech industry, providing advertisers with real-time bidding capabilities and audience segmentation tools.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Advertising Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Advertising Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Advertising Type, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Advertising Type, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: South Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 27: South Asia Market Value (US$ Million) Forecast by Advertising Type, 2018 to 2033

Table 28: South Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Advertising Type, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Advertising Type, 2018 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Advertising Type, 2018 to 2033

Table 46: MEA Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 48: MEA Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Solution, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Advertising Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Platform, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Advertising Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Advertising Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Advertising Type, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 25: Global Market Attractiveness by Solution, 2023 to 2033

Figure 26: Global Market Attractiveness by Advertising Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 28: Global Market Attractiveness by Platform, 2023 to 2033

Figure 29: Global Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Advertising Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Advertising Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Advertising Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Advertising Type, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 55: North America Market Attractiveness by Solution, 2023 to 2033

Figure 56: North America Market Attractiveness by Advertising Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 58: North America Market Attractiveness by Platform, 2023 to 2033

Figure 59: North America Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Advertising Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Advertising Type, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Advertising Type, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Advertising Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Solution, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Advertising Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Platform, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Solution, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Advertising Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Platform, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Advertising Type, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Advertising Type, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Advertising Type, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 115: Europe Market Attractiveness by Solution, 2023 to 2033

Figure 116: Europe Market Attractiveness by Advertising Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 118: Europe Market Attractiveness by Platform, 2023 to 2033

Figure 119: Europe Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Advertising Type, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Platform, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Advertising Type, 2018 to 2033

Figure 134: South Asia Market Value Share (%) and BPS Analysis by Advertising Type, 2023 to 2033

Figure 135: South Asia Market Y-o-Y Growth (%) Projections by Advertising Type, 2023 to 2033

Figure 136: South Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 137: South Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 138: South Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 139: South Asia Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 143: South Asia Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Solution, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Advertising Type, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 148: South Asia Market Attractiveness by Platform, 2023 to 2033

Figure 149: South Asia Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Advertising Type, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Platform, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Advertising Type, 2018 to 2033

Figure 164: East Asia Market Value Share (%) and BPS Analysis by Advertising Type, 2023 to 2033

Figure 165: East Asia Market Y-o-Y Growth (%) Projections by Advertising Type, 2023 to 2033

Figure 166: East Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 167: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 168: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 169: East Asia Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Solution, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Advertising Type, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Platform, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Solution, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Advertising Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Platform, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Advertising Type, 2018 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Advertising Type, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Advertising Type, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Solution, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Advertising Type, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Platform, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Solution, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Advertising Type, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Platform, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 221: MEA Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 222: MEA Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) Analysis by Advertising Type, 2018 to 2033

Figure 224: MEA Market Value Share (%) and BPS Analysis by Advertising Type, 2023 to 2033

Figure 225: MEA Market Y-o-Y Growth (%) Projections by Advertising Type, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 227: MEA Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 228: MEA Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 229: MEA Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 234: MEA Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 235: MEA Market Attractiveness by Solution, 2023 to 2033

Figure 236: MEA Market Attractiveness by Advertising Type, 2023 to 2033

Figure 237: MEA Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 238: MEA Market Attractiveness by Platform, 2023 to 2033

Figure 239: MEA Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA