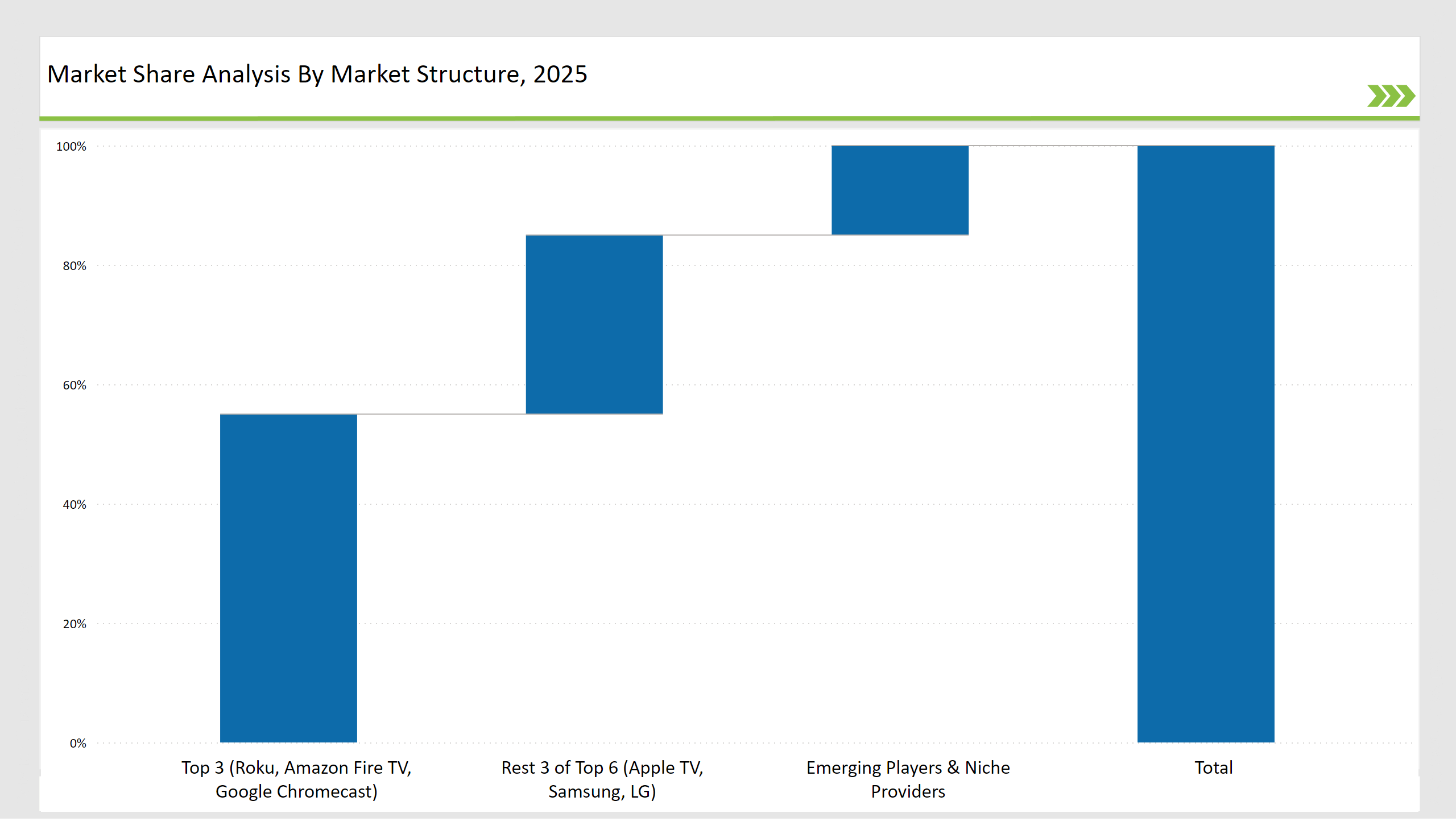

The growth of the Connected TV sector is attributed to the migration of more and more consumers from traditional cable services to online internet streaming platforms. Roku, Amazon Fire TV, and Google Chromecast are the main competitors on the market, and thanks to their strong ecosystem and buddying with the top streaming services, they account for a whopping 55% of the market on a global scale.

Other big players in the picture are Apple TV, Samsung Smart TV, and LG WebOS having a cumulative 30% of the market share out of it. The emerging and niche players hold 15%. Factors such as the speed of adoption of smart TVs and OTT services are propelling the industry, with a forecasted 16.8% CAGR to reach USD 18.7 billion by 2035.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 18.7 billion |

| CAGR (2025 to 2035) | 16.8% |

| Category | Industry Share (%) |

|---|---|

| Top 3 (Roku, Amazon Fire TV, Google Chromecast) | 55% |

| Rest 3 of Top 6 (Apple TV, Samsung, LG) | 30% |

| Emerging Players & Niche Providers | 15% |

| Market Concentration | Assessment |

|---|---|

| High (> 60% by top 10 players) | Medium |

| Medium (40-60%) | High |

| Low (< 40%) | Low |

The Smart TV Platform segment leads the market with a 45% share. Increasing demand for built-in streaming services and seamless device integration fuels this growth. Roku and Google Chromecast drive this segment with user-friendly interfaces, voice assistant capabilities, and app-based content delivery.

As consumers seek personalized entertainment, manufacturers innovate with AI-powered recommendations and cloud-based content synchronization.

The media and entertainment sector leads the market share at 50%. The need for streaming service providers, including Netflix, Disney+, and YouTube, to form partnerships with CTV manufacturers to distribute content easily and enhance viewing experiences has increased.

By leveraging data-driven insights to optimize engagement and ROI, advertisers are also raising the stakes with programmatic CTV ads. The, Connected TV providers are redefining advertisement strategies and blending platforms in response to tough competition.

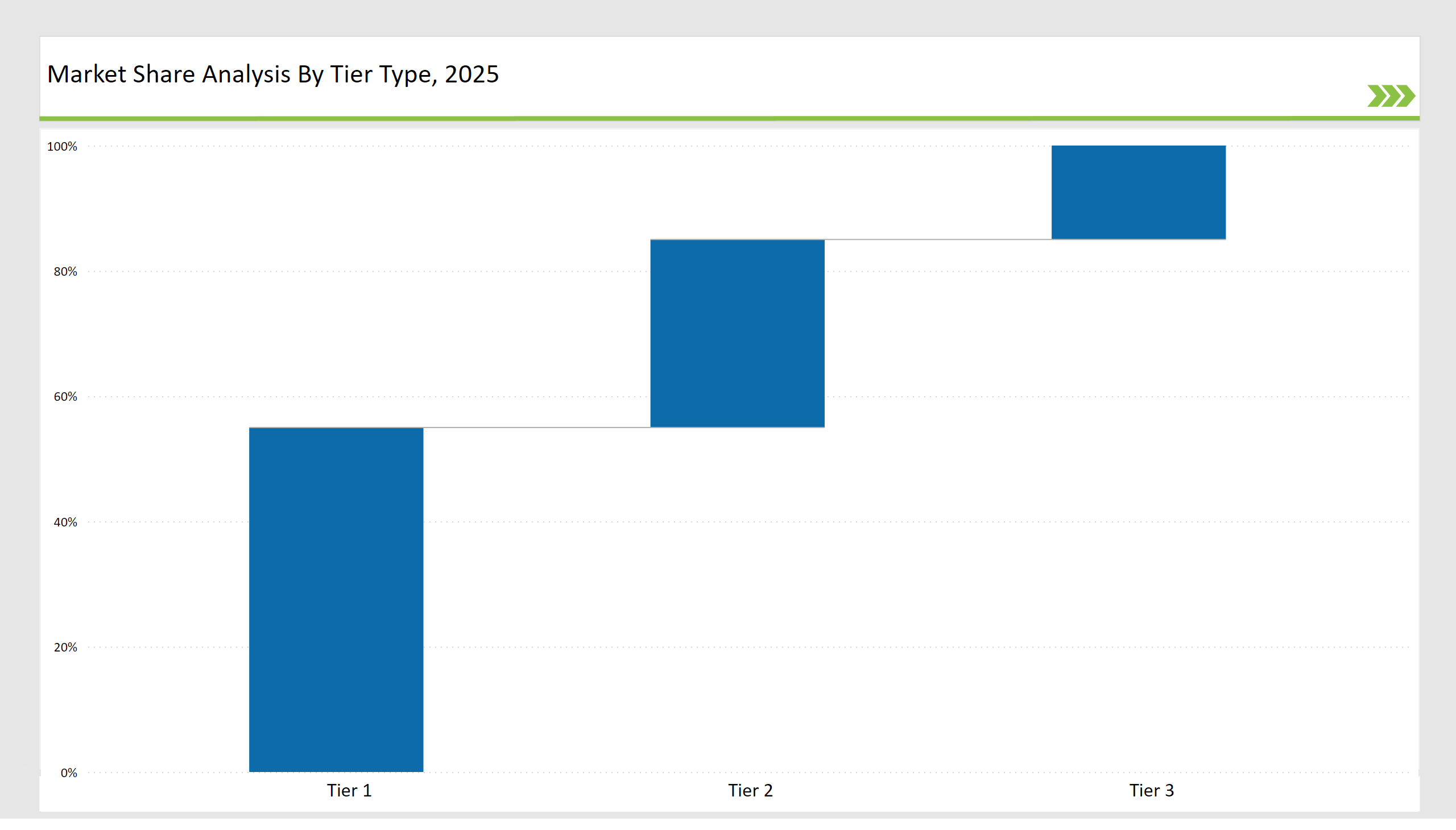

| Tier | Tier 1 |

|---|---|

| Vendors | Roku, Amazon Fire TV, Google Chromecast |

| Consolidated Market Share (%) | 55% |

| Tier | Tier 2 |

|---|---|

| Vendors | Apple TV, Samsung Smart TV, LG WebOS |

| Consolidated Market Share (%) | 30% |

| Tier | Tier 3 |

|---|---|

| Vendors | Hisense, Vizio, TCL, Panasonic |

| Consolidated Market Share (%) | 15% |

| Vendor | Key Focus |

|---|---|

| Roku | Expands ad-supported content and original programming. |

| Amazon Fire TV | Enhances AI-powered navigation and free streaming services. |

| Google Chromecast | Integrates live TV and AI-driven recommendations. |

| Apple TV | Strengthens gaming and fitness content integration. |

| Samsung Smart TV | Advances AI upscaling and partnerships with streaming providers. |

| LG WebOS | Introduces cloud gaming and smart AI-driven content curation. |

| Vizio | Expands direct-to-device ad solutions and smart picture enhancements. |

| TCL | Focuses on high-quality 4K and 8K CTV displays. |

| Panasonic | Strengthens sustainability efforts in smart TV production. |

Vendors must continue innovating AI-driven content curation to enhance viewer engagement and maximize ad revenue. Expanding partnerships with streaming services will ensure content diversity and improve accessibility. The adoption of 5G will make cloud-based gaming smoother, and smart home integrations will further personalize entertainment ecosystems.

Free Ad-Supported Streaming TV (FAST) service demand will increase, pushing vendors to spend on high-quality, advertiser-friendly content. Real-time programmatic capabilities will unlock the higher revenue opportunity for connected TV advertising technology.

As competition hot up, there are opportunities for connected TV vendors to focus more on cross-device synchronization, voice-enabled interfaces, and sustainability in production. Connected TVs will also move further into developing markets with affordable price points, ensuring greater global connectivity.

Leading vendors Roku, Amazon Fire TV, and Google Chromecast hold 55% of the market.

Apple TV, Samsung Smart TV, and LG WebOS collectively hold 30% of the market.

Emerging players and niche providers hold 15% of the market.

Market concentration in 2025 is categorized as medium, with the top 10 players controlling 60-70% of the market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Connected Sensors Market Size and Share Forecast Outlook 2025 to 2035

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Connected RHM (Remote Healthcare Monitoring) Market Size and Share Forecast Outlook 2025 to 2035

Connected Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Connected Packaging Market Size and Share Forecast Outlook 2025 to 2035

Connected Living Room Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Connected Vehicle Technology Market Size and Share Forecast Outlook 2025 to 2035

Connected Tire Market Size and Share Forecast Outlook 2025 to 2035

Connected Logistics Market Growth - Trends, Demand & Innovations 2025 to 2035

Connected Drug Delivery Devices Market Size and Share Forecast Outlook 2025 to 2035

Connected Home Surveillance Devices Market Growth - Trends & Forecast 2025-2035

Connected Game Console Market Analysis by Product Type, Application, and Region through 2035

Connected Healthcare Market

Connected Car Market Growth – Trends & Forecast 2024-2034

AI-Driven Smart Home Appliances – Enhancing Home Automation

Connected Lighting Platform Market

Connected Enterprise Video Surveillance Solutions Market

Connected Energy Market

Connected Solutions for Oil & Gas Market Insights – Trends & Forecast 2020-2030

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA