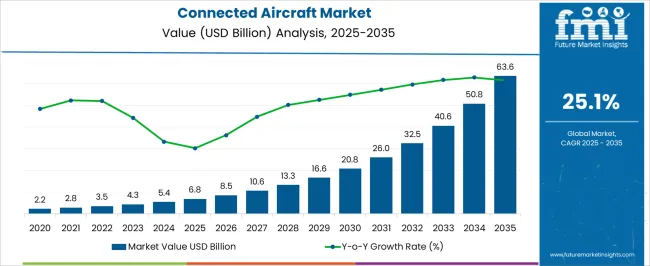

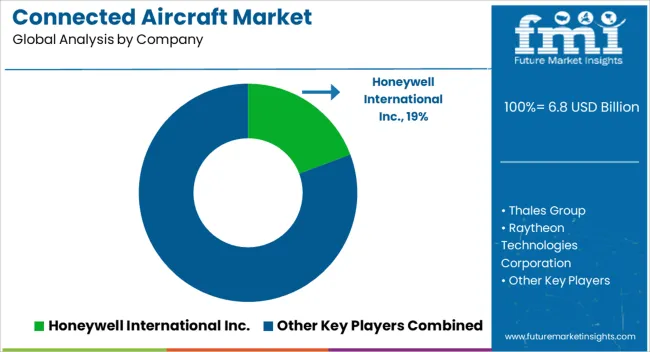

The Connected Aircraft Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 63.6 billion by 2035, registering a compound annual growth rate (CAGR) of 25.1% over the forecast period.

| Metric | Value |

|---|---|

| Connected Aircraft Market Estimated Value in (2025 E) | USD 6.8 billion |

| Connected Aircraft Market Forecast Value in (2035 F) | USD 63.6 billion |

| Forecast CAGR (2025 to 2035) | 25.1% |

The connected aircraft market is expanding rapidly, supported by the aviation industry’s focus on enhancing operational efficiency, passenger experience, and safety through advanced connectivity solutions. Increasing demand for real-time data exchange between aircraft and ground stations is influencing airlines and operators to integrate high-performance connectivity technologies. Regulatory encouragement for safety management systems and the rising adoption of predictive maintenance practices are driving reliance on connected platforms.

Growth is also being reinforced by the rising need for inflight entertainment and connectivity services, particularly in commercial aviation, as passengers expect seamless digital experiences. Technological advancements in satellite communications and the availability of higher bandwidth are enabling more robust connectivity options for both cockpit and cabin applications.

Airlines are increasingly prioritizing solutions that improve fuel efficiency, reduce downtime, and enable proactive decision-making through data analytics With aviation traffic projected to increase globally and digital transformation accelerating across airlines, the connected aircraft market is positioned to achieve strong growth, supported by both infrastructure upgrades and continuous innovation in connectivity solutions.

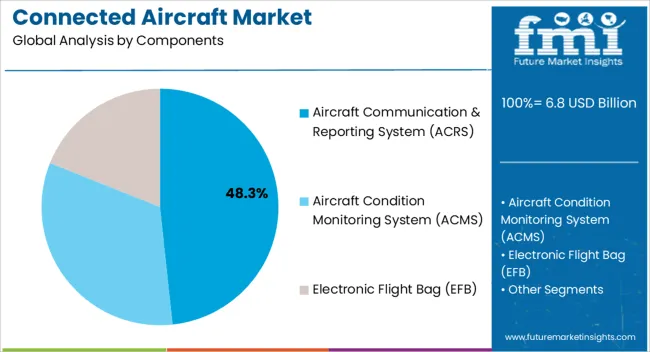

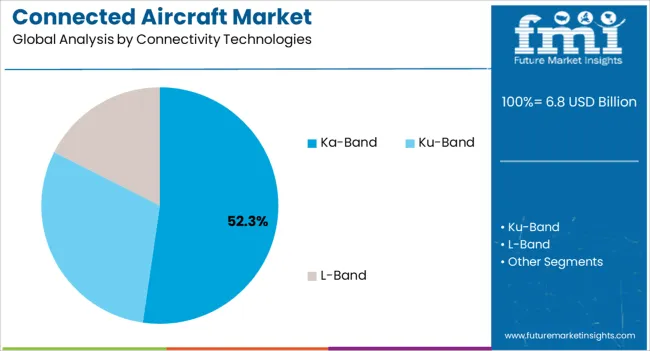

The connected aircraft market is segmented by components, connectivity technologies, and geographic regions. By components, connected aircraft market is divided into Aircraft Communication & Reporting System (ACRS), Aircraft Condition Monitoring System (ACMS), and Electronic Flight Bag (EFB). In terms of connectivity technologies, connected aircraft market is classified into Ka-Band, Ku-Band, and L-Band. Regionally, the connected aircraft industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aircraft communication and reporting system segment is projected to account for 48.3% of the connected aircraft market revenue share in 2025, making it the leading component category. Its leadership is being driven by its essential role in enabling secure and continuous communication between aircraft and ground systems, supporting both operational efficiency and safety requirements. Airlines are increasingly adopting these systems to ensure reliable data exchange for flight tracking, weather updates, and performance monitoring.

The ability of communication and reporting systems to enhance situational awareness and optimize routing decisions is contributing to cost savings and improved safety outcomes. This segment is also being strengthened by regulatory emphasis on communication reliability, particularly for long-haul and transoceanic flights where continuous connectivity is vital.

The integration of these systems with advanced satellite technologies further enhances performance, ensuring uninterrupted data flow in diverse operating environments As the industry prioritizes operational resilience and efficiency, the aircraft communication and reporting system is expected to maintain its dominant share in the connected aircraft market.

The Ka-band segment is anticipated to capture 52.3% of the connected aircraft market revenue share in 2025, establishing it as the leading connectivity technology. Its dominance is being driven by the ability to provide higher bandwidth and faster data transfer speeds compared to other frequency bands, enabling seamless passenger connectivity and efficient operational data exchange. The segment is benefiting from the increasing adoption of inflight entertainment and connectivity services, as airlines respond to rising passenger expectations for uninterrupted internet access.

The higher spectrum availability within Ka-band frequencies supports greater capacity, making it suitable for modern aircraft that require multiple simultaneous data-intensive applications. Ongoing satellite launches and the deployment of advanced constellations are improving coverage and reliability, further reinforcing adoption.

The capability of Ka-band technology to support both cockpit and cabin applications, including real-time data analytics, predictive maintenance, and passenger services, has strengthened its market position With increasing demand for high-speed connectivity across the aviation sector, Ka-band is expected to remain the preferred choice for airlines and operators worldwide.

The connected aircraft revolution has arrived in aviation, transforming the way people communicate both on and off an aircraft and making trips safer, more productive, and much more interesting. As a result, key players are delivering solutions that improve the passenger experience while also increasing staff productivity through the use of gear that provides seamless, high-speed broadband. Their array of satellite communication products offers business aviation, airlines, and helicopters quick, consistent, and reliable global in-flight connections, anywhere in the world. As a result, end users benefit from dependable high-speed connectivity for the cabin and cockpit. This is likely to drive the connected aircraft market growth. These market players also provide a wide range of maintenance plans, tools, and services to provide maintenance teams with the correct data and diagnostics at the right time.

Airlines operate in an environment that is becoming increasingly complicated. As a result, key providers offer the most powerful analytics solutions, which have assisted more than 100 airlines in identifying, implementing, and optimize dozens of projects to improve flight and maintenance operations, which evidently surges the demand for connected aircraft. The platform's core comprises two complementing apps, with additional applications and mobile capabilities now being tested with airline customers. Furthermore, it has aided in the improvement of efficiency and drive sustainability for 30 significant airlines and airline groups. It is also the premier solution for flight data analytics, which aids in fuel savings, flight route optimization, and on-time performance.

Most critical companies have taken the lead in providing high-speed Wi-Fi in the skies, which is estimated to contribute to the expansion of the connected aircraft market size. They claim that new firms cannot match their wide product range, install base, and "satellite to services, airtime to applications" offered through acquisition and in-house knowledge. Their breadth and depth of technologies, experience in avionics, mechanical components, and propulsion systems, and leadership in satellite communications set them apart. As a result, they are ideally positioned to secure the adoption of connected aircraft. Key players are also defending the virtual world, securing the vast caches of data coming on and off the aircraft, building on a tradition of expertise, and leveraging their position in the Connected Aircraft industry. Furthermore, they are bolstering their efforts by establishing a cybersecurity center of excellence to assist their end users' demand for connected aircraft.

Key companies work hard to deliver the advantages of dependable, high-quality internet connectivity solutions to the aviation sector. They understand their clients' demands and provide them with next-generation aviation Satcom systems, which are likely to contribute to market growth. In addition, they claim to provide aviation-specific connection networks that are exclusively owned and controlled by them. This gold standard provides passenger satisfaction, customer loyalty, operational efficiency, and safety-critical services today and in the future, owing to a fully-funded technological roadmap. Most key providers aspire to define in-flight entertainment as their legacy - and reimagining the passenger experience is their purpose - as the world's top supplier of IFEC solutions.

The connected aircraft market growth is expected to augment since OneWeb has entered into a distribution agreement with a certain market player to sell and support its Low Earth Orbit (LEO) network for commercial aircraft globally. The addition of LEO to their already industry-leading network enables them to create a multi-orbit solution geared to provide market-leading in-flight connectivity services. Their wireless connectivity devices are propelling the future of IoT Connected Aircraft and offer data-driven solutions to improve the passenger experience. The solutions, designed with both customers and airline employees in mind, ensure that all airline experiences exceed expectations. All these factors are anticipated to drive service demand and expand the connected aircraft market size.

In airline industry, customers across the globe are demanding for high speed internet access during their travel. In order to meet rising demand from passengers, the operators around the world are implementing broadband and satellite based connectivity solutions to their airplanes.

Currently, concept of connected aircraft has gone far beyond from just a provision of internet access over 30,000 feet to travellers. Connected aircrafts has ability to send and receive the real time data from ground based operating systems, that provides the critical information related to avionic system in real time.

In order to facilitate the real time data capturing, Airplanes are used as node in the sky to capture the hundreds of gigabytes of data from take-off to landing that helps to improve safety and efficiency of flight.

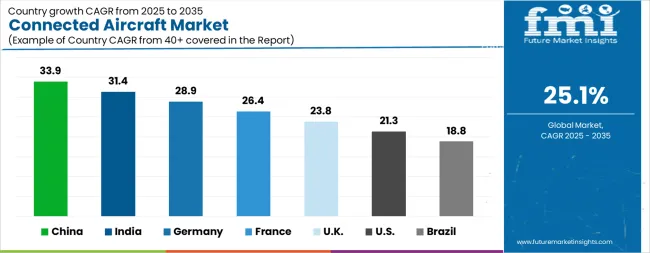

| Country | CAGR |

|---|---|

| China | 33.9% |

| India | 31.4% |

| Germany | 28.9% |

| France | 26.4% |

| UK | 23.8% |

| USA | 21.3% |

| Brazil | 18.8% |

The Connected Aircraft Market is expected to register a CAGR of 25.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 33.9%, followed by India at 31.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 18.8%, yet still underscores a broadly positive trajectory for the global Connected Aircraft Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 28.9%. The USA Connected Aircraft Market is estimated to be valued at USD 2.4 billion in 2025 and is anticipated to reach a valuation of USD 16.5 billion by 2035. Sales are projected to rise at a CAGR of 21.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 370.2 million and USD 218.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.8 Billion |

| Components | Aircraft Communication & Reporting System (ACRS), Aircraft Condition Monitoring System (ACMS), and Electronic Flight Bag (EFB) |

| Connectivity Technologies | Ka-Band, Ku-Band, and L-Band |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc., Thales Group, Raytheon Technologies Corporation, BAE Systems PLC, Viasat Inc., TE Connectivity Ltd., and Gogo Inc. |

The global connected aircraft market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the connected aircraft market is projected to reach USD 63.6 billion by 2035.

The connected aircraft market is expected to grow at a 25.1% CAGR between 2025 and 2035.

The key product types in connected aircraft market are aircraft communication & reporting system (acrs), aircraft condition monitoring system (acms) and electronic flight bag (efb).

In terms of connectivity technologies, ka-band segment to command 52.3% share in the connected aircraft market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Connected Sensors Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA