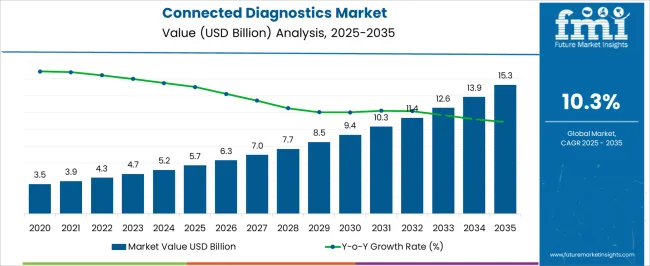

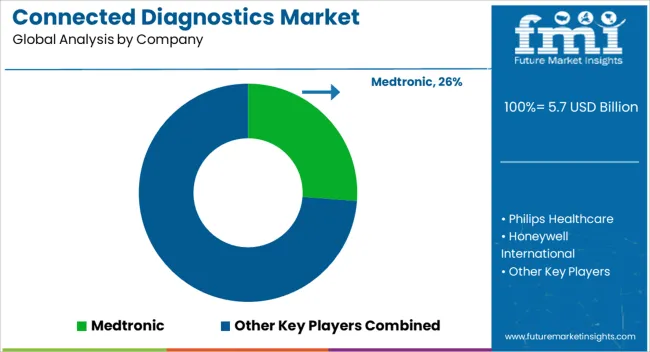

The Connected Diagnostics Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 15.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period.

| Metric | Value |

|---|---|

| Connected Diagnostics Market Estimated Value in (2025 E) | USD 5.7 billion |

| Connected Diagnostics Market Forecast Value in (2035 F) | USD 15.3 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

The Connected Diagnostics market is being driven by advancements in digital health solutions and increased demand for remote patient monitoring and data integration. The current market is characterized by the growing adoption of cloud-based platforms, which support real-time data sharing, predictive analytics, and telemedicine applications. The rise in chronic diseases and the need for efficient healthcare delivery systems have accelerated the adoption of connected diagnostic tools.

Investments in healthcare IT infrastructure and growing interoperability between devices and electronic health records have further supported the expansion of the market. The integration of artificial intelligence and machine learning with diagnostic tools is improving early detection, reducing hospital stays, and enhancing patient outcomes. Looking forward, the market is expected to benefit from increasing healthcare digitization, especially in emerging regions where accessibility and affordability are major concerns.

Government initiatives aimed at promoting digital health, coupled with the rising penetration of smartphones and wearable devices, are creating new opportunities for healthcare providers, insurers, and technology developers These factors are expected to sustain market growth and drive innovation in connected diagnostics solutions.

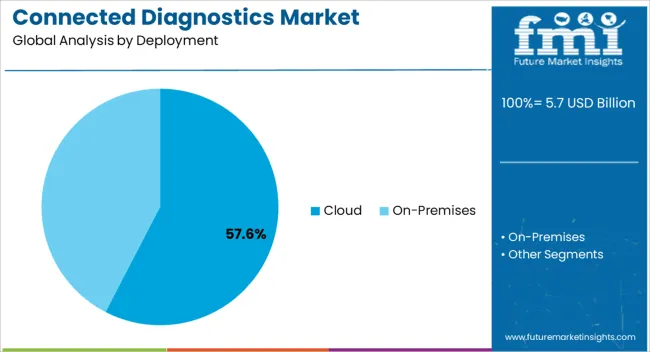

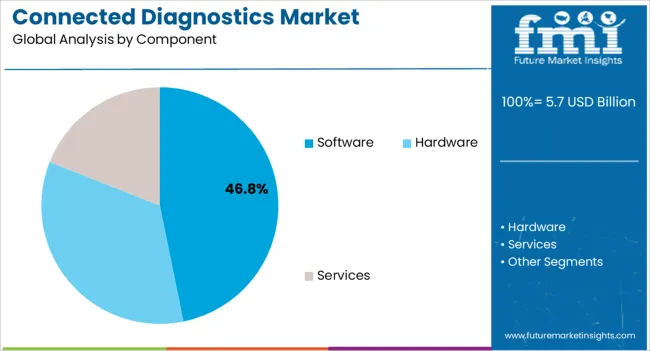

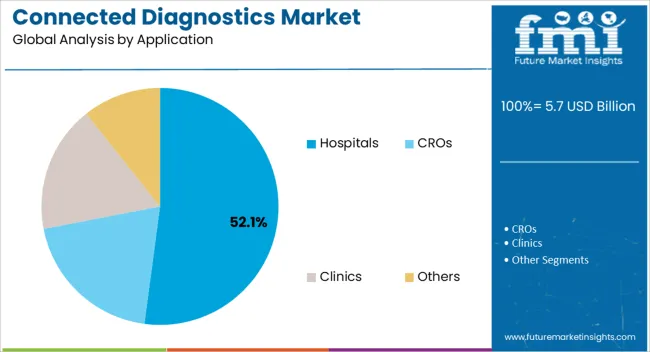

The connected diagnostics market is segmented by deployment, component, application, and geographic regions. By deployment, connected diagnostics market is divided into Cloud and On-Premises. In terms of component, connected diagnostics market is classified into Software, Hardware, and Services. Based on application, connected diagnostics market is segmented into Hospitals, CROs, Clinics, and Others. Regionally, the connected diagnostics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud deployment segment is expected to hold 57.60% of the Connected Diagnostics market revenue in 2025, making it the largest deployment type. The dominance of cloud-based solutions has been attributed to their scalability, ease of integration, and ability to handle large volumes of healthcare data securely. The adoption of cloud platforms has been supported by the need for real-time data access, remote patient monitoring, and interoperability between diagnostic devices and healthcare systems.

Cloud deployment has also been favored due to reduced infrastructure costs and improved data storage and retrieval capabilities. Additionally, healthcare providers have increasingly preferred cloud-based platforms to support telehealth services, patient engagement, and analytics-driven decision-making.

The flexibility offered by cloud deployment models has enabled organizations to scale operations and integrate new diagnostic tools without substantial upfront investments Furthermore, advancements in data security protocols and compliance frameworks have increased confidence in cloud-based healthcare solutions, positioning this deployment type as the preferred choice for connected diagnostics in both developed and emerging markets.

The software component segment is projected to account for 46.80% of the Connected Diagnostics market revenue in 2025, making it the leading component. The segment’s growth has been supported by the increasing reliance on software-driven platforms for data interpretation, diagnostics management, and patient monitoring. Software solutions have been favored due to their ability to integrate multiple diagnostic tools and provide actionable insights through advanced algorithms.

The development of artificial intelligence and machine learning technologies has further enhanced the capabilities of diagnostic software, improving accuracy and reducing diagnostic time. Software-based solutions have been increasingly deployed to streamline workflows, ensure compliance, and deliver personalized healthcare recommendations. Additionally, the rise in demand for remote monitoring and digital therapeutics has boosted the integration of software into diagnostic solutions.

With healthcare providers seeking cost-effective and efficient methods for managing patient care, the adoption of software platforms has been accelerated The ability to upgrade features remotely and the availability of cloud-based deployment options have further reinforced the market’s reliance on software as a critical component of connected diagnostics solutions.

The hospitals application segment is expected to hold 52.10% of the Connected Diagnostics market revenue in 2025, establishing it as the largest application area. The prominence of hospitals in this market has been driven by their need to integrate advanced diagnostic tools into clinical workflows to improve patient care and operational efficiency. Hospitals have increasingly adopted connected diagnostics solutions to support real-time data collection, early disease detection, and remote monitoring of patients, especially in critical care settings.

The integration of connected diagnostics into hospital information systems has improved care coordination, reduced hospital readmissions, and enhanced patient safety. Additionally, hospitals are focusing on improving diagnostic accuracy and reducing turnaround times, with connected platforms providing the tools necessary to meet these objectives.

Investments in infrastructure upgrades, along with regulatory support for digital health transformation, have further encouraged adoption within hospital settings As healthcare delivery models evolve to incorporate data-driven approaches, hospitals continue to be at the forefront of adopting connected diagnostic solutions, positioning the segment for sustained growth driven by patient care optimization and resource efficiency.

Nowadays, the use of the Internet is widespread in day-to-day life. Connected diagnostics service providers offer consumers a wide range of choices for sharing, viewing, protecting, and storing growing collections of data. Connected diagnostics technology is used to collect data through wireless LAN (WLAN) or wireless WAN digital cellular connections. Connected diagnostics include digital equipment by connecting embedded technology. The usage of connected diagnostics technology is common in the healthcare industry. With the help of connected diagnostics, doctors can detect any medical problem. The technology enhances collaboration among radiologists, physicians, and technologists. The performance of a communication system (PACS) gets improved with the help of connected diagnostics. Through remote monitoring, predictive maintenance, and remote maintenance, offsite service contract connected diagnostics providers can fix problems. Connected diagnostics offer several advantages such as improved performance, application optimization, real-time load optimization, and storage virtualization.

Many end users adopt connected diagnostics technology for better performance and accurate data. Connected diagnostic technology is easy to use and can be operated from multiple places, as it is designed to showcase complete data of the patient. Connected diagnostics technology has a lot of applications. It can be used in continuous monitoring and diagnosis of system fault alerts in both on-highway and off-highway mode. Connected diagnostics work across a broad range of equipment, using a convenient mobile app, an email, or a web portal. Healthcare sector conducts lots of documentation that requires maintenance, updates, and files on a regular basis. Medical practices use an EPRMS, referred to as an Electronic Patient Record Management System, to collect the data generated from connected diagnostic devices.

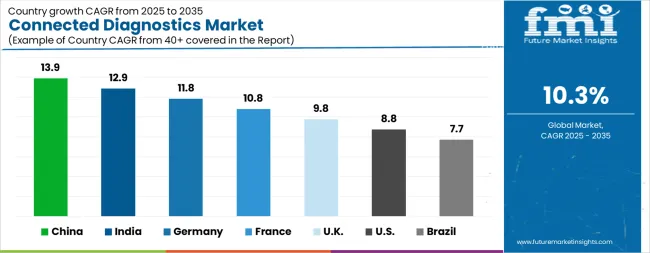

| Country | CAGR |

|---|---|

| China | 13.9% |

| India | 12.9% |

| Germany | 11.8% |

| France | 10.8% |

| UK | 9.8% |

| USA | 8.8% |

| Brazil | 7.7% |

The Connected Diagnostics Market is expected to register a CAGR of 10.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 13.9%, followed by India at 12.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Brazil posts the lowest CAGR at 7.7%, yet still underscores a broadly positive trajectory for the global Connected Diagnostics Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 11.8%.

The USA Connected Diagnostics Market is estimated to be valued at USD 2.1 billion in 2025 and is anticipated to reach a valuation of USD 4.8 billion by 2035. Sales are projected to rise at a CAGR of 8.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 260.6 million and USD 169.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 Billion |

| Deployment | Cloud and On-Premises |

| Component | Software, Hardware, and Services |

| Application | Hospitals, CROs, Clinics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Medtronic, Philips Healthcare, Honeywell International, Abbott Laboratories, GE Healthcare, Siemens Healthineers, Cerner Corporation, and IBM Watson Health |

The global connected diagnostics market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the connected diagnostics market is projected to reach USD 15.3 billion by 2035.

The connected diagnostics market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in connected diagnostics market are cloud and on-premises.

In terms of component, software segment to command 46.8% share in the connected diagnostics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Connected Sensors Market Size and Share Forecast Outlook 2025 to 2035

Connected RHM (Remote Healthcare Monitoring) Market Size and Share Forecast Outlook 2025 to 2035

Connected Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Connected Packaging Market Size and Share Forecast Outlook 2025 to 2035

Connected Living Room Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Connected Vehicle Technology Market Size and Share Forecast Outlook 2025 to 2035

Connected Tire Market Size and Share Forecast Outlook 2025 to 2035

Connected Logistics Market Growth - Trends, Demand & Innovations 2025 to 2035

Connected Drug Delivery Devices Market Size and Share Forecast Outlook 2025 to 2035

Connected Home Surveillance Devices Market Growth - Trends & Forecast 2025-2035

Connected Game Console Market Analysis by Product Type, Application, and Region through 2035

Understanding Connected TV Market Share & Growth Trends

Connected TV’s Market Outlook 2025 to 2035

Connected Healthcare Market

Connected Car Market Growth – Trends & Forecast 2024-2034

AI-Driven Smart Home Appliances – Enhancing Home Automation

Connected Lighting Platform Market

Connected Enterprise Video Surveillance Solutions Market

Connected Energy Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA