The Connected Living Room Market is estimated to be valued at USD 55.4 billion in 2025 and is projected to reach USD 119.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period. During the early adoption phase from 2020 to 2024, the market experienced gradual uptake driven by tech enthusiasts and early movers integrating smart devices such as connected TVs, voice assistants, and smart lighting into home entertainment setups. Awareness, interoperability challenges, and high device costs limited broader penetration during this period.

From 2025 to 2030, the market will enter a rapid scaling phase with a projected market value increasing from USD 55.4 billion in 2025 to approximately USD 75.4 billion by 2030, reflecting robust adoption across mainstream consumers. This phase is characterized by widespread consumer acceptance, enhanced connectivity, and expanded device ecosystems enabling seamless interaction between entertainment, lighting, and smart home devices. Companies intensify marketing, expand product portfolios, and invest in software integration and cloud-based services to capture market share. Between 2030 and 2035, the market progresses toward consolidation, reaching USD 119.6 billion by 2035. Growth begins to stabilize as penetration saturates in mature markets. Competition focuses on differentiation through service quality, AI-driven personalization, and integration with emerging home automation standards. Strategic mergers, acquisitions, and partnerships become common as leading players aim to strengthen market position while incremental innovation drives continued consumer engagement.

| Metric | Value |

|---|---|

| Connected Living Room Market Estimated Value in (2025 E) | USD 55.4 billion |

| Connected Living Room Market Forecast Value in (2035 F) | USD 119.6 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The connected living room market is expanding steadily as consumers seek seamless integration across entertainment, communication, and smart home functionalities. Increasing adoption of smart home ecosystems, coupled with advancements in content delivery and device interconnectivity, is driving this growth. Consumers now expect real-time access to high-quality streaming, intuitive device control, and consolidated media experiences from a single interface.

Manufacturers are responding with innovations that support multi-device synchronisation, voice-enabled control, and cross-platform compatibility. The rise in disposable income, especially in urban regions, along with growing awareness of connected technologies, has further accelerated adoption.

With strong momentum in infrastructure such as broadband penetration and 5G deployment, the connected living room is becoming a central hub for digital lifestyles. This evolving user expectation is shaping future product design, content strategies, and home automation standards.

The connected living room market is segmented by type, technology, application, and geographic regions. By type, the connected living room market is divided into Smart TVs, Gaming Consoles, Computers and Laptops, Smart Speakers, Smartphones and Tablets, and Others. The connected living room market is classified into Wi-Fi, Bluetooth, and Others.

Based on application, the connected living room market is segmented into Video Streaming, Audio Streaming, Gaming, and Security. Regionally, the connected living room industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The smart TVs segment is projected to hold 48.60% of the total market revenue by 2025 under the type category, making it the leading segment. This dominance is being driven by increased consumer demand for internet-enabled entertainment solutions and integration with popular streaming platforms.

Smart TVs offer built-in connectivity, eliminating the need for external devices, and support real-time updates for content applications. Their role as the primary screen in the digital household, combined with expanding screen sizes and 4K resolution options, makes them a preferred choice in connected living environments.

Manufacturers are increasingly embedding AI-driven personalization and voice assistant compatibility, further enhancing user interaction and functionality. As content consumption becomes more personalized and platform agnostic, smart TVs continue to anchor the connected living room experience.

The Wi Fi segment is expected to account for 53.20% of market revenue within the technology category by 2025, making it the most prominent technology in use. Its leadership is attributed to widespread availability, ease of deployment, and compatibility across a wide range of smart devices.

Wi Fi enables high-speed data transfer essential for smooth video streaming, online gaming, and device communication within the home. The flexibility to connect multiple devices without extensive wiring or setup makes it highly adaptable in modern households.

Continuous upgrades in Wi Fi standards have improved signal strength, bandwidth efficiency, and latency reduction, supporting advanced use cases such as 4K streaming and multi room device coordination. As consumers increasingly demand uninterrupted connectivity and content access, Wi Fi remains the backbone of connected living room infrastructure.

The video streaming segment is forecasted to contribute 44.70% of the total revenue in the application category by 2025, establishing it as the dominant usage scenario in the connected living room. A surge in on-demand content consumption, subscription-based streaming services, and the decline of traditional cable television is driving this growth.

Consumers value flexibility, personalized content libraries, and ad-free viewing experiences, which streaming platforms efficiently deliver. Smart devices designed to prioritize streaming performance are becoming standard in living rooms, reinforcing this trend.

Additionally, partnerships between streaming service providers and device manufacturers are enabling deeper platform integration, enhancing content accessibility. With user engagement metrics showing sustained upward trends, video streaming continues to define the core functionality of the connected living room environment.

The connected living room market is growing rapidly as consumers seek integrated home entertainment, smart control, and IoT-enabled experiences. Rising adoption of smart TVs, streaming devices, voice assistants, and connected speakers is transforming living spaces into interactive hubs. Consumers increasingly value seamless content access, personalized experiences, and centralized device control through smartphones or AI assistants.

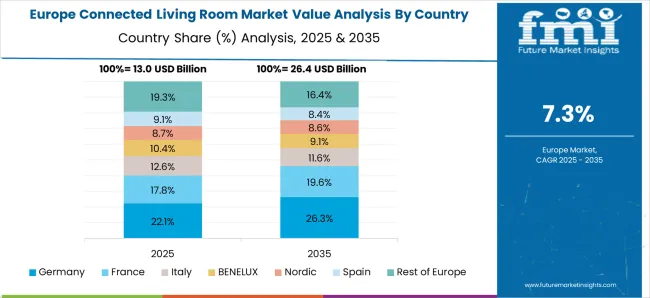

North America and Europe lead due to high digital penetration, while Asia-Pacific shows strong growth driven by urbanization, rising disposable incomes, and increasing smart home adoption. Technological innovation, interoperability standards, and enhanced user interfaces are key drivers. Manufacturers focus on ecosystem integration, AI-powered recommendations, and energy-efficient devices to differentiate products. Growth is also supported by partnerships between content providers, device manufacturers, and telecom operators to deliver bundled services, creating an immersive, convenient, and intelligent living room experience.

One of the major challenges in the connected living room market is interoperability between devices from different brands and platforms. Consumers often face difficulties integrating TVs, speakers, smart lights, streaming devices, and gaming consoles into a cohesive ecosystem. Proprietary protocols, firmware updates, and inconsistent standards lead to compatibility issues, disrupting the seamless user experience expected in smart living spaces. Additionally, complex installation requirements and a lack of user-friendly interfaces can hinder adoption among non-technical households. Vendors must invest in universal standards, open APIs, and cross-platform compatibility solutions to address these barriers. Failure to achieve seamless integration may result in lower customer satisfaction and increased churn. Companies that provide plug-and-play solutions, simplified device setup, and consistent software updates gain a competitive edge by delivering a reliable, hassle-free connected living room environment that encourages long-term adoption and ecosystem loyalty.

Technological innovation is a key driver in the connected living room market. Advanced smart TVs, voice-controlled assistants, IoT hubs, and AI-powered recommendation engines enable a personalized, interactive, and immersive experience. Features like 4K/8K streaming, high-dynamic-range (HDR) content, multi-room audio, and motion detection enhance entertainment quality. AI-driven automation allows predictive lighting, temperature control, and content suggestions, improving convenience and energy efficiency. Integration with cloud services enables remote monitoring and device control, while emerging protocols like Matter and Zigbee enhance device interoperability. Companies investing in intuitive interfaces, app ecosystems, and seamless firmware updates strengthen customer engagement. Continuous innovation also includes AR/VR integration and interactive gaming experiences, which create new entertainment opportunities. Brands leveraging cutting-edge technologies gain differentiation, attract tech-savvy consumers, and stimulate adoption across residential and premium housing segments.

The connected living room market faces critical challenges related to privacy, data security, and compliance with regulations. Smart devices continuously collect usage data, personal preferences, and behavioral patterns, raising concerns about unauthorized access, data breaches, and misuse. Regulatory frameworks, such as GDPR in Europe, mandate strict data handling, storage, and consent protocols. Security vulnerabilities in connected devices can expose households to hacking, surveillance, and privacy invasions. Manufacturers must implement end-to-end encryption, secure authentication mechanisms, and firmware update protocols to protect users. Clear privacy policies and transparent data practices are essential for building consumer trust. Companies that proactively address cybersecurity and regulatory compliance gain a reputational advantage and higher adoption rates. Failure to ensure privacy and security can lead to legal penalties, loss of consumer confidence, and slowed market growth, particularly in regions with stringent data protection laws.

The connected living room market is highly competitive, featuring global tech giants, electronics manufacturers, and emerging startups. Companies compete on product innovation, ecosystem integration, pricing, and user experience. Premium brands differentiate with superior display quality, AI features, and seamless device interoperability, while cost-effective solutions appeal to price-sensitive consumers seeking basic smart capabilities. Partnerships with content providers, telecom operators, and smart home platforms create bundled offerings that enhance value and stickiness. Consumer expectations are increasingly high, demanding intuitive interfaces, real-time responsiveness, and multi-device control. Supply chain stability, firmware support, and after-sales service are critical to maintaining brand loyalty. Firms investing in R&D, ecosystem expansion, and customer support achieve stronger market penetration. As adoption grows, companies that balance affordability, performance, and integration are well-positioned to capture long-term growth in the connected living room segment.

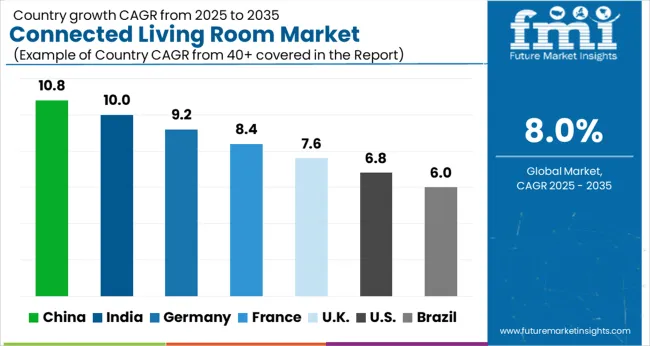

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The global Connected Living Room Market is projected to grow at a CAGR of 8.0% through 2035, supported by increasing demand across home automation, entertainment, and smart appliance applications. Among BRICS nations, China has been recorded with 10.8% growth, driven by large-scale production and deployment in smart home systems, while India has been observed at 10.0%, supported by rising utilization in home entertainment and connected living solutions. In the OECD region, Germany has been measured at 9.2%, where production and adoption for smart home, entertainment, and appliance integration have been steadily maintained. The United Kingdom has been noted at 7.6%, reflecting consistent use in connected home and entertainment setups, while the USA has been recorded at 6.8%, with production and utilization across smart home, entertainment, and appliance sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The connected living room market in China is growing at a CAGR of 10.8%, driven by rising consumer demand for smart home solutions and IoT-enabled entertainment systems. Integration of smart TVs, voice assistants, connected speakers, and home automation devices enhances convenience, comfort, and energy efficiency in households. Increasing urbanization, high disposable incomes, and technology-savvy consumers are fueling adoption. Companies are introducing advanced solutions with seamless connectivity, AI-powered features, and personalized entertainment options. Government initiatives promoting smart city infrastructure and IoT adoption further support market growth. The trend toward home-based entertainment, remote work, and smart home integration ensures a steady increase in demand for connected living room products across China.

India’s connected living room market is expanding at a CAGR of 10.0%, driven by increasing consumer interest in smart home technology and home entertainment solutions. Smart TVs, voice-controlled devices, connected lighting, and entertainment systems are becoming mainstream in urban households. Rising internet penetration, mobile device usage, and affordable smart devices boost market adoption. Government programs promoting digital infrastructure, IoT connectivity, and smart home adoption accelerate growth. Consumers are increasingly seeking personalized experiences, energy efficiency, and remote accessibility in home entertainment. As urbanization, disposable income, and tech-savviness grow, the Indian connected living room market is poised for robust growth, with manufacturers introducing innovative and affordable solutions.

The connected living room market in Germany is growing at a CAGR of 9.2%, supported by demand for smart home integration, IoT connectivity, and advanced entertainment solutions. Consumers increasingly adopt smart TVs, connected speakers, lighting controls, and home automation devices for convenience, energy efficiency, and personalized experiences. Germany’s high disposable income, technological literacy, and focus on energy-efficient solutions promote the adoption of connected living room products. Manufacturers focus on integrating AI, voice control, and seamless device connectivity to enhance user experience. Regulatory support for energy efficiency and smart home technologies, coupled with urbanization and digital infrastructure development, further strengthens market growth.

The connected living room market in the United Kingdom is expanding at a CAGR of 7.6%, driven by smart home adoption, home entertainment needs, and energy efficiency awareness. Smart TVs, connected speakers, lighting systems, and home automation devices are widely adopted in urban households. Government initiatives supporting energy-efficient homes, IoT adoption, and digital infrastructure boost market growth. Increasing consumer demand for seamless connectivity, remote access, and personalized entertainment experiences further accelerates adoption. Manufacturers focus on integrating AI, voice assistants, and cross-device connectivity to enhance user convenience. With rising awareness and adoption of smart home technologies, the UK connected living room market is expected to maintain steady growth.

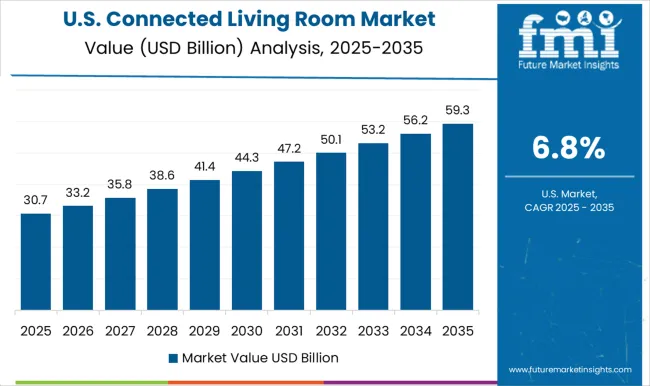

The United States connected living room market is projected to grow at a CAGR of 6.8%, with connected devices becoming the core of household entertainment. By 2024, more than 83% of the 122 million TV households owned smart TVs, reflecting a shift toward integrated operating systems that reduce dependence on external streaming sticks. Competitive strength is distributed among Roku, Fire TV, Samsung, Apple, and Google, each expanding ecosystems through partnerships with television manufacturers and streaming services.

Consumer preference for seamless integration is shaping demand for larger 4K and 8K panels, Dolby Atmos soundbars, and AI powered voice assistants. Streaming behavior is evolving, as subscription fatigue has led to rising adoption of ad supported tiers across platforms. The market outlook is seen as innovation led, where hardware advances, ecosystem lock ins, and content driven experiences together sustain demand momentum.

The connected living room market encompasses smart TVs, voice-controlled devices, streaming media players, sound systems, and home automation solutions that enhance entertainment, convenience, and user interactivity. Growth in this sector is driven by rising consumer demand for immersive home entertainment experiences, the proliferation of smart home ecosystems, and advancements in AI, IoT, and high-speed internet connectivity. Amazon.com, Inc. is a key player with its Fire TV and Echo devices, integrating streaming, voice control, and smart home capabilities. Apple Inc. contributes with Apple TV and HomeKit integration, providing seamless ecosystem connectivity and premium user experiences.

Bose Corporation focuses on high-quality audio solutions, offering smart speakers and soundbars that enhance home entertainment systems. Google LLC delivers connected living room solutions through Chromecast, Google TV, and Nest devices, combining streaming, voice assistant functionality, and smart home integration. LG Electronics offers smart TVs and home entertainment systems featuring AI-based interfaces and webOS platforms for intuitive user interaction. Microsoft Corporation, through Xbox and associated entertainment services, contributes interactive gaming and media streaming capabilities. NVIDIA Corporation provides streaming and AI-driven graphics solutions via its SHIELD TV, enhancing high-performance media experiences. These companies lead the connected living room market by leveraging technology innovation, ecosystem compatibility, and premium design, catering to consumers seeking interactive, high-quality, and convenient home entertainment solutions. The market continues to expand as smart devices and digital content consumption grow, enabling fully integrated and immersive living room experiences.

| Item | Value |

|---|---|

| Quantitative Units | USD 55.4 Billion |

| Type | Smart TVs, Gaming Consoles, Computer and Laptop, Smart Speakers, Smartphones and Tablets, and Others |

| Technology | Wi-Fi, Bluetooth, and Others |

| Application | Video Streaming, Audio Streaming, Gaming, and Security |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon.com, Inc., Apple Inc., Bose Corporation, Google LLC, LG Electronics, Microsoft Corporation, and NVIDIA Corporation |

| Additional Attributes | Dollar sales vary by product type, including smart TVs, set-top boxes, smart speakers, smart lighting, and home entertainment systems; by technology, spanning IoT-enabled devices, AI-powered assistants, and smart home automation platforms; by application, such as residential, commercial, and hospitality; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by increasing adoption of smart home technologies, rising consumer preference for integrated home entertainment and automation, expansion of high-speed internet and 5G networks, AI and voice assistant integration, and demand for energy-efficient and connected home solutions. |

The global connected living room market is estimated to be valued at USD 55.4 billion in 2025.

The market size for the connected living room market is projected to reach USD 119.6 billion by 2035.

The connected living room market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in connected living room market are smart tvs, gaming consoles, computer and laptop, smart speakers, smartphones and tablets and others.

In terms of technology, wi-fi segment to command 53.2% share in the connected living room market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Connected Sensors Market Size and Share Forecast Outlook 2025 to 2035

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Connected RHM (Remote Healthcare Monitoring) Market Size and Share Forecast Outlook 2025 to 2035

Connected Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Connected Packaging Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Connected Vehicle Technology Market Size and Share Forecast Outlook 2025 to 2035

Connected Tire Market Size and Share Forecast Outlook 2025 to 2035

Connected Logistics Market Growth - Trends, Demand & Innovations 2025 to 2035

Connected Drug Delivery Devices Market Size and Share Forecast Outlook 2025 to 2035

Connected Home Surveillance Devices Market Growth - Trends & Forecast 2025-2035

Connected Game Console Market Analysis by Product Type, Application, and Region through 2035

Understanding Connected TV Market Share & Growth Trends

Connected TV’s Market Outlook 2025 to 2035

Connected Healthcare Market

Connected Car Market Growth – Trends & Forecast 2024-2034

AI-Driven Smart Home Appliances – Enhancing Home Automation

Connected Lighting Platform Market

Connected Enterprise Video Surveillance Solutions Market

Connected Energy Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA