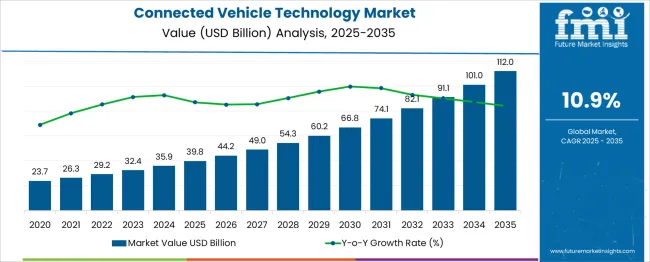

The Connected Vehicle Technology Market is estimated to be valued at USD 39.8 billion in 2025 and is projected to reach USD 112.0 billion by 2035, registering a compound annual growth rate (CAGR) of 10.9% over the forecast period. During this phase, the market will be driven by increasing adoption of advanced telematics systems, connected navigation, and safety technologies such as V2X (vehicle-to-everything) communication, as well as regulatory requirements for autonomous driving systems.

The market will expand from USD 39.8 billion to USD 66.8 billion, accounting for 43.2% of the total forecasted growth, driven by rising demand for enhanced vehicle connectivity and infotainment solutions. The second half (2030–2035) will contribute USD 46.2 billion, representing 56.8% of the total growth, reflecting the rapid adoption of autonomous driving features, enhanced driver assistance systems (ADAS), and AI-enabled vehicle control systems. Annual increments will rise from USD 5.4 billion in the early years to USD 9.2 billion by 2035, driven by technological advancements and strong growth in electric vehicle adoption. Companies focusing on AI, 5G connectivity, cybersecurity, and IoT integration in vehicles will capture significant value within this USD 73.2 billion growth window, particularly in regions like North America, Europe, and Asia-Pacific, where connected vehicle demand is accelerating.

| Metric | Value |

|---|---|

| Connected Vehicle Technology Market Estimated Value in (2025 E) | USD 39.8 billion |

| Connected Vehicle Technology Market Forecast Value in (2035 F) | USD 112.0 billion |

| Forecast CAGR (2025 to 2035) | 10.9% |

The connected vehicle technology market is evolving rapidly due to advancements in real-time communication infrastructure, stringent automotive safety mandates, and rising demand for intelligent transport systems. Governments and OEMs are increasingly collaborating to develop smart mobility ecosystems that rely on vehicle-to-everything (V2X) integration for traffic optimization, collision avoidance, and autonomous driving capabilities.

High-speed connectivity enabled by 5G, along with edge computing and AI-based telematics, is reshaping how vehicles interact with their surroundings. Software-defined vehicle architecture and continuous firmware upgrades are enabling automakers to introduce features remotely, enhancing both performance and safety post-sale.

The integration of cybersecurity frameworks into connected systems and a growing preference for predictive maintenance and infotainment services are further accelerating adoption. Moving forward, policy support, digital infrastructure deployment, and cross-sector collaborations are expected to reinforce scalable implementation across developed and emerging markets.

The connected vehicle technology market is segmented by technology, vehicle, application, end use, and geographic regions. The connected vehicle technology market is divided into V2X communication and embedded systems. In terms of vehicles, the connected vehicle technology market is classified into Passenger cars and commercial vehicles. Based on the application of the connected vehicle technology market, it is segmented into Safety and security, Autonomous driving, Mobility as a Service (MaaS), Infotainment, Fleet management, Vehicle diagnostics and maintenance. The end use of the connected vehicle technology market is segmented into OEMs and the Aftermarket. Regionally, the connected vehicle technology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

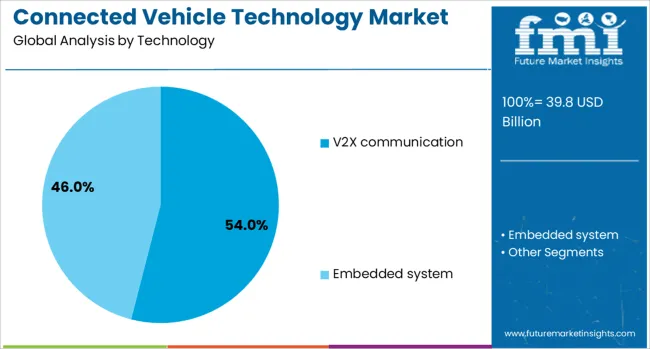

V2X communication is anticipated to account for 54.0% of the total connected vehicle technology market revenue in 2025, emerging as the dominant technology segment. Its leadership is attributed to its ability to facilitate direct and real-time data exchange between vehicles, infrastructure, pedestrians, and networks, enhancing traffic efficiency and road safety.

The segment has been favored by increasing investments in 5G-V2X testbeds, urban mobility pilots, and national ITS (intelligent transport systems) policies. Its flexibility to support applications such as lane-change assistance, blind spot warnings, and intersection management has elevated its relevance for both ADAS and autonomous driving systems.

As regulatory agencies emphasize crash prevention and traffic decongestion, V2X is being positioned as a core technology enabler, supported by automotive alliances and smart city frameworks.

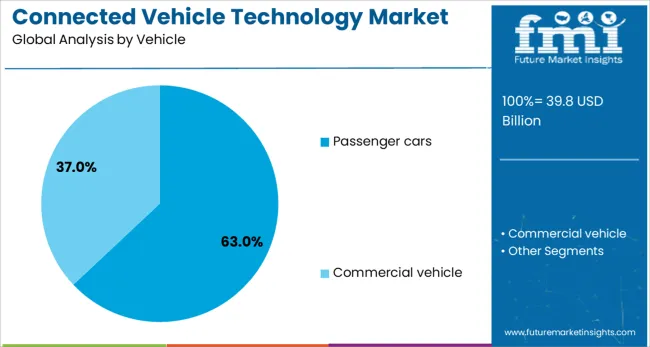

Passenger cars are projected to generate 63.0% of the connected vehicle technology market revenue in 2025, establishing themselves as the leading vehicle segment. Growth in this category is being driven by high consumer adoption of digital cockpit features, rising demand for in-vehicle connectivity, and integration of real-time navigation and driver-assist systems.

Automakers are increasingly embedding telematics control units and over-the-air (OTA) functionality in mid-range and premium car models to meet rising expectations for personalization and convenience. As urban mobility solutions evolve, connected passenger cars are being designed to operate as digital nodes, enabling vehicle-to-cloud interactions and seamless data sharing.

Stringent safety regulations and customer demand for enhanced infotainment, diagnostics, and remote servicing have reinforced the segment’s dominance in global deployments.

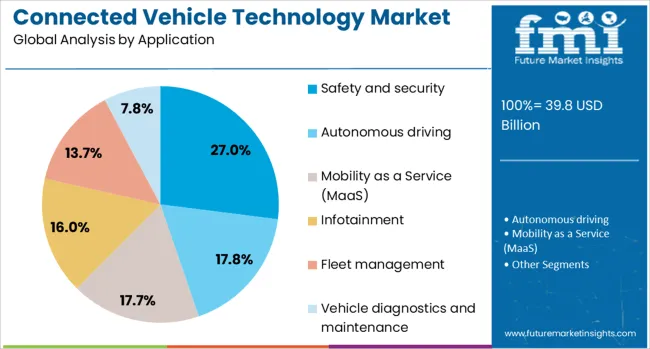

Safety and security applications are expected to contribute 27.0% of the total market share in 2025, making them the leading application area for connected vehicle technology. Their prominence stems from the growing emphasis on accident prevention, emergency response coordination, and theft deterrence systems.

Advanced driver-assistance features like automatic emergency braking, vehicle tracking, SOS calling, and predictive collision warnings are now fundamental in regulatory frameworks across key automotive markets. Consumer awareness of safety ratings and demand for secure, digitally traceable vehicle systems have led OEMs to prioritize connectivity for protection features.

The integration of AI, sensor fusion, and vehicle-to-network communication has enhanced the responsiveness and reliability of safety protocols, establishing this segment as the cornerstone of connected mobility strategies.

The connected vehicle technology market is expanding due to increased demand for safety, efficiency, and autonomous driving features. Growth in 2024 and 2025 was driven by regulatory mandates for vehicle-to-everything (V2X) communication and advancements in 5G connectivity. Opportunities are evident in the integration of AI-powered systems, real-time diagnostics, and enhanced navigation features. Emerging trends include over-the-air updates and the shift toward autonomous fleets. However, challenges such as data security concerns, high integration costs, and infrastructure limitations pose significant barriers to widespread adoption.

The major growth driver is the increasing regulatory push for safety standards and consumer preference for enhanced in-vehicle experiences. In 2024 and 2025, government initiatives mandated advanced driver-assistance systems (ADAS) and V2X technologies in commercial and passenger vehicles, driving market demand. Consumers’ increasing interest in in-car connectivity features like real-time traffic updates, automated parking, and predictive maintenance further supported adoption. These factors emphasize that regulatory compliance and consumer convenience remain crucial drivers for the connected vehicle technology market globally.

Significant opportunities lie in autonomous vehicle development and AI-driven features. In 2025, the integration of AI-powered predictive maintenance and real-time data analytics offered cost-saving benefits to fleet operators. Autonomous vehicle manufacturers sought to deploy V2X technology for enhanced vehicle communication and collision avoidance systems. Additionally, partnerships between automotive companies and tech firms for AI integration in vehicle systems opened new avenues for growth. These developments suggest that investing in AI-based solutions for self-driving capabilities will capture substantial market share in the rapidly evolving automotive landscape.

Emerging trends highlight the integration of over-the-air (OTA) updates and the expansion of V2X technologies. In 2024, automotive manufacturers deployed OTA updates for vehicle software, enabling remote performance improvements and enhancing consumer satisfaction. V2X communication systems became essential for improving safety and efficiency in traffic management, particularly in urban areas. Additionally, the rise of shared and electric vehicle fleets contributed to demand for connected services, driving the need for centralized vehicle data management. These innovations demonstrate a shift toward greater interconnectivity and operational flexibility in the automotive industry.

Key restraints include data security concerns and infrastructure limitations. In 2024 and 2025, the increase in vehicle-generated data raised privacy and security challenges, particularly concerning the protection of driver information. Additionally, the integration of connected vehicle systems with existing infrastructure, such as 5G networks and smart city grids, remained inconsistent in some regions, limiting the technology’s widespread implementation. These factors underline the need for robust cybersecurity protocols and investment in smart infrastructure to ensure secure and reliable connectivity for connected vehicle technologies in the future.

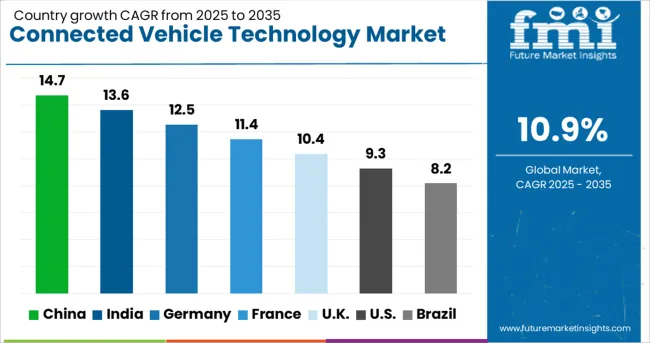

| Country | CAGR |

|---|---|

| China | 14.7% |

| India | 13.6% |

| Germany | 12.5% |

| France | 11.4% |

| UK | 10.4% |

| USA | 9.3% |

| Brazil | 8.2% |

The global connected vehicle technology market is projected to grow at 10.9% CAGR from 2025 to 2035. China leads at 14.7% CAGR, driven by strong government initiatives and high adoption of smart infrastructure in urban areas. India follows at 13.6%, supported by the rising demand for safety and connectivity features in vehicles, particularly in emerging markets. Germany records 12.5% CAGR, emphasizing automotive innovation, IoT integration, and industry collaborations in the manufacturing sector. The United Kingdom grows at 10.4%, while the United States posts 9.3%, reflecting steady adoption in mature automotive markets with increasing demand for autonomous driving features and integrated infotainment systems. Asia-Pacific leads in terms of growth, while Europe and North America focus on advanced safety features and IoT connectivity. This report includes insights on 40+ countries; the top markets are shown here for reference.

The connected vehicle technology market in China is forecasted to grow at 14.7% CAGR, supported by government-backed smart city initiatives and the widespread adoption of 5G networks for connected car infrastructure. The demand for advanced driver assistance systems (ADAS), including autonomous driving features, increases across the country. China’s leadership in electric vehicles (EVs) further accelerates the use of connected technologies for smart charging and battery management. Additionally, strong partnerships between automakers and tech firms drive innovation in vehicle-to-vehicle (V2V) communication and telematics.

The connected vehicle technology market in India is projected to grow at 13.6% CAGR, driven by rapid urbanization, government regulations on safety features, and rising consumer demand for smart connectivity in vehicles. With increasing adoption of telematics and infotainment systems in passenger and commercial vehicles, OEMs focus on integrating 4G and 5G networks to improve data connectivity. Growth in electric and hybrid vehicles further contributes to demand for connected solutions, with features such as remote diagnostics, smart charging, and real-time tracking becoming critical.

The connected vehicle technology market in Germany is expected to grow at 12.5% CAGR, driven by Germany’s strong automotive sector, regulatory pressure on emissions, and the shift toward autonomous driving technologies. Innovations in ADAS, autonomous vehicles, and vehicle-to-everything (V2X) communication lead the market, while 5G networks enable faster and more reliable connectivity for connected cars. Manufacturers also focus on in-vehicle data analytics for enhancing safety features and vehicle performance monitoring.

The connected vehicle technology market in the United Kingdom is forecasted to grow at 10.4% CAGR, supported by advancements in automotive safety features and consumer demand for enhanced infotainment systems. With the increasing rollout of 5G, the UK is accelerating the deployment of connected car technologies, including V2X communication and autonomous driving features. The UK government’s focus on electric mobility and smart infrastructure enhances the integration of connected vehicle systems for smarter energy management and traffic flow control.

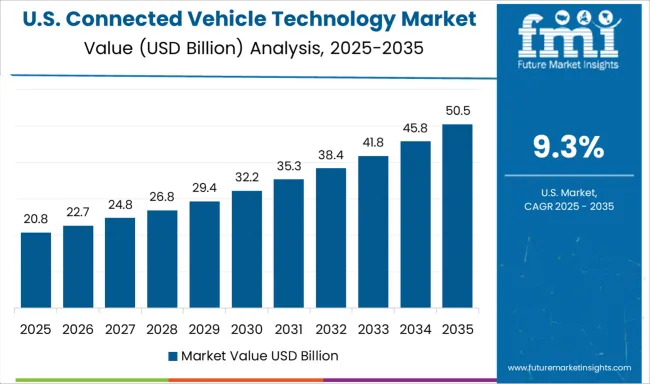

The connected vehicle technology market in the United States is projected to grow at 9.3% CAGR, reflecting steady adoption in a mature automotive market. Demand for connected vehicle solutions is growing in both passenger and commercial segments, driven by innovations in autonomous vehicles, ADAS, and connected infotainment. OEMs and tech companies focus on developing 5G-enabled in-car connectivity, while regulatory efforts on vehicle emissions and safety accelerate the integration of advanced sensors and real-time monitoring systems for fleet management.

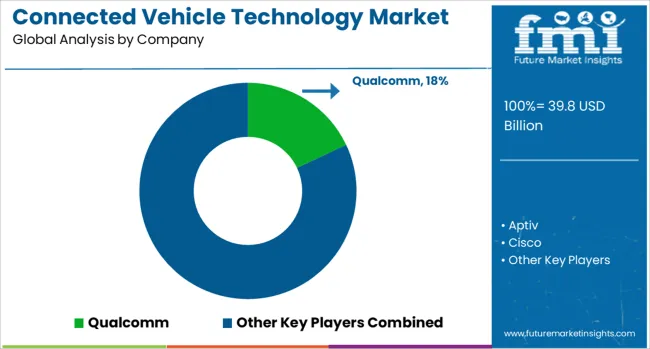

The connected vehicle technology market is dominated by Qualcomm, which secures its leadership through a wide range of semiconductor solutions designed to enable vehicle connectivity, including 5G communication, in-car networking, and autonomous driving systems. Qualcomm strengthens its dominant position with advanced chipsets and strong partnerships with automakers, technology providers, and telecom operators. Key players such as Aptiv, Ericsson, Harman, Intel, Denso, and NXP Semiconductors maintain significant market shares by offering a broad spectrum of connectivity solutions, including vehicle-to-everything (V2X) communication, infotainment systems, and ADAS (advanced driver-assistance systems).

These companies focus on integrating IoT technologies, improving vehicle safety, and enhancing the in-car user experience. Emerging players like Cisco, Microsoft, and Waymo are gaining traction by focusing on software, cloud-based platforms, and autonomous vehicle technologies.

Their strategies include developing scalable solutions for data management, connectivity infrastructure, and cloud-to-vehicle communications. Market growth is driven by increasing demand for autonomous driving, improved vehicle safety features, and the need for seamless communication between vehicles, infrastructure, and the cloud. Continuous advancements in 5G connectivity, edge computing, and real-time data processing are expected to influence competitive dynamics, opening up opportunities for both established players and emerging innovators to lead in this rapidly evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.8 Billion |

| Technology | V2X communication and Embedded system |

| Vehicle | Passenger cars and Commercial vehicle |

| Application | Safety and security, Autonomous driving, Mobility as a Service (MaaS), Infotainment, Fleet management, and Vehicle diagnostics and maintenance |

| End use | OEMs and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Qualcomm, Aptiv, Cisco, Denso, Ericsson, Harman, Intel, Microsoft, NXP Semiconductors, and Waymo |

| Additional Attributes | Dollar sales by connectivity type (embedded, tethered, integrated) and vehicle class (passenger, commercial, electric). North America leads, followed by Europe and Asia-Pacific. Growth driven by OTA updates, V2X communication, ADAS, and autonomous driving. Innovations focus on cybersecurity, compliance with ISO/SAE 21434, and expanding digital ecosystems. |

The global connected vehicle technology market is estimated to be valued at USD 39.8 billion in 2025.

The market size for the connected vehicle technology market is projected to reach USD 112.0 billion by 2035.

The connected vehicle technology market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types in connected vehicle technology market are v2x communication and embedded system.

In terms of vehicle, passenger cars segment to command 63.0% share in the connected vehicle technology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Interior Air Quality Monitoring Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vehicle-Mounted Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Connected Sensors Market Size and Share Forecast Outlook 2025 to 2035

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Connected RHM (Remote Healthcare Monitoring) Market Size and Share Forecast Outlook 2025 to 2035

Connected Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Connected Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA