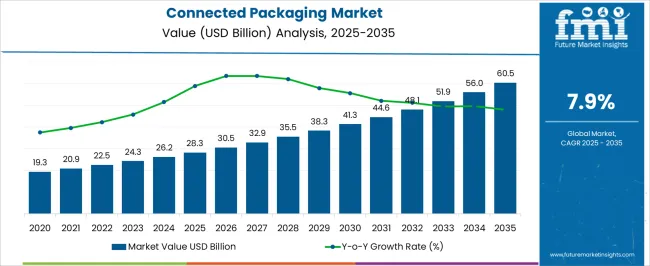

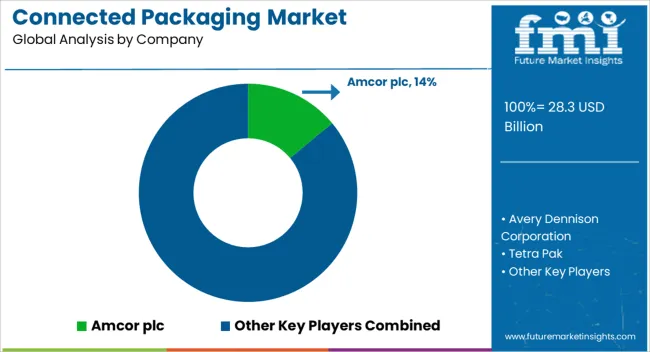

The connected packaging market is estimated to be valued at USD 28.3 billion in 2025 and is projected to reach USD 60.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

The curve takes on a compounding shape, reflecting how digitalization in consumer engagement and smart packaging technologies are driving incremental adoption year over year. From USD 19.3 billion in the early part of the timeline to more than USD 60 billion by the end, the market trajectory showcases both consistency and resilience. This rise is fueled by increasing demand for traceability in food, beverages, and pharmaceuticals, as well as by regulatory emphasis on sustainability and transparency in supply chains. The curve shape also highlights an inflection point around 2029–2031, where adoption of QR-enabled packaging, NFC tags, and blockchain-based traceability solutions becomes mainstream, contributing to sharper year-on-year increments.

Advancements in IoT and AI-powered analytics integrated with packaging enhance not just consumer interaction but also provide manufacturers with real-time data to optimize inventory and customer engagement strategies. The consistent steepness of the curve indicates robust long-term prospects, ensuring that connected packaging evolves from a marketing tool into an operational necessity across industries by 2035.

| Metric | Value |

|---|---|

| Connected Packaging Market Estimated Value in (2025 E) | USD 28.3 billion |

| Connected Packaging Market Forecast Value in (2035 F) | USD 60.5 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The connected packaging market secures a significant position within the global smart packaging ecosystem, representing nearly 30–33% share due to its integration of digital technologies such as QR codes, NFC tags, and AR interfaces that enhance consumer engagement and product traceability. Within the broader packaging innovation category, connected solutions hold around 22–24% share, supported by growing adoption among food, beverage, and pharmaceutical companies seeking transparency and direct-to-consumer communication. In the supply chain and logistics monitoring segment, connected packaging contributes nearly 16–18% share, as embedded digital identifiers improve real-time tracking, inventory control, and anti-counterfeiting measures. Within the digital marketing and brand engagement domain, its share stands at approximately 12–14%, reflecting the role of smart labels and interactive packaging in boosting customer loyalty and personalized experiences.

Growth momentum is being fueled by rising demand for traceability, regulatory pressures on product authenticity, and consumer interest in interactive experiences. Brand owners are investing in cloud-based platforms, blockchain integration, and IoT-enabled packaging ecosystems to expand visibility and engagement. While high implementation costs and technical integration challenges pose barriers, the adoption trajectory continues to strengthen. Strategic partnerships between packaging converters, digital solution providers, and consumer goods companies are accelerating the development of scalable models, positioning connected packaging as a cornerstone of future-ready packaging strategies across global industries.

The market is experiencing rapid expansion as brands and manufacturers increasingly integrate digital touchpoints into physical products to enhance consumer engagement, supply chain transparency, and brand protection. The market is being driven by the adoption of technologies that connect packaging to digital ecosystems, enabling interactive experiences and real-time data capture. Regulatory pressures for traceability, the growing focus on sustainability, and the rising need for anti-counterfeiting measures are accelerating adoption.

Advancements in mobile scanning, cloud platforms, and IoT integration have allowed packaging to serve as a dynamic channel for customer communication and loyalty building. In addition, the proliferation of smartphones and internet connectivity has broadened consumer access to connected features, making them more effective for marketing and compliance purposes.

The future outlook remains positive, supported by ongoing investments from packaging innovators, retailers, and consumer goods companies This evolving landscape is expected to deliver new revenue streams and operational efficiencies, reinforcing connected packaging as a core element of digital transformation strategies.

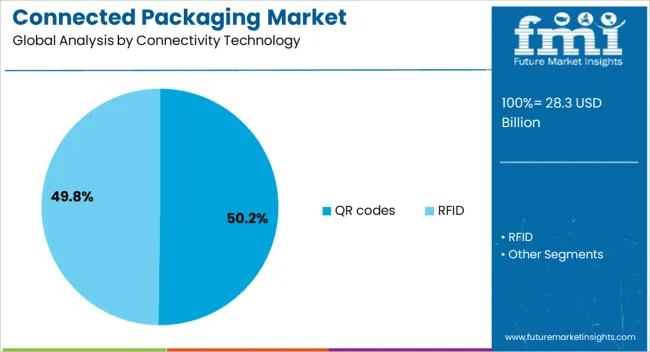

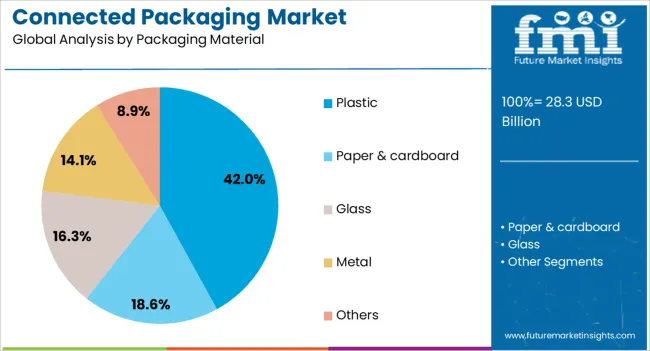

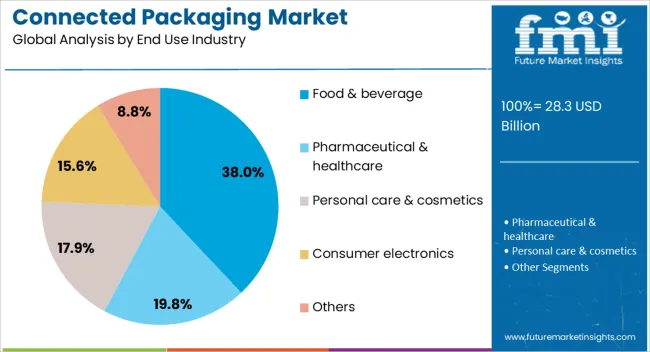

The connected packaging market is segmented by connectivity technology, packaging material, end use industry, and geographic regions. By connectivity technology, connected packaging market is divided into QR codes and RFID. In terms of packaging material, connected packaging market is classified into plastic, paper & cardboard, glass, metal, and others. Based on end use industry, connected packaging market is segmented into food & beverage, pharmaceutical & healthcare, personal care & cosmetics, consumer electronics, and others. Regionally, the connected packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The QR codes connectivity technology segment is projected to hold 50.20% of the connected packaging market revenue share in 2025, positioning it as the leading connectivity technology. This dominance is attributed to the ease of implementation, low cost, and broad compatibility of QR codes with consumer devices. Their ability to be printed directly on packaging without altering the overall design has supported widespread adoption across industries. QR codes have also been preferred for their flexibility, allowing dynamic content updates and integration with analytics platforms for real-time tracking of customer interactions. The growth of mobile commerce and the increasing reliance on direct-to-consumer engagement have further reinforced their prominence. As brands seek to deliver personalized content and verify product authenticity, QR codes have provided a reliable and scalable solution Their adaptability to both marketing and regulatory compliance needs has strengthened their role as a central component in connected packaging strategies.

The plastic packaging material segment is expected to account for 42% of the market revenue share in 2025, making it the leading packaging material. This position has been driven by the versatility, durability, and cost-effectiveness of plastic in various packaging applications. Plastic materials have provided an ideal surface for printing and embedding connected features, including QR codes and NFC tags, without compromising structural integrity. The segment’s growth has also been supported by advancements in recyclable and biodegradable plastic solutions, addressing sustainability concerns while maintaining functional benefits. The lightweight nature of plastic has contributed to reduced transportation costs and improved supply chain efficiency. Its compatibility with high-volume manufacturing processes and ability to maintain product safety have further solidified its dominance As connected packaging expands into mass-market products, plastic’s balance of performance, cost, and adaptability ensures its continued leadership.

The food and beverage segment is projected to command 38% of the market revenue share in 2025, making it the largest end-use industry. This leadership is a result of increasing consumer demand for transparency, safety, and convenience in food and beverage products. Connected packaging has enabled producers to provide real-time information on ingredients, sourcing, and expiration dates, supporting both regulatory compliance and consumer trust. The segment’s growth has been further driven by the integration of interactive features that enhance brand engagement and loyalty through promotions, recipes, and sustainability messaging. The high turnover rate of food and beverage products has created frequent opportunities for implementing connected technologies at scale. Additionally, the industry’s investment in smart supply chain solutions has reinforced the role of connected packaging in ensuring traceability and reducing waste With growing emphasis on digital consumer experiences and safety assurance, this segment is expected to maintain its dominant market position.

The connected packaging market is shaped by rising consumer engagement, stronger supply chain integration, regulatory compliance, and cost challenges. Its dual role as both a marketing tool and operational asset drives continued adoption.

The connected packaging industry is witnessing rapid adoption as brands seek to build stronger connections with consumers. By embedding digital features such as QR codes, NFC tags, and AR-enabled labels, companies can share product information, promotions, and interactive experiences. This creates transparency in sourcing, ingredients, and authenticity while driving loyalty through personalized content. Consumer goods companies in food, beverages, and cosmetics are leveraging connected packaging to differentiate in competitive markets. The ability to transform packaging into a communication channel has made it a vital marketing tool. This shift reflects the growing importance of packaging not only as a protective medium but also as a digital gateway for customer interaction.

Connected packaging has become essential for supply chain visibility, offering real-time data collection and traceability across logistics networks. Embedded identifiers enable stakeholders to track product location, condition, and movement, improving operational efficiency. This level of insight reduces risks related to counterfeiting, spoilage, and stock shortages while supporting regulatory compliance in pharmaceuticals and food industries. Logistics providers benefit from digital packaging that integrates with IoT platforms and cloud-based dashboards, enabling predictive inventory management. The value extends beyond efficiency by improving transparency for end consumers who demand detailed product journeys. This expansion in supply chain applications highlights the dual utility of connected packaging in operations and consumer-facing roles.

Governments and industry bodies are driving adoption of connected packaging as stricter regulations around authenticity, labeling, and safety intensify. Pharmaceutical firms are under pressure to implement packaging that ensures tamper evidence and provides digital records of supply chain movements. Food manufacturers are adopting smart labels to provide consumers with nutritional and sourcing data in compliance with local and international regulations. The healthcare sector is also advancing the use of track-and-trace systems for patient safety. These compliance-driven requirements push companies to integrate digital features into packaging formats. By meeting regulatory obligations while also serving consumer interests, connected packaging strengthens its position as both a protective and value-added tool.

Connected packaging faces hurdles due to implementation costs and integration challenges across large-scale operations. Developing interactive features and integrating them into existing packaging lines requires upfront investment and technological expertise. Smaller manufacturers in cost-sensitive regions often hesitate to adopt these solutions without clear ROI visibility. Concerns also exist around data management, cybersecurity, and compatibility with existing IT infrastructure. To overcome these barriers, companies are exploring partnerships with tech providers and investing in scalable models that balance cost and functionality. While challenges remain, the benefits of engagement, compliance, and efficiency continue to push adoption upward across industries.

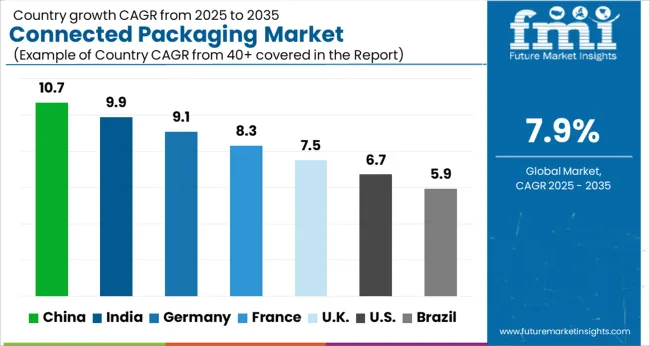

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

| USA | 6.7% |

| Brazil | 5.9% |

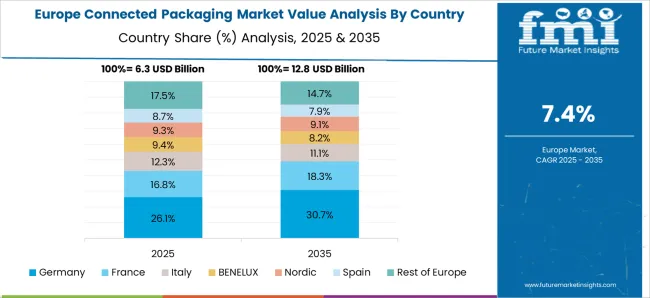

The connected packaging market is projected to expand globally at a CAGR of 7.9% from 2025 to 2035, supported by rising adoption of smart labels, QR codes, and NFC-enabled packaging across food, beverage, and pharmaceutical sectors. China leads with a CAGR of 10.7%, fueled by rapid consumer digitalization, large-scale adoption of traceability systems, and strong e-commerce growth. India follows at 9.9%, supported by demand for transparency in food and pharmaceutical products, government-backed digital initiatives, and growing interest in interactive packaging formats. France posts 8.3%, with momentum linked to regulatory frameworks for consumer safety and packaging innovations in cosmetics and luxury goods. The United Kingdom achieves 7.5%, shaped by adoption in retail chains and foodservice applications where consumer engagement is a priority. The United States registers 6.7%, reflecting a mature but slower market with growth largely tied to pilot deployments, regulatory compliance, and marketing-driven packaging upgrades. The analysis highlights Asia-Pacific as the fastest-growing hub, Europe as a regulation-driven adopter, and North America as a steady yet slower region prioritizing consumer engagement and compliance initiatives.

China is projected to record a CAGR of 10.7% for 2025–2035, higher than the 9.2% observed during 2020–2024, outperforming the global average of 7.9%. Early growth was linked to e-commerce adoption, smartphone penetration, and demand for QR code–based authenticity checks. The stronger increase reflects government-backed digital traceability frameworks, large-scale investment in retail technology, and consumer expectations for transparency. Food and beverage manufacturers have deployed smart packaging to meet traceability standards, while cosmetics and luxury goods brands are using interactive labels to combat counterfeiting. In my view, China will sustain its lead as manufacturers expand innovation clusters and integrate connected packaging across diverse consumer-facing industries.

India is forecasted to post a CAGR of 9.9% for 2025–2035, up from nearly 8.4% between 2020–2024, above the 7.9% global benchmark. The earlier period saw limited adoption restricted to metro-based retailers and initial pharma compliance projects. The step-up reflects the acceleration of government digital initiatives, expansion of packaged food markets, and the growing need for authenticity in pharmaceuticals. Local packaging converters are investing in cost-efficient connected packaging solutions, while FMCG companies are integrating QR codes and NFC features for consumer engagement. My assessment is that India’s rapid retail growth and regulatory tightening will keep adoption high, supported by scalable innovations.

France is expected to achieve a CAGR of 8.3% for 2025–2035, compared with around 7.0% in 2020–2024, slightly above the global 7.9% rate. The earlier stage was characterized by niche adoption in cosmetics and luxury products. The improvement comes from EU-wide compliance standards, which mandate transparency and product traceability in food, beverages, and pharmaceuticals. French brands are also leveraging connected packaging as a marketing tool, linking consumers to personalized digital content. In my perspective, the French market benefits from strong regulatory alignment and consumer preference for authenticity, making it a balanced growth region with a focus on both compliance and engagement.

The United Kingdom is projected to deliver a CAGR of 7.5% between 2025–2035, compared with nearly 6.2% in 2020–2024, below the global benchmark of 7.9%. The earlier phase was shaped by pilot projects in retail and selective use in foodservice packaging. The improvement stems from increased demand for consumer engagement, wider adoption in retail chains, and stricter compliance with labeling standards. Retailers and FMCG companies are investing in interactive packaging formats to enhance brand loyalty and provide traceability. In my assessment, the UK’s stronger momentum reflects its gradual shift from trial deployments toward mainstream integration across packaged food and beverage sectors.

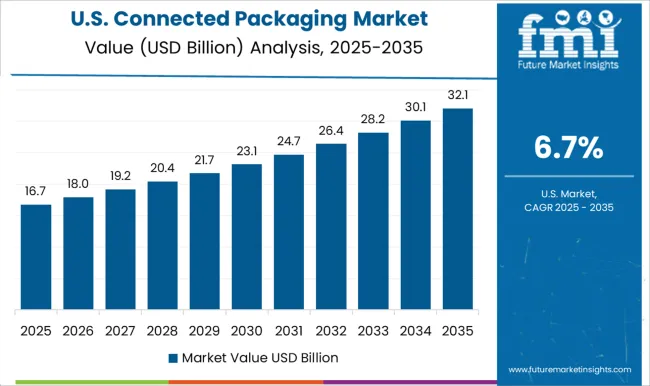

The United States is projected to post a CAGR of 6.7% for 2025–2035, up from about 5.8% during 2020–2024, under the global average of 7.9%. Earlier growth reflected pilot-scale adoption in pharmaceuticals and consumer electronics. The gradual rise comes from regulatory pressures on labeling accuracy, increased investment in consumer marketing, and brand-driven efforts to combat counterfeiting. Large FMCG and beverage companies are integrating connected packaging into their marketing campaigns, while retailers test QR-based loyalty programs. My perspective is that the US will remain a moderate-growth market, where adoption is steady but restrained by mature infrastructure and cost considerations.

The connected packaging market is shaped by leading global packaging providers, labeling specialists, and digital technology enablers including Amcor plc, Avery Dennison Corporation, Tetra Pak, Stora Enso, Huhtamäki Oyj, and Constantia Flexibles. These companies compete on packaging design innovation, integration of smart labeling technologies, scalability across sectors, and ability to support interactive consumer experiences. Amcor plc maintains a strong position by offering connected packaging solutions integrated with recyclable formats, enhancing both traceability and consumer engagement. Avery Dennison Corporation plays a pivotal role with its RFID and NFC labeling expertise, enabling smart tracking and authentication across supply chains. Tetra Pak leverages its presence in food and beverage packaging by embedding QR codes and digital platforms for consumer interaction.

Stora Enso strengthens its competitive standing by providing fiber-based packaging with embedded digital identifiers, aligning with EU compliance and consumer transparency initiatives. Huhtamäki Oyj expands its offering by combining packaging functionality with QR-enabled features, catering to global FMCG and foodservice markets. Constantia Flexibles positions itself strongly in flexible packaging with digital watermarking and traceability solutions that support both authenticity and engagement. The competitive environment is defined by partnerships with FMCG companies, retailers, and technology providers. Strategies emphasize expanding digital ecosystems, advancing authentication features to combat counterfeiting, and scaling consumer engagement platforms. Future competitiveness will depend on cost-efficient integration, stronger collaboration across supply chains, and adaptation to evolving regulatory frameworks that reinforce the role of connected packaging in global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.3 billion |

| Connectivity Technology | QR codes and RFID |

| Packaging Material | Plastic, Paper & cardboard, Glass, Metal, and Others |

| End Use Industry | Food & beverage, Pharmaceutical & healthcare, Personal care & cosmetics, Consumer electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor plc, Avery Dennison Corporation, Tetra Pak, Stora Enso, Huhtamäki Oyj, and Constantia Flexibles |

| Additional Attributes | Dollar sales, share, consumer engagement trends, supply chain traceability, regulatory compliance impact, competitor strategies, adoption in FMCG, and integration with digital marketing platforms. |

The global connected packaging market is estimated to be valued at USD 28.3 billion in 2025.

The market size for the connected packaging market is projected to reach USD 60.5 billion by 2035.

The connected packaging market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in connected packaging market are qr codes and rfid.

In terms of packaging material, plastic segment to command 42.0% share in the connected packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Connected Sensors Market Size and Share Forecast Outlook 2025 to 2035

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Connected RHM (Remote Healthcare Monitoring) Market Size and Share Forecast Outlook 2025 to 2035

Connected Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Connected Living Room Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Connected Vehicle Technology Market Size and Share Forecast Outlook 2025 to 2035

Connected Tire Market Size and Share Forecast Outlook 2025 to 2035

Connected Logistics Market Growth - Trends, Demand & Innovations 2025 to 2035

Connected Drug Delivery Devices Market Size and Share Forecast Outlook 2025 to 2035

Connected Home Surveillance Devices Market Growth - Trends & Forecast 2025-2035

Connected Game Console Market Analysis by Product Type, Application, and Region through 2035

Understanding Connected TV Market Share & Growth Trends

Connected TV’s Market Outlook 2025 to 2035

Connected Healthcare Market

Connected Car Market Growth – Trends & Forecast 2024-2034

AI-Driven Smart Home Appliances – Enhancing Home Automation

Connected Lighting Platform Market

Connected Enterprise Video Surveillance Solutions Market

Connected Energy Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA