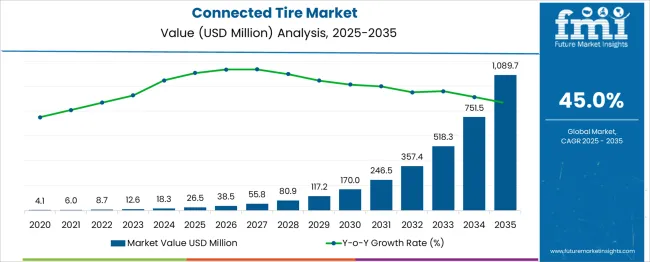

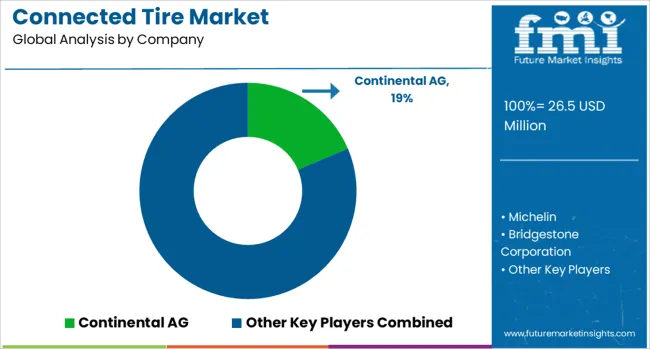

The Connected Tire Market is estimated to be valued at USD 26.5 million in 2025 and is projected to reach USD 1089.7 million by 2035, registering a compound annual growth rate (CAGR) of 45.0% over the forecast period.

| Metric | Value |

|---|---|

| Connected Tire Market Estimated Value in (2025 E) | USD 26.5 million |

| Connected Tire Market Forecast Value in (2035 F) | USD 1089.7 million |

| Forecast CAGR (2025 to 2035) | 45.0% |

Increasing integration of advanced telematics, vehicle-to-everything (V2X) communication, and sensor-based analytics is driving the adoption of connected tires across global markets.

These intelligent systems provide continuous feedback on tire pressure, temperature, tread wear, and load capacity, enabling proactive maintenance and reducing the risk of on-road failures. The market outlook remains promising due to rising consumer expectations for smart features and regulatory mandates emphasizing tire safety and fuel efficiency.

OEMs are increasingly incorporating connected tires in new models, particularly in premium and electric vehicle segments. Growth in connected vehicle infrastructure, along with rising fleet management digitalization, is expected to propel demand. The combination of performance monitoring and data-driven maintenance is positioning connected tires as a critical element in the evolving smart mobility ecosystem.

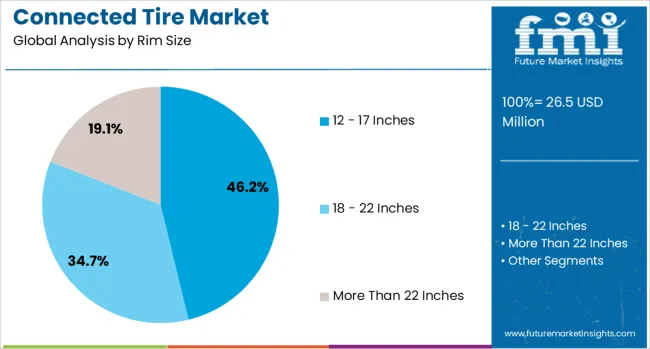

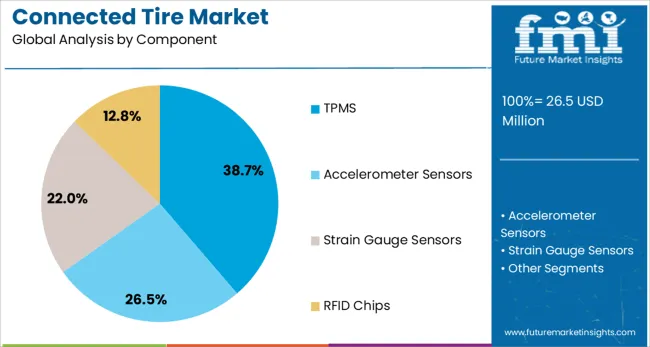

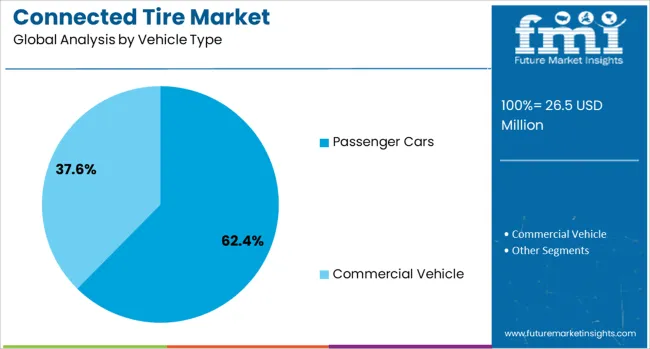

The connected tire market is segmented by rim size, component, vehicle type, propulsion, and sales channel and geographic regions. The connected tire market is divided by rim size into 12 - 17 Inches, 18 - 22 Inches, and More Than 22 Inches. In terms of components, the connected tire market is classified into TPMS, Accelerometer Sensors, Strain Gauge Sensors, and RFID Chips. Based on vehicle type, the connected tire market is segmented into Passenger Cars and Commercial Vehicles. The connected tire market is segmented by propulsion into ICE and Electric. The sales channel of the connected tire market is segmented into Aftermarket and OEM. Regionally, the connected tire industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 12 – 17 inches rim size segment holds a leading 46.2% share in the connected tire market, supported by its widespread usage across compact and mid-size passenger vehicles. This rim size is favored for its balance between performance, comfort, and cost, making it an ideal fit for the most common vehicle categories globally.

The segment has benefitted from the high production volumes of vehicles in this size range, encouraging manufacturers to standardize sensor integration and data capabilities within this category. Increasing consumer demand for real-time tire monitoring and preventive maintenance is boosting adoption in both original equipment and aftermarket channels.

Furthermore, the compatibility of connected solutions with existing rim structures allows for easier deployment without significant design changes. As mid-segment passenger cars continue to dominate global vehicle sales, the 12 - 17 inches rim size segment is expected to maintain its dominance in the near term, supported by affordability and market scalability.

The Tire Pressure Monitoring System (TPMS) segment leads the component category with a 38.7% share, driven by its critical role in enhancing road safety, tire longevity, and fuel efficiency. TPMS has become a regulatory requirement in many regions, accelerating its integration into new vehicle models and making it the most prevalent connected tire component.

Its ability to provide real-time alerts on tire pressure deviations enables drivers to take corrective actions, reducing accident risk and improving overall vehicle performance. The adoption of direct TPMS, which includes in-tire sensors capable of transmitting accurate, real-time data, is gaining traction across both OEM and aftermarket channels.

Additionally, TPMS data is increasingly being utilized for advanced analytics in fleet management platforms, contributing to operational efficiency and reduced downtime. With increasing consumer awareness and regulatory backing, TPMS is expected to remain the cornerstone of connected tire technology adoption.

The passenger cars segment accounts for a commanding 62.4% share of the connected tire market, reflecting the rapid integration of smart tire technologies in this high-volume vehicle category. Increasing consumer demand for connected and intelligent driving experiences has encouraged automakers to embed tire sensors and data systems as standard or optional features in passenger car models.

The segment is further supported by rising electric vehicle production, where efficiency and predictive maintenance are critical, making connected tires a natural complement. OEM collaborations with tire manufacturers have accelerated the commercialization of sensor-embedded tires, particularly in the premium and EV subsegments.

Additionally, growth in urban mobility, shared vehicle platforms, and long-distance commuting is reinforcing the value proposition of connected tires in enhancing safety, comfort, and vehicle performance. As passenger cars continue to evolve with next-generation connectivity and autonomy features, this segment is expected to drive sustained growth in the connected tire ecosystem.

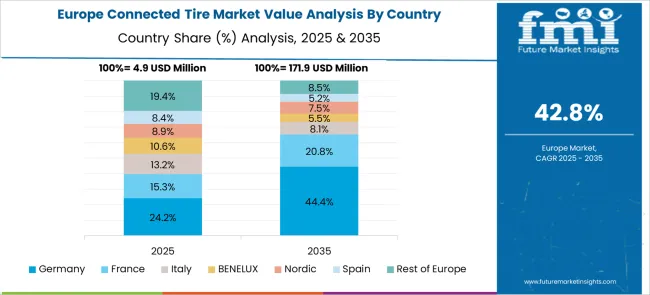

Demand for connected tires is growing due to integration in fleet safety systems and vehicle intelligence platforms. Sales are rising sharply in regions prioritizing predictive maintenance, regulatory compliance, and EV efficiency. Europe leads adoption while Asia-Pacific shows the fastest growth in deployment scale and retrofit installations.

Demand for connected tires increased by 42% in 2024, supported by growing adoption in passenger vehicles and logistics fleets. Sensors tracking pressure, temperature, and tread depth helped reduce tire-related breakdowns by 31% and improve fuel efficiency by 4%. Integration with onboard diagnostic systems enabled real-time alerts and preventive maintenance scheduling. In fleet operations, downtime reductions of 22% were observed as predictive models prioritized tire replacements based on wear data. Use is strongest in vehicles operating under high-load or long-haul conditions where safety compliance and uptime are critical.

Sales of sensor-integrated tire platforms rose 38% year-over-year in 2024, with Europe accounting for the highest deployment share due to early regulatory mandates and integration in advanced driver assistance systems. Asia-Pacific experienced the highest growth rate, driven by rising EV penetration and smart fleet modernization. OEMs in China, Japan, and South Korea are embedding connected tire features in new models to improve road safety and after-sales service. Retrofitting in commercial fleets has grown rapidly, helping reduce maintenance costs and enabling telematics-driven performance insights.

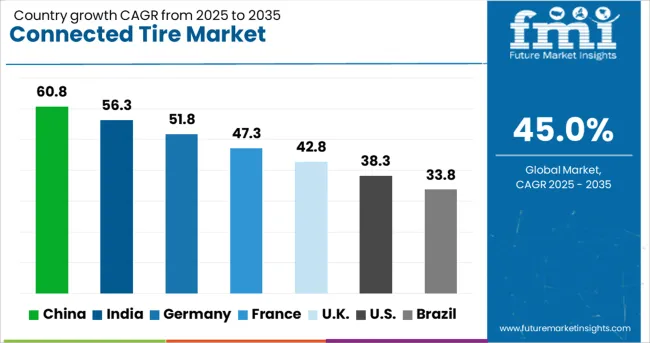

| Country | CAGR |

|---|---|

| China | 60.8% |

| India | 56.3% |

| Germany | 51.8% |

| France | 47.3% |

| UK | 42.8% |

| USA | 38.3% |

| Brazil | 33.8% |

The global market is expected to expand at a staggering CAGR of 45.0% between 2025 and 2035, driven by the shift toward autonomous vehicles, real-time fleet monitoring, and vehicle safety compliance. China leads the pack with a CAGR of 60.8%, backed by aggressive EV adoption, smart logistics infrastructure, and government mandates for IoT integration in transportation. India, growing at 56.3%, is witnessing rapid digitization in commercial fleet management and an uptick in demand from tech-enabled vehicle leasing platforms. Germany, with a CAGR of 51.8%, benefits from high R&D in tire sensor integration by premium auto OEMs and robust aftermarket demand. The UK, at 42.8%, is focusing on intelligent transport systems and sustainable mobility innovations. The US, at 38.3%, sees rising demand from shared mobility fleets and highway safety programs. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 60.8% CAGR, driven by rapid EV adoption, government-backed IoT mandates, and expansion of smart logistics ecosystems. Major domestic automakers are integrating sensor-embedded tires for predictive maintenance and fleet safety monitoring. Connected tire applications in EV platforms enhance energy efficiency and real-time diagnostics. Strategic partnerships between tire manufacturers and telematics solution providers are enabling over-the-air data updates and remote performance optimization. The country’s fast-growing highway infrastructure and autonomous vehicle projects further amplify demand for connected solutions in passenger and commercial segments.

India is forecast to grow at a 56.3% CAGR, supported by digitization in fleet management and increased adoption by vehicle leasing platforms. Connected tires are being introduced in logistics corridors to improve load safety and reduce downtime through real-time pressure and temperature monitoring. Domestic tire companies are investing in embedded chip technology to integrate with telematics platforms used by commercial fleets. The government’s push for intelligent transport systems and connected vehicle frameworks is creating favorable conditions for adoption. Growth in ride-hailing and subscription-based vehicle ownership models further expands the connected tire market in urban centers.

Germany is expected to grow at a 51.8% CAGR, driven by premium automotive OEMs integrating connected tire technology as standard in high-end EVs and luxury vehicles. R&D initiatives focus on advanced tire sensor systems for road-condition detection, predictive wear analytics, and adaptive braking controls. The aftermarket segment is experiencing strong demand as connected tire kits are installed on existing vehicle fleets. Regulatory compliance with EU safety directives on connected mobility further accelerates adoption. German automakers are partnering with software firms to enable seamless cloud connectivity for real-time tire performance data analytics.

The United Kingdom is forecast to grow at a 42.8% CAGR, supported by advancements in intelligent transportation systems and connected mobility infrastructure. Tire manufacturers are introducing smart tire solutions compatible with next-generation telematics and vehicle-to-infrastructure communication systems. Adoption in EVs and ride-hailing fleets is expanding, as operators focus on improving energy efficiency and reducing tire-related maintenance costs. Pilot programs under government smart mobility initiatives are encouraging connected tire integration in city transit fleets. The growing penetration of subscription-based mobility models is also creating steady demand for sensor-enabled tires in urban transportation.

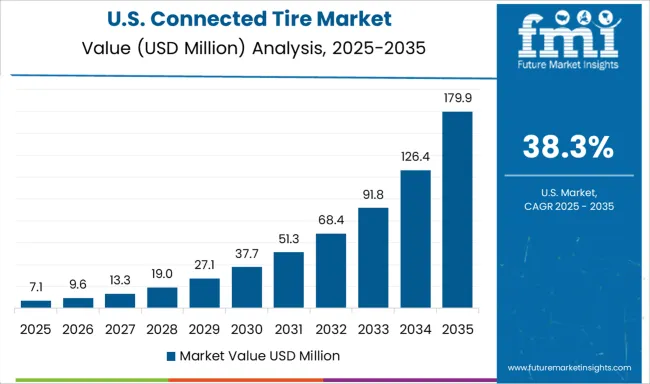

The United States is expected to post a 38.3% CAGR, driven by demand from shared mobility operators and highway safety enhancement programs. Connected tires are gaining traction in autonomous and semi-autonomous vehicle platforms to support real-time road-condition sensing. Fleet managers across logistics and rental companies are deploying smart tires for predictive maintenance and compliance monitoring. Integration with cloud-based analytics platforms enables tire performance benchmarking, reducing operational costs. Partnerships between leading tire manufacturers and connected vehicle solution providers are advancing innovations in AI-driven predictive wear and automated pressure control systems.

Continental AG leads the connected tire market with a significant market share, driven by its advanced sensor-integrated tires and strong OEM partnerships. Michelin and Bridgestone Corporation are expanding their portfolios by integrating real-time data solutions for fleet and passenger vehicle applications. The Goodyear Tire & Rubber Company focuses on intelligent tire systems that enhance vehicle performance and predictive maintenance. Pirelli & C SpA invests in cyber tire technologies aimed at premium and electric vehicles. Nokian Tyres plc emphasizes safety-driven smart features tailored for harsh climates. Sumitomo Rubber Industries Ltd leverages AI-based monitoring tools to develop tires that optimize fuel efficiency and road grip.

In August 2024, Continental unveiled its ContiConnect sensor series with automated tire tread-depth measurement at IAA Transportation. Integrated with AI models, the system delivers real-time wear insights for fleet tires, enhancing safety, cost-efficiency, and CO₂ reduction. Full market launch is scheduled for summer 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.5 Million |

| Rim Size | 12 - 17 Inches, 18 - 22 Inches, and More Than 22 Inches |

| Component | TPMS, Accelerometer Sensors, Strain Gauge Sensors, and RFID Chips |

| Vehicle Type | Passenger Cars and Commercial Vehicle |

| Propulsion | ICE and Electric |

| Sales Channel | Aftermarket and OEM |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Continental AG, Michelin, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., Nokian Tyres plc, and Sumitomo Rubber Industries Ltd. |

| Additional Attributes | Dollar sales by tire type (passenger‑vehicle vs commercial fleet) and sensor category (TPMS, accelerometers, RFID), demand dynamics across OEM vs aftermarket and EV/autonomous segments, regional dominance in North America with fastest growth in Asia‑Pacific, innovation in 5G‑enabled, visuotactile and predictive‑analytics tires, and environmental impact via fuel-efficiency gains and emissions tracking. |

The global connected tire market is estimated to be valued at USD 26.5 million in 2025.

The market size for the connected tire market is projected to reach USD 1,089.7 million by 2035.

The connected tire market is expected to grow at a 45.0% CAGR between 2025 and 2035.

The key product types in connected tire market are 12 - 17 inches, 18 - 22 inches and more than 22 inches.

In terms of component, tpms segment to command 38.7% share in the connected tire market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Connected Sensors Market Size and Share Forecast Outlook 2025 to 2035

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Connected RHM (Remote Healthcare Monitoring) Market Size and Share Forecast Outlook 2025 to 2035

Connected Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Connected Packaging Market Size and Share Forecast Outlook 2025 to 2035

Connected Living Room Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Connected Vehicle Technology Market Size and Share Forecast Outlook 2025 to 2035

Connected Logistics Market Growth - Trends, Demand & Innovations 2025 to 2035

Connected Drug Delivery Devices Market Size and Share Forecast Outlook 2025 to 2035

Connected Home Surveillance Devices Market Growth - Trends & Forecast 2025-2035

Connected Game Console Market Analysis by Product Type, Application, and Region through 2035

Understanding Connected TV Market Share & Growth Trends

Connected TV’s Market Outlook 2025 to 2035

Connected Healthcare Market

Connected Car Market Growth – Trends & Forecast 2024-2034

AI-Driven Smart Home Appliances – Enhancing Home Automation

Connected Lighting Platform Market

Connected Enterprise Video Surveillance Solutions Market

Connected Energy Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA