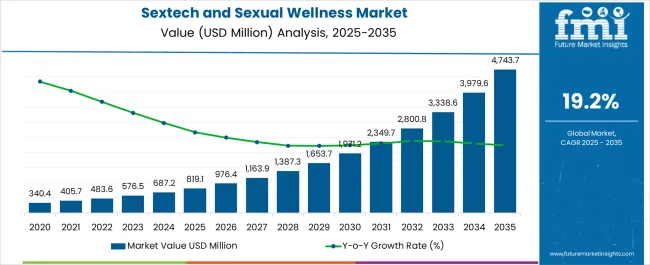

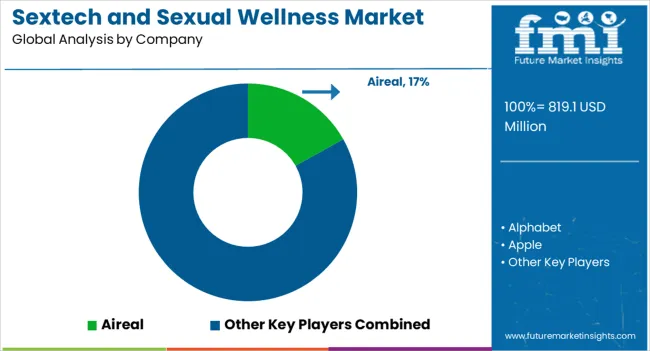

The Sextech and Sexual Wellness Market is estimated to be valued at USD 819.1 million in 2025 and is projected to reach USD 4743.7 million by 2035, registering a compound annual growth rate (CAGR) of 19.2% over the forecast period.

| Metric | Value |

|---|---|

| Sextech and Sexual Wellness Market Estimated Value in (2025 E) | USD 819.1 million |

| Sextech and Sexual Wellness Market Forecast Value in (2035 F) | USD 4743.7 million |

| Forecast CAGR (2025 to 2035) | 19.2% |

The sextech and sexual wellness market is expanding rapidly, driven by increasing societal openness toward sexual health, greater emphasis on mental and physical well being, and technological innovation in intimate products. Advancements in virtual reality, connected devices, and AI enabled platforms are transforming user experiences and enhancing personalization.

The growing acceptance of sexual wellness as a key component of overall health has resulted in strong demand across both developed and emerging economies. Specialty product innovations designed for safety, discretion, and enhanced pleasure are gaining mainstream recognition, while wellness brands are incorporating inclusive design approaches catering to diverse demographics.

The outlook remains promising as regulatory landscapes mature, online education platforms normalize sexual health discussions, and investments in cutting edge sexual wellness technologies continue to expand global reach.

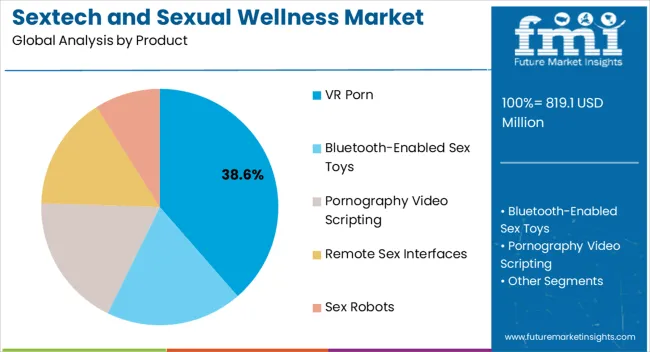

The VR porn product segment is projected to represent 38.60% of total revenue by 2025 within the product category, making it the leading segment. Growth is being driven by immersive content experiences, increasing consumer interest in virtual engagement, and rapid adoption of VR devices across global markets.

Enhanced realism, personalized interaction, and accessibility have reinforced its popularity, particularly among younger demographics seeking technology enabled intimacy.

As VR hardware becomes more affordable and content libraries expand, this product segment continues to capture a dominant share.

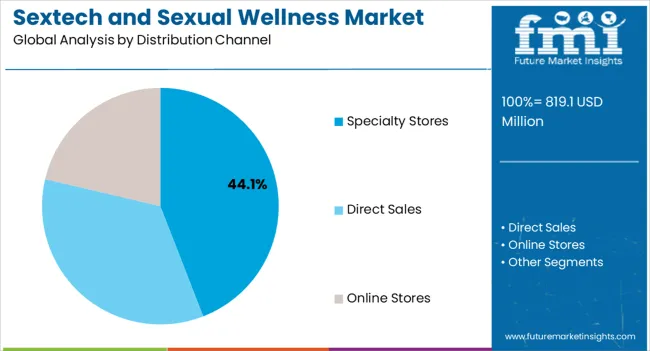

The specialty stores distribution channel segment is anticipated to hold 44.10% of total market revenue by 2025, positioning it as the most significant channel. This prominence is attributed to the ability of specialty outlets to provide privacy, product variety, and expert guidance to consumers.

Personalized in store experiences, premium product displays, and a trusted shopping environment have contributed to their dominance.

These factors have positioned specialty stores as the preferred choice for purchasing sextech and sexual wellness products despite the growth of e commerce alternatives.

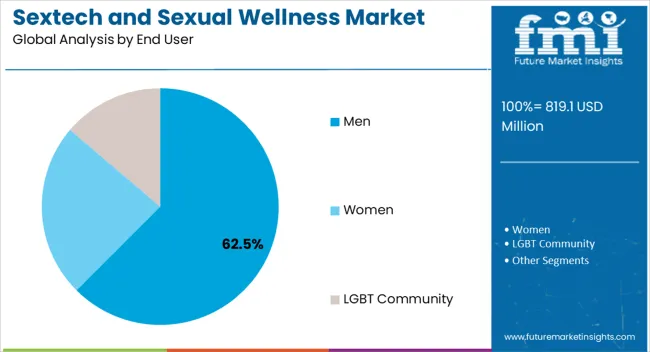

The men segment is expected to account for 62.50% of total market revenue by 2025 within the end user category, securing its role as the dominant segment. This share is attributed to higher spending patterns, strong adoption of VR and connected sexual wellness devices, and greater representation in early adoption of emerging technologies.

Targeted marketing campaigns, wide product availability, and increased societal acceptance of male sexual wellness have further reinforced segment leadership.

The men category is expected to sustain dominance as product manufacturers continue to innovate around immersive, customizable, and technology integrated experiences.

The global market for sextech and sexual wellness is expanded at a CAGR of 22.4% over the last five years (2020 to 2025). The market growth is projected to saturate with the projected drop in prices coupled with mass-level manufacturing resulting in the benefits of economies of scale.

The global sextech and sexual wellness market is predicted to surge at a CAGR of 19.2% and record sales worth USD 4743.7 million by 2035. United States will remain the largest market throughout the analysis period accounting for over USD 10.7 million absolute dollar opportunity in the coming 10-year epoch.

Depression, anxiety, and loneliness have long been recognized as global mental health concerns. To temporarily alleviate psychological distress, atypical social behavior, usually consisting of promiscuous sexual behaviors, is not uncommon.

In addition, it's been examined that stress and anxiety tend to be associated with sextech use, as psychological and bodily loneliness is among the risk factors for pressure. People with higher anxiety or depression were more inclined to make sexual advances through sextech.

However, people who were more introverted did not tend to engage with sextech, indicating the former patterns may have had nothing to do with a lack of social activity. Sextech has been identified as a healing means for loneliness, offering a healthful connection with sex.

The Asia-Pacific region is approximated to be extensively lucrative for the Global sextech and sexual wellness market. In May 2020, one of its kind sextech hackathon was coordinated by SPARK (Sex, Pleasure and Relationship Konversations) Fest in Singapore.

Events like this are anticipated to be beneficial to the growth of Asia-Pacific as a profitable region for the sextech and sexual wellness market. Among other additional driving factors for the sextech and sexual wellness market in the Asia-Pacific region are the rising cases of sexually transmitted diseases (STDs).

WHO posits that as many as 340 million patients suffer from either one of the sexually transmitted infections (STIs) - syphilis, gonorrhea, chancroid, or chlamydial infection on a yearly basis in India.

It further states that annually 6% cohort of the Indian adult population contract reproductive tract infections and sexually transmitted infections (RTIs/STIs). As of June 2025, the Federation of Obstetric and Gynecological Societies of India (FOGSI), in collaboration with the United States Agency for International Development (USAID), issued Adolescent and Youth Friendly Health Services (AYFHS) directives and guidelines keeping in mind the creation of better awareness regarding sexual health and reproduction related issues among the youth.

Since 2008, AIDS has been among the most destructive ailments faced by the nation, with as many as 19,600 deaths in 2024. By 2035, it is estimated that the sextech and sexual wellness market in China will expand at a CAGR of 18.1%, while in Japan, it is anticipated to witness a 16.9% CAGR.

It is anticipated that approximately more than 30% share of the North American region in the sextech and sexual wellness market is going to remain intact during the forthcoming years. It is projected for the United States to lead the sextech and sexual wellness market in this region.

The market in the North American region is further aided by the ease of access associated with e-commerce pertaining to the numerous sexual wellness products, ranging from sex toys and devices to sex robots.

Further beneficial for the sextech and sexual wellness market in the region is the surge the LGBTQ (Lesbian, Gay, Bisexual, Transgender, and Queer) communities, especially in the United States, are witnessing and anticipated to continue to witness during the forthcoming years, related to acceptance and long due recognition. Another attribute useful to the sextech and sexual wellness market in the North-American region is the surge in awareness regarding safe sex and healthy sexual practices.

The United States market is expected to expand at a CAGR of 18.6%, and an anticipated absolute dollar opportunity of USD 10.7 million is important attributed to propelling this growth during the forthcoming years.

As per the Centers for Disease Control and Prevention (CDC) estimates, as many as 340.4 million of the total population of the United States was suffering from STIs (sexually transmitted infections) as of 2020. An April 2025 article published in USA Today states that since 2020, cases of congenital syphilis have seen a startling increase of 235% over the years.

This climactic surge in the cases of various sexually transmitted diseases (STDs) is one of the attributes responsible for the propelling growth of the United States sextech and sexual wellness market. Furthermore, government initiatives are also working for the benefit of the sextech and sexual wellness industry.

During the pandemic, the New York City (NYC) Health Department promoted masturbation as one of the safest sexual activities to engage in in order to decrease contact with others to reduce the spread of the COVID-19 virus subsequently. During the upcoming 10-year forecast epoch, the United States is thus anticipated to impact the Global Sextech and Sexual Wellness Market positively.

The women segment by end-user is set for positively impacting the sextech and sexual wellness market. It is anticipated that this segment is to expand with 18.7% CAGR during the upcoming 10-year epoch. A recent survey in May 2025 brought to the fore the fact that as many as 82% of the female cohort of the population in the United States possesses one sexual wellness and pleasure-related device.

The gradual transition of sextech and sexual wellness products towards the mainstream has additionally proven to be advantageous to the growth of the women segment by end-user. As of 2020, Japan has vending machines for dispensing sexual pleasure and wellness-related products and devices.

These automatic machines are becoming increasingly popular among citizens, especially the female cohort of the population, pertaining of the ease of access to sexual wellness products associated with their use. All of these attributes are subsequently estimated to positively impact the growth of the Global sextech and sexual wellness market during the forthcoming years.

The Sextech and Sexual Wellness industry is a dynamic and highly competitive market driven by evolving consumer demands and advancements in technology. Here is a closer look at the competitive landscape within the industry:

The industry is characterized by the presence of numerous players offering a wide range of products and services. From innovative sex toys and intimate accessories to sexual health supplements and digital platforms, there is a diverse array of offerings to cater to different consumer preferences.

Companies strive to establish strong brand identities and differentiate themselves from competitors. Effective branding, unique product positioning, and compelling marketing strategies play a crucial role in gaining consumer trust and loyalty.

Companies operating in the sextech and sexual wellness industry face regulatory challenges due to the sensitive nature of the products. Adhering to local and international regulations is essential to ensure consumer safety and maintain trust in the market.

The industry players employ various distribution channels to reach their target audience. These channels include online platforms, specialized retail stores, e-commerce platforms, and collaborations with healthcare providers or wellness centers. Some players in the industry focus on consumer education and advocacy for sexual wellness. They strive to break taboos, promote open conversations about sexual health, and provide accurate information to empower individuals.

To stay ahead in the competitive landscape, companies focus on continuous innovation and technological advancements. This includes incorporating smart technologies, virtual reality experiences, app-based solutions, and connected devices into their product offerings.

Recent Developments

The global sextech and sexual wellness market is estimated to be valued at USD 819.1 million in 2025.

The market size for the sextech and sexual wellness market is projected to reach USD 4,743.7 million by 2035.

The sextech and sexual wellness market is expected to grow at a 19.2% CAGR between 2025 and 2035.

The key product types in sextech and sexual wellness market are vr porn, bluetooth-enabled sex toys, pornography video scripting, remote sex interfaces and sex robots.

In terms of distribution channel, specialty stores segment to command 44.1% share in the sextech and sexual wellness market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Dandruff Control Shampoos Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Hand & Arm Protection (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA