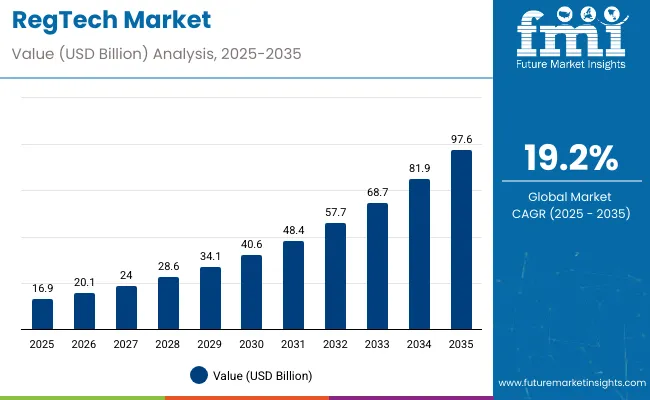

The global RegTech market is projected to expand significantly, from USD 16.9 billion in 2025 to USD 97.6 billion by 2035, growing at a CAGR of 19.2% over the forecast period. The market was valued at approximately USD 14.9 billion in 2024 and has shown signs of steady momentum supported by digital transformation efforts and tightening regulatory frameworks globally. The continued rise in compliance complexities across banking, insurance, and fintech has accelerated investments in intelligent regulatory technologies.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 16.9 billion |

| Projected Size, 2035 | USD 97.6 billion |

| Value-based CAGR (2025 to 2035) | 19.2% |

In 2025, the demand for RegTech solutions is being driven by heightened scrutiny from global financial regulators and the need to prevent financial crimes through more sophisticated means. Companies are now deploying machine learning, natural language processing, and blockchain to automate regulatory reporting, monitor transactions in real time, and manage evolving requirements. Sectors such as AML (Anti-Money Laundering), fraud detection, and Know Your Customer (KYC) are leading adoption.

A major development reinforcing this trend occurred in May 2025. Corlytics, a Dublin-based RegTech firm, became the first dedicated company in the sector to earn ISO/IEC 42001:2023 certification for AI governance. This certification demonstrates a formal commitment to responsible AI development and management across the entire lifecycle of regulatory technologies. The certification was granted after a two-stage audit by cybersecurity compliance firm A-LIGN, which reported zero non-conformities.

It reflects Corlytics’ enterprise-wide integration of ethical and risk-aware AI practices, in line with the EU AI Act and UK’s National AI Strategy. This move is likely to set a precedent for other RegTech firms amid growing regulatory oversight of AI in financial technologies.

Furthermore, blockchain's role in maintaining transparent and immutable records for compliance checks is being increasingly recognized. Generative AI is also gaining ground, with firms leveraging it for real-time compliance alerts, document interpretation, and automated risk scoring. In parallel, financial authorities like the UK’s FCA and Singapore’s MAS have announced pilot collaborations with RegTech providers to enhance market surveillance capabilities.

The future outlook of the RegTech market appears promising as more companies across emerging economies adopt digital-first compliance strategies. Startups and legacy players alike are expected to collaborate more closely with regulators to co-develop sandboxed solutions. As AI ethics and governance become non-negotiable in compliance systems, certifications like ISO 42001 are expected to emerge as industry standards.

This evolving landscape is likely to redefine how organizations manage risk, protect customer data, and stay compliant in a fast-moving regulatory environment.

In 2025, RegTech adoption is being pulled forward by two landmark policy changes. The EU’s Digital Operational Resilience Act (DORA) began applying on 17 January 2025, requiring banks, insurers, and other financial entities to strengthen ICT risk management, incident reporting, and third-party oversight. Supervisors are also tasked with delivering registers of firms’ ICT outsourcing arrangements to the European Supervisory Authorities by April 2025, driving demand for tooling that supports contract inventories, risk scoring, and resilience testing.

The EU AI Act also began its first phase of obligations, with bans on “unacceptable-risk” AI coming into effect in February 2025, followed by phased requirements for codes of practice and transparency for general-purpose AI. Compliance teams are responding with model inventories, provenance controls, and AI governance workflows tailored to the Act’s risk tiers.

Supervisory bodies themselves are going more digital, shaping industry demand. The Bank of England emphasized AI risks and oversight in financial services, nudging firms to strengthen controls around data quality, explainability, and human oversight. The Bank for International Settlements added momentum through publications on governance frameworks for central banks using AI and a stocktake of generative AI in supervision. These efforts signal that AI in compliance is moving from pilot projects to codified practice, with regulators expecting auditable pipelines and documented accountability.

In parallel, the UK’s Financial Conduct Authority reinforced the use of data and technology in its 2025/26 Business Plan to combat financial crime and improve outcomes. Beyond Europe, Singapore is positioning itself as a RegTech proving ground, with funding and supervisory structures that embed SupTech, surveillance, and analytics directly into operations. Collectively, these moves are shifting RegTech from optional innovation to mandatory, regulator-aligned capabilities, especially in ICT resilience, AI governance, and financial-crime controls.

The below table presents the expected CAGR for the global RegTech market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 17.2%, followed by a slightly higher growth rate of 17.5% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 17.2% (2024 to 2034) |

| H2, 2024 | 17.5% (2024 to 2034) |

| H1, 2025 | 19.2% (2025 to 2035) |

| H2, 2025 | 19.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to increase slightly to 19.2% in the first half and remain relatively moderate at 19.6% in the second half. In the first half H1 the market witnessed a decrease of 60 BPS while in the second half H2, the market witnessed an increase of 50 BPS.

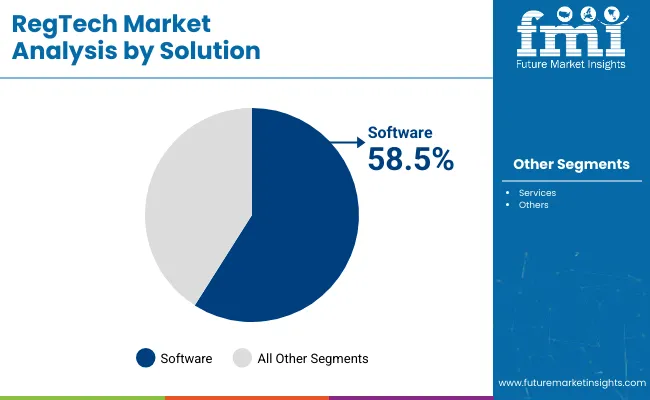

In 2025, the software segment in the RegTech market accounts for a dominant 58.5% share, owing to its unmatched efficiency in automating compliance with evolving regulations. Industries such as banking and insurance face increasing scrutiny and require robust systems to monitor rules, validate data, and generate real-time reports. RegTech software simplifies these processes, minimizes human error, and ensures adherence to regulatory updates without delays. This makes it the preferred solution for compliance automation.

Enterprises are prioritizing software tools that integrate with existing systems while offering scalability and adaptability. RegTech platforms now incorporate AI and machine learning to improve decision-making and automate risk assessment. These technologies allow businesses to proactively manage compliance, avoid penalties, and maintain a competitive edge in a fast-changing regulatory environment. The combination of agility, accuracy, and cost savings continues to drive high adoption of software-based RegTech solutions across regulated sectors.

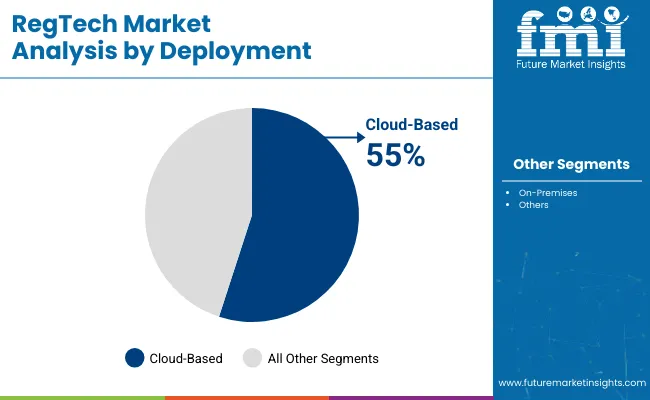

The cloud-based RegTech segment is forecasted to grow at a strong CAGR of 20.5% from 2025 to 2035, reflecting rising demand for flexible and scalable compliance tools. Cloud platforms enable organizations to access compliance systems remotely, perform real-time monitoring, and implement regulatory updates without disruption. This capability has become vital in supporting hybrid and remote workforces while ensuring uninterrupted compliance oversight.

As data volumes increase and global regulations become more intricate, cloud-based RegTech offers a cost-effective path to real-time compliance management. The adoption is further accelerated by the push toward digital transformation, where cloud infrastructure enables faster deployments and updates. Enhanced cybersecurity features and built-in audit capabilities have also made cloud solutions more attractive to enterprises aiming to meet privacy laws and security standards. Collectively, these advantages position cloud-based tools as a cornerstone of the future RegTech landscape.

The demand for instant payment with faster financial transactions is increasing on a larger note. Incorporation of technology in transactions assist in reducing the time taken for internal as well as external transactions.

Several financial institutions and insurance providers incorporate blockchain minimizing errors, speed up financial transactions and eliminate reconciliation which improves and enhances the organizations capabilities for KYC, AML, regulatory compliance data.

With this customer are able to transact easily while eliminating the intermediary charging fee for making the process more streamlined. This saves labor intensive procedures which financial institutions go through with currency exchanges and customers.

Thus as the demand for consumers for faster transactions increases, the adoption of regulatory technology market increases.

Operational risk across organizations have become part of the course. However, implementation of regulatory technologies i.e. RegTech software and solutions help in reducing large amount of mundane and repetitive tasks which is driving the demand the demand across several regions of the globe.

As regulatory landscape is evolving and changing at a very fast rate, new directives have increased and happen at a very fast rate. With the adoption of regulatory technology (RegTech) software and solutions organizations are able to reduce the exposure to operational risk which drives the market demand.

Moreover, Regtech also facilitates data optimization and provides a more thorough view of activities as standardizing and automating procedures creates a more transparent environment. Furthermore, combination of Regtech with connected technologies such as artificial intelligence helps in intelligently automating processes and can be more flexible efficient and adaptable.

These factors contribute to growth of the regulatory technology market and surge market demand.

Several risk and compliance management functions within banking and insurance service organizations, noticeably focus on data related and cybersecurity risks. Regulatory technology (RegTech) solutions often house sensitive company data and hence these firms require to guarantee that data is safeguarded in line with current cybersecurity best practices.

The guidelines and regulations are updated regularly and therefore requires close eye on changes required for making the necessary changes to the software. Several organizations struggle in keeping up with the rate of change and struggle to gain trust of the customer base.

Organizations using regtech tools continuously require to focus on risk assessment, technical controls incident response and more. Moreover, simply ensuring compliance is not enough as organizations require to proactively address the weak points over security and enhance the same.

These cybersecurity concerns related to regtech solutions often slow down the market adoption of regulatory technology.

The adoption of regulatory technology (RegTech) offers streamlined marketing, improved risk management enhancing time and cost efficiency. While the offered benefits by regtech continue to increase, the initial cost associated with implementation is considerably high.

Moreover, implementation of regulatory technologies across enterprise which incorporates advanced technologies requires proper budgeting and designing of initial cost required for implementation of the same. Limited budgets and unclear return of investments restricts regtech investments across several small and medium organizations.

Moreover, cost required for maintenance of these software and solutions is rising exponentially as the cost of maintaining software can be three times higher than the cost of development which often restricts the regtech market adoption.

Thus, cost associated with adoption and maintenance of regulatory technologies often seem to restrain the market growth.

From 2019 to 2023, the RegTech market share experienced steady growth, driven by increasing regulatory requirements, the digitization of financial services, and the need for cost-effective compliance solutions. Sales were propelled by advancements in AI and data analytics, with major adoption seen in North America and Europe.

Looking ahead, from 2024 to 2034, demand for RegTech solutions is expected to accelerate, outpacing previous growth rates as regulations become more stringent, and financial institutions increasingly prioritize real-time compliance and risk management. The forecasted period will likely see a broader adoption across emerging markets and expanded use cases beyond traditional financial services.

IBM, Microsoft, Oracle Corporation, and Intel Corporation are top players in the RegTech market. They have a big market presence, offer many products, and invest a lot in research and development. IBM and Microsoft stand out by providing IAM solutions that work well for big companies in different industries.

Oracle and Intel lead the market with their strong cloud systems and advanced security. These companies use their global reach many customers, and partnerships to keep coming up with new ideas. They offer IAM solutions that use AI and can grow to fit complex setups with multiple clouds.

MetricStream Inc., Nice Ltd., Broadridge Financial Solutions, Inc., and Comply Advantage stand out as important players in the RegTech field. These companies have made a name for themselves by offering specialized tools for governance, risk, and compliance (GRC). Although they might not have the worldwide reach of top-tier companies, they lead in their specific areas.

They provide cutting-edge expandable systems that meet particular regulatory requirements. By focusing on new ideas and being quick to adapt, these firms can go head-to-head with bigger players and win over customers among medium-sized financial businesses.

Actico GmbH, Acuant Inc., Ascent, FundApps. These companies offer new and specialized RegTech solutions often using AI, machine learning, and automation to tackle specific compliance challenges. They serve niche markets or smaller financial institutions that need targeted solutions focusing on flexibility and keeping costs down. These firms stand out for their new ideas and quick responses to changes in regulations making them key players shaking up the RegTech scene.

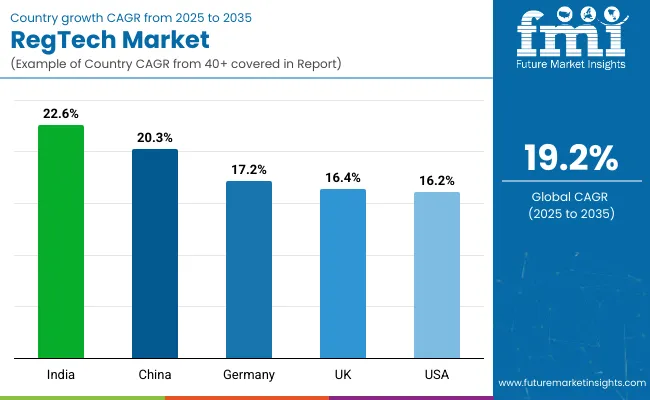

The section below covers the industry analysis for the RegTech market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, UK, China and India are provided.

The united states is expected to remains at the forefront in North America, with a value share of 64.2% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 22.6% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 16.2% |

| Germany | 17.2% |

| UK | 16.4% |

| China | 20.3% |

| India | 22.6% |

The USA RegTech market is experiencing fast growth because of its complex rules in finance. Tough laws like Dodd-Frank, AML (Anti-Money Laundering), and GDPR have made companies want better RegTech answers.

Also, the USA leads the world in new tech, with many RegTech startups and big companies using AI, blockchain, and data tools to create top-notch ways to follow the rules.

India's RegTech market is growing as the country undergoes a quick digital shift and the government aims to boost regulatory oversight in financial services. Programs like Digital India and efforts to include more people in the financial system have caused a rise in digital transactions. This has created a need for strong RegTech solutions to handle compliance, stop fraud, and protect data.

The Reserve Bank of India (RBI) and other regulatory groups are more and more using RegTech to simplify and enforce rules.

China's RegTech market is growing alongside its expanding financial sector and strong government backing for regulatory technologies. As China's financial services industry updates and grows, the demand to manage compliance is increasing.

The Chinese government has taken the lead in pushing for RegTech adoption to keep financial stability and lower risks linked to digital finance, including the rise of fintech and services based on block chain.

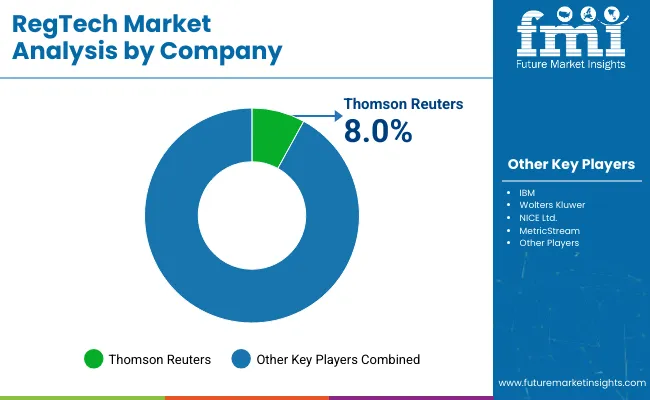

The RegTech market's competitive scene includes a blend of big tech companies specialized RegTech businesses, and new startups. Big names like IBM, Thomson Reuters, and Wolters Kluwer lead the pack with their all-in-one compliance tools. These companies have an influence on the market because of their worldwide presence and years of know-how in the field.

At the same time medium-sized companies like MetricStream and ComplyAdvantage target specific areas such as risk management and financial crime prevention. They provide specialized tools that address particular regulatory requirements. New companies and startups, including FundApps and Ascent, are bringing new ideas to the table.

They offer AI-powered, cloud-based solutions that are flexible and cost-effective. The industry is also seeing more partnerships, mergers, and buyouts. Companies are doing this to expand what they can offer and to make their position stronger in the fast-changing world of regulations.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 16.9 billion |

| Projected Market Size (2035) | USD 97.6 billion |

| CAGR (2025 to 2035) | 19.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand deployments for volume |

| Solutions Analyzed (Segment 1) | Software, Services |

| Deployment Types Analyzed (Segment 2) | Cloud-Based, On-Premises |

| Industries Analyzed (Segment 3) | Financial Risk & Compliance Management, Identity Management & Control, Transaction Monitoring, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the RegTech Market | IBM, MetricStream Inc., Nice Ltd., Thomson Reuters, Wolters Kluwer N.V., Actico GmbH, Acuant Inc., Ascent, Broadridge Financial Solutions Inc., ComplyAdvantage, Deloitte Touche Tohmatsu Limited, FundApps |

| Additional Attributes | Growth in RegTech adoption for real-time regulatory monitoring, AI and machine learning-driven automation, Dominance of cloud-native RegTech tools, SME adoption trends in identity verification and anti-money laundering, Regional digital regulation frameworks fueling RegTech growth |

| Customization and Pricing | Customization and Pricing Available on Request |

The global RegTech industry is projected to witness CAGR of 19.2% between 2025 and 2035.

The global RegTech industry stood at USD 14.2 billion in 2024.

The global RegTech industry is anticipated to reach USD 97.6 billion by 2035 end.

East Asia is set to record the highest CAGR of 24.6% in the assessment period.

The key players operating in the global RegTech industry include IBM, MetricStream Inc., Nice Ltd., Thomson Reuters and Others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of RegTech Solution Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA