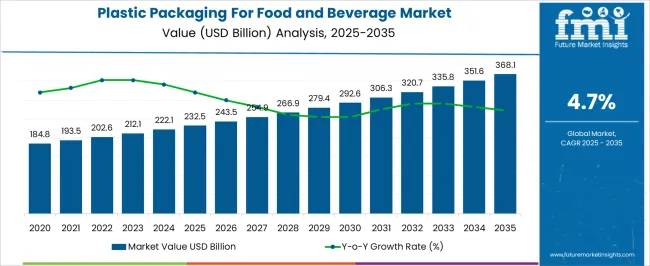

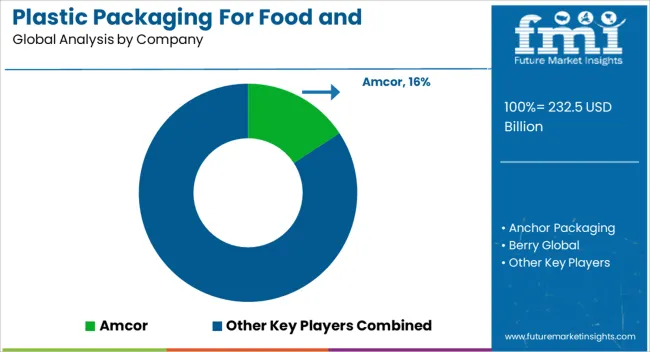

The plastic packaging for food and beverage market is estimated to be valued at USD 232.5 billion in 2025 and is projected to reach USD 368.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. The growth has been reinforced by the increasing demand for durable, lightweight, and convenient packaging solutions that preserve product freshness and extend shelf life. From an industry perspective, consumer preferences for ready-to-eat, on-the-go, and takeaway food items have been a significant driver, encouraging manufacturers to adopt versatile plastic packaging formats. In this opinion, the steady CAGR of 4.7% reflects a market that, while mature, continues to be shaped by evolving packaging designs, branding needs, and regulatory compliance across the food and beverage sector.

By 2035, the market is expected to reach USD 368.1 billion, highlighting that plastic packaging will remain a key component of global food and beverage distribution. The absolute dollar opportunity indicates that companies offering lightweight, tamper-evident, and consumer-friendly packaging formats are likely to capture a substantial share. In this opinion, growth is being reinforced by investments in production efficiency, innovative design, and material optimization that balance functionality and cost-effectiveness.

The trajectory also suggests that retail chains, food service providers, and beverage manufacturers will continue to rely on plastic packaging solutions to maintain product quality, ensure brand recognition, and respond to evolving consumer behavior, making this market an essential and resilient segment for long-term industry players.

| Metric | Value |

|---|---|

| Plastic Packaging For Food and Beverage Market Estimated Value in (2025 E) | USD 232.5 billion |

| Plastic Packaging For Food and Beverage Market Forecast Value in (2035 F) | USD 368.1 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The plastic packaging for food and beverage market holds a significant share within its parent markets, reflecting its widespread adoption and versatility. In the food packaging market, plastic packaging accounts for approximately 50.6% of the total market share, driven by its cost-effectiveness and ability to preserve food freshness. Within the beverage packaging market, plastic represents over 31.0%, as it offers lightweight and durable solutions for various beverage products. The flexible packaging market sees plastic comprising a substantial portion, with flexible plastic packaging leading the segment due to its convenience and efficiency. In the rigid packaging market, plastic holds a significant share, particularly in applications requiring sturdy and protective packaging solutions. The single-use packaging market also sees a considerable contribution from plastic, as it remains the material of choice for disposable packaging needs. These figures highlight the dominance of plastic in packaging solutions across multiple sectors, driven by its functional benefits and consumer preference. Despite challenges such as environmental concerns and regulatory pressures, the plastic packaging for food and beverage market continues to thrive, supported by ongoing demand and innovation in packaging solutions.

The plastic packaging for food and beverage market is experiencing sustained growth, supported by the sector’s need for durable, lightweight, and cost-efficient materials capable of ensuring product safety, shelf life, and ease of distribution. Current market conditions reflect strong demand from both retail and foodservice sectors, with polyethylene, polypropylene, PET, and other polymers widely adopted for their adaptability and regulatory compliance.

Packaging innovation has been focused on sustainability, with the integration of recyclable and bio-based plastics gaining traction, though performance and cost competitiveness remain central to material selection. Supply chain optimization, coupled with automation in manufacturing, is enhancing production efficiency and meeting large-scale demand requirements.

Over the forecast period, the market is expected to expand due to increasing packaged food consumption, e-commerce growth in grocery distribution, and heightened focus on food safety and convenience-driven formats. Strategic investment in barrier technologies, lightweighting, and circular economy initiatives is anticipated further to solidify the market’s growth trajectory and competitive positioning globally.

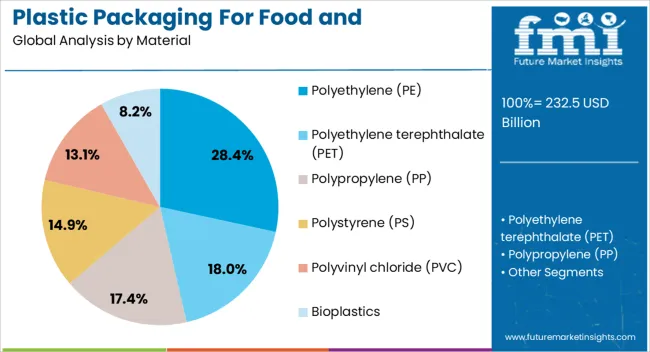

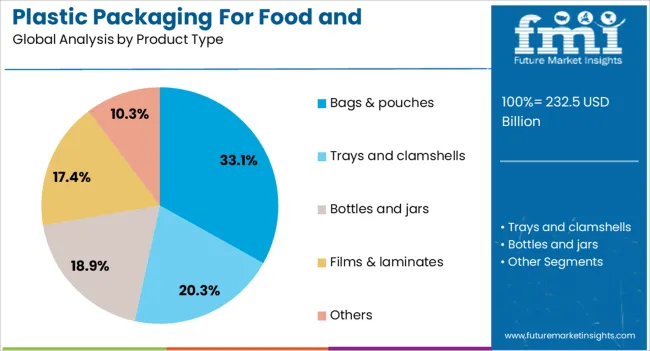

The plastic packaging for food and beverage market is segmented by material, product type, functionality, usability, end-use, and geographic regions. By material, plastic packaging for food and beverage market is divided into Polyethylene (PE), Polyethylene terephthalate (PET), Polypropylene (PP), Polystyrene (PS), Polyvinyl chloride (PVC), and Bioplastics. In terms of product type, plastic packaging for food and beverage market is classified into Bags & pouches, Trays and clamshells, Bottles and jars, Films & laminates, and Others.

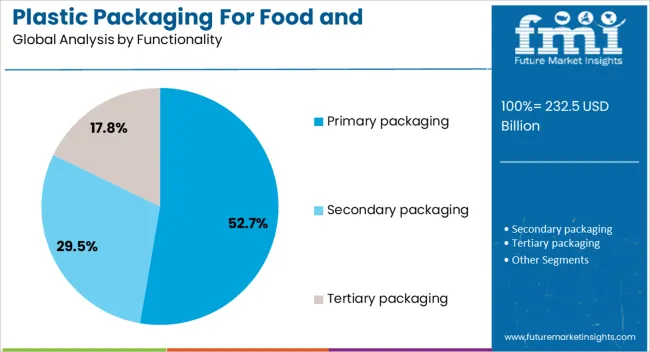

Based on functionality, plastic packaging for food and beverage market is segmented into Primary packaging, Secondary packaging, and Tertiary packaging. By usability, plastic packaging for food and beverage market is segmented into Single-use plastic, Recycled plastic, Reusable plastic, and Compostable/biodegradable plastic. By end-use, plastic packaging for food and beverage market is segmented into Food packaging and Beverage packaging. Regionally, the plastic packaging for food and beverage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyethylene (PE), accounting for 28.40% of the material category, has maintained its leadership due to its versatility, durability, and cost-effectiveness in food and beverage applications. Its adaptability to various formats, including films, pouches, and containers, enables broad adoption across multiple product categories.

Resistance to moisture, chemicals, and physical stress has made PE a preferred choice for primary and secondary packaging, while advancements in high-density and low-density PE formulations have expanded performance capabilities. Manufacturing efficiencies, supported by large-scale production and global availability, have contributed to its sustained market presence.

Regulatory compliance, combined with the potential for recyclability, has strengthened its position in sustainability-focused procurement strategies. Continued demand growth is expected as PE remains integral to flexible and rigid packaging innovations, balancing performance requirements with cost management, especially in high-volume consumer goods distribution.

Bags & pouches, representing 33.10% of the product type category, lead the segment due to their lightweight nature, space efficiency, and ability to offer high product-to-packaging ratios. Their dominance is reinforced by suitability for a wide range of food and beverage products, from dry goods to liquids, supported by improved sealing and barrier technologies.

Cost advantages in manufacturing and distribution have encouraged their widespread adoption, particularly in single-serve and portion-controlled packaging formats. Flexibility in design, printing, and customization enhances brand visibility and consumer engagement, making them a preferred choice in competitive retail environments.

Sustainability adaptations, such as recyclable mono-material pouches, are gaining traction, allowing manufacturers to align with environmental targets while maintaining performance. As demand for convenient, portable, and longer shelf-life packaging rises, bags & pouches are expected to retain their market leadership and evolve with advancements in materials and sealing processes.

Primary packaging, holding 52.70% of the functionality category, dominates due to its critical role in direct product protection, preservation, and presentation. Its leadership is attributed to its necessity in safeguarding product integrity against contamination, physical damage, and spoilage, ensuring compliance with safety regulations and consumer expectations.

The segment benefits from ongoing innovation in materials, coatings, and barrier layers designed to extend shelf life and maintain product freshness. In the food and beverage sector, primary packaging serves as a key branding and information platform, integrating labeling, QR codes, and tamper-evident features.

Growth is further supported by the shift toward ready-to-eat, single-serve, and on-the-go consumption trends, which demand packaging that balances protection with convenience. The combination of regulatory compliance, marketing value, and functional necessity ensures the primary packaging segment continues to be the cornerstone of the market’s value proposition.

The plastic packaging for food and beverage market is expanding due to rising demand for convenience, durability, and extended shelf life. Opportunities exist in functional and innovative packaging solutions, while trends favor lightweight, multi-functional designs. Challenges include regulatory pressures and environmental concerns regarding plastic waste. Overall, the market is expected to grow steadily as manufacturers balance consumer convenience, product preservation, and responsible packaging practices across the global food and beverage industry.

The plastic packaging for food and beverage market is witnessing increasing demand due to consumer preference for convenience, portability, and extended shelf life. Ready-to-eat meals, packaged beverages, and processed foods rely heavily on plastic containers, bottles, and wraps to maintain freshness and prevent contamination. Retailers and foodservice operators are also driving adoption through on-the-go packaging solutions. With urban lifestyles and busy schedules shaping consumption patterns, plastic packaging continues to be favored for its durability, lightweight design, and cost-effectiveness, supporting consistent market growth globally.

Opportunities are emerging from the development of innovative and functional plastic packaging solutions. Manufacturers are introducing smart packaging with tamper-evident seals, portion control designs, and resealable features to enhance user convenience. Barrier films, vacuum-sealed containers, and multilayer structures improve product preservation, particularly for perishable food and beverage items. Expansion into e-commerce packaging, ready-to-drink beverages, and health-focused foods offers additional growth potential. Companies investing in research to create value-added packaging solutions that ensure freshness, usability, and brand differentiation can capture a larger share in competitive markets.

A notable trend in the market is the shift toward lightweight, easy-to-handle, and multi-functional plastic packaging. Manufacturers are optimizing designs to reduce material usage while maintaining durability and barrier properties. Transparent, microwavable, and stackable packaging formats are increasingly popular among consumers. Smart labeling, QR codes, and packaging that supports portion control or single-serve servings are also gaining traction. These trends highlight the emphasis on convenience, cost-effectiveness, and enhanced user experience, reflecting evolving consumer expectations in food and beverage consumption globally.

The plastic packaging market faces challenges due to growing environmental concerns, regulatory restrictions, and consumer awareness around plastic waste. Governments are enforcing stricter packaging guidelines, including bans on single-use plastics and mandates for recyclable materials. Consumer preference is increasingly shifting toward sustainable alternatives, putting pressure on manufacturers to innovate responsibly. Recycling infrastructure limitations and high costs of eco-friendly plastics further constrain adoption. Overcoming these challenges requires investment in recyclable and reusable packaging technologies, improved waste management, and transparent communication to maintain brand loyalty while addressing environmental concerns.

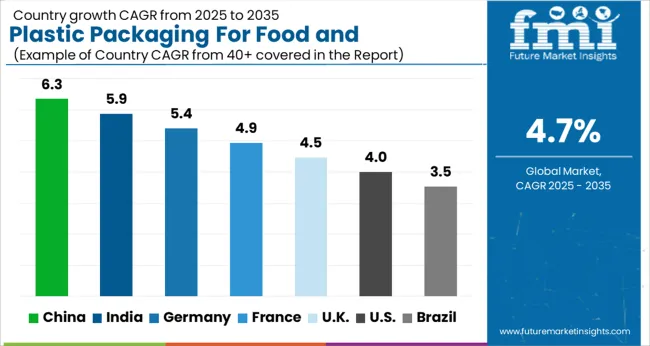

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The global plastic packaging for food and beverage market is projected to grow at a CAGR of 4.7% from 2025 to 2035. China leads with a growth rate of 6.3%, followed by India at 5.9% and France at 4.9%. The United Kingdom is expected to expand at 4.5%, while the United States shows steady growth at 4%.

Rising demand for convenience foods, packaged beverages, and extended shelf-life solutions is driving market expansion. China and India are witnessing rapid growth due to urbanization, evolving consumer lifestyles, and increasing modern retail penetration. Mature markets such as the USA, UK, and France emphasize premium packaging, recyclability, and regulatory compliance. Overall, rising awareness of food safety and convenience continues to support adoption across both emerging and developed regions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The plastic packaging for the food and beverage market in China is projected to grow at a 6.3% CAGR. Rising demand for packaged foods and beverages, driven by urban lifestyles and increasing disposable incomes, is fueling market adoption. E-commerce and modern retail formats are expanding distribution channels, making packaged goods widely accessible. Domestic manufacturers are scaling production to meet rising demand, while international brands are introducing premium and functional packaging solutions. Focus on convenience, portion control, and innovative designs is enhancing consumer appeal. Government policies promoting food safety and quality standards also support the adoption of advanced plastic packaging solutions. China’s strong industrial base and growing consumer awareness position it as the fastest-growing market globally.

The plastic packaging for food and beverage market in India is expected to grow at 5.9% CAGR. Increasing consumption of ready-to-eat meals, packaged beverages, and processed foods is boosting demand for plastic packaging. Modern retail expansion and online grocery platforms are strengthening distribution channels. Domestic manufacturers are focusing on flexible and cost-effective packaging solutions, while global brands are introducing premium designs for urban consumers. Consumer preference for convenience and hygiene is driving innovation in resealable, portion-controlled, and lightweight packaging. Government initiatives to improve food quality and packaging standards are further supporting market growth. India’s dynamic consumer base and evolving lifestyle trends indicate robust long-term growth potential for plastic packaging in the food and beverage sector.

The plastic packaging for food and beverage market in France is projected to grow at 4.9% CAGR. French consumers emphasize convenience, safety, and premium packaging for packaged foods and beverages. Manufacturers are introducing recyclable and functional packaging solutions to align with consumer expectations and regulatory requirements.

Supermarkets and retail chains play a key role in shaping market demand through modern merchandising strategies. Technological improvements in packaging design, barrier materials, and portion control enhance product appeal and shelf life. The market also benefits from France’s focus on high-quality food products and efficient supply chains, ensuring steady adoption of plastic packaging solutions across the food and beverage sector.

The plastic packaging for the food and beverage market in the United Kingdom is forecast to grow at a 4.5% CAGR. Rising consumption of ready-to-eat meals, beverages, and convenience foods is boosting packaging demand. UK consumers seek high-quality, safe, and innovative packaging designs, including resealable, lightweight, and portion-controlled solutions. Retailers and online platforms are expanding product availability and visibility, while manufacturers are focusing on efficient supply chains and sustainable production methods.

Regulatory compliance and quality assurance are central to market expansion, ensuring consumer confidence in packaged food and beverage products. The UK market reflects a balance between mature consumer demand, premium packaging trends, and innovation-driven adoption.

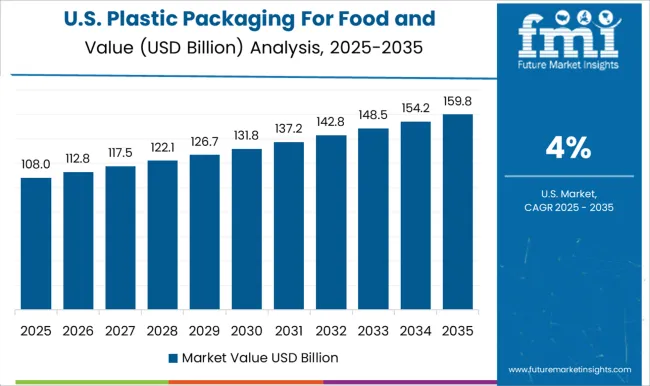

The plastic packaging for food and beverage market in the United States is projected to expand at 4% CAGR. Increasing demand for packaged foods, beverages, and convenience meals supports adoption of advanced plastic packaging. USA consumers value hygiene, convenience, and product safety, driving innovation in resealable, portion-controlled, and lightweight packaging. Retail chains, supermarkets, and e-commerce platforms facilitate wide product availability.

Manufacturers focus on cost-effective, high-performance packaging while ensuring compliance with strict regulatory standards. The USA market benefits from strong consumer awareness, technological adoption, and a preference for premium and convenient packaging formats, making it a key contributor to global market stability despite slower growth compared to emerging economies.

The plastic packaging for food and beverage market is being shaped by global and regional players emphasizing innovation, sustainability alternatives, and efficient supply chains. Amcor, Berry Global, and Huhtamaki lead by offering versatile packaging solutions that enhance shelf life, reduce food waste, and maintain product quality. Their brochures highlight flexible films, rigid containers, and barrier technologies designed for diverse food and beverage applications.

Anchor Packaging, Graham Packaging, and Mondi focus on customizable solutions for retail and industrial customers, emphasizing lightweight designs, durability, and branding opportunities. Coveris and DS Smith strengthen market presence with high-performance films and rigid packaging, targeting convenience foods, beverages, and ready-to-eat products. Other players, including Novolex, Pactiv Evergreen, and Plastipak, differentiate through specialty packaging formats, including thermoformed containers, bottles, and multilayer films tailored to specific product requirements.

ProAmpac, Sealed Air, and Silgan focus on protective packaging solutions, while Sonoco, Transcontinental, UFlex, and Winpak emphasize global distribution capabilities and turnkey solutions for manufacturers. Product brochures consistently highlight barrier properties, product safety, cost-efficiency, and ease of handling. Market competition is driven by innovation, operational scalability, and the ability to provide packaging that meets both regulatory requirements and consumer expectations in the fast-evolving food and beverage sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 232.5 Billion |

| Material | Polyethylene (PE), Polyethylene terephthalate (PET), Polypropylene (PP), Polystyrene (PS), Polyvinyl chloride (PVC), and Bioplastics |

| Product Type | Bags & pouches, Trays and clamshells, Bottles and jars, Films & laminates, and Others |

| Functionality | Primary packaging, Secondary packaging, and Tertiary packaging |

| Usability | Single-use plastic, Recycled plastic, Reusable plastic, and Compostable/biodegradable plastic |

| End-Use | Food packaging and Beverage packaging |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Anchor Packaging, Berry Global, Coveris, DS Smith, Graham Packaging, Huhtamaki, Mondi, Novolex, Pactiv Evergreen, Plastek Group, Plastipak, ProAmpac, Sealed Air, Silgan, Sonoco, Transcontinental, UFlex, and Winpak |

| Additional Attributes | Dollar sales by packaging type (bottles, trays, films, containers) and material (PET, HDPE, PP, PVC) are key metrics. Trends include rising demand for lightweight, durable, and convenient packaging, growth in ready-to-eat and takeaway food segments, and increasing focus on recyclability. Regional adoption, technological innovations, and consumer preferences are driving market growth. |

The global plastic packaging for food and beverage market is estimated to be valued at USD 232.5 billion in 2025.

The market size for the plastic packaging for food and beverage market is projected to reach USD 368.1 billion by 2035.

The plastic packaging for food and beverage market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in plastic packaging for food and beverage market are polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), polystyrene (PS), polyvinyl chloride (PVC) and bioplastics.

In terms of product type, bags & pouches segment to command 33.1% share in the plastic packaging for food and beverage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Tube Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bag Market Size and Share Forecast Outlook 2025 to 2035

Plastic Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Plastic Transistors Market Size and Share Forecast Outlook 2025 to 2035

Plastic Processing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plastic Liner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plastic Calendering Resins Market Size and Share Forecast Outlook 2025 to 2035

Plastic Pallets Market Size and Share Forecast Outlook 2025 to 2035

Plastics-To-Fuel (PTF) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA