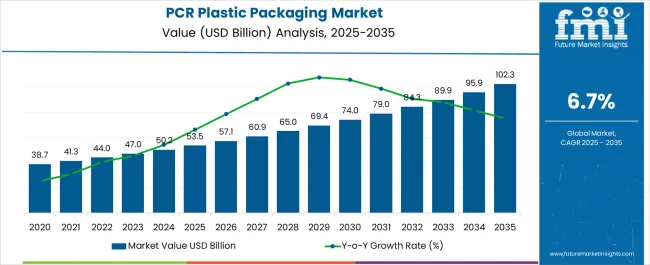

The PCR plastic packaging market is estimated to be valued at USD 53.5 billion in 2025 and is projected to reach USD 102.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The PCR plastic packaging market is valued at USD 53.5 billion in 2025 and is expected to reach USD 102.3 billion by 2035, advancing at a CAGR of 6.7 percent. Half-decade weighted growth analysis reveals that the market expansion will not be evenly distributed across the forecast timeline, but will instead demonstrate varying momentum across three key phases. Between 2025 and 2030, the market is expected to capture stronger annualized increments, driven by increasing incorporation of post-consumer recycled plastics in bottles, trays, and flexible formats, encouraged by regulatory frameworks and brand-owner commitments toward lowering virgin plastic usage.

This early half-decade contributes more heavily to the weighted growth, setting a strong foundation for scale. From 2030 to 2035, growth continues but with a slightly moderated pace, reflecting a shift from rapid adoption to market normalization. While developed economies will already have integrated PCR materials into mainstream packaging, emerging markets will drive the later phase through infrastructure investments and rising consumer awareness.

The weighted contribution of the second half-decade, although lower compared to the first, will still be substantial in absolute dollar terms, adding nearly USD 30 billion. Weighted analysis confirms that the earlier five years account for greater proportional acceleration, yet the latter years ensure long-term market sustainability and broader regional adoption.

| Metric | Value |

|---|---|

| PCR Plastic Packaging Market Estimated Value in (2025 E) | USD 53.5 billion |

| PCR Plastic Packaging Market Forecast Value in (2035 F) | USD 102.3 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The PCR plastic packaging market is driven by five primary parent markets with specific shares. Food and beverages lead with 40%, as PCR plastics are used for bottles, trays, and containers to meet demand for eco-friendly packaging. Personal care and cosmetics account for 20%, using PCR packaging for lotions, shampoos, and skincare products. Household products represent 15%, adopting PCR bottles and jars for cleaning and utility items. Pharmaceuticals contribute 15%, utilizing PCR plastics for medicine bottles and blister packs. Retail and e-commerce hold 10%, where sustainable packaging supports logistics and brand positioning. These parent markets collectively shape global PCR plastic packaging demand.

Recent developments in the PCR plastic packaging market focus on material innovation, circular economy strategies, and regulatory compliance. Companies are enhancing processing technologies to improve clarity, strength, and food-grade safety of PCR plastics. Integration of advanced sorting and recycling systems is boosting the supply of high-quality PCR resins. Brands are launching packaging with higher PCR content, coupled with lightweight designs to reduce material use. Partnerships across recycling firms, resin producers, and FMCG companies are strengthening supply chains. These trends are promoting closed-loop recycling, sustainable packaging adoption, and innovation across industries relying on PCR plastic packaging.

The PCR (post-consumer recycled) plastic packaging market is witnessing strong growth momentum, fueled by increasing environmental awareness, corporate sustainability commitments, and tightening regulatory frameworks on plastic waste reduction. Rising consumer demand for eco-friendly packaging solutions has accelerated adoption across multiple industries, including food and beverages, personal care, and household products.

The market benefits from advancements in recycling technologies, which improve the quality, consistency, and safety of PCR plastics. Integration of PCR materials into existing packaging lines supports brand positioning and compliance with circular economy initiatives.

Current growth is further supported by extended producer responsibility (EPR) policies and investments in closed-loop supply chains. With continued innovation in material properties and recycling processes, PCR plastic packaging is expected to expand its role as a mainstream sustainable packaging option in the coming years.

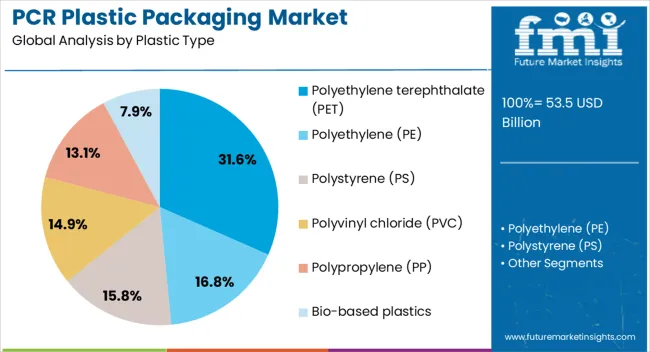

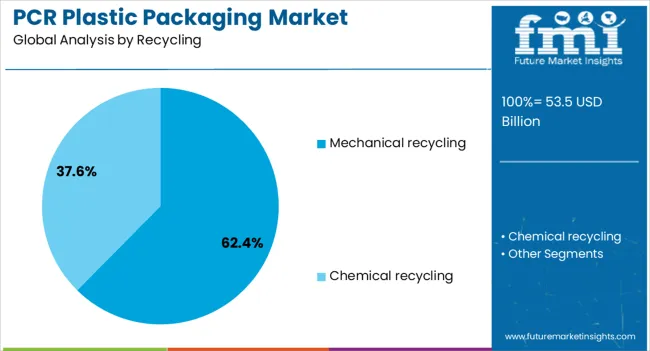

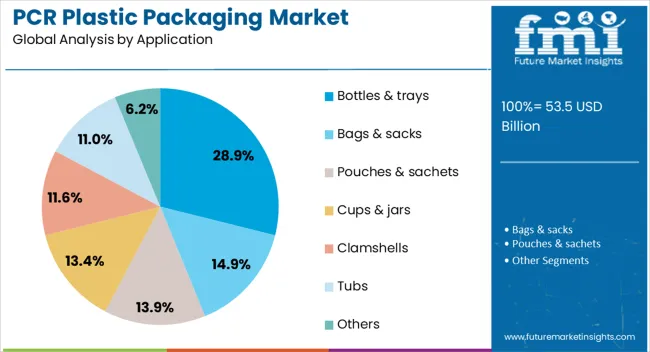

The PCR plastic packaging market is segmented by plastic type, recycling, application, and geographic regions. By plastic type, PCR plastic packaging market is divided into polyethylene terephthalate (PET), polyethylene (PE), polystyrene (PS), polyvinyl chloride (PVC), polypropylene (PP), and bio-based plastics. In terms of recycling, PCR plastic packaging market is classified into mechanical recycling and chemical recycling. Based on application, PCR plastic packaging market is segmented into bottles & trays, bags & sacks, pouches & sachets, cups & jars, clamshells, tubs, and others. Regionally, the pcr plastic packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene terephthalate (PET) segment leads the plastic type category in the PCR plastic packaging market, holding approximately 31.6% share. PET is widely favored for its clarity, strength, and recyclability, making it suitable for a broad range of packaging applications.

The segment’s dominance is supported by well-established collection and recycling infrastructure, which ensures consistent supply of high-quality PCR PET. Its compatibility with food-grade applications has reinforced demand from beverage and packaged food industries.

The segment also benefits from lightweight properties that reduce transportation costs and carbon footprint. With increasing brand commitments to incorporate higher percentages of recycled content, PET is expected to remain the leading plastic type in the market.

The mechanical recycling segment dominates the recycling category, representing approximately 62.4% share. This leadership is attributed to the cost-effectiveness, scalability, and maturity of mechanical recycling technologies compared to chemical alternatives.

The process involves collecting, sorting, cleaning, and reprocessing plastics into pellets for reuse, making it suitable for large-scale production needs. Widespread infrastructure and lower energy requirements contribute to its preference in both developed and developing markets.

Mechanical recycling’s ability to maintain material integrity for multiple cycles further supports its leading position. As regulations increasingly require recycled content in packaging, mechanical recycling is expected to retain its primary role in supply chains.

The bottles & trays segment holds approximately 28.9% share of the application category in the PCR plastic packaging market. Demand in this segment is driven by the high consumption of beverages, ready-to-eat meals, and packaged fresh produce.

PET bottles and trays made from PCR content meet both performance and sustainability requirements, offering durability, transparency, and food safety compliance. This application benefits from strong brand adoption as companies seek to demonstrate environmental responsibility and reduce reliance on virgin plastics.

With continuous investment in improving recycled resin quality and consumer acceptance, the bottles & trays segment is expected to sustain its strong position in the market.

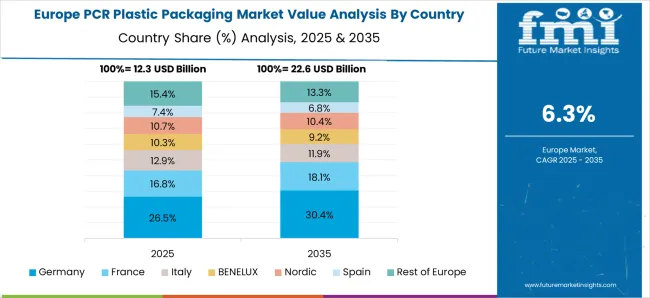

The global PCR plastic packaging market was valued at USD 50-52 billion in 2024 and is projected to reach USD 70-100 billion by 2032-2034. North America accounted for 30-35% of value share, while Europe leads in volume due to mature recycling systems. PET is the largest material segment, followed by PP, PE, and PVC. Bottles dominate product formats, with rigid containers and pouches following. Food and beverage applications represent the largest end-use, with cosmetics and personal care gaining traction. Growth is driven by regulatory mandates, brand sustainability initiatives, and rising consumer demand for eco-friendly packaging.

Regulatory mandates in Europe, the USA, and Asia require minimum recycled content in packaging, often 25–50% for rigid containers or bottles. Leading FMCG and beverage companies are committing to over 50% PCR usage by 2030. Surveys indicate 60–70% of consumers prefer products packaged with recycled plastics. Investments in mechanical and chemical recycling infrastructure are increasing to improve feedstock quality and food-contact compliance. These drivers reduce reliance on virgin plastics and lower lifecycle costs. Adoption in high-volume food and beverage applications is accelerating market expansion, while cosmetic and personal care brands capitalize on sustainability to differentiate products.

PET maintains dominance due to established bottle-to-bottle recycling loops and food-contact approvals, while PP is projected to grow fastest because chemical recycling enables food-grade certification. Innovations such as barrier-coated films, multilayer trays, and flexible pouches preserve shelf-life while reducing material usage by 10–15%. Cosmetic and personal care brands increasingly use PCR jars, caps, and tubes. Asia Pacific is experiencing strong growth with rising packaging volumes and local PCR resin production reducing costs and supply chain lead times. Functional packaging and luxury segment adoption create opportunities for companies offering innovative, high-quality PCR solutions in global markets.

Extended Producer Responsibility programs are expanding globally, requiring brands to manage end-of-life packaging. Digital traceability using QR codes or labeling verifies PCR content and ensures transparency. Lightweighting reduces material usage by 10–30%, mitigating higher costs for PCR resins. Flexible packaging and multilayer pouches are growing faster than rigid containers, particularly in emerging markets. Chemical recycling for PP and PE is increasing to address feedstock contamination and meet food-grade standards. E-commerce packaging is adopting PCR content while maintaining durability. The integration of advanced recycling, traceability, and packaging design reflects a global trend toward sustainable, consumer-centric packaging solutions.

High PCR resin prices, typically 20–35% above virgin resins, remain a major restraint, particularly for transparent or food-grade grades. Contamination in post-consumer feedstock can reduce quality and lead to regulatory rejection. Collection and sorting infrastructure in developing regions is insufficient, limiting availability of clean PCR pellets. Food-contact certification requires time and capital investment, and small converters may lack resources for advanced sorting, chemical recycling, or quality control. These factors slow adoption in price-sensitive regions. Manufacturers must optimize feedstock sourcing, production efficiency, and quality assurance to expand global adoption and maintain competitive pricing.

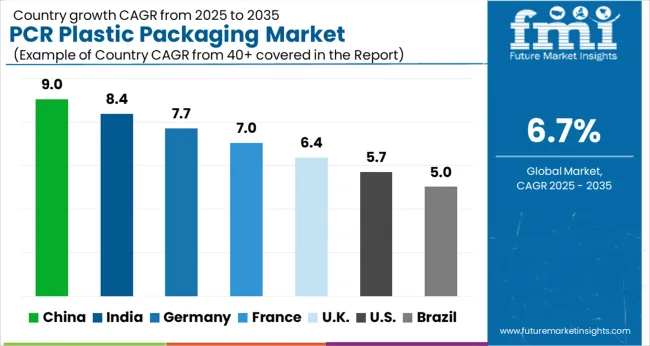

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The PCR plastic packaging market is projected to increase at a global CAGR of 6.7% through 2035, supported by circular economy programs, stricter recycling mandates, and rising consumer preference for eco-friendly packaging solutions. China is the frontrunner at 9.0%, translating to a 1.34× multiple of the global rate, driven by large-scale recycling infrastructure expansion and high-volume packaging consumption. India follows at 8.4%, or 1.25× the benchmark, with growth linked to government-backed waste management initiatives and strong demand from the food and beverage sector. Germany records 7.7%, 1.15× the global pace, underpinned by stringent EU recycling directives and advanced sorting technology adoption. The United Kingdom, at 6.4%, tracks just below the global average, shaped by packaging compliance targets and increasing use of recycled polymers in FMCG. The United States stands at 5.7%, 0.85× the global CAGR, reflecting moderate adoption supported by corporate sustainability pledges and retail-driven recycling demand. The full study covers 40+ countries, with key growth markets highlighted here.

The PCR plastic packaging market in China is expected to expand at a CAGR of 9.0%, driven by strong consumer goods demand and government initiatives promoting recycled material usage. Food and beverage companies are incorporating PCR-based PET and HDPE packaging to align with circular economy goals. Major FMCG players and e-commerce companies are collaborating with recyclers to secure consistent PCR feedstock supply. Packaging producers are upgrading manufacturing facilities with advanced sorting and washing technologies to improve material quality. Policy measures for reducing virgin plastic usage in packaging are also strengthening adoption across key industries.

The PCR plastic packaging market in Germany is set to increase at a CAGR of 7.7%, supported by strict recycling policies and consumer preference for sustainable packaging solutions. German packaging manufacturers are adopting advanced recycling technologies to deliver high-quality PCR resins suitable for food-contact applications. Demand is high in beverages, dairy products, and cosmetics where brands are required to comply with EU plastic recycling targets. Local players are leading innovation in multi-layer PCR packaging solutions designed for high-barrier applications. Retailers are also encouraging suppliers to adopt PCR packaging in private-label products, driving demand across multiple categories.

The PCR plastic packaging market in the United Kingdom is forecast to grow at a CAGR of 6.4%, supported by regulations on recycled content and demand from consumer brands. Companies in food, beverage, and personal care sectors are adopting PCR-based PET and HDPE packaging to meet mandated recycling targets. Local recyclers and packaging converters are investing in chemical recycling facilities to improve material quality and expand supply. The Plastic Packaging Tax has accelerated the shift toward higher PCR content in packaging across industries. Retailers are also introducing store-level initiatives to promote collection and recycling for circular packaging solutions.

The chemical boiler market in the United Kingdom is projected to grow at a CAGR of 3.4%, driven by chemical, pharmaceutical, and food processing industries seeking reliable and energy-efficient boiler systems. Key suppliers such as Babcock, Spirax Sarco, and Bosch provide automated, high-performance chemical boilers. Adoption is concentrated in industrial facilities, chemical parks, and processing plants. Technological trends focus on emission reduction, energy efficiency, and process automation. Government policies supporting industrial modernization, energy efficiency, and emission standards reinforce market growth. Rising industrial demand for reliable and low-maintenance boilers supports steady adoption in the United Kingdom.

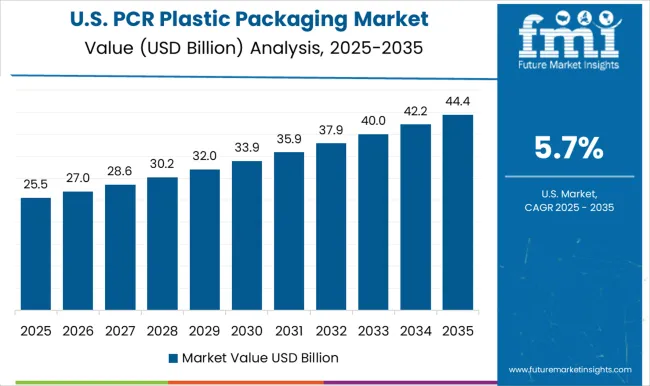

The PCR plastic packaging market in the United States is anticipated to grow at a CAGR of 5.7%, driven by brand commitments to reduce virgin plastic usage and state-level recycling mandates. Food and beverage companies, including bottled water and soft drink producers, are investing in PCR-based PET bottles. Large retailers and consumer goods companies are setting minimum PCR content targets across product categories. Supply chain challenges related to consistent PCR resin quality are pushing investments in advanced recycling technologies. Collaboration between packaging suppliers and recyclers is expanding collection systems, strengthening the domestic supply of high-grade PCR materials.

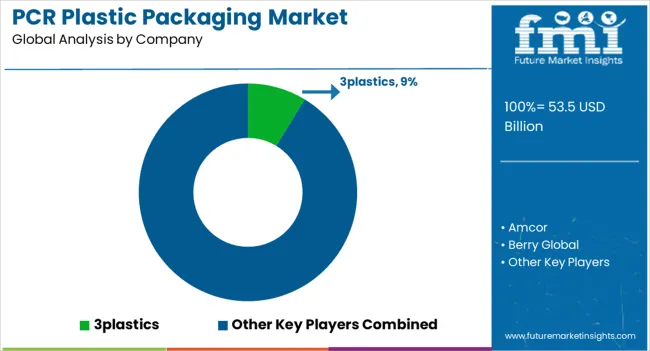

Competition in the PCR plastic packaging market is driven by global leaders and regional specialists striving to differentiate through material quality, design, and production capacity. Amcor, Berry Global, and Mondi lead with large-scale production, highlighting packaging that integrates post-consumer resin while maintaining strength and clarity. PTT Global Chemical supports packaging solutions with advanced resin technologies. Proampac and Glenroy focus on flexible formats, emphasizing barrier performance and extended shelf life in their brochures.

3plastics, Sanle Plastic, and Longdapac compete through customization and cost-effective production, supplying bottles, jars, and containers for cosmetics, household, and food products. Regent Plast and Red Pack leverage regional distribution networks to serve fast-moving consumer goods. Evergreen Resources and Cambrian Packaging emphasize consistent quality and recycled content, appealing to clients seeking compliance with environmental standards. Product brochures play a key role in market competition, showcasing recyclability, performance testing, and compatibility with existing filling systems.

Visual and technical details are structured to inform and persuade, with frequent updates reflecting regulatory changes and client partnerships. Larger companies rely on global reach and production scale, while smaller players highlight agility, niche offerings, and faster turnaround times. The market is defined by how effectively brochures communicate durability, material quality, and overall value in PCR plastic packaging solutions.

| Items | Values |

|---|---|

| Quantitative Units | USD 53.5 billion |

| Plastic Type | Polyethylene terephthalate (PET), Polyethylene (PE), Polystyrene (PS), Polyvinyl chloride (PVC), Polypropylene (PP), and Bio-based plastics |

| Recycling | Mechanical recycling and Chemical recycling |

| Application | Bottles & trays, Bags & sacks, Pouches & sachets, Cups & jars, Clamshells, Tubs, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3plastics, Amcor, Berry Global, Cambrian Packaging, Evergreen Resources, Glenroy, Longdapac, Mondi, Proampac, PTT Global Chemical, Red Pack, Regent Plast, and Sanle Plastic |

| Additional Attributes | Dollar sales by packaging type and end use, demand dynamics across food, beverages, personal care, and healthcare, regional trends in recycled plastic adoption, innovation in material quality, design, and barrier properties, environmental impact of recycling efficiency and waste reduction, and emerging use cases in circular economy and sustainable packaging solutions. |

The global pcr plastic packaging market is estimated to be valued at USD 53.5 billion in 2025.

The market size for the pcr plastic packaging market is projected to reach USD 102.3 billion by 2035.

The pcr plastic packaging market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in pcr plastic packaging market are polyethylene terephthalate (pet), polyethylene (pe), polystyrene (ps), polyvinyl chloride (pvc), polypropylene (pp) and bio-based plastics.

In terms of recycling, mechanical recycling segment to command 62.4% share in the pcr plastic packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PCR Tire Building Machine Market Size and Share Forecast Outlook 2025 to 2035

PCR Plate Sealer Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

PCR Pouches Market

qPCR Instruments Market Analysis - Growth, Trends & Forecast 2025 to 2035

RT-PCR Kits Market Growth - Trends & Forecast 2023 to 2035

1-Step RT-PCR Kits Market Size and Share Forecast Outlook 2025 to 2035

Multiplex PCR Assays Market Size and Share Forecast Outlook 2025 to 2035

Real-Time PCR Systems Market Growth – Trends & Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Global One Step RT-qPCR Kits Market Analysis – Size, Share & Forecast 2024-2034

Cartridges for RT-PCR Automatic Systems Market

Mycobacterium Tuberculosis PCR Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA