The temperature loggers market is projected to grow from USD 2.2 billion in 2025 to USD 3.9 billion by 2035, registering a CAGR of 5.7% during the forecast period. Sales in 2024 reached USD 2.0 billion. Demand has been driven by rising cold chain operations across pharmaceuticals, food, and biotech industries.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2.2 billion |

| Projected Market Size in 2035 | USD 3.9 billion |

| CAGR (2025 to 2035) | 5.7% |

Enhanced traceability and real-time monitoring have remained essential for compliance with health safety protocols. Expansion of vaccine distribution networks and biologic shipments has played a key role in influencing purchasing decisions. The increasing importance of end-to-end temperature-sensitive logistics in emerging markets has pushed demand.

In 2023, Tive, the global leader in real-time end-to-end shipment visibility solutions, announced reduced pricing for the revolutionary Tive Tag a reusable, cloud-enabled temperature logger in the form of a thin, flexible shipping label. “We have made tremendous technological advancements with Tive Tag in the last few months, all of which have enabled us to reduce the cost of manufacturing and we are passing those savings on to our customers,” says Krenar Komoni, Founder & CEO of Tive. “As the most affordable temperature logger available in the world, Tive Tag empowers all perishable and cold chain shippers to fully protect their delicate cargo from start to finish.”

The temperature loggers market has been significantly influenced by the increasing demand for sustainable and environmentally friendly monitoring solutions. Manufacturers have been transitioning towards recyclable and biodegradable materials to align with environmental sustainability goals and meet regulatory requirements.

Innovations in sensor technologies have led to the development of devices that not only provide superior accuracy but also minimize environmental impact. Advancements in manufacturing technologies have enabled the production of lightweight and durable temperature loggers, catering to a wide range of applications across different industries.

Future demand for temperature loggers is expected to be led by biopharma cold chain expansion and real-time diagnostics for biologic drugs and high-value foods. Industry players are likely to compete through advanced sensor accuracy, remote calibration, and cloud analytics integration. Strategic emphasis will continue on cost optimization, network automation, and battery-free sensor designs.

Asia-Pacific is forecasted to gain significant momentum due to rising vaccine manufacturing and medical logistics. M&A activity is expected to target sensor firms and software providers for end-to-end logging solutions. Regulatory audits and real-time temperature validation in high-risk sectors are forecasted to drive premium logger adoption. Growth potential also exists in micro-loggers for single-dose shipments.

The market is segmented based on product type, application type, end-use industry, and region. By product type, it includes single-use temperature loggers, reusable temperature loggers, wireless/Bluetooth temperature loggers, USB temperature loggers, and real-time GPS-enabled temperature loggers. These devices cater to varying monitoring needs across mobility and storage phases.

By application type, segments include cold chain monitoring, warehouse & storage, in-transit monitoring, laboratory & freezer monitoring, and HVAC system monitoring. Key end-use industries comprise pharmaceuticals & biotechnology, food & beverage, chemicals, logistics & supply chain, agriculture & floriculture, and electronics. Regional segmentation includes North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

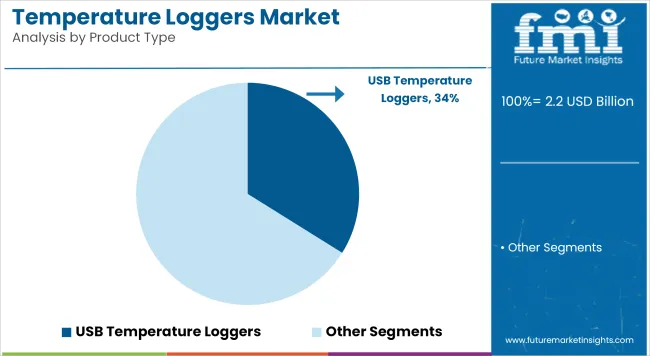

USB temperature loggers are projected to dominate the market with a 33.9% share in 2025, owing to their ease of use, compact form factor, and direct data accessibility without specialized software. These loggers have been extensively adopted in cold chain monitoring and short-duration shipments. They have enabled temperature-sensitive sectors to ensure product integrity through simple plug-and-play validation at delivery points. USB models have been preferred for their cost-effectiveness in both single-use and multi-use formats.

Pharmaceuticals, food logistics, and clinical trials have increasingly utilized USB loggers for real-time alerts and post-trip compliance auditing. Device durability and onboard memory storage have further boosted their appeal in dynamic transit environments. Continued demand for regulatory traceability and lightweight shipment monitoring tools is expected to drive the preference for USB-based loggers in both developed and emerging markets.

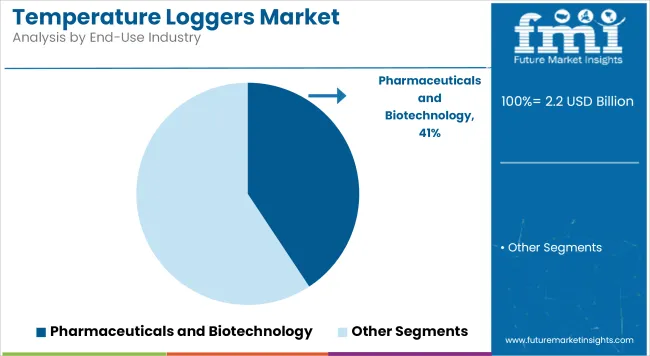

The pharmaceuticals and biotechnology sector is anticipated to hold 40.7% of the temperature loggers market in 2025, driven by the rising need for precision monitoring of temperature-sensitive biologics and vaccines. Stringent GDP and GxP regulations have mandated real-time thermal data capture across global supply routes. Loggers have been widely implemented in vaccine distribution, cell and gene therapy logistics, and biopharma clinical trials. Specialized packaging solutions integrated with temperature tracking have become standard for regulatory compliance.

USB and real-time GPS loggers have enabled end-to-end thermal mapping for high-value shipments under strict time and temperature controls. These solutions have minimized spoilage risk and improved visibility during multimodal transit. With increased investment in biologics, global immunization efforts, and cold chain infrastructure, temperature loggers are expected to remain indispensable tools in the pharmaceutical logistics ecosystem.

Calibration Accuracy, Connectivity Issues, and Industry-Specific Compliance

Maintaining high-calibration accuracy for an extended period is necessary for predictable behavior at different middays, which is essential for applications ranging from Pharmaceuticals to food security and cold chain logistics, but comes at the trade of repeated recalibrations and quality checks. Another challenge might be the reliability of connectivity, for example in remote or mobile environments where maintaining data synchronization might be delayed or interrupted.

Temperature loggers have to comply with industry-specific standards such as the FDA 21 CFR Part 11, WHO GDP, or EN 12830, which can significantly drive up certification costs and also make integration challenging for smaller manufacturers.

Cold Chain Expansion, Real-Time Monitoring, and IoT Integration

However, the market is steadily growing owing to the grow consumption of cold chain infrastructure across the globe, especially by vaccines, biologics, and perishable food products. Temperature loggers keep logistics, manufacturing, and storage environments safe and compliant. You are also witnessing an increase in their usage for HVAC systems, environmental monitoring and industrial automation etc.

Opportunities The prospects are continuously increasing with the emerging IoT-powered loggers, wireless data transmission, and cloud-based monitoring tools. Firms are putting money into USB-based plug-and-play apparatuses, Bluetooth-appropriate loggers, and constant caution frameworks that trigger activity when temperature creeps past foreordained points of confinement.

Multi-sensor data logging, such as humidity, pressure, and location, is increasingly in demand most notably for high-value supply chains and regulatory-sensitive industries.

The USA dominates the global market because of its developed pharmaceutical logistics network, adherence to stringent FDA and CDC guidelines, and speedy digitization of cold-storage/refrigerated transport systems. Bluetooth and Wi-Fi-based loggers for real-time monitoring are increasingly being adopted across healthcare, food service, and aerospace sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

In the UK, increased adoption is driven by demand for tracking temperature-sensitive medications, post-Brexit trade compliance, and digitally integrated food distribution. Automated auditing and mobile dashboard alerts, particularly for perishable goods and vaccine delivery, are the focus of companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

EU countries are GDP compliance and temperature-intelligent products. France, Germany, and the Netherlands are spending out lots in smart warehouse technologies themselves, starting with temperature loggers extensively used in pharmaceutical, biotech, and organic food export.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 5.7% |

Adding its own high-precision temperature logging to production and storage systems, Japan’s advanced electronics and pharmaceutical sectors Compact, programmable loggers are being employed more in biotech manufacturing, medical transport, and vaccine monitoring.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

Multi-point and real-time monitoring solutions are in high demand due to South Korea’s booming biopharma exports, semiconductor manufacturing, and intelligent logistics infrastructure. IoT-based temperature control systems are being promoted by startups and government-backed initiatives to create an efficient supply chain.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

Demand for temperature loggers is surging in segments such as cold chain logistics, pharmaceuticals, food safety, and industrial process monitoring which is driving the growth of the temperature loggers market. Wireless data loggers, NFC/RFID enabled devices, and cloud-synced analytics are being spurred by the need for real-time visibility, global transport regulation compliance, and IoT integration.

As a result, companies are investing in disposable and multi-use loggers, temperature-humidity combined sensors and ultra-low temperature tracking for biologics and vaccines. Accuracy, data integrity, and connectivity continue to dominate the concerns of sensor manufacturers and supply chain technology providers.

The overall market size for the temperature loggers market was USD 2.2 billion in 2025.

The temperature loggers market is expected to reach USD 3.9 billion in 2035.

The demand for temperature loggers is rising due to increasing need for real-time temperature monitoring in cold chain logistics, growing regulatory requirements in healthcare, and advancements in web-based data logger technology. The expanding medical and pharmaceutical sectors are further boosting market growth.

The top 5 countries driving the development of the temperature loggers market are the USA, Germany, China, Japan, and India.

Web-based data loggers and medical & pharma are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Temperature Controlled Pharmaceutical Packaging Solutions Market Forecast and Outlook 2025 to 2035

Temperature Monitoring Device Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Vaccine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Temperature and Freshness Sensors Market Size and Share Forecast Outlook 2025 to 2035

Temperature Detection Screen Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Pharma Packaging Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Packaging Solution Market - Size, Share, and Forecast Outlook 2025 to 2035

Temperature Transmitter Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Temperature Controlled Packaging Solutions

Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

Temperature Controlled Pharmaceutical Container Market Analysis, Size, Share & Forecast 2024 to 2034

Temperature Controlled Packaging Boxes Market

Temperature Sensing Foley Catheter Market

Temperature Calibrator Market

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA