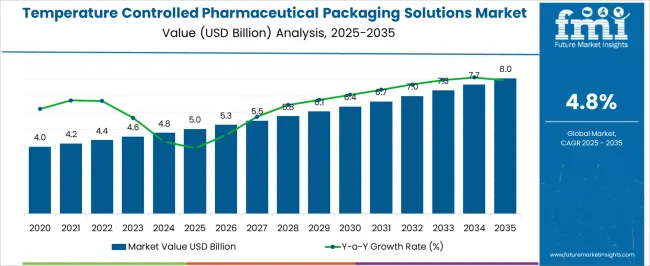

The Temperature Controlled Pharmaceutical Packaging Solutions Market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 8.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The temperature controlled pharmaceutical packaging solutions market is experiencing robust growth driven by the rising demand for thermally stable packaging to preserve the integrity of temperature-sensitive drugs. The current market landscape is defined by expanding biopharmaceutical production, increasing distribution of vaccines and biologics, and the growing adoption of advanced cold-chain logistics.

Regulatory mandates for maintaining product efficacy during transportation are further accelerating the adoption of high-performance packaging materials and technologies. Manufacturers are investing in innovative insulation materials, phase change systems, and smart monitoring solutions to enhance temperature accuracy and minimize spoilage risks.

The future outlook is shaped by the continued expansion of global pharmaceutical supply chains and the growing need for reliable storage and distribution systems in emerging economies Growth rationale is supported by the convergence of quality compliance, efficiency in temperature monitoring, and sustainability initiatives, which are collectively strengthening the market’s position across commercial, clinical, and research-based applications.

| Metric | Value |

|---|---|

| Temperature Controlled Pharmaceutical Packaging Solutions Market Estimated Value in (2025 E) | USD 5.0 billion |

| Temperature Controlled Pharmaceutical Packaging Solutions Market Forecast Value in (2035 F) | USD 8.0 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

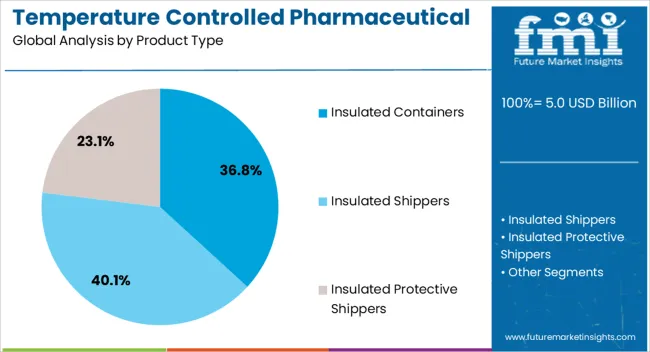

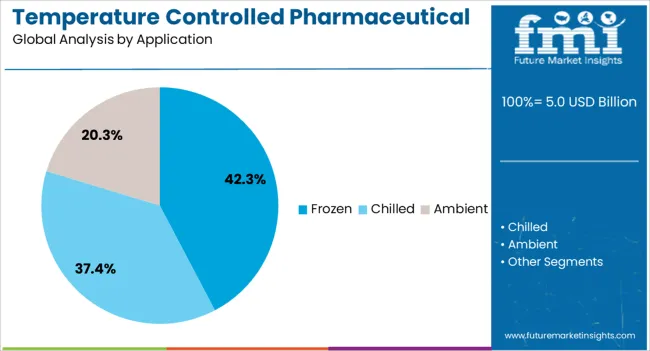

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Insulated Containers, Insulated Shippers, and Insulated Protective Shippers. In terms of Application, the market is classified into Frozen, Chilled, and Ambient. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The insulated containers segment, holding 36.80% of the product type category, is leading the market due to its high reliability in maintaining consistent temperature profiles during pharmaceutical transport. Demand has been reinforced by increasing shipments of temperature-sensitive products such as biologics, vaccines, and specialty drugs.

Technological enhancements in insulation design, lightweight materials, and multi-layer construction have improved durability and performance. The segment’s adoption has been accelerated by compliance with international temperature control standards and growing preference for reusable solutions that reduce logistics costs and environmental impact.

Strategic collaborations between packaging providers and pharmaceutical companies are enabling innovation in thermal performance and digital tracking systems These advancements are ensuring quality assurance across long-distance and last-mile deliveries, allowing insulated containers to retain their dominant position within the temperature controlled pharmaceutical packaging solutions market.

The frozen segment, accounting for 42.30% of the application category, has remained the leading application due to the extensive requirement for ultra-low temperature storage and transport of biologics, vaccines, and plasma-derived products. Its dominance is supported by increasing production of temperature-sensitive therapies and the growing prevalence of biotechnological formulations requiring controlled frozen environments.

The segment’s growth is being reinforced by advancements in phase change materials and vacuum-insulated panels that enable precise temperature maintenance during long transit durations. Regulatory emphasis on preserving product stability throughout the supply chain has further strengthened frozen packaging demand.

Manufacturers are integrating IoT-based sensors and data loggers to enhance traceability and ensure compliance with stringent cold-chain protocols These technological and operational improvements are expected to sustain the frozen segment’s leadership, ensuring its continued contribution to the market’s overall expansion.

The global demand for the temperature controlled pharmaceutical packaging solutions market was estimated to reach a valuation of USD 4 billion in 2020, according to a report from Future Market Insights. From 2020 to 2025, the temperature controlled pharmaceutical packaging solutions market witnessed significant growth, registering a CAGR of 5.5%.

| Historical CAGR from 2020 to 2025 | 5.5% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 4.8% |

The development of temperature controlled packaging solutions that include blockchain technology is a latest innovation in this domain. This concept would improve supply chain transparency and traceability, guaranteeing that pharmaceutical items remain at the appropriate temperature levels throughout their journey from manufacturing plants to end users, hence improving product safety and regulatory compliance.

The market for temperature controlled pharmaceutical packaging solutions is expected to grow in the future due to these factors:

Strict Temperature Control Regulations to Enhance Market Growth

The growing demand for biologics, vaccines, and specialized pharmaceuticals need stringent temperature control to ensure efficacy and safety, driving the need for innovative packaging solutions. Temperature controlled pharmaceutical packaging solutions are becoming more popular as pharmaceutical distribution networks expand into new areas with harsh climatic conditions.

Investments in dependable packaging solutions are prompted by the strict regulatory requirements for temperature sensitive medications, which demand adherence to temperature control standards. Pharmaceutical supply chains are becoming more global, which emphasizes how crucial temperature controlled pharmaceutical packaging solutions is to maintaining product integrity while in transit.

Challenges in the Cold Chain Management to Impede the Market Growth

Maintaining temperature control throughout the supply chain for temperature sensitive pharmaceuticals involves logistical problems that need specialized infrastructure and knowledge, thereby limiting market accessibility and scalability for some enterprises.

Adoption of current temperature controlled packaging technology is hindered, especially by smaller pharmaceutical businesses, by the high initial cost involved. Challenges in supply chain logistics, such as the requirement for specialized infrastructure and cold chain management, impede industry entrance and growth.

This section focuses on providing detailed analysis of two particular market segments for temperature controlled pharmaceutical packaging solutions, the dominant product type and the significant application. The two main segments discussed below are the insulated chillers and chilled segments.

| Product Type | Insulated Chillers |

|---|---|

| CAGR from 2025 to 2035 | 62.30% |

In 2025, the insulated chillers are anticipated to gain a 62.30% market share. Pharmaceutical supply chains are becoming more and more globalized, making dependable temperature control solutions necessary to preserve product integrity while shipping across several climatic zones.

The necessity for accurate temperature control is highlighted by the rising need for drugs that are sensitive to changes in temperature, such as biologics and vaccinations. Pharmaceutical firms must invest in insulated chillers to maintain compliance and product safety across the supply chain due to strict regulatory standards and quality assurance requirements and costs.

| Application | Chilled |

|---|---|

| Market Share in 2025 | 42.90% |

In 2025, the chilled application segment is anticipated to acquire almost 42.90% market share. A growing number of drugs, such as vaccinations and biologics, must be stored and transported at certain cold temperatures in order to be effective.

The use of chilled solutions is becoming increasingly practical due to advancements in refrigeration and cold chain logistics. Pharmaceutical firms are compelled by strict regulations and elevated quality standards to invest in dependable chilled packaging solutions in order to guarantee product safety and stability.

This section will go into detail on the temperature controlled pharmaceutical packaging solutions markets in a few key countries, including the United States, the United Kingdom, China, Japan and South Korea.

This part will focus on the key factors that are driving up demand in these countries for temperature controlled pharmaceutical packaging solutions.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 36.6% |

| The United Kingdom | 37% |

| France | 36.9% |

| China | 37.6% |

| Japan | 38.1% |

The United States temperature controlled pharmaceutical packaging solutions ecosystem is anticipated to gain a CAGR of 2% through 2035. Factors that are bolstering the growth are:

The temperature controlled pharmaceutical packaging solutions market in the United Kingdom is expected to expand with a 3.80% CAGR through 2035. The factors pushing the growth are:

The temperature controlled pharmaceutical packaging solutions ecosystem in China is anticipated to develop with a 5.10% CAGR from 2025 to 2035. The drivers behind this growth are:

The temperature controlled pharmaceutical packaging solutions industry in Japan is anticipated to reach a 2.60% CAGR from 2025 to 2035. The drivers propelling growth forward are:

The temperature controlled pharmaceutical packaging solutions ecosystem in South Korea is likely to evolve with a 3.40% CAGR during the forecast period. The factors bolstering the growth are:

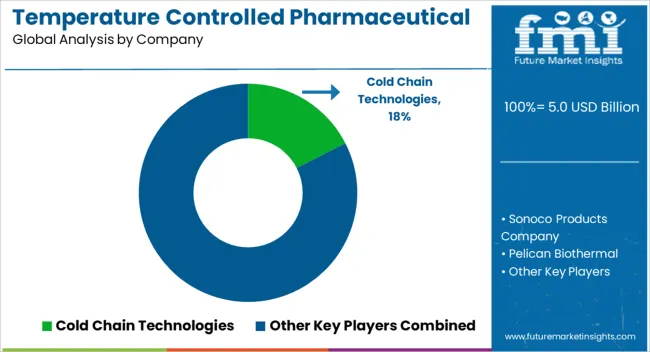

The key players in the market for temperature controlled pharmaceutical packaging solutions are concentrating on a number of tactics to satisfy the strict needs for the transportation and storage of drugs that are sensitive to temperature. Investing in research and development to improve temperature monitoring systems and insulating materials is part of this.

They are also diversifying their product lines to provide a greater selection of packaging alternatives that are suited to various temperature needs. To guarantee the integrity of the supply chain from beginning to finish, cooperation with pharmaceutical firms and logistical partners is also given top priority.

Significant corporations are progressively implementing sustainable practices in order to lessen their impact on the environment and adhere to legal requirements. The key players in this market include:

Significant advancements in the temperature controlled pharmaceutical packaging solutions market are being made by key market participants, and these include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.8% from 2025 to 2035 |

| Market value in 2025 | USD 5.0 billion |

| Market value in 2035 | USD 8.0 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Application, Region |

| Region Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Sonoco Products Company; Pelican Biothermal; Sofrigam SA Ltd.; Cryopak; Cold Chain Technologies; Envirotainer Ltd.; Cencora Inc.; Inmark Packaging; American Aerogel Corporation; Aeris Dynamics |

| Customization Scope | Available on Request |

The global temperature controlled pharmaceutical packaging solutions market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the temperature controlled pharmaceutical packaging solutions market is projected to reach USD 8.0 billion by 2035.

The temperature controlled pharmaceutical packaging solutions market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in temperature controlled pharmaceutical packaging solutions market are insulated containers, _chest style, _upright style, _others, insulated shippers, _panels & envelopes, _eps foam containers, _fibreboard, _pur containers and insulated protective shippers.

In terms of application, frozen segment to command 42.3% share in the temperature controlled pharmaceutical packaging solutions market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Temperature Monitoring Device Market Size and Share Forecast Outlook 2025 to 2035

Temperature and Freshness Sensors Market Size and Share Forecast Outlook 2025 to 2035

Temperature Detection Screen Market Size and Share Forecast Outlook 2025 to 2035

Temperature Loggers Market Size, Share & Forecast 2025 to 2035

Temperature Transmitter Market Growth - Trends & Forecast 2025 to 2035

Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

Temperature Sensing Foley Catheter Market

Temperature Calibrator Market

Temperature Controlled Packaging Solution Market - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Temperature Controlled Packaging Solutions

Temperature Controlled Packaging Boxes Market

Temperature Controlled Pharma Packaging Market Size, Share & Forecast 2025 to 2035

Temperature Controlled Vaccine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Pharmaceutical Container Market Analysis, Size, Share & Forecast 2024 to 2034

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

RTD Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA