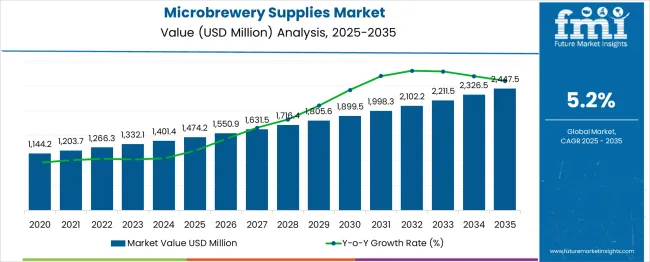

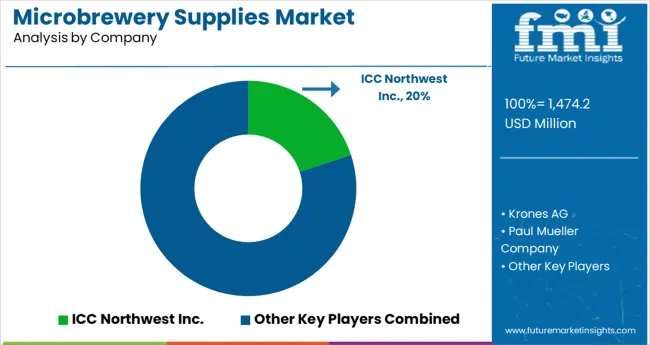

The Microbrewery Supplies Market is estimated to be valued at USD 1474.2 million in 2025 and is projected to reach USD 2447.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The microbrewery supplies market is witnessing significant growth as craft beer consumption rises alongside increasing interest in artisanal and locally produced beverages. This momentum is being supported by changing consumer preferences toward authentic and diverse flavors, coupled with the expansion of microbreweries in urban and suburban areas.

Investments in advanced brewing technology and emphasis on efficient space utilization are enabling small and mid-sized breweries to scale operations without compromising quality. Environmental considerations, such as water and energy efficiency, are influencing equipment innovation, while greater access to financing and supportive regulatory frameworks are further encouraging market entry.

Future growth opportunities are expected to arise from premiumization trends, collaborative brewing models, and integration of automation to enhance productivity and consistency.

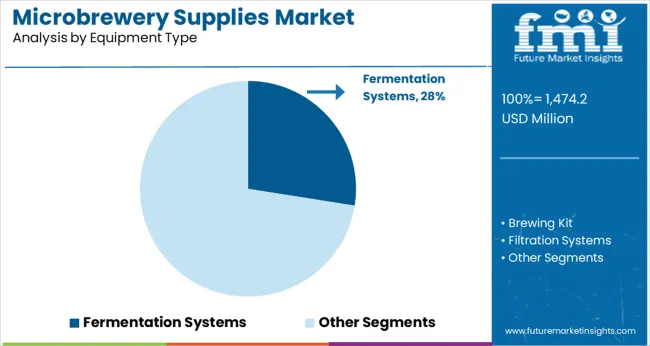

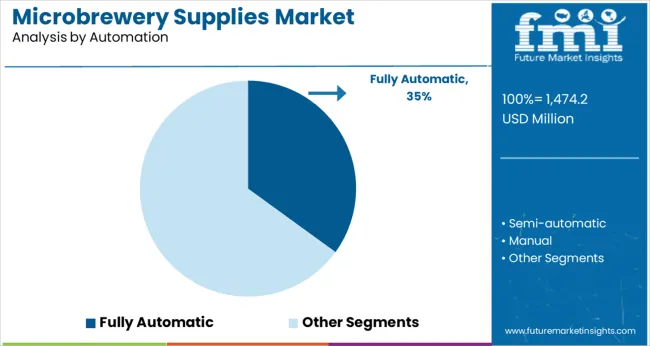

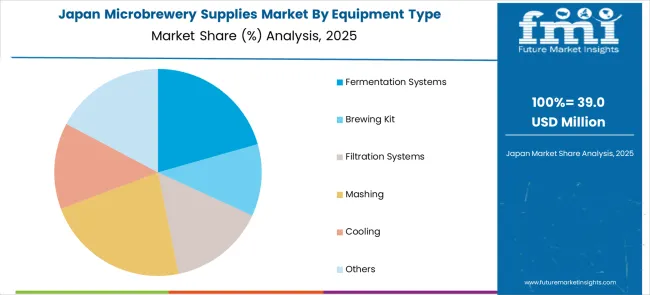

The market is segmented by Equipment Type, Automation, and Application and region. By Equipment Type, the market is divided into Fermentation Systems, Brewing Kit, Filtration Systems, Mashing, Cooling, and Others. In terms of Automation, the market is classified into Fully Automatic, Semi-automatic, and Manual.

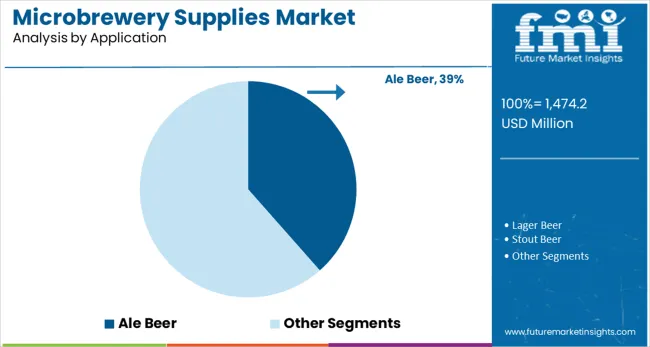

Based on Application, the market is segmented into Ale Beer, Lager Beer, Stout Beer, Witbier, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by equipment type, fermentation systems are expected to hold 27.5% of the total market revenue in 2025, positioning themselves as the leading subsegment. This leadership has been attributed to their indispensable role in defining the quality, consistency, and character of craft beer.

The segment has benefited from advancements in temperature control, hygienic design, and material durability, which have improved efficiency and reduced contamination risks. Fermentation systems are increasingly being chosen for their ability to support varied recipes and small batch production, meeting the diverse preferences of craft beer consumers.

The growing demand for premium and specialty brews has reinforced investment in customized and scalable fermentation solutions, further solidifying the segment’s prominence within the equipment category.

In terms of automation, the fully automatic segment is projected to account for 35.0% of the market revenue in 2025, emerging as the dominant choice among microbreweries. This dominance has been driven by the desire to improve operational efficiency, reduce manual intervention, and maintain consistency across batches.

Fully automatic systems have been adopted for their ability to monitor and control critical parameters in real time, minimizing human error and enhancing productivity. Their contribution to labor cost savings and compliance with sanitary standards has also strengthened their appeal.

As microbreweries scale up to meet rising demand while preserving artisanal quality, the integration of intelligent sensors, programmable controls, and data analytics in fully automatic systems has become increasingly vital, reinforcing this segment’s leading share in the market.

Segmented by application, ale beer is forecast to represent 38.5% of the market revenue in 2025, securing its place as the leading application segment. This leadership is reinforced by its historical significance, diverse flavor profiles, and strong consumer demand for traditional yet customizable beer varieties.

Microbreweries have embraced ale production due to its shorter fermentation period, adaptability to innovative recipes, and appeal to a broad audience.

The versatility of ale styles allows brewers to differentiate their offerings and cater to niche tastes while maintaining operational efficiency. The cultural resonance of ale beer within craft beer communities and its suitability for experimentation have further cemented its leading position in the microbrewery supplies market.

The craze for beer rises with the advent of microbreweries that can easily be set up in small spaces, thriving the demand for microbrewery supplies.

The global market for microbrewery supplies increased from USD 1,065.9 million to USD 1,266.3 million between 2020 and 2025 with a CAGR of 4.4%.

The study attributes this potential growth to a number of factors, including the increasing popularity of craft beer and the growing number of microbreweries around the world. Additionally, they noted that there has been a recent trend of large breweries acquiring smaller ones, which could lead to further consolidation in the industry and increased demand for microbrewery supplies. Looking ahead, the study predicts that the microbrewery supplies market is likely to continue to grow at a rapid pace.

During the forecast period, the global microbrewery supplies market is anticipated to grow from USD 1,332.1 billion in 2025 to USD 2,211.5 billion by 2035 with a healthy CAGR of 5.2%.

Microbreweries are usually pretty specific about the type of automation supplies they prefer. Most microbreweries prefer fully automatic because it offers more control over the brewing process. A semi-automatic is also an option for some microbreweries, but it generally requires more manual labor.

Microbreweries have become increasingly popular over the past few years. They offer a variety of beers, including Ales, Stouts, and even Witbiers. Each type of beer has its own unique flavor and brewing process.

Ales are the most common type of beer brewed by microbreweries. They are typically light in color and have a slightly fruity flavor. Witbiers are another popular type of beer brewed by microbreweries. They are usually pale in color and have a wheat-based malt flavor. Stouts are the least common type of beer brewed by microbreweries. They are dark in color and have a roasted malt flavor.

A Fully Automated Microbrewery Supply has a number of benefits that make it an appealing option for many brewers. Perhaps the most obvious benefit is the cost savings. Automation can help to reduce the amount of labor required, as well as the costs associated with ingredients and supplies. In addition, automated systems can help to improve the quality and consistency of your product. Automated brewing systems can also help to speed up the brewing process, allowing you to produce more beer in less time.

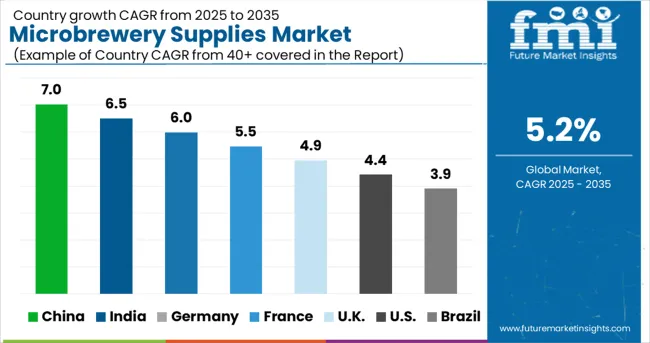

The United Kingdom microbrewery supplies market is likely to grow at a 6.5% CAGR between 2025 and 2035. Europe has its special space in the global beer market due to the variety of beers available such as wheat and lager. The demand for beer in the United Kingdom spikes as people get more aware of the skin and other benefits.

Furthermore, the rising geriatric population indulges in drinking activities at a higher rate ends up entities, bars, and other beverage-serving outlets have started adopting microbrewery supplies.

China with the unique home-based bars opening is consuming the most from the microbrewery supplies market. It is due to advanced technology and rising demand for beer with a native touch that complements the Chinese pallet. The local food markets have started applying this equipment to produce fresh beer so that they do not run out of beer. The long-range of beer types present in the Asian market along with new packaging has flourished the demand for microbrewery supplies. Another factor that makes China an attractive market for microbrewery supplies is the rising level of tourists.

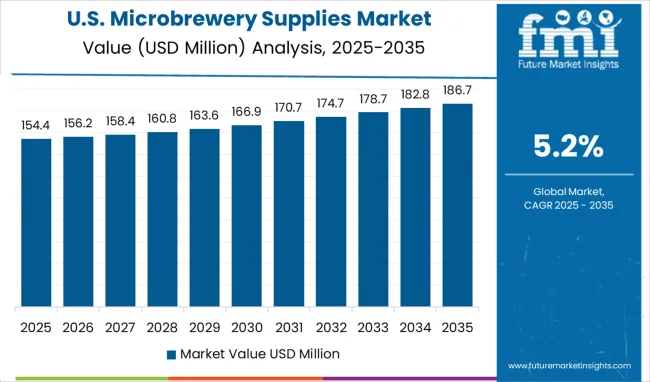

The USA accounted for 33.2% of the Global market with a value of USD 1474.2 million in 2025. The USA microbrewery Supplies market has seen exponential growth in recent years. The number of breweries has more than doubled and shows no signs of slowing down. The United States holds the biggest share of the global microbrewery supplies market.

The USA has become the biggest region because of the craze for beer consumption, the long range of beverage-based startups, and proliferating number of bars and restaurants that offer beer that is produced in local breweries The suppliers & exporters in the region have introduced a new discount for clients with highlighter consumption. Furthermore, the enlarged capacity for the never-ending brewing process has increased the demand for this advanced microbrewery equipment.

Alcohol consumption among young people is rising in Japan due to the rising number of bars and breweries. Popular craft beer is made with twists and experiments that penetrate young beer lovers. The new beer material that enhances the taste and froth is likely to be added to the microbrewery supplies as it helps in giving a new flavor to people.

The higher alcohol consumption along with a lower number of government approvals over home-based microbreweries has led to the rising growth of the microbrewery supplies market.

The changing consumer preferences towards beer drinking, along with the growing disposable income, are some of the other factors driving the growth of this market. Moreover, the rising per capita income is pushing people to adopt microbreweries that brew fresh beer in the glass.

The India microbrewery supplies market is likely to grow at a 6.2% CAGR between 2025 and 2035. In the past decade, there has been a surge in the number of microbreweries in India. This is due to the changes in the law that now allow for smaller breweries to operate. The microbrewery supplies market is also growing in India. This is due to the growing demand for craft beer.

There are a number of suppliers who are now providing microbrewery supplies to Indian breweries. These suppliers are able to provide a range of products and services that can help breweries to produce high-quality beer.

The microbrewery supplies market is expected to grow in the coming years. This growth is due to the increasing popularity of craft beer and the corresponding rise in demand for microbrewery supplies. The competitive landscape of the microbrewery supplies market is highly fragmented, with a large number of small and medium-sized suppliers competing for market share. The key players in the market are expected to focus on expanding their product portfolios and geographical reach to gain a competitive advantage.

Recent Market Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | The USA, Mexico, Canada, The United Kingdom, Germany, France, Italy, China, Spain, India, Japan, South Korea, Australia, Argentina, Brazil, South Africa, UAE |

| Key Segments Covered | Equipment Type, Automation, Application, Region |

| Key Companies Profiled | ICC Northwest Inc; Krones AG; Paul Mueller Company; BrauKon GmbH; Shanghai HengCheng Beverage Equipment Co. Ltd; MEURA; ALFA LAVAL; GEA Group; Della Toffola SpA; LEHUI; Portland Kettle Works; Specific Mechanical Systems Ltd. |

| Report Coverage | Company Share Analysis, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives, Market Forecast, Competitive Landscape, |

| Customization & Pricing | Available upon Request |

The global microbrewery supplies market is estimated to be valued at USD 1,474.2 million in 2025.

It is projected to reach USD 2,447.5 million by 2035.

The market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types are fermentation systems, brewing kit, filtration systems, mashing, cooling and others.

fully automatic segment is expected to dominate with a 35.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microbrewery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sheep Supplies Market Analysis by Supply, Farm, Sales and Region: A Forecast for 2025 and 2035

Cattle Supplies Market Analysis & Forecast for 2025 to 2035

Moving Supplies Market Analysis - Growth & Demand 2025 to 2035

Key Players & Market Share in the Dental Supplies Industry

Medical Supplies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brewing Supplies Market Analysis by Product Type, Application, Category, and Region Forecast Through 2035

Hospital Supplies Market Size and Share Forecast Outlook 2025 to 2035

DC Power Supplies Market - Size, Share, and Forecast 2025 to 2035

Printing Supplies Market Analysis by Application, Technology, and Region Forecast Through 2035

Strapping Supplies Market Analysis - Demand & Growth Forecast 2025 to 2035

Laboratory Supplies Market Size and Share Forecast Outlook 2025 to 2035

Pet Bathing Supplies Market Growth - Trends & Forecast to 2035

Horse Stable Supplies Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Supplies Market Size and Share Forecast Outlook 2025 to 2035

Commercial Bar Supplies Market Size and Share Forecast Outlook 2025 to 2035

Operating Room Supplies Market Analysis Size and Share Forecast Outlook 2025 to 2035

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Physical Therapy Supplies Market Size and Share Forecast Outlook 2025 to 2035

Ice Cream Service Supplies Market - Premium Serving Essentials 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA