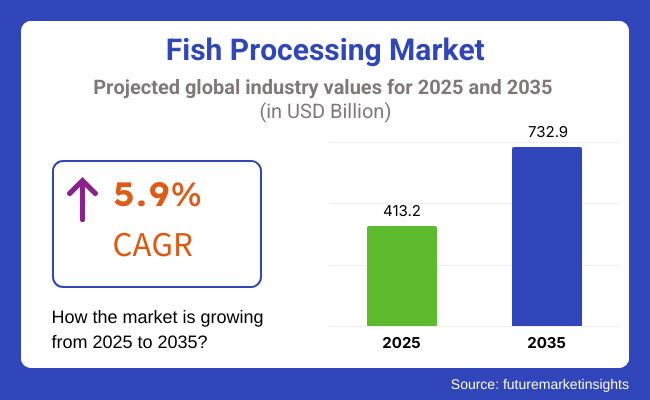

The fish processing industry is expected to grow from USD 413.2 billion in the year 2025 to USD 732.9 billion by the end of the year 2035. The industry is slated to grow at 5.9% CAGR during the forecast period spanning from 2025 to 2035. This growth can be attributed to increasing global demand for processed seafood - the general population seeks convenience, nutrition, and a sustainable method to source their food.

A diverse range of processed fish are consumed in the form of frozen fillets, convenience seafood meals, marinated fish products and a few others. Industry development is attributed to new food processing technologies, improved cold chain logistics, and increasing adoption of sustainable, traceable fishing hygiene practices. Industry giants like Thai Union Group, Maruha Nichiro and Nippon Suisan Kaisha are boosting production capacities and overhauling processing plants in expectation of increasing consumer demands.

The fish processing industry is growing due to several factors. One of which is the ongoing trend of the consumption of convenience food. Rising hectic lifestyles are generating a higher desire for ready-to-cook and pre-processed fish products, particularly in urban centers.

Ensuring fish as an adequate protein source has also led consumers to embrace fish with increasing awareness revolving around the health benefits of seafood such as omega-3 fatty acids and important nutrients. Moreover, sustainability challenges make it essential for companies to engage in responsible fishing, minimize waste, and invest in renewable processing, HPP, and natural preservatives.

Though the growth prospects in the fish processing industry are quite positive, there are a number of challenges associated with the industry. One of the main issues is overfishing and depletion of resources, which requires regulatory restrictions on the catch of fish. Government policies tightly limiting sea biodiversity and catch quotas in a sustainable mode can interrupt supply chains and access to raw materials.

Preserving product freshness and integrity across near-global distribution channels is yet another challenge that requires massive investment in cold storage and logistical infrastructure. Another industry challenge business operators need to deal with are high raw seafood price fluctuations & labour cost and strong food safety regulations.

Technological developments and changing consumer demand are also driving opportunities for the fish processing industry. Open factories are becoming cheaper, more productive and automated fish processing. Sales of clean-label seafood - foods with no artificial preservatives or additives - are surging in North America and Europe. But it is innovative packaging concepts that sit at the heart of what brands want to do to produce less plastic waste while retaining healthy food for longer.

Moreover, by the introduction of digitalization and traceability technologies greater transparency in sourcing and processing is possible, allowing companies to increase their commitment to sustainability and the consumptive choice of responsible seafood. Increasing consumer demand for premium, sustainable and convenient fish products is expected to drive the industry across the globe in the next decade.

The world fish processing industry is undergoing an exponential growth with the urge for seafood products, longer shelf-life solutions, and value-added fish products leading the charge. Fish processors incline towards the priority of freshness, food safety, and the use of the sustainable source while applying innovative processing such as freezing, drying, and filleting to get rid of waste, and enhance quality.

Retail giants target the variety of products, affordability, and following the laws that health-conscious consumers need. Distributors address the issue of cold chain logistics being the main factor in efficient transport and worrying about coasts to ensure the supply is continuous. The end consumers are inclined to preferring premium quality, inner fishery, and SIOC (source-identified, owned company) packaging, thus driving the trend o f ready-to-cook, frozen, and pre-seasoned fish products.

Sustainability worries and stringent governmental regulations on quarrying practices and seafood safety are also directly related to the industry theories; for instance; the companies that deal with bioplastic packaging, the ones that work on transparency, and the producers of plant-based seafood mainly because the customers of today turn to these brands.

The table below presents a comparative assessment of the variation in CAGR over six-month periods for the base year (2024) and the current year (2025) for the global industry. This analysis highlights critical shifts in industry performance, providing insights into revenue trends and business growth dynamics. The first half of the year (H1) spans from January to June, while the second half (H2) extends from July to December.

| Particular | Value CAGR |

|---|---|

| 2024 to 2034 (H1) | 5.4% |

| 2024 to 2034 (H2) | 6.0% |

| 2025 to 2035 (H1) | 5.5% |

| 2025 to 2035 (H2) | 6.2% |

In the first half (H1) of the decade from 2025 to 2035, the industry is anticipated to expand at a CAGR of 5.4%, followed by an improved growth rate of 6.0% in the second half (H2). Moving forward, from H1 2025 to H2 2035, the CAGR is projected to reach 5.5% in the first half and sustain at 6.2% in the second half. During H1, the sector experienced a 10 BPS rise, while in H2, the business witnessed a rise of 20 BPS.

Shifting Consumer Preferences Toward Ready-to-Eat Seafood

The global industry is experiencing a strong shift towards ready-to-eat seafood products. Urbanization, rising disposable incomes, and hectic lifestyles are driving demand for convenient, pre-cooked, and marinated fish products. Consumers are increasingly seeking quick meal solutions that require minimal preparation time, leading to the expansion of value-added fish products such as frozen fillets, smoked seafood, and fish-based snacks.

This trend is especially prominent in North America and Europe, where frozen seafood categories are expanding due to their longer shelf life and convenience. Additionally, advancements in freezing and vacuum-sealing technologies are helping maintain product freshness without artificial preservatives, aligning with consumer demand for clean-label and minimally processed foods.

As a result, manufacturers are investing in diverse product offerings with innovative flavors and packaging formats to capture this growing segment. The emergence of high-protein, omega-rich ready-to-eat fish meals is further expected to fuel industry expansion over the next decade.

Premiumization Driving Higher Prices for Specialty Seafood

The global industry is witnessing a notable rise in pricing for premium seafood products. Increasing demand for wild-caught, sustainably sourced, and organic fish is pushing prices higher, especially in niche segments such as sashimi-grade tuna, cold-water salmon, and artisanal smoked fish. Consumers, particularly in developed markets, are willing to pay a premium for high-quality seafood with traceable origins and superior taste.

This trend is reshaping the pricing structure within the industry, with premium categories seeing higher margins compared to conventional processed fish products. Additionally, as aquaculture expands, high-end farm-raised fish with strict quality control and specialized feeding techniques are commanding premium prices.

With rising interest in responsibly sourced seafood, brands that emphasize superior quality, ethical fishing methods, and environmental sustainability are expected to capture a larger consumer base. The growing preference for gourmet fish products is encouraging manufacturers to diversify their premium product portfolios.

Sustainability and Ethical Sourcing Shaping Industry Dynamics

Sustainability has become a core focus in the global fish processing market, with ethical sourcing playing a crucial role in shaping industry practices. Overfishing concerns, marine ecosystem degradation, and increasing regulatory scrutiny are prompting manufacturers to adopt responsible sourcing strategies.

Many companies are committing to sustainable fishing certifications, such as MSC (Marine Stewardship Council) and ASC (Aquaculture Stewardship Council), to build consumer trust and enhance their industry positioning. Additionally, technological advancements in traceability solutions, including blockchain and AI-driven tracking, are being integrated into supply chains to ensure transparency from ocean to plate.

Governments and industry organizations are also pushing for stricter compliance with eco-friendly fishing practices and reduced bycatch levels. Sustainability-driven product innovations, such as plant-based seafood alternatives and eco-conscious packaging solutions, are gaining traction among environmentally aware consumers. As the demand for ethically sourced seafood rises, companies investing in responsible practices are expected to gain a competitive edge.

World fish processing market revenues increased at a CAGR of 5.6% during 2020 to 2024. During the period between 2025 and 2035, the industry is expected to grow at an even higher CAGR of 5.9% due to changing consumer sentiments, process technology upgrades, and growing global seafood consumption.

People demand for a protein-rich diet today. This is driving the growth of the industry, where consumers are looking for healthy and convenient seafood products. The growing use of fish products in which nutrients are added, including ready-to-eat and marinated seafood, has been a major driver of industry growth.

Sustainability issues and traceability initiatives have also compelled manufacturers to adopt environmentally friendly sourcing and processing methods, enhancing consumer confidence and industry acceptance.

As sustainable seafood awareness among consumers increases, certified and ethically produced fish products are increasingly preferred. This change is compelling producers to be more transparent and invest in sustainable sourcing programs. Current technological innovations in freezing, packaging, and preservation technology will keep taking the industry ahead, making processed fish products a household name across the world.

Through strategic branding, commitment to sustainable fishing, and technology, the industry will be expected to experience continued growth in the coming decade.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing world seafood consumption drives demand for processed fish products. | Better processing technology improves quality, shelf life, and nutritional value. |

| North America, Europe, and Asia-Pacific lead with strong seafood industries. | Latin American and African emerging markets experience explosive expansion in processing capacity. |

| If a company is not fishing by ethical means, it impacts the industry reputation. | Adopting sustainable fishing practices and aquaculture expansion ensures that the supply remains for a long time. |

| Frozen and canned fish dominate the markets, with slow penetration of added-value seafood products. | Increased demand for ready-to-consume, marinated, and high-end seafood products. |

| Thorough food safety laws pose small processors with compliance issues. | Sophisticated automation and blockchain traceability enhance food safety and compliance with regulations. |

| Volatile raw material costs and supply chain disruptions affect profitability. | Diversified sourcing and strategic alliances stabilize cost and provide stable supply. |

| Byproduct use remains low, and most fish waste is wasted. | Fish byproduct processing expansion for collagen, fish oil, and protein extracts enhances profitability. |

The industry is aware of the dangers faced due to raw material, environmental, and regulatory compliance, supply chain problems, and competition in the industry.

The risk of the raw material's availability is the most serious, as fish stocks are maturing due to overfishing, climate changes, and the fluctuation of the seasons. The increase in the production of farmed fish and the decrease of the fish in the ocean can make the price of raw materials inconsistent.

Environmental issues are sustainable fishing practices, habitat destruction, and bycatch problems. Serious sustainability requirements, for example, are the MSC (Marine Stewardship Council) certification that the fish processors must fulfill by responsible sourcing which is the only way for them to avoid reputational and regulatory risks.

Issues with the supply chain are due to temperature-sensitive storage, transportation logistics, and contamination risks. To keep the fish fresh and cut down on spoilage, the establishment of cold chain logistics and efficient distribution networks is essential.

Industry competition is serious, as the focus is increasing on the processed seafood, ready-to-eat fish products, and green substitutes. To ensure competitiveness, enterprises need to deliver value-added products, green packaging, and advanced processing techniques.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.0% |

| India | 5.8% |

| United States | 4.5% |

| Indonesia | 5.5% |

| Japan | 3.9% |

A decrease in seafood consumption, the decline of exports and government efforts to broaden the aquaculture sector are on track to make China the world’s largest industry. However, Indonesia is the biggest seafood producer and exporter in the entire world, has high processing technology and a huge domestic industry.

Growing health awareness among Chinese consumers has also boosted demand for processed fish products like fillets, canned fish, and frozen seafood. Urbanization and changing dietary patterns are also increasing the demand for convenient, ready-to-eat/cooked seafood products. The growth is also boosted by modern preservation technologies and sustainable fishing practices.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Seafood Production & Export | China is the world leader in seafood production and the global supplier of processed fish products. |

| Increased Consumption of Seafood at Home | Consumers prefer to prioritize fish as the main diet due to the health benefits attributed to high protein and omega-3 content. |

India's industry lags well behind other seafood exporting countries globally, but a sharp spike in seafood exports and rising domestic consumption buoyed by Government intervention is fueling industry growth in ship-based processing. India is one of the largest fish-producing nations in the world, having a long coastline, vast aquaculture potential, and a modern processing sector.

This, together with the growing consumption of value-added seafood food products, such as frozen fish, canned seafood, and fish fillets, is fueling demand in the industry. Processing efficiency has also increased due to new cold-storage infrastructure and improvements in supply chain logistics. As far as future potential goes, the increased demand from health-aware consumers and the growing trend of high-protein diets support the sector.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Rising Seafood Exports | India is one of the biggest seafood exporters and provides processed fish to worldwide markets like the USA, Europe and Japan. |

| Government Support & Policies | Schemes such as the Pradhan Mantri Matsya Sampada Yojana (PMMSY) promote modern processing and aquaculture development. |

Factors such as increasing consumption of seafood, technological advancements in processing, and increasing demand for value-added seafood products are some of the reasons that are contributing to the growth of the USA fish processing market. Consumers are turning to healthier diets, increasing demand for high protein and omega-3-rich seafood.

The aquaculture industry expansion and sustainable fishing approaches also reinforce the industry growth. The expansion of cold chain logistics, government regulations to encourage seafood sanitation, and the advent of e-commerce platforms have also improved the availability and distribution of processed fish products nationwide.

Growth Factors in USA

| Key Drivers | Details |

|---|---|

| Rising Seafood consumption | Demand is being spurred by increasing knowledge about the health benefits of seafood, including omega-3 fatty acids. |

| Expansion of Aquaculture Industry | Growth in domestic fish farming reduces dependence on imports and ensures a stable supply. |

With huge marine resources, government programs favoring the seafood industry, and growing worldwide demand for processed fish, the sector in Indonesia is growing rapidly. Indonesia is one of the largest fish-producing nations globally, thanks to a large aquaculture sector and rising exports.

Modern processing techniques, enhanced cold storage facilities, and value-added seafood product investments further propel market expansion. Moreover, the increase in domestic demand for seafood, driven by increasing income and changes in dietary preferences, is a positive factor for the development of the fish processing industry.

Growth Factors in Indonesia

| Key Drivers | Details |

|---|---|

| Abundant Marine Resources | Indonesia is one of the largest fish-producing countries in the world, and it guarantees the availability of raw materials. |

| Strong Aquaculture Growth | Farming all fish better means we produce more fish while being less dependent on wild catches. |

This growth is being driven by Japanese fish consumption, advanced fish processing technologies, and export demand. Japan is one of the world's largest consumers of seafood, relying heavily on processed fish products like sushi, sashimi, canned tuna, and frozen seafood. However, the rising trend of convenience foods has increased the demand for ready-to-eat fish products.

Moreover, progress in freezing and packaging technologies improves product quality and extends shelf-life. In addition, rising government initiatives for sustainability in fishing and aquaculture, as well as the increasing consumption of plant-based and alternative forms, are also propelling the market growth.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| High Seafood Consumption | Japan has among the highest per capita seafood consumption rates in the world. |

| Advanced Processing Technologies | Revolutionized freezing, canning , and packaging techniques to preserve quality |

The world fish processing industry is competitive, fueled by growing demand for processed seafood in retail, food service, and industrial markets. The processors are investing in capacity expansion, automation, and meeting sustainability standards to improve their market share. Freezing technologies, packaging technologies and traceability technologies are influencing the growth of the industry.

Major Players are Maruha Nichiro Corporation, Mowi ASA, Thai Union Group, Nippon Suisan Kaisha (Nissui), and Charoen Pokphand Foods PCL. They utilize supply chains that have sophisticated processing technologies, as well as international distribution networks, to sustain their competitive advantage.

Key Offerings include frozen, canned, and value-added seafood products, with increasing attention to ready-to-eat meals and premium seafood. Companies are also implementing sustainable sourcing and environmentally friendly processing solutions to meet consumers' requirements.

Market evolution is marked by a move to eco-certification, increasing calls for convenient seafood products, and the adoption of digital monitoring technology in the units for processing. Growth is driven by penetrating emerging markets like Asia-Pacific and Latin America, which is an important growth plan.

Strategic Factors involve acquisitions, mergers, and strategic alliances to increase production capacity and access to the market. Sustainability programs, including ecologically responsible aquaculture practices, carbon-neutral processing, and ethical sourcing, are becoming key differentiators. Companies work on brand positioning and e-marketing to attract more consumers and reach deeper into the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Maruha Nichiro Corporation | 20-25% |

| Mowi ASA | 15-20% |

| Thai Union Group | 12-18% |

| Nippon Suisan Kaisha (Nissui) | 10-15% |

| Charoen Pokphand Foods PCL | 8-12% |

| Other Players | 20-30% |

| Company Name | Major Offerings/Activities |

|---|---|

| Maruha Nichiro Corporation | An international fish processing giant with a solid presence in frozen, canned, and added-value seafood products, emphasizing sustainability and technology. |

| Mowi ASA | Large seafood company involved in farming and processing salmon with a major focus on traceability and sustainable aquaculture. |

| Thai Union Group | A leading canned and frozen seafood player, spearheading innovation in the form of ready-to-eat and high-protein seafood products with sustainability support. |

| Nippon Suisan Kaisha (Nissui) | A big-time processed seafood manufacturer with sophisticated R&D functions, serving retail and foodservice industries. |

| Charoen Pokphand Foods PCL | Increasing its footprint in aquaculture and processed seafood, with a focus on global market expansion and food safety compliance. |

Key Company Insights

Maruha Nichiro Corporation (20-25%)

Conducts large-scale operations in order to maintain its market position.

Mowi ASA (15-20%)

Significant investments in automation and green aquaculture.

Thai Union Group (12-18%)

Spearheaded global growth via strategic acquisitions and brought several innovative products.

Nippon Suisan Kaisha (Nissui) (10-15%)

Emphasizes diversified seafood products and sophisticated processing methods, meeting increasing demand for quality seafood.

Charoen Pokphand Foods PCL (8-12%)

Enhances its international supply chain while moving into value-added and convenience seafood products for changing consumer patterns.

Other Key Players (20-30%)

The market is segmented into freshwater, marine, and inland.

The market is segmented into food, feed, biomedical, and others.

The market is segmented into frozen, preserved, dried, and others.

The market is segmented into slaughtering, deheading & gutting, skinning, scaling, filleting, desliming & rinsing, and others.

The market is segmented into North America, Latin America, Asia Pacific, the Middle East & Africa, and Europe.

The industry is expected to reach USD 413.2 billion in 2025.

The industry is projected to reach USD 732.9 billion by 2035.

Key companies include Maruha Nichiro Corporation, Mowi ASA, Thai Union Group, Nippon Suisan Kaisha (Nissui), Charoen Pokphand Foods PCL, Austevoll Seafood ASA, High Liner Foods, Lerøy Seafood Group, Trident Seafoods, and Pacific Seafood Group.

China, growing at a CAGR of 6.0% during the forecast period, is expected to see the fastest growth.

Frozen fish processing is being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Processing Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Processing Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Processing Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Processing Type, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Processing Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Processing Type, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Processing Type, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Processing Type, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Equipment, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Processing Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Processing Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Processing Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Processing Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 21: Global Market Attractiveness by Source, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Processing Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Equipment, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Processing Type, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Processing Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Processing Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Processing Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 46: North America Market Attractiveness by Source, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Processing Type, 2023 to 2033

Figure 49: North America Market Attractiveness by Equipment, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Processing Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Processing Type, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Processing Type, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Processing Type, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Processing Type, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Equipment, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Processing Type, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Processing Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Processing Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Processing Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Processing Type, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Equipment, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Processing Type, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Processing Type, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Processing Type, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Processing Type, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Processing Type, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Equipment, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Processing Type, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Processing Type, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Processing Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Processing Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Processing Type, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Equipment, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Processing Type, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Processing Type, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Processing Type, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Processing Type, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Processing Type, 2023 to 2033

Figure 174: East Asia Market Attractiveness by Equipment, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Processing Type, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Equipment, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Processing Type, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Processing Type, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Processing Type, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Equipment, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Equipment, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Equipment, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Processing Type, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Equipment, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA