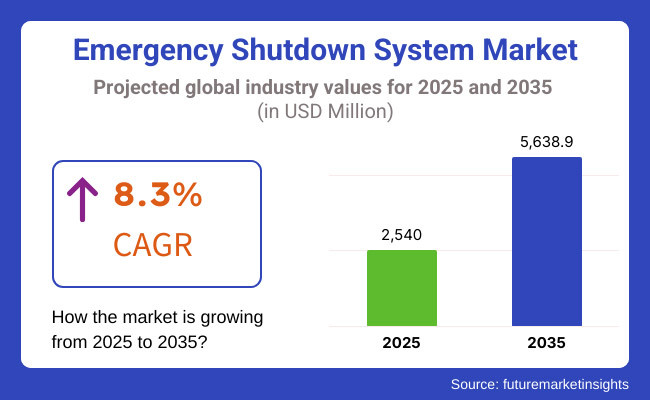

The market is projected to reach USD 2,540 Million in 2025 and is expected to grow to USD 5,638.9 Million by 2035, registering a CAGR of 8.3% over the forecast period. The integration of AI-powered predictive shutdown mechanisms, adoption of Industrial Internet of Things based safety solutions, and increasing demand for cyber-secure emergency shutdown systems are shaping the industry’s future. Additionally, advancements in fail-safe controllers, smart actuators, and wireless emergency shutdown technologies are driving market expansion.

During the time period from 2025 to 2035 the emergency shutdown system (ESD) market will experience significant growth because safety regulations have become stricter across industries that cover oil & gas, chemicals and power generation and manufacturing. Worldwide safety protocols now become more stringent through government regulations thus driving organizations to select advanced ESD solutions more frequently.

The pursuit of operational excellence and risk prevention through risk reduction techniques encourages industries to include automated systems and intelligent technologies in their emergency operations. The market expansion grows because businesses need IIoT-enabled ESD systems to track operations in real-time and make predictions for maintenance tasks.

ESD systems perform a vital task of shielding against accidents and equipment breakdowns and unexpected downtime thus they remain essential in high-risk facilities. Businesses currently invest in customized automated remotely operated ESD solutions because they want to improve workplace safety and meet industry standards while handling increasing process complexity.

Market growth patterns are sustained through the oil & gas sector due to rising safety requirements in offshore and onshore drilling operations. ESD systems witness rising demand throughout power generation facilities because of expanding renewable energy facilities and growing nuclear power capacity.

The Emergency Shutdown System Market will experience continued growth because industries are dedicating more time and resources toward creating safer and more dependable systems backed by sensor developments and artificial intelligence technologies and cloud-based monitoring solutions.

The emergency shutdown system market will maintain its dominance in North America through the combination of tight safety rules and expanding industrial automation investments and the rising need for secure ESD solutions. The Emergency Shutdown System Market has its strongest presence in North America where United States and Canada control this area because of their Occupational Safety and Health Administration (OSHA) and Environmental Protection Agency (EPA) rules enforced in hazardous sectors.

The market demonstrates growing momentum because of new oil & gas infrastructure development coupled with rising use of artificial intelligence-based predictive maintenance technology and refinery shutdown system modernization investments. ESD adoption receives further support from both the leading automation industry organizations and the quick implementation of IIoT-based safety solutions.

The emergency shutdown system market demonstrates strong presence in Europe where industrial safety along with automation-based shutdown solutions receive particular development from countries including Germany and the UK along with France and Italy while conforming to EU safety regulations. High-risk industries throughout Europe adopt advanced ESD solutions because of the EU Machinery Directive 2006/42/EC and ATEX Directives which enforce safety standards on explosion-proof equipment.

Market opportunities in the emergency shutdown system sector increase because of Industry 4.0 growth as well as increased autonomous safety system implementation requirements throughout industrial facilities and real-time safety requirements across manufacturing plants. The market grows because of energy-efficient processes in manufacturing and safety simulations using digital twins which quicken implementation across industries.

Emergency shutdown system market expansion in the Asia-Pacific region will maintain the highest compound annual growth rate because this area combines fast industrial development with rising oil and gas exploration ventures while the government dedicates funds to workplace safety initiatives. China alongside India and Japan together with South Korea dominate the emergency shutdown market through their widespread adoption of shutdown systems and factory automation protocols.

The combination of China's industrial safety modernization initiatives and strict pollution control standards triggers industrial demand for automated ESD systems that serve power facilities and chemical production plants. Market growth in India advances due to its developing energy sector together with rising investments in refinery safety solutions. The regional adoption of industrial safety solutions benefits from Japanese and South Korean leadership in robotics development and AI risk assessment and cyber-secure platform creation.

Challenges

High Implementation Costs and Integration Complexity

The high expenses needed to introduce improved ESD solutions stands as a major hurdle within the emergency shutdown system market when deploying such systems in older industrial sites. The implementation of IIoT-based emergency shutdown systems needs existing infrastructure updates which include sensor replacement alongside control systems and network infrastructure upgrades and proves technically demanding and expensive.

Connected ESD systems create cybersecurity challenges affecting systems through hacking attempts as well as unauthorized shutdowns and operational disruptions that need continual security monitoring and sustainable investments in secured industrial control network infrastructure.

Opportunities

AI-Driven Predictive Shutdown, Wireless ESD Solutions, and Cyber-Secure Safety Systems

The emergency shutdown system market maintains substantial potential for development despite facing certain obstacles. AI predictive shutdown technology coupled with real-time analytics and machine learning algorithms and digital twins helps industries execute automated shutdown procedures to maximize operational efficiency and safeguard personnel security.

Organizations implement wireless emergency shutdown systems to achieve remote and real-time activation of safety mechanisms across offshore oil rigs and remote power plants along with hazardous material processing units. Industrial security benefits from the combination of blockchain with AI-powered anomaly detection which protects systems from unauthorized shutdowns as it enhances safety compliance in connected industrial environments.

Market expansion for next-generation safety automation occurs because ESD solutions find increasing applications in the manufacturing of electric vehicle (EV) batteries while powering nuclear facilities and renewable energy installations.

During the period from 2020 through 2024 the emergency shutdown (ESD) system market consistently expanded because industrial safety regulations intensified and high-risk industries continued their automation advancements together with fail-safe control technology developments.

Advanced ESD solutions became standard practice within the oil & gas sector along with chemicals and power generation and manufacturing due to regulations and to avoid industrial catastrophes and reduce facility downtime. The market for programmable logic controllers (PLCs) and safety instrumented systems (SIS) together with real-time monitoring sensors expanded substantially due to business emphasis on operational safety and risk reduction measures.

The emergency shutdown system market will experience significant modifications in the upcoming years starting from 2025 through 2035 thanks to the advent of AI-driven autonomous shutdown systems and quantum-enhanced failure prediction capabilities and decentralized safety ecosystems. Self-learning AI predictive risk models combined with blockchain security tracking systems create an environment for real-time accident prevention as well as automated reporting and secure industrial data exchange throughout production networks. ESS systems that use edge computing will decrease latency to deliver fast responses when critical equipment failures happen.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with OSHA, IEC 61508/61511, API 2350, and NFPA industrial safety standards. |

| Technological Advancements | Growth in PLC-based shutdown controllers, wireless ESD triggers, and SCADA-integrated shutdown systems. |

| Industry Applications | Used in oil & gas, petrochemicals, manufacturing, power generation, and marine operations. |

| Adoption of Smart Equipment | Integration of IoT-connected safety sensors, cloud-based shutdown controls, and real-time fault detection software. |

| Sustainability & Cost Efficiency | Shift toward low-energy fail-safe ESD mechanisms, renewable energy-powered shutdown controls, and predictive maintenance for cost reduction. |

| Data Analytics & Predictive Modeling | Use of historical failure data analysis, SCADA-based real-time monitoring, and remote system diagnostics. |

| Production & Supply Chain Dynamics | Challenges in high ESD deployment costs, cybersecurity threats in remote safety automation, and global compliance variations. |

| Market Growth Drivers | Growth fueled by increasing industrial safety regulations, automation in hazardous environments, and digital transformation in process industries. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-backed safety compliance tracking, AI-powered real-time risk assessment, and global predictive shutdown automation regulations. |

| Technological Advancements | Quantum-computing-powered predictive fault detection, AI-enhanced autonomous shutdown mechanisms, and decentralized ESD safety networks. |

| Industry Applications | Expanded into AI-driven industrial safety ecosystems, autonomous factory shutdowns, and real-time edge-computing ESD analytics. |

| Adoption of Smart Equipment | AI-powered self-regulating shutdown systems, biometric-based wearable ESD triggers, and edge-computing-driven emergency response networks. |

| Sustainability & Cost Efficiency | Carbon-neutral industrial safety systems, AI-optimized emergency response, and decentralized smart safety automation. |

| Data Analytics & Predictive Modeling | AI-driven predictive shutdown modeling, quantum-enhanced fault analysis, and blockchain-backed industrial safety record-keeping. |

| Production & Supply Chain Dynamics | Decentralized AI-assisted safety monitoring, blockchain-secured industrial risk assessment, and automated predictive ESD supply chain optimization. |

| Market Growth Drivers | Future expansion driven by AI-integrated autonomous safety controls, real-time predictive risk assessment, and next-gen decentralized safety ecosystems. |

United States emergency shutdown (ESD) system market growth remains fast-paced because of strict industrial safety standards alongside increasing hazardous environment automation and higher industry demand for risk reduction in oil gas chemical and power sectors. Advanced ESD systems gain increased demand from both Occupational Safety and Health Administration (OSHA) and Environmental Protection Agency (EPA) through their strict enforcement of safety protocols.

Established system efficiency comes from the combination of predictive maintenance through AI and emergency response solutions through IoT technology and reliable programable logic controllers (PLCs). The market adoption strengthens due to increasing investments in smart factories together with automated plant shutdown systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.6% |

The UK emergency shutdown system market expands because businesses focus on workplace safety while implementing process automation technology and maintain safety requirements in hazardous operations. Oil refineries along with offshore platforms and chemical plants must implement ESD systems under regulations by UK Health and Safety Executive (HSE) and Control of Major Accident Hazards (COMAH).

Operational safety gets better through the implementation of wireless safety shutdown systems in combination with AI-based anomaly detection and modular ESD solutions. Smart shutdown solutions required by the rising renewable energy sector particularly benefit wind and solar power generation systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.0% |

Strong market expansion in the emergency shutdown system sector throughout the European Union occurs because of rigorous safety standards and rising Industry 4.0 investments and expanding requirement for safe automated solutions in dangerous operational environments. The emergency safety enforcement of EU-OSHA and Seveso III Directive maintains safety rules throughout every sector including petrochemicals and manufacturing and the energy industry.

The adoption of EDS technology through AI-combined security monitoring and SIL-certified shutdown systems and cloud-enabled emergency services dominates the German and French markets as well as the system implementations in Italy. The efficiency of ESD systems increases through progress made in edge computing that supports instant safety decision-making.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.3% |

Japan's emergency shutdown system market is growing as a result of increased adoption of intelligent factory safety solutions, augmented investments in artificial intelligence-based automation, and stringent government regulations regarding industrial hazard control. The METI of Japan implements strict safety protocols in chemical, automotive, and power generation sectors.

Japanese firms are combining robot-assisted emergency response, Internet of Things -enabled gas detection, and programmable safety controllers with high speed into ESD systems. Moreover, the growth of smart grid technology is also fueling demand for sophisticated shutdown solutions in energy infrastructure.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

The South Korean emergency shutdown system market is growing very fast with rising industrial automation, growing usage of smart sensors to mitigate risk, and government-imposed safety regulations in workplaces. The Korea Occupational Safety and Health Agency (KOSHA) and the Ministry of Employment and Labor are applying stringent process safety regulations for dangerous industries.

South Korea's expansion in petrochemical, semiconductor, and automotive production is fueling demand for AI-based predictive shutdown systems, high-speed emergency actuators, and self-learning safety networks. Moreover, the growth of connected safety systems based on 5G and cloud computing is further propelling market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.7% |

The emergency shutdown system market is expanding due to rising safety regulations, increasing industrial automation, and the need to prevent hazardous incidents in high-risk environments. Among different components, sensors and safety valves dominate the market, ensuring efficient detection of critical failures and rapid shutdown response to mitigate risks.

The primary function of ESD systems depends on sensors to detect various abnormal occurrences such as pressure jumps and gas leaks as well as temperature changes and equipment system breakdowns. Programmable safety systems receive instant sensor data which enables them to execute automatic shutdown sequences to prevent disasters.

Industrial use of sensors within oil & gas and chemical processing facilities and power generation plants keeps rising because they help prevent accidents at work along with decreasing operational halts and improving predictive maintenance approaches. Modern IoT technology coupled with AI anomaly detection capabilities team up with wireless sensor networks to produce more reliable data and effective central control system integration alongside enhanced accuracy.

Several implementation hurdles including calibration problems along with exposure to harsh conditions and misreading conditions emerge in their use. AI-diagnosed sensor systems together with self-adjustable sensor platforms and multi-sensor detection solutions will boost the market's adoption level alongside enhanced safety metrics.

Emergency shutdown systems heavily depend on safety valves to achieve quick pressure release and process shutdown control when operational failures occur. Safety valves function widely across oil & gas pipelines together with refineries and power plants and manufacturing facilities because they provide immediate pressure relief in situations involving pressure imbalances or equipment failures or fire hazards.

Safety valves within critical infrastructure and high-risk industries experience growing demand because of strict regulatory needs as well as stronger attention to risk prevention plus new high-performance valve engineering achievements. Smart valve monitoring technology with remote actuator control backed by artificial intelligence systems now improves safety valve operational reliability and shutdown performance.

Despite these advances the system presents difficulties when it comes to mechanical deterioration and repair periods together with time delays that occur under harsh environmental conditions. Continuous advancements in automatic safety valves together with advanced corrosion-fighting materials and intelligent valve health assessment tools will boost operational reliability and decrease maintenance expenses.

The demand for emergency shutdown systems is primarily driven by control method efficiency, with pneumatic and electrical ESD systems emerging as the most widely used due to their fast response times, reliability, and suitability for diverse industrial applications.

Pneumatic ESD systems serve the oil & gas processing plants and petrochemical refineries and offshore drilling operations through compressed air or gas systems responsible for activating shutdown mechanisms to deal with hazardous situations. These safety systems stand out due to their high reliability as well as fast response and their ability to function even in power outages.

The increasing market adoption of pneumatic control systems results from their safety features along with their easy maintenance and their operational capabilities at harsh temperatures. Advanced smart pneumatic actuators as well as AI-controlled pressure monitoring and hybrid electro-pneumatic control methods enhance shutdown precision and automation functions.

Although pneumatic control systems provide numerous benefits there are fundamental limitations to their implementation due to dependent compressed air sourcing together with potential leakage risks and restricted expandability in sophisticated industrial situations. The performance and reliability of pneumatic control designs will improve alongside the implementation of real-time leak detection systems and hybrid ESD configurations in addition to developments in energy-efficient pneumatic control designs.

Manufacturers in the high automation class that includes nuclear power plants and chemical manufacturers and automated production lines adopt electrical ESD systems to gain precise electrically controlled shutdown mechanisms and remote system operation capability. Real-time diagnostics and predictive maintenance and automatic shutdown sequences are possible through system integration between programmable safety logic controllers and industrial IoT networks.

The market demand for electrical ESD systems continues to grow because these systems work with present industrial automation and they combine with predictive AI analytics and deliver improved safety results in vital applications. Technological innovations in the field have lately enabled the development of wireless shutdown controls with cloud-based monitoring capabilities that boost both operational resilience and system response times.

The primary limitations of ESD systems include power outages along with cybersecurity threats and expensive initial implementation expenses. Market adoption of advanced safety systems will grow due to new implementations of redundant power supply systems along with AI-based cybersecurity measures and hybrid electrical-pneumatic ESD solutions.

Increasing demand for safety automation in hazardous industries such as oil & gas, chemicals, power generation and manufacturing is causing the emergency shutdown system market to grow. This market is driven by ever-tighter safety regulations, the upswing in industrial automation, and IoT-driven safety monitoring innovations. To extend risk mitigation, plant safety and regulatory compliance, companies are working on fail-safe controllers, emergency shutdown solutions that are certified SIL-rated (Safety Integrity Level), and AI-based predictive security systems.

Leading automation companies, security system design organizations, and suppliers of industrial control technology all play a role in advancing the sector from high-speed shutdown valves to intelligent response web-of-emergency ESD systems and cloud-integrated ESD control platforms.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Honeywell International Inc. | 18-22% |

| Schneider Electric SE | 12-16% |

| Emerson Electric Co. | 10-14% |

| Rockwell Automation, Inc. | 8-12% |

| Yokogawa Electric Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Honeywell International Inc. | Develops fail-safe emergency shutdown systems, SIL-rated safety controllers, and SCADA-integrated shutdown solutions. |

| Schneider Electric SE | Specializes in Triconex™ safety instrumented systems (SIS) for industrial shutdown applications. |

| Emerson Electric Co. | Provides DeltaV™ SIS solutions, emergency valve actuation, and real-time ESD monitoring platforms. |

| Rockwell Automation, Inc. | Manufactures GuardLogix® safety controllers with built-in ESD functionality for process industries. |

| Yokogawa Electric Corporation | Focuses on ProSafe-RS safety systems, integrating emergency shutdown with distributed control systems (DCS). |

Key Company Insights

Honeywell International Inc. (18-22%)

Honeywell leads the ESD system market, offering advanced SIL-rated safety automation solutions with integrated real-time monitoring and predictive maintenance capabilities.

Schneider Electric SE (12-16%)

Schneider Electric specializes in Triconex™ SIS, a globally recognized safety solution for emergency shutdown and risk mitigation in critical industries.

Emerson Electric Co. (10-14%)

Emerson provides high-speed shutdown solutions with integrated safety valves and control systems, ensuring operational safety in hazardous environments.

Rockwell Automation, Inc. (8-12%)

Rockwell Automation’s GuardLogix® safety controllers offer programmable ESD functionality, ensuring quick response times and compliance with global safety standards.

Yokogawa Electric Corporation (6-10%)

Yokogawa’s ProSafe-RS integrates emergency shutdown with DCS, enabling seamless safety response and process control in industrial applications.

Other Key Players (30-40% Combined)

Several automation firms, industrial control providers, and safety system integrators contribute to advancements in high-speed emergency shutdown mechanisms, cloud-based safety monitoring, and regulatory compliance solutions. These include:

The overall market size for the emergency shutdown system Market was USD 2,540 Million in 2025.

The emergency shutdown system market is expected to reach USD 5,638.9 Million in 2035.

Stringent safety regulations in industrial sectors, increasing adoption of automation in hazardous environments, and growing demand for risk mitigation solutions will drive market growth.

The USA, Germany, China, Japan, and India are key contributors.

Sensors and Safety Valves are expected to lead in the Emergency Shutdown System Market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Component, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Control Method, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Control Method, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Industry Vertical, 2017 to 2032

Table 8: Global Market Volume (Units) Forecast by Industry Vertical, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Component, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Control Method, 2017 to 2032

Table 14: North America Market Volume (Units) Forecast by Control Method, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Industry Vertical, 2017 to 2032

Table 16: North America Market Volume (Units) Forecast by Industry Vertical, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 20: Latin America Market Volume (Units) Forecast by Component, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Control Method, 2017 to 2032

Table 22: Latin America Market Volume (Units) Forecast by Control Method, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Industry Vertical, 2017 to 2032

Table 24: Latin America Market Volume (Units) Forecast by Industry Vertical, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 28: Europe Market Volume (Units) Forecast by Component, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Control Method, 2017 to 2032

Table 30: Europe Market Volume (Units) Forecast by Control Method, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by Industry Vertical, 2017 to 2032

Table 32: Europe Market Volume (Units) Forecast by Industry Vertical, 2017 to 2032

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 36: Asia Pacific Market Volume (Units) Forecast by Component, 2017 to 2032

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Control Method, 2017 to 2032

Table 38: Asia Pacific Market Volume (Units) Forecast by Control Method, 2017 to 2032

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Industry Vertical, 2017 to 2032

Table 40: Asia Pacific Market Volume (Units) Forecast by Industry Vertical, 2017 to 2032

Table 41: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: Middle East & Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 43: Middle East & Africa Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 44: Middle East & Africa Market Volume (Units) Forecast by Component, 2017 to 2032

Table 45: Middle East & Africa Market Value (US$ Million) Forecast by Control Method, 2017 to 2032

Table 46: Middle East & Africa Market Volume (Units) Forecast by Control Method, 2017 to 2032

Table 47: Middle East & Africa Market Value (US$ Million) Forecast by Industry Vertical, 2017 to 2032

Table 48: Middle East & Africa Market Volume (Units) Forecast by Industry Vertical, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Component, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Control Method, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Industry Vertical, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 10: Global Market Volume (Units) Analysis by Component, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Control Method, 2017 to 2032

Figure 14: Global Market Volume (Units) Analysis by Control Method, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Control Method, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Control Method, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by Industry Vertical, 2017 to 2032

Figure 18: Global Market Volume (Units) Analysis by Industry Vertical, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Industry Vertical, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Industry Vertical, 2022 to 2032

Figure 21: Global Market Attractiveness by Component, 2022 to 2032

Figure 22: Global Market Attractiveness by Control Method, 2022 to 2032

Figure 23: Global Market Attractiveness by Industry Vertical, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Component, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Control Method, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by Industry Vertical, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 34: North America Market Volume (Units) Analysis by Component, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Control Method, 2017 to 2032

Figure 38: North America Market Volume (Units) Analysis by Control Method, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Control Method, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Control Method, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by Industry Vertical, 2017 to 2032

Figure 42: North America Market Volume (Units) Analysis by Industry Vertical, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by Industry Vertical, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by Industry Vertical, 2022 to 2032

Figure 45: North America Market Attractiveness by Component, 2022 to 2032

Figure 46: North America Market Attractiveness by Control Method, 2022 to 2032

Figure 47: North America Market Attractiveness by Industry Vertical, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Component, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Control Method, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by Industry Vertical, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 58: Latin America Market Volume (Units) Analysis by Component, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Control Method, 2017 to 2032

Figure 62: Latin America Market Volume (Units) Analysis by Control Method, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Control Method, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Control Method, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by Industry Vertical, 2017 to 2032

Figure 66: Latin America Market Volume (Units) Analysis by Industry Vertical, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Industry Vertical, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Industry Vertical, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Component, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Control Method, 2022 to 2032

Figure 71: Latin America Market Attractiveness by Industry Vertical, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Component, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Control Method, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by Industry Vertical, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 82: Europe Market Volume (Units) Analysis by Component, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Control Method, 2017 to 2032

Figure 86: Europe Market Volume (Units) Analysis by Control Method, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Control Method, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Control Method, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by Industry Vertical, 2017 to 2032

Figure 90: Europe Market Volume (Units) Analysis by Industry Vertical, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Industry Vertical, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Industry Vertical, 2022 to 2032

Figure 93: Europe Market Attractiveness by Component, 2022 to 2032

Figure 94: Europe Market Attractiveness by Control Method, 2022 to 2032

Figure 95: Europe Market Attractiveness by Industry Vertical, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: Asia Pacific Market Value (US$ Million) by Component, 2022 to 2032

Figure 98: Asia Pacific Market Value (US$ Million) by Control Method, 2022 to 2032

Figure 99: Asia Pacific Market Value (US$ Million) by Industry Vertical, 2022 to 2032

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 106: Asia Pacific Market Volume (Units) Analysis by Component, 2017 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Control Method, 2017 to 2032

Figure 110: Asia Pacific Market Volume (Units) Analysis by Control Method, 2017 to 2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Control Method, 2022 to 2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Control Method, 2022 to 2032

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Industry Vertical, 2017 to 2032

Figure 114: Asia Pacific Market Volume (Units) Analysis by Industry Vertical, 2017 to 2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Industry Vertical, 2022 to 2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Industry Vertical, 2022 to 2032

Figure 117: Asia Pacific Market Attractiveness by Component, 2022 to 2032

Figure 118: Asia Pacific Market Attractiveness by Control Method, 2022 to 2032

Figure 119: Asia Pacific Market Attractiveness by Industry Vertical, 2022 to 2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 121: Middle East & Africa Market Value (US$ Million) by Component, 2022 to 2032

Figure 122: Middle East & Africa Market Value (US$ Million) by Control Method, 2022 to 2032

Figure 123: Middle East & Africa Market Value (US$ Million) by Industry Vertical, 2022 to 2032

Figure 124: Middle East & Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: Middle East & Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 127: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: Middle East & Africa Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 130: Middle East & Africa Market Volume (Units) Analysis by Component, 2017 to 2032

Figure 131: Middle East & Africa Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 132: Middle East & Africa Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 133: Middle East & Africa Market Value (US$ Million) Analysis by Control Method, 2017 to 2032

Figure 134: Middle East & Africa Market Volume (Units) Analysis by Control Method, 2017 to 2032

Figure 135: Middle East & Africa Market Value Share (%) and BPS Analysis by Control Method, 2022 to 2032

Figure 136: Middle East & Africa Market Y-o-Y Growth (%) Projections by Control Method, 2022 to 2032

Figure 137: Middle East & Africa Market Value (US$ Million) Analysis by Industry Vertical, 2017 to 2032

Figure 138: Middle East & Africa Market Volume (Units) Analysis by Industry Vertical, 2017 to 2032

Figure 139: Middle East & Africa Market Value Share (%) and BPS Analysis by Industry Vertical, 2022 to 2032

Figure 140: Middle East & Africa Market Y-o-Y Growth (%) Projections by Industry Vertical, 2022 to 2032

Figure 141: Middle East & Africa Market Attractiveness by Component, 2022 to 2032

Figure 142: Middle East & Africa Market Attractiveness by Control Method, 2022 to 2032

Figure 143: Middle East & Africa Market Attractiveness by Industry Vertical, 2022 to 2032

Figure 144: Middle East & Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emergency Communication Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Emergency Lighting Market Growth - Trends & Forecast 2025 to 2035

Emergency Light Sticks Market Analysis and Forecast by Type, Distribution Channel, End Use, and Region through 2035

Emergency Spill Response Market Growth - Size, Trends & Forecast 2025 to 2035

Emergency Medical Services Market Overview – Trends & Industry Outlook 2024-2034

Emergency Vent Cover Market Growth – Trends & Forecast 2024-2034

Emergency Response and Rescue Vessels Market

Emergency Beacon Transmitter Market

Emergency Venting System Market Growth – Trends & Forecast 2024-2034

EMEA Emergency Medical Service Market Analysis by Services, Provider, Fleet, and Region Forecast Through 2035

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Personal Emergency Response System Market Analysis – Growth & Forecast 2024-2034

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emergency Braking System Market - Size, Share, and Forecast 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA