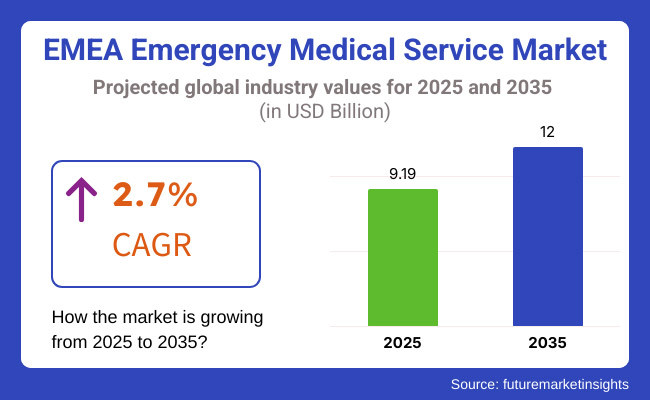

The EMEA emergency medical service market is anticipated to be valued at USD 9.19 billion in 2025. It is expected to grow at a CAGR of 2.7% during the forecast period and reach a value of USD 12.00 billion in 2035.

Emerging medical service in definition terms refers to a system that provides timely pre-hospital care, transportation, and medical assistance to individuals experiencing medical emergencies, including, but not limited to, cardiac arrest, injuries, or accidents. It is widely used in ambulances, hospitals, disaster response, and community healthcare to ensure rapid and effective medical treatment. This can be an urgent emergency entrance.

The emergency medical service market includes systems and services providing urgent pre-hospital care and transportation for medical emergencies. The course of the market is primarily increased by the growing number of accident cases, increasing cardiovascular emergencies, improving healthcare infrastructure, and advancement in technological help ambulance services to provide better turnaround times and patient outcomes in urban and rural areas.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady growth driven by population aging, urbanization, and increased emergency cases. | Rapid expansion fueled by AI, automation, and advanced telemedicine solutions for emergency response. |

| Adoption of GPS tracking, real-time communication, and digital patient records. | Widespread use of AI-powered emergency dispatch, 5G-connected online diagnostic facilities, and automatic medical units. |

| Increased response times due to demand outpacing resources, particularly in rural areas. | Very enhanced response times using advanced prediction analysis, AI-based dispatch, and drone-assisted emergency support. |

| Early-stage integration of telemedicine in emergency care, but with limited accessibility. | Full-fledged operation of telemedicine with AI-powered remote consultation and paramhelp support. |

| Shortage of trained emergency personnel, leading to high workload and burnout. | AI-assisted decision-making, robotic support, and enhanced training programs reducing personnel strain. |

| Limited integration with urban planning and public health networks. | Advanced coordination with smart city infrastructure, including AI-driven traffic management for ambulances. |

| Standard ambulances with incremental improvements in medical equipment. | Autonomous ambulances, AI-powered mobile ICUs, and next-generation life-saving devices. |

| Strengthened regulations for EMS safety, but slow implementation in some regions. | Standardized emergency care protocols across borders, ensuring universal access to high-quality EMS. |

| Minimal focus on sustainability, with diesel-powered ambulance fleets. | Transition to electric, hybrid, and hydrogen-powered ambulances with eco-conscious medical waste disposal. |

| There has been a growing tendency of collaboration between the government and private EMS providers even under the constraints of funding. | Stronger public-private initiatives leveraging AI and IoT to improve EMS accessibility and affordability. |

AI-Powered Emergency Response and Predictive Analytics

The reliance on AI-enabled emergency medical services that speed up response times and increase patient survivability is increasing among consumers. Companies are applying machine learning algorithms to predict emergency hotspots, develop ambulance dispatch optimization methods, and gain insights in real-time patient data so as to speed up decision-making.

These systems prepare paramedics before arrival with specific medical conditions for more effective and sometimes life-saving behaviors. As cities swell with populations and demands for quicker emergency care rise, Australians today expect fully-fledged EMS services that incorporate cutting-edge technologies offering smarter, faster, and more responsive healthcare solutions.

Telemedicine Integration for Pre-Hospital Care

The consumers now tend to embrace telemedicine solutions even in emergency medical services, providing real-time consultation for the paramedics with a specialist. Advanced mobile communication tools now make it possible for first responders to communicate live patient data, ECG readings, and video assessments with hospitals; this ensures better pre-hospital care.

This move will reduce unnecessary admissions to hospitals while improving early-intervention strategies. As digital healthcare is being adopted more and more by individuals, it will not be long before they demand EMS solutions that will introduce them to the gap from emergency care to hospital treatment, making critical care accessible and more efficient.

| Attributes | Details |

|---|---|

| Top Services | Basic Life Support |

| Market Share in 2025 | 2.9% |

As per FMI research, BLS, Basic Life Support, continues to be a primary service in the EMEA Emergency Medical Services Market with a share of 2.9% in the year 2025. There has been an increased demand for BLS ambulances programmed with trained paramedics and equipped with primary medical apparatuses with the occurrence of a non-critical emergency like minor injuries and a complaint of respiratory distress.

Pre-hospital care access is to be improved by governments with increased expansion of BLS services. Investments in new ambulances, training, and community health programs continue to expand along with an increasing emphasis on faster response times and improved emergency medical infrastructure. Digital communication tools help responders coordinate and communicate with hospitals faster so patient outcomes benefit greatly.

| Attributes | Details |

|---|---|

| Top Provider | Government EMS |

| Market Share in 2025 | 5.8% |

The Government EMS is the largest provider in the EMEA emergency medical services sector with a 5.8% market share in 2025, it is growing incomplete due to government-financed ambulance fleets, paramedic training programs, and accessible public healthcare infrastructure, thus making an appropriate emergency response service accessible in all areas-from urban to rural.

Rising public health initiatives and partnerships between government agencies and private healthcare providers are enhancing emergency response efficiency. Investments in technology-driven dispatch systems and automated patient monitoring tools further improve the quality and speed of emergency care, strengthening government EMS capabilities throughout the region.

| Attributes | Details |

|---|---|

| Top Fleet | Air Transport |

| Market Share in 2025 | 4.6% |

Air Transport stands out as an emerging segment that is projected to achieve a 4.6% market share in 2025, emerging from the increased demand for air ambulances resulting from rapid medical evacuations and emergency responses in remote areas. Air ambulance services are indeed the backbone for the transfer of critically ill patients and the provision of disaster response wherever there are road transport limitations.

Advances in airborne medical technologies, telemedicine combined with GPS tracking systems, indeed raised the effectiveness with which air ambulances perform their operations. Investment in government-private air-rescue operations has also increased to ensure speedier and safer patient transportations during critical dangerous emergencies.

Cutting-edge providers of medical equipment coupled with operators of ambulance service lines hold forth in becoming the forefront players in delivering emergency medical services in EMEA through adoption of sophisticated technological tools, regulatory know-how, and an extensive distribution network. Their prowess in stocking life-saving equipment, vehicles for emergency transport, and health solutions in the digital world enable them to hold relatively good bilateral relationships with government and health providers hence has a tightgrip on procurement and service deployment.

Regrettably, the above industry players have developed a habit of investing heavily in advanced ambulance technologies, integrating telemedicine, and designing intelligent systems for emergency care through the use of AI. Their essential expertise in their line comes from the development of trackable devices and communication platforms for high-level performance. They therefore lock out competitors from this space through long-term public health agency and private hospital contracts for steady access to service and infrastructure development.

Established corporations have all the power structures for pricing and setting industry standards through their well-thought-out alliances with and private expertise. They afford the benefits of excellent economies of scale, which entail cost-effective production of highly advanced emergency solutions, while remaining impressive in operational efficiency. Brand credibility and constant innovation collude to provide the company with an edge in sustaining consumer allegiance, which would ultimately put at risk the chances of smaller firms seeking business in large-scale emergency response services.

Concentration is still at a very high degree; the major players have ventured into the isolated or unreached regions by pursuing strategic acquisitions and going for digital transformation. Applying real time analytics, AI-powered dispatch systems, and eco-friendly ambulance fleets into their huge stock of efficiencies would further make their services smarter. That will keep most of the emergency medical logistics within grasp of established competitors to the point that it can be said to have no room for new entrants to disrupt the system.

The EMEA emergency medical services market is diverse, with several regional and international players actively competing for different service segments. The Emergency Medical Services (EMS) market for Europe, Middle East and Africa (EMEA) will continue to experience steady growth, due to an increase in demand for emergency care and breakthrough innovations in medical technology.

As of December 2023, the market is projected to reach a valuation of around USD11.69 billion by 2034, and the compound annual growth rate (CAGR) is 2.7%. This growth is a result of increasing rates of medical emergencies, an older population, and the integration of advanced technologies such as artificial intelligence and telemedicine into EMS operations.

Key players in the EMEA EMS market include major names such as Falck A/S, International SOS, and Airbus, to mention just a few. Falck A/S-a Danish multinational company-provides a comprehensive range of emergency services, such as firefighting, ambulance, and roadside assistance services, in most EMEA countries.

International SOS is headquartered in London and Singapore, and provides world-class health and security services, including emergency medical assistance and evacuation services to peoples across the globe. The company is well known for its aerospace expertise; with regard to the EMS market, Airbus provides sophisticated air ambulances and supporting technologies, improving aerial medical evacuation capabilities.

Stiff competition of both private and public EMS providers can be seen in this scenario. Companies are more focused on the enhancement of services on quality and response times. Such innovations in technology would include 5G-connected ambulances or artificial intelligence monitoring and analysis of real-time patient data.

For instance, Response Plus Medical launched in October 2023 a new generation of enhanced 5G-connected ambulances in the United Arab Emirates, which are designed to enhance the efficiency of emergency responses. Furthermore, it is becoming increasingly common to see collaborations and partnerships among EMS providers, health institutions, and technology companies for the purpose of convenient integration of futuristic solutions into emergency medical services.

Geographically, Italy and France continue emerging in Europe as key contributors to the EMS market with projected CAGRs of 2.1% and 1.6%, respectively, during the forecast period. Supported by government programs aimed at strengthening health infrastructure, growth in capital investments in emergency medical services, and a growing focus on improving patient outcomes in emergencies, the Mid East and African regions are also developing more modern EMS systems.

The market is segmented by services into basic life support, advanced life support, and patient transfer services.

Based on the provider, the market is segmented into fire-department-based EMS, government EMS, hospital-based EMS, private ambulance service, and other.

The market is categorized based on fleet, including ground transport and air transport.

In terms of region, the market is segmented into Europe and the Middle East & Africa.

The EMEA Emergency Medical Service market is projected to be valued at USD 9.19 billion in 2025 and reach USD 12.00 billion by 2035, growing at a CAGR of 2.7%.

EMEA Emergency Medical Service product sales are expected to grow steadily due to increasing medical emergencies, technological advancements, and expanding government and private EMS collaborations.

Key manufacturers in the EMEA Emergency Medical Service market include Falck A/S, Airbus, International SOS, Air Ambulance Worldwide, and ER24, among others.

Europe, particularly Italy and France, along with the Middle East and Africa, is expected to generate lucrative opportunities for market players due to government investments in EMS infrastructure and rising demand for emergency care.

Table 01: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 02: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 03: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 04: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Region

Table 05: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Country

Table 06: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 07: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 08: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 09: UK Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 10: UK Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 11: UK Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 12: UK Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 13: Germany Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 14: Germany Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 15: Germany Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 16: Germany Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 17: Spain Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 18: Spain Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 19: Spain Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 20: Spain Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 21: Italy Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 22: Italy Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 23: Italy Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 24: Italy Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 25: France Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 26: France Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 27: France Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 28: France Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 29: BENELUX Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 30: BENELUX Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 31: BENELUX Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 32: BENELUX Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 33: Nordic Countries Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 34: Nordic Countries Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 35: Nordic Countries Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 36: Nordic Countries Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 37: Switzerland Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 38: Switzerland Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 39: Switzerland Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 40: Switzerland Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 41: Hungary Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 42: Hungary Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 43: Hungary Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 44: Hungary Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 45: Poland Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 46: Poland Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 47: Poland Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 48: Poland Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 49: Romania Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 50: Romania Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 51: Romania Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 52: Romania Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 53: Czech Republic Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By States

Table 54: Czech Republic Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 55: Czech Republic Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 56: Czech Republic Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 57: Rest of Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 58: Rest of Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 59: Rest of Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 60: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Country

Table 61: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 62: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 63: Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 64: Kingdom of Saudi Arabia Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 65: Kingdom of Saudi Arabia Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 66: Kingdom of Saudi Arabia Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 67: United Arab Emirates Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 68: United Arab Emirates Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 69: United Arab Emirates Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 70: Bahrain Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 71: Bahrain Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 72: Bahrain Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 73: Oman Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 74: Oman Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 75: Oman Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 76: Qatar Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 77: Qatar Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 78: Qatar Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 79: Kuwait Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 80: Kuwait Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 81: Kuwait Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 82: Yemen Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 83: Yemen Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 84: Yemen Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 85: Türkiye Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 86: Türkiye Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 87: Türkiye Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 88: Israel Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 89: Israel Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 90: Israel Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 91: South Africa Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 92: South Africa Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 93: South Africa Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 94: Egypt Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 95: Egypt Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 96: Egypt Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 97: Morocco Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 98: Morocco Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 99: Morocco Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 100: Libya Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 101: Libya Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 102: Libya Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 103: Lebanon Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 104: Lebanon Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 105: Lebanon Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Table 106: Rest of Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Service

Table 107: Rest of Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Provider

Table 108: Rest of Market Size (US$ Million) Analysis 2016 to 2023 and Forecast 2024 to 2034, By Fleet

Figure 01: Market Share, By Services, 2024 (E)

Figure 02: Market Share, By Provider, 2024 (E)

Figure 03: Market Share, By Fleet, 2024 (E)

Figure 04: Market Share, By Region, 2024 (E)

Figure 05: Market Size (US$ Million) Analysis, 2016 to 2023

Figure 06: Market Size (US$ Million) & Y-o-Y Growth (%) Analysis, 2024 to 2034

Figure 07: Market Absolute $ Opportunity, 2024 to 2034

Figure 08: Market Share Analysis (%), By Service, 2024 (E) to 2034 (F)

Figure 09: Market Y-o-Y Analysis (%), By Service, 2024 to 2034

Figure 10: Market Attractiveness Analysis By Service, 2024 to 2034

Figure 11: Market Share Analysis (%), By Provider, 2024 (E) to 2034 (F)

Figure 12: Market Y-o-Y Analysis (%), By Provider, 2024 to 2034

Figure 13: Market Attractiveness Analysis By Provider, 2024 to 2034

Figure 14: Market Share Analysis (%), By Fleet, 2024 (E) to 2034 (F)

Figure 15: Market Y-o-Y Analysis (%), By Fleet, 2024 to 2034

Figure 16: Market Attractiveness Analysis By Fleet, 2024 to 2034

Figure 17: Market Share Analysis (%), By Region, 2024 (E) to 2034 (F)

Figure 18: Market Y-o-Y Analysis (%), By Region, 2024 to 2034

Figure 19: Market Attractiveness Analysis By Region, 2024 to 2034

Figure 20: Market Value Share, By Service 2024 (E)

Figure 21: Market Value Share, By Provider 2024 (E)

Figure 22: Market Value Share, By Fleet 2024 (E)

Figure 23: Market Value Share, By Country 2024 (E)

Figure 24: Market Size (US$ Million) Analysis, 2016 to 2023

Figure 25: Market Size (US$ Million) & Y-o-Y Growth (%) Analysis, 2024 to 2034

Figure 26: Market Attractiveness Analysis By Service, 2024 to 2034

Figure 27: Market Attractiveness Analysis By Provider, 2024 to 2034

Figure 28: Market Attractiveness Analysis By Fleet, 2024 to 2034

Figure 29: Market Attractiveness Analysis By Country, 2024 to 2034

Figure 30: UK Market Share Analysis (%) By Service, 2023 to 2034

Figure 31: UK Market Share Analysis (%) By Provider, 2023 to 2034

Figure 32: UK Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 33: Germany Market Share Analysis (%) By Service, 2023 to 2034

Figure 34: Germany Market Share Analysis (%) By Provider, 2023 to 2034

Figure 35: Germany Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 36: Spain Market Share Analysis (%) By Service, 2023 to 2034

Figure 37: Spain Market Share Analysis (%) By Provider, 2023 to 2034

Figure 38: Spain Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 39: Italy Market Share Analysis (%) By Service, 2023 to 2034

Figure 40: Italy Market Share Analysis (%) By Provider, 2023 to 2034

Figure 41: Italy Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 42: France Market Share Analysis (%) By Service, 2023 to 2034

Figure 43: France Market Share Analysis (%) By Provider, 2023 to 2034

Figure 44: France Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 45: BENELUX Market Share Analysis (%) By Service, 2023 to 2034

Figure 46: BENELUX Market Share Analysis (%) By Provider, 2023 to 2034

Figure 47: BENELUX Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 48: Nordic Countries Market Share Analysis (%) By Service, 2023 to 2034

Figure 49: Nordic Countries Market Share Analysis (%) By Provider, 2023 to 2034

Figure 50: Nordic Countries Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 51: Switzerland Market Share Analysis (%) By Service, 2023 to 2034

Figure 52: Switzerland Market Share Analysis (%) By Provider, 2023 to 2034

Figure 53: Switzerland Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 54: Hungary Market Share Analysis (%) By Service, 2023 to 2034

Figure 55: Hungary Market Share Analysis (%) By Provider, 2023 to 2034

Figure 56: Hungary Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 57: Poland Market Share Analysis (%) By Service, 2023 to 2034

Figure 58: Poland Market Share Analysis (%) By Provider, 2023 to 2034

Figure 59: Poland Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 60: Romania Market Share Analysis (%) By Service, 2023 to 2034

Figure 61: Romania Market Share Analysis (%) By Provider, 2023 to 2034

Figure 62: Romania Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 63: Czech Republic Market Share Analysis (%) By Service, 2023 to 2034

Figure 64: Czech Republic Market Share Analysis (%) By Provider, 2023 to 2034

Figure 65: Czech Republic Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 66: Rest of Market Share Analysis (%) By Service, 2023 to 2034

Figure 67: Rest of Market Share Analysis (%) By Provider, 2023 to 2034

Figure 68: Rest of Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 69: Market Value Share, By Service 2024 (E)

Figure 70: Market Value Share, By Provider 2024 (E)

Figure 71: Market Value Share, By Fleet 2024 (E)

Figure 72: Market Value Share, By Country 2024 (E)

Figure 73: Market Size (US$ Million) Analysis, 2016 to 2023

Figure 74: Market Size (US$ Million) & Y-o-Y Growth (%) Analysis, 2024 to 2034

Figure 75: Market Attractiveness Analysis By Service, 2024 to 2034

Figure 76: Market Attractiveness Analysis By Provider, 2024 to 2034

Figure 77: Market Attractiveness Analysis By Fleet, 2024 to 2034

Figure 78: Market Attractiveness Analysis By Country, 2024 to 2034

Figure 79: Kingdom of Saudi Arabia Market Share Analysis (%) By Service, 2023 to 2034

Figure 80: Kingdom of Saudi Arabia Market Share Analysis (%) By Provider, 2023 to 2034

Figure 81: Kingdom of Saudi Arabia Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 82: United Arab Emirates Market Share Analysis (%) By Service, 2023 to 2034

Figure 83: United Arab Emirates Market Share Analysis (%) By Provider, 2023 to 2034

Figure 84: United Arab Emirates Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 85: Bahrain Market Share Analysis (%) By Service, 2023 to 2034

Figure 86: Bahrain Market Share Analysis (%) By Provider, 2023 to 2034

Figure 87: Bahrain Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 88: Oman Market Share Analysis (%) By Service, 2023 to 2034

Figure 89: Oman Market Share Analysis (%) By Provider, 2023 to 2034

Figure 90: Oman Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 91: Qatar Market Share Analysis (%) By Service, 2023 to 2034

Figure 92: Qatar Market Share Analysis (%) By Provider, 2023 to 2034

Figure 93: Qatar Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 94: Kuwait Market Share Analysis (%) By Service, 2023 to 2034

Figure 95: Kuwait Market Share Analysis (%) By Provider, 2023 to 2034

Figure 96: Kuwait Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 97: Yemen Market Share Analysis (%) By Service, 2023 to 2034

Figure 98: Yemen Market Share Analysis (%) By Provider, 2023 to 2034

Figure 99: Yemen Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 100: Türkiye Market Share Analysis (%) By Service, 2023 to 2034

Figure 101: Türkiye Market Share Analysis (%) By Provider, 2023 to 2034

Figure 102: Türkiye Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 103: Israel Market Share Analysis (%) By Service, 2023 to 2034

Figure 104: Israel Market Share Analysis (%) By Provider, 2023 to 2034

Figure 105: Israel Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 106: South Africa Market Share Analysis (%) By Service, 2023 to 2034

Figure 107: South Africa Market Share Analysis (%) By Provider, 2023 to 2034

Figure 108: South Africa Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 109: Egypt Market Share Analysis (%) By Service, 2023 to 2034

Figure 110: Egypt Market Share Analysis (%) By Provider, 2023 to 2034

Figure 111: Egypt Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 112: Morocco Market Share Analysis (%) By Service, 2023 to 2034

Figure 113: Morocco Market Share Analysis (%) By Provider, 2023 to 2034

Figure 114: Morocco Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 115: Libya Market Share Analysis (%) By Service, 2023 to 2034

Figure 116: Libya Market Share Analysis (%) By Provider, 2023 to 2034

Figure 117: Libya Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 118: Lebanon Market Share Analysis (%) By Service, 2023 to 2034

Figure 119: Lebanon Market Share Analysis (%) By Provider, 2023 to 2034

Figure 120: Lebanon Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 121: Rest of Market Share Analysis (%) By Service, 2023 to 2034

Figure 122: Rest of Market Share Analysis (%) By Provider, 2023 to 2034

Figure 123: Rest of Market Share Analysis (%) By Fleet, 2023 to 2034

Figure 124: England Market Value Share, By Service 2024 (E)

Figure 125: England Market Value Share, By Provider 2024 (E)

Figure 126: England Market Value Share, By Fleet 2024 (E)

Figure 127: Wales Market Value Share, By Service 2024 (E)

Figure 128: Wales Market Value Share, By Provider 2024 (E)

Figure 129: Wales Market Value Share, By Fleet 2024 (E)

Figure 130: Northern Ireland Market Value Share, By Service 2024 (E)

Figure 131: Northern Ireland Market Value Share, By Provider 2024 (E)

Figure 132: Northern Ireland Market Value Share, By Fleet 2024 (E)

Figure 133: Scotland Market Value Share, By Service 2024 (E)

Figure 134: Scotland Market Value Share, By Provider 2024 (E)

Figure 135: Scotland Market Value Share, By Fleet 2024 (E)

Figure 136: Baden-Württemberg Market Value Share, By Service 2024 (E)

Figure 137: Baden-Württemberg Market Value Share, By Provider 2024 (E)

Figure 138: Baden-Württemberg Market Value Share, By Fleet 2024 (E)

Figure 139: Bavaria Market Value Share, By Service 2024 (E)

Figure 140: Bavaria Market Value Share, By Provider 2024 (E)

Figure 141: Bavaria Market Value Share, By Fleet 2024 (E)

Figure 142: Lower Saxony Market Value Share, By Service 2024 (E)

Figure 143: Lower Saxony Market Value Share, By Provider 2024 (E)

Figure 144: Lower Saxony Market Value Share, By Fleet 2024 (E)

Figure 145: Hesse Market Value Share, By Service 2024 (E)

Figure 146: Hesse Market Value Share, By Provider 2024 (E)

Figure 147: Hesse Market Value Share, By Fleet 2024 (E)

Figure 148: Madrid Market Value Share, By Service 2024 (E)

Figure 149: Madrid Market Value Share, By Provider 2024 (E)

Figure 150: Madrid Market Value Share, By Fleet 2024 (E)

Figure 151: Barcelona Market Value Share, By Service 2024 (E)

Figure 152: Barcelona Market Value Share, By Provider 2024 (E)

Figure 153: Barcelona Market Value Share, By Fleet 2024 (E)

Figure 154: Valencia Market Value Share, By Service 2024 (E)

Figure 155: Valencia Market Value Share, By Provider 2024 (E)

Figure 156: Valencia Market Value Share, By Fleet 2024 (E)

Figure 157: Seville Market Value Share, By Service 2024 (E)

Figure 158: Seville Market Value Share, By Provider 2024 (E)

Figure 159: Seville Market Value Share, By Fleet 2024 (E)

Figure 160: Rome Market Value Share, By Service 2024 (E)

Figure 161: Rome Market Value Share, By Provider 2024 (E)

Figure 162: Rome Market Value Share, By Fleet 2024 (E)

Figure 163: Abruzzo Market Value Share, By Service 2024 (E)

Figure 164: Abruzzo Market Value Share, By Provider 2024 (E)

Figure 165: Abruzzo Market Value Share, By Fleet 2024 (E)

Figure 166: Basilicata Market Value Share, By Service 2024 (E)

Figure 167: Basilicata Market Value Share, By Provider 2024 (E)

Figure 168: Basilicata Market Value Share, By Fleet 2024 (E)

Figure 169: Calabria Market Value Share, By Service 2024 (E)

Figure 170: Calabria Market Value Share, By Provider 2024 (E)

Figure 171: Calabria Market Value Share, By Fleet 2024 (E)

Figure 172: Auvergne - Rhône-Alpes Market Value Share, By Service 2024 (E)

Figure 173: Auvergne - Rhône-Alpes Market Value Share, By Provider 2024 (E)

Figure 174: Auvergne - Rhône-Alpes Market Value Share, By Fleet 2024 (E)

Figure 175: Bretagne (Brittany) Market Value Share, By Service 2024 (E)

Figure 176: Bretagne (Brittany) Market Value Share, By Provider 2024 (E)

Figure 177: Bretagne (Brittany) Market Value Share, By Fleet 2024 (E)

Figure 178: Bourgogne - Franche-Comté Market Value Share, By Service 2024 (E)

Figure 179: Bourgogne - Franche-Comté Market Value Share, By Provider 2024 (E)

Figure 180: Bourgogne - Franche-Comté Market Value Share, By Fleet 2024 (E)

Figure 181: Ile de France (Paris) Market Value Share, By Service 2024 (E)

Figure 182: Ile de France (Paris) Market Value Share, By Provider 2024 (E)

Figure 183: Ile de France (Paris) Market Value Share, By Fleet 2024 (E)

Figure 184: Belgium Market Value Share, By Service 2024 (E)

Figure 185: Belgium Market Value Share, By Provider 2024 (E)

Figure 186: Belgium Market Value Share, By Fleet 2024 (E)

Figure 187: Netherlands Market Value Share, By Service 2024 (E)

Figure 188: Netherlands Market Value Share, By Provider 2024 (E)

Figure 189: Netherlands Market Value Share, By Fleet 2024 (E)

Figure 190: Luxembourg Market Value Share, By Service 2024 (E)

Figure 191: Luxembourg Market Value Share, By Provider 2024 (E)

Figure 192: Luxembourg Market Value Share, By Fleet 2024 (E)

Figure 193: Denmark Market Value Share, By Service 2024 (E)

Figure 194: Denmark Market Value Share, By Provider 2024 (E)

Figure 195: Denmark Market Value Share, By Fleet 2024 (E)

Figure 196: Norway Market Value Share, By Service 2024 (E)

Figure 197: Norway Market Value Share, By Provider 2024 (E)

Figure 198: Norway Market Value Share, By Fleet 2024 (E)

Figure 199: Sweden Market Value Share, By Service 2024 (E)

Figure 200: Sweden Market Value Share, By Provider 2024 (E)

Figure 201: Sweden Market Value Share, By Fleet 2024 (E)

Figure 202: Finland Market Value Share, By Service 2024 (E)

Figure 203: Finland Market Value Share, By Provider 2024 (E)

Figure 204: Finland Market Value Share, By Fleet 2024 (E)

Figure 205: Zurich Market Value Share, By Service 2024 (E)

Figure 206: Zurich Market Value Share, By Provider 2024 (E)

Figure 207: Zurich Market Value Share, By Fleet 2024 (E)

Figure 208: Geneva Market Value Share, By Service 2024 (E)

Figure 209: Geneva Market Value Share, By Provider 2024 (E)

Figure 210: Geneva Market Value Share, By Fleet 2024 (E)

Figure 211: Basel Market Value Share, By Service 2024 (E)

Figure 212: Basel Market Value Share, By Provider 2024 (E)

Figure 213: Basel Market Value Share, By Fleet 2024 (E)

Figure 214: Budapest Market Value Share, By Service 2024 (E)

Figure 215: Budapest Market Value Share, By Provider 2024 (E)

Figure 216: Budapest Market Value Share, By Fleet 2024 (E)

Figure 217: Debrecen Market Value Share, By Service 2024 (E)

Figure 218: Debrecen Market Value Share, By Provider 2024 (E)

Figure 219: Debrecen Market Value Share, By Fleet 2024 (E)

Figure 220: Miskolc Market Value Share, By Service 2024 (E)

Figure 221: Miskolc Market Value Share, By Provider 2024 (E)

Figure 222: Miskolc Market Value Share, By Fleet 2024 (E)

Figure 223: Warsaw Market Value Share, By Service 2024 (E)

Figure 224: Warsaw Market Value Share, By Provider 2024 (E)

Figure 225: Warsaw Market Value Share, By Fleet 2024 (E)

Figure 226: Lodz Market Value Share, By Service 2024 (E)

Figure 227: Lodz Market Value Share, By Provider 2024 (E)

Figure 228: Lodz Market Value Share, By Fleet 2024 (E)

Figure 229: Krakow Market Value Share, By Service 2024 (E)

Figure 230: Krakow Market Value Share, By Provider 2024 (E)

Figure 231: Krakow Market Value Share, By Fleet 2024 (E)

Figure 232: Bucharest Market Value Share, By Service 2024 (E)

Figure 233: Bucharest Market Value Share, By Provider 2024 (E)

Figure 234: Bucharest Market Value Share, By Fleet 2024 (E)

Figure 235: Constanța Market Value Share, By Service 2024 (E)

Figure 236: Constanța Market Value Share, By Provider 2024 (E)

Figure 237: Constanța Market Value Share, By Fleet 2024 (E)

Figure 238: TimiÅŸoara Market Value Share, By Service 2024 (E)

Figure 239: TimiÅŸoara Market Value Share, By Provider 2024 (E)

Figure 240: TimiÅŸoara Market Value Share, By Fleet 2024 (E)

Figure 241: Prague Market Value Share, By Service 2024 (E)

Figure 242: Prague Market Value Share, By Provider 2024 (E)

Figure 243: Prague Market Value Share, By Fleet 2024 (E)

Figure 244: Brno Market Value Share, By Service 2024 (E)

Figure 245: Brno Market Value Share, By Provider 2024 (E)

Figure 246: Brno Market Value Share, By Fleet 2024 (E)

Figure 247: Ostrava Market Value Share, By Service 2024 (E)

Figure 248: Ostrava Market Value Share, By Provider 2024 (E)

Figure 249: Ostrava Market Value Share, By Fleet 2024 (E)

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emergency Communication Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Emergency Lighting Market Growth - Trends & Forecast 2025 to 2035

Emergency Light Sticks Market Analysis and Forecast by Type, Distribution Channel, End Use, and Region through 2035

Emergency Shutdown System Market Trends - Growth & Forecast 2025 to 2035

Emergency Spill Response Market Growth - Size, Trends & Forecast 2025 to 2035

Emergency Vent Cover Market Growth – Trends & Forecast 2024-2034

Emergency Venting System Market Growth – Trends & Forecast 2024-2034

Emergency Response and Rescue Vessels Market

Emergency Beacon Transmitter Market

Emergency Medical Services Market Overview – Trends & Industry Outlook 2024-2034

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Personal Emergency Response System Market Analysis – Growth & Forecast 2024-2034

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emergency Braking System Market - Size, Share, and Forecast 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA