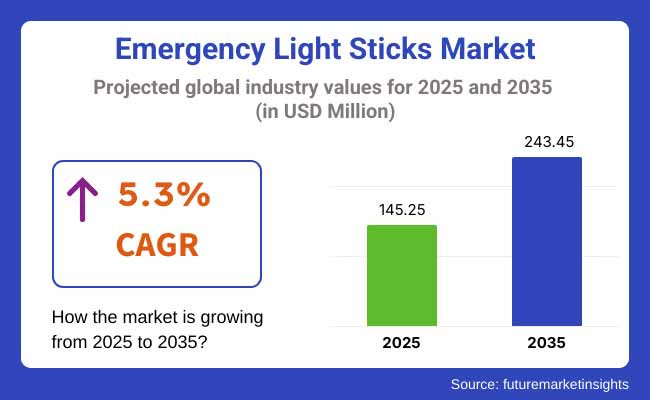

The Emergency Light Sticks Market is valued at USD 145.25 million in 2025. As per FMI's analysis, the Emergency Light Sticks Industry will grow at a CAGR of 5.3% and reach USD 243.45 million by 2035.

In 2024, the industry experienced steady growth driven by increasing demand from sectors such as emergency services, defense, and outdoor recreation. A notable rise in disaster preparedness initiatives, particularly in regions prone to natural calamities, led to an increased adoption of emergency light sticks.

Additionally, government bodies and non-profit organizations expanded their procurement of these devices for emergency relief kits. Manufacturers responded to growing demand by enhancing product durability, brightness, and shelf life. Innovations in biodegradable and non-toxic materials also gained traction, catering to sustainability-conscious consumers.

The year also saw a surge in online sales through various channels, allowing consumers to access a variety of products with ease. Partnerships between e-commerce platforms and manufacturers further facilitated industry expansion. Furthermore, companies invested in branding and awareness campaigns, emphasizing the reliability and cost-effectiveness of light sticks compared to battery-operated alternatives.

Looking ahead, 2025 and beyond are expected to witness continued industry growth, driven by urbanization, increasing disaster management initiatives, and rising outdoor activities. Technological advancements, including chemical innovations for longer-lasting illumination, will likely enhance product performance.

Additionally, expanding applications in industrial and mining operations will provide further opportunities for industry growth. Stakeholders should prioritize sustainability, innovation, and strategic partnerships to maintain a competitive edge in this evolving landscape.

The emergency light stick industry is experiencing steady growth, driven by increasing demand from the safety, military, and outdoor recreational sectors. Rising awareness about disaster preparedness and advancements in non-toxic, long-lasting light stick technology further propel the industry. Manufacturers and suppliers catering to defense agencies, event organizers, and adventure enthusiasts stand to benefit the most.

Expand Product Innovation

Invest in the development of eco-friendly, long-lasting, and multifunctional light sticks to cater to increasing consumer preferences for sustainable and reliable safety solutions.

Strengthen Partnerships in Key Sectors

Form strategic alliances with government agencies, disaster management organizations, and outdoor gear retailers to expand industry reach and build brand credibility.

Optimize Distribution Channels

Leverage e-commerce platforms and strengthen distributor networks in emerging industry’s to ensure efficient product availability and capitalize on growing demand for emergency preparedness solutions.

| Risk | Probability & Impact |

|---|---|

| Supply Chain Disruptions | Medium Probability, High Impact |

| Regulatory Changes on Chemical Components | Low Probability, Medium Impact |

| Increased Competition from Alternative Products | High Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Expand Product Innovation | Conduct R&D on eco-friendly and longer-lasting light stick options. |

| Strengthen Industry Partnerships | Initiate collaborations with disaster management agencies and outdoor retailers. |

| Enhance Industry Reach | Launch a regional distributor incentive program and expand e-commerce presence. |

To stay ahead, companies must prioritize innovation by developing eco-friendly, long-lasting emergency light sticks that meet evolving safety and sustainability demands. Strengthening partnerships with disaster response agencies, military organizations, and outdoor retailers will ensure wider industry penetration.

Additionally, expanding e-commerce channels and offering targeted incentives to distributors can accelerate growth. Monitoring supply chain resilience and staying agile to regulatory changes will be critical for maintaining a competitive edge in this growing industry.

(Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, emergency response agencies, and retailers in the USA, Western Europe, Japan, and South Korea)

Regional Variance:

High Variance:

ROI Perspectives:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users:

Alignment:

Divergence:

Key Variances:

Strategic Insight:

Companies must adopt region-specific strategies, such as durable, high-tech models in the USA, eco-friendly alternatives in Europe, and budget-friendly options in Asia to maximize industry penetration.

| Country | Policies & Regulations Impacting the Industry |

|---|---|

| The USA |

|

| UK |

|

| France |

|

| Germany |

|

| Italy |

|

| South Korea |

|

| Japan |

|

| China |

|

| Australia-NZ |

|

The industry is expected to see notable growth in the reusable light sticks segment, driven by increased consumer preference for sustainable and cost-effective options. Single-use light sticks remain popular for emergency and recreational purposes, but advancements in eco-friendly and longer-lasting alternatives are influencing industry trends. Innovations in chemical formulations and enhanced durability further support this growth.

Additionally, increased safety regulations in hazardous environments continue to favour specialized light sticks, contributing to steady demand. With an expanding application base in industrial, military, and outdoor activities, the type segment will experience balanced growth, with reusable products leading the way.

The e-commerce distribution channel is set to experience the fastest growth, propelled by the increasing convenience of online shopping. Consumers benefit from wider product availability, competitive pricing, and rapid delivery options. Offline retail channels, including specialty stores and hardware outlets, remain essential for bulk purchases and direct consultations.

Additionally, manufacturers are focusing on omnichannel strategies, integrating online platforms with physical stores for a seamless shopping experience. While traditional distribution channels retain importance in rural and underdeveloped regions, online platforms are expected to lead industry expansion, driving significant growth.

The industrial end-use segment is expected to continue dominating the emergency light sticks industry with a CAGR of 5.0%. Industrial applications will remain the leading segment due to strict workplace safety regulations and increased preparedness for emergencies. Construction sites, mining operations, and hazardous workplaces heavily rely on reliable lighting solutions.

Additionally, growing investments in infrastructure and defense projects further strengthen this segment's dominance. While the recreational and personal use segments will grow steadily, the consistent demand from industries for durable, high-performance lighting products ensures the industrial sector's continued leadership.

In the United States, the emergency lighting industry is expected to grow at a CAGR of 5.5% between 2025 to 2035. Growing demand is driven by an increasing focus on workplace safety regulations and disaster preparedness. Rising investments in construction and infrastructure projects further contribute to industry growth.

Policies set by governments worldwide for public safety only serve to expedite the adoption of advanced lighting solutions. Moreover, the availability of established manufacturers and consistent technological developments help the demand for products. The growth of the e-commerce industry provides greater access for both consumers and businesses.

China is forecasted to experience robust growth with a CAGR of 6.5% from 2025 to 2035. The nation's rapid industrialization and urban development drive significant demand for reliable lighting solutions. Stringent government safety regulations and extensive infrastructure projects further boost industry expansion.

Domestic manufacturers offer competitive pricing and innovative products, strengthening industry accessibility. Moreover, frequent natural disasters increase the necessity for reliable lighting. E-commerce platforms and digital advancements provide wider reach, ensuring that both individuals and institutions have access to appropriate solutions.

Japan is expected to grow at a steady CAGR of 5.6% between 2025 and 2035 due to its heightened focus on disaster preparedness and technological development. As earthquakes and typhoons frequently occur, there is greater need for portable and reliable lighting. This, along with government programs to actively improve public safety systems and emergency preparedness, fuels industry growth.

Japanese companies are at the forefront of creating energy-efficient and eco-friendly products. With the support of advanced manufacturing capabilities and collaboration with global organizations, the industry has been experiencing consistent growth.

South Korea is projected to grow at a CAGR of 5.8% between 2025 and 2035. The country’s emphasis on industrial safety, construction growth, and infrastructure development fosters the demand for lighting solutions. Government regulations mandating emergency preparedness measures in public and private sectors provide additional growth opportunities.

Technological advancements and energy-efficient product innovations further contribute to the industry's growth. Additionally, partnerships between manufacturers and emergency service providers drive innovation and improve product availability across the region.

Germany, with respect to compound annual growth rate (CAGR) from 2025 to 2035 is at 5.1% owing to stringent safety standards and the regulatory compliance across industries. Key consumers include industrial sectors, particularly manufacturing and logistics, which look for reliable and sustainable solutions. Demand is also bolstered by government campaigns for disaster preparedness.

Most importantly, technological innovations in energy-efficient lighting systems will also comply with the country’s sustainability vision. With its superior logistics infrastructure and burgeoning e-commerce channels, Germany provides the most efficient product delivery, creating a self-sustaining cycle of successful industry expansion.

United Kingdom is expected to grow at a CAGR of 4.8% during the forecast period from 2025 to 2035 owing to rising investment in public safety initiatives and strict safety regulations. Increasing use from construction, defense, and emergency response industries is impelling the industry. Other innovations like eco-friendly lighting solutions are gaining momentum.

Government disaster preparedness programs are a main driver for product adoption. The growth of e-commerce and the expansion of distribution networks provide easy access to products across the country. This facilitates easier access to potential customers and aids in expanding the industry's presence.

France is expected to expand with a CAGR of 4.9% in the years 2025 to 2035. The expansion of investments into workplace safety infrastructure and the implementation of strict safety regulations are major facilitating forces. Increased awareness about emergency preparedness in industries drives the industry growth.

The increasing consumer preference for energy-efficient and sustainable lighting solutions also drives product innovation. The main consumers are still defense and industrial. The easier access to products through e-commerce platforms helps small and medium enterprises increase their reach and adds to overall industry growth.

Australia and New Zealand are also expected to grow by a CAGR of 5.4% between 2025 and 2035, mostly due to the rising number of natural disasters and growing government initiatives toward public safety. Awareness campaigns for emergency preparedness and regulatory measures also play a role in product adoption. The increase in demand is also driven by the growing industries of construction and mining.

Moreover, the demand for sustainable and energy-efficient solutions drives the innovation of products. The expansion of e-commerce ensures that there is a wide variety of products available to residential as well as commercial consumers.

Italy is estimated to register with a moderate growth with a CAGR of 4.5% from 2025 to 2035. Increased safety awareness and a need for emergency preparedness contribute to the growth of this industry especially in the construction and industrial sectors. Also, government regulations that require the implementation of safety measures boost the demand even more.

Local manufacturers are focusing on eco-friendly innovations to promote sustainable lighting solutions. E-commerce platforms also improve accessibility of goods for sale so that products are found in rural and urban regions fuelling the growth of industry access.

In 2024, notable developments in the emergency light sticks industry include Myers Emergency Power Systems acquiring Storage Power Solutions (SPS) in February to enhance its energy storage capabilities and expand its industry presence. This acquisition strengthens Myers EPS’s commitment to providing innovative and sustainable solutions.

Additionally, companies are increasingly focusing on technological advancements and sustainability initiatives, with the adoption of eco-friendly materials and energy-efficient designs. Partnerships and collaborations to enhance product distribution and improve customer experience have also been prominent, further driving competition and industry growth.

Cyalume Technologies, Inc. (30-35%)

The global industry leader in chemiluminescent light sticks, dominating military and industrial sectors through long-term government contracts and advanced chemical formulations.

Energizer Holdings, Inc. (20-25%)

Major consumer brand with strong retail distribution, leveraging its household name recognition to capture the mass industry emergency preparedness segment.

Orion Safety Products (15-20%)

Specialized provider for aviation and marine applications, maintaining industry position through rigorous safety certifications and industry-specific solutions.

Nite Ize Inc. (10-15%)

Innovator in reusable LED light sticks, gaining industry share through eco-friendly products targeting outdoor enthusiasts and urban preppers.

AmeriGlo (5-10%)

Tactical-focused manufacturer carving out a niche in law enforcement and military accessory industrys through specialized product designs.

Military Products Group (5-8%)

Trusted supplier to defense organizations worldwide, with particular strength in bulk government procurement contracts.

Lumica Corporation (3-5%)

Japanese specialist known for high-quality chemical light sticks, maintaining strong position in Asian industrys through precision manufacturing.

Dorcy International (3-5%)

Value-oriented competitor offering affordable alternatives through big-box retail channels and online marketplaces.

Atlantic Glow (2-4%)

Marine safety specialist providing USCG-approved solutions for commercial shipping and recreational boating sectors.

Coghlan's Ltd. (2-3%)

Outdoor recreation-focused brand popular among campers and backpackers through specialty sporting goods retailers.

Life Gear, Inc. (1-2%)

Emergency preparedness company offering bundled survival kits that include light sticks as part of comprehensive packages.

The industry is bifurcated into battery-operated and chemiluminescent.

It is bifurcated into distributor and direct sales.

The landscape is categorized into industrial, commercial, and recreational.

The industry is studied across North America, Latin America, Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Increasing safety regulations, infrastructure development, and the need for reliable backup lighting during power outages are major factors driving growth.

North America and Asia-Pacific are experiencing strong demand due to rapid urbanization, industrial growth, and stringent safety norms.

LED-based lights, exit signs, and battery-powered systems are widely preferred for their energy efficiency and durability.

Innovations like smart lighting systems, remote monitoring, and energy-efficient designs are enhancing safety and reducing operational costs.

Industrial facilities, commercial buildings, hospitals, and residential complexes are key users, ensuring safety and compliance with regulations.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emergency Communication Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Emergency Shutdown System Market Trends - Growth & Forecast 2025 to 2035

Emergency Spill Response Market Growth - Size, Trends & Forecast 2025 to 2035

Emergency Medical Services Market Overview – Trends & Industry Outlook 2024-2034

Emergency Vent Cover Market Growth – Trends & Forecast 2024-2034

Emergency Venting System Market Growth – Trends & Forecast 2024-2034

Emergency Response and Rescue Vessels Market

Emergency Beacon Transmitter Market

Emergency Lighting Market Growth - Trends & Forecast 2025 to 2035

EMEA Emergency Medical Service Market Analysis by Services, Provider, Fleet, and Region Forecast Through 2035

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Personal Emergency Response System (PERS) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emergency Braking System Market - Size, Share, and Forecast 2025 to 2035

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA