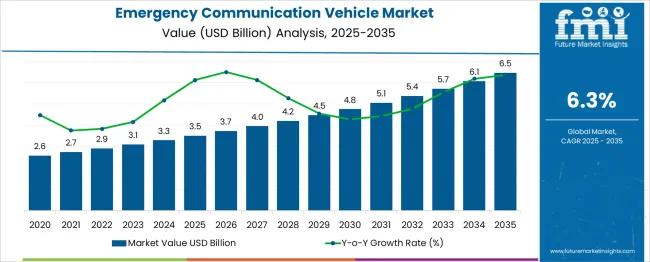

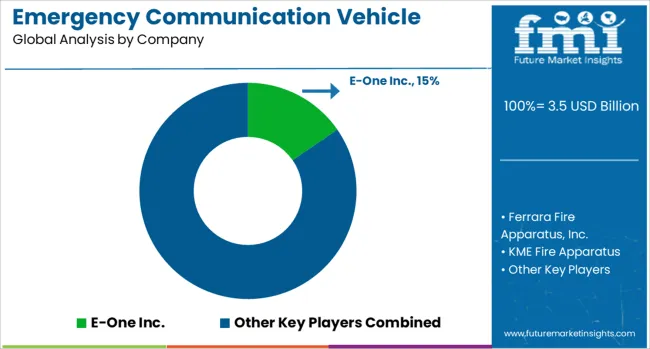

The Emergency Communication Vehicle Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Emergency Communication Vehicle Market Estimated Value in (2025 E) | USD 3.5 billion |

| Emergency Communication Vehicle Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The emergency communication vehicle market is gaining momentum as governments and agencies prioritize rapid response capabilities in disaster-prone and high-risk zones. These vehicles serve as mobile command centers equipped with real-time communication tools to ensure uninterrupted connectivity during emergencies, including natural disasters, terror attacks, and infrastructure failures.

With the increasing frequency of climate-related catastrophes and growing emphasis on national security, the deployment of communication vehicles has become a strategic investment. Advanced integrations of multi-band communication, GPS tracking, and autonomous power supply systems have made these units more effective and reliable.

The outlook remains strong, driven by public safety mandates, rising defense budgets, and modernization of emergency management protocols across urban and rural geographies. As inter-agency coordination becomes increasingly data-dependent, the market is poised for long-term growth driven by innovation, interoperability, and real-time situational awareness solutions.

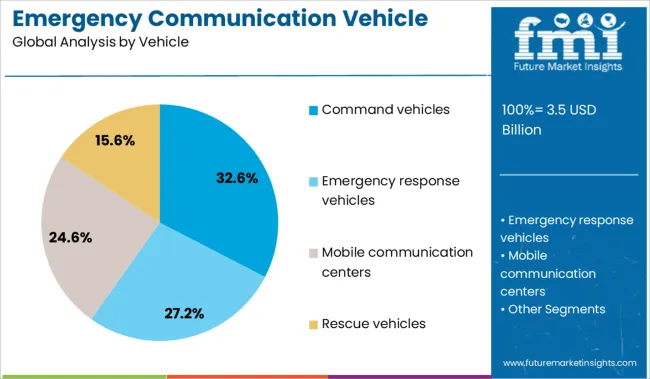

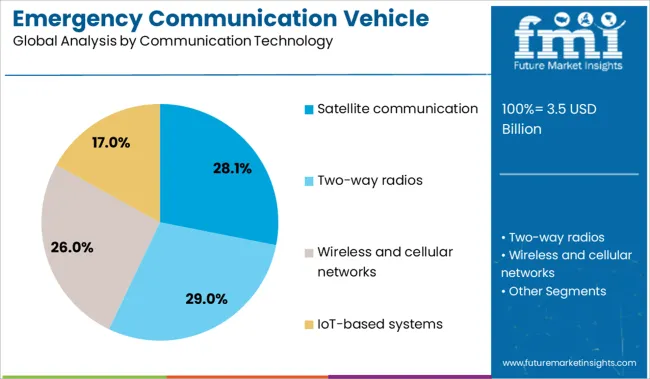

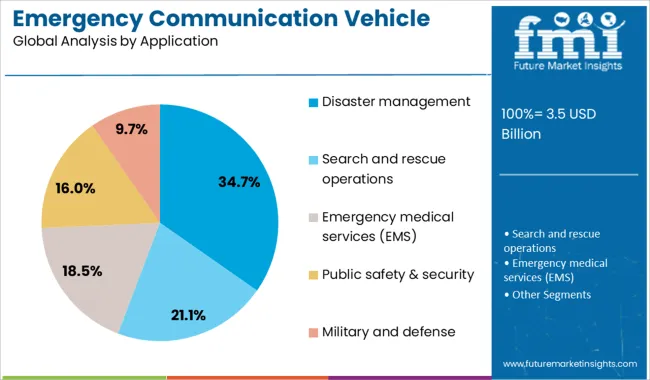

The emergency communication vehicle market is segmented by vehicle, communication technology, and application and geographic regions. The emergency communication vehicle market is divided into Command vehicles, Emergency response vehicles, Mobile communication centers, and Rescue vehicles. The emergency communication vehicle market is classified into Satellite communication, Two-way radios, Wireless and cellular networks, and IoT-based systems. Based on the application of the emergency communication vehicle market, it is segmented into Disaster management, Search and rescue operations, Emergency medical services (EMS), Public safety & security, and Military and defense. Regionally, the emergency communication vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The command vehicles segment leads the market with a 32.6% share, supported by its critical role in field coordination, decision-making, and emergency communication relay. These vehicles are typically deployed by police, fire departments, and emergency response agencies to act as centralized hubs during crisis events.

Equipped with surveillance, mapping, communication, and power management systems, command vehicles provide mobile infrastructure where fixed networks may be compromised. Demand for these platforms has increased with the need for on-site intelligence, enabling field personnel to operate with agility and precision.

Their capability to host temporary control rooms with satellite uplinks and multi-agency communication channels further cements their utility. Future adoption is expected to rise with defense and homeland security programs prioritizing tactical mobility, situational command, and the ability to operate independently across varied terrains.

Satellite communication holds a significant 28.1% market share in the communication technology category, due to its unmatched ability to ensure connectivity in remote or disaster-struck areas where terrestrial infrastructure is either damaged or absent. This technology provides a vital link for transmitting voice, video, and data between field teams and command centers, regardless of geographic barriers.

As the reliance on real-time, high-bandwidth data grows, satellite systems have become integral to emergency response strategies, especially in scenarios involving floods, wildfires, and cross-border conflicts. Integration of compact satellite terminals, high-throughput satellites (HTS), and resilient uplink/downlink systems has enhanced the reliability and deployment efficiency of this segment.

The ongoing need for uninterrupted communication in life-critical operations and the growing availability of commercial satellite networks are expected to sustain the expansion of satellite-based communication technologies in emergency vehicles.

Disaster management applications dominate the market with a 34.7% share, reflecting the critical requirement for mobile communication infrastructure during natural and man-made disasters. Emergency communication vehicles serve as vital assets in rapid response scenarios, enabling command coordination, rescue planning, and information dissemination when traditional networks are offline.

Governments, NGOs, and emergency services increasingly invest in such vehicles to enhance resilience and operational readiness. The rising occurrence of floods, earthquakes, wildfires, and pandemics has accelerated the deployment of communication-equipped mobile units that support medical triage, logistics management, and inter-agency collaboration.

The segment’s growth is reinforced by government policies and funding aimed at strengthening disaster preparedness and post-incident recovery capabilities. Future demand is expected to remain strong, with regional and national emergency frameworks integrating advanced vehicle-based communication tools as part of broader risk mitigation strategies.

Emergency communication vehicles are increasingly adopted to ensure reliable connectivity during disasters, public safety events, and military operations. Their deployment is driven by government initiatives, mission-critical communication needs, and investments in secure, resilient network infrastructure.

Demand for emergency communication vehicles has been fueled by the increasing frequency of natural calamities and security threats. These vehicles serve as mobile command centers equipped with advanced communication tools, ensuring seamless coordination between field teams and control units. Public safety agencies and defense authorities have prioritized investments in such systems to maintain uninterrupted communication during large-scale emergencies. Integration with satellite-based networks and secure radio systems enhances operational resilience, especially in remote areas where conventional infrastructure is unavailable. Government initiatives for improving disaster preparedness and emergency management frameworks are further accelerating deployment. The role of these vehicles in healthcare support during crisis events has also gained prominence across developed and emerging economies.

Growing reliance on uninterrupted communication channels during rescue and relief operations has elevated the importance of mission-critical connectivity solutions. Emergency communication vehicles are being deployed for functions beyond disaster recovery, including large public gatherings, law enforcement surveillance, and military operations. The capability to provide real-time video streaming, voice data transmission, and secure broadband services in challenging environments positions these vehicles as essential assets. Investment in redundant network systems and power backup solutions within these vehicles ensures high reliability under adverse conditions. Increased public and private sector collaborations are driving demand, focused on enhancing emergency response infrastructure for both civilian and defense use cases globally.

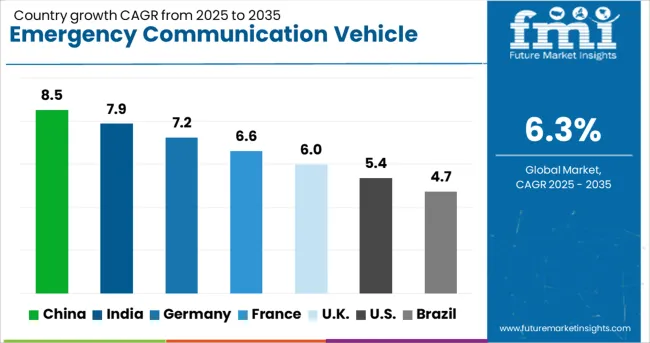

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The emergency communication vehicle market, expected to grow at a global CAGR of 6.3% from 2025 to 2035, is exhibiting uneven growth across major economies. China leads with a CAGR of 8.5%, driven by government initiatives for disaster management readiness, deployment of next-gen communication systems, and smart city emergency infrastructure upgrades. India follows at 7.9%, supported by state-level disaster response modernization, adoption of mobile command units, and rising demand from rural connectivity programs. Germany records 7.2%, underpinned by integration of satellite-enabled communication tools, advanced vehicle customization, and EU safety mandates.

The UK posts 6.0%, benefitting from digitized emergency services and public-private collaborations, though growth is moderated by procurement delays. The USA shows 5.4%, reflecting upgrades in state emergency fleets and increasing interoperability projects, despite budgetary constraints in certain regions. BRICS countries are driving rapid adoption fueled by disaster resilience priorities and expanding telecom coverage, while OECD markets emphasize technology integration, compliance with operational standards, and real-time data management capabilities. The report covers in-depth analysis across 40+ nations, with the five fastest-growing markets summarized here

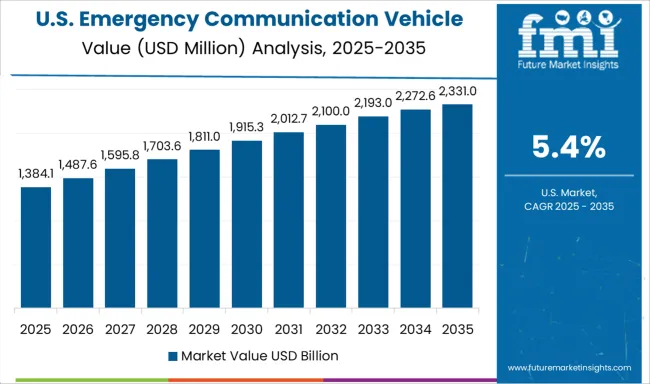

The CAGR in the United States grew from nearly 4.2% during 2020–2024 to 5.4% in 2025–2035, driven by heightened disaster readiness programs and adoption of mobile command centers in wildfire-prone regions. Federal agencies prioritized secure communication systems under public safety modernization initiatives. Increased budget allocation post-2025 for integrated satellite and broadband connectivity supported reliable field operations. Investments in defense-grade vehicles enabled rapid deployment during emergencies such as hurricanes and large-scale power outages. Private contractors expanded fleet modernization programs for law enforcement, adding advanced connectivity modules. This growth reflects the country’s approach toward resilience in mission-critical communication and emergency logistics.

The CAGR in the United Kingdom climbed from 4.8% during 2020–2024 to 6.0% for 2025–2035, supported by NHS and emergency services initiatives aimed at enhancing disaster recovery capabilities. Flood-prone areas in Northern England prompted the deployment of vehicles equipped with redundant communication systems. Post-2025, procurement programs included fiber-linked backup networks and 4G/5G-enabled command vehicles. Investment was influenced by updated national emergency guidelines, which required improved interoperability among response teams. The shift from regional-only to centralized communication hubs drove adoption of new fleets. Integration of energy-resilient backup modules within these vehicles further positioned the UK market for consistent growth.

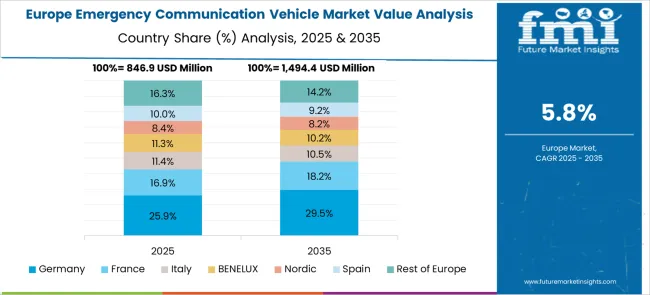

The CAGR in Germany moved up from about 6.3% in 2020–2024 to 7.2% in 2025–2035, fueled by civil protection initiatives and enhanced requirements for mobile connectivity in disaster scenarios. State-driven procurement accelerated after legislative updates on emergency readiness post-2024. Integration of satellite-based video conferencing and encrypted voice services within fleets became mandatory. High investment in multipurpose vehicles capable of healthcare and security roles dominated demand. The role of such vehicles in supporting public safety during events and regional disasters was reinforced by coordinated EU resilience programs.

China’s CAGR surged from around 7.1% during 2020–2024 to 8.5% for 2025–2035, driven by regional flood management strategies and expansion of state-led disaster response systems. Emergency vehicles equipped with 5G broadband and high-speed satellite networks were integrated into provincial fleets. After 2025, smart control cabins with AI-based data sharing will enhance disaster command capabilities. Local manufacturers accelerated production under national guidelines promoting emergency logistics technology. Cross-sector partnerships between telecom firms and vehicle producers increased operational reach during high-impact events such as typhoons.

India’s CAGR rose from 6.4% during 2020–2024 to 7.9% for 2025–2035, supported by the National Disaster Management Authority’s emphasis on mobile emergency command platforms. Increased climate-related incidents and urban disaster vulnerability accelerated the adoption of fleet-based communication units post-2025. Telecom providers partnered with emergency service agencies to implement satellite and broadband connectivity, improving communication reliability during relief missions. Public-private partnerships enabled deployment in Tier 2 and Tier 3 regions for healthcare and evacuation support. Investment in modular, cost-efficient designs further boosted accessibility.

In the emergency communication vehicle segment, prominent manufacturers are advancing vehicle platforms to integrate cutting-edge communication systems, satellite connectivity, and mobile command features. Companies like E-One Inc., Ferrara Fire Apparatus, Inc., and KME Fire Apparatus specialize in rugged, mission-ready designs that cater to firefighting and emergency response demands. LDV, Inc. and Marion Body Works, Inc. are recognized for highly customized command centers suited for public safety and disaster management operations. Industry leaders such as Oshkosh Corporation, Pierce Manufacturing Inc., and REV Group, Inc. dominate the North American market with high-capacity fleets and technology-driven solutions, while Rosenbauer International AG and Seagrave Fire Apparatus, LLC strengthen global positioning through innovation in modular communication systems and advanced interoperability capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Vehicle | Command vehicles, Emergency response vehicles, Mobile communication centers, and Rescue vehicles |

| Communication Technology | Satellite communication, Two-way radios, Wireless and cellular networks, and IoT-based systems |

| Application | Disaster management, Search and rescue operations, Emergency medical services (EMS), Public safety & security, and Military and defense |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | E-One Inc., Ferrara Fire Apparatus, Inc., KME Fire Apparatus, LDV, Inc., Marion Body Works, Inc., Oshkosh Corporation, Pierce Manufacturing Inc., REV Group, Inc., Rosenbauer International AG, and Seagrave Fire Apparatus, LLC |

| Additional Attributes | Dollar sales, share, regional demand split, adoption across defense, law enforcement, and disaster response, competitive benchmarking, pricing trends, procurement cycles, technology integration, and regulatory compliance drivers. |

The global emergency communication vehicle market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the emergency communication vehicle market is projected to reach USD 6.5 billion by 2035.

The emergency communication vehicle market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in emergency communication vehicle market are command vehicles, emergency response vehicles, mobile communication centers and rescue vehicles.

In terms of communication technology, satellite communication segment to command 28.1% share in the emergency communication vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emergency Transfer Vacuum Mattress Market Size and Share Forecast Outlook 2025 to 2035

Emergency Lighting Market Growth - Trends & Forecast 2025 to 2035

Emergency Light Sticks Market Analysis and Forecast by Type, Distribution Channel, End Use, and Region through 2035

Emergency Shutdown System Market Trends - Growth & Forecast 2025 to 2035

Emergency Spill Response Market Growth - Size, Trends & Forecast 2025 to 2035

Emergency Medical Services Market Overview – Trends & Industry Outlook 2024-2034

Emergency Vent Cover Market Growth – Trends & Forecast 2024-2034

Emergency Venting System Market Growth – Trends & Forecast 2024-2034

Emergency Response and Rescue Vessels Market

Emergency Beacon Transmitter Market

EMEA Emergency Medical Service Market Analysis by Services, Provider, Fleet, and Region Forecast Through 2035

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Personal Emergency Response System (PERS) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emergency Braking System Market - Size, Share, and Forecast 2025 to 2035

Communication Test and Measurement Market Size and Share Forecast Outlook 2025 to 2035

Communication Platform as a Service (CPaaS) Market Analysis - Size, Share & Forecast 2025 to 2035

Communications Platform as a Service (CPaaS) Market in Korea Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA