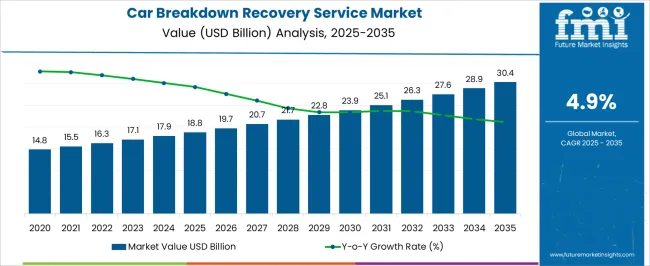

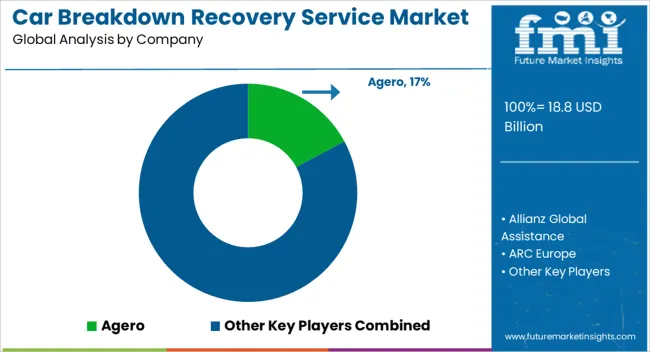

The car breakdown recovery service market is valued at USD 18.8 billion in 2025 and is anticipated to reach USD 30.4 billion by 2035, registering a CAGR of 4.9%. A growth momentum analysis highlights how the market accelerates across different phases and the key factors influencing expansion. Between 2021 and 2025, the market grows from USD 14.8 billion to 18.8 billion, passing through USD 15.5 billion, 16.3 billion, 17.1 billion, and 17.9 billion. Early momentum is driven by rising vehicle ownership, increasing road traffic density, and growing awareness of emergency roadside services, coupled with digital platforms enabling faster response times and service bookings.

This phase exhibits strengthened momentum as insurance partnerships, fleet management services, and subscription-based recovery solutions expand market penetration, creating recurring revenue streams and higher adoption in urban and semi-urban regions. Between 2031 and 2035, the market rises from USD 25.1 billion to 30.4 billion, moving through USD 26.3 billion, 27.6 billion, and 28.9 billion. Growth momentum in this stage is supported by technological integration, such as vehicle telematics, AI-driven dispatch systems, and predictive maintenance services, which enhance operational efficiency and customer satisfaction.

| Metric | Value |

|---|---|

| Car Breakdown Recovery Service Market Estimated Value in (2025 E) | USD 18.8 billion |

| Car Breakdown Recovery Service Market Forecast Value in (2035 F) | USD 30.4 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The car breakdown recovery service market is influenced by five parent markets that collectively drive its growth, adoption, and service innovation across the automotive and mobility sectors. The automotive roadside assistance and emergency services market contributes the largest share, about 28-32%, as breakdown recovery services provide timely support to stranded motorists, ensuring vehicle towing, repair, and on-site assistance. The automotive insurance market adds approximately 20-24%, with insurers increasingly offering breakdown recovery packages as part of comprehensive motor insurance policies to enhance customer satisfaction and risk management. The vehicle fleet management market contributes around 15-18%, where commercial fleets, logistics operators, and car rental companies rely on breakdown recovery services to minimize downtime, optimize fleet availability, and maintain operational efficiency. The automotive repair and maintenance market accounts for roughly 12-15%, as service centers and workshops collaborate with recovery providers to ensure seamless vehicle transport and prompt mechanical attention. Finally, the telematics and connected vehicle market represents about 8-10%, leveraging GPS tracking, mobile apps, and IoT-based alerts to facilitate rapid response, accurate location identification, and proactive service deployment.

The car breakdown recovery service market is expanding steadily, supported by the increasing number of vehicles on the road, growing urbanization, and rising consumer demand for reliable emergency roadside assistance. Industry reports, insurer updates, and automotive association releases have highlighted the role of improved vehicle connectivity and GPS-enabled assistance platforms in streamlining recovery operations.

Enhanced service coverage, 24/7 availability, and faster response times have strengthened consumer trust in professional recovery providers. Insurance companies and dedicated service providers have invested in expanding their fleet and integrating mobile applications to improve real-time tracking and service dispatch.

Additionally, the rise in long-distance travel, the growth of used car ownership, and stricter road safety regulations have contributed to service adoption. The market outlook remains positive, with further growth expected through partnerships between motor insurance companies and recovery specialists, along with increasing penetration of value-added roadside assistance plans.

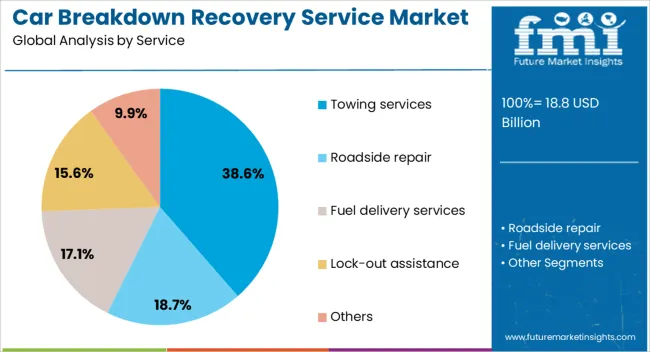

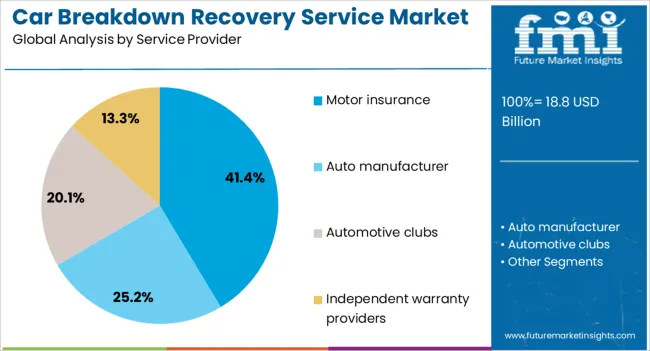

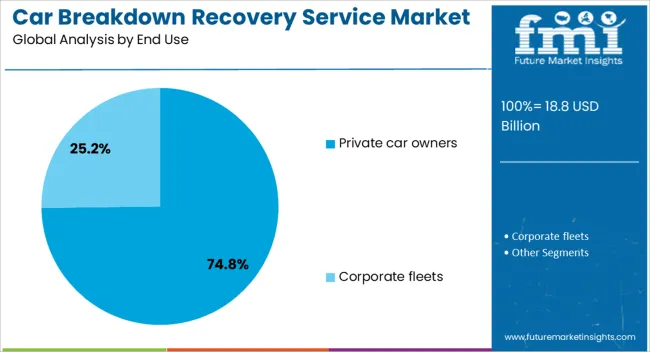

The car breakdown recovery service market is segmented by service, service provider, end use, and geographic regions. By service, car breakdown recovery service market is divided into Towing services, Roadside repair, Fuel delivery services, Lock-out assistance, and Others. In terms of service provider, car breakdown recovery service market is classified into Motor insurance, Auto manufacturer, Automotive clubs, and Independent warranty providers. Based on end use, car breakdown recovery service market is segmented into Private car owners and Corporate fleets. Regionally, the car breakdown recovery service industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Towing Services segment is projected to contribute 38.6% of the car breakdown recovery service market revenue in 2025, maintaining its position as a core service offering. This segment’s dominance is linked to the high demand for vehicle relocation following mechanical failures, accidents, or immobilization due to extreme weather.

Recovery operators have enhanced towing capabilities by investing in specialized vehicles capable of handling a wide range of passenger cars, SUVs, and light commercial vehicles. Service providers have also improved response networks to ensure faster assistance, particularly in high-traffic areas and remote regions.

The necessity of towing services for vehicles that cannot be repaired on-site has ensured consistent demand, while flexible towing packages offered by insurance companies have supported market penetration. As vehicle breakdown patterns and traffic congestion continue to evolve, towing services are expected to remain a critical component of roadside recovery portfolios.

The Motor Insurance segment is projected to account for 41.4% of the car breakdown recovery service market revenue in 2025, reflecting its role as a primary channel for delivering roadside assistance. Insurance providers have increasingly bundled breakdown recovery as part of comprehensive or premium motor policies, offering customers cost-effective access to emergency services.

This approach has enhanced policyholder value and loyalty, while reducing the operational burden on customers during emergencies. Partnerships between insurers and third-party recovery operators have expanded geographical coverage and improved service speed.

Additionally, insurers have adopted digital platforms to enable instant service requests, policy verification, and real-time status updates. With the insurance sector focusing on customer retention and value-added services, motor insurance-linked recovery packages are expected to maintain strong growth and market share.

The Private Car Owners segment is projected to hold 74.8% of the car breakdown recovery service market revenue in 2025, making it the dominant end-user category. This growth is driven by the increasing number of privately owned vehicles and heightened awareness of the benefits of professional recovery services.

Private car owners are more likely to subscribe to annual roadside assistance plans, either directly through service providers or as part of their vehicle insurance policies. Urban and suburban drivers, in particular, value the convenience and security of knowing that immediate help is available in the event of a breakdown.

Additionally, consumer behavior trends indicate a growing preference for prepaid membership plans that cover multiple types of assistance, including towing, battery jump-starts, and flat tire replacements. As vehicle ownership continues to rise and consumers place a premium on reliability and safety, private car owners are expected to remain the primary driver of demand in the breakdown recovery market.

The car breakdown recovery service market is growing due to rising vehicle ownership, urban traffic congestion, and demand for timely roadside assistance. Services include towing, on-site repairs, and emergency support, with providers leveraging mobile apps, GPS tracking, and AI-based dispatch. Challenges include high operational costs, regulatory compliance, and maintaining rapid response capabilities. Opportunities lie in fleet management services, subscription models, and predictive maintenance integration. Companies offering digitally connected, reliable, and value-added recovery solutions are best positioned to capture market growth. Asia-Pacific, North America, and Europe lead adoption due to increasing vehicle fleets and mobility demands.

The car breakdown recovery service market is expanding as vehicle owners and fleet operators increasingly prioritize timely roadside assistance, emergency towing, and on-the-spot repairs. Growth is driven by rising vehicle ownership, urban traffic congestion, and the need for quick resolution of mechanical failures. Service providers, including RAC, AA, Allianz, and local towing operators, are enhancing response times and coverage to meet consumer expectations. Adoption of mobile apps, GPS tracking, and real-time communication systems improves operational efficiency and customer experience. Expanding fleets, commercial logistics, and long-distance travel further fuel demand. Providers offering 24/7 support, rapid dispatch, and integrated digital platforms for service requests are well-positioned to capture growth in developed and emerging markets globally.

Despite rising demand, the car breakdown recovery market faces challenges from high operational costs, including vehicle maintenance, driver wages, fuel expenses, and insurance premiums. Regulatory compliance, including local traffic laws, safety standards, and licensing requirements, adds complexity for service providers. Operational constraints such as traffic congestion, availability of skilled technicians, and regional coverage gaps impact service efficiency. Customers increasingly demand verified, timely, and reliable service, along with transparent pricing. Companies investing in fleet management systems, GPS-enabled dispatch, and predictive maintenance of recovery vehicles can reduce operational inefficiencies. Managing costs, regulatory compliance, and rapid response capabilities is critical for providers to maintain competitiveness and meet growing roadside assistance demand worldwide.

The market is witnessing opportunities in B2B fleet management services, subscription-based roadside assistance, and app-based emergency request platforms. Fleet operators in logistics, ride-hailing, and car rental segments increasingly adopt comprehensive recovery services to minimize downtime. Digital platforms enable real-time tracking, faster response, and automated invoicing, enhancing service efficiency and customer satisfaction. Expansion in urban areas, highways, and long-distance travel corridors supports market growth. Asia-Pacific, North America, and Europe are key growth regions due to rising vehicle penetration and urban mobility challenges. Companies offering subscription-based plans, integrated mobile apps, and value-added services such as minor repairs and tire changes are well-positioned to capture new customer segments and increase recurring revenue streams.

Technological trends are reshaping the car breakdown recovery market, including AI-enabled dispatch, route optimization, and predictive maintenance alerts. Mobile applications allow customers to request assistance instantly, track service vehicles, and receive estimated arrival times. Integration with telematics in modern vehicles enables proactive detection of breakdown risks, reducing downtime and improving fleet reliability. Companies are investing in automated call centers, AI-driven route planning, and IoT-enabled vehicle monitoring to enhance service efficiency. Collaboration with insurance providers and automobile manufacturers is increasing adoption of connected services. Providers delivering digitally integrated, timely, and high-quality roadside assistance are well-positioned to meet evolving consumer expectations and capitalize on global growth opportunities.

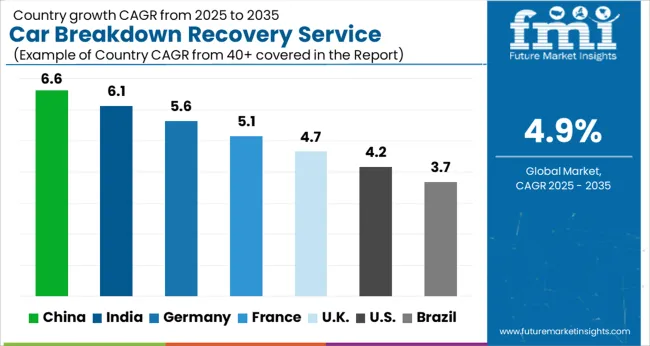

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The global car breakdown recovery service market is projected to expand at a CAGR of 4.9% from 2025 to 2035. China (6.6%) and India (6.1%) are the fastest-growing markets, driven by rising vehicle ownership, urban traffic growth, and mobile app-based roadside assistance adoption. France (5.1%) emphasizes rapid response and premium service packages, while the UK (4.7%) and USA (4.2%) show steady growth across private, commercial, and fleet segments. Growth drivers include GPS-enabled dispatch, insurance partnerships, subscription-based services, and fleet expansion. Providers are focusing on AI-assisted routing, real-time tracking, and value-added roadside services to capture market share. The analysis covers over 40 countries, with the leading markets shown below.

The car breakdown recovery service market in China is projected to grow at a CAGR of 6.6% from 2025 to 2035, driven by the rapid expansion of the automotive fleet, urbanization, and rising road traffic density. The growing number of private vehicle owners and commercial fleets has increased demand for reliable roadside assistance and recovery services. Service providers are focusing on integrating GPS tracking, mobile app-based service requests, and AI-powered dispatch systems to improve response times and customer satisfaction. Partnerships between insurance companies and recovery service providers are also fueling growth. The expansion of highway networks and e-commerce-enabled vehicle maintenance services contributes to market penetration. Local players are scaling operations, offering subscription-based packages and value-added services for enhanced competitiveness.

The car breakdown recovery service market in India is expected to grow at a CAGR of 6.1% from 2025 to 2035, fueled by increasing vehicle ownership, urban traffic congestion, and demand for timely roadside assistance. Mobile application-based platforms and real-time vehicle tracking are enhancing service delivery, while partnerships with insurance companies enable faster claim processing. The rise of multi-brand car dealerships, vehicle subscription services, and roadside assistance packages further boosts market growth. Demand is also driven by long-distance travel, logistics fleet expansion, and government initiatives to improve highway safety. Companies are focusing on expanding coverage areas, improving response times, and offering value-added services like on-site repair, towing, and battery jump-start.

The car breakdown recovery service market in France is projected to expand at a CAGR of 5.1% from 2025 to 2035, driven by a strong automotive market and increased focus on consumer convenience. Service providers emphasize rapid response, nationwide coverage, and premium roadside assistance packages for private and commercial vehicles. Integration of mobile applications, telematics, and predictive maintenance alerts is enhancing efficiency and reducing wait times. Collaboration with car rental services, insurance providers, and fleet operators further accelerates adoption. Urban traffic growth and long-distance travel requirements increase reliance on professional recovery services. Continuous innovation in service models and customer-centric offerings supports market expansion.

The UK car breakdown recovery service market is expected to grow at a CAGR of 4.7% from 2025 to 2035, supported by high vehicle ownership, commuter traffic, and growing consumer demand for convenient roadside solutions. Service providers focus on rapid response, roadside repair, towing, and battery assistance. Mobile app platforms and subscription-based roadside packages are improving service accessibility and customer experience. Collaborations with insurance companies and fleet operators enhance coverage and reliability. Demand is further driven by long-distance travel, highway networks, and increased awareness of vehicle maintenance. Companies are investing in fleet expansion, advanced diagnostics, and value-added services to maintain competitiveness.

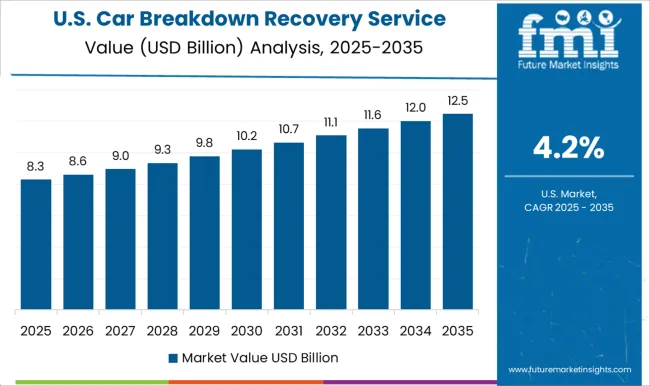

The USA car breakdown recovery service market is projected to grow at a CAGR of 4.2% from 2025 to 2035, driven by increasing vehicle registrations, highway travel, and demand for reliable roadside assistance. Providers focus on towing, battery jump-start, flat tire repair, and emergency fuel delivery services. Mobile app-based platforms, AI-powered dispatch, and GPS tracking improve response times and customer experience. Partnerships with insurance providers, fleet operators, and automotive dealerships expand market reach. Growth is supported by the increasing need for on-demand assistance, corporate fleet services, and integration with vehicle telematics. Service differentiation through rapid response, customer support, and subscription plans remains critical for market players.

Competition in the car breakdown recovery service market is defined by response speed, coverage networks, and service reliability. Agero competes through nationwide and cross-border roadside assistance, offering rapid dispatch, mobile app tracking, and integration with insurance partners. Allianz Global Assistance emphasizes bundled travel and automotive protection, providing roadside recovery, towing, and repair coordination for policyholders worldwide. ARC Europe focuses on pan-European coverage, leveraging local service providers and multilingual support to ensure consistent assistance across borders. AutoVantage differentiates with membership-based programs that combine breakdown recovery with concierge-style support and digital claims management. Bosch Car Service integrates vehicle diagnostics with roadside assistance, offering workshops and certified repair networks for timely resolution of mechanical and electrical faults. Falck competes through rapid-response teams and specialized equipment for towing, battery jump-start, and accident recovery, emphasizing efficiency and safety. GEICO and Liberty Mutual Insurance strengthen market presence by integrating breakdown services into insurance policies, providing bundled roadside assistance, claims support, and emergency coordination. Green Flag offers extensive coverage across the UK and Ireland, leveraging fleet management, real-time tracking, and call center support to minimize wait times. Paragon Motor Club targets premium and fleet customers with tailored recovery solutions, including nationwide towing, battery service, and accident assistance. Strategies across the market focus on expanding coverage networks, improving digital platforms, integrating real-time tracking, and partnering with insurance providers to offer value-added services. Product brochures highlight 24/7 roadside assistance, towing, battery jump-start, flat tire and fuel delivery, accident support, mobile app dispatch, and cross-border recovery. Collectively, these offerings illustrate a market where speed, reliability, and integrated service solutions define competitiveness, with sustained investment in technology and network expansion critical to maintaining customer trust and market leadership.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.8 Billion |

| Service | Towing services, Roadside repair, Fuel delivery services, Lock-out assistance, and Others |

| Service Provider | Motor insurance, Auto manufacturer, Automotive clubs, and Independent warranty providers |

| End Use | Private car owners and Corporate fleets |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Agero, Allianz Global Assistance, ARC Europe, AutoVantage, Bosch Car Service, Falck, GEICO, Green Flag, Liberty Mutual Insurance, and Paragon Motor Club |

| Additional Attributes | Dollar sales by service type (roadside assistance, vehicle recovery, on-site repair), coverage model (membership-based, insurance-inclusive), and vehicle type (passenger cars, commercial vehicles). Demand is driven by vehicle ownership growth, urban traffic density, and consumer preference for convenient, reliable breakdown services. Regional trends highlight strong adoption in North America, Europe, and Asia-Pacific, supported by high vehicle penetration and increasing focus on customer-centric automotive services. |

The global car breakdown recovery service market is estimated to be valued at USD 18.8 billion in 2025.

The market size for the car breakdown recovery service market is projected to reach USD 30.4 billion by 2035.

The car breakdown recovery service market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in car breakdown recovery service market are towing services, roadside repair, fuel delivery services, lock-out assistance and others.

In terms of service provider, motor insurance segment to command 41.4% share in the car breakdown recovery service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cartridge Heating Element Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Kernel Powder Market Size and Share Forecast Outlook 2025 to 2035

Car Tail Light Mould Market Size and Share Forecast Outlook 2025 to 2035

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA