The rolling stock management market is experiencing steady growth driven by the modernization of rail networks, increasing demand for efficient fleet operations, and technological advancements in monitoring and maintenance systems. Rising passenger traffic and expansion of railway infrastructure are creating sustained opportunities for digitalized management solutions. Current trends indicate a shift toward integrated asset management platforms that enhance operational efficiency and reduce lifecycle costs.

Governments and private operators are investing in smart rail systems to improve safety, reliability, and service performance. The future outlook remains optimistic as predictive analytics, IoT-based diagnostics, and real-time monitoring gain traction, allowing rail operators to achieve optimized utilization of rolling stock assets.

Growth rationale is centered on the rising need to minimize downtime, extend asset lifespan, and ensure cost-efficient operation Strategic collaborations, combined with data-driven maintenance and advanced management systems, are expected to strengthen market adoption across both passenger and freight segments over the forecast period.

| Metric | Value |

|---|---|

| Rolling Stock Management Market Estimated Value in (2025 E) | USD 63.0 billion |

| Rolling Stock Management Market Forecast Value in (2035 F) | USD 118.3 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

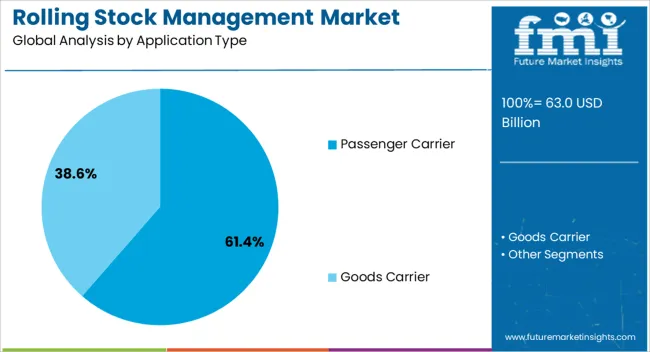

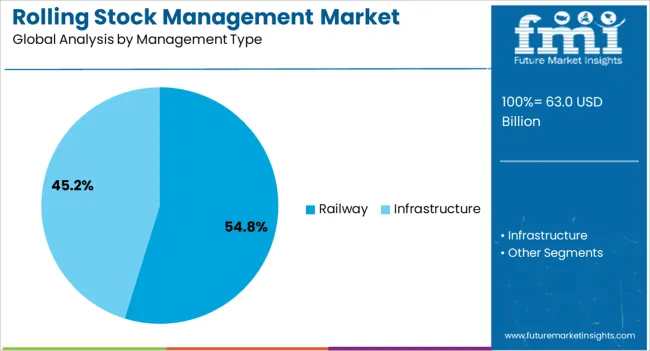

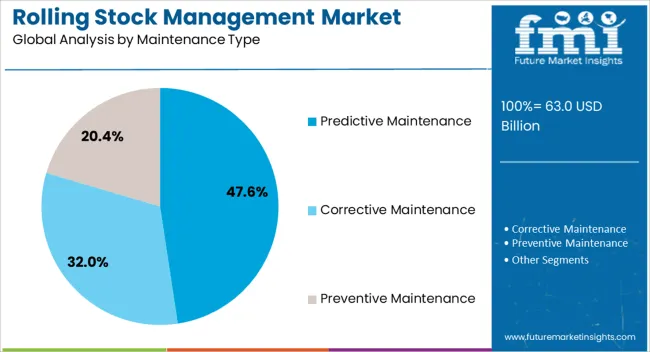

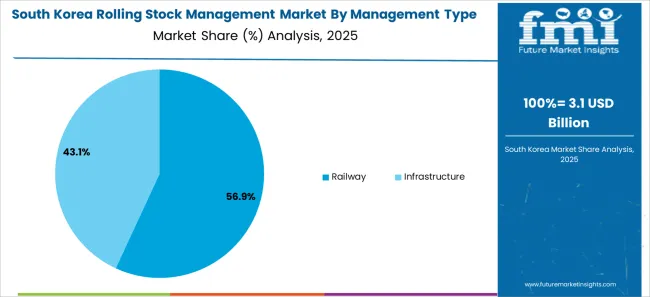

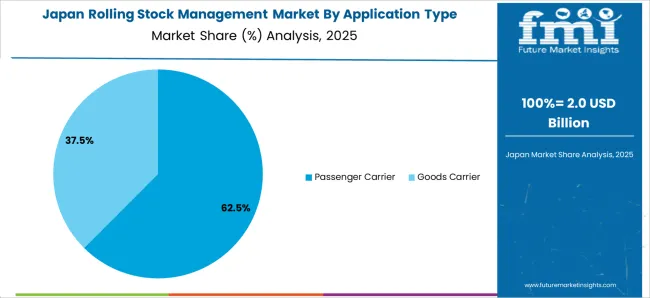

The market is segmented by Application Type, Management Type, and Maintenance Type and region. By Application Type, the market is divided into Passenger Carrier and Goods Carrier. In terms of Management Type, the market is classified into Railway and Infrastructure. Based on Maintenance Type, the market is segmented into Predictive Maintenance, Corrective Maintenance, and Preventive Maintenance. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger carrier segment, accounting for 61.40% of the application type category, has been leading due to increasing investments in urban mobility and intercity transportation infrastructure. Growth has been driven by the rising number of metro and high-speed rail projects focused on enhancing passenger experience and operational safety.

The integration of digital monitoring systems and fleet management tools has improved scheduling accuracy and energy efficiency. Government initiatives supporting sustainable and high-capacity public transport have reinforced segment dominance.

Continuous maintenance upgrades and modernization of aging fleets are further contributing to performance optimization As passenger expectations evolve toward greater comfort, reliability, and punctuality, operators are prioritizing efficient rolling stock management frameworks, which is expected to sustain the segment’s leading position throughout the forecast period.

The railway management segment, holding 54.80% of the management type category, has remained dominant owing to its critical role in ensuring network reliability and coordination across national and regional rail systems. The segment’s leadership is supported by large-scale adoption of centralized management software that streamlines operations, asset tracking, and resource allocation.

Enhanced integration of communication-based train control systems and real-time data analytics has improved decision-making and safety compliance. Railway authorities are increasingly deploying digital asset management systems to optimize train scheduling, capacity planning, and operational visibility.

The ongoing modernization of rail infrastructure and expansion of high-speed networks have amplified the need for efficient railway management frameworks These factors collectively ensure sustained demand for advanced management solutions that enable operational excellence and regulatory compliance.

The predictive maintenance segment, representing 47.60% of the maintenance type category, has emerged as the leading approach due to its capacity to reduce downtime and prevent costly equipment failures. Adoption is being driven by the integration of sensor-based monitoring systems, AI-driven analytics, and machine learning models that enable early detection of component wear and system anomalies.

This approach allows rail operators to optimize maintenance schedules, extend asset lifespan, and lower operational costs. The transition from reactive to predictive maintenance has improved reliability and ensured greater safety in railway operations.

Continuous advancements in real-time diagnostics and data interpretation are enhancing efficiency across maintenance cycles As digital transformation accelerates across the rail sector, predictive maintenance is expected to remain the preferred strategy, reinforcing its market leadership and long-term growth trajectory.

Between 2020 and 2025, the historical CAGR for the market exhibited robust growth at 8.2%. This period saw significant advancements in technology, increasing demand for efficient solutions, and expanding global trade activities, driving the growth of the market.

Factors such as rising investments in infrastructure projects, stringent regulations requiring regular maintenance, and the need for modernization initiatives contributed to the accelerated growth rate during this timeframe.

Looking ahead to the forecasted period from 2025 to 2035, the market is projected to experience a slightly lower but still considerable CAGR of 6.5%. This moderated growth rate reflects factors such as market saturation in some regions, economic fluctuations, and evolving consumer preferences.

Despite the slight decrease in growth rate, the market is anticipated to continue expanding steadily, driven by ongoing infrastructure developments, technological advancements, and an increasing focus on sustainability and efficiency in rolling stock management practices.

| Historical CAGR from 2020 to 2025 | 8.2% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 6.5% |

The table ranks the top five countries by revenue, with Japan holding the top position. One major reason Japan leads the rolling stock management market is its longstanding commitment to technological innovation and excellence in railway systems.

The renowned reputation for high-speed trains, punctuality, and safety standards stems from continuous advancements in rolling stock management practices.

The railway operators prioritize efficiency, reliability, and passenger comfort, driving the adoption of cutting-edge management solutions. The extensive railway network, which includes bullet trains and urban transit systems, serves as a testing ground for innovative rolling stock management technologies, cementing its position as a global leader in the industry.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 6.8% |

| South Korea | 7.9% |

| Japan | 8% |

| China | 6.9% |

| The United Kingdom | 7.6% |

The market is extensively utilized in the United States due to the vast railway network, which spans various regions and serves freight and passenger transportation needs.

With a significant portion of the population relying on trains for commuting and freight transportation being a crucial component of the economy, efficient rolling stock management is essential. This includes ensuring timely maintenance, optimizing operations, and enhancing safety standards to meet the demands of a highly developed railway system.

The emphasis on technological innovation and efficiency drives the utilization of the market. The country boasts advanced railway infrastructure, including high-speed trains and urban transit systems, necessitating sophisticated management solutions.

The focus on enhancing passenger experience, safety, and operational efficiency by adopting cutting-edge technology fuels the demand for comprehensive rolling stock management systems to ensure smooth and reliable railway operations.

In Japan, renowned for its world-class railway systems, the market is crucial for maintaining its punctuality, reliability, and safety reputation. With densely populated urban areas and extensive high-speed rail networks, effective rolling stock management is essential to meet the high passenger transportation and freight logistics demand.

The commitment to continuous improvement and innovation in railway operations drives the adoption of advanced management solutions to optimize fleet performance and ensure seamless service delivery.

The rapid urbanization and economic development have led to significant investments in railway infrastructure, making the market integral to the transportation sector.

With the largest high-speed rail network and extensive freight transportation networks, efficient rolling stock management is vital for meeting growing passenger and freight demands.

The focus on enhancing connectivity, mobility, and sustainability through modern railway systems drives the adoption of advanced management technologies to optimize operations and ensure safe and reliable transportation services.

In the United Kingdom, the market is crucial in supporting diverse railway operations, including commuter services, long-distance travel, and freight transportation. With a well-established railway network and a strong emphasis on safety, reliability, and customer satisfaction, effective rolling stock management is essential.

The commitment to modernizing railway infrastructure and improving service quality drives the adoption of advanced management solutions to optimize fleet performance, minimize disruptions, and enhance passenger experience.

The below section shows the leading segment. Based on application type, the goods carrier is estimated to register at 6.3% CAGR by 2035. Based on management type, the railway segment is anticipated to expand at 6.1% CAGR by 2035.

Goods carriers are crucial in facilitating this trade by transporting raw materials, finished products, and commodities between manufacturers, suppliers, and consumers. Railways offer a viable alternative to road transportation, providing a cost-effective and environmentally friendly commuting and freight transport mode.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Goods Carrier | 6.3% |

| Railway | 6.1% |

The goods carrier segment is projected to achieve a CAGR of 6.3% by 2035. This growth trajectory reflects the increasing demand for efficient freight transportation solutions globally. As economies expand and international trade flourishes, transporting goods across various distances becomes paramount.

The goods carrier application encompasses a wide range of freight transportation activities, including moving raw materials, finished products, and commodities. Factors such as infrastructure development, trade liberalization, and e-commerce growth contribute to the steady expansion of the goods carrier segment, driving its projected CAGR.

The railway management segment is expected to experience a CAGR of 6.1% by 2035, reflecting sustained investments in railway infrastructure and operations management. Effective management of railway systems is essential for ensuring safe, reliable, and efficient transportation services.

The railway management segment encompasses various activities such as scheduling, maintenance, asset management, and passenger services. Factors driving the growth of this segment include technological advancements in railway management systems, increasing urbanization leading to higher demand for public transportation, and government initiatives aimed at modernizing railway infrastructure.

The anticipated CAGR underscores the importance of efficient railway management in meeting the evolving needs of passengers and freight operators while ensuring the sustainability and competitiveness of railway transportation.

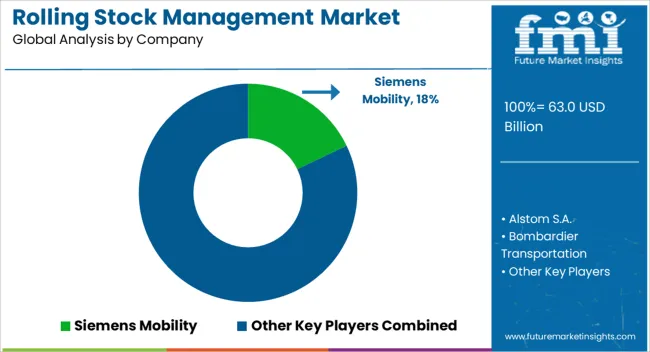

The presence of established players such as Siemens AG, Alstom SA, Bombardier Inc., and General Electric Company characterizes the competitive landscape of the rolling stock management market. These companies offer various rolling stock management solutions, including predictive maintenance systems, asset management software, and remote monitoring services.

Competition in the market is driven by factors such as technological innovation, service quality, geographic reach, and pricing strategies. Collaborations, partnerships, and mergers are common strategies market players employ to enhance their capabilities, expand their market presence, and address evolving customer needs in the global railway industry. Some of the key developments are:

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 59.2 billion |

| Projected Market Valuation in 2035 | USD 111 billion |

| Value-based CAGR 2025 to 2035 | 6.5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Application Type, Management Type, Maintenance, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Rest of Latin America, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Alstom S.A.; Siemens Mobility; Bombardier Transportation; General Electric; ABB; Hitachi; Mitsubishi Heavy Industries; Talgo; Thales Group; Tech Mahindra |

The global rolling stock management market is estimated to be valued at USD 63.0 billion in 2025.

The market size for the rolling stock management market is projected to reach USD 118.3 billion by 2035.

The rolling stock management market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in rolling stock management market are passenger carrier and goods carrier.

In terms of management type, railway segment to command 54.8% share in the rolling stock management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rolling Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Rolling Papers Market Trends - Growth & Demand 2025 to 2035

Rolling Stocks Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Leaf Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Ring Rolling Products Market Size, Growth, and Forecast 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Wire Rolling Machine Market Share, Trends & Forecast 2024-2034

Boat Trolling Motor Market Size and Share Forecast Outlook 2025 to 2035

Kayak Trolling Motor Market Growth – Trends & Forecast 2025 to 2035

Cereal Rolling Machine Market – Growth & Market Trends 2025-2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Portable Rolling Toolbox Market

Japan Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Korea Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

High Speed Rolling Bearings Market Size and Share Forecast Outlook 2025 to 2035

Industrial Rolling Ladder Market Growth, Trends & Forecast 2025 to 2035

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA