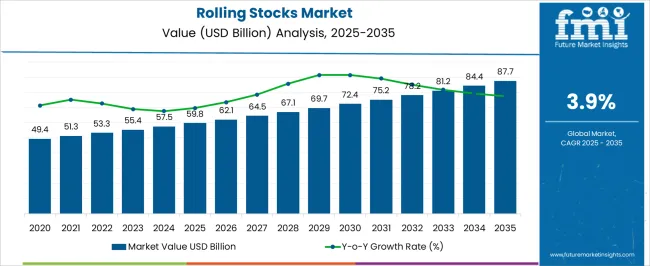

The Rolling Stocks Market is estimated to be valued at USD 59.8 billion in 2025 and is projected to reach USD 87.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

| Metric | Value |

|---|---|

| Rolling Stocks Market Estimated Value in (2025 E) | USD 59.8 billion |

| Rolling Stocks Market Forecast Value in (2035 F) | USD 87.7 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The rolling stocks market is experiencing steady growth, supported by rising demand for efficient rail transportation systems across both freight and passenger applications. Expanding investments in rail infrastructure, urban transit development, and cross-border connectivity are driving long-term opportunities. The market is also benefiting from the global emphasis on sustainable and cost-effective transport solutions, with rail being positioned as a low-emission alternative to road and air freight.

Advancements in propulsion systems, digital monitoring technologies, and predictive maintenance solutions are improving performance, safety, and operational efficiency, which is fostering adoption across developed and emerging economies. The modernization of aging fleets and the integration of smart technologies such as IoT-based monitoring are further reinforcing market momentum.

With increasing government support for green mobility initiatives, rolling stock manufacturers are focusing on capacity expansion, lightweight material adoption, and hybrid solutions to meet evolving requirements As demand for both freight and passenger mobility rises, the market is expected to continue its upward trajectory, driven by infrastructure upgrades and technological innovation.

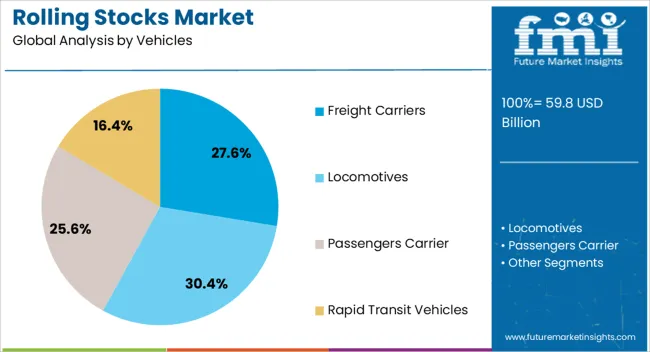

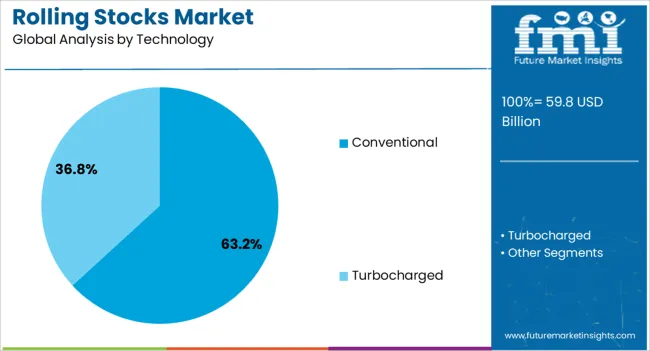

The rolling stocks market is segmented by vehicles, technology, and geographic regions. By vehicles, rolling stocks market is divided into Freight Carriers, Locomotives, Passengers Carrier, and Rapid Transit Vehicles. In terms of technology, rolling stocks market is classified into Conventional and Turbocharged. Regionally, the rolling stocks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The freight carriers segment is projected to hold 27.6% of the rolling stocks market revenue share in 2025, establishing itself as the leading vehicle category. This segment’s leadership is being driven by the growing reliance on railways for bulk goods transportation, supported by the need for cost efficiency and reduced carbon emissions compared to road freight. Freight carriers are increasingly being utilized for the movement of minerals, agricultural products, chemicals, and industrial goods, reflecting their ability to handle large volumes at lower operational costs.

Rising investments in dedicated freight corridors and modernization of logistics infrastructure are further enhancing the demand for rail-based cargo solutions. The durability and long service life of freight wagons, combined with reduced congestion in comparison with road transport, make this segment highly attractive.

Governments and private operators are prioritizing freight efficiency as global supply chains expand, encouraging the deployment of high-capacity and specialized freight rolling stock With sustainability gaining prominence in logistics planning, the freight carriers segment is expected to maintain its dominance in the overall market landscape.

The conventional technology segment is expected to capture 63.2% of the rolling stocks market revenue share in 2025, making it the leading technology category. Its strong position is attributed to the widespread presence of existing railway infrastructure globally, where conventional rail remains the backbone of transportation systems. The segment is being reinforced by cost advantages, reliability, and ease of integration into existing networks compared to newer technologies.

Continuous improvements in design, fuel efficiency, and safety standards are supporting the long-term adoption of conventional rolling stocks in both freight and passenger services. The segment is also benefiting from modernization programs aimed at upgrading legacy systems with enhanced braking systems, digital controls, and efficient traction technologies.

In developing economies, conventional rolling stock offers a practical solution to meet rising mobility needs without the high capital expenditure associated with advanced alternatives such as high-speed rail The strong global presence, coupled with ongoing upgrades and regulatory compliance, is ensuring that conventional technology remains the dominant choice in the rolling stocks market.

Rolling stocks is generally referred as any wheeled vehicles running on a railway tracks, which includes locomotives, passenger coaches and freight wagons among others.

Railway transport is an indispensable part of transport system and plays crucial role in the development of a nation, because the development of trade, commerce and industries is highly dependable on the transport system.

It drives the growth of industrialization of a nation through transporting variety of goods such as raw materials, basic commodities, vegetables, and utilities goods among others, with speed and certainty.

Rolling stocks are highly customized and can be easily tailored as per customer's requirement. It is available in variety of types such as diesel locomotives, electric locomotives, freight carriers and rapid transit vehicles among others.

Diesel locomotives are featured with low axel load and used for passenger and freight traffic. It especially designed for narrow gauged or broad gauged railway. It has high demand from developing countries such as Argentina, India, China, Iraq, Malaysia, Pakistan, and Brazil among others.

One of the main factors behind the expansion of the rolling stock market is the increase in urban population together with expanding industrial mining activities around the world. The market benefits from the rise in demand for swift trams and fast metro trains.

The expansion of the rolling stock market is accelerated by the rise in steps being made by governments around the world to incorporate fast trains. These trains are seen as affordable, secure, and a quick mode of transportation that has a favourable effect on the market.

The rolling stock market is further influenced by the global expansion of the tourism industry. The increase in tourism and the resulting traffic increases the need for bullet trains. Additionally, the expansion of the industry is aided by the rise in transportation-related issues and their negative effects on the environment.

The rolling stock market is also benefited by the growth of the automotive industry, a spike in investments, and rising disposable income.

The rolling stock market rehabilitation has grown as a result of the need to enhance vehicle capacity and the surge in demand for lower travel expenses. To meet the rising number of passengers, the current fleet must be expanded. However, the current capacity of numerous rail franchises' rolling stock is insufficient to satisfy the rising demand. Refurbishment is therefore a practical option for increasing capacity and offers a chance to fix known reliability issues, enhance train energy efficiency, and modernise vehicles to meet needs.

During the forecast period, technological developments like magnetic levitation trains offer lucrative potential to market participants. Additionally, the growth of the data logger market will be further accelerated by the development of hydrogen fuel cell locomotives.

On the other hand, hefty overhaul, maintenance, and rolling stock refurbishment expenses are anticipated to restrain market expansion.

Due to the COVID-19 epidemic, transportation via the railway has seen significant losses as customers seek individualised transit options for their daily commute and short-distance trips. As a result, over the predicted period, organisations that regulate railway routes and railway service operators suffered significant losses.

Due to a shortage of funding, some existing railway projects and the order of new rolling stock have been put on hold or are progressing slowly. Governments, however, also have a funding shortage as a result of COVID-19.

Rolling stocks are reliable and safest mode of transport for goods compared against other mode of transports such as automotive, ships, and airplane. It additionally offers flexible and largest carrying capacity and if required its capacity can be easily increased by further addition of stocks.

Growing population, industrialization and government initiatives to provide faster, cleaner and safest transport system are key drivers to promote growth of the global rolling stock market.

However huge capital investment and high dependency on government's policies is expected to retrain the entry of new market players in the established rolling stocks market.

Additionally highly competitive environment created by other modes of transport such as road and air transportation is expected to hinder the growth of market. The sustainability of global rolling stocks market is dependent on innovation with respect to offer low weight, high speed, and low maintenance products.

Rolling stocks market is highly dependable on the government policies of nation and increasing population and industrialization has forced governments to provide sustainable transport system.

Global rolling stocks market is expected to grow steadily owing to increasing global demand for well structure transport infrastructure. Rolling stocks market is well established in North America and Western Europe countries, and it is expected to grow linearly over the forecast period.

Growing economies such as China, India and Brazil are expected to emerge as most attractive geographical segment in global rolling stocks market. This is primarily because of rapidly expanding industries and governments initiatives to build advanced railway transport system.

According to the report published by Ministry of Railway of India, Indian government has plan to invest around US$ 120 billion to expand and electrify its railway network, over next five years.

Similarly, Latin America and Middle East & Africa are expected to create opportunities for the rolling stocks manufacturer, as regional governments has already launched several program to expand and improve railway network within these geographies.

Some of the key players in global rolling stocks market are as follow as;

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments and geographies.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macroeconomic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies.

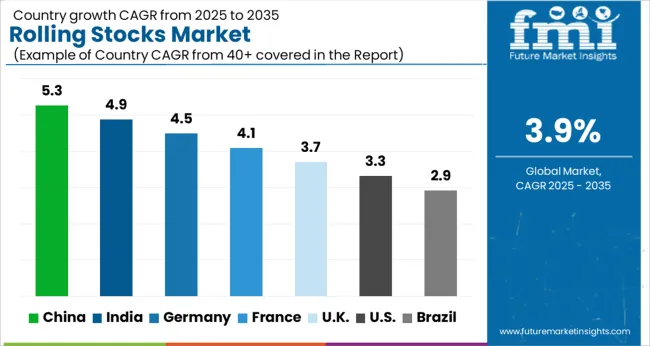

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The Rolling Stocks Market is expected to register a CAGR of 3.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.3%, followed by India at 4.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.9%, yet still underscores a broadly positive trajectory for the global Rolling Stocks Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.5%. The USA Rolling Stocks Market is estimated to be valued at USD 20.8 billion in 2025 and is anticipated to reach a valuation of USD 28.8 billion by 2035. Sales are projected to rise at a CAGR of 3.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 3.2 billion and USD 1.9 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 59.8 Billion |

| Vehicles | Freight Carriers, Locomotives, Passengers Carrier, and Rapid Transit Vehicles |

| Technology | Conventional and Turbocharged |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

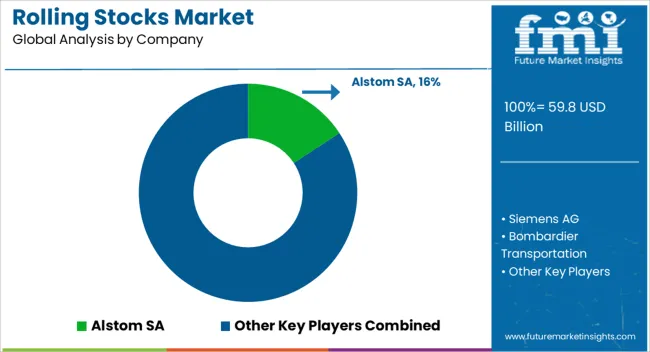

| Key Companies Profiled | Alstom SA, Siemens AG, Bombardier Transportation, Hitachi, Ltd., CSR Corporation Limited, Kawasaki Heavy Industries Rolling Stock Company, Mitsubishi Heavy Industries, Japan Transport Engineering Company, CJSC Transmashholding, and Gene al Electrical Company |

The global rolling stocks market is estimated to be valued at USD 59.8 billion in 2025.

The market size for the rolling stocks market is projected to reach USD 87.7 billion by 2035.

The rolling stocks market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in rolling stocks market are freight carriers, locomotives, passengers carrier and rapid transit vehicles.

In terms of technology, conventional segment to command 63.2% share in the rolling stocks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rolling Stock Management Market Forecast Outlook 2025 to 2035

Rolling Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Rolling Papers Market Trends - Growth & Demand 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Leaf Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Ring Rolling Products Market Size, Growth, and Forecast 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Wire Rolling Machine Market Share, Trends & Forecast 2024-2034

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Boat Trolling Motor Market Size and Share Forecast Outlook 2025 to 2035

Kayak Trolling Motor Market Growth – Trends & Forecast 2025 to 2035

Cereal Rolling Machine Market – Growth & Market Trends 2025-2035

Modular Rolling Mill Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Portable Rolling Toolbox Market

Korea Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Japan Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

High Speed Rolling Bearings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA