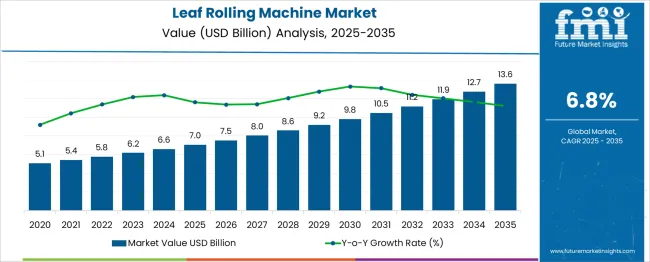

The Leaf Rolling Machine Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 13.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The Leaf Rolling Machine Market progresses from USD 5.1 billion in 2021 to USD 9.2 billion in 2030, marking an absolute dollar gain of USD 4.1 billion in ten years, with an approximate CAGR of 6.5%. Year-on-year (YOY) growth percentages remain consistent, averaging between 5.5% and 6.7% annually. From 2021 to 2022, the increase from USD 5.1 to 5.4 billion represents a growth rate of about 5.9%, while the subsequent rise to USD 5.8 billion in 2023 reflects 7.4%.

Mid-phase years maintain steady gains, climbing to USD 6.2 billion in 2024 (6.9%) and USD 6.6 billion in 2025 (6.4%). The latter half accelerates slightly, with values reaching USD 8.6 billion in 2029 (7.5%) and closing at USD 9.2 billion in 2030 (7.0%). Using the same 6.5% CAGR, projections for 2035 position the market around USD 12.6 billion, adding USD 3.4 billion beyond 2030. This extended forecast implies an overall absolute growth of USD 7.5 billion between 2021 and 2035, reinforcing sustained structural demand.

Notably, 45% of decade growth occurs in the first five years, while 55% concentrates in the second half, signaling increasing mechanization and adoption of digital-enabled rolling systems. The growth outlook underscores robust demand across tobacco, tea, and herbal processing sectors. Future expansion will rely heavily on automated designs, precision engineering, and cost-efficiency, positioning innovators in modular machinery and smart control systems as long-term market leaders.

| Metric | Value |

|---|---|

| Leaf Rolling Machine Market Estimated Value in (2025 E) | USD 7.0 billion |

| Leaf Rolling Machine Market Forecast Value in (2035 F) | USD 13.6 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The leaf rolling machine market occupies a niche within several interlinked sectors such as tobacco processing equipment, cigar and cigarette manufacturing machinery, herbal and medicinal product processing, food wrapping automation, and industrial packaging systems. Within tobacco processing equipment, leaf rolling machines hold an estimated 16 % share, as they form a core part of automated cigar and cigarette production lines. In the cigar manufacturing machinery segment, the share is higher at around 22 %, driven by the precision and uniformity these machines provide compared to manual processes. For cigarette manufacturing, the contribution stands close to 12 %, as large-scale automated systems dominate this category.

Within herbal and medicinal product processing, the share is approximately 8 %, supported by rising demand for rolled herbal products in specialty markets. Lastly, in the food wrapping automation and related packaging machinery sector, the share remains modest at nearly 5 %, as application is limited to niche edible leaf products. The importance of leaf rolling machines lies in their ability to improve production consistency, reduce labor dependency, and enhance throughput efficiency. Market growth is reinforced by automation trends and premium product demand, particularly in premium cigars and herbal segments. Manufacturers focusing on modular designs, easy maintenance, and compliance with international standards are poised to secure stronger positioning in these interconnected sectors.

The leaf rolling machine market is witnessing robust growth as industries increasingly prioritize efficiency, consistency, and product standardization. The surge in demand for high-speed processing equipment across the tobacco and herbal product sectors has accelerated the adoption of technologically advanced leaf rolling solutions. The market is being shaped by the rising trend of machine customization, improved energy efficiency, and reduced operational downtime.

Manufacturers are actively investing in machines capable of integrating automation, real-time monitoring, and digital calibration systems. Stricter regulatory environments and heightened focus on product uniformity have prompted end-users to shift from manual to machine-assisted rolling, ensuring compliance and quality assurance.

Moreover, the need to address skilled labor shortages and improve throughput across production lines has supported the development of intelligent machinery with predictive maintenance capabilities. As consumer preferences evolve and niche segments such as flavored or organic rolled products gain traction, the demand for adaptive and scalable rolling machinery is expected to rise significantly across both mature and emerging markets.

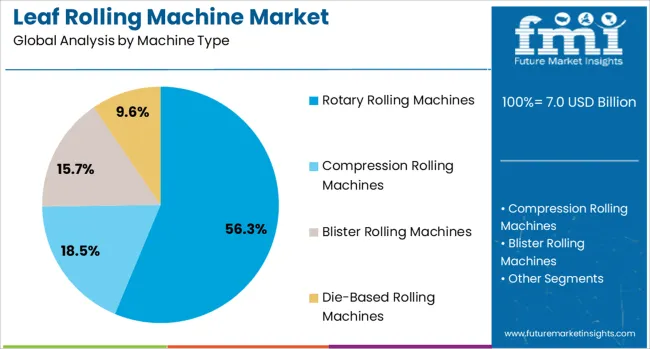

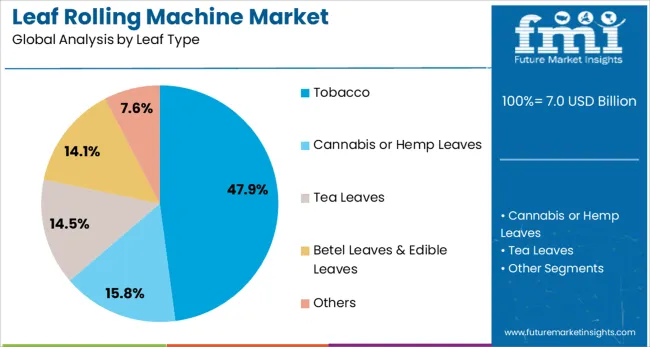

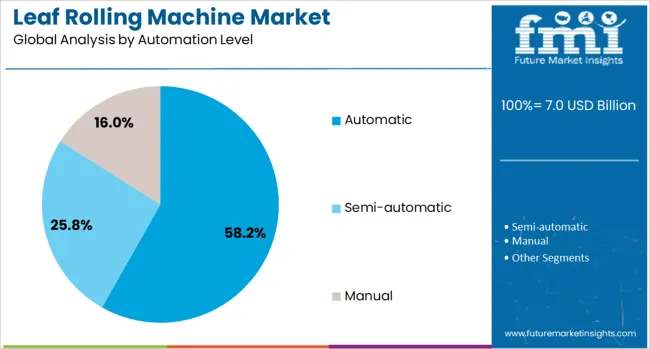

The leaf rolling machine market is segmented by machine type, leaf type, automation level, production capacity, end use, distribution channel, and geographic regions. The leaf rolling machine market is divided by machine type into Rotary Rolling Machines, Compression Rolling Machines, Blister Rolling Machines, and Die-Based Rolling Machines. The leaf type of the leaf rolling machine market is classified into Tobacco, Cannabis or Hemp Leaves, Tea Leaves, Betel Leaves & Edible Leaves, and Others.

Based on the automation level, the leaf rolling machine market is segmented into Automatic, Semi-automatic, and Manual. The leaf rolling machine market is segmented by production capacity into Medium Capacity (501-2,000 units/hour), Low Capacity (500 units/hour), and High Capacity (>2,001 units/hour). By end use, the leaf rolling machine market is segmented into Industrial and Commercial. The distribution channel of the leaf rolling machine market is segmented into Direct Sales and Indirect Sales. Regionally, the leaf rolling machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Rotary rolling machines are projected to account for 56.3% of the total revenue share in the leaf rolling machine market in 2025, establishing them as the leading machine type. The segment's dominance is being driven by the high-speed capabilities and uniform pressure distribution enabled by rotary mechanisms, which ensure consistent product quality at scale. These machines are preferred in high-volume production settings due to their efficiency in handling continuous operations with minimal manual oversight.

The integration of rotary technology with automation software and digital feedback systems has enhanced process stability and reduced variation in rolled output. Additionally, rotary designs facilitate smoother material flow, reducing wear and tear on mechanical components and thereby extending equipment lifespan.

The adaptability of rotary rolling machines to various leaf sizes and moisture content has also contributed to their widespread deployment in industrial production lines. Their ability to meet stringent hygiene and safety standards further reinforces their leadership in this segment.

The tobacco leaf segment is expected to represent 47.9% of the overall revenue share in the leaf rolling machine market in 2025, underscoring its primary role in shaping machine demand. This prominence is being influenced by the sustained global demand for tobacco-based rolled products and the continued industrialization of the tobacco processing supply chain.

Manufacturers have increasingly adopted leaf rolling machines to ensure precision wrapping, enhanced product uniformity, and compliance with packaging standards. The segment has benefited from the development of machines tailored specifically to the fibrous and moisture-sensitive properties of tobacco leaves, enabling optimized tension control and leaf alignment.

The growing shift from hand-rolled to machine-rolled tobacco products, driven by cost reduction and higher consumer acceptance of factory-finished goods, has reinforced equipment investments in this segment. Regulatory pressure to maintain consistent nicotine levels and limit impurities has further elevated the reliance on automated rolling systems designed specifically for tobacco leaf handling.

The automatic segment is forecast to capture 58.2% of the total revenue share in the leaf rolling machine market in 2025, making it the most significant automation level. This growth is being fueled by the need for high operational throughput, reduced labor dependency, and enhanced precision in the rolling process.

Automatic machines offer real-time adjustments, programmable settings, and minimal human intervention, allowing consistent product output across multiple batches. Industries favor this segment due to its superior efficiency in handling complex tasks such as feeding, aligning, rolling, and cutting, all integrated into a single automated cycle.

The rise of smart manufacturing and Industry 4.0 frameworks has supported the incorporation of IoT modules and advanced control systems within automatic leaf rolling machines, further boosting process transparency and predictive maintenance. As demand grows for tailored product configurations and higher hygiene standards, automatic machines provide the flexibility and regulatory compliance needed in modern production environments, ensuring their continued preference across industries.

Leaf rolling machines are gaining traction due to automation benefits, quality consistency, and increased demand from small-scale herbal and tobacco units. Growth opportunities lie in custom-built designs, IoT integration, and flexible leasing models for emerging manufacturers.

Demand for leaf rolling machines has increased as precision and uniformity in rolled products have become critical for quality consistency. Automated mechanisms have been preferred by producers to reduce labor dependency and improve processing speed. Growth in small-scale manufacturing units for herbal, tobacco, and tea products has pushed the requirement for compact and efficient rolling solutions. Enhanced integration with weighing and cutting systems has provided operational convenience, which has been widely accepted by mid-sized facilities. Advanced roller calibration has been implemented to maintain output standards in varying humidity conditions, supporting long-term operational reliability. Manufacturers have explored new material combinations for rollers to increase durability, ensuring higher adoption across regional manufacturing hubs.

Opportunities have been recognized in custom-built machines designed for specialty herbal products and premium tobacco formats. Adoption of leaf rolling systems for organic formulations and alternative nicotine delivery methods has created new revenue channels for producers seeking differentiation. Integration of IoT-based monitoring features has enabled real-time fault detection, reducing downtime and operational costs. Expansion of local manufacturing clusters in Asia and Latin America has presented scope for regional players to offer cost-effective solutions. Semi-automatic machines with modular attachments have been identified as a strong segment for small enterprises aiming to scale gradually. Rental and leasing models for high-capacity rolling units have gained traction among emerging businesses seeking capital efficiency.

The leaf rolling machine market is gaining traction due to increasing automation in the tobacco industry, where manufacturers seek precision and higher output in cigar and cigarette production. Growing consumer preference for premium hand-rolled alternatives has driven demand for machines that can replicate artisanal quality at scale. Automated systems offer benefits such as uniform wrapping, reduced waste, and faster processing, which are critical for meeting export-oriented production targets. Expansion of high-value tobacco markets in Asia and Latin America is further reinforcing equipment adoption. Compliance with regulatory standards for product consistency and hygiene has also contributed to the preference for mechanized rolling processes, replacing traditional labor-intensive methods in large manufacturing setups.

Beyond tobacco, leaf rolling machines are finding applications in herbal products, medicinal leaves, and niche food segments, driven by growing interest in natural and plant-based consumables. These machines are being adapted to handle varied leaf textures and moisture levels, enabling manufacturers to diversify product portfolios and cater to wellness-oriented consumers. The customization trend has encouraged equipment suppliers to integrate adjustable controls, ensuring compatibility with non-tobacco materials. Growing investments in premium herbal blends and edible leaf packaging solutions are adding momentum to market expansion. Companies offering modular, multi-purpose machines with user-friendly interfaces are positioned to gain a competitive edge in emerging specialty categories.

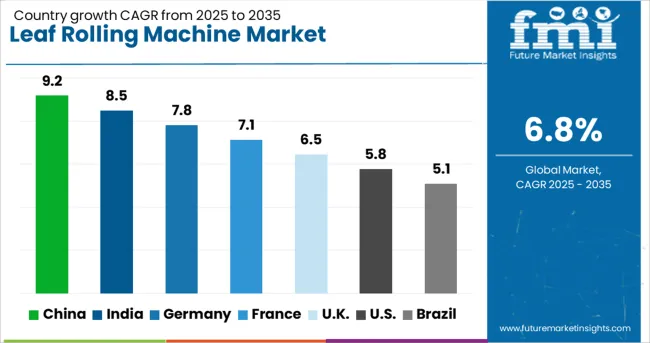

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The leaf rolling machine industry, projected to grow at a global CAGR of 6.8% from 2025 to 2035, shows diverse growth patterns across major economies. A 9.2% CAGR is being recorded in China, a BRICS member, supported by the presence of large-scale equipment manufacturers and rapid adoption in herbal and tobacco processing clusters. A strong 8.5% CAGR is being reported in India, another BRICS member, where expansion in small and mid-sized manufacturing units is fueling high demand for compact rolling systems.

Germany, an OECD member, is demonstrating a 7.8% CAGR due to the integration of advanced engineering features in automated systems and strong export capabilities within the European market. The United Kingdom is seeing a 6.5% CAGR driven by premium product lines and specialized machinery requirements in niche tobacco segments. The United States, an OECD member, follows with a 5.8% CAGR, supported by established players focusing on IoT-enabled machines and contract-based manufacturing solutions. The report includes a comprehensive assessment of over 40 countries, with the top five markets highlighted for reference.

The CAGR in China moved from approximately 7.4% during 2020–2024 to 9.2% for 2025–2035, supported by an accelerated shift toward high-volume automated rolling systems. This rise has been influenced by increased production of premium tobacco formats and herbal products that require precision-engineered rolling machines. Government-led industrial modernization policies created demand for equipment featuring IoT-based monitoring and energy-efficient operation. Strategic partnerships between local manufacturers and international brands enhanced machine availability with localized cost advantages. Import substitution policies boosted domestic manufacturing clusters, particularly in Jiangsu and Zhejiang.

India saw its CAGR grow from nearly 6.7% in 2020–2024 to 8.5% during 2025–2035, driven by a surge in mid-sized processing units for herbal and smokeless tobacco products. Increased automation in regional clusters such as Gujarat and Maharashtra led to a transition from manual rolling toward semi-automatic and compact modular machines. Government support for small manufacturing enterprises and favorable credit lines for equipment financing encouraged higher procurement levels. Domestic manufacturers enhanced design efficiency with multi-functional attachments to meet diverse production requirements.

The CAGR in Germany climbed from about 6.5% during 2020–2024 to 7.8% for the 2025–2035 period, driven by strong engineering integration and adoption in premium tobacco production. German manufacturers implemented high-precision calibrations to maintain uniform output in variable humidity conditions. Automation standards were enhanced to incorporate predictive maintenance and integrated weighing systems, which attracted institutional buyers in both domestic and export markets. EU regulatory compliance requirements influenced machine redesigns for enhanced operational safety, creating demand for modernized units across the region.

The CAGR for the UK market improved from 5.2% in 2020–2024 to 6.5% in 2025–2035, influenced by premium product demand and expanded adoption of smart rolling systems. Growing preference for artisanal and specialty herbal products pushed smaller producers toward precision rolling technology. Limited domestic production capacity led to higher imports from European manufacturers, although a few local players introduced customizable compact machines targeting small-scale operators. Digital monitoring features integrated into rolling machines allowed better quality consistency for premium-grade products.

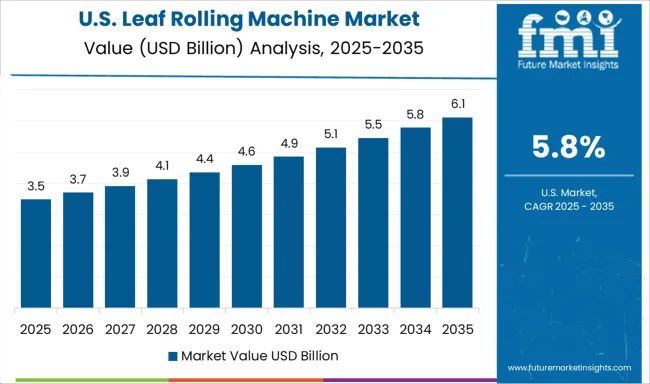

The USA market experienced a CAGR increase from 4.9% in 2020–2024 to 5.8% for the 2025–2035 timeframe, supported by niche demand in premium cigars and herbal wellness products. Manufacturing activity remained consolidated among established firms, emphasizing high-performance automated solutions. Integration of IoT-based diagnostics and energy-efficient drives became standard across most new installations. Investments in customized solutions for boutique tobacco manufacturers, along with the rising popularity of alternative nicotine delivery formats, ensured steady equipment demand.

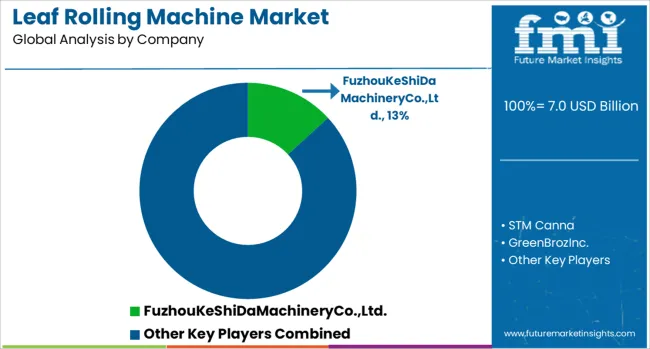

The leaf rolling machine industry is evolving with companies deploying advanced technologies to improve speed, precision, and product versatility across tobacco, herbal, and tea sectors. Fuzhou KeShiDa Machinery Co., Ltd., STM Canna, and GreenBroz Inc. lead with high-capacity automated machines equipped with precision control systems, targeting large-scale operations requiring consistent wrapping quality.

Hangzhou LOM Technology Co., Ltd. and Tobacco and Machines are incorporating digital integration features for predictive maintenance and real-time fault detection, optimizing production efficiency for industrial clients. Emerging players such as Teamachinerys (ZC Machinery), Hubei Pinyang Technology Co., Ltd., and Zhengzhou Jawo Machinery Co., Ltd. are catering to small and mid-sized enterprises with semi-automatic and compact solutions, balancing affordability and performance.

Langfang ShengXing Food Machinery Co., Ltd., Shenzhen Hana-Tech Co., Ltd., and Zhengzhou Wenming Machinery Co., Ltd. are strengthening their international footprint through aggressive export strategies to Asia, Europe, and Latin America, focusing on machines adaptable for both tobacco and herbal segments. Meanwhile, Quanzhou Wit Tea Machinery Co., Ltd. and Quanzhou Deli Agroforestrial Machinery Co., Ltd. specialize in tea leaf rolling systems with customizable attachments for premium tea production, addressing demand from high-end beverage markets. This combination of automation, modular design, and region-specific customization positions these companies to capitalize on the growing global shift toward mechanized rolling across diverse product applications.

In 2024 and 2025, strategies in the leaf rolling machine market focus on automation upgrades, modular designs, and integration of digital monitoring systems to improve efficiency and reduce downtime. Manufacturers aim to expand into herbal and tea-processing segments while strengthening exports to Asia-Pacific and Europe.

Key drivers include rising demand for premium tobacco products, growth in herbal wellness applications, and the need for consistent product quality at scale. Adoption of semi-automatic solutions by small enterprises and the shift toward energy-efficient machinery are also influencing purchasing decisions, creating opportunities for both established and emerging equipment providers globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Machine Type | Rotary Rolling Machines, Compression Rolling Machines, Blister Rolling Machines, and Die-Based Rolling Machines |

| Leaf Type | Tobacco, Cannabis or Hemp Leaves, Tea Leaves, Betel Leaves & Edible Leaves, and Others |

| Automation Level | Automatic, Semi-automatic, and Manual |

| Production Capacity | Medium Capacity (501-2,000 units/hour), Low Capacity (500 units/hour), and High Capacity (>2,001 units/hour) |

| End Use | Industrial and Commercial |

| Distribution Channel | Direct Sales and Indirect Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FuzhouKeShiDaMachineryCo.,Ltd., STM Canna, GreenBrozInc., HangzhouLOMTechnologyCo.,Ltd., TobaccoAndMachines, Teamachinerys(ZCMachinery), HubeiPinyangTechnologyCo.,Ltd., ZhengzhouJawoMachineryCo.,Ltd., LangfangShengXingFoodMachineryCo,.Ltd, ShenzhenHana-TechCo.,Ltd., ZhengzhouWenmingMachineryCo.,Ltd., QuanzhouWitTeaMachineryCo.,Ltd., and QuanzhouDeliAgroforestrialMachineryCo.,Ltd. |

| Additional Attributes | Dollar sales, share, growth by machine type, adoption trends in herbal and tobacco sectors, regional demand shifts, pricing benchmarks, competitor strategies, distribution models, and upcoming IoT-enabled automation opportunities. |

The global leaf rolling machine market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the leaf rolling machine market is projected to reach USD 13.6 billion by 2035.

The leaf rolling machine market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in leaf rolling machine market are rotary rolling machines, compression rolling machines, blister rolling machines and die-based rolling machines.

In terms of leaf type, tobacco segment to command 47.9% share in the leaf rolling machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leaf Spring Assembly Market Size and Share Forecast Outlook 2025 to 2035

Bay Leaf Oil Market Size and Share Forecast Outlook 2025 to 2035

Bay Leaf Market Size and Share Forecast Outlook 2025 to 2035

Olive Leaf Extract Market

Mullein Leaf Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Red Vine Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Lawn and Leaf Bags Market Size and Share Forecast Outlook 2025 to 2035

Peppermint Leaf Powder Market

Abies Alba (Fir) Leaf Oil Market – Growth & Demand 2025 to 2035

Camellia Sinensis Leaf Extract Market

Non-Selective Broadleaf Herbicides Market Size and Share Forecast Outlook 2025 to 2035

Automotive Composite Leaf Springs Market Growth - Trends & Forecast 2025 to 2035

Platycladus Orientalis Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

China Automotive Composite Leaf Springs Market Trends – Size, Share & Growth 2025-2035

India Automotive Composite Leaf Springs Market Trends – Size, Share & Growth 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Germany Automotive Composite Leaf Springs Market Report – Demand & Forecast 2025-2035

Rolling Stock Management Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA