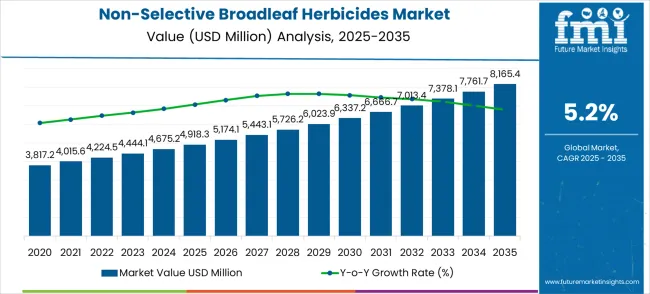

The global non-selective broadleaf herbicides market is forecasted to grow from USD 4,918.3 million in 2025 to USD 8,165.4 million by 2035, registering a steady CAGR of 5.2% over the forecast period. The market exhibits a consistent upward trend without significant stagnation or decline, reflecting sustained demand driven by agricultural expansion, weed resistance management, and increasing adoption of advanced formulations.

This decade-long growth trajectory underscores the critical role of non-selective broadleaf herbicides in modern crop management and large-scale land maintenance.

From 2025 to 2027, the market increases from USD 4,918.3 million to USD 5,443.1 million, showing moderate growth with annual increments of USD 255.8 million in 2026 and USD 269.0 million in 2027. This early stage of development represents the base of a long-term upward trajectory, supported by steady demand from agricultural sectors, urban weed control projects, and infrastructure maintenance. This growth phase benefits from increased investment in farming technologies and regulatory approvals for effective herbicide variants that efficiently control broadleaf weeds.

Between 2028 and 2031, the market expands from USD 5,726.2 million to USD 7,013.4 million, contributing a significant share of the growth. Annual growth in this period ranges from USD 277.7 million to USD 346.7 million, reflecting a sustained acceleration. This phase reflects enhanced market penetration due to rising adoption of precision agriculture, where herbicide application is optimized through digital mapping and automated spraying technologies. Regulatory support for efficient and environmentally safe formulations also drives growth, while the need for higher productivity across agricultural landscapes reinforces demand for non-selective broadleaf herbicides.

From 2032 to 2035, the market grows from USD 7,378.1 million to USD 8,165.4 million, maintaining steady gains averaging USD 260–300 million annually. This stage represents a mature growth period where demand is underpinned by established usage patterns and continuous product innovation. The CAGR of 5.2% reflects balanced growth over the forecast period, supported by the herbicide segment’s resilience against price fluctuations and its adaptability to various agricultural conditions globally. Trendline analysis suggests a near-linear trajectory, indicating predictable and stable expansion throughout the decade, with no significant volatility or downturns.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4,918.3 million |

| Forecast Value in (2035F) | USD 8,165.4 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

Market expansion is being supported by the exponential growth of global agricultural production requirements and the corresponding demand for efficient weed management solutions that can support large-scale farming operations, crop yield optimization, and sustainable agricultural practices. Modern agricultural operators are increasingly focused on herbicide solutions that provide broad-spectrum weed control while enabling mechanized application and integrated pest management strategies. Non-selective broadleaf herbicides' proven ability to deliver comprehensive weed elimination, operational efficiency, and cost-effectiveness makes them essential crop protection tools for commercial agriculture and sustainable farming initiatives.

The growing focus on agricultural mechanization and precision farming is driving demand for herbicide systems that can support automated application technologies, variable rate application, and data-driven weed management strategies. Farmer preference for herbicide solutions that combine broad-spectrum efficacy with application flexibility and economic benefits is creating opportunities for innovative non-selective herbicide implementations. The rising influence of sustainable agriculture practices and integrated crop management approaches is also contributing to increased adoption of non-selective herbicides that can provide efficient weed control while supporting environmental stewardship and resistance management protocols.

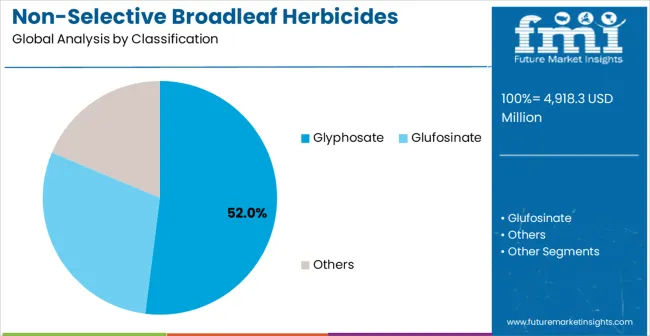

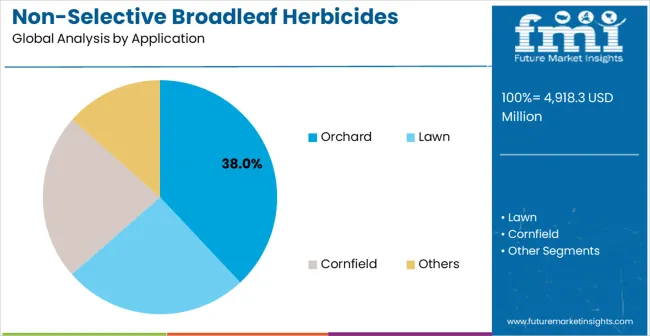

The market is segmented by active ingredient and application. By active ingredient, the market is divided into glyphosate, glufosinate, and others. Based on application, the market is categorized into orchards, lawns, cornfields, and others.

The glyphosate segment is projected to account 67.0% share of the market in 2025, reaffirming its position as the leading active ingredient category. Glyphosate-based herbicides increasingly attract agricultural operators for their broad-spectrum effectiveness characteristics, systemic action capabilities, and suitability for various crop production and non-crop applications. Glyphosate's proven performance and cost-effectiveness directly address the operational and economic requirements for comprehensive weed management systems across different agricultural applications.

This active ingredient segment forms the foundation of non-selective herbicide adoption, as it represents the herbicide category with the greatest appeal for large-scale agricultural operations requiring reliable broad-spectrum weed control without crop selectivity limitations. Agrarian investments in efficient weed management technologies and cost optimization strategies continue to strengthen adoption among glyphosate-based herbicide users. With farmers prioritizing proven effectiveness and economic efficiency, glyphosate systems align with both performance requirements and budget constraints, making them the central component of non-selective broadleaf herbicides market growth strategies.

Orchards are projected to account 34.0% share for application segment of non-selective broadleaf herbicides demand in 2025, underscoring their critical role in driving market growth and herbicide adoption. Orchard applications prefer non-selective herbicides for their comprehensive weed control capabilities, pre-emergence effectiveness, and ability to maintain clean cultivation areas around fruit trees without interfering with crop growth. Positioned as essential crop protection tools for fruit production, non-selective herbicides offer both operational advantages and yield protection benefits for orchard management systems.

The segment is supported by continuous expansion in fruit production areas and the growing recognition of herbicide benefits that enable efficient orchard maintenance and reduced manual labor requirements. Herbicide manufacturers are investing in orchard-specific formulations to support tree fruit cultivation and specialized application requirements. As orchard management becomes more mechanized and efficiency-focused, orchards will continue to dominate non-selective herbicide utilization while supporting market expansion and agricultural productivity improvements.

The non-selective broadleaf herbicides market is advancing steadily due to increasing agricultural productivity demands and the growing need for efficient weed management solutions that support commercial farming operations and sustainable crop protection practices. The market faces challenges, including regulatory restrictions on certain active ingredients, environmental concerns about herbicide persistence and non-target effects, and the development of herbicide-resistant weed populations. Innovation in formulation technology and resistance management strategies continues to influence market development and adoption patterns.

The expanding adoption of precision agriculture technologies and mechanized farming systems is enabling non-selective broadleaf herbicides to support advanced weed management applications where traditional selective herbicides cannot provide comprehensive broadleaf weed control across diverse crop production systems. Precision agriculture development provides enhanced market opportunities while allowing targeted herbicide applications across various cropping systems and field conditions. Agricultural organizations are increasingly recognizing the competitive advantages of non-selective herbicides for integrated weed management and operational efficiency optimization.

Modern non-selective herbicide providers are incorporating sustainable agriculture principles and resistance management programs to enhance product appeal and address farmer concerns about environmental impact and long-term herbicide effectiveness. These sustainability enhancements improve herbicide value while enabling new market segments, including organic transition programs and integrated pest management systems requiring balanced weed control and environmental stewardship. Advanced sustainability integration also allows non-selective herbicides to differentiate from conventional crop protection methods while supporting responsible agriculture practices and regulatory compliance.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| USA | 4.9% |

| UK | 4.4% |

| Japan | 3.9% |

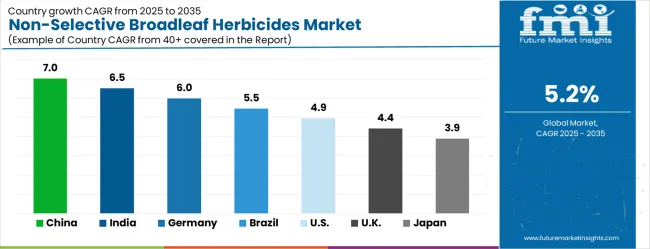

The market is experiencing solid growth globally, with China leading at a 7.0% CAGR through 2035, driven by massive agricultural modernization programs, increasing mechanized farming adoption, and comprehensive crop protection technology development. India follows closely at 6.5%, supported by expanding agricultural production, growing commercial farming operations, and increasing adoption of modern herbicide technologies.

Germany shows strong growth at 6.0%, focusing precision agriculture development and sustainable crop protection practices. Brazil records 5.5%, focusing on large-scale agricultural expansion and herbicide technology advancement.

The United States shows 4.9% growth, prioritizing agricultural innovation and integrated weed management systems. The United Kingdom demonstrates 4.4% growth, supported by advanced farming practices and crop protection technology adoption. Japan shows 3.9% growth, focusing precision application technology and sustainable agriculture practices.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to exhibit exceptional growth with a CAGR of 7.0% through 2035, driven by massive agricultural modernization initiatives and advancing mechanized farming programs requiring comprehensive weed management solutions. The country's leadership in agricultural production and strong government support for farming technology advancement are creating significant demand for sophisticated herbicide systems. Major domestic and international crop protection companies are establishing comprehensive herbicide production and distribution capabilities to serve both domestic agricultural markets and global export opportunities.

India is expanding at a CAGR of 6.5%, supported by the rapidly developing commercial agriculture sector, expanding mechanized farming practices, and increasing adoption of modern crop protection technologies among growing agricultural operations. The country's large agricultural base and strong focus on food security are driving requirements for efficient herbicide solutions. International crop protection companies and domestic manufacturers are establishing comprehensive development and distribution capabilities to address the growing demand for herbicide technologies.

Germany is projected to grow at a CAGR of 6.0% through 2035, focusing precision agriculture development and sustainable crop protection practices within Europe's leading agricultural technology hub. The country's established agricultural industry and commitment to environmental stewardship are driving sophisticated herbicide application requirements. German farmers and agricultural companies consistently demand high-precision herbicide systems that meet stringent environmental standards and provide superior integration capabilities with precision farming technologies.

Brazil is expanding at a CAGR of 5.5% through 2035, focusing on large-scale agricultural expansion and herbicide technology advancement across Latin America's largest agricultural market. Brazilian organizations value cost-effective crop protection solutions, operational reliability, and proven performance characteristics, positioning non-selective broadleaf herbicides as essential components for modern agricultural operations. The country's expanding agricultural land and increasing focus on agricultural productivity are creating sustained demand for advanced herbicide technologies.

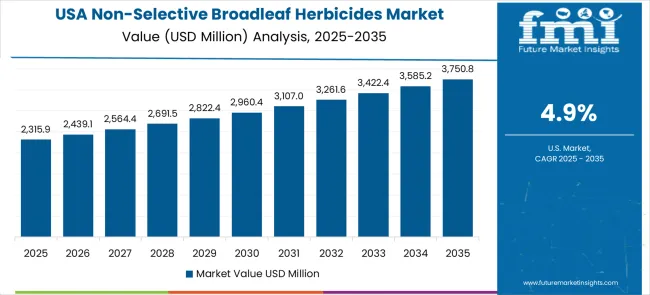

The United States is projected to grow at a CAGR of 4.9% through 2035, driven by agricultural innovation leadership, integrated weed management system development, and established regulatory frameworks supporting advanced crop protection technologies. American farmers prioritize operational efficiency, technological advancement, and regulatory compliance, making non-selective broadleaf herbicides a strategic choice for comprehensive weed management applications. The market benefits from mature agricultural infrastructure and sophisticated farming technology requirements.

The United Kingdom is expanding at a CAGR of 4.4% through 2035, supported by advanced farming practices, established agricultural expertise, and growing commitment to sustainable crop protection and agricultural efficiency. British farmers value regulatory compliance, technological sophistication, and operational reliability, positioning non-selective broadleaf herbicides as essential technology for modern agricultural applications.

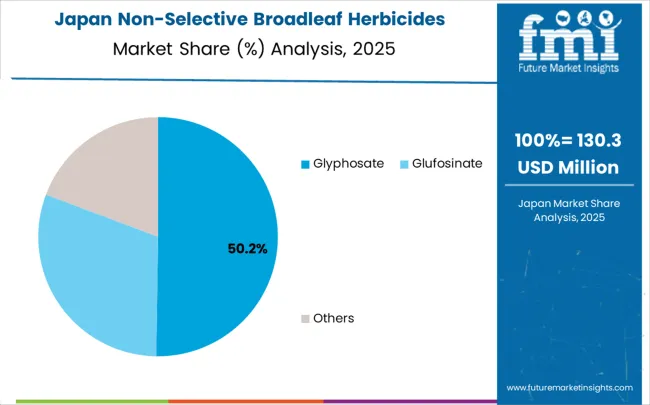

Japan is projected to grow at a CAGR of 3.9% through 2035, focusing precision application technology development, advanced quality control standards, and comprehensive sustainable agriculture integration aligned with Japanese farming excellence. Japanese farmers prioritize technological precision, application efficiency, and long-term environmental sustainability, making non-selective broadleaf herbicides a strategic choice for precision agricultural applications. The market is supported by sophisticated farming infrastructure and established agricultural technology expertise.

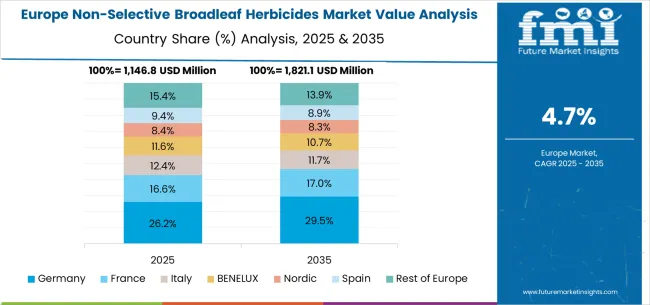

The non-selective broadleaf herbicides market in Europe is projected to grow from USD 1,342.6 million in 2025 to USD 2,145.8 million by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership position with a 29.8% market share in 2025, projected to reach 30.4% by 2035, supported by its advanced agricultural technology capabilities and comprehensive crop protection programs, including major farming operations in Bavaria, Lower Saxony, and North Rhine-Westphalia.

France follows with a 22.1% share in 2025, projected to reach 22.6% by 2035, driven by comprehensive agricultural modernization programs and advanced crop protection practices in major agricultural regions. The United Kingdom holds an 18.9% share in 2025, expected to reach 19.2% by 2035 due to expanding precision agriculture adoption and sustainable farming practices.

Italy commands a 14.7% share, while Spain accounts for 9.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.3% to 5.6% by 2035, attributed to increasing herbicide adoption in Nordic countries and emerging Eastern European agricultural markets implementing modern crop protection technologies.

The market is characterized by competition among established agricultural chemical companies, specialized crop protection providers, and emerging sustainable agriculture technology developers. Companies are investing in advanced formulation development, resistance management programs, application technology integration, and comprehensive weed management solutions to deliver effective, sustainable, and economically viable herbicide systems. Innovation in active ingredient development, formulation optimization, and precision application technology is central to strengthening market position and farmer acceptance.

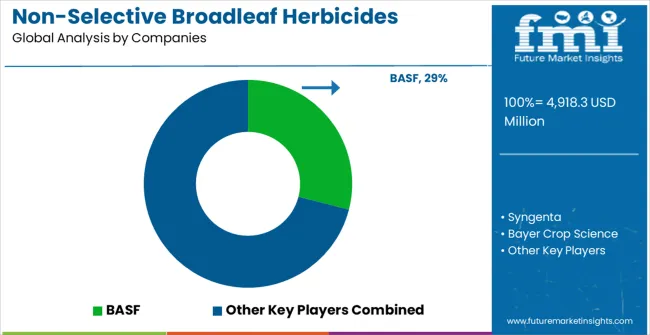

BASF leads the market with comprehensive crop protection solutions, offering advanced herbicide formulations with a focus on efficacy optimization and sustainable agriculture integration. Syngenta provides innovative herbicide technologies with focus on integrated weed management and precision agriculture applications. Bayer Crop Science delivers comprehensive crop protection systems with a focus on resistance management and sustainable farming practices. Corteva Agriscience focuses on advanced herbicide development with focus on farmer productivity and environmental stewardship.

FMC specializes in innovative crop protection solutions with focus on specialty applications and targeted weed control. ADAMA provides comprehensive herbicide portfolios with focus on cost-effective solutions and global market access. UPL focuses on integrated crop protection systems with sustainable agriculture positioning. Nufarm delivers specialized herbicide solutions with regional market expertise. Albaugh provides cost-effective herbicide alternatives with a focus on generic formulations. Sumitomo Chemical, Ishihara Sangyo, Jiangsu Yangnong Chemical, and Zhejiang Xinan Chemical contribute specialized manufacturing capabilities and regional market development across various herbicide applications.

Non-selective broadleaf herbicides are critical tools for modern agricultural productivity, providing comprehensive weed control across diverse farming systems while supporting mechanized operations and crop yield optimization. With the market projected to grow from USD 4,918.3 million in 2025 to USD 8,165.4 million by 2035 at a 5.2% CAGR, these herbicides enable efficient large-scale farming, reduce labor costs, and support sustainable agricultural practices when properly managed.

The market development faces significant challenges including regulatory restrictions, environmental concerns, herbicide resistance issues, and evolving consumer preferences for reduced chemical inputs. Balancing agricultural productivity needs with environmental stewardship requires coordinated action across regulatory bodies, agricultural research institutions, crop protection manufacturers, farming communities, and sustainability advocates.

Science-Based Registration Frameworks: Establish rigorous but efficient registration processes that evaluate herbicide safety, environmental impact, and efficacy based on current scientific evidence. Develop expedited pathways for products demonstrating improved environmental profiles or resistance management benefits while maintaining thorough safety assessments.

Integrated Resistance Management Policies: Mandate resistance management plans for glyphosate and other key active ingredients, requiring rotation with alternative modes of action and integrated weed management approaches. Support research into herbicide resistance monitoring and provide early warning systems for emerging resistance issues.

Precision Agriculture Incentives: Provide funding and tax incentives for farmers adopting precision application technologies, variable rate systems, and data-driven herbicide programs that reduce total chemical usage while maintaining efficacy. Support development of agricultural infrastructure needed for precision farming adoption.

Environmental Monitoring Programs: Invest in comprehensive monitoring systems tracking herbicide residues in soil, water, and non-target organisms to ensure regulatory decisions reflect real-world impacts. Use data to refine application guidelines and identify areas requiring enhanced environmental protection measures.

Research and Development Funding: Support public-private research partnerships developing next-generation herbicide technologies, biological alternatives, and integrated pest management systems that reduce reliance on chemical inputs while maintaining agricultural productivity.

Alternative Weed Control Research: Develop and validate integrated weed management systems combining reduced herbicide inputs with cover cropping, mechanical cultivation, biological control, and precision timing strategies. Demonstrate economic viability and practical implementation for different farming systems.

Resistance Management Science: Conduct long-term research on herbicide resistance evolution, cross-resistance patterns, and management strategies. Develop predictive models for resistance development and create decision-support tools helping farmers optimize herbicide rotation programs.

Environmental Impact Studies: Perform comprehensive studies on herbicide fate in agricultural ecosystems, including impacts on soil health, beneficial insects, and non-target plant species. Develop best practices minimizing environmental risks while maintaining weed control efficacy.

Precision Application Technology: Research sensor-based weed detection, AI-powered application systems, and robotic technologies that enable targeted herbicide application only where needed, significantly reducing total chemical usage and environmental exposure.

Economic Analysis and Extension: Quantify total costs and benefits of different weed management approaches including herbicide programs, labor requirements, yield impacts, and long-term sustainability. Translate research findings into practical recommendations for farmers through extension programs.

Next-Generation Active Ingredients: Invest in discovery and development of herbicides with novel modes of action, improved environmental profiles, and reduced resistance potential. Focus on molecules that degrade rapidly in soil and water while maintaining effective weed control.

Advanced Formulation Technology: Develop slow-release, targeted-delivery, and microencapsulated formulations that improve herbicide efficiency, reduce drift potential, and minimize environmental exposure while maintaining or enhancing weed control performance.

Digital Integration Solutions: Create comprehensive digital platforms integrating weather data, soil conditions, weed pressure monitoring, and application timing optimization to help farmers maximize herbicide effectiveness while minimizing usage rates and environmental impact.

Resistance Management Tools: Develop herbicide mixtures, rotation programs, and application strategies specifically designed to delay resistance evolution. Provide farmers with decision-support tools and resistance monitoring services to optimize long-term weed control sustainability.

Stewardship and Training Programs: Implement comprehensive stewardship programs including applicator training, equipment calibration services, and environmental monitoring to ensure responsible herbicide use and maintain public confidence in crop protection technologies.

Integrated Weed Management Implementation: Adopt diversified weed control strategies combining herbicides with crop rotation, cover crops, mechanical cultivation, and cultural practices. Develop farm-specific weed management plans that reduce herbicide dependency while maintaining productivity.

Precision Application Technology: Invest in GPS-guided sprayers, variable rate technology, and sensor-based application systems that optimize herbicide placement and timing while reducing total chemical usage and input costs.

Resistance Prevention Practices: Implement herbicide rotation programs, tank mixing strategies, and non-chemical control methods to prevent resistance development. Participate in resistance monitoring programs and report suspected resistance issues promptly.

Environmental Stewardship: Adopt buffer zones, drift reduction technologies, and weather-sensitive application timing to minimize herbicide impacts on non-target areas. Implement soil health practices that support natural weed suppression and reduce herbicide requirements.

Knowledge Sharing and Education: Participate in farmer education programs, demonstration projects, and peer-to-peer learning networks focused on sustainable weed management. Share successful practices and challenges to accelerate adoption of responsible herbicide use.

Sustainable Agriculture Technology: Finance development of precision agriculture technologies, biological control systems, and integrated pest management solutions that reduce chemical herbicide dependency while maintaining agricultural productivity and profitability.

Research and Development Investment: Support long-term research programs developing herbicide alternatives, resistance management strategies, and environmental monitoring technologies. Fund university-industry partnerships addressing complex sustainability challenges.

Market Infrastructure Development: Invest in agricultural service companies, precision application contractors, and technology platforms that make sustainable weed management practices accessible to farmers of all sizes, particularly in emerging markets like China (7.0% CAGR) and India (6.5% CAGR).

Risk Management Solutions: Develop insurance products and financial instruments that help farmers transition to lower-input weed management systems while managing yield risks during adoption periods. Support economic incentives for sustainable farming practices.

Supply Chain Sustainability: Finance traceability systems and certification programs that reward farmers implementing responsible herbicide use practices, creating market premiums for sustainably produced agricultural products and supporting consumer transparency.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4,918.3 million |

| Active Ingredient | Glyphosate, Glufosinate, Others |

| Application | Orchard, Lawn, Cornfield, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | BASF, Syngenta, Bayer Crop Science, Corteva Agriscience, FMC, ADAMA, UPL, Nufarm, Albaugh, Sumitomo Chemical, Ishihara Sangyo, Jiangsu Yangnong Chemical, Zhejiang Xinan Chemical |

| Additional Attributes | Dollar sales by active ingredient and application, regional demand trends, competitive landscape, farmer preferences for glyphosate versus alternative active ingredients, integration with precision agriculture and resistance management systems, innovations in formulation technology and application methods for diverse agricultural applications |

The global industrial robotics retrofit service market is estimated to be valued at USD 2,716.3 million in 2025.

The market size for the industrial robotics retrofit service market is projected to reach USD 4,864.5 million by 2035.

The industrial robotics retrofit service market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in industrial robotics retrofit service market are control system upgrades, mechanical enhancements, sensor and vision integration and others.

In terms of application, automotive segment to command 42.6% share in the industrial robotics retrofit service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Herbicides Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA