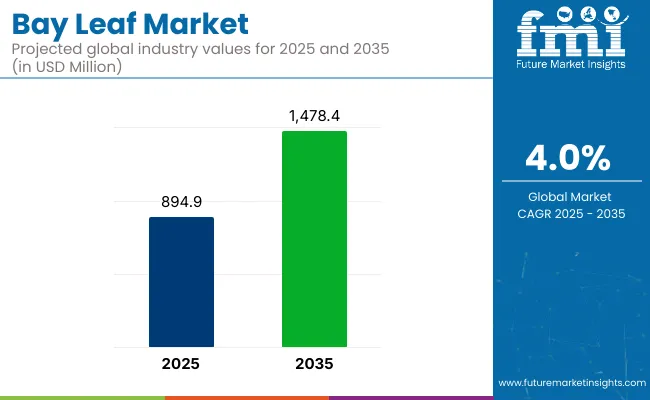

The bay leaf market is projected to reach a valuation of USD 894.9 million in 2025, advancing toward an estimated USD 1,478.4 million by 2035. This represents a steady compound annual growth rate of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 894.9 million |

| Industry Value (2035F) | USD 1,478.4 million |

| CAGR (2025 to 2035) | 4.0% |

The market has expanded from a value of USD 827.3 million in 2023, supported by consistent global demand for aromatic herbs used in cooking and traditional wellness practices. As of 2023, a consolidated 63% of global consumption was concentrated in the United States, Germany, Japan, and Australia, reflecting strong uptake in OECD economies with mature culinary and natural remedy traditions.

With rising attention to natural food ingredients and traceable sourcing, commercial bay leaf plantations are expanding in suitable agro-climatic zones across North Africa, Southern Europe, and South Asia to secure supply continuity.

The industry accounts for an estimated 3.1% share within the broader herbs and spices category, which remains its primary parent segment. Within the seasonings and condiments market, its contribution is smaller at approximately 1.8%, due to the dominance of salt, pepper, and blended seasonings.

In the food and beverage ingredients domain, bay leaf accounts for nearly 0.7%, largely driven by its niche role in culinary and processed food formulations. In the botanical extracts market, bay leaf contributes about 1.2%, supported by essential oil applications. Its share in the nutraceutical ingredients segment stands near 0.5%, where use is limited to traditional digestive remedies.

Driving the market forward is the growing premiumization of spices and herbs, coupled with shifting consumer awareness toward regionally sourced and chemical-free plant ingredients. In developed markets, demand has been supported by ethnic cuisine proliferation and a resurgence of homemade cooking, where bay leaves are essential in traditional recipes from Mediterranean, Indian, and Latin American cultures.

In parallel, developing regions are witnessing a formalization of spice trade channels, where improved drying, processing, and certification practices are boosting export readiness. Bay leaf’s multifunctional profile, aromatic, therapeutic, and preservative, continues to expand its footprint beyond seasoning aisles into nutraceuticals, cosmeceuticals, and aromatherapy-based personal care products.

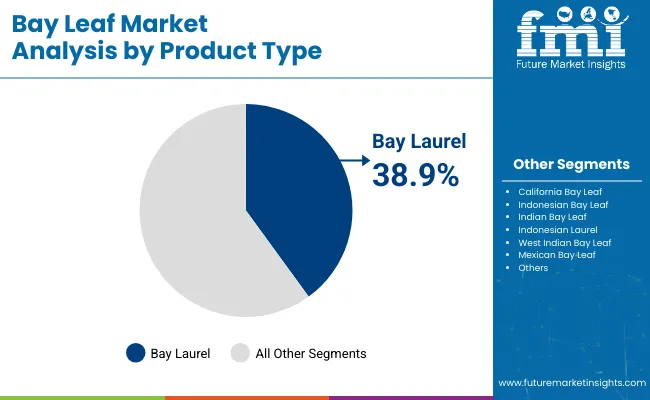

Bay Laurel remains the most widely used bay leaf type due to its processing efficiency, aromatic profile, and adaptability in global cuisines. Food applications continue to drive demand, reinforced by the herb’s integration into processed meals and spice blends. The food and beverage industry leads usage, while healthcare and consumer goods applications expand gradually through herbal remedies and aromatherapy products.

Bay Laurel is expected to maintain its leading position in the market in 2025, accounting for an estimated 38.9% market share. This slight gain reflects continued demand in both consumer and industrial culinary applications, supported by stable harvests from Mediterranean-producing countries.

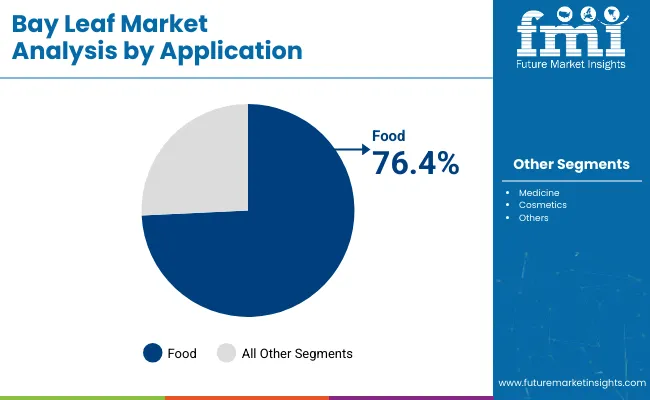

Food applications are projected to register the dominant share of the market in 2025, accounting for 76.4% of global revenue. This continued lead is driven by strong demand across culinary traditions in Europe, Asia, and Latin America, where bay leaves are integrated into soups, sauces, stews, and spice blends.

The food and beverage industry is estimated to account for 72.8% of usage in 2025, making it the dominant segment by usage industry. Its widespread integration into flavoring agents, spice mixes, and ready-to-eat meal formulations supports consistent demand across both retail and foodservice channels.

Bay leaf trade is being reshaped by sourcing disruptions and rising compliance demands, prompting diversification into new growing regions. Its use as a functional ingredient is expanding, with clean-label positioning and traceable sourcing gaining traction in retail and nutraceutical channels.

Export Trade Shifts and Sourcing Pressures

Export-oriented product supply chains have undergone structural shifts as traditional sourcing zones like Turkey and India face climatic volatility and phytosanitary scrutiny. In response, secondary producers in North Africa and Southeast Europe are expanding controlled cultivation.

Supply reliability is being prioritized by global distributors, particularly in the USA and EU, where demand depends on year-round consistency and certification. These changes are prompting price adjustments and longer lead times across import-heavy markets, particularly for Bay Laurel and Indian, influencing procurement cycles for bulk buyers and food processors.

Functional Ingredient Use and Retail Labeling Impact

Bay leaf’s repositioning as a functional botanical is shaping new product development in the nutraceutical and premium grocery segments. Demand is shifting beyond traditional seasoning, with essential oil derivatives and powdered extracts entering herbal teas, detox formulas, and clean-label soups. This diversification aligns with retailer interest in promoting natural origin and therapeutic positioning.

Labeling strategies now emphasize wild-harvested, pesticide-free, and traceable product ingredients, which influence consumer perception and shelf space allocation. Premiumization and differentiation through ingredient sourcing are becoming critical, especially in OECD and BRICS retail channels.

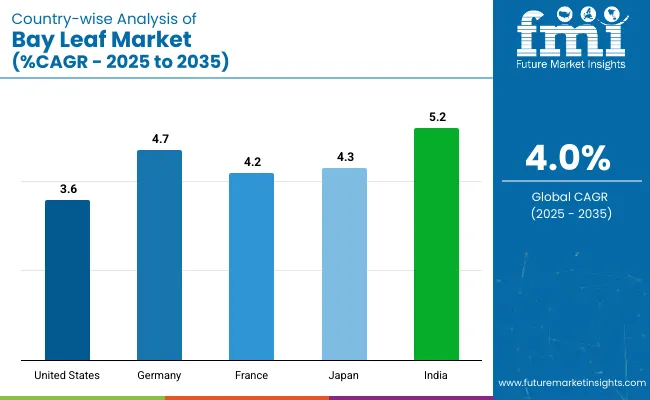

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

| Germany | 4.7% |

| France | 4.2% |

| Japan | 4.3% |

| India | 5.2% |

Global demand for products is projected to expand at a 4.0% CAGR from 2025 to 2035. India, a BRICS economy, exceeds the baseline with 5.7% growth, driven by robust domestic consumption, regional culinary integration, and expansion in value-added exports like powdered blends and oil extracts. Commercial cultivation is rising in Himachal Pradesh and parts of Uttarakhand, with contract farming supporting consistency in leaf grade and moisture control.

Turkey, bridging OECD and emerging trade corridors, grows at 4.3%, supplying nearly 35% of dried laurel exports to Europe. Its lead position reflects established drying infrastructure, EU-compliant residue standards, and strong port logistics near Izmir and Mersin. Vietnam and Indonesia, part of ASEAN, maintain 3.9% and 3.7% CAGR, just under the global average.

Both are scaling up supply through agroforestry integration and targeting Middle Eastern spice exporters. The United States shows slower expansion at 2.8%, constrained by limited domestic cultivation and reliance on imports for ethnic food categories.

The USA bay leaf market is estimated to grow at 3.6% CAGR during the forecast period.Demand in the United States continues to be influenced by ethnic cuisine penetration, particularly Mediterranean, Indian, and Latin American recipes that rely on bay leaf flavor profiles. The proliferation of packaged meal kits and seasoning blends in retail aisles has elevated demand consistency throughout the year.

Wellness-driven consumers are incorporating product into infusions and at-home herbal remedies. Foodservice operators are also sourcing higher-grade bay laurel leaves for use in sauces, stocks, and slow-cooked preparations. Increased regulatory oversight on dried spice imports has prompted importers to prioritize origin-traced, residue-free leaf batches, boosting sourcing from certified exporters.

The Germany bay leaf market is projected to expand at a 4.7% CAGR through 2035.Germany’s consistent demand for culinary herbs stems from its structured processed food industry and increasing consumer reliance on flavor-rich, preservative-free ingredients. Bay laurel is favored in traditional stews, meat broths, and pickling recipes across German households and institutional kitchens.

The health food sector is also adopting product as a digestive-support botanical in herbal mixtures and natural remedies. Regulatory clarity under EU food safety norms has led to strong importer partnerships with Mediterranean and Balkan growers, ensuring quality and traceability. Germany’s organic food market also provides new opportunities for wild-harvested or pesticide-free bay leaves certified under EU organic guidelines.

The Japan bay leaf market is forecast to grow at 4.3% CAGR between 2025 and 2035.In Japan, steady expansion of the bay leaf market is being driven by demand across premium ready-meals, gourmet sauces, and culinary seasoning sachets. Japanese food processors value bay leaf’s aroma-retention properties during thermal processing, making it a staple in shelf-stable products.

Home cooking trends among older consumers and increased interest in Mediterranean diets have also contributed to retail uptake. A separate demand stream comes from wellness brands blending product into kampo-style formulations. Japanese importers focus on low-moisture, high-oil content bay laurel from European sources, meeting domestic quality thresholds set by health and food safety agencies.

The India bay leaf market is anticipated to grow at 5.2% CAGR over the forecast period.India represents both a high-demand and high-supply market for bay leaves, particularly the Indian bay leaf (Tej Patta) variety. Domestic demand continues to grow due to its essential role in regional cooking traditions across North India. Its usage spans biryanis, lentil dishes, and spice blends.

India’s rising processed food exports also contribute to institutional demand for dried bay leaves with long shelf life. On the production side, states like Uttarakhand and Himachal Pradesh are scaling semi-organic product cultivation, driven by rising prices and export potential. Demand from wellness companies using Indian product extract in Ayurvedic digestive and immunity products also adds to consumption.

The France bay leaf market is forecast to grow at 4.2% CAGR during the forecast period.France maintains a steady consumption of bay leaves across both culinary and herbal segments, anchored in its gastronomic tradition of using aromatic herbs in stews, pâtés, and broths.

Bay laurel is favored in “bouquet garni” herb bundles, a staple in French kitchens and foodservice operations. Artisanal food producers and gourmet retailers emphasize the use of Mediterranean-sourced bay leaves for their aromatic depth and traditional authenticity.

Beyond cooking, demand is expanding in the herbal infusion and wellness segments, where bay leavesare promoted for digestive support and mild detox properties. French importers prioritize high oil content and whole-leaf integrity, sourcing primarily from Southern Europe and North Africa to meet domestic quality expectations and regulatory compliance.

Grote Company, Hobart, and Bizerba dominate the industrial segment with high-capacity automated slicers and portioning systems, often equipped with IoT-enabled diagnostics to reduce downtime. For mid-tier users like bakeries, delis, and QSRs, brands such as Berkel, Vollrath, and KWS offer compact, ergonomic countertop units tailored for daily use.

Nemco, Estella, and Beswood cater to cloud kitchens and regional foodservice operators with cost-effective stainless-steel machines known for durability and ease of use. Doyon and Vevor are expanding in the prep segment with versatile mixers and dough-handling equipment designed for batter customization.

Edlund, Garde, and LEM Products support small-scale butchers and artisanal kitchens through manual slicers and utility tools. Omcan and other import-driven companies supply a broad range of SKUs via e-commerce, helping meet equipment needs in remote or under-served regions.

Recent Bay Leaf Industry News

In June 2025, Frontier Natural Products Co-op launched a new line of Regenerative Organic Certified® spices, which includes bay leaves. This initiative is part of their broader strategy to promote regenerative organic agriculture and support smallholder farmers in Central America, Asia, and Africa.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 894.9 million |

| Projected Market Size (2035) | USD 1,478.4 million |

| CAGR (2025 to 2035) | 4.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in metric tons |

| Product Type Analyzed (Segment 1) | California Bay Leaf, Bay Laurel, Indonesian Bay Leaf, Indian Bay Leaf, Indonesian Laurel, West Indian Bay Leaf, Mexican Bay Leaf. |

| Application Analyzed (Segment 2) | Food, Medicine, and Cosmetics. |

| Usage Industry Analyzed (Segment 3) | Healthcare, Food and Beverage, and Consumer Goods. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Gourmet Foods Inc., Spice World USA, Alpina Organic Company, Badia Spices, McCormick & Company, Inc., Anatoli Spices, Frontier Natural Products Co-op, Sultar Ltd, Mars Incorporated, Zizira, Tea Haven, Darsil, Just a Little Spice, Pacific Spice Company, Inc., Laurus, Hoby Agriculture and Forest Product Co. Ltd, G2m, Mountain Rose Herbs, ALDERA. |

| Additional Attributes | Dollar sales, share, volume growth, sourcing trends, regional demand shifts, export-import flows, consumer usage patterns, pricing benchmarks, competitor positioning, and regulatory outlook. |

The global bay leaf market is estimated to be valued at USD 894.9 million in 2025.

The market size for the bay leaf market is projected to reach USD 1,324.7 million by 2035.

The bay leaf market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in bay leaf market are california bay leaf, bay laurel, indonesian bay leaf, indian bay leaf, indonesian laurel, west indian bay leaf and mexican bay leaf.

In terms of application, food segment to command 55.3% share in the bay leaf market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bay Leaf Oil Market Size and Share Forecast Outlook 2025 to 2035

Leaf Spring Assembly Market Size and Share Forecast Outlook 2025 to 2035

Bays and Bows Window Market Size and Share Forecast Outlook 2025 to 2035

Leaf Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Olive Leaf Extract Market

Mullein Leaf Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Red Vine Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Lawn and Leaf Bags Market Size and Share Forecast Outlook 2025 to 2035

Peppermint Leaf Powder Market

Abies Alba (Fir) Leaf Oil Market – Growth & Demand 2025 to 2035

Camellia Sinensis Leaf Extract Market

Non-Selective Broadleaf Herbicides Market Size and Share Forecast Outlook 2025 to 2035

Automotive Composite Leaf Springs Market Growth - Trends & Forecast 2025 to 2035

Platycladus Orientalis Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

China Automotive Composite Leaf Springs Market Trends – Size, Share & Growth 2025-2035

India Automotive Composite Leaf Springs Market Trends – Size, Share & Growth 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Germany Automotive Composite Leaf Springs Market Report – Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA